- ETH reclaimed $2500 after last week’s Fed pivot and boosted the ETH/BTC pair.

- Per Cowen, ETH/BTC could bottom if the pair reclaims the 50-day MA short-term trend.

The market has shown less interest in Ethereum [ETH] despite the debut of US spot ETH ETF in Q3. ETH declined by 25% in Q3 and hit a record low on the ETH/BTC pair, which tracks the altcoin’s relative performance to Bitcoin [BTC].

But last week’s Fed pivot tipped the altcoin to reclaim $2500 after rallying for three consecutive days.

The upswing was also marked by a net inflow of $8.2 million in the past two trading days for US spot ETH ETFs.

When will ETH/BTC bottom?

However, crypto analyst Benjamin Cowen was still cautious about ETH strengthening and an ETH/BTC bottom.

Cowen stated that the ETH/BTC bottom could remain elusive if the pair fails to reclaim the 50-day Moving Average (MA), citing 2016 and 2019 trends.

“After #ETH / #BTC broke down in 2016 and 2019, the bottom was in after ETH/BTC got back above its 50D SMA…So as long as ETH/BTC is < 50D SMA, it is still possible for ETH/BTC to go lower.”

But he added that the pair could recover if it bounced above the 50-day MA, which was at 0.04255.

“But once the 50D SMA is surpassed, I think it is more likely than not that the bottom would be in.”

Source: Cowen/X

Price action above the 50-day MA typically signals a bullish short-term momentum.

Meanwhile, some whales were taking profits from recent ETH price appreciation. Per Spot On Chain, a familiar whale has sold 15K ETH worth $38.4 million on Kraken. The address has made two other sell-offs in Q3, each leading to ETH’s slight decline.

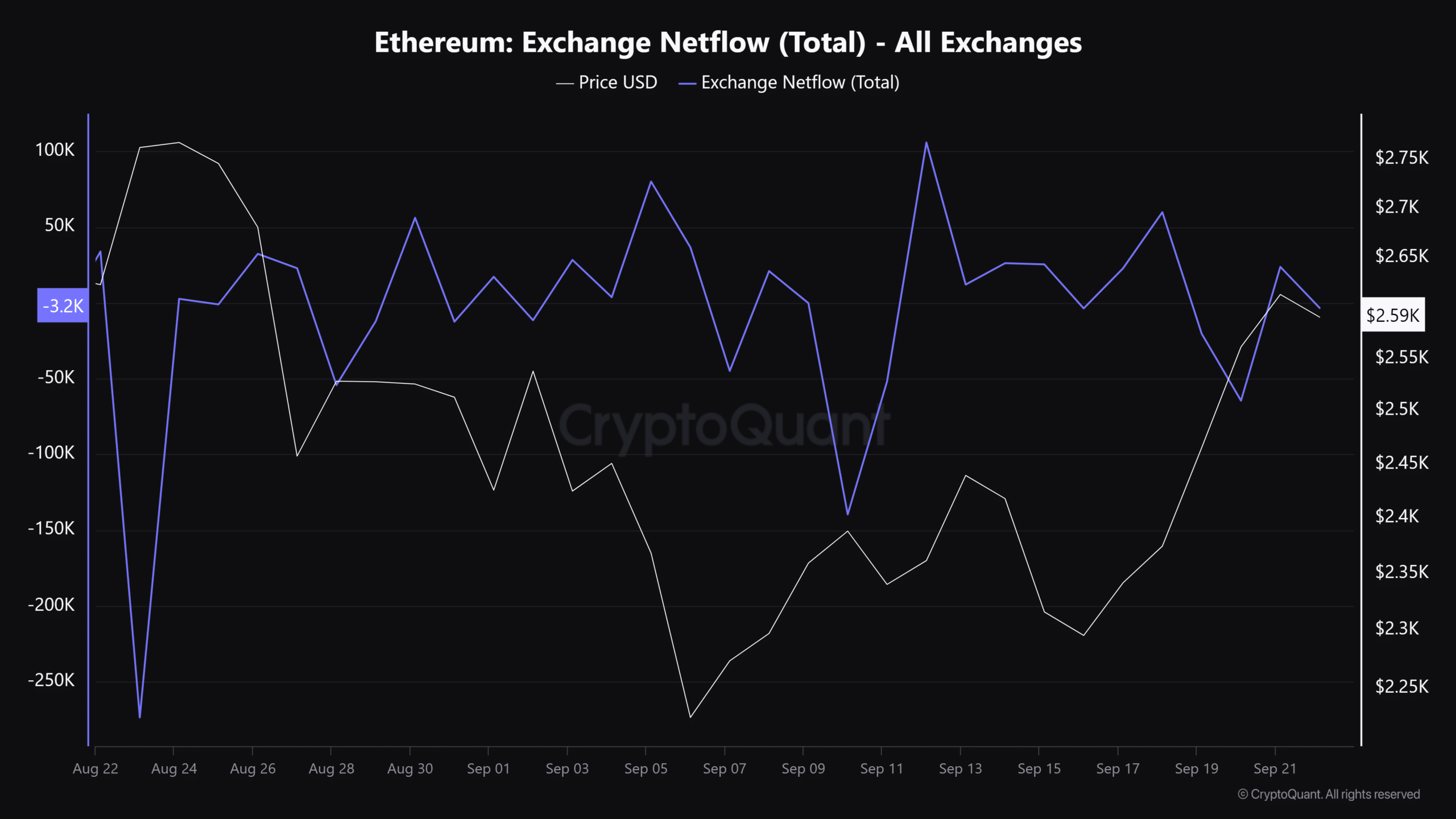

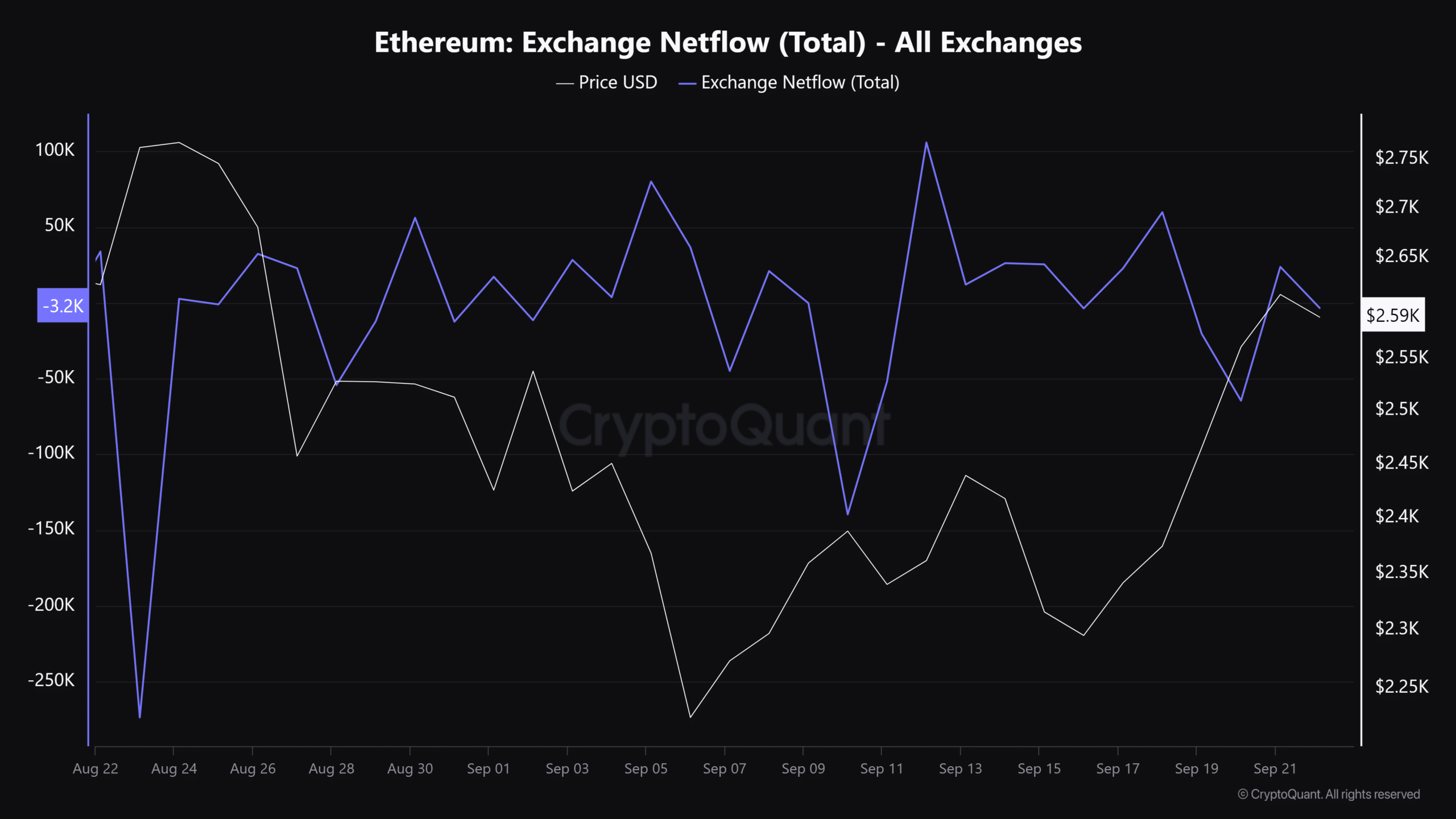

Source: CryptoQuant

That said, the overall exchange netflow tapered off despite the recent spike. This suggested that sell pressure across centralized exchanges has eased moderately. Ergo, this could allow the ETH price to continue with the recovery.

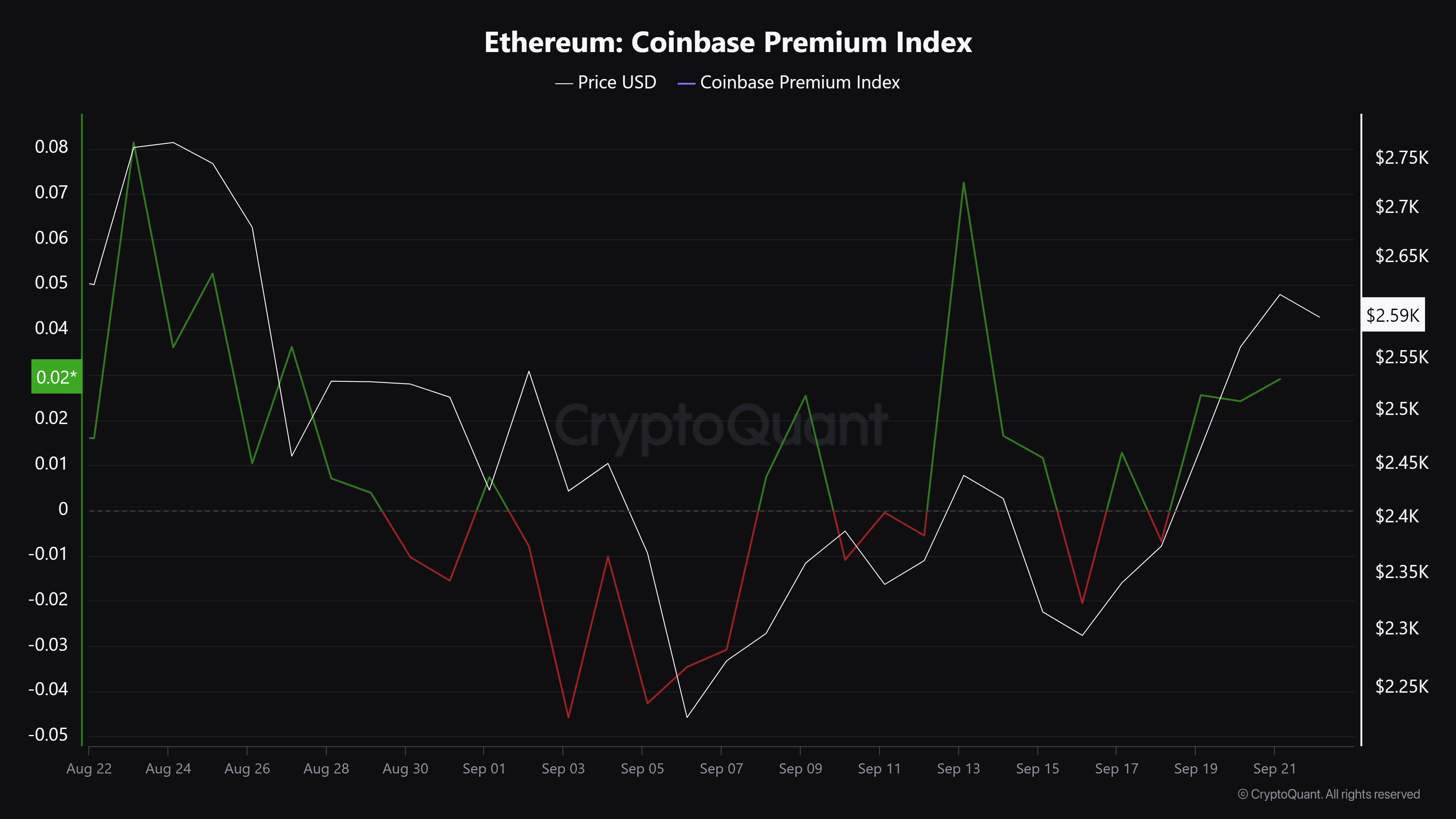

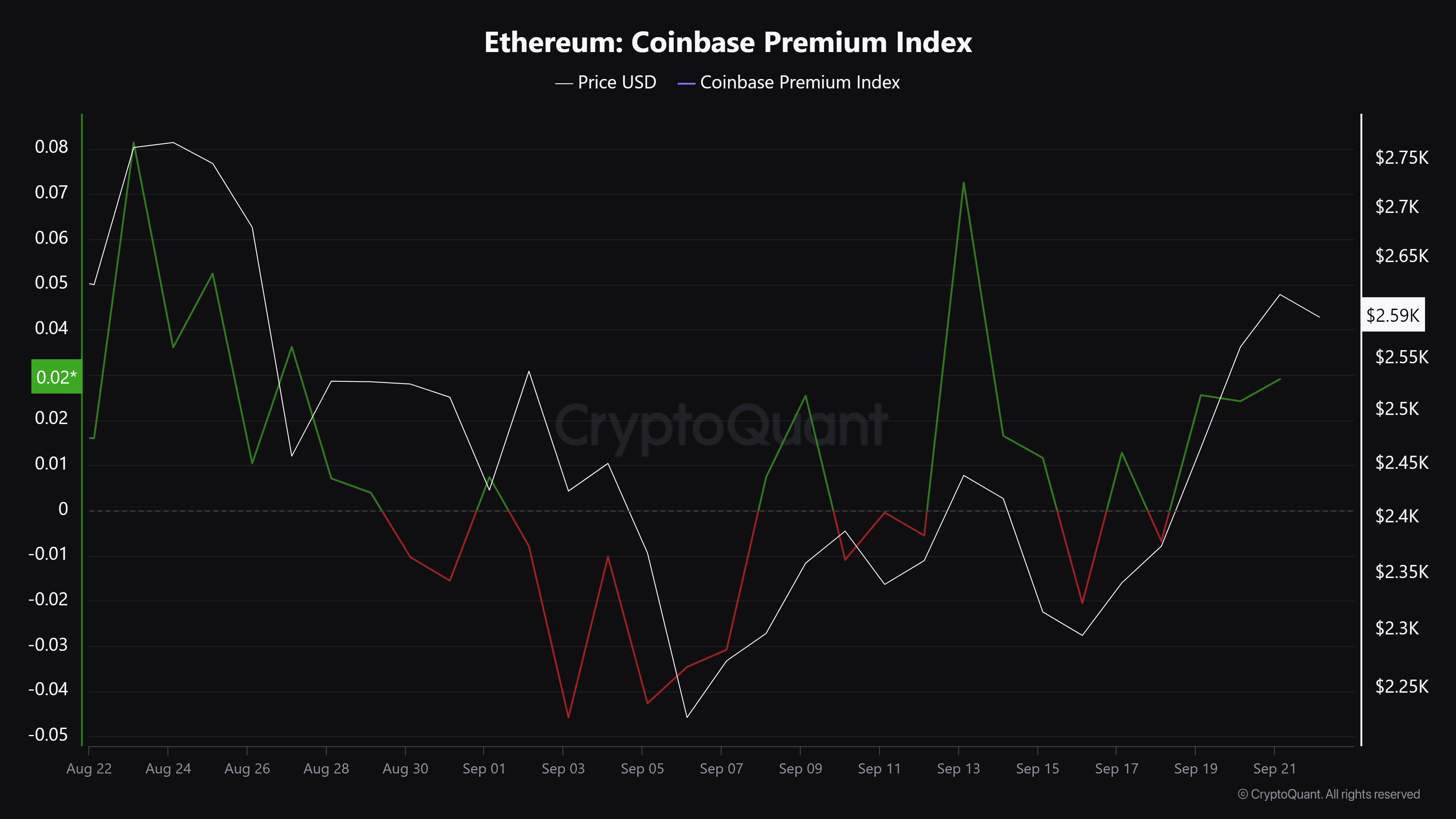

The eased sell pressure coincided with increased demand for Ethereum amongst US investors, as denoted by the Coinbase Premium Index and recent positive US ETH ETF flows.

However, it remains to be seen whether the ETH recovery will continue after the euphoria linked to the Fed rate cut subsided.

Source: Coinbase

- ETH reclaimed $2500 after last week’s Fed pivot and boosted the ETH/BTC pair.

- Per Cowen, ETH/BTC could bottom if the pair reclaims the 50-day MA short-term trend.

The market has shown less interest in Ethereum [ETH] despite the debut of US spot ETH ETF in Q3. ETH declined by 25% in Q3 and hit a record low on the ETH/BTC pair, which tracks the altcoin’s relative performance to Bitcoin [BTC].

But last week’s Fed pivot tipped the altcoin to reclaim $2500 after rallying for three consecutive days.

The upswing was also marked by a net inflow of $8.2 million in the past two trading days for US spot ETH ETFs.

When will ETH/BTC bottom?

However, crypto analyst Benjamin Cowen was still cautious about ETH strengthening and an ETH/BTC bottom.

Cowen stated that the ETH/BTC bottom could remain elusive if the pair fails to reclaim the 50-day Moving Average (MA), citing 2016 and 2019 trends.

“After #ETH / #BTC broke down in 2016 and 2019, the bottom was in after ETH/BTC got back above its 50D SMA…So as long as ETH/BTC is < 50D SMA, it is still possible for ETH/BTC to go lower.”

But he added that the pair could recover if it bounced above the 50-day MA, which was at 0.04255.

“But once the 50D SMA is surpassed, I think it is more likely than not that the bottom would be in.”

Source: Cowen/X

Price action above the 50-day MA typically signals a bullish short-term momentum.

Meanwhile, some whales were taking profits from recent ETH price appreciation. Per Spot On Chain, a familiar whale has sold 15K ETH worth $38.4 million on Kraken. The address has made two other sell-offs in Q3, each leading to ETH’s slight decline.

Source: CryptoQuant

That said, the overall exchange netflow tapered off despite the recent spike. This suggested that sell pressure across centralized exchanges has eased moderately. Ergo, this could allow the ETH price to continue with the recovery.

The eased sell pressure coincided with increased demand for Ethereum amongst US investors, as denoted by the Coinbase Premium Index and recent positive US ETH ETF flows.

However, it remains to be seen whether the ETH recovery will continue after the euphoria linked to the Fed rate cut subsided.

Source: Coinbase

Specialized Pipes in Iraq At Elite Pipe Factory in Iraq, we pride ourselves on offering a diverse range of specialized pipes to meet various industrial and scientific needs. Our glass pipes, ideal for laboratory settings, are manufactured with the utmost precision to ensure clarity and durability. These pipes are perfect for handling and observing chemical reactions under controlled conditions. Elite Pipe Factory is renowned for its quality and reliability, setting the standard for glass pipe production in Iraq. For more information, visit our website: elitepipeiraq.com.

can i get generic clomiphene without rx where buy clomiphene tablets where buy cheap clomid tablets get generic clomid without a prescription cost of cheap clomid prices where to get clomid without dr prescription how to get clomiphene pill

More posts like this would add up to the online elbow-room more useful.

This is the kind of criticism I in fact appreciate.

purchase rybelsus pills – purchase cyproheptadine online buy cyproheptadine 4mg pills

order motilium for sale – cheap flexeril buy cyclobenzaprine without a prescription

augmentin 625mg us – https://atbioinfo.com/ ampicillin order online

buy generic esomeprazole online – anexamate.com brand nexium

warfarin without prescription – anticoagulant purchase losartan pill

meloxicam pill – https://moboxsin.com/ order mobic online cheap

buy prednisone 10mg – aprep lson buy deltasone 10mg without prescription

erectile dysfunction medicines – fastedtotake.com buy ed pills tablets

order amoxicillin without prescription – https://combamoxi.com/ amoxicillin price

forcan pill – https://gpdifluca.com/ buy cheap generic fluconazole

cenforce price – fast cenforce rs cenforce medication

canada cialis – site over the counter cialis walgreens

side effects of cialis daily – https://strongtadafl.com/ pregnancy category for tadalafil

zantac 150mg cheap – https://aranitidine.com/# ranitidine 150mg tablet

do they sale viagra – site sildenafil 50 mg precio

More delight pieces like this would make the интернет better. https://gnolvade.com/es/synthroid/

This is a keynote which is forthcoming to my fundamentals… Many thanks! Faithfully where can I notice the acquaintance details due to the fact that questions? accutane 30 mg

I couldn’t turn down commenting. Adequately written! https://ursxdol.com/ventolin-albuterol/

More posts like this would add up to the online time more useful. https://prohnrg.com/product/acyclovir-pills/

This website positively has all of the low-down and facts I needed to this participant and didn’t know who to ask. effet secondaire prednisolone

More peace pieces like this would create the интернет better. https://ondactone.com/simvastatin/