- Analyst have downplayed the long-term positive impact of the U.S. BTC ETF.

- Instead, the analyst viewed the BTC ETFs as benefiting TradFi and a threat to DeFi.

Bitcoin [BTC] went from around $40K to a new all-time of $73.7K on the back of the approval of U.S. spot BTC ETFs.

The massive flows from institutions through the ETFs have been long viewed as a bullish catalyst for BTC price action.

However, Jim Bianco, a macro investment research analyst, downplayed the ETFs’ ‘bullish’ catalyst narrative.

Instead, Bianco termed the BTC ETFs as ‘pulling the money off-chain’ into TradFi, especially in Q1.

“My other concern was that these instruments (ETFs) would not lead to on-chain adoption but instead drag money back into the TradFi world. $COIN Q1 earnings offered hints this might be the case. Coinbase revenue surges to $1.64 billion – But retail volume just 50% of 2021 levels”

According to Bianco, the Q1 BTC ETF trend was ‘pulling money off-chain into the Tradfi world’ and could undermine a new DeFi system.

Bianco’s bearish take on U.S. Bitcoin ETFs

Bianco’s bearish stance on U.S. BTC ETF contradicted Michael Saylor and Bitwise CIO Matt Hougan’s positions.

For his part, Michael Saylor viewed U.S. BTC ETFs as a way to move capital from TradFi into digital assets, fueling BTC’s competitiveness.

Similarly, Hougan, based on the 13F filings, noted that large firms bought $10.7 billion of the U.S. BTC ETFs in Q1. To Hougan, the amount was a ‘down payment,’ and he expected more to come.

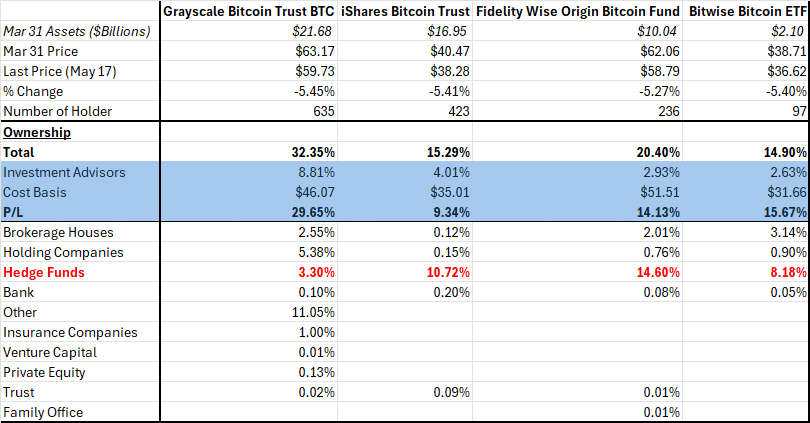

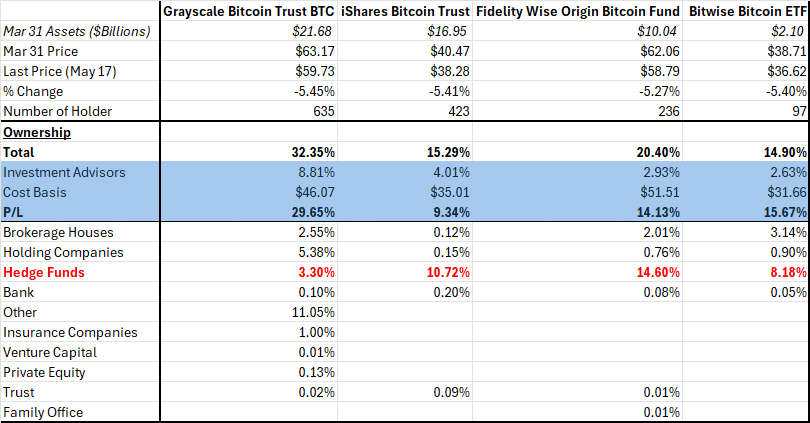

However, Bianco took a contrarian position and cited two other factors for his argument. Notably, investment advisors’ holdings of BTC ETF in Q1 were below average to inspire the bullish catalyst narrative.

“They (Investment advisors) are very small, between 2.5% and 4% (and 8.81% for $GBTC). A recent Citi report says the AVERAGE ETF is about 35% owned by investment advisors.”

Source: X/Jim Bianco

He also claimed that BTC ETFs aren’t recording massive demand as expected, and the long-term impact of BTC ETFs could have been far-fetched.

“If anything, it is concerning that the headlong rush into Spot BTC ETFs “only” drove this price back to the old high (of November 2021) and not $100k.”

In the meantime, BTC’s short-term recovery eased near the supply area below $68K. Should bulls clear the hurdle, an extended recovery to the range-high of $71K could be feasible.

- Analyst have downplayed the long-term positive impact of the U.S. BTC ETF.

- Instead, the analyst viewed the BTC ETFs as benefiting TradFi and a threat to DeFi.

Bitcoin [BTC] went from around $40K to a new all-time of $73.7K on the back of the approval of U.S. spot BTC ETFs.

The massive flows from institutions through the ETFs have been long viewed as a bullish catalyst for BTC price action.

However, Jim Bianco, a macro investment research analyst, downplayed the ETFs’ ‘bullish’ catalyst narrative.

Instead, Bianco termed the BTC ETFs as ‘pulling the money off-chain’ into TradFi, especially in Q1.

“My other concern was that these instruments (ETFs) would not lead to on-chain adoption but instead drag money back into the TradFi world. $COIN Q1 earnings offered hints this might be the case. Coinbase revenue surges to $1.64 billion – But retail volume just 50% of 2021 levels”

According to Bianco, the Q1 BTC ETF trend was ‘pulling money off-chain into the Tradfi world’ and could undermine a new DeFi system.

Bianco’s bearish take on U.S. Bitcoin ETFs

Bianco’s bearish stance on U.S. BTC ETF contradicted Michael Saylor and Bitwise CIO Matt Hougan’s positions.

For his part, Michael Saylor viewed U.S. BTC ETFs as a way to move capital from TradFi into digital assets, fueling BTC’s competitiveness.

Similarly, Hougan, based on the 13F filings, noted that large firms bought $10.7 billion of the U.S. BTC ETFs in Q1. To Hougan, the amount was a ‘down payment,’ and he expected more to come.

However, Bianco took a contrarian position and cited two other factors for his argument. Notably, investment advisors’ holdings of BTC ETF in Q1 were below average to inspire the bullish catalyst narrative.

“They (Investment advisors) are very small, between 2.5% and 4% (and 8.81% for $GBTC). A recent Citi report says the AVERAGE ETF is about 35% owned by investment advisors.”

Source: X/Jim Bianco

He also claimed that BTC ETFs aren’t recording massive demand as expected, and the long-term impact of BTC ETFs could have been far-fetched.

“If anything, it is concerning that the headlong rush into Spot BTC ETFs “only” drove this price back to the old high (of November 2021) and not $100k.”

In the meantime, BTC’s short-term recovery eased near the supply area below $68K. Should bulls clear the hurdle, an extended recovery to the range-high of $71K could be feasible.

Hi there,

My name is Mike from Monkey Digital,

Allow me to present to you a lifetime revenue opportunity of 35%

That’s right, you can earn 35% of every order made by your affiliate for life.

Simply register with us, generate your affiliate links, and incorporate them on your website, and you are done. It takes only 5 minutes to set up everything, and the payouts are sent each month.

Click here to enroll with us today:

https://www.monkeydigital.org/affiliate-dashboard/

Think about it,

Every website owner requires the use of search engine optimization (SEO) for their website. This endeavor holds significant potential for both parties involved.

Thanks and regards

Mike Nash

Monkey Digital

can you get clomid without insurance where can i get cheap clomid price can i get generic clomiphene without rx can i get clomiphene for sale can i order clomiphene without insurance where to buy generic clomiphene without prescription clomid prices in south africa

More articles like this would pretence of the blogosphere richer.

More posts like this would make the blogosphere more useful.

order azithromycin online – buy ofloxacin no prescription buy metronidazole pills

buy rybelsus 14mg generic – semaglutide cheap buy periactin 4mg generic

where can i buy domperidone – buy domperidone cheap buy cyclobenzaprine online cheap

how to get amoxicillin without a prescription – order valsartan 160mg online cheap ipratropium 100mcg canada

order zithromax for sale – order bystolic for sale bystolic 20mg ca

amoxiclav for sale – atbioinfo.com purchase ampicillin generic

esomeprazole brand – nexiumtous buy esomeprazole cheap

warfarin cheap – blood thinner losartan online buy

order meloxicam 15mg online – https://moboxsin.com/ order mobic 15mg online

prednisone 20mg drug – https://apreplson.com/ deltasone 5mg oral

buy generic amoxil for sale – comba moxi cheap amoxil generic

fluconazole 100mg pills – diflucan tablet brand diflucan 100mg

oral cenforce 100mg – https://cenforcers.com/# buy cenforce medication

where can i buy cialis online in canada – https://ciltadgn.com/ evolution peptides tadalafil

cheap zantac 150mg – https://aranitidine.com/# order zantac 300mg

buy cialis online in austalia – e20 pill cialis where to buy cialis over the counter

This is a question which is near to my verve… Myriad thanks! Unerringly where can I upon the acquaintance details due to the fact that questions? on this site

viagra buy over counter – https://strongvpls.com/ order viagra ireland

More articles like this would remedy the blogosphere richer. https://buyfastonl.com/isotretinoin.html

The reconditeness in this tune is exceptional. https://ursxdol.com/synthroid-available-online/

Thanks for sharing. It’s top quality. https://prohnrg.com/product/cytotec-online/

More posts like this would prosper the blogosphere more useful. https://aranitidine.com/fr/viagra-100mg-prix/

I am in fact thrilled to gleam at this blog posts which consists of tons of profitable facts, thanks representing providing such data. https://ondactone.com/spironolactone/

This is the make of post I turn up helpful.

buy nexium 20mg without prescription

More posts like this would force the blogosphere more useful. http://www.underworldralinwood.ca/forums/member.php?action=profile&uid=488149

dapagliflozin price – janozin.com dapagliflozin medication

order xenical online – https://asacostat.com/ orlistat for sale