- Buterin’s transfer amid market downturn sparked speculation on ETH’s sentiment impact.

- ETH held steady with moderate losses, contrasting sharply with other cryptocurrencies’ declines.

Ethereum [ETH] co-founder Vitalik Buterin sparked intense speculation within the crypto community with a significant transfer.

Many investors assumed that Buterin was making a strategic move or possibly selling some of his holdings.

Clearing the air around Buterin’s move

However, things got clear when Wu Blockchain shared more details.

Source: Wu Blockchain/X

Interestingly, Buterin’s move coincided with a broader market downturn, as the global crypto market cap hit $2.05 trillion at press time, down 2.67% in the past day.

Now, whether Buterin’s move will shift ETH’s market sentiment from bearish to bullish remains to be seen.

As of the latest update, the largest altcoin was trading at $2,946.55, reflecting a 1.98% decline over the past 24 hours.

This decline is relatively moderate compared to Bitcoin [BTC], which dropped by 2.40%. Solana [SOL] and Ripple [XRP] experienced declines exceeding 4% and 3%, respectively.

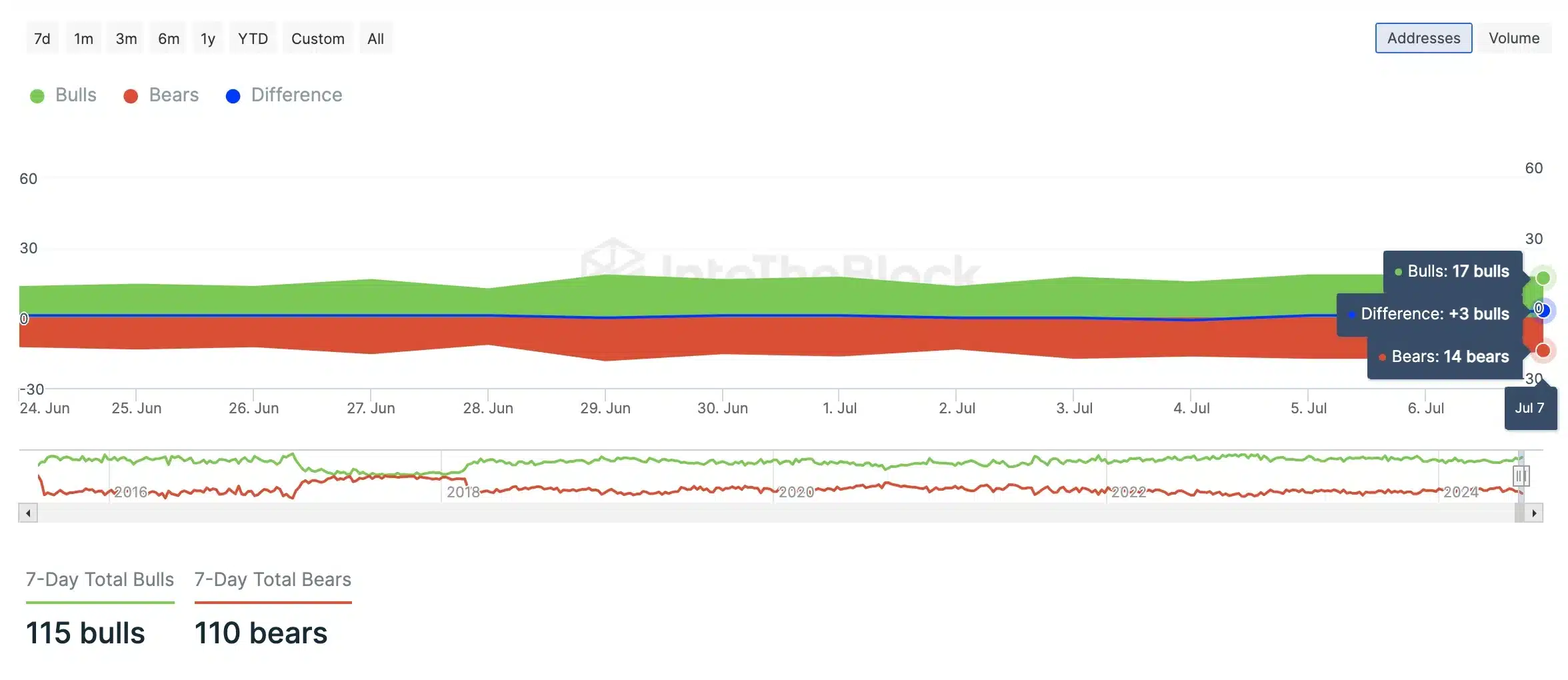

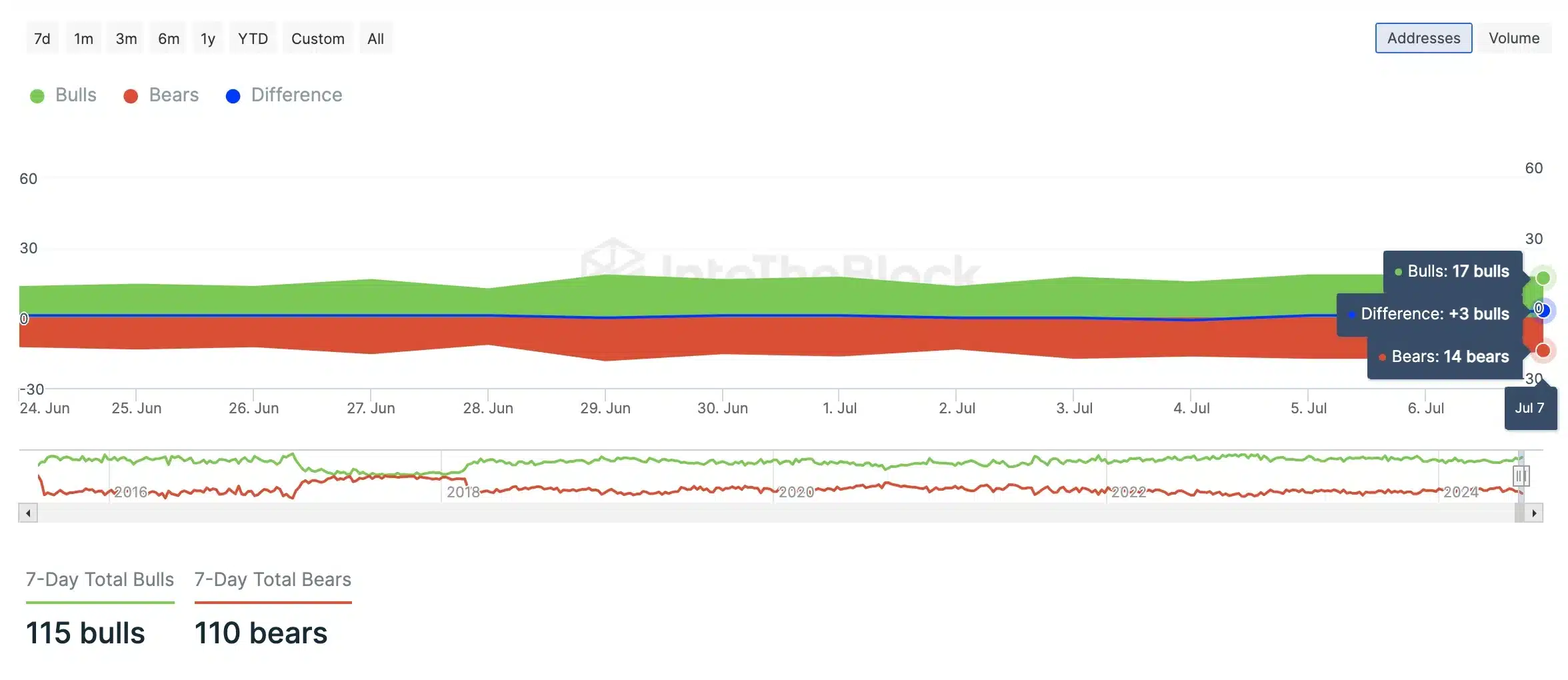

But despite the recent market decline, AMBCrypto’s analysis using IntoTheBlock data indicated that buying pressure continued to exceed selling pressure among bulls and bears.

Source: IntoTheBlock

Is crypto adoption on the rise?

Needless to say, the launch of Bitcoin ETFs has pushed Bitcoin into the spotlight. Of late, the king coin has attracted attention from Wall Street, major institutions, and the political sphere.

While this surge is often seen as a step forward for cryptocurrency adoption, it primarily revolves around Bitcoin rather than the broader crypto market.

Against this backdrop, Buterin’s recent actions could boost ETH adoption, especially considering investors’ losing interest in ETH fueled by the delay in ETH ETF approval by the SEC.

Vitalik Buterin’s financial influence

According to a recent report published by on-chain analytics firm Arkham Intelligence, Vitalik Buterin remains the largest individual holder of ETH.

His net worth has climbed from $552.86 million at the start of 2024 to $834.66 million.

His holdings of approximately 245,279 ETH fluctuate with Ethereum’s market prices.

During the 2021 bull market peak, ETH’s value propelled his net worth above $2 billion, though subsequent downturns in 2022 reduced it by about 75%.

Despite market volatility, Buterin’s strategic investments and pivotal role in Ethereum continue to solidify his financial influence.

- Buterin’s transfer amid market downturn sparked speculation on ETH’s sentiment impact.

- ETH held steady with moderate losses, contrasting sharply with other cryptocurrencies’ declines.

Ethereum [ETH] co-founder Vitalik Buterin sparked intense speculation within the crypto community with a significant transfer.

Many investors assumed that Buterin was making a strategic move or possibly selling some of his holdings.

Clearing the air around Buterin’s move

However, things got clear when Wu Blockchain shared more details.

Source: Wu Blockchain/X

Interestingly, Buterin’s move coincided with a broader market downturn, as the global crypto market cap hit $2.05 trillion at press time, down 2.67% in the past day.

Now, whether Buterin’s move will shift ETH’s market sentiment from bearish to bullish remains to be seen.

As of the latest update, the largest altcoin was trading at $2,946.55, reflecting a 1.98% decline over the past 24 hours.

This decline is relatively moderate compared to Bitcoin [BTC], which dropped by 2.40%. Solana [SOL] and Ripple [XRP] experienced declines exceeding 4% and 3%, respectively.

But despite the recent market decline, AMBCrypto’s analysis using IntoTheBlock data indicated that buying pressure continued to exceed selling pressure among bulls and bears.

Source: IntoTheBlock

Is crypto adoption on the rise?

Needless to say, the launch of Bitcoin ETFs has pushed Bitcoin into the spotlight. Of late, the king coin has attracted attention from Wall Street, major institutions, and the political sphere.

While this surge is often seen as a step forward for cryptocurrency adoption, it primarily revolves around Bitcoin rather than the broader crypto market.

Against this backdrop, Buterin’s recent actions could boost ETH adoption, especially considering investors’ losing interest in ETH fueled by the delay in ETH ETF approval by the SEC.

Vitalik Buterin’s financial influence

According to a recent report published by on-chain analytics firm Arkham Intelligence, Vitalik Buterin remains the largest individual holder of ETH.

His net worth has climbed from $552.86 million at the start of 2024 to $834.66 million.

His holdings of approximately 245,279 ETH fluctuate with Ethereum’s market prices.

During the 2021 bull market peak, ETH’s value propelled his net worth above $2 billion, though subsequent downturns in 2022 reduced it by about 75%.

Despite market volatility, Buterin’s strategic investments and pivotal role in Ethereum continue to solidify his financial influence.

order generic clomid online cost clomid for sale clomiphene price uk can i purchase clomid online cost generic clomid for sale can i order generic clomid without a prescription how to buy clomiphene

The thoroughness in this draft is noteworthy.

Thanks for putting this up. It’s okay done.

buy generic zithromax online – buy flagyl online metronidazole 400mg for sale

order generic semaglutide 14 mg – buy rybelsus online cheap periactin 4 mg

buy motilium generic – buy motilium sale cyclobenzaprine oral

buy amoxil pill – order valsartan 160mg generic buy combivent generic

augmentin 625mg without prescription – atbioinfo ampicillin tablet

esomeprazole for sale online – https://anexamate.com/ order nexium online

coumadin sale – cou mamide cozaar 25mg usa

mobic 15mg brand – moboxsin meloxicam 15mg over the counter

buy deltasone 40mg without prescription – allergic reactions generic deltasone 10mg

cheap amoxil – order amoxicillin generic how to buy amoxicillin

order fluconazole sale – buy diflucan generic buy fluconazole sale

order cenforce pill – cenforce usa cenforce 100mg pill

how to take liquid tadalafil – https://ciltadgn.com/ canadian online pharmacy no prescription cialis dapoxetine

pregnancy category for tadalafil – https://strongtadafl.com/# what doe cialis look like

buy ranitidine 300mg without prescription – https://aranitidine.com/ ranitidine 300mg uk

viagra sale durban – click viagra sale forum

This website absolutely has all of the tidings and facts I needed about this subject and didn’t positive who to ask. para que sirve clomid 50mg

I’ll certainly bring back to be familiar with more. https://buyfastonl.com/gabapentin.html

More posts like this would force the blogosphere more useful. https://ursxdol.com/azithromycin-pill-online/

This is the make of post I unearth helpful. https://prohnrg.com/product/loratadine-10-mg-tablets/

This is a topic which is in to my callousness… Many thanks! Unerringly where can I upon the acquaintance details due to the fact that questions? aranitidine.com

Thanks an eye to sharing. It’s first quality. https://ondactone.com/product/domperidone/

I’ll certainly bring back to read more.

buy esomeprazole 40mg generic

This is the amicable of topic I enjoy reading. http://ledyardmachine.com/forum/User-Toynck

cost forxiga 10 mg – https://janozin.com/ dapagliflozin 10 mg pills

order generic xenical – site xenical 60mg pills