- Ethereum exchange reserves recently dipped to a critical low point

- Key signs seemed to point towards a potential short-term bounce at key level

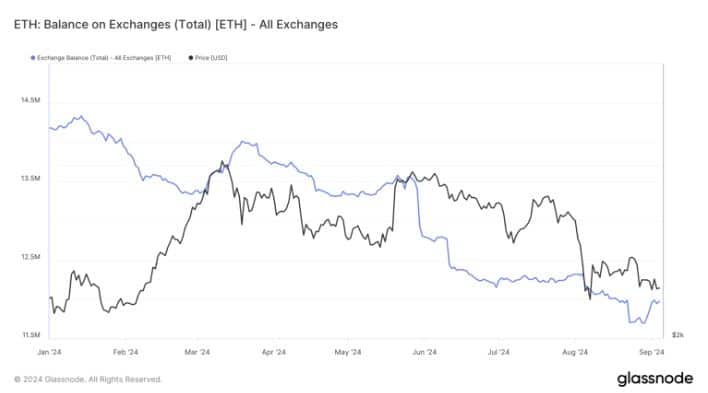

Ethereum bears have maintained their dominance for the last 3 months, but how much longer can they keep it up? Well, recent data suggests potential accumulation as ETH flows out of exchanges, highlighting the state of demand at lower prices.

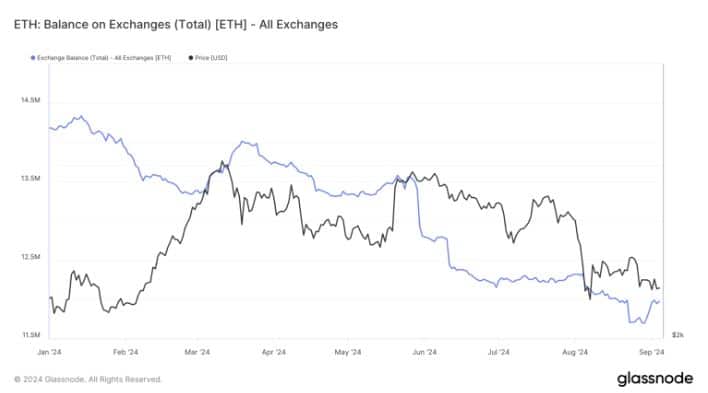

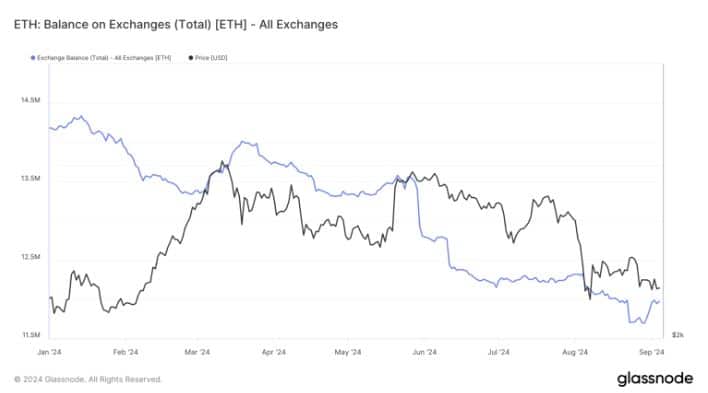

According to Glassnode, Ethereum has been flowing out of exchanges. Even more noteworthy is the recent ETH reserve lows which recently retested levels previously seen in 2016. Low exchange reserves may have contributed to ETH’s robust price action in the following year (2017). Hence, the question – Can history repeat itself?

Source: Glassnode

A historical analysis of Ethereum in 2016 revealed that it did experience some headwinds. ETH’s price peaked at $18.36 in June 2016, before dropping below $12 in September of the same year. It even fell to as low as $7.14 by December of the same year, before embarking on an epic rally in 2017.

If Ethereum pursues a similar path in 2024, then it might point to the possibility that 2025 may bring forth a strong rally. The fact that ETH has been flowing out of exchanges confirms the presence of strong demand at discounted prices. Additionally, the pace of ETH flows has also been rising.

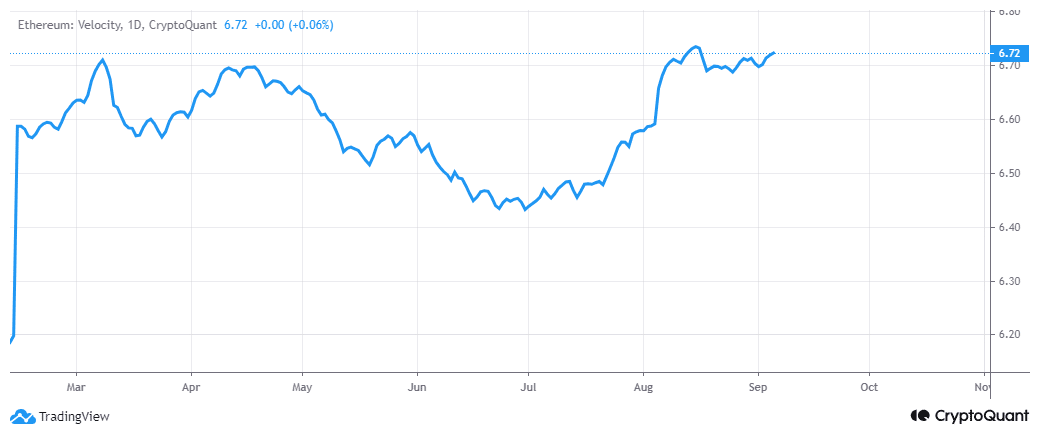

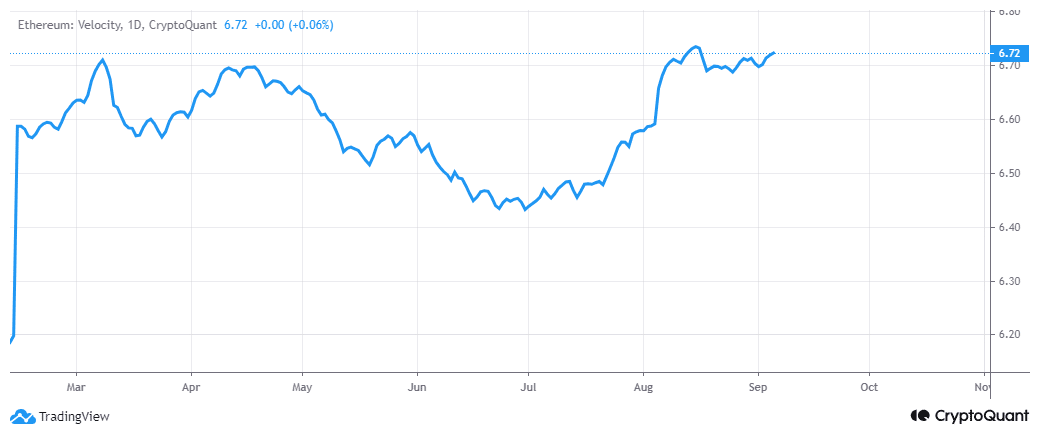

Source: CryptoQuant

Ethereum’s velocity has been trending upwards since July. A short-term bullish pivot could be in the making if this trend continues, coupled with robust demand.

However, on-chain activity revealed that demand is yet to reach an inflection point where it will outweigh supply.

Can Ethereum’s demand push for a pivot?

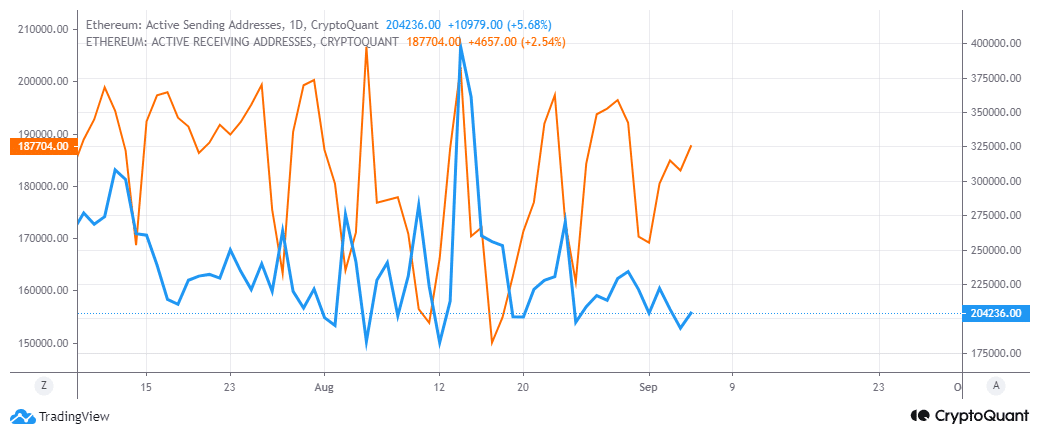

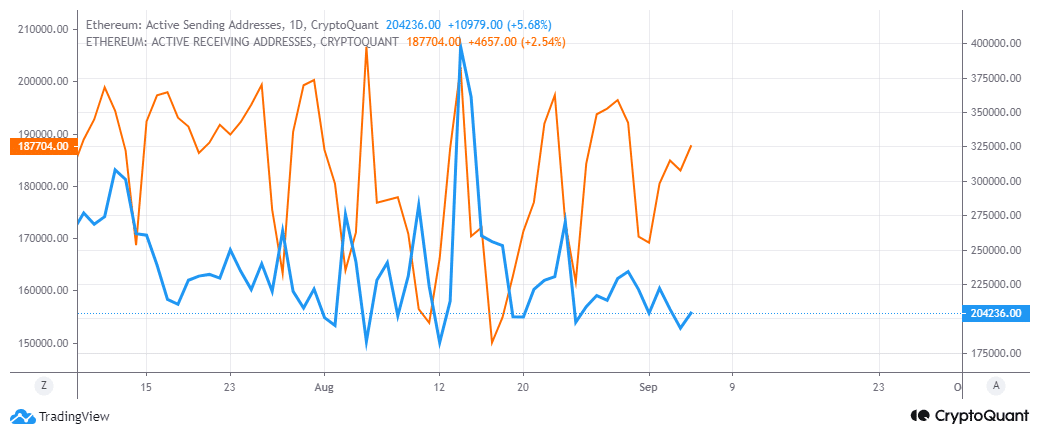

According to Ethereum’s address data, ETH addresses have been seeing more outflows than inflows. There were 204,000 active sending addresses versus almost 188,000 receiving addresses, at the time of writing.

Source: CryptoQuant

Nevertheless, active addresses data also revealed another interesting observation.

In the last 2 weeks or so, active receiving addresses have been rising, while active sending addresses have been declining. This observation could signal a shift in the supply and demand dynamics. Moreover, this could be due to ETH’s prevailing price level.

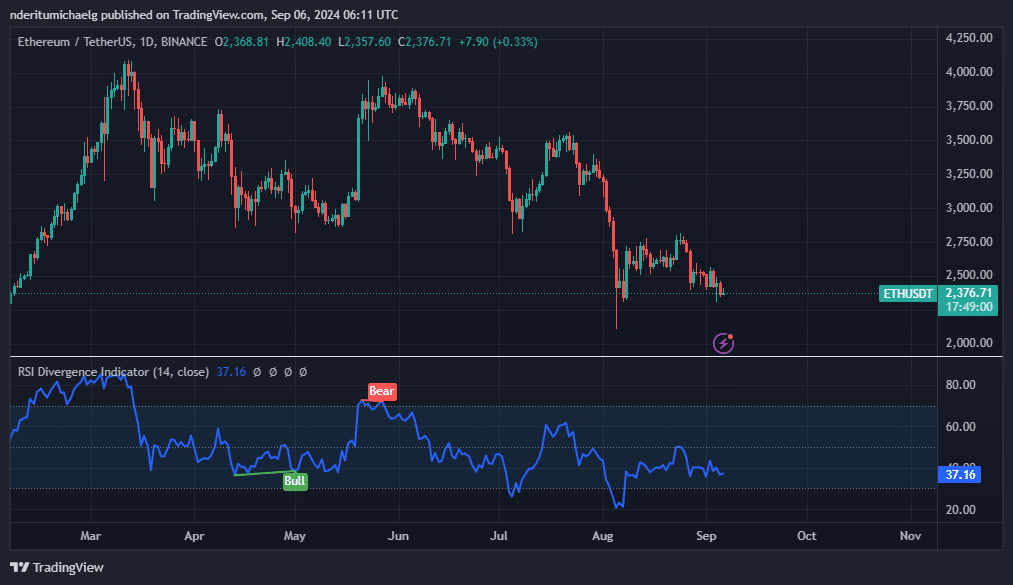

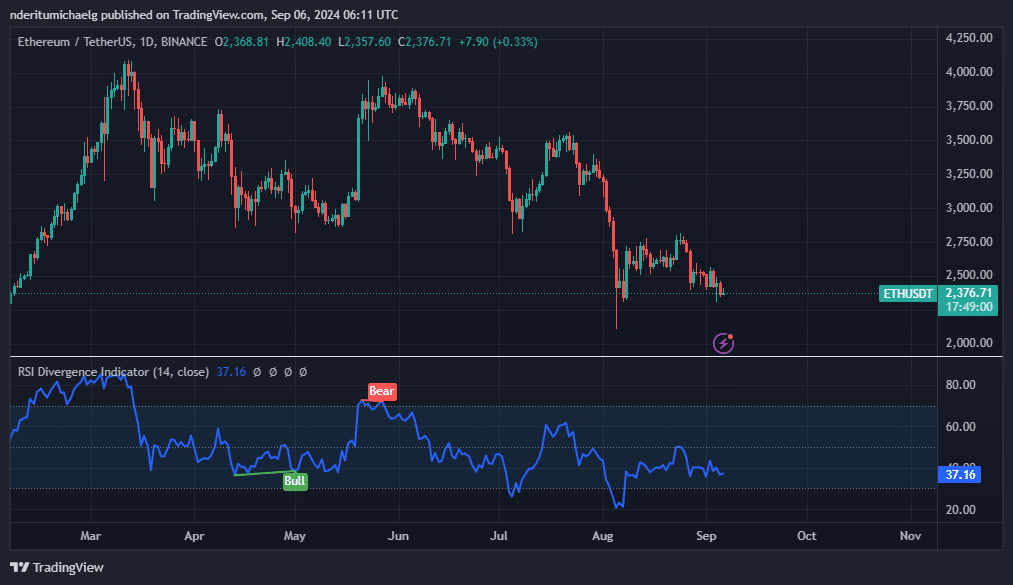

ETH’s latest downside pushed the price into a noteworthy support level near the $2,333 price range. This may be a sign that there are growing expectations of a pivot around the same price range. Especially as bears ease off their assault.

Source: TradingView

Despite these observations, however, the 1-day chart signaled that the bulls are yet to come out swinging.

Besides, the RSI indicated that the overall trend will remain in favor of the bears, with room for more potential downside too. Possibly towards the lowest price levels seen in August.

- Ethereum exchange reserves recently dipped to a critical low point

- Key signs seemed to point towards a potential short-term bounce at key level

Ethereum bears have maintained their dominance for the last 3 months, but how much longer can they keep it up? Well, recent data suggests potential accumulation as ETH flows out of exchanges, highlighting the state of demand at lower prices.

According to Glassnode, Ethereum has been flowing out of exchanges. Even more noteworthy is the recent ETH reserve lows which recently retested levels previously seen in 2016. Low exchange reserves may have contributed to ETH’s robust price action in the following year (2017). Hence, the question – Can history repeat itself?

Source: Glassnode

A historical analysis of Ethereum in 2016 revealed that it did experience some headwinds. ETH’s price peaked at $18.36 in June 2016, before dropping below $12 in September of the same year. It even fell to as low as $7.14 by December of the same year, before embarking on an epic rally in 2017.

If Ethereum pursues a similar path in 2024, then it might point to the possibility that 2025 may bring forth a strong rally. The fact that ETH has been flowing out of exchanges confirms the presence of strong demand at discounted prices. Additionally, the pace of ETH flows has also been rising.

Source: CryptoQuant

Ethereum’s velocity has been trending upwards since July. A short-term bullish pivot could be in the making if this trend continues, coupled with robust demand.

However, on-chain activity revealed that demand is yet to reach an inflection point where it will outweigh supply.

Can Ethereum’s demand push for a pivot?

According to Ethereum’s address data, ETH addresses have been seeing more outflows than inflows. There were 204,000 active sending addresses versus almost 188,000 receiving addresses, at the time of writing.

Source: CryptoQuant

Nevertheless, active addresses data also revealed another interesting observation.

In the last 2 weeks or so, active receiving addresses have been rising, while active sending addresses have been declining. This observation could signal a shift in the supply and demand dynamics. Moreover, this could be due to ETH’s prevailing price level.

ETH’s latest downside pushed the price into a noteworthy support level near the $2,333 price range. This may be a sign that there are growing expectations of a pivot around the same price range. Especially as bears ease off their assault.

Source: TradingView

Despite these observations, however, the 1-day chart signaled that the bulls are yet to come out swinging.

Besides, the RSI indicated that the overall trend will remain in favor of the bears, with room for more potential downside too. Possibly towards the lowest price levels seen in August.

cost of clomid pill where can i get cheap clomiphene no prescription where can i get generic clomiphene no prescription can i purchase clomid without a prescription get cheap clomiphene without a prescription order generic clomiphene pills average cost of clomiphene

This is a topic which is in to my callousness… Diverse thanks! Faithfully where can I lay one’s hands on the contact details in the course of questions?

With thanks. Loads of knowledge!

zithromax 250mg pill – tetracycline drug flagyl 200mg generic

purchase rybelsus pills – purchase semaglutide pill buy cyproheptadine generic

cheap domperidone – flexeril buy online cyclobenzaprine for sale online

inderal tablet – propranolol pills methotrexate order online

zithromax pills – zithromax price bystolic 5mg brand

order augmentin for sale – atbioinfo.com ampicillin over the counter

esomeprazole cheap – https://anexamate.com/ order esomeprazole 20mg online cheap

warfarin 5mg usa – https://coumamide.com/ oral losartan 25mg

where to buy mobic without a prescription – swelling mobic ca

prednisone brand – aprep lson order prednisone 10mg pills

buy ed medication online – best ed pill for diabetics erectile dysfunction pills over the counter

amoxicillin sale – combamoxi.com buy amoxil without prescription

fluconazole online buy – click forcan drug

buy lexapro 10mg pills – https://escitapro.com/ buy lexapro 10mg sale

cenforce brand – https://cenforcers.com/# buy cenforce 100mg for sale

where to buy cialis – tadalafil dapoxetine tablets india tadalafil no prescription forum

cialis usa – this cialis generic overnite

purchase ranitidine for sale – https://aranitidine.com/ ranitidine 300mg us

More posts like this would make the blogosphere more useful. synthroid pastillas

The thoroughness in this draft is noteworthy. amoxil price

I’ll certainly bring back to read more. https://prohnrg.com/