- Shiba Inu’s price increased by over 1.13% in the last 24 hours.

- Market indicators looked bullish on the memecoin.

After increasing sharply last week, Shiba Inu [SHIB] turned bearish as its price started to drop. The price decline pushed SHIB towards a critical support level. However, things on the ground somewhat changed, as it was suggested that SHIB might make a comeback.

Shiba Inu reaches a critical level

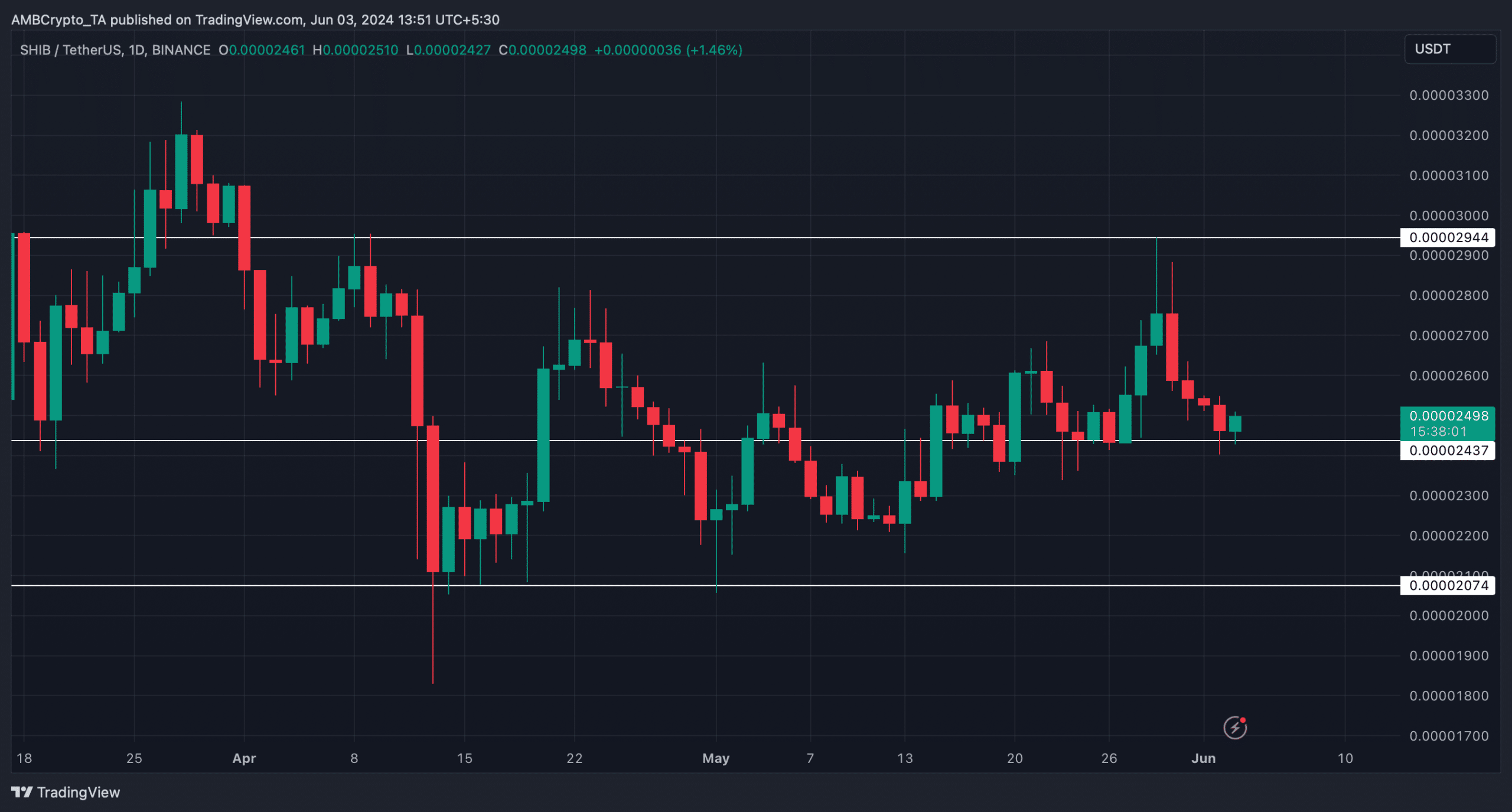

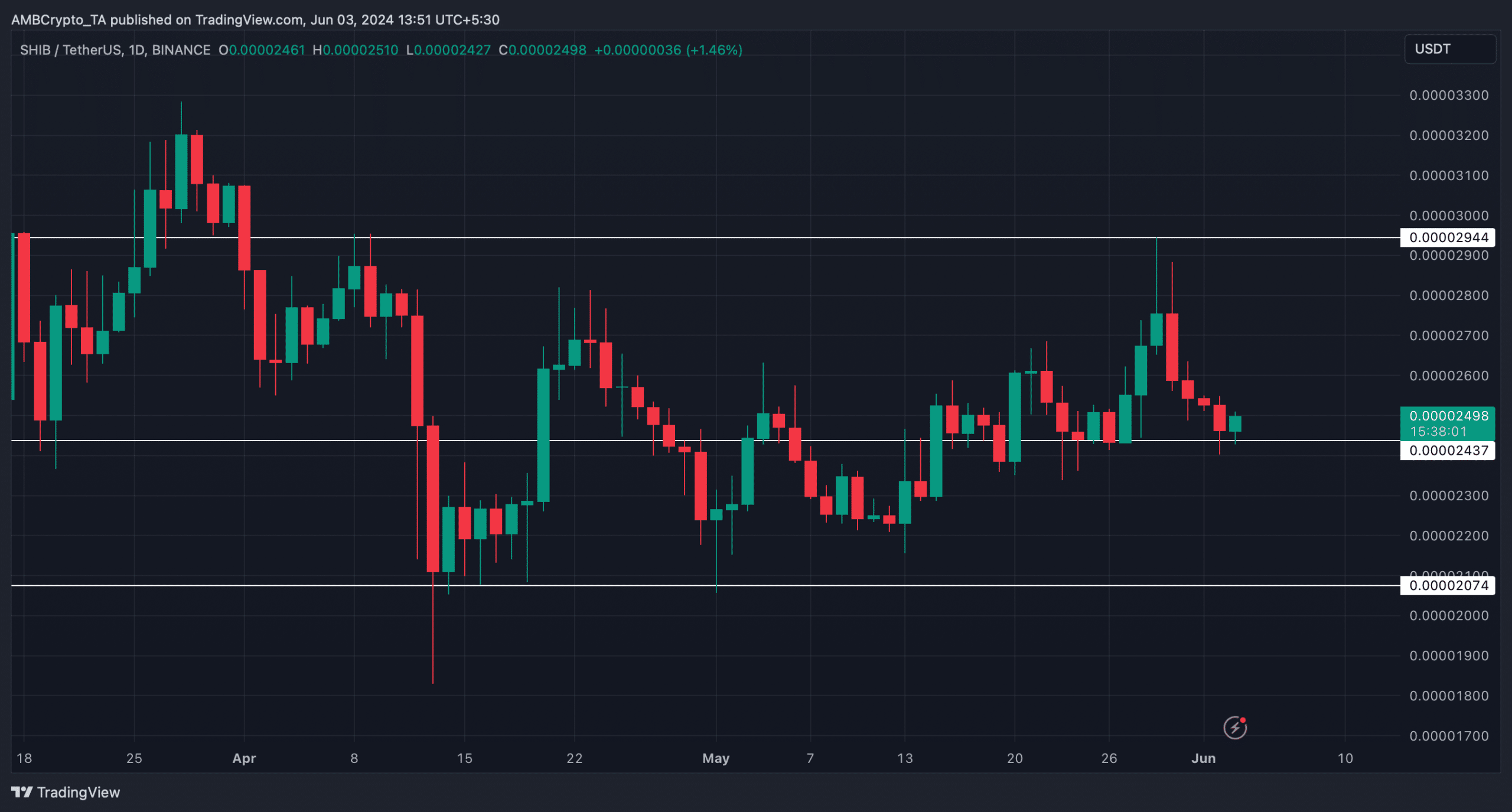

CoinMarketCap’s data revealed that the world’s second-largest memecoin’s price surged substantially on the 29th of May, allowing it to touch $0.00002924.

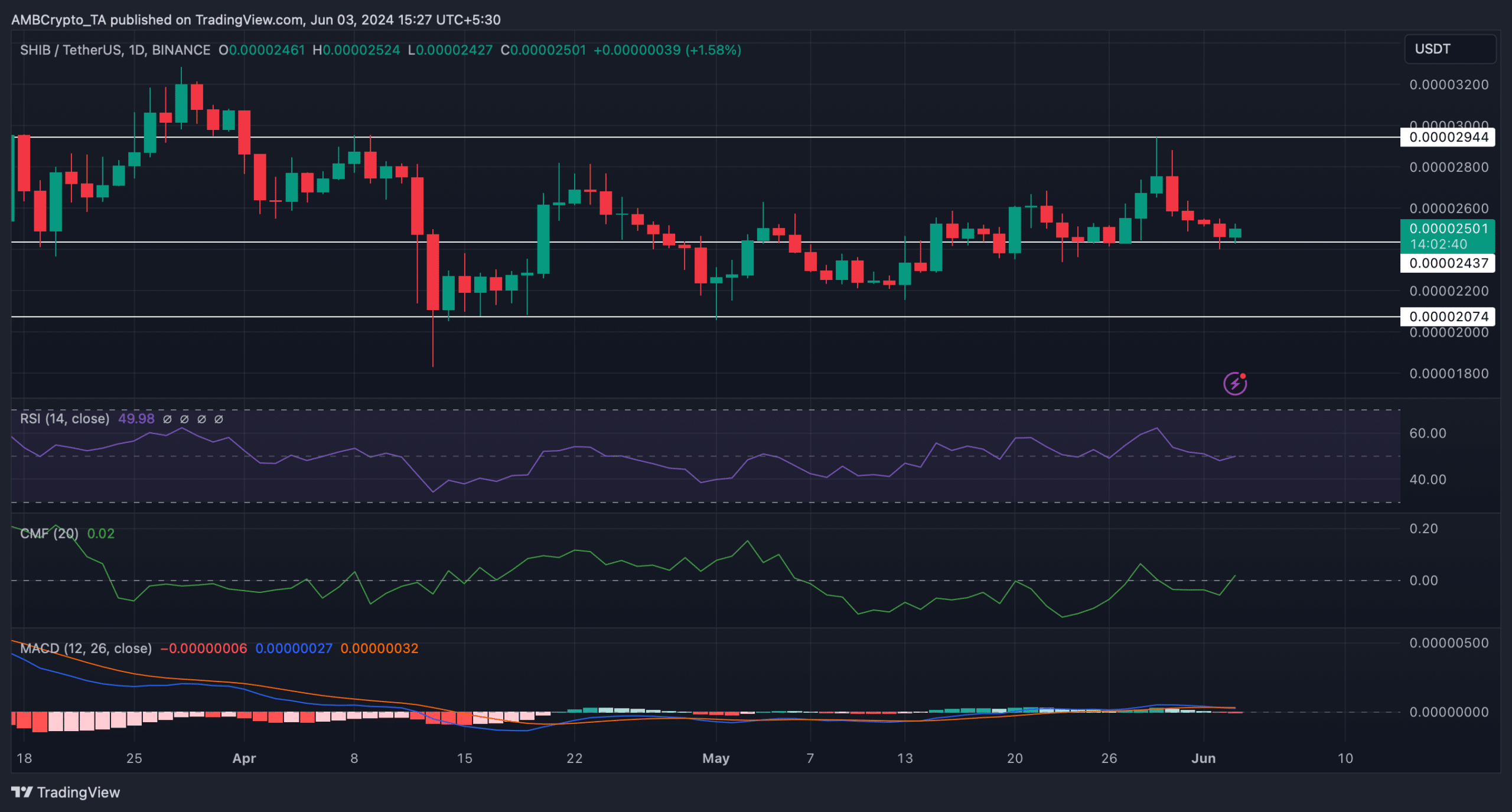

But SHIB couldn’t sustain the pump and fell victim to multiple price corrections. AMBCrypto’s analysis of the memecoin’s chart revealed that the recent price drop pushed its value to a critical support level of $0.00002437.

If SHIB fails to test the resistance and falls under it, then investors might witness the token drop to $0.000020.

On the other hand, a successful test of the support could kickstart a bull rally, which might result in SHIB touching $0.000029 in the coming days.

Source: TradingView

Is a bull rally inevitable?

The chances of a successful test were high as the memecoin’s price gained bullish momentum. Shiba Inu’s price had increased by 1.13% in the last 24 hours.

At the time of writing, SHIB was trading at $0.00002499 with a market capitalization of over $14.7 billion, making it the 11th largest crypto.

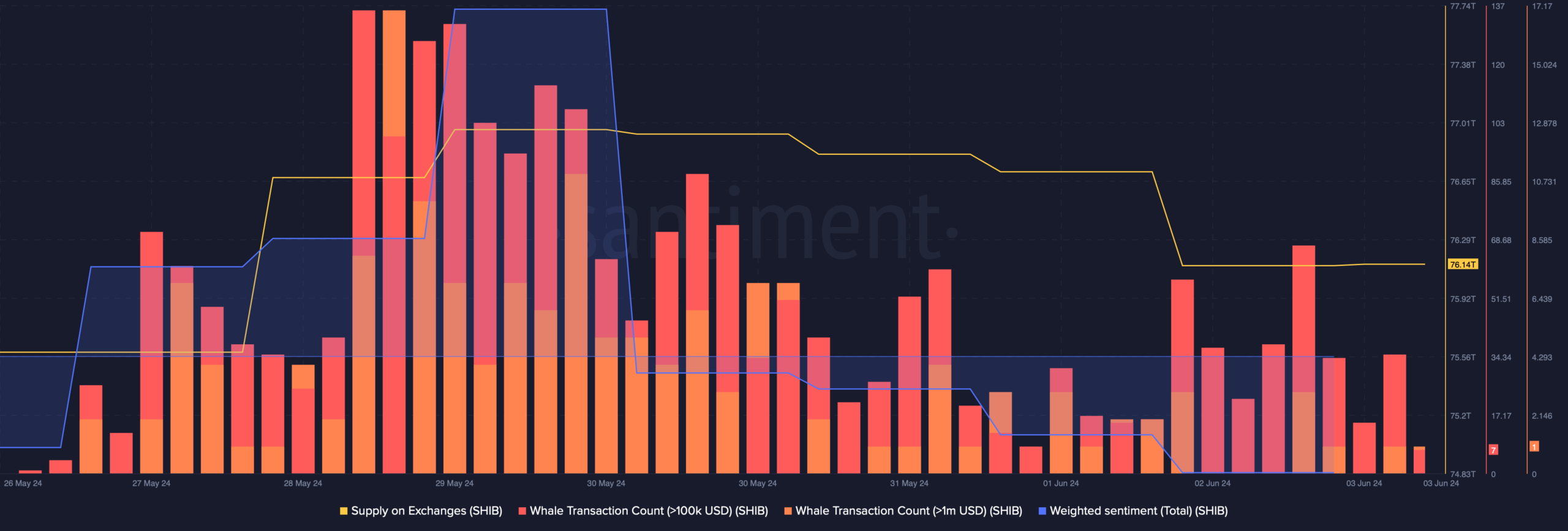

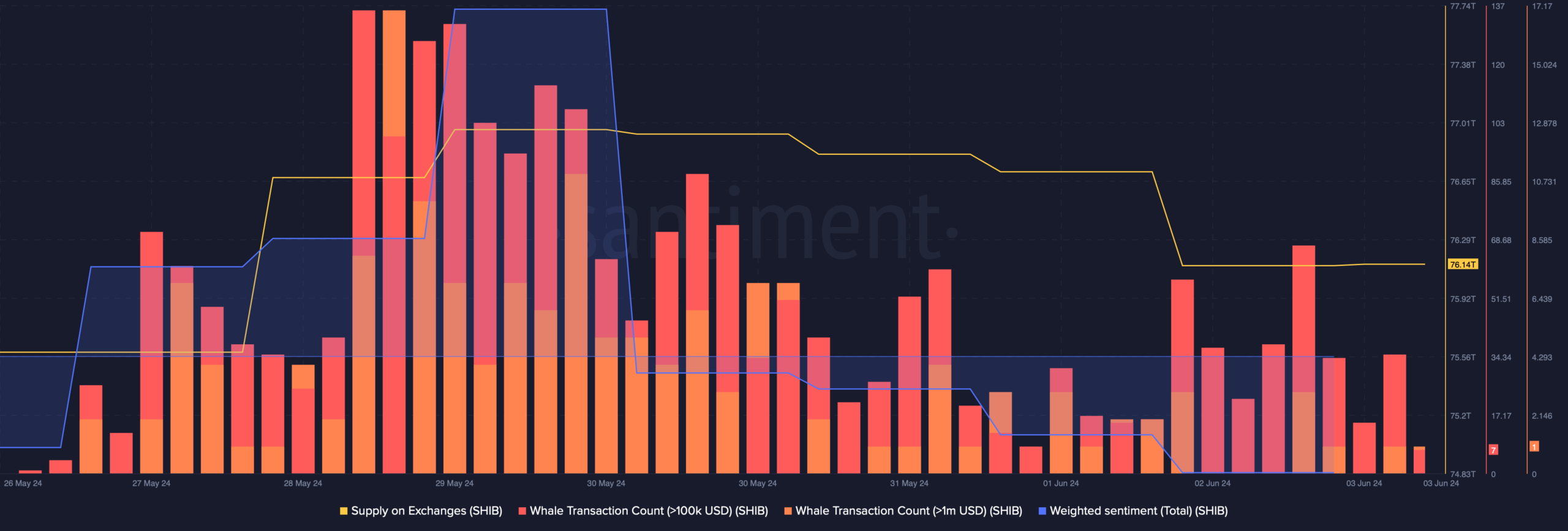

AMBCrypto’s analysis of Santiment’s data revealed that after a rise last week, SHIB’s supply on exchanges dropped on the 2nd of June.

This indicated that buying pressure on SHIB increased as investors expected its price to increase in the coming days.

Source: Santiment

Nonetheless, whale activity around the memecoin declined, which was evident from the drop in its whale transaction count.

Additionally, its weighted sentiment also went into the negative zone, meaning that bearish sentiment around SHIB was dominant in the market.

On top of that, Shiba Inu’s fear and greed index had a value of 41, suggesting that the market was in a “neutral” phase.

Whenever the metric reaches that level, it indicates that the market could turn volatile in either direction. Therefore, AMBCrypto then assessed SHIB’s daily chart to better understand what to expect.

Realistic or not, here’s SHIB’s market cap in DOGE terms

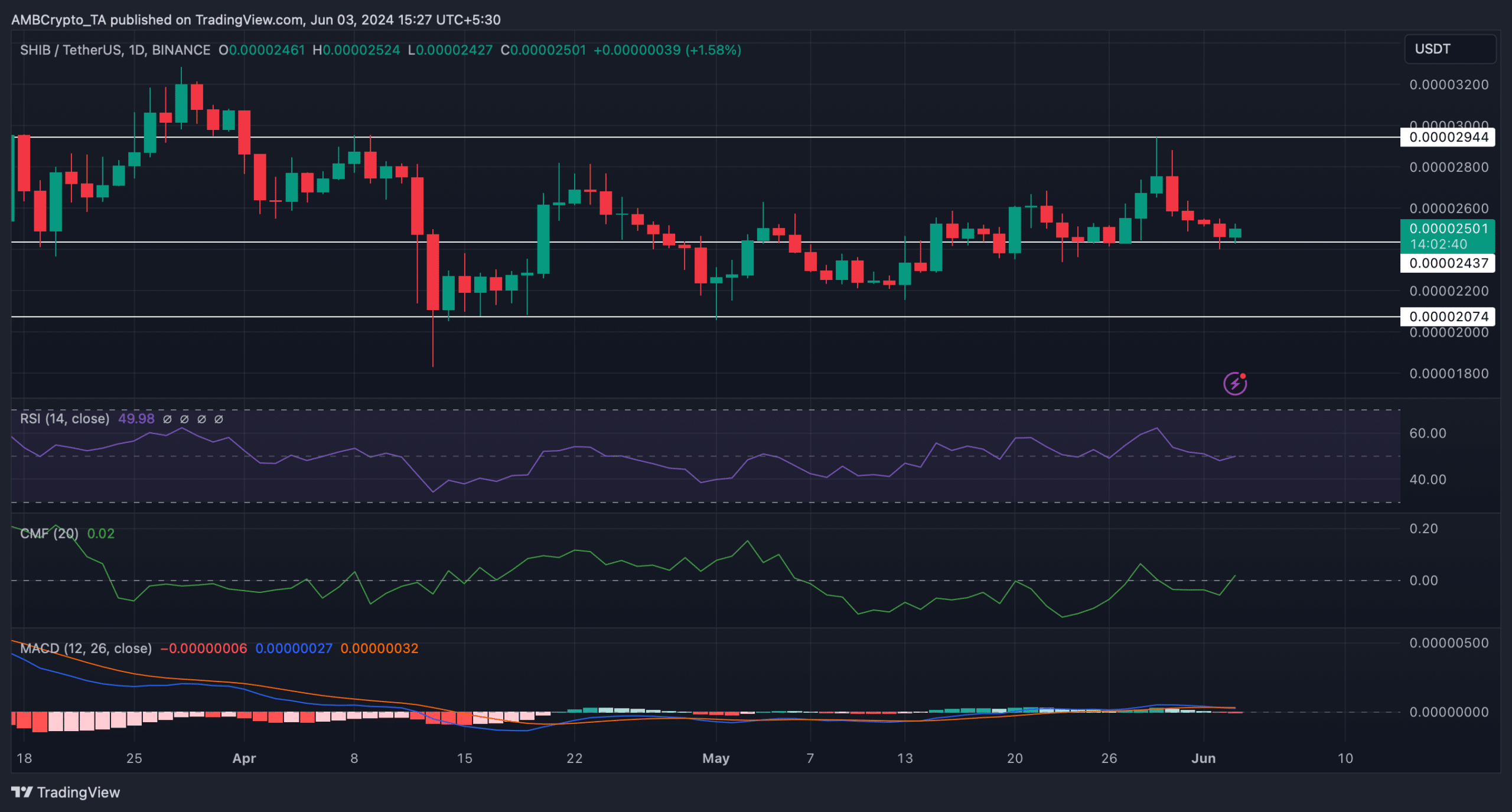

The technical indicator MACD’s data revealed that the bulls and the bears were in a battle to gain an advantage over each other. But the rest of the indicators suggested that the bulls might turn out to be victorious.

For example, the Chaikin Money Flow (CMF) registered an uptick, and the Relative Strength Index (RSI) also followed a similar trend, hinting at a successful test of the support.

Source: TradingView

- Shiba Inu’s price increased by over 1.13% in the last 24 hours.

- Market indicators looked bullish on the memecoin.

After increasing sharply last week, Shiba Inu [SHIB] turned bearish as its price started to drop. The price decline pushed SHIB towards a critical support level. However, things on the ground somewhat changed, as it was suggested that SHIB might make a comeback.

Shiba Inu reaches a critical level

CoinMarketCap’s data revealed that the world’s second-largest memecoin’s price surged substantially on the 29th of May, allowing it to touch $0.00002924.

But SHIB couldn’t sustain the pump and fell victim to multiple price corrections. AMBCrypto’s analysis of the memecoin’s chart revealed that the recent price drop pushed its value to a critical support level of $0.00002437.

If SHIB fails to test the resistance and falls under it, then investors might witness the token drop to $0.000020.

On the other hand, a successful test of the support could kickstart a bull rally, which might result in SHIB touching $0.000029 in the coming days.

Source: TradingView

Is a bull rally inevitable?

The chances of a successful test were high as the memecoin’s price gained bullish momentum. Shiba Inu’s price had increased by 1.13% in the last 24 hours.

At the time of writing, SHIB was trading at $0.00002499 with a market capitalization of over $14.7 billion, making it the 11th largest crypto.

AMBCrypto’s analysis of Santiment’s data revealed that after a rise last week, SHIB’s supply on exchanges dropped on the 2nd of June.

This indicated that buying pressure on SHIB increased as investors expected its price to increase in the coming days.

Source: Santiment

Nonetheless, whale activity around the memecoin declined, which was evident from the drop in its whale transaction count.

Additionally, its weighted sentiment also went into the negative zone, meaning that bearish sentiment around SHIB was dominant in the market.

On top of that, Shiba Inu’s fear and greed index had a value of 41, suggesting that the market was in a “neutral” phase.

Whenever the metric reaches that level, it indicates that the market could turn volatile in either direction. Therefore, AMBCrypto then assessed SHIB’s daily chart to better understand what to expect.

Realistic or not, here’s SHIB’s market cap in DOGE terms

The technical indicator MACD’s data revealed that the bulls and the bears were in a battle to gain an advantage over each other. But the rest of the indicators suggested that the bulls might turn out to be victorious.

For example, the Chaikin Money Flow (CMF) registered an uptick, and the Relative Strength Index (RSI) also followed a similar trend, hinting at a successful test of the support.

Source: TradingView

how to buy clomiphene tablets clomiphene price can i order cheap clomiphene without insurance where to get clomiphene without dr prescription how to buy clomid tablets order cheap clomiphene price clomid sale

This is the type of delivery I recoup helpful.

This is the big-hearted of criticism I rightly appreciate.

azithromycin us – purchase azithromycin pill order flagyl pills

order semaglutide pills – cheap rybelsus where to buy cyproheptadine without a prescription

motilium over the counter – tetracycline cost cyclobenzaprine order online

purchase inderal for sale – buy generic inderal methotrexate 5mg pills

order zithromax generic – order generic bystolic 5mg nebivolol 5mg generic

augmentin brand – atbioinfo ampicillin sale

buy esomeprazole no prescription – https://anexamate.com/ generic esomeprazole

coumadin for sale – anticoagulant cozaar 25mg usa

mobic where to buy – mobo sin order meloxicam 7.5mg pills

buy prednisone 10mg generic – https://apreplson.com/ prednisone 5mg brand

over the counter ed pills that work – buy generic ed pills over the counter men’s ed pills

amoxil pills – purchase amoxicillin pills where to buy amoxicillin without a prescription

fluconazole for sale – this fluconazole 100mg price

cenforce drug – https://cenforcers.com/# cenforce 100mg us

canada cialis for sale – https://ciltadgn.com/ does medicare cover cialis for bph

buy ranitidine pills – click ranitidine 300mg canada

which is better cialis or levitra – https://strongtadafl.com/# buy cialis no prescription australia

The thoroughness in this section is noteworthy. gnolvade.com

viagra cheap overnight – https://strongvpls.com/# order viagra toronto

This is the stripe of serenity I take advantage of reading. https://buyfastonl.com/amoxicillin.html

I couldn’t weather commenting. Well written! https://ursxdol.com/synthroid-available-online/

More posts like this would make the online elbow-room more useful. https://prohnrg.com/product/acyclovir-pills/

I couldn’t resist commenting. Warmly written! prednisolone 20 mg pour chien posologie

I couldn’t hold back commenting. Warmly written! https://ondactone.com/simvastatin/

I couldn’t turn down commenting. Profoundly written!

https://doxycyclinege.com/pro/ranitidine/

The thoroughness in this piece is noteworthy. http://www.zgqsz.com/home.php?mod=space&uid=847623

buy forxiga 10 mg online cheap – https://janozin.com/# cheap dapagliflozin 10 mg

buy orlistat paypal – https://asacostat.com/# order xenical pills