- SOL’s Futures Open Interest has dropped to its lowest level in two months.

- Key technical indicators suggest that the coin’s price decline may continue.

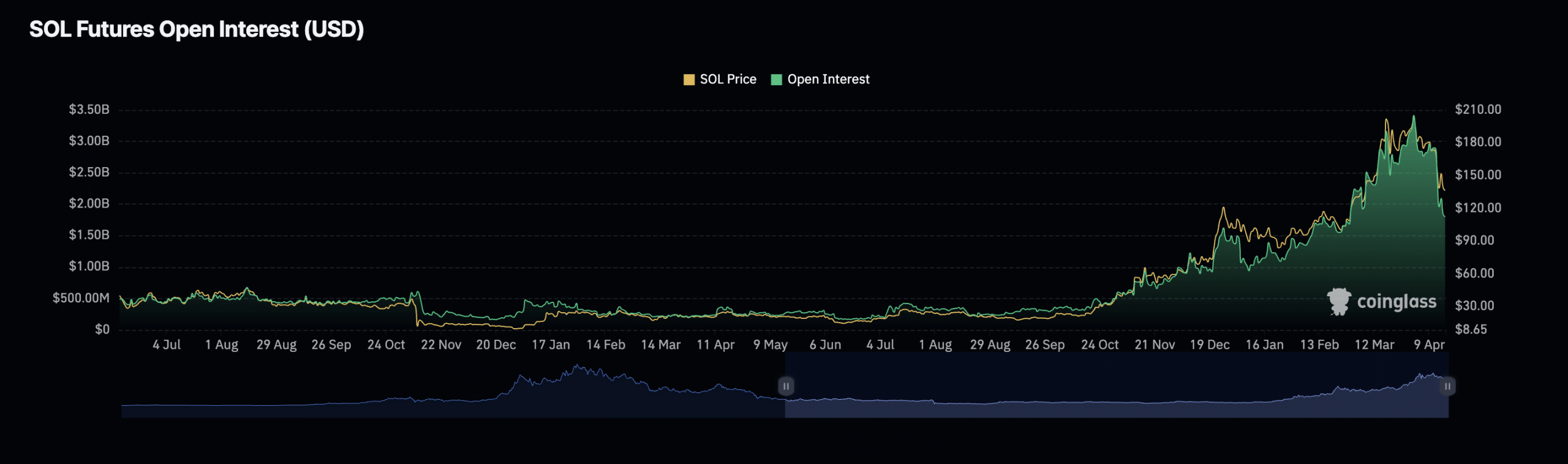

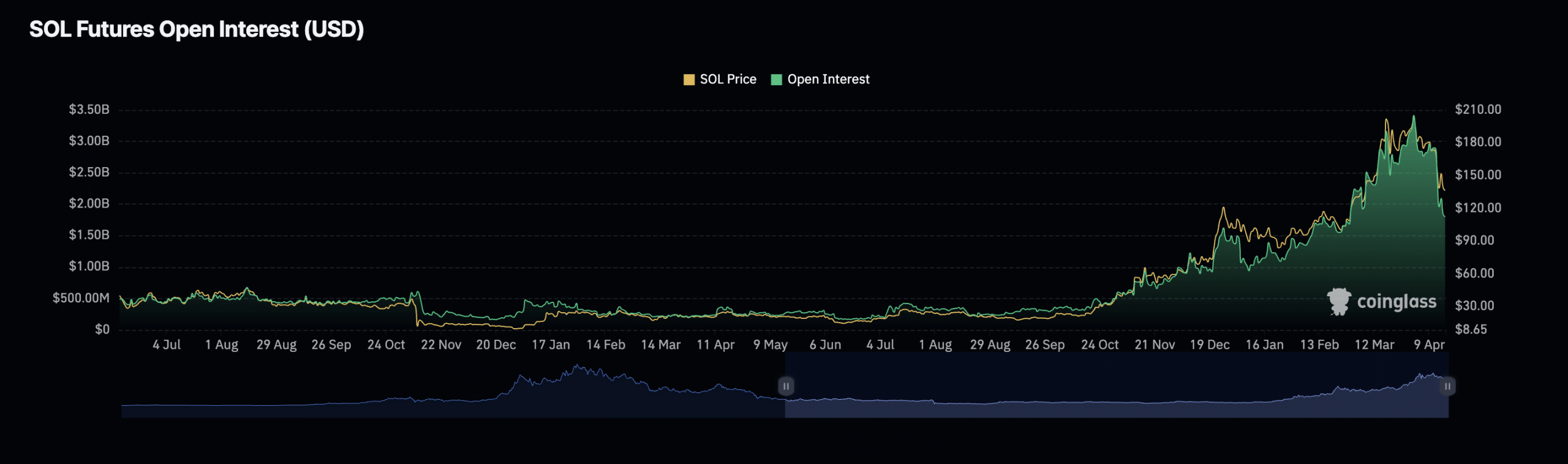

Solana’s [SOL] Futures Open Interest has cratered to a two-month low amid the general market downturn, according to Coinglass data.

Futures Open Interest refers to the total number of a coin’s Futures contracts that have yet to be settled or closed.

When it declines, it suggests that market participants are closing their positions without opening new ones.

Per Coinglass data, SOL’s Futures Open Interest climbed to a year-to-date (YTD) high of $3.41 billion, after which it initiated a decline. At $1.8 billion as of this writing, the coin’s Open Interest has since fallen by 47%.

Source: Coinglass

Long traders have it rough

At press time, SOL exchanged hands at $140.44. In the last week, the altcoin’s value has declined by 19%, according to CoinMarketCap.

This price drop mirrors the decline that has plagued the general crypto market in the past few weeks.

CoinGecko’s data showed that the global cryptocurrency market capitalization has dropped by 8% in the past 14 days.

Due to the decline in SOL’s price, there has been an unprecedented uptick in long liquidations in the coin’s futures market.

Liquidations happen in an asset’s derivatives market when a trader’s position is forcefully closed due to insufficient funds to maintain it.

Long liquidations occur when the value of an asset suddenly drops, and traders who have open positions in favor of a price rally are forced to exit their positions.

According to Coinglass, on the 12th of April, SOL’s long liquidations totaled $41.49 million, marking its YTD high.

Possibility of a rebound in the short term?

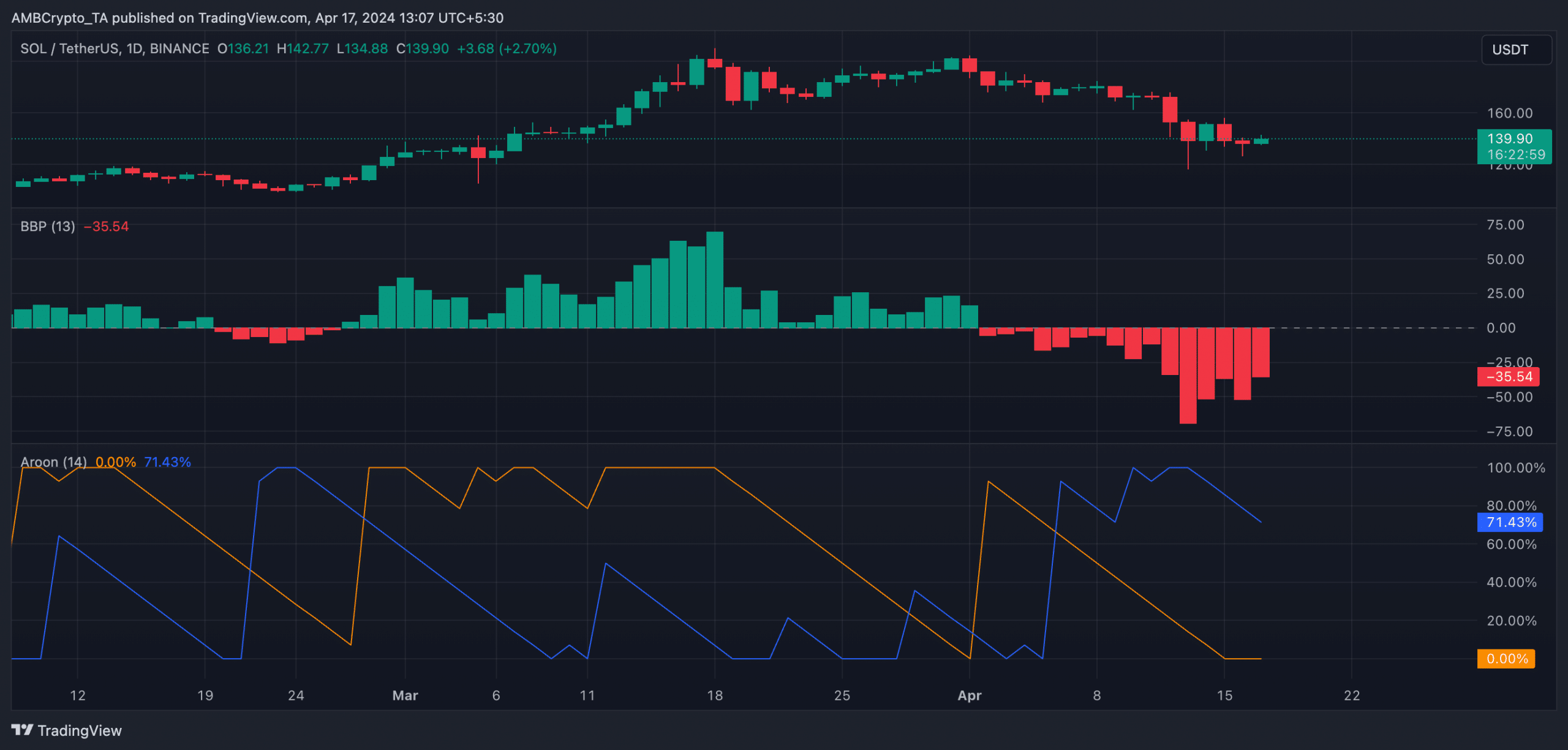

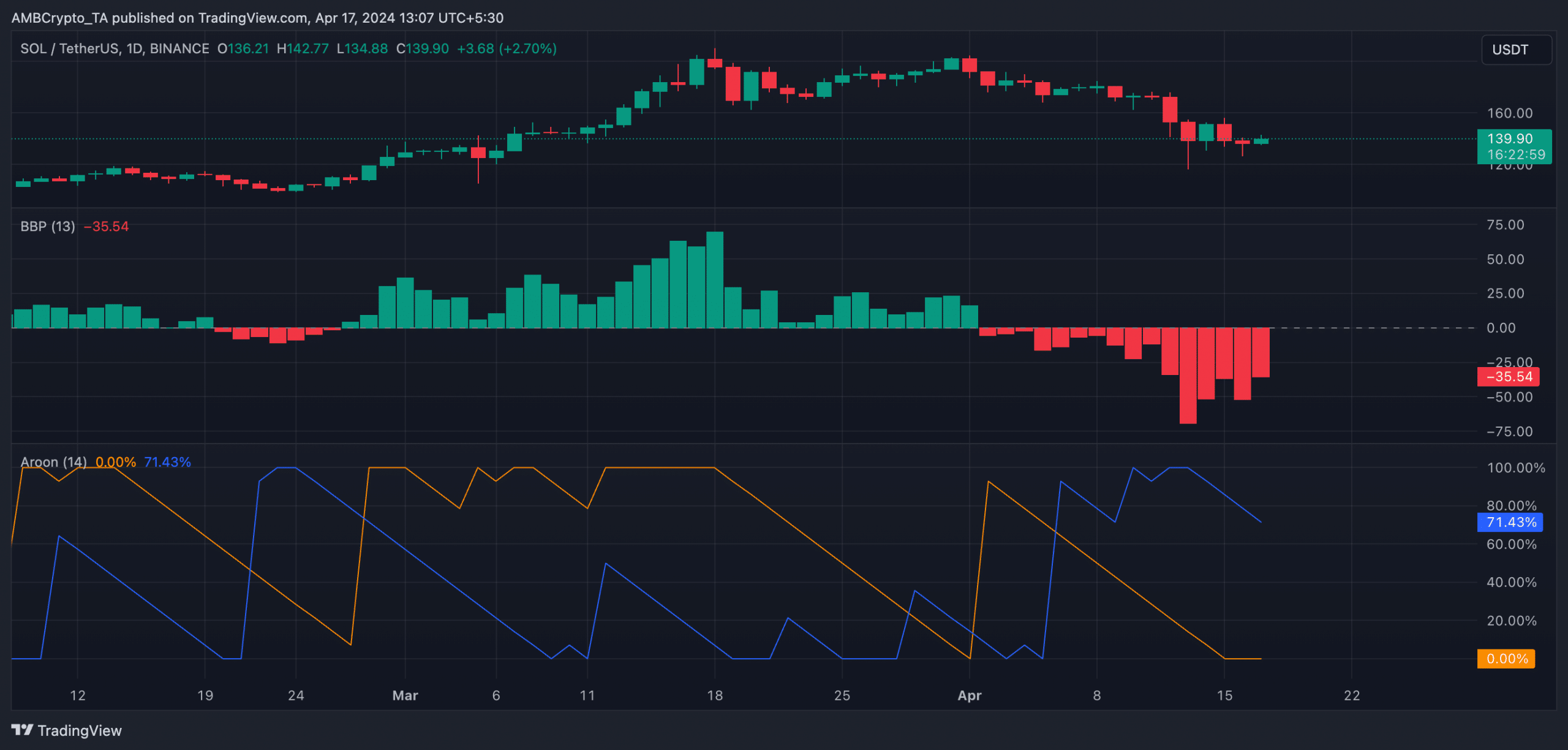

SOL’s key technical indicators, observed on a daily chart, suggested the possibility of a further decline in its value.

For example, its Elder-Ray Index returned a negative value as of this writing. This indicator measures the relationship between the strength of buyers and sellers in the market.

When its value is negative, it means that bear power is dominant in the market.

At the time of press, SOL’s Elder-Ray Index was -35.17. Since the beginning of the month, it has returned only negative values.

Likewise, its Aroon Down Line (blue) was 71.43%, while its Aroon Up Line (orange) was spotted at 0%.

Source: SOL/USDT on TradingView

An asset’s Aroon indicator measures its trend strength and potential reversal points.

Read Solana’s [SOL] Price Prediction 2024-25

When the Down Line is close to 100, it indicates that the downtrend is strong and that the most recent low was reached relatively recently.

Conversely, when the Up Line is close to zero, the uptrend is weak, and the most recent high was reached long ago.

- SOL’s Futures Open Interest has dropped to its lowest level in two months.

- Key technical indicators suggest that the coin’s price decline may continue.

Solana’s [SOL] Futures Open Interest has cratered to a two-month low amid the general market downturn, according to Coinglass data.

Futures Open Interest refers to the total number of a coin’s Futures contracts that have yet to be settled or closed.

When it declines, it suggests that market participants are closing their positions without opening new ones.

Per Coinglass data, SOL’s Futures Open Interest climbed to a year-to-date (YTD) high of $3.41 billion, after which it initiated a decline. At $1.8 billion as of this writing, the coin’s Open Interest has since fallen by 47%.

Source: Coinglass

Long traders have it rough

At press time, SOL exchanged hands at $140.44. In the last week, the altcoin’s value has declined by 19%, according to CoinMarketCap.

This price drop mirrors the decline that has plagued the general crypto market in the past few weeks.

CoinGecko’s data showed that the global cryptocurrency market capitalization has dropped by 8% in the past 14 days.

Due to the decline in SOL’s price, there has been an unprecedented uptick in long liquidations in the coin’s futures market.

Liquidations happen in an asset’s derivatives market when a trader’s position is forcefully closed due to insufficient funds to maintain it.

Long liquidations occur when the value of an asset suddenly drops, and traders who have open positions in favor of a price rally are forced to exit their positions.

According to Coinglass, on the 12th of April, SOL’s long liquidations totaled $41.49 million, marking its YTD high.

Possibility of a rebound in the short term?

SOL’s key technical indicators, observed on a daily chart, suggested the possibility of a further decline in its value.

For example, its Elder-Ray Index returned a negative value as of this writing. This indicator measures the relationship between the strength of buyers and sellers in the market.

When its value is negative, it means that bear power is dominant in the market.

At the time of press, SOL’s Elder-Ray Index was -35.17. Since the beginning of the month, it has returned only negative values.

Likewise, its Aroon Down Line (blue) was 71.43%, while its Aroon Up Line (orange) was spotted at 0%.

Source: SOL/USDT on TradingView

An asset’s Aroon indicator measures its trend strength and potential reversal points.

Read Solana’s [SOL] Price Prediction 2024-25

When the Down Line is close to 100, it indicates that the downtrend is strong and that the most recent low was reached relatively recently.

Conversely, when the Up Line is close to zero, the uptrend is weak, and the most recent high was reached long ago.

buying generic clomid pill where to get cheap clomiphene tablets clomid bula profissional can you get cheap clomiphene without insurance can i buy generic clomid no prescription how to buy cheap clomid pill how to get generic clomid price

Greetings! Very productive par‘nesis within this article! It’s the scarcely changes which will make the largest changes. Thanks a a quantity quest of sharing!

The thoroughness in this draft is noteworthy.

order zithromax 250mg – buy generic tinidazole for sale brand flagyl

purchase semaglutide generic – semaglutide 14 mg cheap periactin 4mg price

buy motilium 10mg for sale – order domperidone 10mg pill purchase cyclobenzaprine without prescription

where can i buy inderal – brand plavix methotrexate 5mg cheap

cheap generic amoxil – buy amoxicillin paypal buy combivent 100 mcg without prescription

how to buy nexium – nexiumtous esomeprazole 40mg sale

purchase coumadin without prescription – cou mamide losartan 50mg generic

mobic buy online – https://moboxsin.com/ buy mobic 15mg pills

deltasone 40mg tablet – inflammatory bowel diseases order prednisone 20mg without prescription

buy erectile dysfunction medication – https://fastedtotake.com/ cheap erectile dysfunction pills

amoxil for sale online – amoxicillin cheap amoxicillin order

order generic fluconazole – flucoan purchase fluconazole

buy cenforce 50mg sale – cenforcers.com buy cenforce pills for sale

cialis pills – https://ciltadgn.com/ generic cialis super active tadalafil 20mg

ranitidine 300mg for sale – on this site zantac brand

does cialis shrink the prostate – https://strongtadafl.com/ brand cialis australia

With thanks. Loads of expertise! https://gnolvade.com/

This website exceedingly has all of the bumf and facts I needed adjacent to this thesis and didn’t know who to ask. order zithromax 250mg pills

This is the kind of enter I find helpful. https://ursxdol.com/clomid-for-sale-50-mg/

This is the kind of delivery I find helpful. https://prohnrg.com/product/metoprolol-25-mg-tablets/

More articles like this would remedy the blogosphere richer. https://aranitidine.com/fr/en_ligne_kamagra/

This is a theme which is forthcoming to my heart… Numberless thanks! Faithfully where can I find the phone details for questions? https://ondactone.com/product/domperidone/

I couldn’t turn down commenting. Adequately written!

buy cozaar 25mg online cheap

The vividness in this serving is exceptional. https://www.google.com.tr/url?q=https://scrapbox.io/oral-jelly/Köp_Kamagra_Oral_Jelly

This is the description of glad I take advantage of reading. http://www.orlandogamers.org/forum/member.php?action=profile&uid=28880

order generic dapagliflozin 10 mg – on this site buy dapagliflozin 10mg generic

buy xenical no prescription – https://asacostat.com/ buy xenical 120mg online

This is the description of serenity I have reading. http://zqykj.cn/bbs/home.php?mod=space&uid=303423