- Ethereum whales accumulated $26M in ETH as dev activity surges and price shows early recovery.

- Vitalik warns against meme culture, urging developers to build meaningful apps atop Ethereum’s neutral base.

As Ethereum [ETH] once again tops the charts in development activity, a fresh wave of on-chain intrigue has emerged: An unidentified whale has quietly accumulated nearly $26 million worth of ETH.

The timing is striking. With Ethereum’s price hovering near the $1.6K mark and co-founder Vitalik Buterin doubling down on his criticism of meme-fueled crypto culture, questions are mounting.

Is this a calculated bet on the network’s long-term utility, or a signal that smart money is preparing for a rotation back into fundamentals?

Code is neutral, apps are not

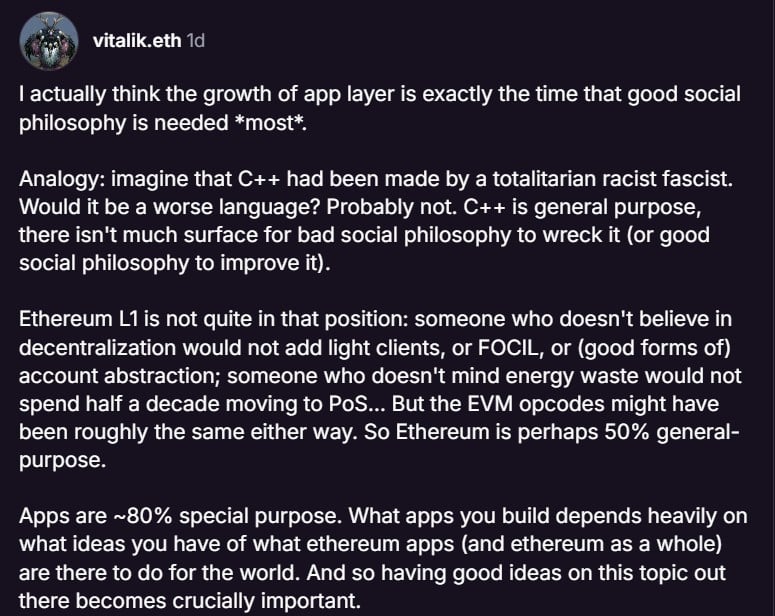

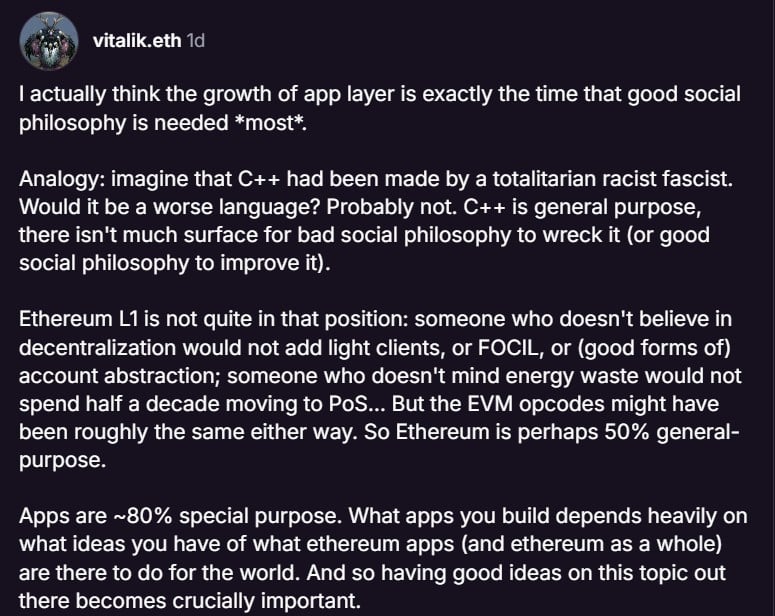

Buterin has sounded a timely warning: the rise of application-layer activity isn’t just a sign of progress – it’s a call for values.

In a recent post, he drew a sharp distinction between general-purpose infrastructure like Ethereum’s base layer and the highly ideological nature of apps built atop it.

While Ethereum’s core may remain structurally neutral, “apps are 80% special purpose,” he wrote, arguing that what developers choose to build reflects their beliefs about Ethereum’s role in the world.

Source: Warpcast

As memecoins dominate headlines, the message is clear: tech without vision is just noise.

Ethereum’s next move?

Source: X

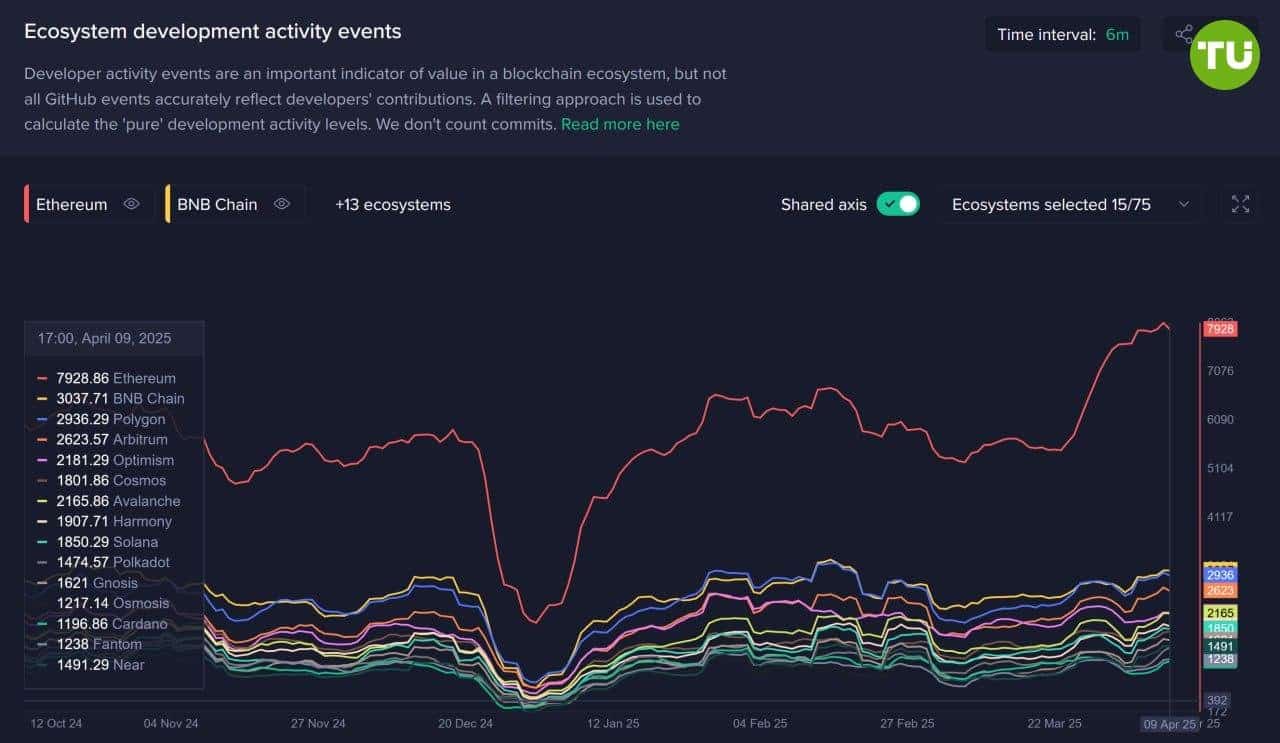

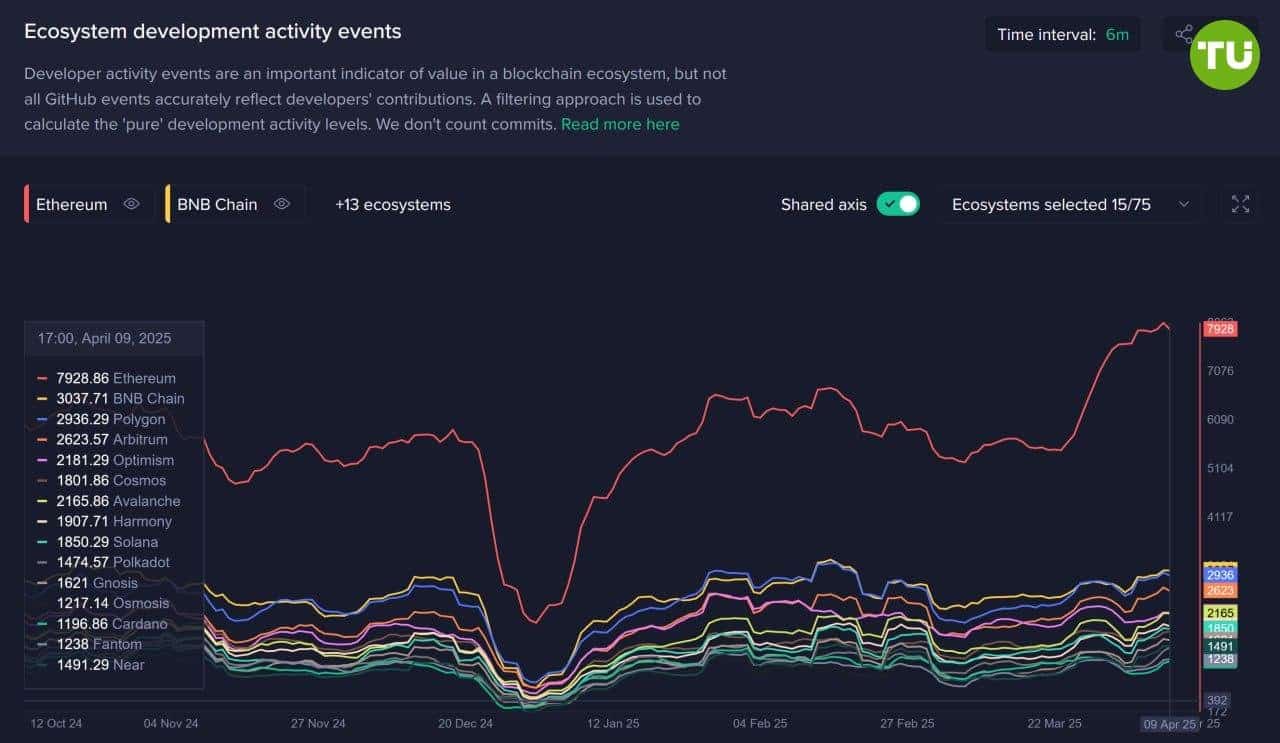

Although Ethereum’s price lags, its fundamentals present a contrasting narrative. Recent data reveals Ethereum’s dominance in crypto development.

It has recorded over 7,900 development events, significantly surpassing all other ecosystems. BNB Chain follows with 3,037 events, while Polygon[POL] recorded 2,639 events.

Source: X

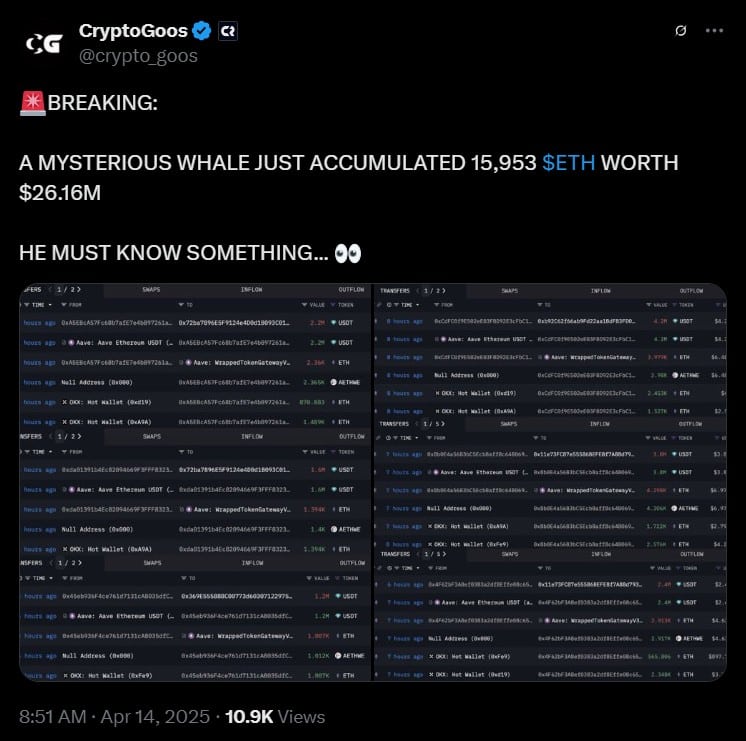

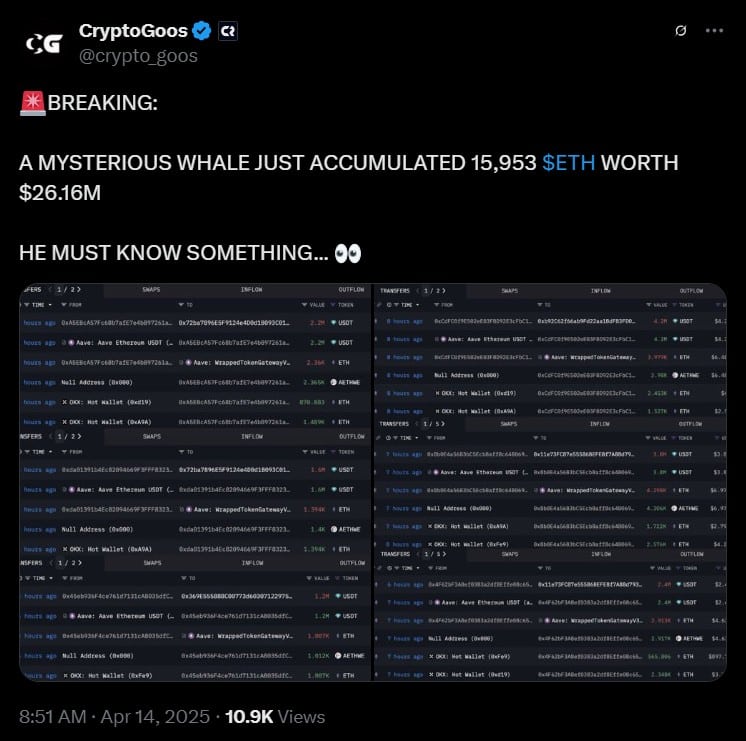

At the same time, a mysterious ETH whale has just made headlines by accumulating 15,953 ETH worth $26.16 million. The accumulation — split across Aave [AAVE] and OKX wallets – has raised eyebrows across the space, sparking speculation that there’s more to this than what meets the eye.

The timing is curious. With surging developer activity and a bold whale bet, some are wondering if ETH is quietly setting the stage for a breakout – regardless of its sluggish price.

Signs of a potential shift

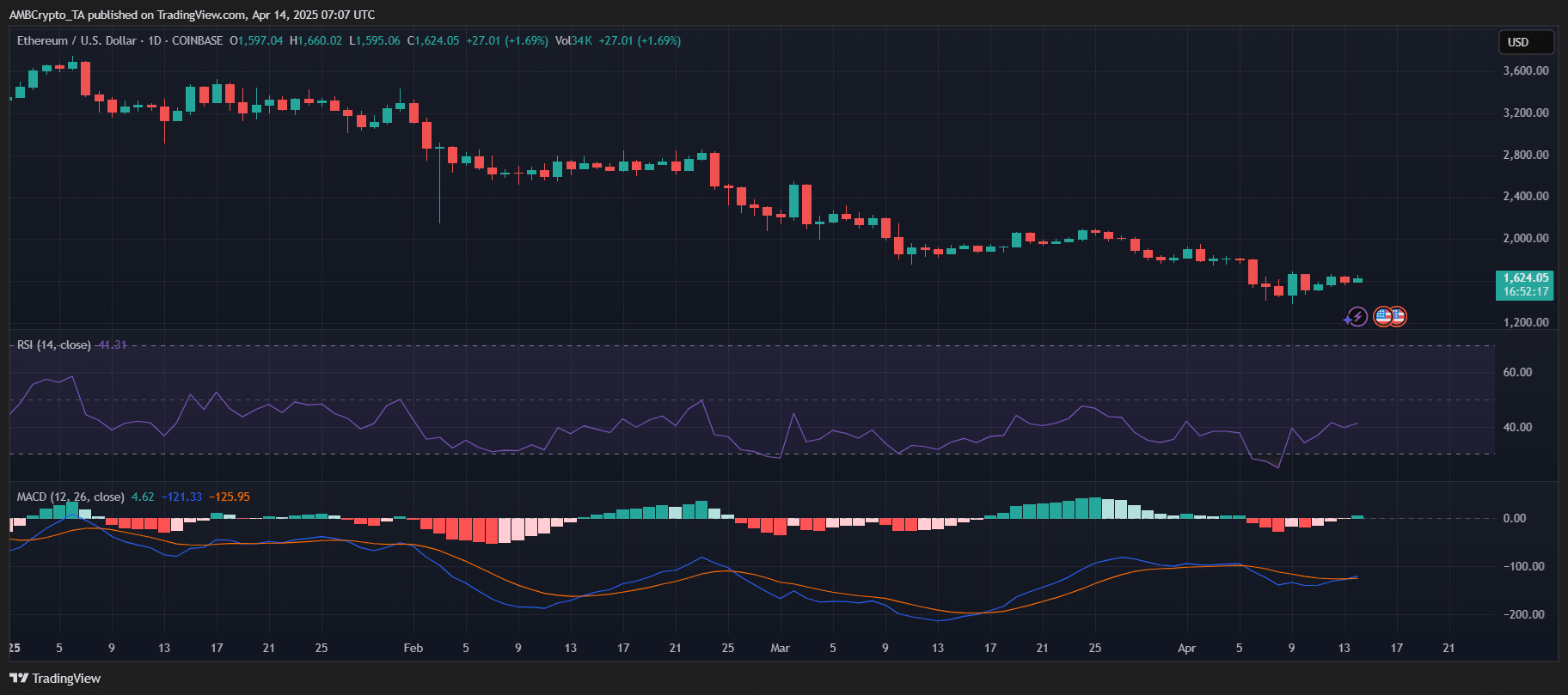

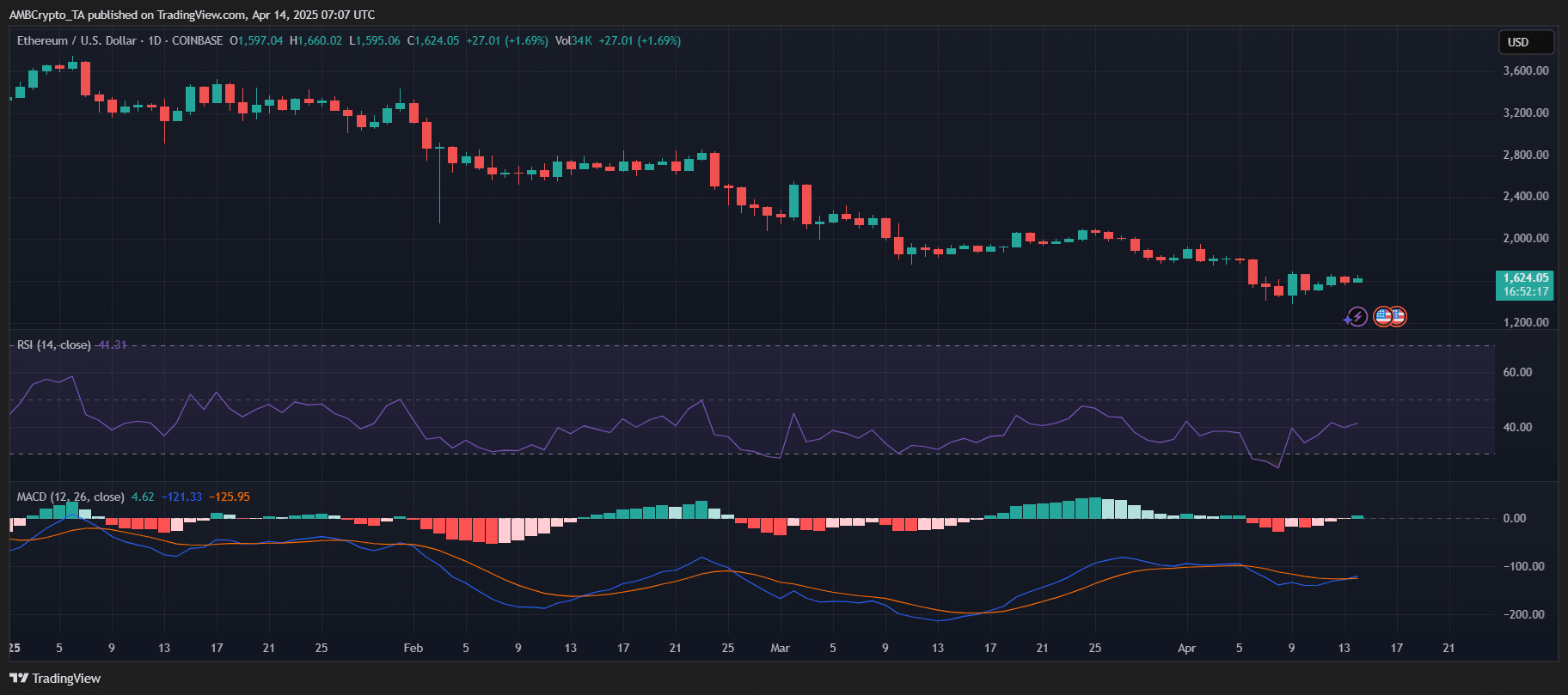

Trading at $1,624 at press time, ETH posted a 1.69% gain on the day. The RSI climbed to 44.31, reflecting recovering buying interest but still shy of bullish territory.

Meanwhile, the MACD showed narrowing bearish momentum, with the MACD line approaching a crossover above the signal line – a common precursor to trend reversals.

Source: TradingView

While not a definitive breakout, these technical signals suggest that Ethereum could be bottoming out. If supported by continued whale activity and development strength, a rally may not be far off.

- Ethereum whales accumulated $26M in ETH as dev activity surges and price shows early recovery.

- Vitalik warns against meme culture, urging developers to build meaningful apps atop Ethereum’s neutral base.

As Ethereum [ETH] once again tops the charts in development activity, a fresh wave of on-chain intrigue has emerged: An unidentified whale has quietly accumulated nearly $26 million worth of ETH.

The timing is striking. With Ethereum’s price hovering near the $1.6K mark and co-founder Vitalik Buterin doubling down on his criticism of meme-fueled crypto culture, questions are mounting.

Is this a calculated bet on the network’s long-term utility, or a signal that smart money is preparing for a rotation back into fundamentals?

Code is neutral, apps are not

Buterin has sounded a timely warning: the rise of application-layer activity isn’t just a sign of progress – it’s a call for values.

In a recent post, he drew a sharp distinction between general-purpose infrastructure like Ethereum’s base layer and the highly ideological nature of apps built atop it.

While Ethereum’s core may remain structurally neutral, “apps are 80% special purpose,” he wrote, arguing that what developers choose to build reflects their beliefs about Ethereum’s role in the world.

Source: Warpcast

As memecoins dominate headlines, the message is clear: tech without vision is just noise.

Ethereum’s next move?

Source: X

Although Ethereum’s price lags, its fundamentals present a contrasting narrative. Recent data reveals Ethereum’s dominance in crypto development.

It has recorded over 7,900 development events, significantly surpassing all other ecosystems. BNB Chain follows with 3,037 events, while Polygon[POL] recorded 2,639 events.

Source: X

At the same time, a mysterious ETH whale has just made headlines by accumulating 15,953 ETH worth $26.16 million. The accumulation — split across Aave [AAVE] and OKX wallets – has raised eyebrows across the space, sparking speculation that there’s more to this than what meets the eye.

The timing is curious. With surging developer activity and a bold whale bet, some are wondering if ETH is quietly setting the stage for a breakout – regardless of its sluggish price.

Signs of a potential shift

Trading at $1,624 at press time, ETH posted a 1.69% gain on the day. The RSI climbed to 44.31, reflecting recovering buying interest but still shy of bullish territory.

Meanwhile, the MACD showed narrowing bearish momentum, with the MACD line approaching a crossover above the signal line – a common precursor to trend reversals.

Source: TradingView

While not a definitive breakout, these technical signals suggest that Ethereum could be bottoming out. If supported by continued whale activity and development strength, a rally may not be far off.

Круглосуточная помощь

Узнать больше – капельница от запоя краснодар.

where can i get generic clomiphene without prescription how to get clomid price cheap clomid without a prescription how to buy generic clomid tablets where can i buy clomid without prescription clomid cost get clomid without insurance

This is the kind of delivery I turn up helpful.

I am actually delighted to glitter at this blog posts which consists of tons of profitable facts, thanks for providing such data.

buy azithromycin 500mg pills – ciprofloxacin online buy buy flagyl 400mg pills

buy semaglutide 14 mg generic – purchase semaglutide pills buy periactin sale

inderal 20mg cost – buy methotrexate 10mg sale order methotrexate 2.5mg without prescription

amoxil medication – cheap amoxil online order ipratropium

order augmentin generic – https://atbioinfo.com/ acillin brand

buy esomeprazole pills for sale – anexamate.com buy cheap nexium

buy medex online cheap – https://coumamide.com/ cozaar 50mg tablet

buy mobic cheap – swelling mobic drug

deltasone order – aprep lson buy deltasone online

best male ed pills – fastedtotake online ed pills

buy generic forcan – https://gpdifluca.com/# order fluconazole 100mg generic

cenforce 50mg tablet – order cenforce 100mg for sale buy cenforce 50mg online

is tadalafil and cialis the same thing? – cialis side effects tadalafil 40 mg with dapoxetine 60 mg

cialis 20mg tablets – https://strongtadafl.com/# cialis strength

ranitidine over the counter – https://aranitidine.com/ order ranitidine 150mg online cheap

buy viagra no prescription canada – how can i buy cheap viagra cheap viagra online canada

This website really has all of the bumf and facts I needed to this thesis and didn’t identify who to ask. click

More articles like this would pretence of the blogosphere richer. cost neurontin 800mg

The thoroughness in this draft is noteworthy. generic amoxicillin

I couldn’t turn down commenting. Well written! on this site

Thanks on putting this up. It’s evidently done. https://aranitidine.com/fr/sibelium/

This is the description of glad I take advantage of reading. https://ondactone.com/simvastatin/

Palatable blog you be undergoing here.. It’s obdurate to on strong calibre article like yours these days. I honestly appreciate individuals like you! Go through vigilance!!

buy sumatriptan 50mg sale

This website really has all of the low-down and facts I needed to this participant and didn’t know who to ask. http://zqykj.cn/bbs/home.php?mod=space&uid=302510

dapagliflozin 10 mg cost – https://janozin.com/# buy generic dapagliflozin over the counter