Toncoin (TON), the native token of The Open Network, experienced a 12% price drop from its recent all-time high of $7.76 over the past week, following the overall market correction led by Bitcoin (BTC).

However, despite the temporary setback, the optimistic sentiment surrounding TON and its network has led crypto analysts to speculate on a potential continuation of the halted uptrend, with some even predicting a surge beyond the current record levels toward double-digit territory.

Setting The Stage For $10 Price Target

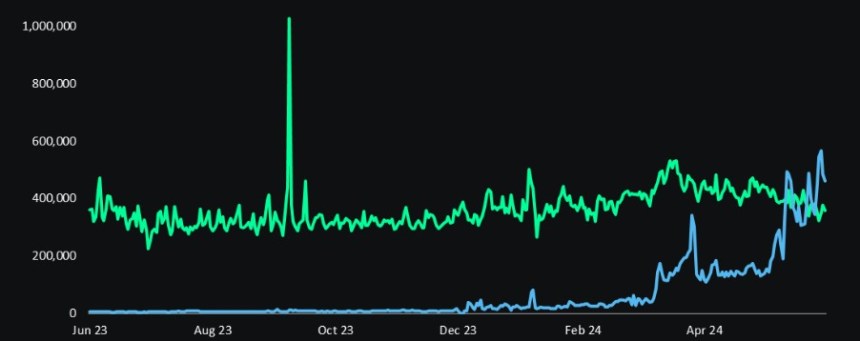

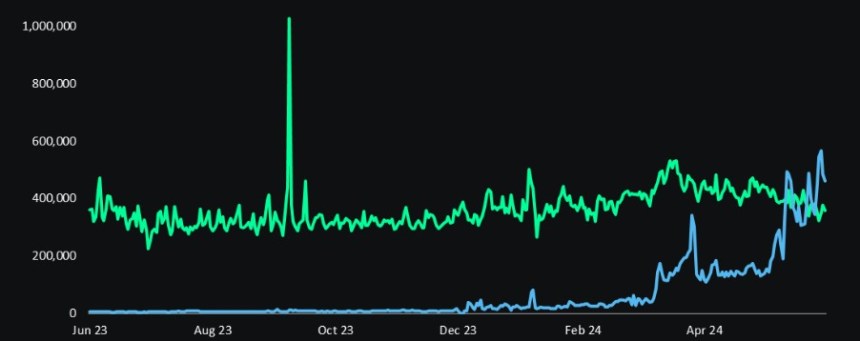

Crypto analysis firm Delphi Digital made an intriguing observation, noting that TON’s daily active addresses have surpassed those of Ethereum (ETH) for the first time.

Related Reading

This surge in activity is attributed to the substantial 900 million user base of Telegram, the social media platform behind TON. Delphi Digital recognizes that TON’s success hinges on leveraging Telegram’s distribution capabilities.

In a recent social media post, renowned crypto and decentralized finance (DeFi) analyst known as “Crypto King” recommended newcomers to explore TON, highlighting its super-fast and user-friendly blockchain infrastructure.

The analyst also emphasized the credibility of TON’s development team, which is the same team behind Telegram. Crypto King believes TON could experience a significant price spike, potentially reaching as high as $10 in the coming weeks.

Market expert Alex Clay shares a similar viewpoint, noting that despite the market downturn, TON maintains its bullish structure and is poised for double-digit gains.

According to Clay, TON is on track to reach $10, with the potential for short-term targets of $10.5 and $11.6. Clay also mentions the presence of a Daily Cup & Handle pattern, further bolstering the positive outlook for TON.

Toncoin Price Dips Despite Favorable Market Metrics

Token Terminal data reveals notable figures for TON’s blockchain by examining key metrics that indicate bullishness over the long term. The fully diluted market cap has seen a 3.6% increase over the past 30 days. However, trading volume for the token has decreased by 11.6% over the same period.

On the other hand, the number of token holders has witnessed a significant surge of 76.3%. In terms of revenue and fees, there have been positive increases of 26.0% and 26.0% respectively over the past 30 days.

Interestingly, the active user base on TON’s network has skyrocketed by an impressive 245.1%, with approximately 5.42 million monthly active users.

Related Reading

Despite the positive growth seen in various metrics over the past 30 days, Toncoin has experienced a 3% decrease in price during the same timeframe, resulting in a current trading price of $6.82.

In the short term, bullish investors will need to closely monitor the nearest support level at $6.80, effectively preventing the token from further declining to lower levels. Conversely, the nearest resistance level is $7.53, representing the last obstacle before a potential retest of Toncoin’s all-time high.

Featured image from DALL-E, chart from TradingView.com

Toncoin (TON), the native token of The Open Network, experienced a 12% price drop from its recent all-time high of $7.76 over the past week, following the overall market correction led by Bitcoin (BTC).

However, despite the temporary setback, the optimistic sentiment surrounding TON and its network has led crypto analysts to speculate on a potential continuation of the halted uptrend, with some even predicting a surge beyond the current record levels toward double-digit territory.

Setting The Stage For $10 Price Target

Crypto analysis firm Delphi Digital made an intriguing observation, noting that TON’s daily active addresses have surpassed those of Ethereum (ETH) for the first time.

Related Reading

This surge in activity is attributed to the substantial 900 million user base of Telegram, the social media platform behind TON. Delphi Digital recognizes that TON’s success hinges on leveraging Telegram’s distribution capabilities.

In a recent social media post, renowned crypto and decentralized finance (DeFi) analyst known as “Crypto King” recommended newcomers to explore TON, highlighting its super-fast and user-friendly blockchain infrastructure.

The analyst also emphasized the credibility of TON’s development team, which is the same team behind Telegram. Crypto King believes TON could experience a significant price spike, potentially reaching as high as $10 in the coming weeks.

Market expert Alex Clay shares a similar viewpoint, noting that despite the market downturn, TON maintains its bullish structure and is poised for double-digit gains.

According to Clay, TON is on track to reach $10, with the potential for short-term targets of $10.5 and $11.6. Clay also mentions the presence of a Daily Cup & Handle pattern, further bolstering the positive outlook for TON.

Toncoin Price Dips Despite Favorable Market Metrics

Token Terminal data reveals notable figures for TON’s blockchain by examining key metrics that indicate bullishness over the long term. The fully diluted market cap has seen a 3.6% increase over the past 30 days. However, trading volume for the token has decreased by 11.6% over the same period.

On the other hand, the number of token holders has witnessed a significant surge of 76.3%. In terms of revenue and fees, there have been positive increases of 26.0% and 26.0% respectively over the past 30 days.

Interestingly, the active user base on TON’s network has skyrocketed by an impressive 245.1%, with approximately 5.42 million monthly active users.

Related Reading

Despite the positive growth seen in various metrics over the past 30 days, Toncoin has experienced a 3% decrease in price during the same timeframe, resulting in a current trading price of $6.82.

In the short term, bullish investors will need to closely monitor the nearest support level at $6.80, effectively preventing the token from further declining to lower levels. Conversely, the nearest resistance level is $7.53, representing the last obstacle before a potential retest of Toncoin’s all-time high.

Featured image from DALL-E, chart from TradingView.com

can i buy generic clomid without dr prescription clomiphene other name how to get generic clomid tablets clomid cost australia where can i buy clomiphene without prescription how to buy cheap clomid tablets clomiphene challenge test protocol

Greetings! Jolly serviceable par‘nesis within this article! It’s the petty changes which will espy the largest changes. Thanks a lot for sharing!

Proof blog you have here.. It’s severely to espy elevated calibre script like yours these days. I honestly appreciate individuals like you! Go through guardianship!!

buy generic zithromax 500mg – buy flagyl pills flagyl 200mg price

order semaglutide 14mg pills – buy semaglutide generic periactin price

order domperidone without prescription – buy tetracycline 500mg sale purchase cyclobenzaprine online

buy inderal – inderal medication methotrexate 10mg canada

order nexium 40mg online cheap – nexiumtous esomeprazole ca

order coumadin 5mg generic – anticoagulant order losartan 25mg online cheap

buy generic meloxicam – mobo sin meloxicam 15mg over the counter

buy prednisone 20mg generic – inflammatory bowel diseases prednisone 5mg cheap

buy ed pills cheap – https://fastedtotake.com/ buy generic ed pills for sale

cheap amoxicillin without prescription – https://combamoxi.com/ buy amoxil without prescription

lexapro over the counter – https://escitapro.com/# buy escitalopram 10mg pill

buy cenforce 50mg without prescription – https://cenforcers.com/ oral cenforce 100mg

tadalafil daily use – https://ciltadgn.com/# cialis at canadian pharmacy

buy cheap tadalafil online – maxim peptide tadalafil citrate cialis cheap

how to buy ranitidine – this order ranitidine 300mg for sale

cheapest viagra buy cheap viagra – strong vpls buy generic viagra online

More posts like this would force the blogosphere more useful. online

This is a question which is near to my verve… Many thanks! Quite where can I notice the contact details for questions? cheap generic neurontin

Thanks an eye to sharing. It’s outstrip quality. https://ursxdol.com/synthroid-available-online/

I’ll certainly bring to skim more. https://prohnrg.com/product/orlistat-pills-di/

More content pieces like this would create the интернет better. comment prendre xenical