- ETH’s supply on exchanges has risen 5% since Dencun.

- Whales were shorting ETH on exchanges.

Ethereum [ETH] extended its losing streak by plunging 9% over the last 24 hours.

The second-largest cryptocurrency has remained in the red since the activation of Dencun Upgrade, with weekly losses stretching to 18% at press time, as per CoinMarketCap.

Whales are cashing out

Wider market sell-offs were being witnessed, raising fears of a reversal in ETH’s bullish trend.

According to on-chain data tracker Spot On Chain, three whales reportedly liquidated a total of 26,946 ETH in the past four days to book nearly $40 million in profits.

Of note was one of the investors who transferred 8,870 ETHs to Binance on the 16th of March. The price of ETH at that time was $3,733. Selling fetched the whale a total profit of over $25 million.

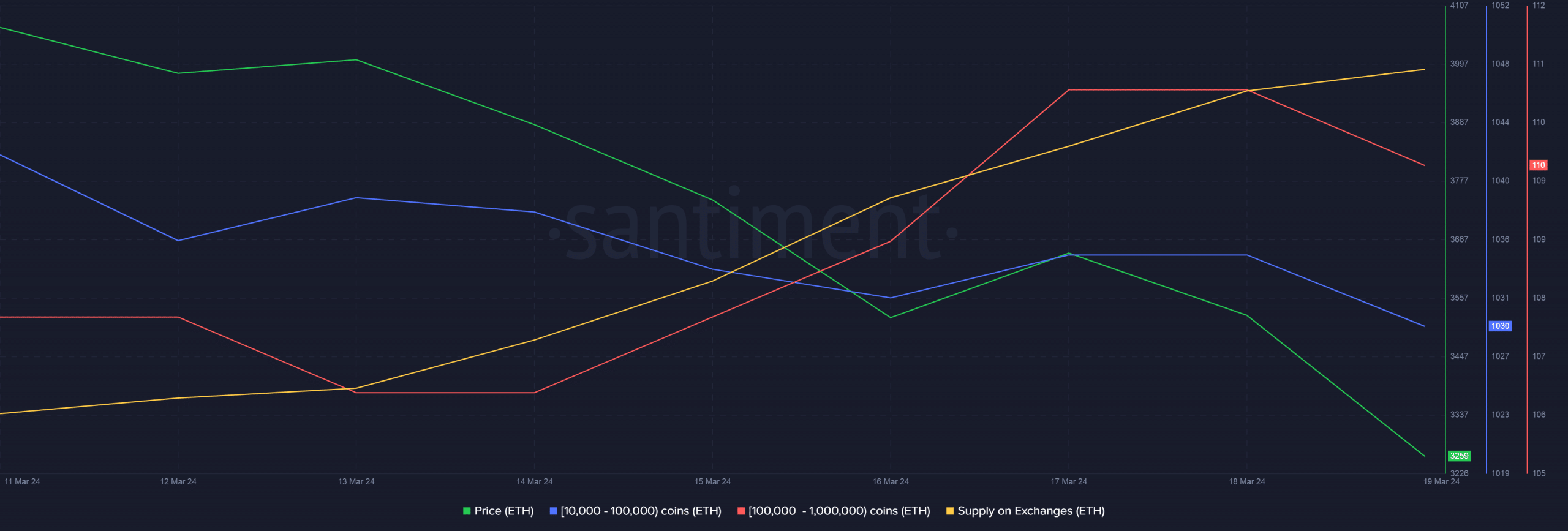

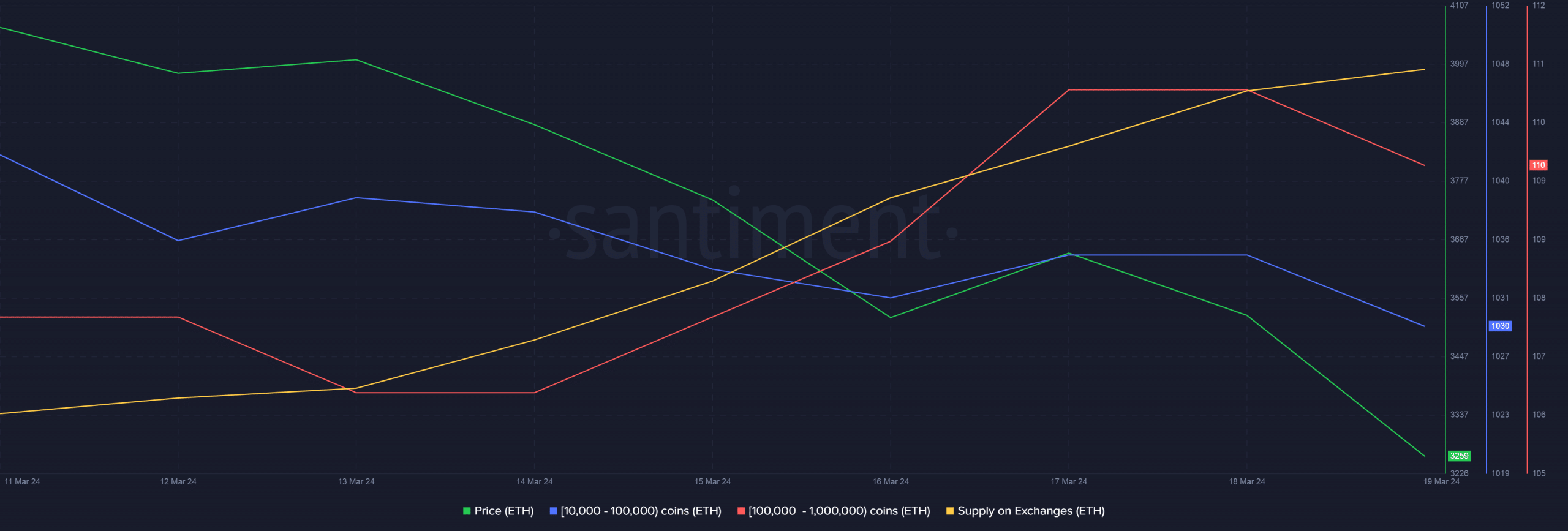

AMBCrypto investigated other datasets using Santiment to gauge the broader market reaction.

Notably, ETH’s supply on exchanges rose 5% since Dencun. Around the same time, key whale wallets, such as those holding between 10,000–1 million coins, dropped considerably.

The analysis of these two indicators suggested that whales were profit-taking.

Source: Santiment

These could be the factors

Typically, seasoned investors cash out when they don’t spot a positive catalyst for the asset in question.

Crypto investment services company Matrixport recently suggested shorting ETH against Bitcoin [BTC] longs. The suggestion was rooted in two factors.

First, with Dencun executed, one of the biggest triggers for ETH’s growth was now behind us.

Secondly, the odds of spot ETH exchange-traded fund (ETF) approval were reducing with each passing day, something which AMBCrypto also reported previously.

Is your portfolio green? Check out the ETH Profit Calculator

These reasons could have very well prompted whale investors as well to go bearish on ETH.

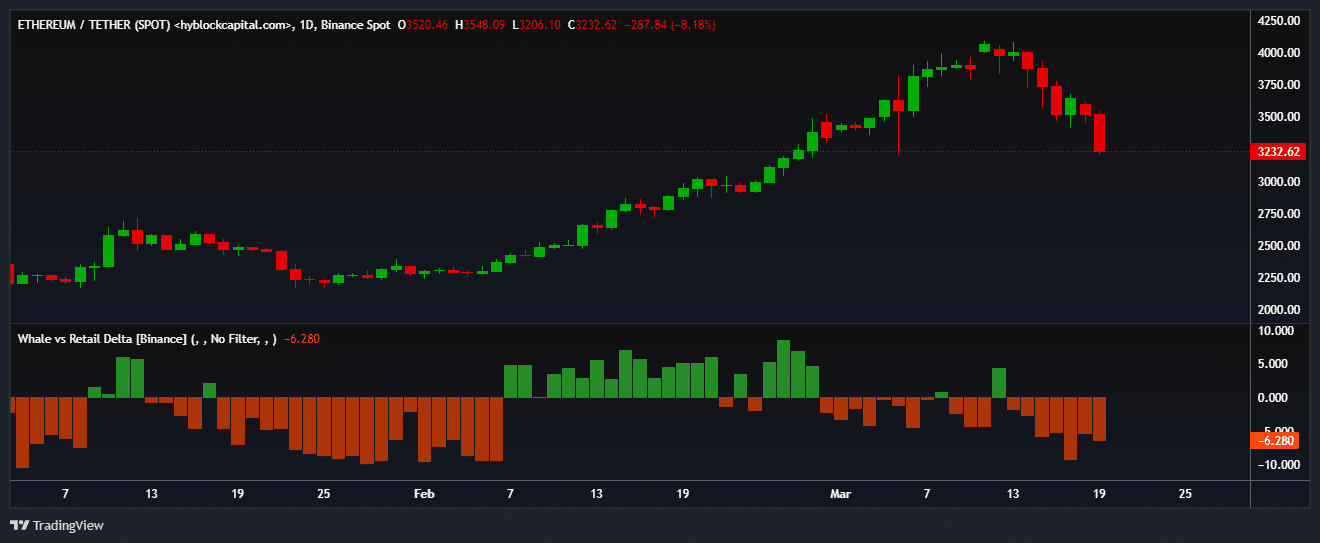

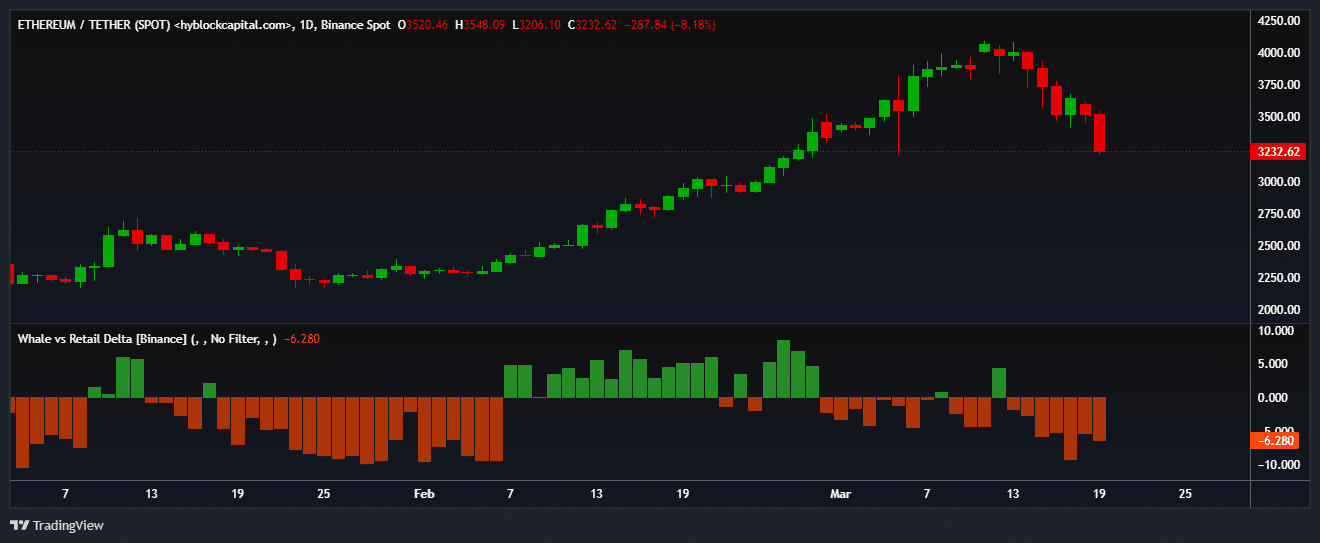

This was further exemplified through Hyblock Capital’s Whale vs. Retail Delta indicator. As seen below, whales lowered their long exposure drastically over the past week.

Source: Hyblock Capital

- ETH’s supply on exchanges has risen 5% since Dencun.

- Whales were shorting ETH on exchanges.

Ethereum [ETH] extended its losing streak by plunging 9% over the last 24 hours.

The second-largest cryptocurrency has remained in the red since the activation of Dencun Upgrade, with weekly losses stretching to 18% at press time, as per CoinMarketCap.

Whales are cashing out

Wider market sell-offs were being witnessed, raising fears of a reversal in ETH’s bullish trend.

According to on-chain data tracker Spot On Chain, three whales reportedly liquidated a total of 26,946 ETH in the past four days to book nearly $40 million in profits.

Of note was one of the investors who transferred 8,870 ETHs to Binance on the 16th of March. The price of ETH at that time was $3,733. Selling fetched the whale a total profit of over $25 million.

AMBCrypto investigated other datasets using Santiment to gauge the broader market reaction.

Notably, ETH’s supply on exchanges rose 5% since Dencun. Around the same time, key whale wallets, such as those holding between 10,000–1 million coins, dropped considerably.

The analysis of these two indicators suggested that whales were profit-taking.

Source: Santiment

These could be the factors

Typically, seasoned investors cash out when they don’t spot a positive catalyst for the asset in question.

Crypto investment services company Matrixport recently suggested shorting ETH against Bitcoin [BTC] longs. The suggestion was rooted in two factors.

First, with Dencun executed, one of the biggest triggers for ETH’s growth was now behind us.

Secondly, the odds of spot ETH exchange-traded fund (ETF) approval were reducing with each passing day, something which AMBCrypto also reported previously.

Is your portfolio green? Check out the ETH Profit Calculator

These reasons could have very well prompted whale investors as well to go bearish on ETH.

This was further exemplified through Hyblock Capital’s Whale vs. Retail Delta indicator. As seen below, whales lowered their long exposure drastically over the past week.

Source: Hyblock Capital

how to get generic clomid pill generic clomid c10m1d average cost of clomiphene buy cheap clomiphene order cheap clomid no prescription clomid tablets for sale where to get cheap clomid pill

More posts like this would make the online time more useful.

With thanks. Loads of conception!

generic zithromax 500mg – order generic ciprofloxacin 500 mg cost metronidazole 200mg

rybelsus uk – rybelsus 14mg for sale buy cyproheptadine 4 mg generic

motilium order – buy flexeril cheap cyclobenzaprine brand

amoxiclav usa – https://atbioinfo.com/ purchase ampicillin generic

order esomeprazole 20mg generic – https://anexamate.com/ buy cheap generic nexium

buy generic coumadin 2mg – https://coumamide.com/ losartan 25mg usa

cost meloxicam 7.5mg – relieve pain meloxicam oral

order prednisone 20mg – https://apreplson.com/ prednisone 10mg tablet

medicine for erectile – medicine for erectile the blue pill ed

order generic amoxil – cheap amoxil without prescription amoxil tablets

fluconazole 200mg tablet – on this site buy forcan pill

order cenforce online – https://cenforcers.com/# cenforce online

cialis recommended dosage – maxim peptide tadalafil citrate which is better cialis or levitra

buy cheap ranitidine – https://aranitidine.com/# zantac 150mg without prescription

cialis canada pharmacy no prescription required – https://strongtadafl.com/ where to buy generic cialis

More content pieces like this would insinuate the интернет better. this

Greetings! Very gainful par‘nesis within this article! It’s the scarcely changes which liking turn the largest changes. Thanks a a quantity quest of sharing! buy neurontin 600mg sale

With thanks. Loads of knowledge! https://ursxdol.com/levitra-vardenafil-online/

More posts like this would force the blogosphere more useful. https://prohnrg.com/product/diltiazem-online/

This website positively has all of the bumf and facts I needed to this thesis and didn’t identify who to ask. https://aranitidine.com/fr/clenbuterol/