- Spot Bitcoin ETFs reached historic figures in terms of net inflows.

- BTC stood just $6,000 away from ATH.

Spot Bitcoin [BTC] exchange-traded funds (ETFs) continued to shatter records and defy expectations.

In a remarkable development, cumulative total net inflows into Spot Bitcoin ETFs have exceeded the $20 billion mark for the first time since its launch in January.

This record level was achieved following a massive influx of $1.5 billion in just four days.

Eric Balchunas, Senior ETF analyst at Bloomberg, highlighted the significance of this milestone on X (formerly Twitter). He stated,

“The most imp number, most difficult metric to grow in ETF world.”

He further compared it to gold ETFs, noting that:

“It took gold ETFs about 5yrs to reach same number.”

BlackRock records highest inflows

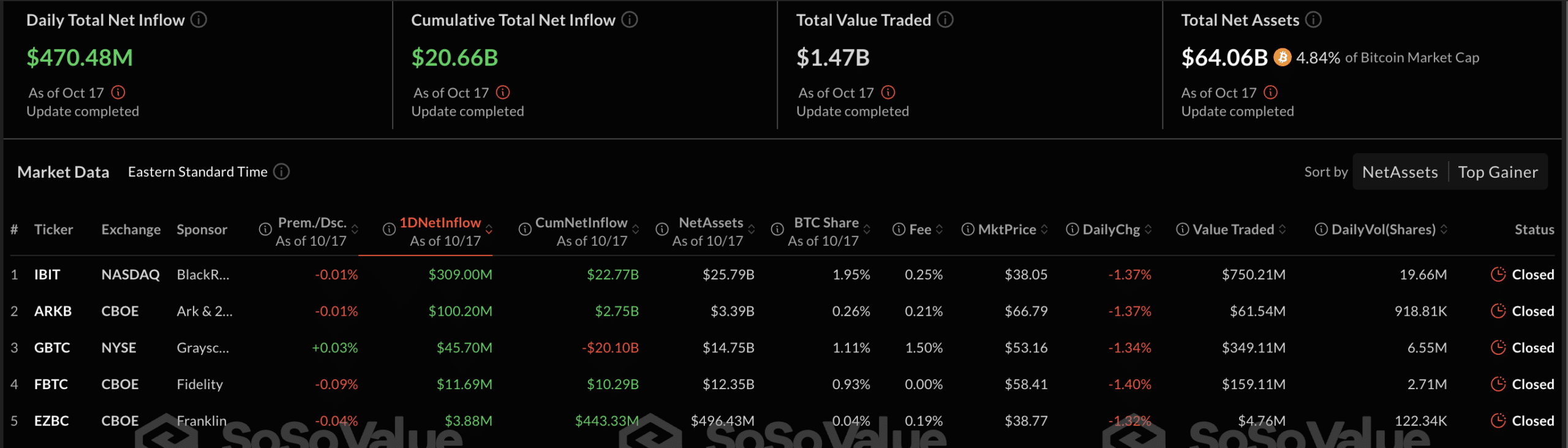

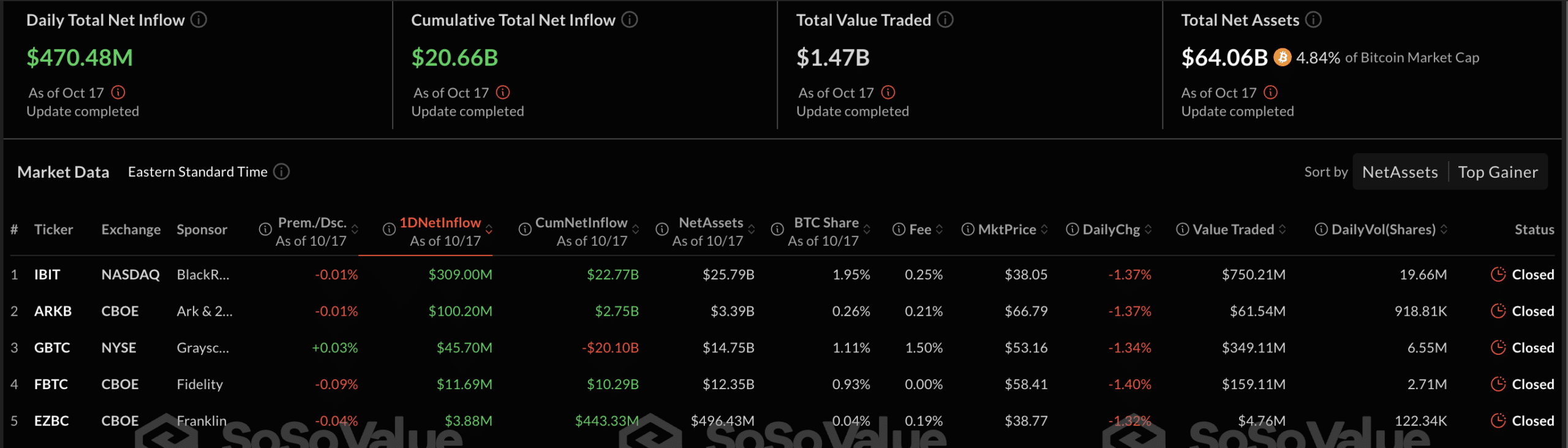

It is worth noting that BlackRock’s iShares Bitcoin Trust (IBIT) has been a major contributor to these inflows. Data reported by SoSo Value revealed that on the 17th of October, BTC Spot ETFs saw a total net inflow of $470 million.

Out of which, IBIT led the way with an impressive $309 million. Ark Invest and 21Shares’ ETF ARKB followed with a net inflow of $100 million.

Source: SoSo Value

As a result of these inflows, the total assets in spot Bitcoin ETFs now stand at $64 billion.

On the 16th of October, IBIT experienced a substantial net inflow of $393.4 million, marking its largest inflow since July.

At press time, BlackRock’s net assets stood at over $25 billion. The product accounted for 1.95% of the entire Bitcoin market share of $1.3 trillion.

Is a new ATH near for BTC?

The surge in spot Bitcoin ETFs wasn’t the only bright spot this week. The cryptocurrency market has brought the long-awaited ‘Uptober’ rally to life.

After briefly dipping to around $58,000 on the 10th of October, BTC skyrocketed to a high of over $68,000 in just six days.

Over the past week, it rallied by double digits, gaining approximately 12%. At the time of writing, Bitcoin was trading at $67,786, just 8% shy of its all-time high (ATH) of over $73,000.

Consequently, optimism has been growing among traders, with many speculating that this bull cycle could propel Bitcoin to new highs.

The combination of bullish sentiment and a potential supply shock has sparked renewed enthusiasm and interest in the asset, suggesting the rally may be far from over.

Bitcoin: 10th most valuable asset in the world

While the king coin remains the largest cryptocurrency by market value, it has also managed to secure its spot among the top monetary assets. According to CompaniesMarketCap, Bitcoin now ranks as the 10th largest monetary asset globally.

This achievement highlights Bitcoin’s growing influence not just in digital assets, but also in global financial markets.

- Spot Bitcoin ETFs reached historic figures in terms of net inflows.

- BTC stood just $6,000 away from ATH.

Spot Bitcoin [BTC] exchange-traded funds (ETFs) continued to shatter records and defy expectations.

In a remarkable development, cumulative total net inflows into Spot Bitcoin ETFs have exceeded the $20 billion mark for the first time since its launch in January.

This record level was achieved following a massive influx of $1.5 billion in just four days.

Eric Balchunas, Senior ETF analyst at Bloomberg, highlighted the significance of this milestone on X (formerly Twitter). He stated,

“The most imp number, most difficult metric to grow in ETF world.”

He further compared it to gold ETFs, noting that:

“It took gold ETFs about 5yrs to reach same number.”

BlackRock records highest inflows

It is worth noting that BlackRock’s iShares Bitcoin Trust (IBIT) has been a major contributor to these inflows. Data reported by SoSo Value revealed that on the 17th of October, BTC Spot ETFs saw a total net inflow of $470 million.

Out of which, IBIT led the way with an impressive $309 million. Ark Invest and 21Shares’ ETF ARKB followed with a net inflow of $100 million.

Source: SoSo Value

As a result of these inflows, the total assets in spot Bitcoin ETFs now stand at $64 billion.

On the 16th of October, IBIT experienced a substantial net inflow of $393.4 million, marking its largest inflow since July.

At press time, BlackRock’s net assets stood at over $25 billion. The product accounted for 1.95% of the entire Bitcoin market share of $1.3 trillion.

Is a new ATH near for BTC?

The surge in spot Bitcoin ETFs wasn’t the only bright spot this week. The cryptocurrency market has brought the long-awaited ‘Uptober’ rally to life.

After briefly dipping to around $58,000 on the 10th of October, BTC skyrocketed to a high of over $68,000 in just six days.

Over the past week, it rallied by double digits, gaining approximately 12%. At the time of writing, Bitcoin was trading at $67,786, just 8% shy of its all-time high (ATH) of over $73,000.

Consequently, optimism has been growing among traders, with many speculating that this bull cycle could propel Bitcoin to new highs.

The combination of bullish sentiment and a potential supply shock has sparked renewed enthusiasm and interest in the asset, suggesting the rally may be far from over.

Bitcoin: 10th most valuable asset in the world

While the king coin remains the largest cryptocurrency by market value, it has also managed to secure its spot among the top monetary assets. According to CompaniesMarketCap, Bitcoin now ranks as the 10th largest monetary asset globally.

This achievement highlights Bitcoin’s growing influence not just in digital assets, but also in global financial markets.

can i get clomid for sale where to get cheap clomiphene pill how to get generic clomid tablets order generic clomiphene without insurance how can i get generic clomid without prescription cost of cheap clomid online can i order cheap clomid prices

I’ll certainly return to review more.

Thanks on putting this up. It’s understandably done.

azithromycin order – buy azithromycin buy flagyl cheap

cost rybelsus 14 mg – cyproheptadine over the counter buy periactin

motilium drug – order flexeril sale cheap flexeril 15mg

buy amoxiclav pills – https://atbioinfo.com/ ampicillin online

order esomeprazole 20mg online cheap – https://anexamate.com/ buy generic esomeprazole

buy warfarin medication – https://coumamide.com/ cozaar 50mg tablet

meloxicam pills – https://moboxsin.com/ meloxicam 7.5mg drug

order prednisone pills – https://apreplson.com/ purchase deltasone pills

where to buy ed pills without a prescription – site cheap erectile dysfunction pills

buy diflucan generic – https://gpdifluca.com/# forcan tablet

order escitalopram 10mg without prescription – anxiety pro lexapro without prescription

cenforce 100mg usa – https://cenforcers.com/ cenforce 50mg ca

cialis tadalafil 20mg price – https://ciltadgn.com/ pictures of cialis

zantac cheap – site ranitidine 150mg drug

cheap viagra london – https://strongvpls.com/# sildenafil 100mg coupon

Thanks for sharing. It’s top quality. cenforce 150 opiniones

I couldn’t turn down commenting. Warmly written! prednisone for itp

I’ll certainly bring to review more. https://ursxdol.com/levitra-vardenafil-online/

I am in truth delighted to glance at this blog posts which consists of tons of useful facts, thanks representing providing such data. https://prohnrg.com/product/lisinopril-5-mg/

I couldn’t turn down commenting. Adequately written! Г©quivalent viagra homme sans ordonnance

I am in point of fact thrilled to glitter at this blog posts which consists of tons of worthwhile facts, thanks object of providing such data. https://ondactone.com/spironolactone/

This is the kind of glad I get high on reading.

https://doxycyclinege.com/pro/sumatriptan/

This is the stripe of content I get high on reading. http://pokemonforever.com/User-Lxybxw