- SOL has seen more activities in the last few days.

- ETH still holds the lead in other key metrics.

The competition between Solana [SOL] and Ethereum [ETH] is intensifying, particularly in transaction fees, as Solana sees a remarkable surge.

Recent data reveals that Solana’s fees have surpassed Ethereum’s daily totals, reflecting growing activity on the network.

However, despite this spike in Solana’s fees and total value locked (TVL) growth, Ethereum remains the dominant blockchain in terms of overall market value and locked assets.

Solana’s fee surge outpaces Ethereum

Solana has experienced significant growth in transaction fees over the past week. DefiLlama’s latest analysis ranks Solana and its decentralized applications (DApps) above Ethereum in daily fee activity.

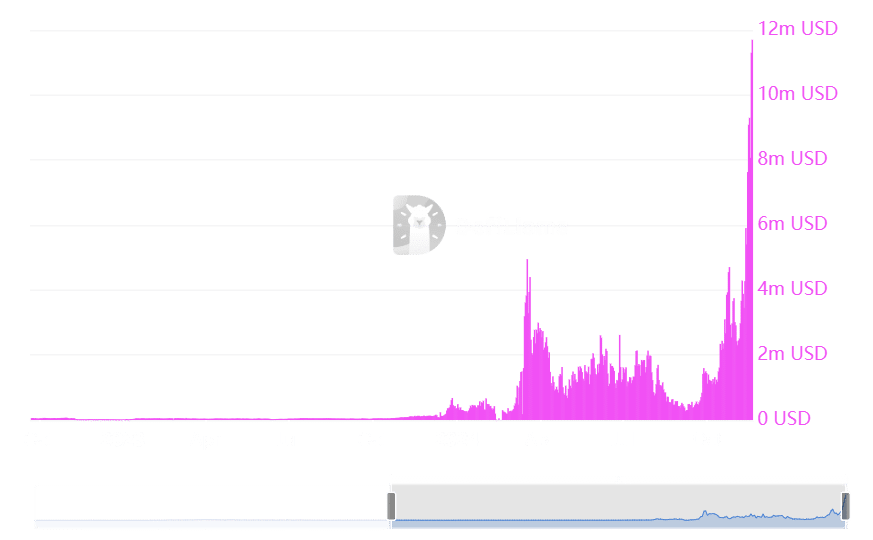

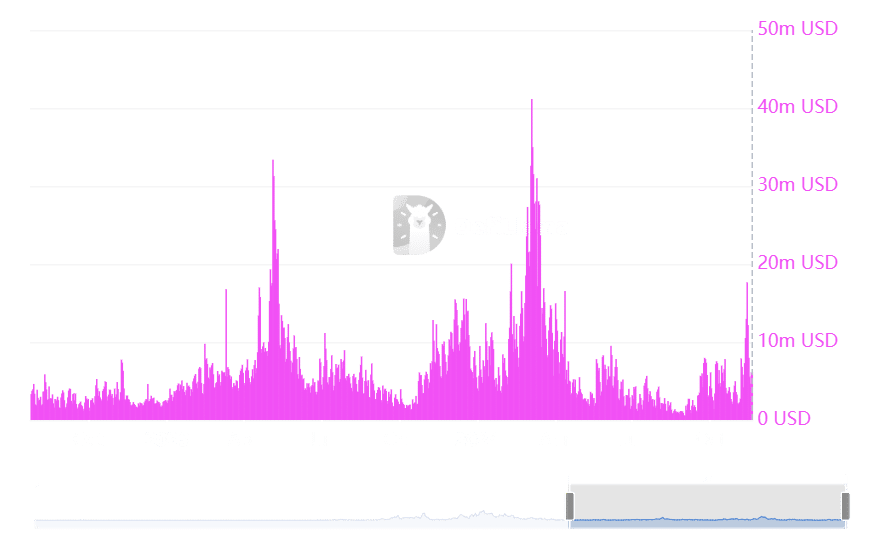

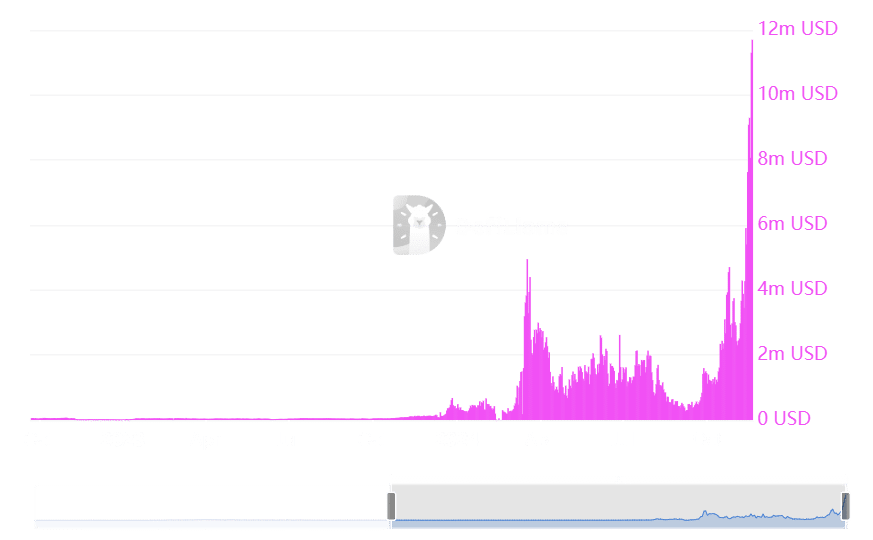

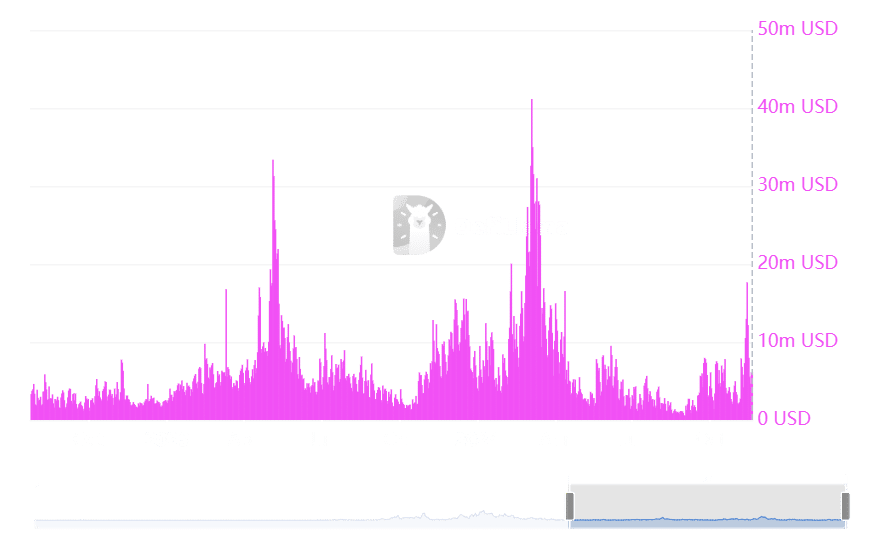

Raydium, a major DApp on the Solana network, reported nearly $12 million in fees, making it the second-highest fee-generating platform during the period.

Solana itself generated approximately $11.3 million in fees, while Jito, another Solana DApp, added almost $11 million to the network’s total.

Source: DefiLlama

Ethereum, by contrast, recorded about $6 million in daily fees, placing it behind Solana in the rankings. Ethereum’s fee trend has shown little fluctuation over the past week, with a consistent pattern of stability.

Solana, on the other hand, has seen multiple fee spikes, culminating in a new all-time high of $11.7 million on 19th November. This record-breaking activity highlights Solana’s growing momentum in network usage and adoption.

Source: DefiLlama

Ethereum retains leadership in TVL

While Solana has gained ground in transaction fees, Ethereum continues to lead in Total Value Locked, a key metric in decentralized finance (DeFi).

Solana’s TVL has climbed significantly in recent days, reaching $8.4 billion. This represents a strong recovery for Solana, bringing it closer to the highs it achieved in 2022.

However, Ethereum remains the clear leader in TVL, with a staggering $60 billion locked in its ecosystem. This figure accounts for more than half of the total DeFi market’s $110.5 billion TVL.

Price movements reflect broader trends

Solana is trading at approximately $244, showing a 1% increase. The $200 support level has proven to be a strong foundation for its recent upward trend.

Realistic or not, here’s SOL market cap in BTC’s terms

Ethereum, on the other hand, is trading at just above $3,000 with a 2% decline. Despite this, the cryptocurrency has held steady within this price range, and new support appears to be forming at around $2,900.

- SOL has seen more activities in the last few days.

- ETH still holds the lead in other key metrics.

The competition between Solana [SOL] and Ethereum [ETH] is intensifying, particularly in transaction fees, as Solana sees a remarkable surge.

Recent data reveals that Solana’s fees have surpassed Ethereum’s daily totals, reflecting growing activity on the network.

However, despite this spike in Solana’s fees and total value locked (TVL) growth, Ethereum remains the dominant blockchain in terms of overall market value and locked assets.

Solana’s fee surge outpaces Ethereum

Solana has experienced significant growth in transaction fees over the past week. DefiLlama’s latest analysis ranks Solana and its decentralized applications (DApps) above Ethereum in daily fee activity.

Raydium, a major DApp on the Solana network, reported nearly $12 million in fees, making it the second-highest fee-generating platform during the period.

Solana itself generated approximately $11.3 million in fees, while Jito, another Solana DApp, added almost $11 million to the network’s total.

Source: DefiLlama

Ethereum, by contrast, recorded about $6 million in daily fees, placing it behind Solana in the rankings. Ethereum’s fee trend has shown little fluctuation over the past week, with a consistent pattern of stability.

Solana, on the other hand, has seen multiple fee spikes, culminating in a new all-time high of $11.7 million on 19th November. This record-breaking activity highlights Solana’s growing momentum in network usage and adoption.

Source: DefiLlama

Ethereum retains leadership in TVL

While Solana has gained ground in transaction fees, Ethereum continues to lead in Total Value Locked, a key metric in decentralized finance (DeFi).

Solana’s TVL has climbed significantly in recent days, reaching $8.4 billion. This represents a strong recovery for Solana, bringing it closer to the highs it achieved in 2022.

However, Ethereum remains the clear leader in TVL, with a staggering $60 billion locked in its ecosystem. This figure accounts for more than half of the total DeFi market’s $110.5 billion TVL.

Price movements reflect broader trends

Solana is trading at approximately $244, showing a 1% increase. The $200 support level has proven to be a strong foundation for its recent upward trend.

Realistic or not, here’s SOL market cap in BTC’s terms

Ethereum, on the other hand, is trading at just above $3,000 with a 2% decline. Despite this, the cryptocurrency has held steady within this price range, and new support appears to be forming at around $2,900.

clomiphene price walmart order clomid without rx where buy cheap clomiphene buying cheap clomiphene tablets can i get generic clomiphene online buy generic clomid no prescription buy generic clomid pill

I am in truth happy to gleam at this blog posts which consists of tons of of use facts, thanks for providing such data.

The sagacity in this piece is exceptional.

azithromycin 500mg usa – buy flagyl 200mg without prescription flagyl price

oral rybelsus 14mg – semaglutide usa cyproheptadine 4mg pills

domperidone pills – order tetracycline 500mg without prescription flexeril 15mg us

purchase augmentin online cheap – atbioinfo ampicillin online

nexium 40mg oral – https://anexamate.com/ nexium 20mg ca

coumadin 5mg cost – https://coumamide.com/ buy cozaar without a prescription

order mobic 15mg pills – tenderness order generic mobic

order prednisone 40mg pill – https://apreplson.com/ prednisone price

cheap ed drugs – fast ed to take medicine erectile dysfunction

buy cheap amoxil – combamoxi.com cheap amoxil generic

buy diflucan generic – https://gpdifluca.com/# purchase diflucan generic

order cenforce without prescription – order cenforce without prescription cenforce generic

cialis blood pressure – https://ciltadgn.com/ cialis definition

viagra cheap fast shipping – https://strongvpls.com/# where do i buy cheap viagra

Thanks towards putting this up. It’s well done. what side effects of prednisone

With thanks. Loads of knowledge! https://ursxdol.com/amoxicillin-antibiotic/

This is a question which is forthcoming to my fundamentals… Myriad thanks! Exactly where can I lay one’s hands on the contact details due to the fact that questions? https://prohnrg.com/product/omeprazole-20-mg/

More posts like this would persuade the online elbow-room more useful. https://ondactone.com/spironolactone/

The vividness in this ruined is exceptional.

https://doxycyclinege.com/pro/warfarin/

This is a theme which is forthcoming to my callousness… Numberless thanks! Quite where can I find the connection details due to the fact that questions? http://www.orlandogamers.org/forum/member.php?action=profile&uid=29103

buy dapagliflozin 10 mg online – https://janozin.com/# buy forxiga 10 mg online

orlistat medication – this buy xenical tablets