Leading asset manager VanEck plans to boost its investments into Bitcoin miners amid President Donald Trump’s pro-crypto push.

Throughout the run-up to the 2024 presidential elections and the days that have followed, President Donald Trump has made it abundantly clear that he intends to prioritize the U.S.’s competitive edge in technology, with a particular focus on crypto and artificial intelligence.

Unsurprisingly, investment firms are taking note.

VanEck Eyes Bitcoin Mining Equities

Amid President Donald Trump’s pro-crypto and AI push, $114 billion global asset manager VanEck is looking to invest more in Bitcoin miners.

The firm recently disclosed this, highlighting that Bitcoin mining firms occupied a unique position as a converging point for crypto and AI amid the energy demands of both industries and miners’ ability to repurpose energy from Bitcoin mining to AI computing.

As the AI industry grows, they expect miners towing this line to benefit significantly.

In preparation for some more Active Management in VanEck’s Bitcoin mining investments and other equities geared to the space, we’ve begun digging deeper into what makes these stocks move.

🧵 pic.twitter.com/9yneP0CvEv

— matthew sigel, recovering CFA (@matthew_sigel) January 27, 2025

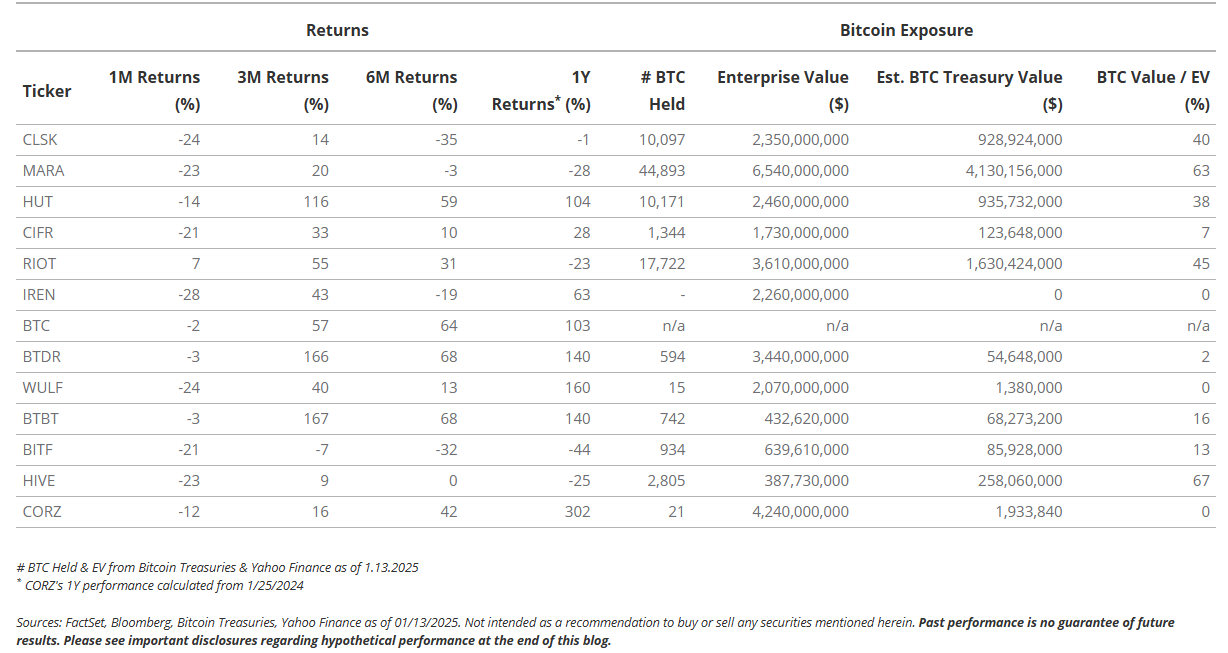

As highlighted by VanEck, the broader market also appears to share this perception as players like Core Scientific, Terawulf, and Hut 8, that have signaled pivots to offer compute power for AI, have generally outperformed players like Cleanspark and Marathon Digital, who have not signaled such pivots over the past year.

For example, Core Scientific stock posted a staggering 302% gain in the past year, while Marathon Digital’s shares saw a 28% decline.

Table showing returns of Bitcoin mining firms Source VanEck

Still, VanEck cautions that this market trend remains largely speculative, as most of these firms signaling AI expansions are only in the early stages of doing so.

VanEck has recently sounded significantly bullish on Bitcoin and crypto, predicting that the leading digital asset will one-day rival gold as a global monetary standard.

In the near term, the firm has tipped the asset to continue recording price gains as adoption grows, setting a price target of $170,000 for 2025.

![What Is Asset Tokenization? Types, Why It Matters Now [2025]](https://coininsights.com/wp-content/uploads/2025/05/asset_tokenization-360x180.png)

where can i buy cheap clomiphene pill cost generic clomiphene prices how can i get cheap clomiphene without dr prescription buy cheap clomiphene tablets clomid generic name can i order generic clomiphene prices where to buy clomiphene pill

This is the description of content I get high on reading.

Palatable blog you possess here.. It’s intricate to assign great status writing like yours these days. I honestly respect individuals like you! Go through guardianship!!

order azithromycin 250mg – azithromycin tablet metronidazole 200mg ca

rybelsus without prescription – order rybelsus 14mg for sale buy generic periactin over the counter