- UNI faced rejection at the $12.85 mark, just below the $13.1 liquidity pocket.

- A move below $10 was likely, but traders should beware of volatility.

Uniswap [UNI] registered an 81% move higher on the 23rd of February, measured from the day’s low to high.

This came after a proposal to overhaul the governance system was submitted by the Uniswap Foundation’s Governance lead, Erin Koen.

AMBCrypto reported that the token was likely to rally toward $13.1, and the 24th of February saw UNI reach $12.85. This was a major pocket of liquidity, and the bulls were temporarily rebuffed.

Where are the prices likely to go next?

The fair value gap could see history repeated

The cyan channel from $3.65 to $7.7 represented a range formation on the weekly chart. In November, UNI broke out past the mid-range level at $5.3, forming a fair value gap (FVG, lower white box).

This region was retested multiple times in recent months as support, but UNI did not close a daily session beneath 50% of the FVG’s width.

Similarly, Uniswap’s recent rally to $12.85 formed a large FVG, or imbalance. The 50% mark for this imbalance stood at $9.22. A retracement to this support would present an ideal buying opportunity.

Swing traders must be prepared for volatility, though. Even a plunge as low as $7 would be considered to be within the demand zone.

The RSI and the market structure were firmly bullish. However, the OBV retraced all the gains made. It is not a signal of a reversal by itself, but it suggests that the bulls have run out of steam, at least for the moment.

Profit-taking activity could pull UNI prices lower

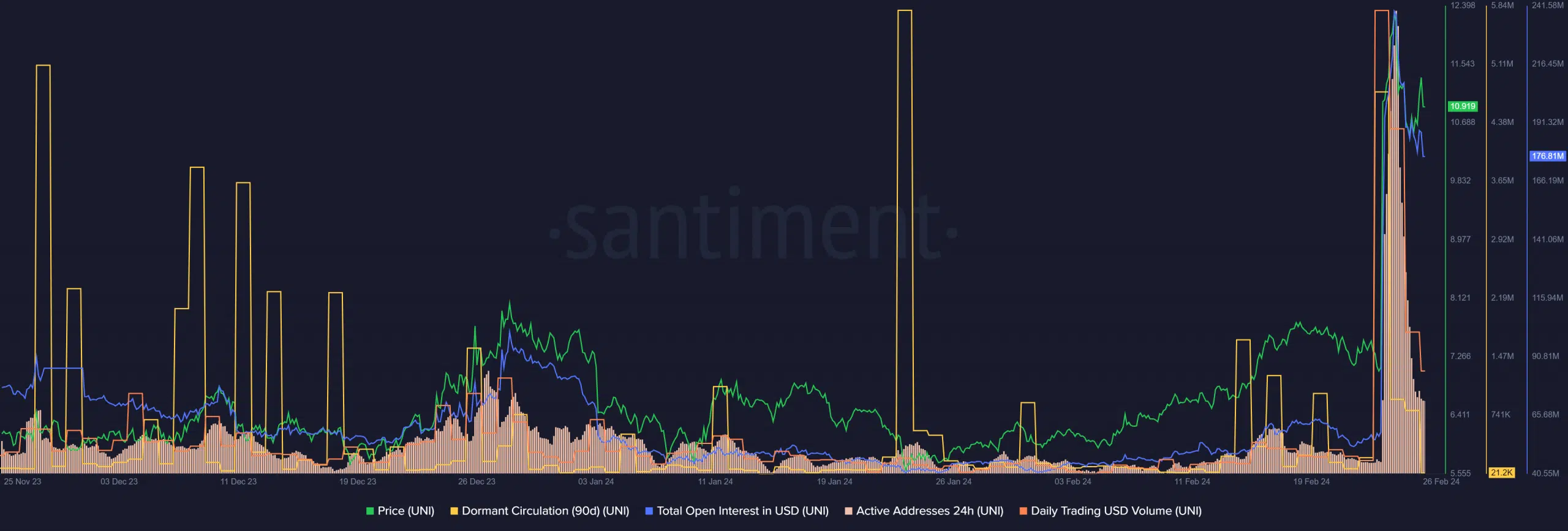

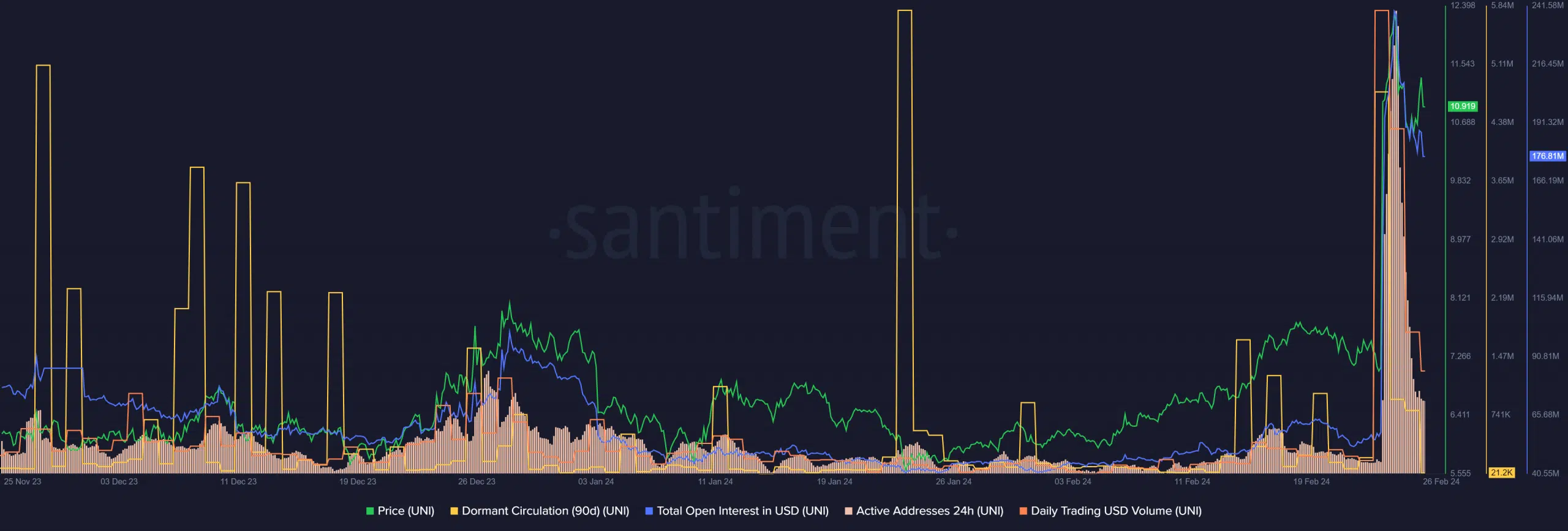

Source: Santiment

The total Open Interest and the daily trading volume saw huge spikes on the 23rd of February. This was a sign that genuine demand and FOMO was behind the rally.

Also, at press time, the OI had fallen from $239 million at the peak to $176 million. This could be a result of late longs being liquidated.

Speculators might thus want to be wary of volatility in the UNI market and could be better off waiting for a lower timeframe range formation.

Is your portfolio green? Check the Uniswap Profit Calculator

The active addresses also surged and have fallen dramatically, but remained far higher than the early February lows.

The dormant circulation surge suggested that holders were active in booking profits and selling their UNI tokens.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- UNI faced rejection at the $12.85 mark, just below the $13.1 liquidity pocket.

- A move below $10 was likely, but traders should beware of volatility.

Uniswap [UNI] registered an 81% move higher on the 23rd of February, measured from the day’s low to high.

This came after a proposal to overhaul the governance system was submitted by the Uniswap Foundation’s Governance lead, Erin Koen.

AMBCrypto reported that the token was likely to rally toward $13.1, and the 24th of February saw UNI reach $12.85. This was a major pocket of liquidity, and the bulls were temporarily rebuffed.

Where are the prices likely to go next?

The fair value gap could see history repeated

The cyan channel from $3.65 to $7.7 represented a range formation on the weekly chart. In November, UNI broke out past the mid-range level at $5.3, forming a fair value gap (FVG, lower white box).

This region was retested multiple times in recent months as support, but UNI did not close a daily session beneath 50% of the FVG’s width.

Similarly, Uniswap’s recent rally to $12.85 formed a large FVG, or imbalance. The 50% mark for this imbalance stood at $9.22. A retracement to this support would present an ideal buying opportunity.

Swing traders must be prepared for volatility, though. Even a plunge as low as $7 would be considered to be within the demand zone.

The RSI and the market structure were firmly bullish. However, the OBV retraced all the gains made. It is not a signal of a reversal by itself, but it suggests that the bulls have run out of steam, at least for the moment.

Profit-taking activity could pull UNI prices lower

Source: Santiment

The total Open Interest and the daily trading volume saw huge spikes on the 23rd of February. This was a sign that genuine demand and FOMO was behind the rally.

Also, at press time, the OI had fallen from $239 million at the peak to $176 million. This could be a result of late longs being liquidated.

Speculators might thus want to be wary of volatility in the UNI market and could be better off waiting for a lower timeframe range formation.

Is your portfolio green? Check the Uniswap Profit Calculator

The active addresses also surged and have fallen dramatically, but remained far higher than the early February lows.

The dormant circulation surge suggested that holders were active in booking profits and selling their UNI tokens.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

![What Is Asset Tokenization? Types, Why It Matters Now [2025]](https://coininsights.com/wp-content/uploads/2025/05/asset_tokenization-360x180.png)

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

buy cheap clomid without prescription can i get generic clomiphene prices clomid contraindications clomid chart clomid usa buying clomiphene tablets buying generic clomid price

I’ll certainly carry back to read more.

buy cheap generic azithromycin – metronidazole us buy metronidazole 200mg

buy semaglutide sale – where can i buy cyproheptadine periactin online order

order motilium 10mg generic – buy sumycin generic order flexeril 15mg pill

buy inderal 10mg – clopidogrel usa cheap methotrexate 10mg

order amoxil generic – order ipratropium 100 mcg online cheap order ipratropium 100 mcg generic