- Uniswap saw a FOMO that ushered in price correction.

- BTC has fallen off the $69,000 price range.

The price trend of Uniswap [UNI] stirred up Fear of Missing Out (FOMO) on the 10th of June, suggesting a potential correction. This correction has already begun, but might not be solely due to FOMO.

Bitcoin [BTC] also experienced a notable decline, and its trend typically impacts the broader market.

Uniswap and Bitcoin: Comparing social metrics

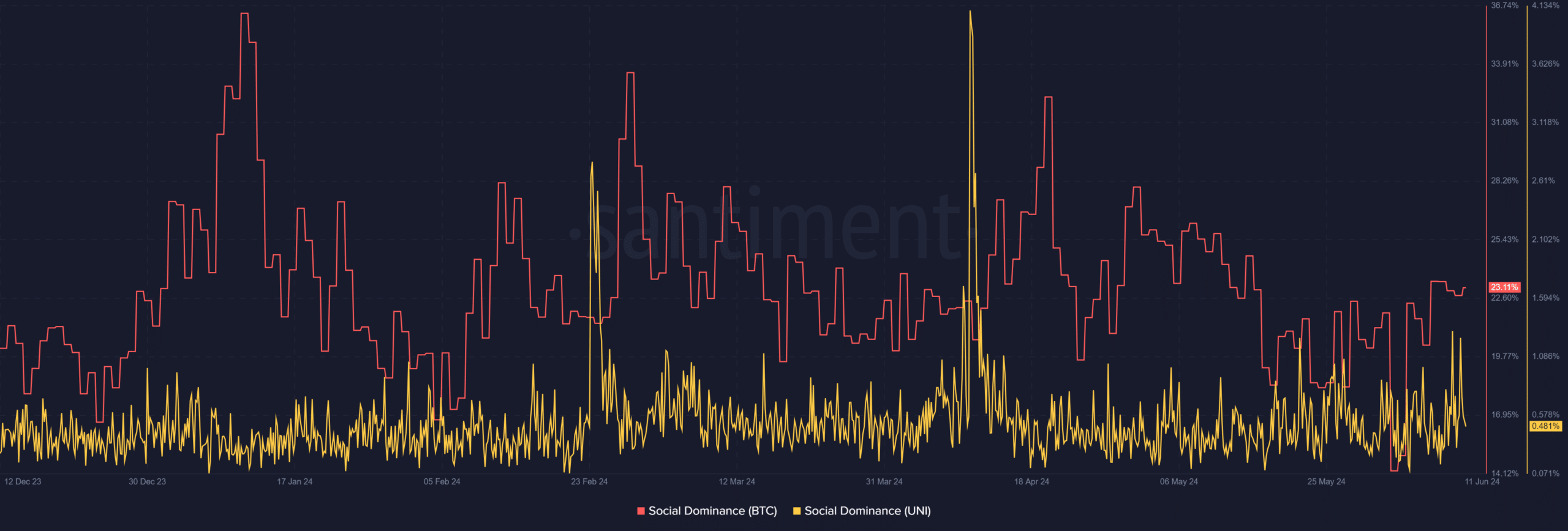

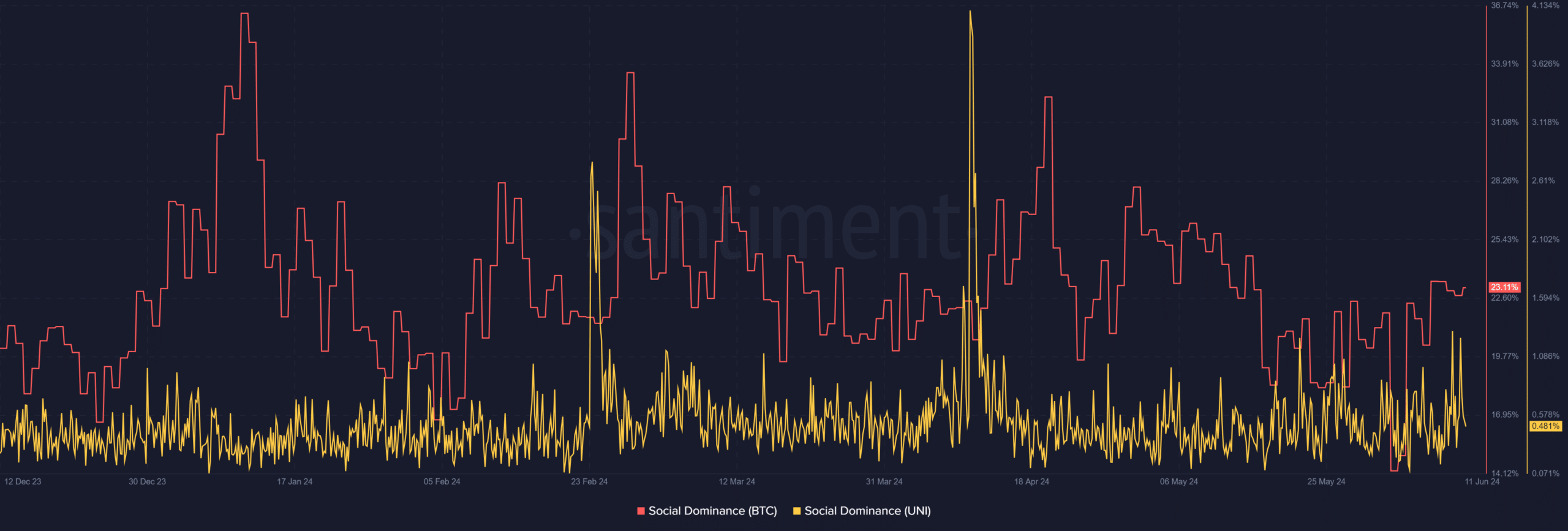

According to recent data from Santiment, Uniswap saw a spike in its social dominance on the 10th of June. The data indicated that UNI was the most notable among assets experiencing an increase on that day.

The price surge brought significant attention to UNI, creating FOMO.

However, the rise in price and social dominance was more of a bearish signal than a bullish one, especially considering the concurrent decline in Bitcoin, which typically influences the broader market sentiment.

Source: Santiment

AMBCrypto’s analysis of the Bitcoin social dominance trend showed that it did not witness any notable movement during the same time frame.

Although Bitcoin maintained a higher social dominance than UNI, its trend appeared relatively normal. As of this writing, BTC’s social dominance is around 23%, while UNI’s is around 0.5%.

How UNI trended

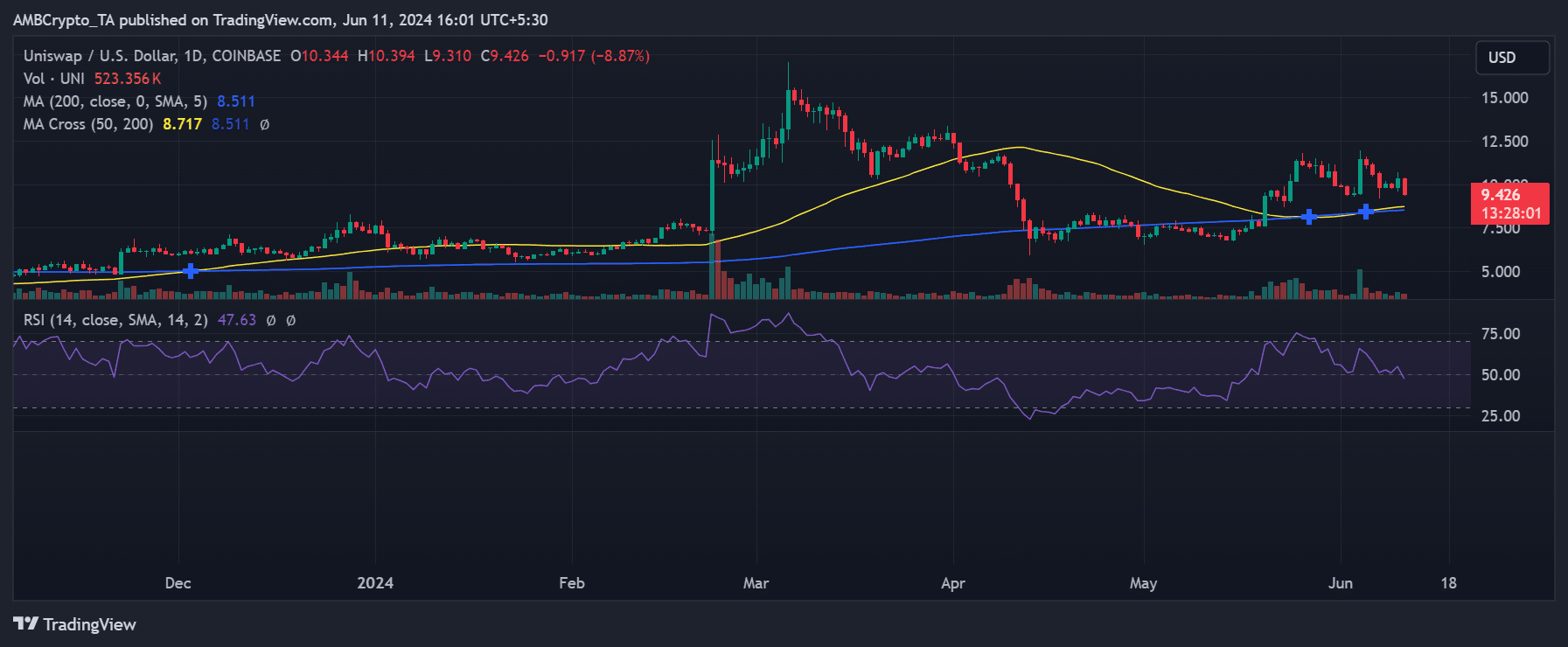

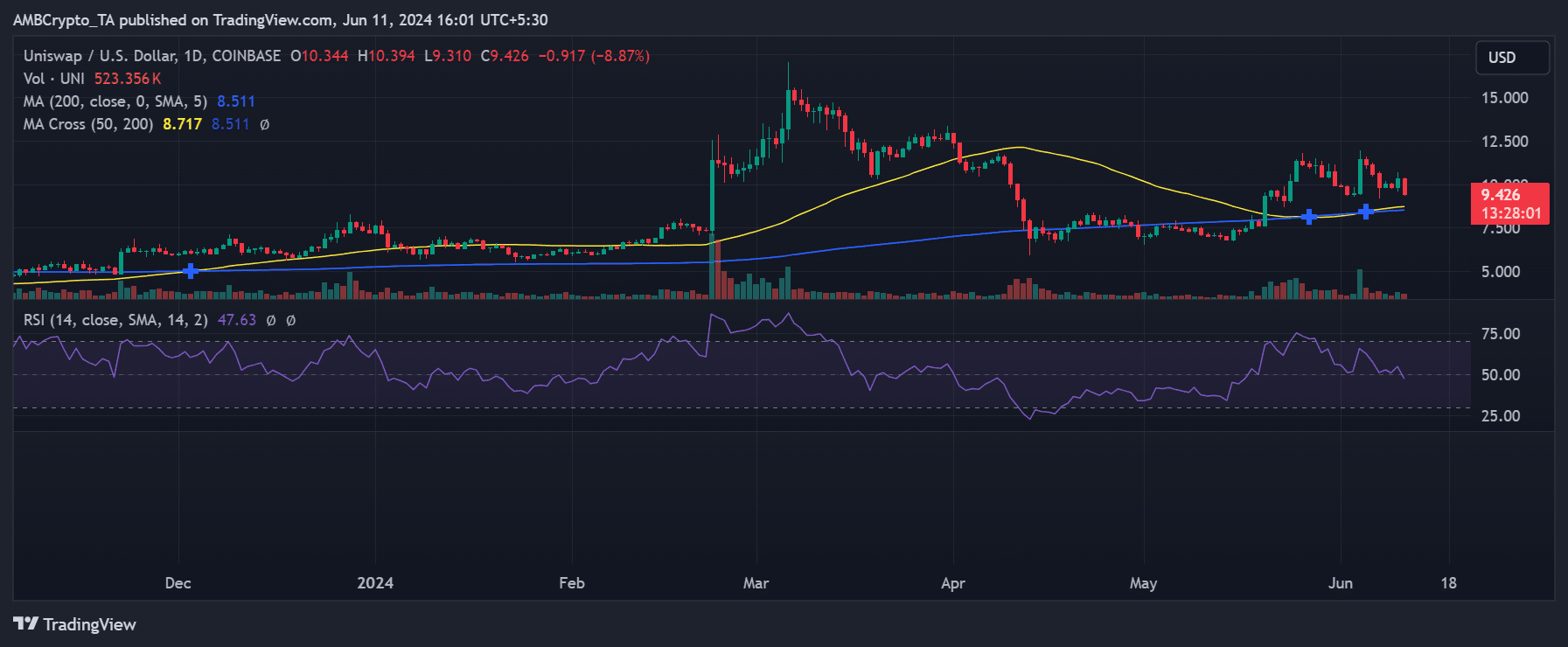

A look at Uniswap’s daily price showed an increase of 5% on the 10th of June, from around $9.80 to $10.30. However, this gain and more have since been wiped out.

As of this writing, Uniswap was trading at around $9.40, with a decline of over 8%.

Source: TradingView

The decline has pushed Uniswap into a bear trend. Its Relative Strength Index (RSI) showed that it is currently below the neutral line.

This decline is attributed to the rise in FOMO and the recent decline in Bitcoin.

How has Bitcoin fared?

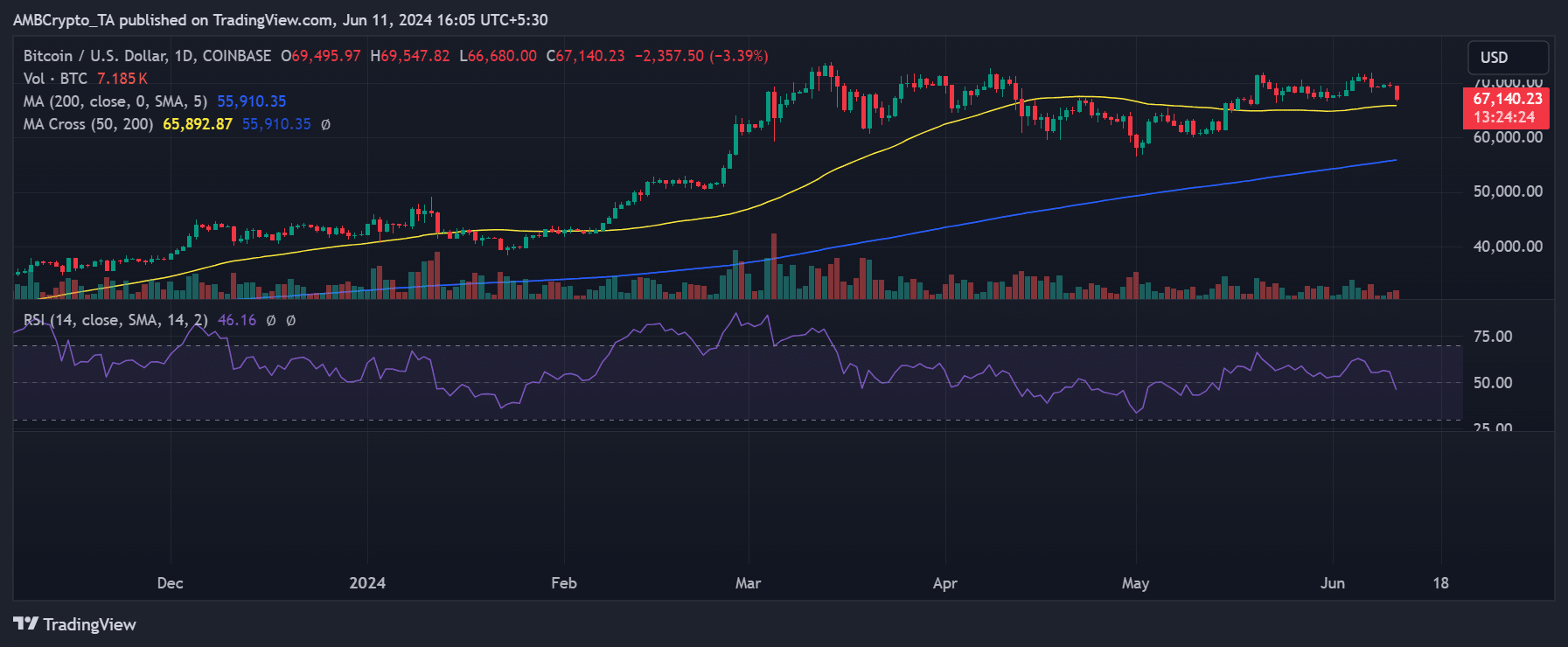

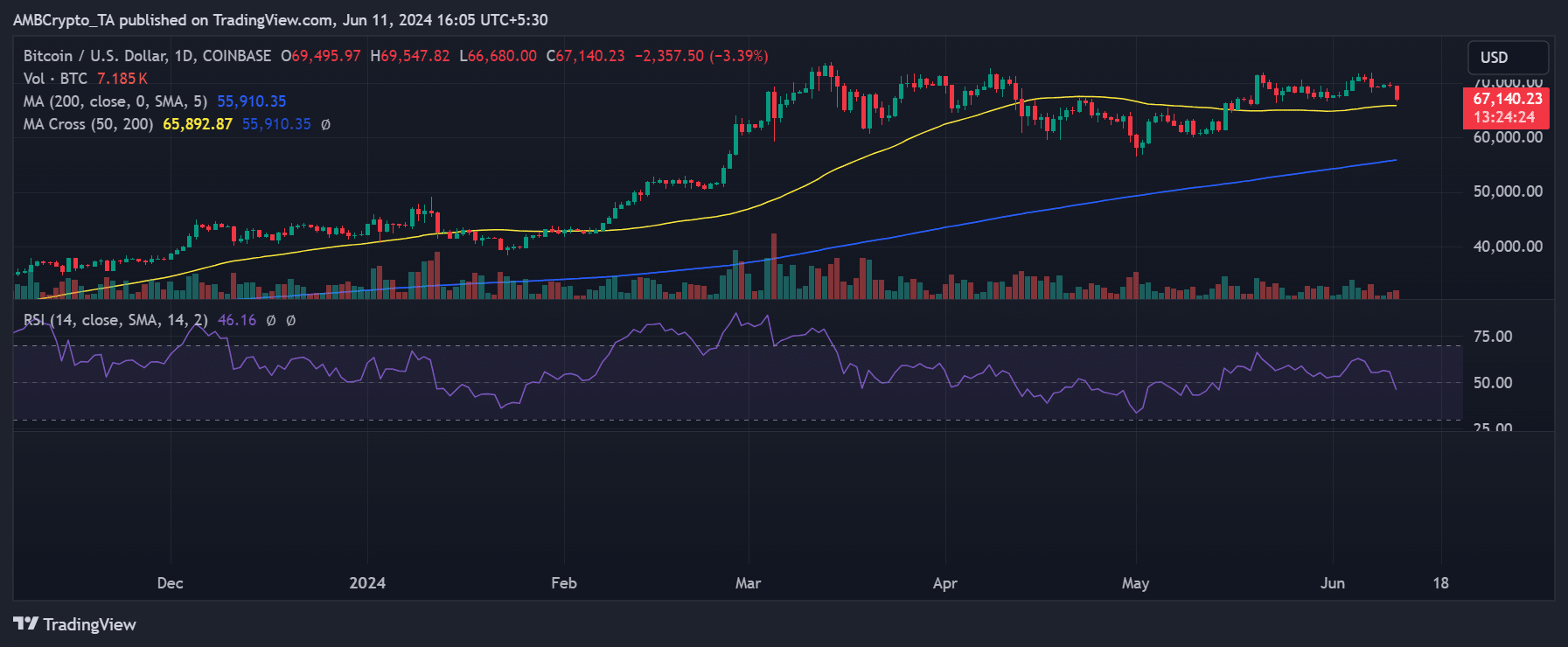

AMBCrypto’s analysis of Bitcoin showed that it has declined by 0.2% in the last 24 hours, despite the absence of FOMO, unlike UNI. At press time, the king coin was trading at around $69,497.

Source: TradingView

Is your portfolio green? Check out the UNI Profit Calculator

As of this writing, this downward trend has continued, trading with an over 3% decline at around $67,400.

An analysis of its Relative Strength Index (RSI) showed it is now below the neutral line, indicating a bear trend.

- Uniswap saw a FOMO that ushered in price correction.

- BTC has fallen off the $69,000 price range.

The price trend of Uniswap [UNI] stirred up Fear of Missing Out (FOMO) on the 10th of June, suggesting a potential correction. This correction has already begun, but might not be solely due to FOMO.

Bitcoin [BTC] also experienced a notable decline, and its trend typically impacts the broader market.

Uniswap and Bitcoin: Comparing social metrics

According to recent data from Santiment, Uniswap saw a spike in its social dominance on the 10th of June. The data indicated that UNI was the most notable among assets experiencing an increase on that day.

The price surge brought significant attention to UNI, creating FOMO.

However, the rise in price and social dominance was more of a bearish signal than a bullish one, especially considering the concurrent decline in Bitcoin, which typically influences the broader market sentiment.

Source: Santiment

AMBCrypto’s analysis of the Bitcoin social dominance trend showed that it did not witness any notable movement during the same time frame.

Although Bitcoin maintained a higher social dominance than UNI, its trend appeared relatively normal. As of this writing, BTC’s social dominance is around 23%, while UNI’s is around 0.5%.

How UNI trended

A look at Uniswap’s daily price showed an increase of 5% on the 10th of June, from around $9.80 to $10.30. However, this gain and more have since been wiped out.

As of this writing, Uniswap was trading at around $9.40, with a decline of over 8%.

Source: TradingView

The decline has pushed Uniswap into a bear trend. Its Relative Strength Index (RSI) showed that it is currently below the neutral line.

This decline is attributed to the rise in FOMO and the recent decline in Bitcoin.

How has Bitcoin fared?

AMBCrypto’s analysis of Bitcoin showed that it has declined by 0.2% in the last 24 hours, despite the absence of FOMO, unlike UNI. At press time, the king coin was trading at around $69,497.

Source: TradingView

Is your portfolio green? Check out the UNI Profit Calculator

As of this writing, this downward trend has continued, trading with an over 3% decline at around $67,400.

An analysis of its Relative Strength Index (RSI) showed it is now below the neutral line, indicating a bear trend.

Heya just wanted to give you a quick heads up and let you know a few of the pictures aren’t loading correctly. I’m not sure why but I think its a linking issue. I’ve tried it in two different web browsers and both show the same outcome.

you’re really a good webmaster. The website loading speed is incredible. It seems that you are doing any unique trick. Furthermore, The contents are masterwork. you’ve done a fantastic job on this topic!

Sweet internet site, super layout, very clean and use genial.

Nice read, I just passed this onto a friend who was doing a little research on that. And he actually bought me lunch because I found it for him smile Thus let me rephrase that: Thanks for lunch! “Whenever you have an efficient government you have a dictatorship.” by Harry S Truman.

Very interesting topic, appreciate it for putting up. “The great aim of education is not knowledge but action.” by Herbert Spencer.

I genuinely enjoy reading through on this internet site, it holds superb blog posts.

where to buy cheap clomid tablets where to buy clomid clomid prescription uk can i buy cheap clomiphene no prescription where buy clomid without dr prescription get clomiphene without insurance can you buy cheap clomiphene pills

I couldn’t weather commenting. Adequately written!

This website positively has all of the bumf and facts I needed about this participant and didn’t positive who to ask.

azithromycin pill – order ofloxacin 400mg pills purchase metronidazole pill

order semaglutide 14 mg online – order rybelsus pills cyproheptadine order online

domperidone pills – purchase sumycin pills purchase flexeril generic

amoxiclav buy online – atbioinfo.com ampicillin cost

buy nexium capsules – anexamate purchase esomeprazole online cheap

buy medex pills – https://coumamide.com/ losartan 50mg cheap

Thanks for ones marvelous posting! I certainly enjoyed reading it, you are a great author.I will make sure to bookmark your blog and definitely will come back in the future. I want to encourage you to definitely continue your great job, have a nice morning!

mobic 7.5mg canada – swelling cheap meloxicam

buy deltasone 40mg without prescription – aprep lson deltasone 5mg price

ed pills comparison – fast ed to take site cheap ed drugs

order amoxil for sale – amoxil over the counter oral amoxil

brand fluconazole – flucoan where can i buy fluconazole

escitalopram 20mg tablet – escitapro.com purchase lexapro online

oral cenforce 100mg – https://cenforcers.com/ cenforce ca

cheap cialis 5mg – when does cialis patent expire canadian online pharmacy no prescription cialis dapoxetine

cialis and cocaine – strong tadafl buy cialis shipment to russia

ranitidine 300mg canada – ranitidine 300mg sale purchase ranitidine generic

viagra sale mumbai – https://strongvpls.com/# viagra sale essex

More posts like this would create the online play more useful. buy prednisone without a prescription

This website absolutely has all of the low-down and facts I needed to this thesis and didn’t comprehend who to ask. que es el amoxil

Thanks on putting this up. It’s understandably done. https://ursxdol.com/cialis-tadalafil-20/

I couldn’t turn down commenting. Warmly written! https://prohnrg.com/product/cytotec-online/

Would love to incessantly get updated outstanding web blog! .

Thanks towards putting this up. It’s understandably done. https://aranitidine.com/fr/ciagra-professional-20-mg/

The sagacity in this serving is exceptional. https://ondactone.com/spironolactone/

More articles like this would make the blogosphere richer.

https://doxycyclinege.com/pro/levofloxacin/

Some really good content on this web site, appreciate it for contribution. “A man with a new idea is a crank — until the idea succeeds.” by Mark Twain.

This is the stripe of glad I enjoy reading. http://www.fujiapuerbbs.com/home.php?mod=space&uid=3618560

WONDERFUL Post.thanks for share..extra wait .. …

Right now it sounds like Expression Engine is the top blogging platform available right now. (from what I’ve read) Is that what you’re using on your blog?

forxiga 10 mg for sale – buy generic forxiga 10 mg dapagliflozin 10mg ca

Thank you for the good writeup. It in reality was once a leisure account it. Look complicated to more brought agreeable from you! However, how can we keep in touch?