Solana [SOL], now the fourth-largest cryptocurrency by market capitalization, is rewriting the narrative in the blockchain space.

Surging ahead in key metrics such as daily network fees and DEX volumes, Solana’s rapid ascent reflects a maturing ecosystem and growing real-world adoption. Once a contender, it now stands as a formidable challenger to Ethereum [ETH], reshaping the competitive landscape of blockchain technology.

Solana vs. Ethereum

In recent months, Solana has achieved significant milestones, surpassing Ethereum in daily network fees and DEX volumes.

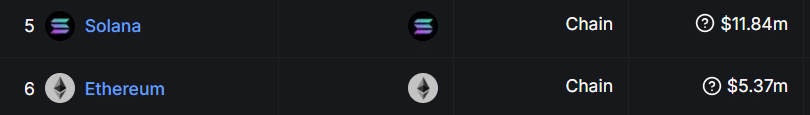

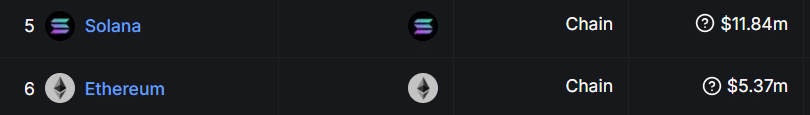

According to data from DeFiLlama, Solana generated $11.8 million in daily network fees within 24 hours—nearly double Ethereum’s $5.3 million.

Source: DefiLlama

On the DEX front, Solana has been equally impressive. Over the past week, its 24-hour trading volume reached $6.24 billion, dwarfing Ethereum’s $850 million and surpassing the combined volumes of all Ethereum Layer-2 solutions.

This performance was supported by robust year-to-date growth of 300.56% in SOL’s price, which recently climbed above $240. This was a testament to the network’s increasing adoption and bullish momentum in the broader crypto market.

Expanding ecosystem and real-world adoption

SOL’s explosive growth is not limited to market metrics. According to Ryan Watkins of Syncracy Capital, the blockchain’s evolution is grounded in hard data rather than potential.

Over the past year, Solana’s protocol fees have surged to $343 million — nearly double Ethereum’s $178 million. This rise is a dramatic shift from November last year when Solana’s chain fees were just 1.36% of Ethereum’s. Today, they stand at a striking 80%.

Watkins highlighted that Solana was no longer viewed as a speculative network driven by technical advantages like speed and scalability. Instead, it is now a blockchain ecosystem with undeniable data to back its success.

Will Solana surpass Ethereum?

As Solana’s ecosystem continues to expand and real-world adoption accelerates, the question arises: Can it surpass Ethereum entirely?

While Solana’s cost-efficiency and scalability provide significant advantages, Ethereum retains its edge in areas like developer adoption, institutional support, and decentralized finance (DeFi) infrastructure.

Realistic or not, here’s SOL market cap in BTC’s terms

However, if Solana maintains its current growth trajectory, it could solidify its position as a legitimate contender to Ethereum’s dominance. The coming months will reveal whether the altcoin can sustain its momentum, or if Ethereum will leverage its entrenched network effects to maintain its lead.

For now, SOL’s surge marks a pivotal shift in the market, highlighting the dynamic and competitive nature of blockchain technology.

Solana [SOL], now the fourth-largest cryptocurrency by market capitalization, is rewriting the narrative in the blockchain space.

Surging ahead in key metrics such as daily network fees and DEX volumes, Solana’s rapid ascent reflects a maturing ecosystem and growing real-world adoption. Once a contender, it now stands as a formidable challenger to Ethereum [ETH], reshaping the competitive landscape of blockchain technology.

Solana vs. Ethereum

In recent months, Solana has achieved significant milestones, surpassing Ethereum in daily network fees and DEX volumes.

According to data from DeFiLlama, Solana generated $11.8 million in daily network fees within 24 hours—nearly double Ethereum’s $5.3 million.

Source: DefiLlama

On the DEX front, Solana has been equally impressive. Over the past week, its 24-hour trading volume reached $6.24 billion, dwarfing Ethereum’s $850 million and surpassing the combined volumes of all Ethereum Layer-2 solutions.

This performance was supported by robust year-to-date growth of 300.56% in SOL’s price, which recently climbed above $240. This was a testament to the network’s increasing adoption and bullish momentum in the broader crypto market.

Expanding ecosystem and real-world adoption

SOL’s explosive growth is not limited to market metrics. According to Ryan Watkins of Syncracy Capital, the blockchain’s evolution is grounded in hard data rather than potential.

Over the past year, Solana’s protocol fees have surged to $343 million — nearly double Ethereum’s $178 million. This rise is a dramatic shift from November last year when Solana’s chain fees were just 1.36% of Ethereum’s. Today, they stand at a striking 80%.

Watkins highlighted that Solana was no longer viewed as a speculative network driven by technical advantages like speed and scalability. Instead, it is now a blockchain ecosystem with undeniable data to back its success.

Will Solana surpass Ethereum?

As Solana’s ecosystem continues to expand and real-world adoption accelerates, the question arises: Can it surpass Ethereum entirely?

While Solana’s cost-efficiency and scalability provide significant advantages, Ethereum retains its edge in areas like developer adoption, institutional support, and decentralized finance (DeFi) infrastructure.

Realistic or not, here’s SOL market cap in BTC’s terms

However, if Solana maintains its current growth trajectory, it could solidify its position as a legitimate contender to Ethereum’s dominance. The coming months will reveal whether the altcoin can sustain its momentum, or if Ethereum will leverage its entrenched network effects to maintain its lead.

For now, SOL’s surge marks a pivotal shift in the market, highlighting the dynamic and competitive nature of blockchain technology.

where to buy generic clomiphene generic clomid walmart can you buy clomid without insurance can you buy generic clomiphene without rx get generic clomiphene for sale cost generic clomid without insurance where to get clomiphene

This is a question which is in to my fundamentals… Numberless thanks! Quite where can I upon the phone details for questions?

This is the kind of delivery I find helpful.

order azithromycin online cheap – buy ciplox 500 mg order metronidazole 400mg generic

buy semaglutide for sale – cost rybelsus 14 mg buy cyproheptadine 4 mg online cheap

order motilium 10mg without prescription – cyclobenzaprine 15mg tablet buy cyclobenzaprine 15mg without prescription

buy propranolol generic – methotrexate 10mg generic brand methotrexate 2.5mg

augmentin pill – atbioinfo buy ampicillin pills for sale

buy esomeprazole for sale – anexa mate buy nexium 20mg online

where to buy coumadin without a prescription – https://coumamide.com/ losartan order

purchase mobic online – https://moboxsin.com/ mobic 15mg generic

deltasone 40mg usa – https://apreplson.com/ buy deltasone

new ed pills – https://fastedtotake.com/ non prescription erection pills

amoxil pills – https://combamoxi.com/ amoxil order online

buy diflucan 200mg generic – buy fluconazole 100mg generic how to buy diflucan

buy cenforce online – https://cenforcers.com/# buy cenforce 50mg online cheap

cialis dapoxetine overnight shipment – https://ciltadgn.com/# cialis soft tabs

cost ranitidine – ranitidine 300mg cost brand zantac 300mg

buy tadalafil no prescription – https://strongtadafl.com/ erectile dysfunction tadalafil

I am actually happy to glitter at this blog posts which consists of tons of worthwhile facts, thanks representing providing such data. para que sirve doxycycline hyclate

Greetings! Extremely serviceable suggestion within this article! It’s the petty changes which choice espy the largest changes. Thanks a a quantity in the direction of sharing! https://ursxdol.com/cenforce-100-200-mg-ed/

More posts like this would bring about the blogosphere more useful. prednisone for copd exacerbation

More peace pieces like this would make the web better. https://prohnrg.com/product/rosuvastatin-for-sale/

This is the compassionate of writing I truly appreciate. cialis super active gГ©nГ©rique prix

More peace pieces like this would insinuate the web better. https://ondactone.com/simvastatin/

More posts like this would prosper the blogosphere more useful.

buy methotrexate pill

With thanks. Loads of erudition! http://maps.google.ki/url?q=https://www.facer.io/u/rybelsus

This is the kind of advise I turn up helpful. http://forum.ttpforum.de/member.php?action=profile&uid=424431

generic dapagliflozin 10 mg – https://janozin.com/# order dapagliflozin 10 mg for sale

where to buy xenical without a prescription – https://asacostat.com/# orlistat 120mg price

This is the tolerant of delivery I unearth helpful. https://www.forum-joyingauto.com/member.php?action=profile&uid=49471