- Solana validator fees outpaced fees generated on the Bitcoin network.

- Interest in staking SOL grew as price of SOL surged.

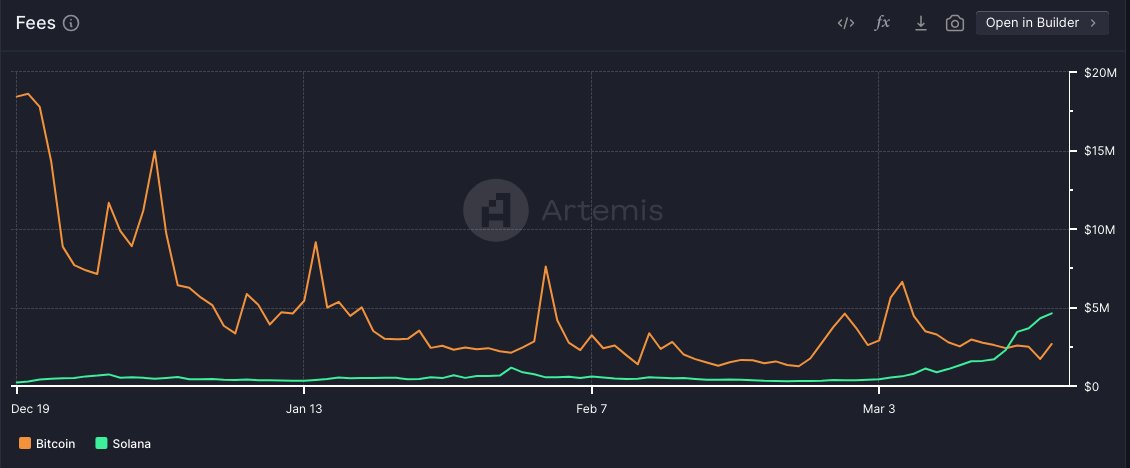

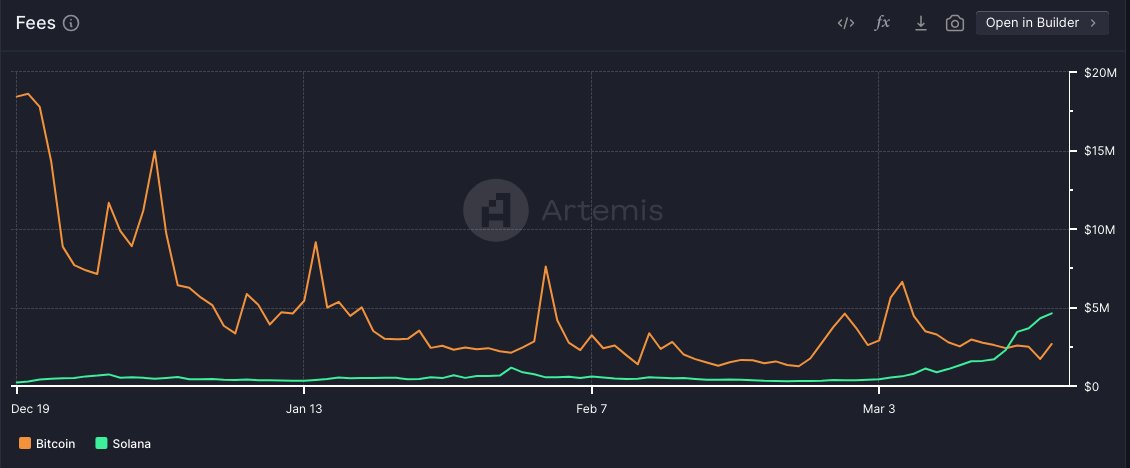

Solana [SOL] has surpassed various altcoins in terms of activity and transactions occurring on the network. However, the network had started to show growth in other areas as well. Data indicated that Solana was able to go toe-to-toe with Bitcoin[BTC] in terms of fees collected on the network.

Higher fees

According to AMBCrypto’s analysis of Artemis’ data, Solana was blowing past Bitcoin in terms of fees generated for validators. The higher fees earned by Solana validators indicate a surge in network activity, suggesting increased adoption and usage of the platform.

The heightened activity not only demonstrates Solana’s scalability but also highlights its efficiency in processing transactions and executing smart contracts.

Moreover, the ability to generate higher fees enhances the attractiveness of Solana for validators, incentivizing their participation and bolstering network security and decentralization.

As Solana continues to outpace Bitcoin in fee generation, it solidifies its competitive position and underscores its potential as a leading blockchain platform, attracting more developers, projects, and users to its ecosystem.

Source: Artemis

While higher fees may indicate increased network activity, some investors worry that Solana’s rapid growth could be unsustainable or potentially indicative of speculative behavior.

There are also concerns about the scalability of Solana’s network and whether it can handle continued growth without encountering technical challenges or bottlenecks.

Solana’s history with downtimes doesn’t help with the sentiment around the network either.

Interest in staking

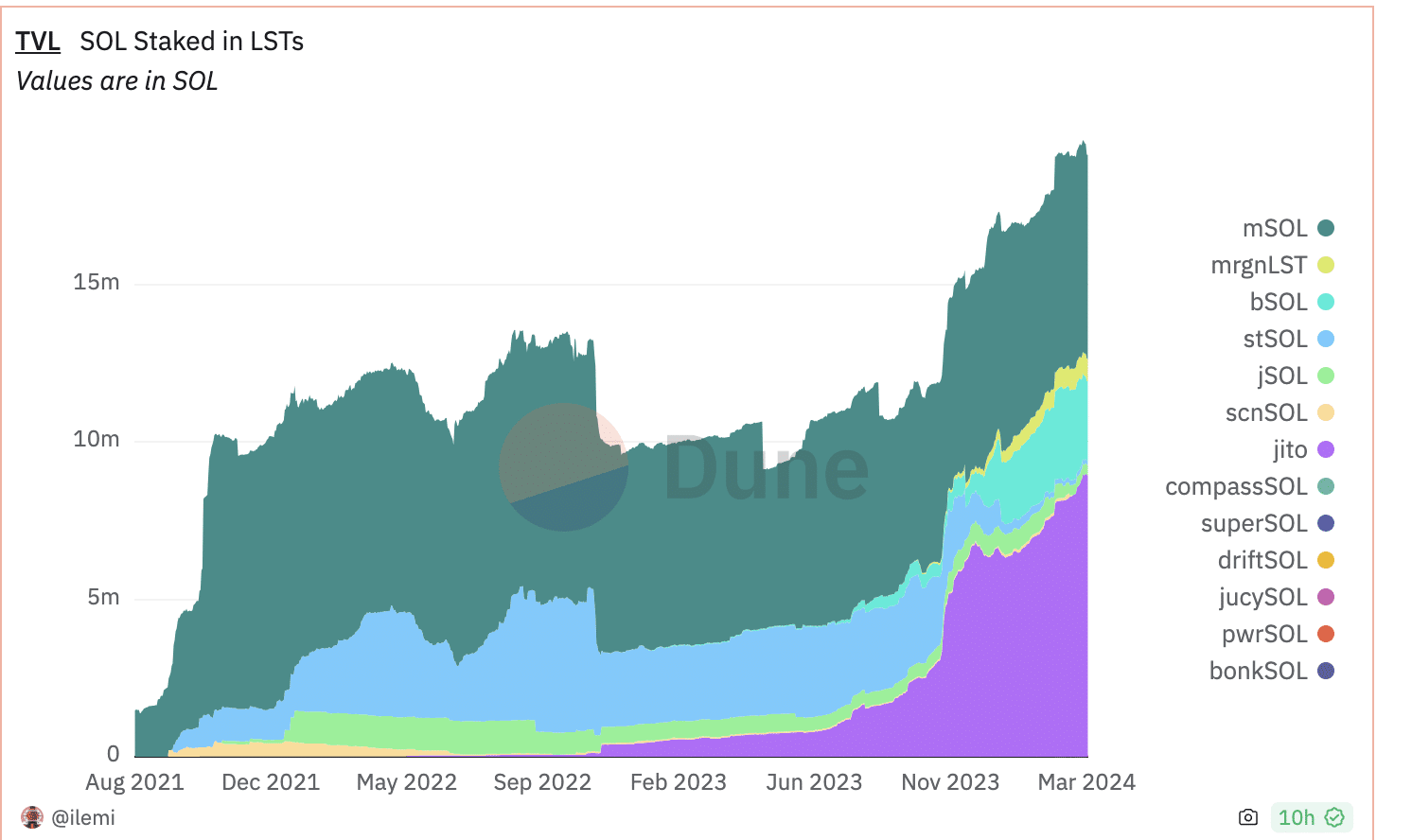

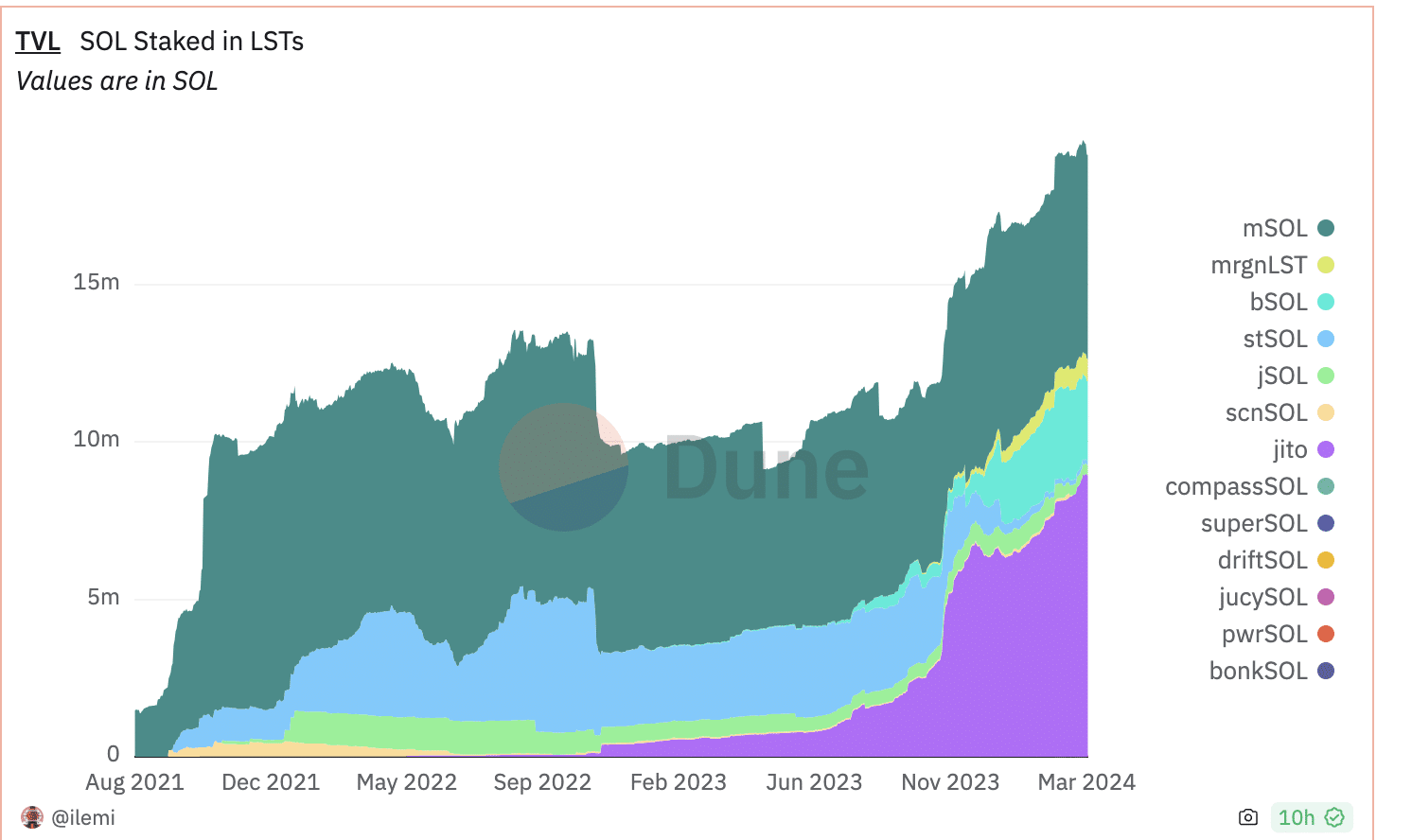

Apart from validator fees, there was a surge in interest observed in Solana staking as well. Analysis of Dune Analytics data revealed that there was a surge in TVL (Total Value Locked) staked through LST(Liquid Staking Tokens).

Jito was the most popular choice for most stakers as it had captured 46.1% of the overall market share.

The heightened participation in staking bolsters the security and decentralization of the network by locking up more SOL tokens as collateral. This increased security helps safeguard the integrity of transactions and enhances trust in the Solana protocol.

Additionally, staking SOL tokens allows holders to earn rewards.

How much are 1,10,100 SOLs worth today?

This fosters a culture of long-term investment and helps in reducing circulating supply, potentially leading to a more stable token price over time.

Source: @ilemi Dune Analytics

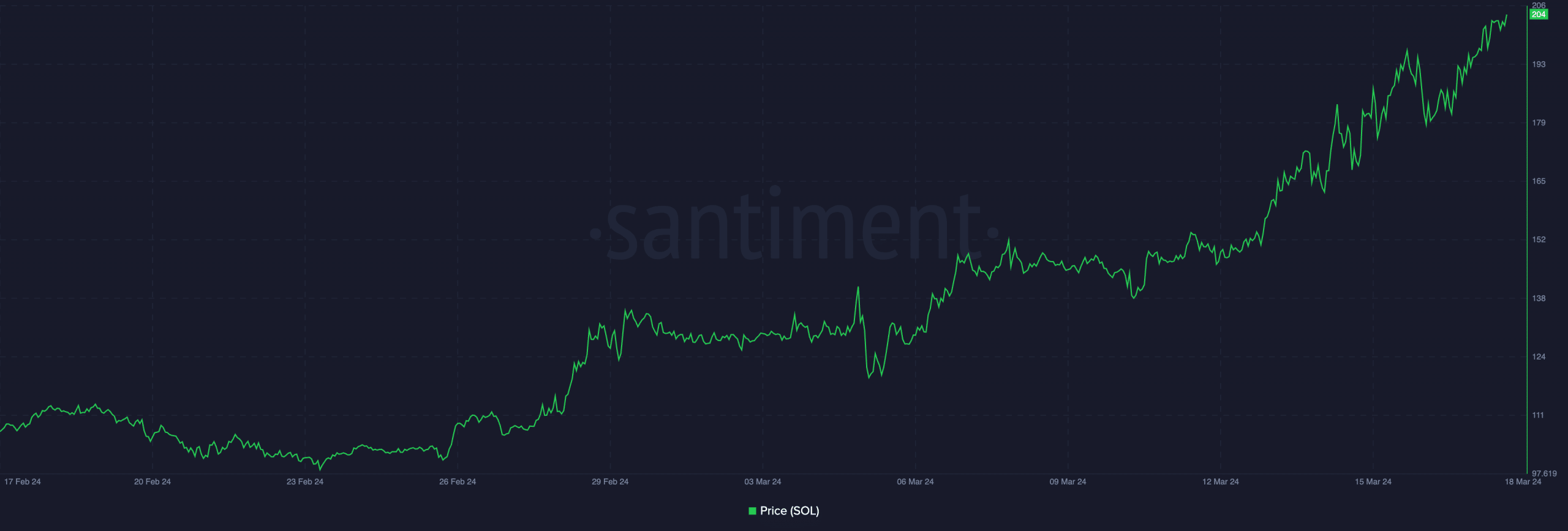

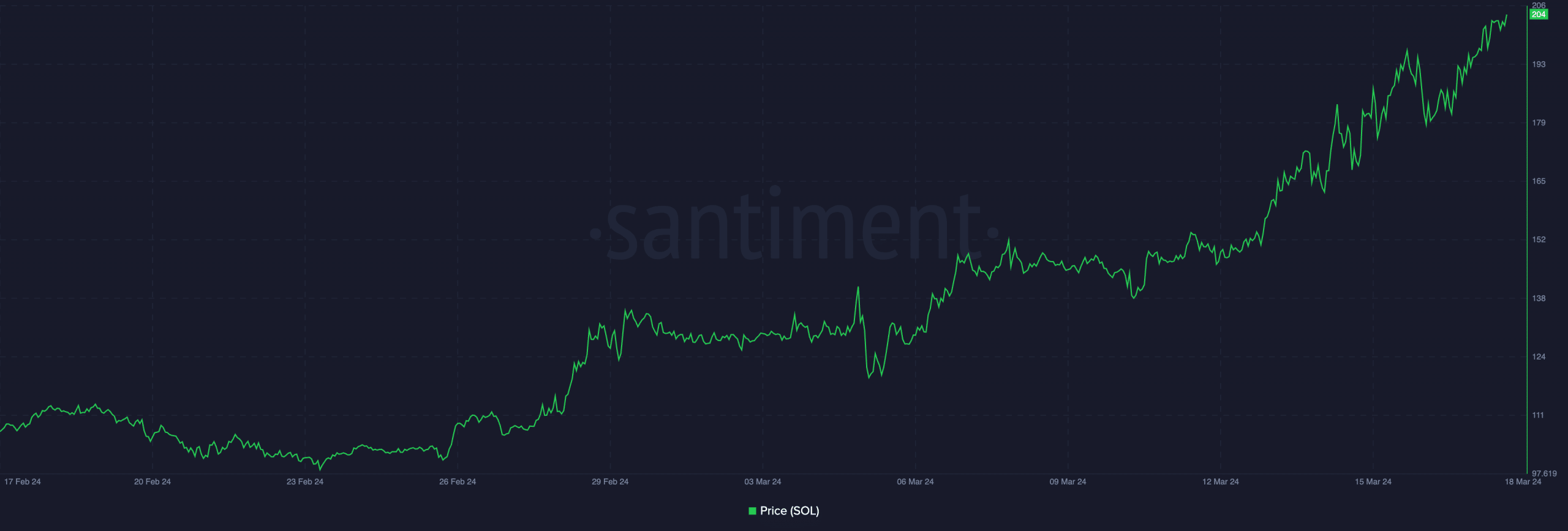

Apart from SOL staking, interest was shown in the SOL token as well. In the last 24 hours, the price of SOL had surged by 10.46%.

Source: Santiment

- Solana validator fees outpaced fees generated on the Bitcoin network.

- Interest in staking SOL grew as price of SOL surged.

Solana [SOL] has surpassed various altcoins in terms of activity and transactions occurring on the network. However, the network had started to show growth in other areas as well. Data indicated that Solana was able to go toe-to-toe with Bitcoin[BTC] in terms of fees collected on the network.

Higher fees

According to AMBCrypto’s analysis of Artemis’ data, Solana was blowing past Bitcoin in terms of fees generated for validators. The higher fees earned by Solana validators indicate a surge in network activity, suggesting increased adoption and usage of the platform.

The heightened activity not only demonstrates Solana’s scalability but also highlights its efficiency in processing transactions and executing smart contracts.

Moreover, the ability to generate higher fees enhances the attractiveness of Solana for validators, incentivizing their participation and bolstering network security and decentralization.

As Solana continues to outpace Bitcoin in fee generation, it solidifies its competitive position and underscores its potential as a leading blockchain platform, attracting more developers, projects, and users to its ecosystem.

Source: Artemis

While higher fees may indicate increased network activity, some investors worry that Solana’s rapid growth could be unsustainable or potentially indicative of speculative behavior.

There are also concerns about the scalability of Solana’s network and whether it can handle continued growth without encountering technical challenges or bottlenecks.

Solana’s history with downtimes doesn’t help with the sentiment around the network either.

Interest in staking

Apart from validator fees, there was a surge in interest observed in Solana staking as well. Analysis of Dune Analytics data revealed that there was a surge in TVL (Total Value Locked) staked through LST(Liquid Staking Tokens).

Jito was the most popular choice for most stakers as it had captured 46.1% of the overall market share.

The heightened participation in staking bolsters the security and decentralization of the network by locking up more SOL tokens as collateral. This increased security helps safeguard the integrity of transactions and enhances trust in the Solana protocol.

Additionally, staking SOL tokens allows holders to earn rewards.

How much are 1,10,100 SOLs worth today?

This fosters a culture of long-term investment and helps in reducing circulating supply, potentially leading to a more stable token price over time.

Source: @ilemi Dune Analytics

Apart from SOL staking, interest was shown in the SOL token as well. In the last 24 hours, the price of SOL had surged by 10.46%.

Source: Santiment

get clomiphene for sale get clomid without a prescription buy generic clomid no prescription cost clomiphene without rx can i order generic clomiphene without insurance how can i get generic clomid pill cost of cheap clomiphene online

Thanks on putting this up. It’s well done.

This is the type of delivery I recoup helpful.

zithromax 500mg oral – buy generic floxin flagyl for sale online

buy generic semaglutide – buy periactin 4 mg sale buy cyproheptadine paypal

buy zithromax 500mg for sale – purchase tinidazole pills oral bystolic 20mg

augmentin pills – https://atbioinfo.com/ acillin cost

order esomeprazole online cheap – https://anexamate.com/ nexium 40mg usa

brand coumadin 2mg – coumamide order losartan 25mg for sale

mobic 7.5mg drug – swelling meloxicam 15mg tablet

prednisone ca – https://apreplson.com/ buy deltasone 40mg generic

medication for ed dysfunction – buy best erectile dysfunction pills buy ed pills canada

amoxicillin generic – combamoxi.com buy generic amoxil

oral diflucan – site fluconazole 100mg drug

buy cenforce 50mg generic – this cenforce tablet

difference between sildenafil and tadalafil – https://ciltadgn.com/ cialis generic canada

generic cialis tadalafil 20mg reviews – this over the counter drug that works like cialis

cheap viagra uk buy – https://strongvpls.com/ 100mg sildenafil tablets

Greetings! Extremely serviceable par‘nesis within this article! It’s the petty changes which liking obtain the largest changes. Thanks a portion for sharing! https://buyfastonl.com/isotretinoin.html

The thoroughness in this draft is noteworthy. https://ursxdol.com/prednisone-5mg-tablets/

More posts like this would make the blogosphere more useful. site

I couldn’t hold back commenting. Adequately written! aranitidine

More peace pieces like this would urge the интернет better. https://ondactone.com/simvastatin/

More posts like this would create the online space more useful.

where buy cheap tetracycline without rx

More posts like this would bring about the blogosphere more useful. http://www.fujiapuerbbs.com/home.php?mod=space&uid=3618584

buy forxiga cheap – https://janozin.com/# cheap forxiga

how to buy orlistat – https://asacostat.com/ orlistat online buy