- Solana’s price appreciated by more than 11% in the last 7 days

- Most market indicators were bullish, but the CMF flashed bearish signs

Solana’s [SOL] price action remained influenced by the market bulls as it continued to rise over the last few days. If the market situation remains the same, then the chances of SOL reclaiming $200 in May would be high. However, there remain a few concerns for SOL’s price on the charts.

What’s going on with Solana?

Solana bulls dominated bears last week as the token’s price surged by more than 11%. In fact, according to CoinMarketCap, SOL’s price increased by 7% in the last 24 hours alone. At the time of writing, SOL was trading at $155.10 with a market capitalization of over $69.5 billion.

Crypto Tony, a popular crypto-analyst, recently posted a tweet highlighting SOL’s possible price movement, pointing out that things might get even better. As per the tweet, SOL’s price might retain its bullish momentum and can go higher on the charts.

SOL’s price seems to be fast approaching a key resistance at $160. A successful breakout above that level could result in SOL touching $200 in May.

To better understand whether that’s possible, AMBCrypto analyzed Santiment’s data. As per our analysis, positive sentiment around SOL spiked sharply on 9 May – A sign that investors are confident in SOL.

Its open interest hiked along with its price too. A rise in this metric usually indicates that the chances of the ongoing price trend continuing are high.

Also, SOL’s funding rate dropped slightly on the charts. Generally, prices tend to move the other way than the funding rate – Another sign of a possible price hike.

Source: Santiment

Concerns galore?

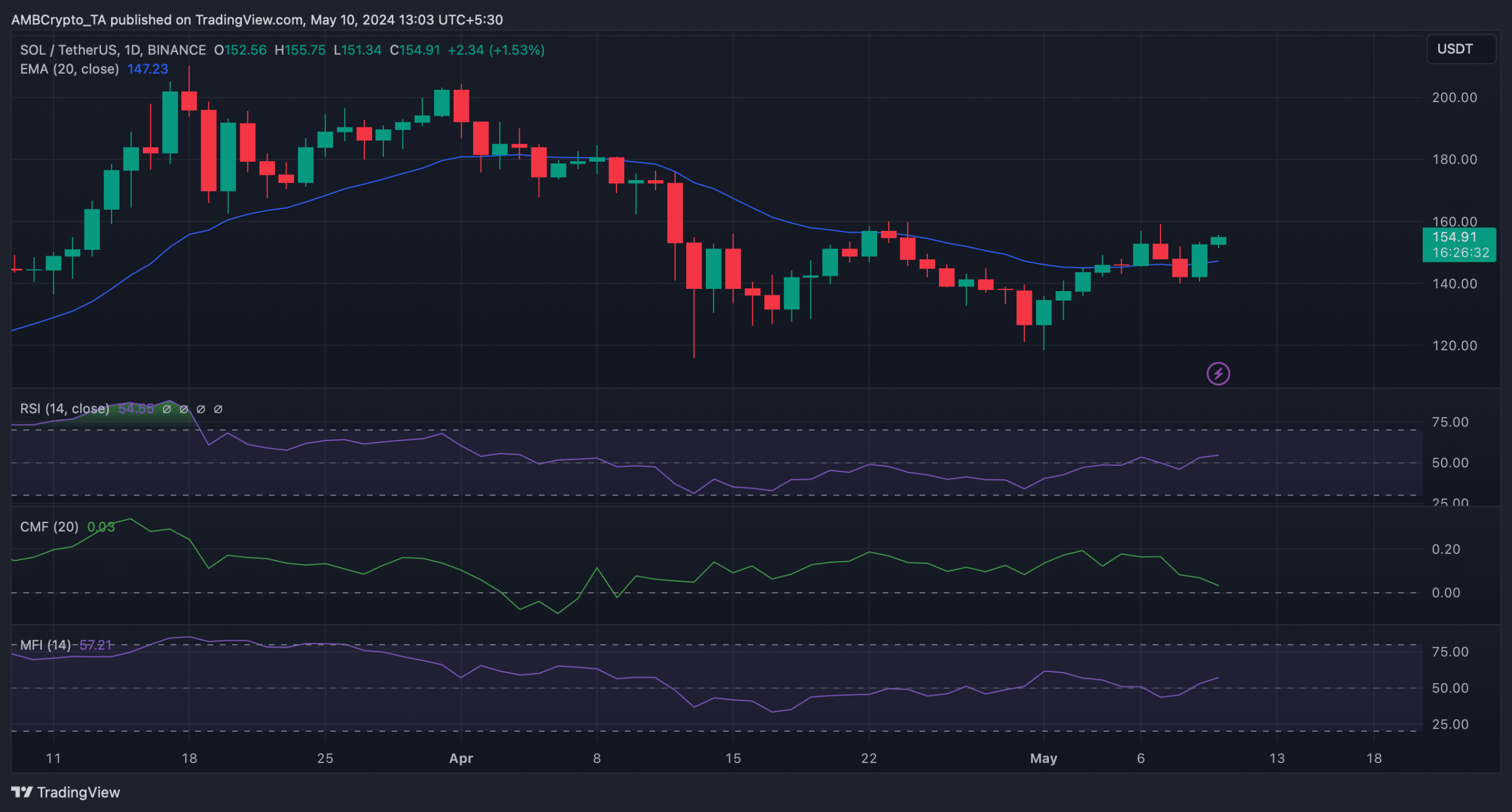

AMBCrypto then analyzed SOL’s daily chart to see whether technical indicators supported the possibility of SOL going above $160. According to our analysis, SOL’s price was resting above its 20-day Exponential Moving Average (EMA).

The Relative Strength Index (RSI) registered a sharp uptick too. At press time, it had a value of 54.6. Solana’s Money Flow Index (MFI) also followed a similar increasing trend. These indicators suggested that SOL’s bull rally might continue.

Source: TradingView

However, the Chaikin Money Flow (CMF) aligned with bears’ interest as it dropped over the last few days.

AMBCrypto had previously reported that SOL was forced to retreat from its $160-level on 7 May.

Realistic or not, here’s SOL’s market cap in BTC’s terms

If the Chaikin Money Flow’s (CMF) indication comes true, then SOL might not be able to breach that level this time either. A rejection from the resistance zone could cause a trend reversal, which can push the token’s price to $120 in the coming days.

cost of cheap clomiphene without insurance where to buy generic clomid tablets cost of cheap clomiphene prices where buy generic clomid no prescription how to buy generic clomid pill can i order cheap clomid prices how to get cheap clomiphene no prescription

More posts like this would make the online time more useful.

With thanks. Loads of erudition!

azithromycin sale – ofloxacin 200mg pill flagyl price

buy rybelsus generic – semaglutide 14mg price buy periactin 4 mg generic

motilium drug – order sumycin for sale cheap cyclobenzaprine 15mg

buy inderal generic – order methotrexate 10mg sale buy methotrexate 5mg generic

azithromycin 500mg cost – nebivolol uk buy nebivolol 5mg generic

buy augmentin generic – https://atbioinfo.com/ buy cheap generic acillin

buy esomeprazole generic – nexium to us order nexium 20mg

buy prednisone paypal – adrenal order prednisone 5mg

best ed medications – https://fastedtotake.com/ buy erectile dysfunction medicine

amoxicillin order – https://combamoxi.com/ purchase amoxicillin generic

buy generic diflucan – this fluconazole for sale

cenforce usa – https://cenforcers.com/ cenforce 100mg price

cialis for daily use cost – tadalafil troche reviews cialis over the counter in spain

cialis online without prescription – https://strongtadafl.com/ tadalafil no prescription forum

cheap zantac 300mg – https://aranitidine.com/ purchase zantac pills

cheap viagra buy online – viagra cheap online uk herbal viagra sale ireland

More articles like this would pretence of the blogosphere richer. click

This is the kind of literature I truly appreciate. buy amoxicillin online cheap

Thanks for putting this up. It’s okay done. https://ursxdol.com/get-cialis-professional/

More content pieces like this would create the web better. https://prohnrg.com/product/orlistat-pills-di/

More posts like this would force the blogosphere more useful. le cial

This is the big-hearted of writing I in fact appreciate. https://ondactone.com/spironolactone/

More posts like this would make the online time more useful.

maxolon canada

Thanks on putting this up. It’s well done. http://zqykj.com/bbs/home.php?mod=space&uid=302514

dapagliflozin 10 mg pills – https://janozin.com/# dapagliflozin 10mg brand

cost orlistat – buy orlistat without prescription order orlistat pills

The depth in this tune is exceptional. http://sols9.com/batheo/Forum/User-Ogqrgf