- There is a high possibility that ETH could fall 4% to the $2,400 level.

- ETH’s reserve on the exchanges has been increasing, indicating higher selling pressure from investors.

In this bearish market sentiment, a recent transaction of Ethereum [ETH] by WazirX exploiters has created an alarming situation, raising concerns of a massive sell-off.

On the 3rd of September, on-chain analytic firm Spot On Chain made a post on X (formerly Twitter) that exploiters had transferred 2,600 ETH worth $6.54 million to Tornado Cash.

However, the exploiters still held a significant amount of 59,156 ETH worth $148.8 million, across nine different cryptocurrency wallet addresses, at press time.

If they sell off their holdings, ETH may witness a significant price decline in the coming days.

Ethereum price action

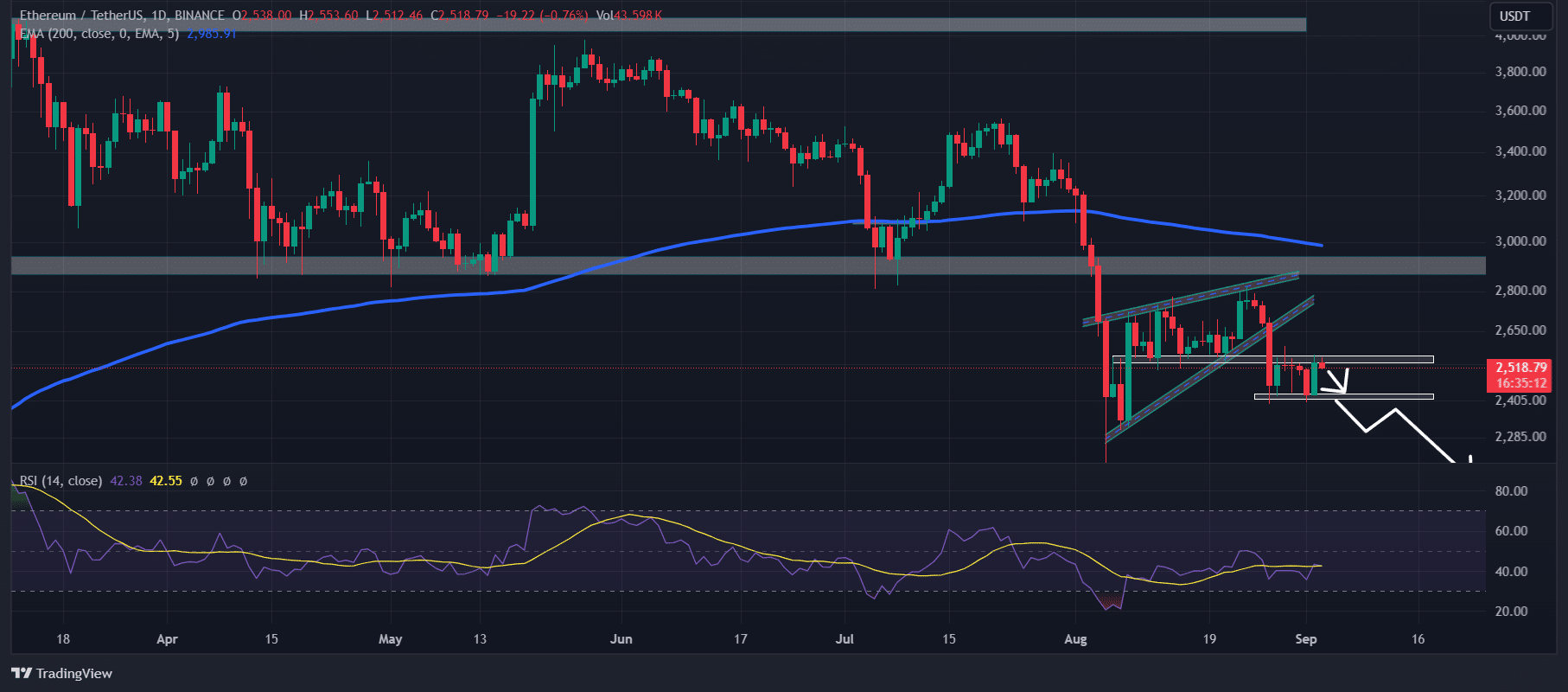

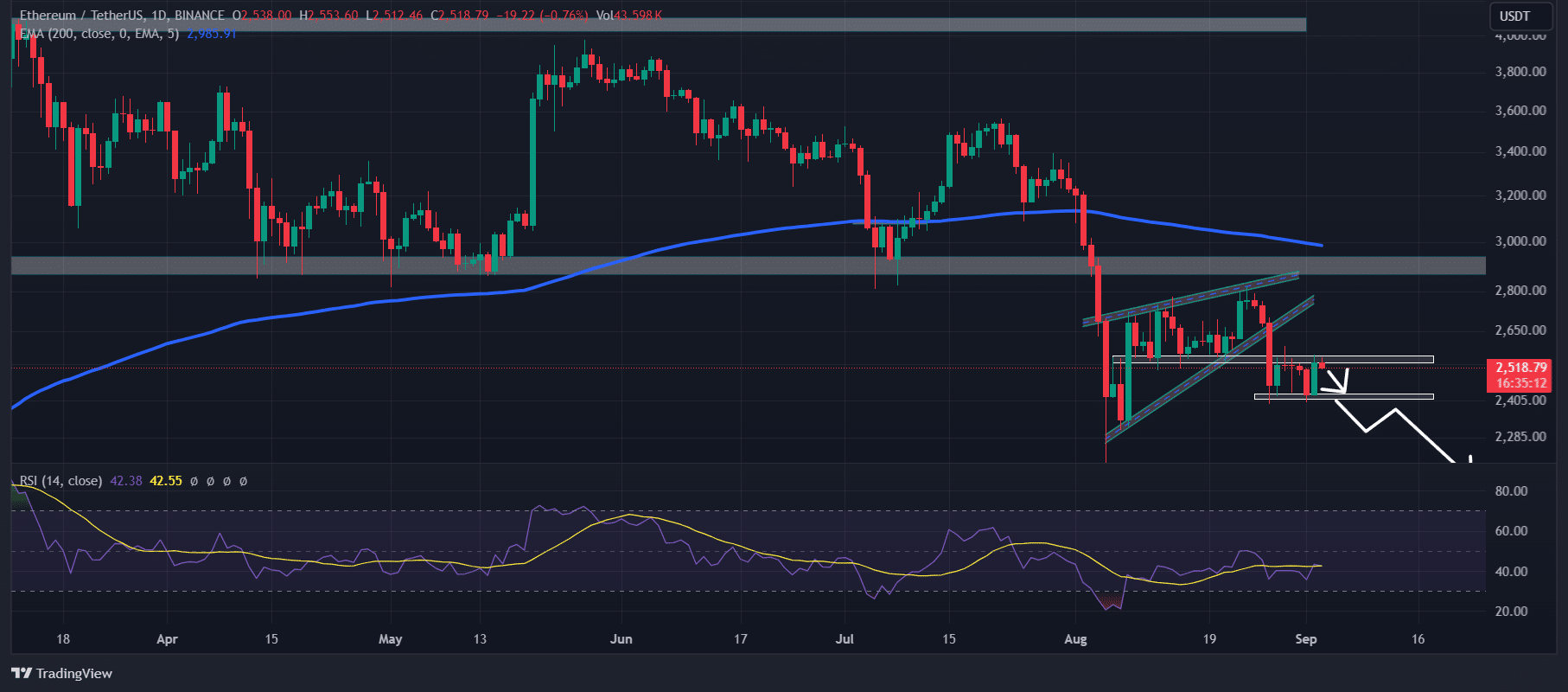

According to AMBCrypto’s look at TradingView data, following the breakdown of a bearish rising wedge price action pattern, ETH seemed to consolidated within a tight range between the $2,400 and $2,555 levels.

If ETH breaks down this consolidation zone and closes a daily candle below the $2,400 level, there is a high possibility it could fall to the $2,200 level in the coming days.

Source: TradingView

Additionally, on a four-hour time frame, ETH looked more bearish as it was at an upper level of the consolidation zone, suggesting a potential 4% price drop to the $2,400 level.

Meanwhile, the altcoin’s Relative Strength Index (RSI) was in an oversold territory, which could potentially signal a price reversal.

Bearish signs ahead?

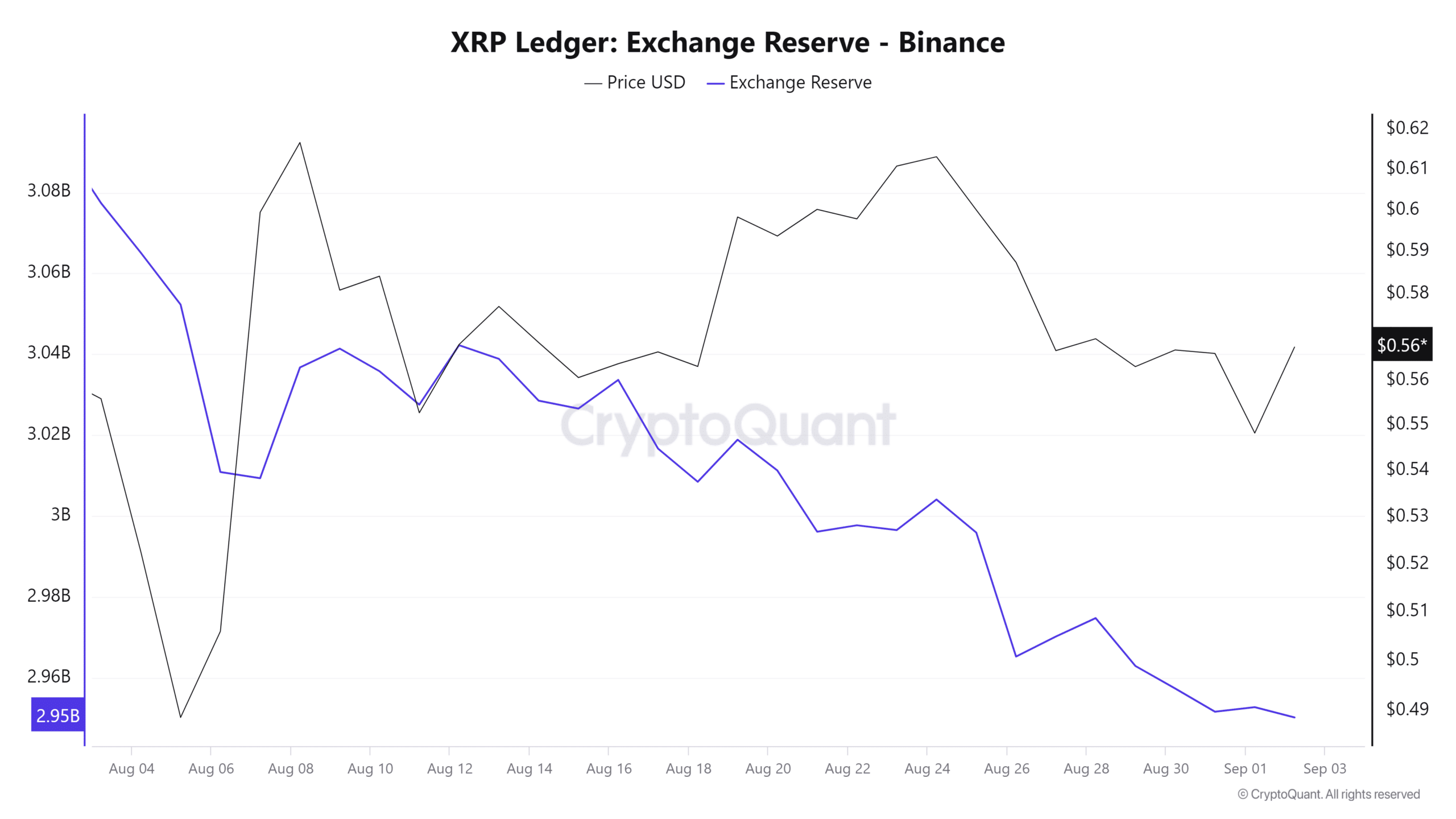

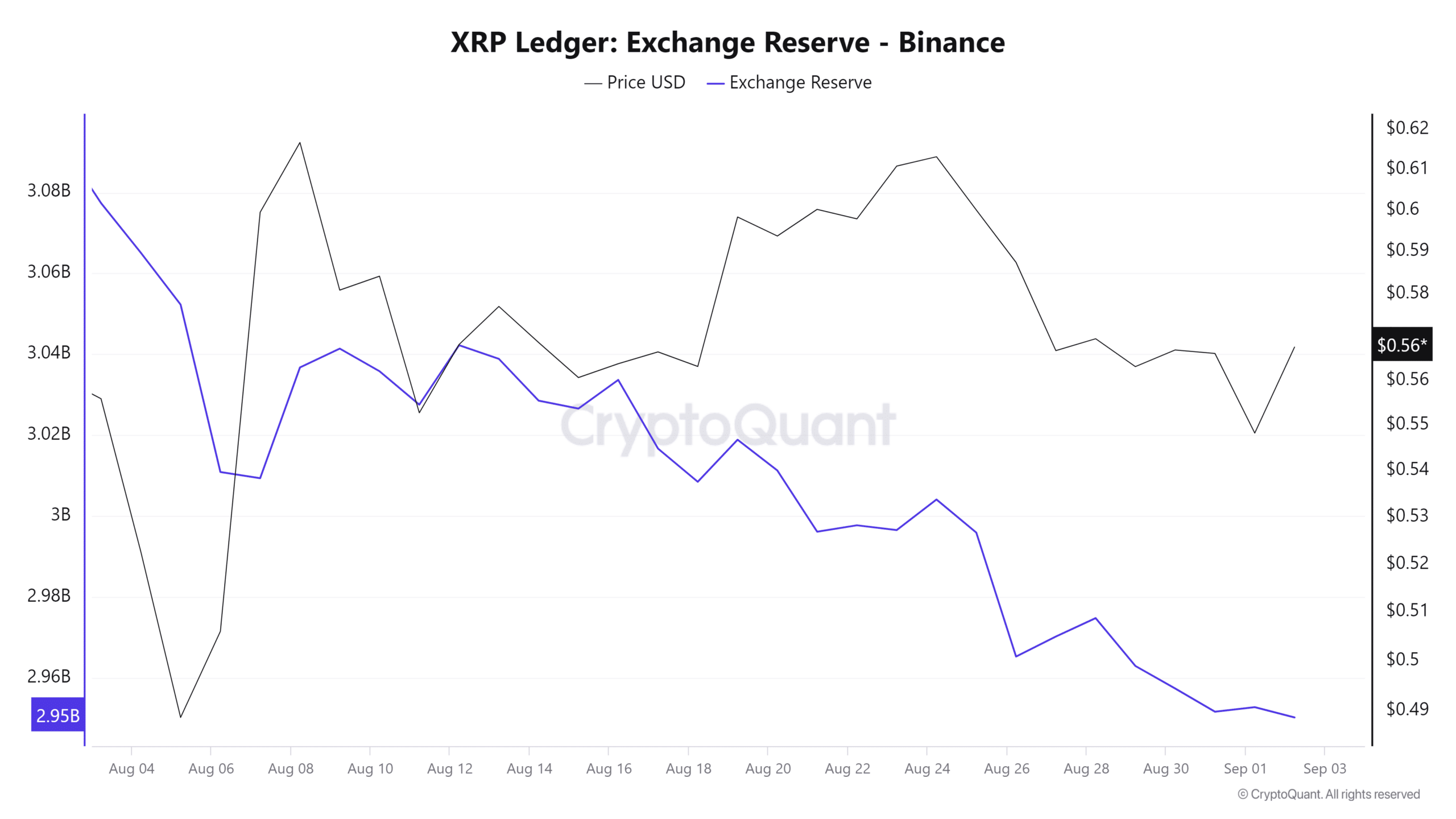

AMBCrypto’s look at the Ethereum exchange reserve via CryptoQuant supported the current bearish outlook, suggesting that ETH may experience a price decline.

Since the 29th of August, ETH’s reserve on the exchanges has been continuously increasing, indicating higher selling pressure from investors and institutions.

The exchange reserve typically rises when investors or institutions are preparing to sell off their assets, prompting them to transfer their holdings from wallets to exchanges.

Source: CryptoQuant

As of press time, the major liquidation levels were near $2,490 on the lower side and $2,550 level on the upper side, as intraday traders were over-leveraged at these levels, according to Coinglass.

Read Ethereum’s [ETH] Price Prediction 2024–2025

At press time, ETH was trading near the 2,510 level, having experienced a price surge of over 2.7% in the last 24 hours.

Its Open Interest increased by 3.5% during the same period, indicating heightened interest from investors despite the recent price decline.

- There is a high possibility that ETH could fall 4% to the $2,400 level.

- ETH’s reserve on the exchanges has been increasing, indicating higher selling pressure from investors.

In this bearish market sentiment, a recent transaction of Ethereum [ETH] by WazirX exploiters has created an alarming situation, raising concerns of a massive sell-off.

On the 3rd of September, on-chain analytic firm Spot On Chain made a post on X (formerly Twitter) that exploiters had transferred 2,600 ETH worth $6.54 million to Tornado Cash.

However, the exploiters still held a significant amount of 59,156 ETH worth $148.8 million, across nine different cryptocurrency wallet addresses, at press time.

If they sell off their holdings, ETH may witness a significant price decline in the coming days.

Ethereum price action

According to AMBCrypto’s look at TradingView data, following the breakdown of a bearish rising wedge price action pattern, ETH seemed to consolidated within a tight range between the $2,400 and $2,555 levels.

If ETH breaks down this consolidation zone and closes a daily candle below the $2,400 level, there is a high possibility it could fall to the $2,200 level in the coming days.

Source: TradingView

Additionally, on a four-hour time frame, ETH looked more bearish as it was at an upper level of the consolidation zone, suggesting a potential 4% price drop to the $2,400 level.

Meanwhile, the altcoin’s Relative Strength Index (RSI) was in an oversold territory, which could potentially signal a price reversal.

Bearish signs ahead?

AMBCrypto’s look at the Ethereum exchange reserve via CryptoQuant supported the current bearish outlook, suggesting that ETH may experience a price decline.

Since the 29th of August, ETH’s reserve on the exchanges has been continuously increasing, indicating higher selling pressure from investors and institutions.

The exchange reserve typically rises when investors or institutions are preparing to sell off their assets, prompting them to transfer their holdings from wallets to exchanges.

Source: CryptoQuant

As of press time, the major liquidation levels were near $2,490 on the lower side and $2,550 level on the upper side, as intraday traders were over-leveraged at these levels, according to Coinglass.

Read Ethereum’s [ETH] Price Prediction 2024–2025

At press time, ETH was trading near the 2,510 level, having experienced a price surge of over 2.7% in the last 24 hours.

Its Open Interest increased by 3.5% during the same period, indicating heightened interest from investors despite the recent price decline.

Im now not sure where you are getting your info, but great topic. I needs to spend a while studying more or understanding more. Thank you for magnificent info I was on the lookout for this information for my mission.

Thanks for every other wonderful article. The place else may anyone get that kind of information in such an ideal approach of writing? I’ve a presentation subsequent week, and I am at the look for such information.

Very interesting topic, thanks for putting up. “Men who never get carried away should be.” by Malcolm Forbes.

where to get clomiphene without prescription can i order clomiphene for sale cost generic clomid for sale cost clomiphene for sale how can i get clomid pill can i purchase cheap clomiphene for sale where buy clomiphene without dr prescription

I’ll certainly return to read more.

More posts like this would add up to the online elbow-room more useful.

buy zithromax 500mg – buy flagyl generic order flagyl 400mg pill

oral rybelsus 14 mg – semaglutide 14 mg drug how to buy periactin

Some truly wonderful content on this website, appreciate it for contribution. “My salad days, When I was green in judgment.” by William Shakespeare.

domperidone canada – order flexeril online cheap order cyclobenzaprine

order inderal 10mg online cheap – buy generic inderal buy methotrexate pills for sale

amoxiclav over the counter – https://atbioinfo.com/ how to get ampicillin without a prescription

nexium 20mg price – https://anexamate.com/ nexium us

buy medex without prescription – anticoagulant order losartan 25mg generic

order generic mobic 7.5mg – https://moboxsin.com/ buy meloxicam medication

Valuable info. Lucky me I found your website by accident, and I am shocked why this accident didn’t happened earlier! I bookmarked it.

buy generic prednisone online – apreplson.com buy prednisone 10mg sale

can i buy ed pills over the counter – site buy ed pill

purchase diflucan sale – https://gpdifluca.com/ diflucan brand

buy cenforce 50mg generic – https://cenforcers.com/ purchase cenforce online

cialis manufacturer coupon – https://ciltadgn.com/ cialis price south africa

tadalafil (exilar-sava healthcare) version of cialis] (rx) lowest price – erectile dysfunction tadalafil cialis from india

ranitidine where to buy – oral zantac zantac us

viagra online – click where can i buy viagra in manila

Thanks on putting this up. It’s well done. click

More posts like this would make the online play more useful. order amoxicillin without prescription

This is the big-hearted of writing I in fact appreciate. https://ursxdol.com/provigil-gn-pill-cnt/

An impressive share, I just given this onto a colleague who was doing a little analysis on this. And he in fact bought me breakfast because I found it for him.. smile. So let me reword that: Thnx for the treat! But yeah Thnkx for spending the time to discuss this, I feel strongly about it and love reading more on this topic. If possible, as you become expertise, would you mind updating your blog with more details? It is highly helpful for me. Big thumb up for this blog post!

More posts like this would force the blogosphere more useful. pharmacie en ligne fiable cialis super active

The thoroughness in this break down is noteworthy. https://ondactone.com/simvastatin/

More articles like this would make the blogosphere richer.

levaquin usa

I’m not sure exactly why but this blog is loading extremely slow for me. Is anyone else having this problem or is it a issue on my end? I’ll check back later and see if the problem still exists.

I’m still learning from you, while I’m making my way to the top as well. I certainly love reading everything that is written on your website.Keep the stories coming. I liked it!

Hi , I do believe this is an excellent blog. I stumbled upon it on Yahoo , i will come back once again. Money and freedom is the best way to change, may you be rich and help other people.

The thoroughness in this piece is noteworthy. https://myrsporta.ru/forums/users/gwmup-2/

Heya! I just wanted to ask if you ever have any problems with hackers? My last blog (wordpress) was hacked and I ended up losing months of hard work due to no backup. Do you have any methods to stop hackers?

Rattling informative and excellent anatomical structure of subject material, now that’s user pleasant (:.

I am always searching online for articles that can aid me. Thank you!

I truly appreciate this post. I have been looking all over for this! Thank goodness I found it on Bing. You’ve made my day! Thx again!

I am not real wonderful with English but I line up this very easygoing to interpret.

dapagliflozin brand – https://janozin.com/ forxiga pill

Very well written story. It will be useful to everyone who utilizes it, including me. Keep up the good work – i will definitely read more posts.