- Whales took profits while small holders are taking advantage of the dip.

- SHIB’s price might extend to $0.000052 when the correction is over.

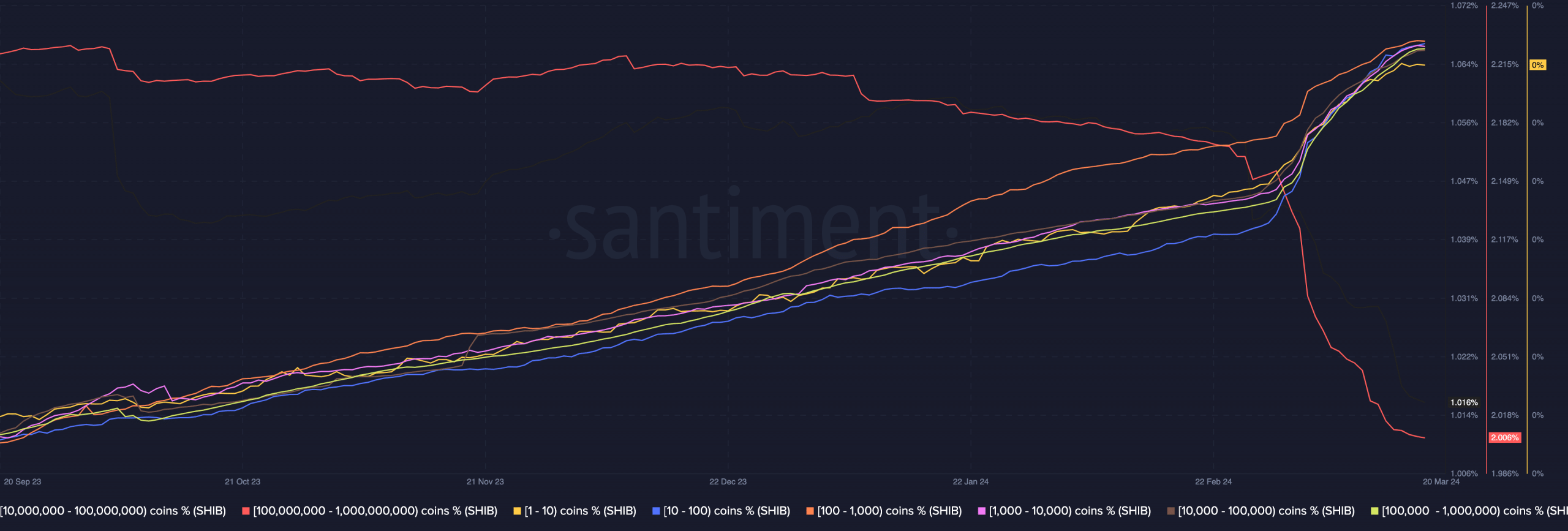

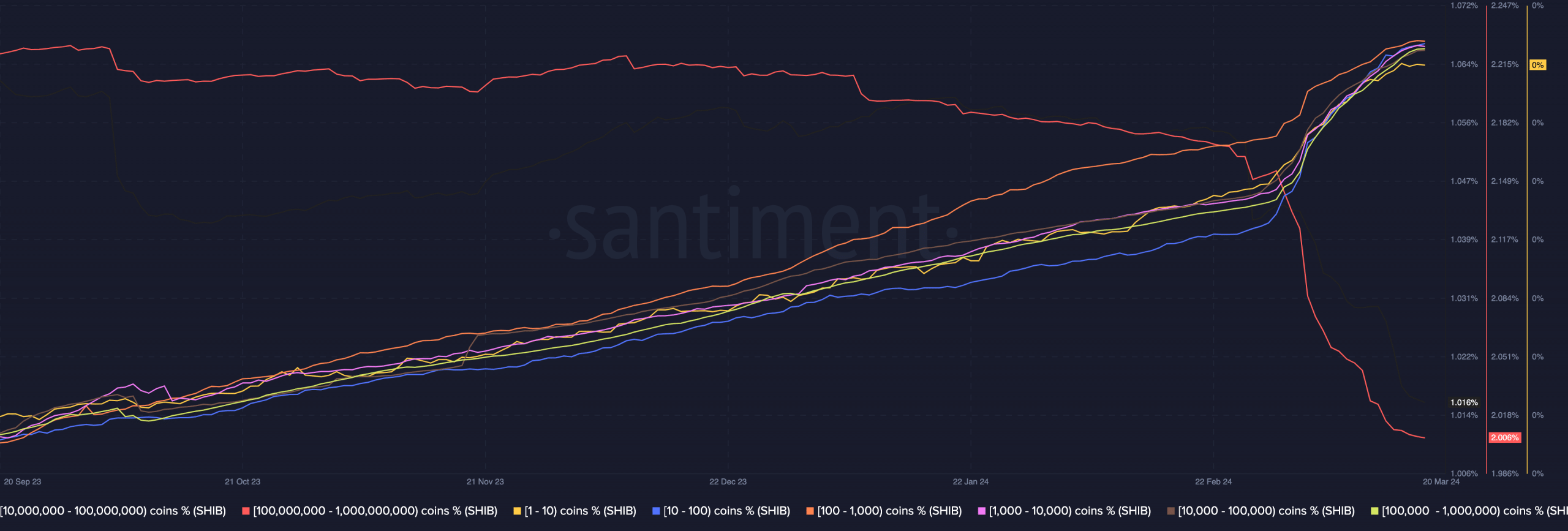

AMBCrypto’s on-chain analysis revealed that Shiba Inu [SHIB] whales were selling some of their holdings while the retail cohort did the opposite. We were able to arrive at this conclusion after examining the balance of addresses.

Whale is a term used to describe holders of a cryptocurrency who own it in large quantities. Because of their holding strength, their actions impact prices.

“We’re not on the same side”

At press time, data from Santiment showed that the 100 million to 1 billion SHIB cohort has continually shed the number of tokens owned. However, those in the 1-1 million group have been accumulating.

Source: Santiment

This conflicting position suggests that whales and the retail cohort shared a different sentiment about the price action. At press time, Shiba Inu’s price was $0.000025. This value was a 22.67% decrease in the last seven days.

Though the broader market experienced a correction, SHIB’s decline could also be connected to the way whales booked profits, especially as the value doubled in the last 30 days. But what is next for SHIB’s price?

The downturn is not forever

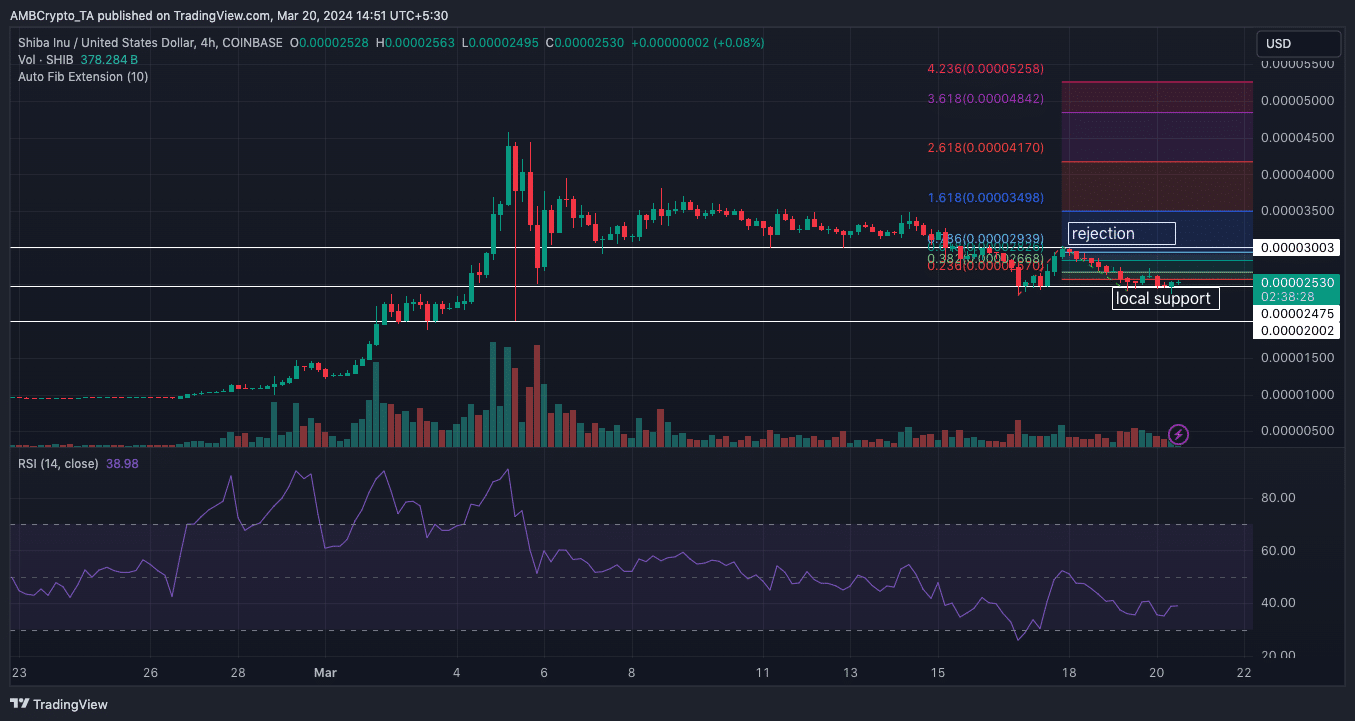

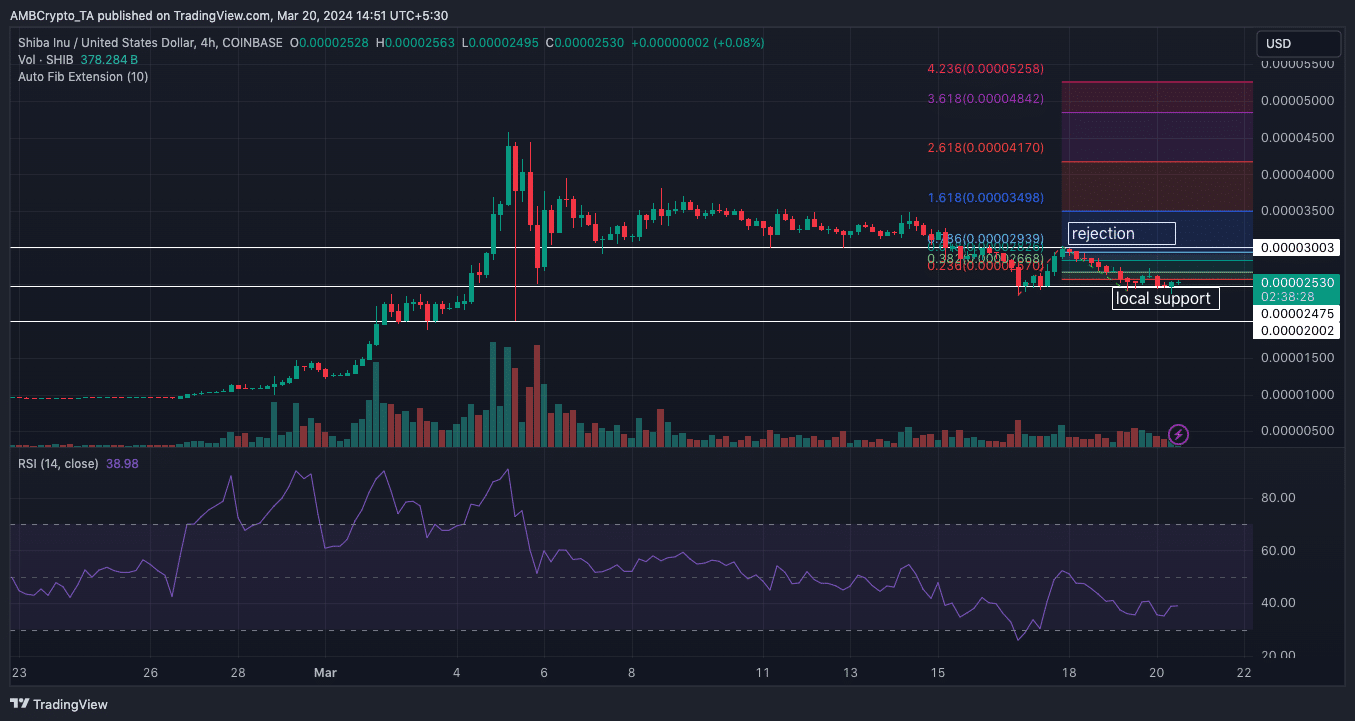

According to the 4-hour SHIB/USD chart, bears resisted the attempt at flipping $0.000030 on the 18th of March. However, bulls seem to be doing well in defending the $0.000024 local support.

Should bears fail to arrest this bullish resolve, then SHIB might rebound off the trough. Conversely, a close below $0.00024 could lead the price down to $0.000020.

In the meantime, the Relative Strength Index (RSI) neared the oversold region. This suggests that Shiba Inu remained in a bearish control and the corrective phase might not be over.

Despite the possibility of a further downtrend, the Fibonacci extension showed the SHIB’s potential recovery could be better. In a highly bullish scenario, the price of SHIB might rally as high as $0.000052. From the current lows, this would indicate a 51.9% rally.

Source: TradingView

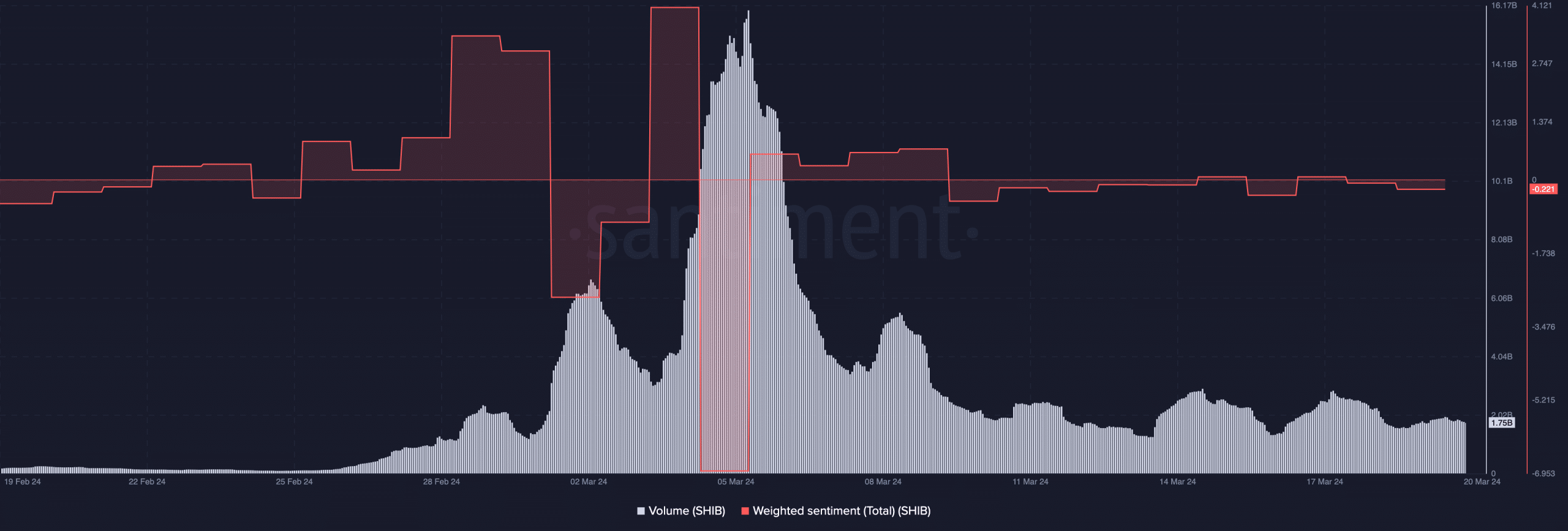

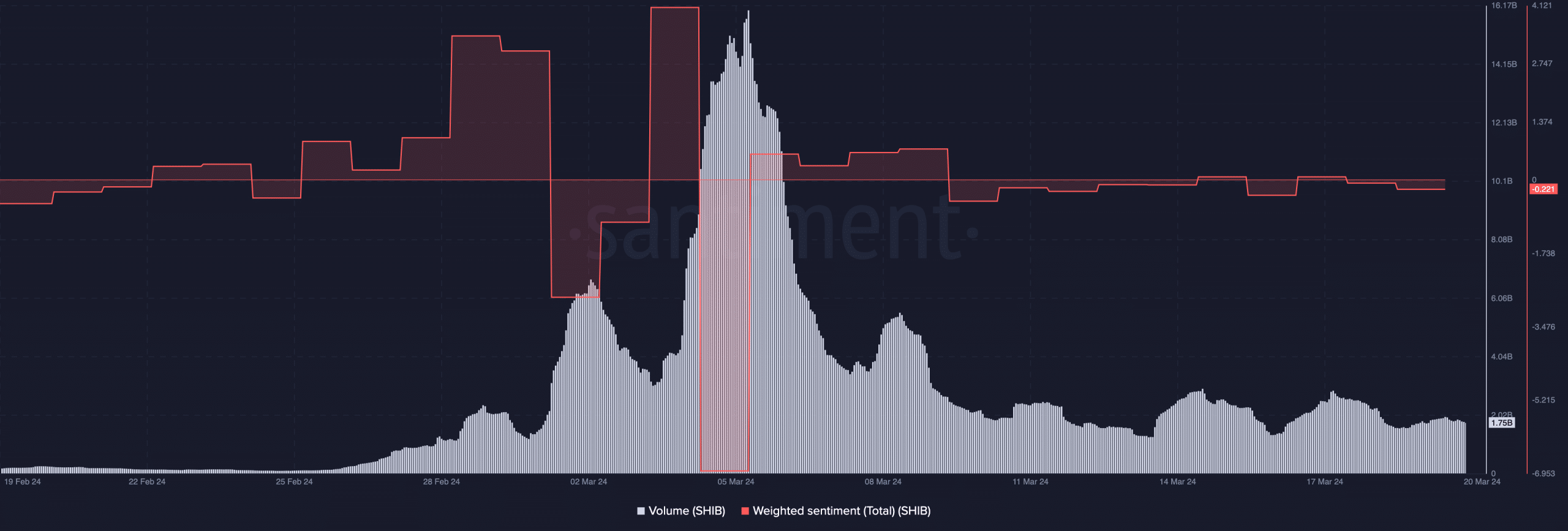

AMBCrypto also looked at Shiba Inu’s on-chain volume. As of this writing, the volume was 1.75 billion— a significant decline from what it was on the 6th of March when the price skyrocketed.

However, the declining volume might not be a bad omen for SHIB. Historically, rising. volume on rising price fuel further jumps. But at the same time, a falling volume while the price decreases could trigger an increase. This is because the downtrend might become weak in the process.

Source: Santiment

Is your portfolio green? Check the SHIB Profit Calculator

In terms of sentiment, on-chain data showed that participants were not yet convinced that SHIB would exit its bearish phase. At press time, the Weighted Sentiment was -0.0221. But this could also signal that it was time to accumulate the token.

Most times, a highly positive sentiment indicates a local top. However, when the sentiment is negative, buying opportunities appear, and that could be the case with SHIB.

- Whales took profits while small holders are taking advantage of the dip.

- SHIB’s price might extend to $0.000052 when the correction is over.

AMBCrypto’s on-chain analysis revealed that Shiba Inu [SHIB] whales were selling some of their holdings while the retail cohort did the opposite. We were able to arrive at this conclusion after examining the balance of addresses.

Whale is a term used to describe holders of a cryptocurrency who own it in large quantities. Because of their holding strength, their actions impact prices.

“We’re not on the same side”

At press time, data from Santiment showed that the 100 million to 1 billion SHIB cohort has continually shed the number of tokens owned. However, those in the 1-1 million group have been accumulating.

Source: Santiment

This conflicting position suggests that whales and the retail cohort shared a different sentiment about the price action. At press time, Shiba Inu’s price was $0.000025. This value was a 22.67% decrease in the last seven days.

Though the broader market experienced a correction, SHIB’s decline could also be connected to the way whales booked profits, especially as the value doubled in the last 30 days. But what is next for SHIB’s price?

The downturn is not forever

According to the 4-hour SHIB/USD chart, bears resisted the attempt at flipping $0.000030 on the 18th of March. However, bulls seem to be doing well in defending the $0.000024 local support.

Should bears fail to arrest this bullish resolve, then SHIB might rebound off the trough. Conversely, a close below $0.00024 could lead the price down to $0.000020.

In the meantime, the Relative Strength Index (RSI) neared the oversold region. This suggests that Shiba Inu remained in a bearish control and the corrective phase might not be over.

Despite the possibility of a further downtrend, the Fibonacci extension showed the SHIB’s potential recovery could be better. In a highly bullish scenario, the price of SHIB might rally as high as $0.000052. From the current lows, this would indicate a 51.9% rally.

Source: TradingView

AMBCrypto also looked at Shiba Inu’s on-chain volume. As of this writing, the volume was 1.75 billion— a significant decline from what it was on the 6th of March when the price skyrocketed.

However, the declining volume might not be a bad omen for SHIB. Historically, rising. volume on rising price fuel further jumps. But at the same time, a falling volume while the price decreases could trigger an increase. This is because the downtrend might become weak in the process.

Source: Santiment

Is your portfolio green? Check the SHIB Profit Calculator

In terms of sentiment, on-chain data showed that participants were not yet convinced that SHIB would exit its bearish phase. At press time, the Weighted Sentiment was -0.0221. But this could also signal that it was time to accumulate the token.

Most times, a highly positive sentiment indicates a local top. However, when the sentiment is negative, buying opportunities appear, and that could be the case with SHIB.

can i order generic clomid pills get cheap clomiphene online where to get clomiphene pill cheapest clomiphene pills can you buy cheap clomid online order generic clomid without a prescription how can i get clomiphene

This is the kind of scribble literary works I truly appreciate.

More delight pieces like this would make the интернет better.

azithromycin cheap – buy generic flagyl 200mg oral metronidazole 400mg

order rybelsus generic – rybelsus generic buy cheap generic cyproheptadine

motilium order online – order domperidone pills flexeril 15mg pills

zithromax for sale – bystolic 20mg generic buy bystolic 5mg pills

buy augmentin 625mg generic – https://atbioinfo.com/ ampicillin buy online

buy esomeprazole generic – https://anexamate.com/ nexium 20mg pill

order coumadin 2mg online cheap – cou mamide buy losartan paypal

brand meloxicam 7.5mg – tenderness order mobic 15mg generic

buy ed pills cheap – fast ed to take site mens ed pills

order amoxil generic – https://combamoxi.com/ amoxicillin drug

forcan where to buy – https://gpdifluca.com/# order diflucan 100mg generic

order cenforce – cenforce us cenforce for sale online

when to take cialis for best results – https://ciltadgn.com/ cialis without a doctor prescription canada

cialis maximum dose – https://strongtadafl.com/ sanofi cialis

zantac 150mg pills – ranitidine 150mg pill generic zantac

100 mg sildenafil – https://strongvpls.com/ buy viagra kamagra online

Greetings! Utter gainful par‘nesis within this article! It’s the scarcely changes which choice obtain the largest changes. Thanks a portion towards sharing! synthroid para mujeres

Facts blog you possess here.. It’s severely to assign high quality article like yours these days. I justifiably comprehend individuals like you! Take mindfulness!! https://buyfastonl.com/

More articles like this would pretence of the blogosphere richer. https://ursxdol.com/amoxicillin-antibiotic/

I’ll certainly bring to skim more. https://prohnrg.com/product/get-allopurinol-pills/

Greetings! Extremely gainful advice within this article! It’s the petty changes which choice make the largest changes. Thanks a lot towards sharing! acheter kamagra pas cher