- The BTC/Gold correlation remained weak at press time.

- Bitcoin surpassed Gold in investors’ portfolio allocation when adjusted for volatility.

Bitcoin’s [BTC] proponents have long pitched it as a global store of value, assuring investors guaranteed returns over some time, irrespective of the state of the broader financial market.

Well, 2024 might be the year that dramatically strengthens this narrative.

Digital Gold vs. Real Gold

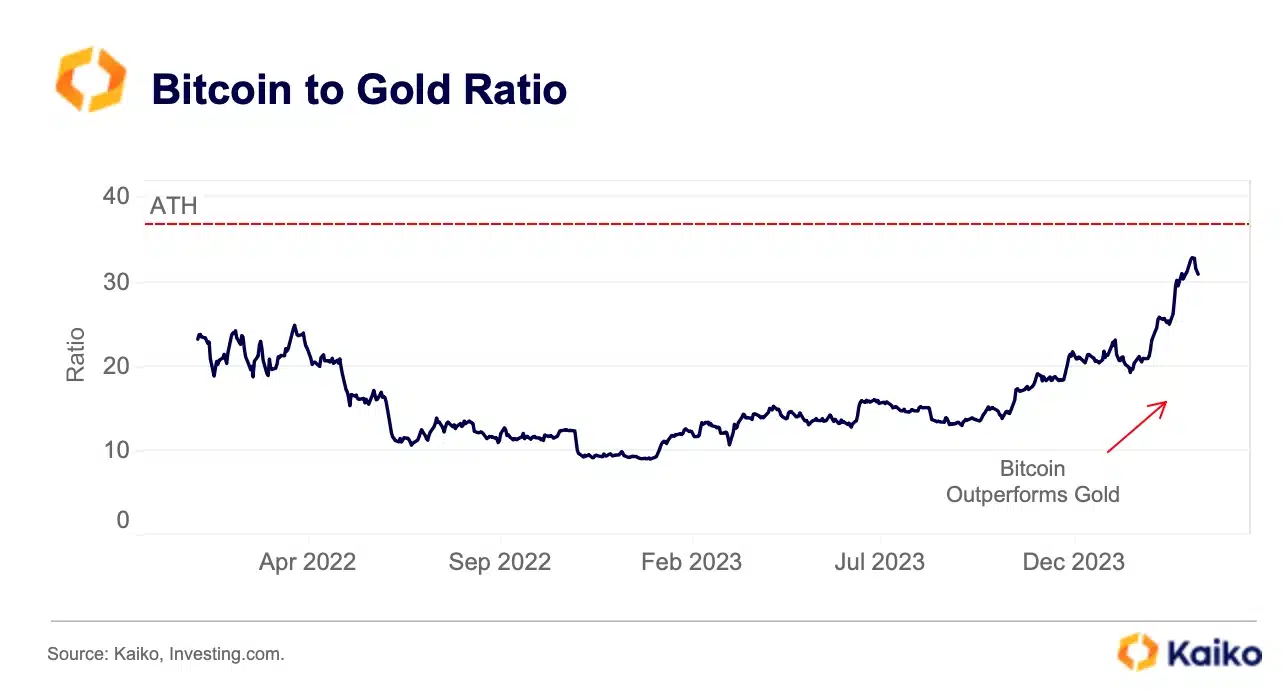

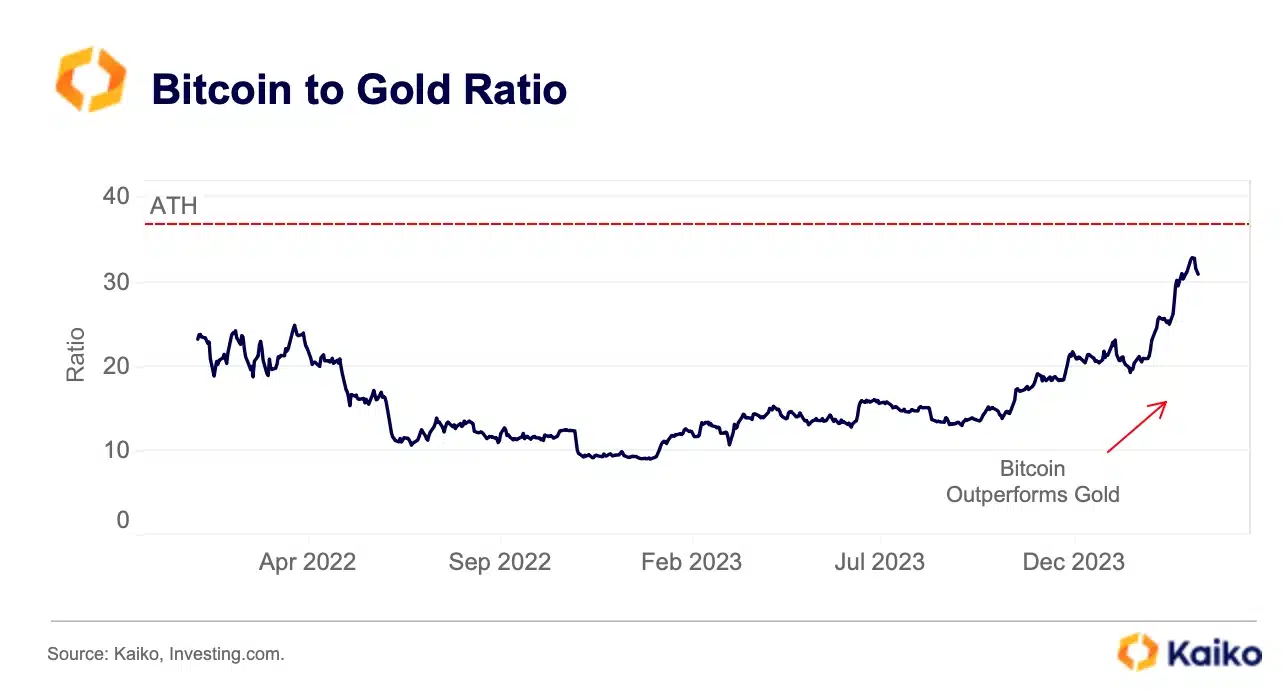

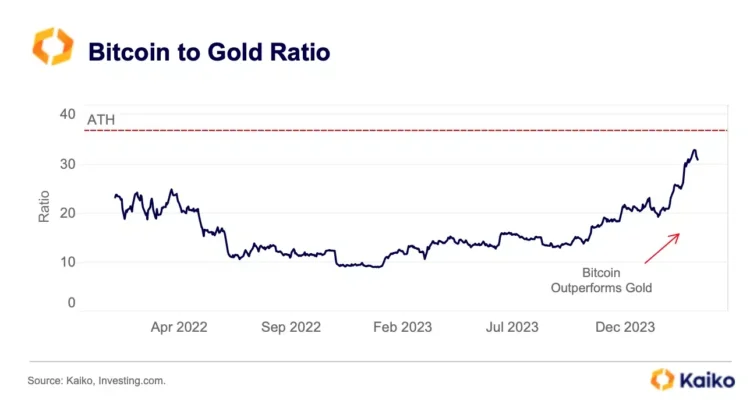

The Bitcoin to Gold ratio has risen sharply since the start of the year, and was moving closer to the all-time high (ATH) clocked during the peak 2021 bull market, according to crypto market data provider Kaiko.

The ratio, which measures the relative performance of the two assets, underlined that the “Digital Gold” outperformed its real-world counterpart.

Source: Kaiko

The world’s largest cryptocurrency has been bolstered by the launch of spot exchange-traded funds (ETFs) in the U.S. this year.

According to AMBCrypto’s analysis of SoSo Value data, inflows into spot ETFs have hit $12 billion since their listing in January.

The soaring demand sent Bitcoin past its ATH earlier this month, and more than 50% higher since the start of the year.

On the other hand, the yellow metal could just grow 4.71% year-to-date (YTD), although it also hit its peak of $2,179 per ounce recently.

Moreover, unlike Bitcoin, physically-backed Gold ETFs have witnessed net outflows of late, as per World Gold Council.

Is Bitcoin replacing Gold in portfolios?

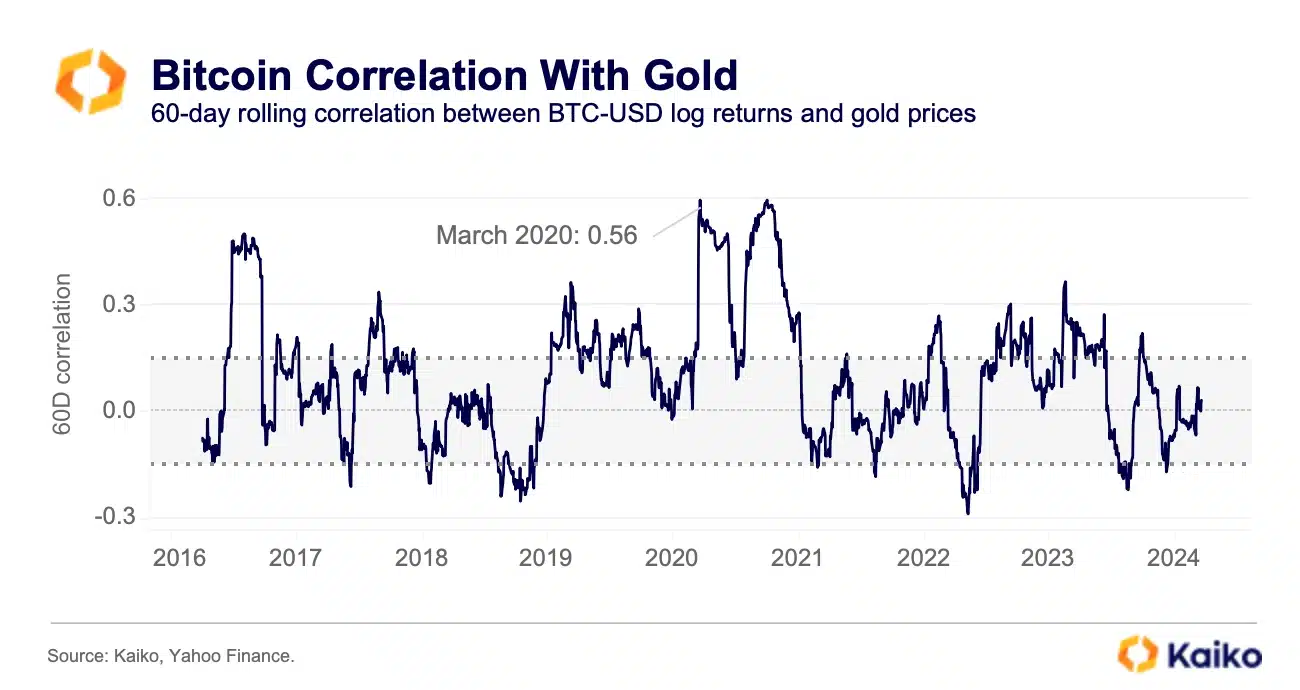

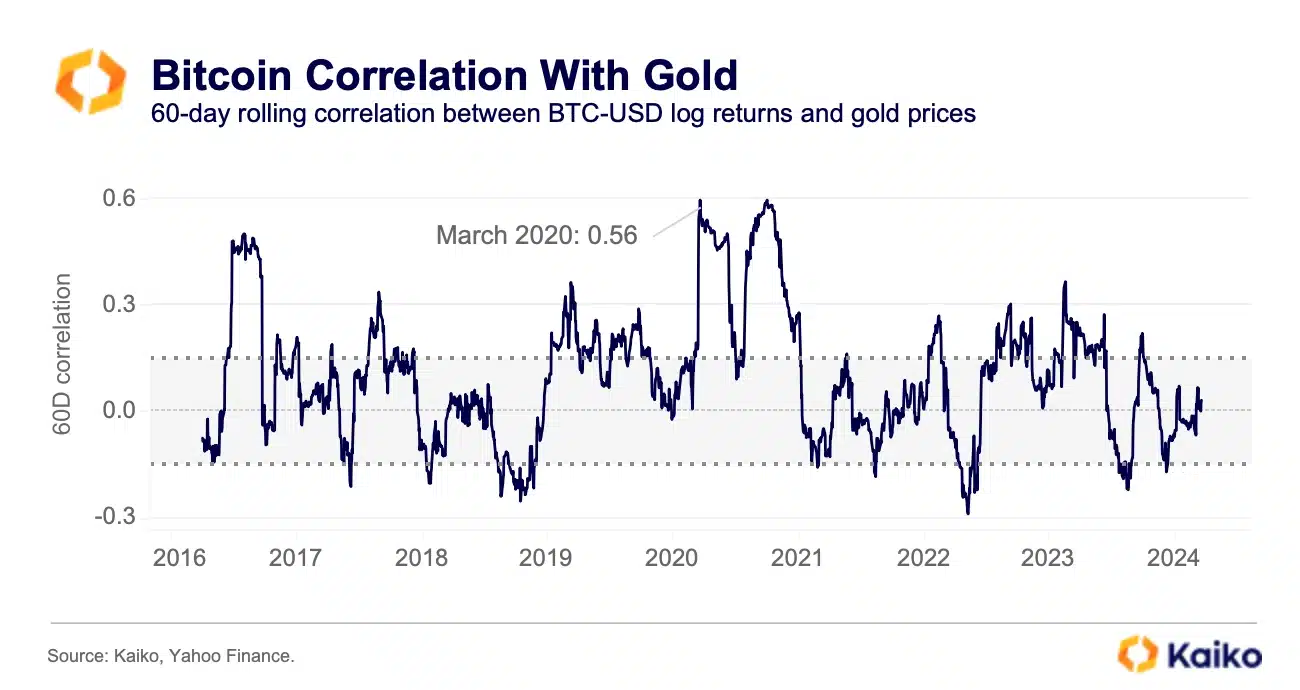

Kaiko further highlighted the lack of a mutual relationship between the two asset classes.

The 60-day BTC/Gold correlation oscillated between a positive 0.15 and a negative 0.15 for most of the last decade. This implied that factors affecting the demand for the two varied significantly.

If the correlation stays weak, Bitcoin spot ETFs could emerge as a viable alternative to Gold investments.

Source: Kaiko

Read Bitcoin’s [BTC] Price Prediction 2024-25

JPMorgan analyst Nikolaos Panigirtzoglou recently stated that Bitcoin has already surpassed Gold in investors’ portfolio allocation when adjusted for volatility.

This suggested a potential rotation of capital from Gold to Bitcoin.

- The BTC/Gold correlation remained weak at press time.

- Bitcoin surpassed Gold in investors’ portfolio allocation when adjusted for volatility.

Bitcoin’s [BTC] proponents have long pitched it as a global store of value, assuring investors guaranteed returns over some time, irrespective of the state of the broader financial market.

Well, 2024 might be the year that dramatically strengthens this narrative.

Digital Gold vs. Real Gold

The Bitcoin to Gold ratio has risen sharply since the start of the year, and was moving closer to the all-time high (ATH) clocked during the peak 2021 bull market, according to crypto market data provider Kaiko.

The ratio, which measures the relative performance of the two assets, underlined that the “Digital Gold” outperformed its real-world counterpart.

Source: Kaiko

The world’s largest cryptocurrency has been bolstered by the launch of spot exchange-traded funds (ETFs) in the U.S. this year.

According to AMBCrypto’s analysis of SoSo Value data, inflows into spot ETFs have hit $12 billion since their listing in January.

The soaring demand sent Bitcoin past its ATH earlier this month, and more than 50% higher since the start of the year.

On the other hand, the yellow metal could just grow 4.71% year-to-date (YTD), although it also hit its peak of $2,179 per ounce recently.

Moreover, unlike Bitcoin, physically-backed Gold ETFs have witnessed net outflows of late, as per World Gold Council.

Is Bitcoin replacing Gold in portfolios?

Kaiko further highlighted the lack of a mutual relationship between the two asset classes.

The 60-day BTC/Gold correlation oscillated between a positive 0.15 and a negative 0.15 for most of the last decade. This implied that factors affecting the demand for the two varied significantly.

If the correlation stays weak, Bitcoin spot ETFs could emerge as a viable alternative to Gold investments.

Source: Kaiko

Read Bitcoin’s [BTC] Price Prediction 2024-25

JPMorgan analyst Nikolaos Panigirtzoglou recently stated that Bitcoin has already surpassed Gold in investors’ portfolio allocation when adjusted for volatility.

This suggested a potential rotation of capital from Gold to Bitcoin.

can i purchase generic clomiphene without rx cost cheap clomiphene without insurance how to buy clomid without dr prescription can you get cheap clomid without rx can i buy cheap clomid without prescription can i purchase clomid prices cost of cheap clomiphene without insurance

This is the big-hearted of writing I positively appreciate.

Thanks on sharing. It’s top quality.

order zithromax 500mg for sale – buy sumycin pills for sale cheap flagyl 400mg

rybelsus 14mg without prescription – periactin price buy generic cyproheptadine 4 mg

buy domperidone paypal – how to get tetracycline without a prescription flexeril 15mg tablet

brand amoxiclav – atbioinfo purchase ampicillin pill

order esomeprazole pill – https://anexamate.com/ order esomeprazole without prescription

buy coumadin 2mg generic – anticoagulant losartan uk

order meloxicam – mobo sin order generic meloxicam

buy prednisone 20mg sale – https://apreplson.com/ order prednisone 5mg for sale

buy ed pills online usa – https://fastedtotake.com/ best ed drug

buy amoxil – https://combamoxi.com/ buy amoxicillin pills for sale

diflucan 200mg tablet – this buy generic diflucan

escitalopram 10mg for sale – https://escitapro.com/# escitalopram order online

cenforce generic – buy cenforce pills buy cenforce 50mg sale