- SEC has approved Grayscale’s Bitcoin Mini Trust ETFs

- With greater institutional adoption, GBTC aims to leverage the changing global financial markets

Following the successful Ethereum Mini Trust model, the SEC has now approved Grayscale’s Bitcoin Mini Trust ETF. This will launch at a low 0.15% fee. From Wednesday next week, the Mini Trust will start trading, as reported by Nate Geraci. On his X page, he shared,

“Grayscale Bitcoin Mini Trust 19b-4 has been APPROVED…A spinoff from GBTC set to happen next Wednesday (date of record is Tuesday). Will be lowest cost spot bitcoin ETF at 15bps.”

SEC greenlights Grayscale Bitcoin Mini Trust

The SEC announced that the 19b-4 form for Grayscale Bitcoin Mini Trust will act as the spinoff of GBTC. The shares of the mini Trust will be distributed to GBTC shareholders since they contribute a particular amount of BTC to the said Trust, according to initial filings.

The commission, through the official document, announced the move, stating,

“After careful review, the Commission finds that the Proposals are consistent with the Exchange Act and rules and regulations thereunder applicable to a national securities exchange.”

The agency further explained,

“… are reasonably designed to promote fair disclosure of information that may be necessary to price the shares of the Trusts appropriately, to prevent trading when a reasonable degree of transparency cannot be assured, to safeguard material non-public information relating to the Trusts’ portfolios, and to ensure fair and orderly markets for the shares of the Trusts.”

However, Grayscale has to wait for the effectiveness of BTC’s registration statement on form S-1. This will allow BTC to open as a spot for Bitcoin ETP.

Reduced fees for competitive advantage

Since the approval of 11 spot BTC ETFs earlier this year, increased institutional interest has increased competition. Therefore, the Mini Trust will have a lower fee at only 15 basis points (15bps). The reduced fees aim to compete with other ETFs with lower fees such as Bitwise, which have a 0.2% in fees.

Therefore, the move will play a critical role in attracting investors while effectively competing with other ETFs as adopting these digital assets becomes a norm among institutional investors.

What SEC approval means for Grayscale Bitcoin Trust

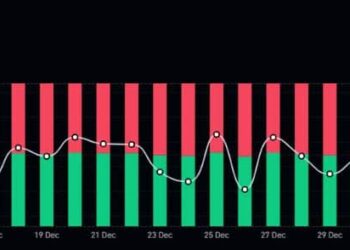

Source: Google Finance

After the SEC’s approval, GBTC’s stock increased by 5.18% in 24 hours. In fact, according to Google Finance, GBTC’s stock has sustained an uptrend over the last 30 days or so too.

Total assets under management have continually increased over the last 30 days from $16.98 billion to $17.54 billion. This trend shows prevailing positive market sentiment towards BTC and greater institutional interest.

In fact, according to the prevailing market sentiment, BTC is now well positioned for growth because of the shifting international monetary systems. The shifts means higher BTC velocity as governments, institutions, and individuals continually integrate and adopt BTC.

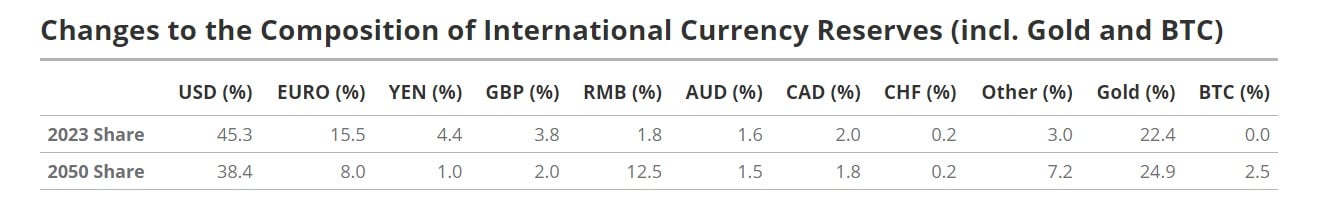

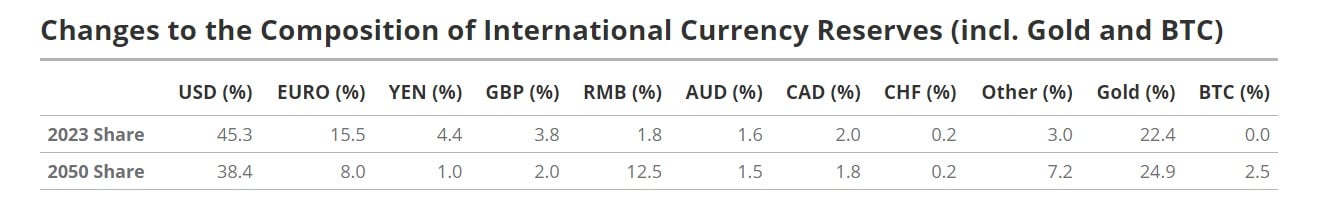

Source: VanEck Research

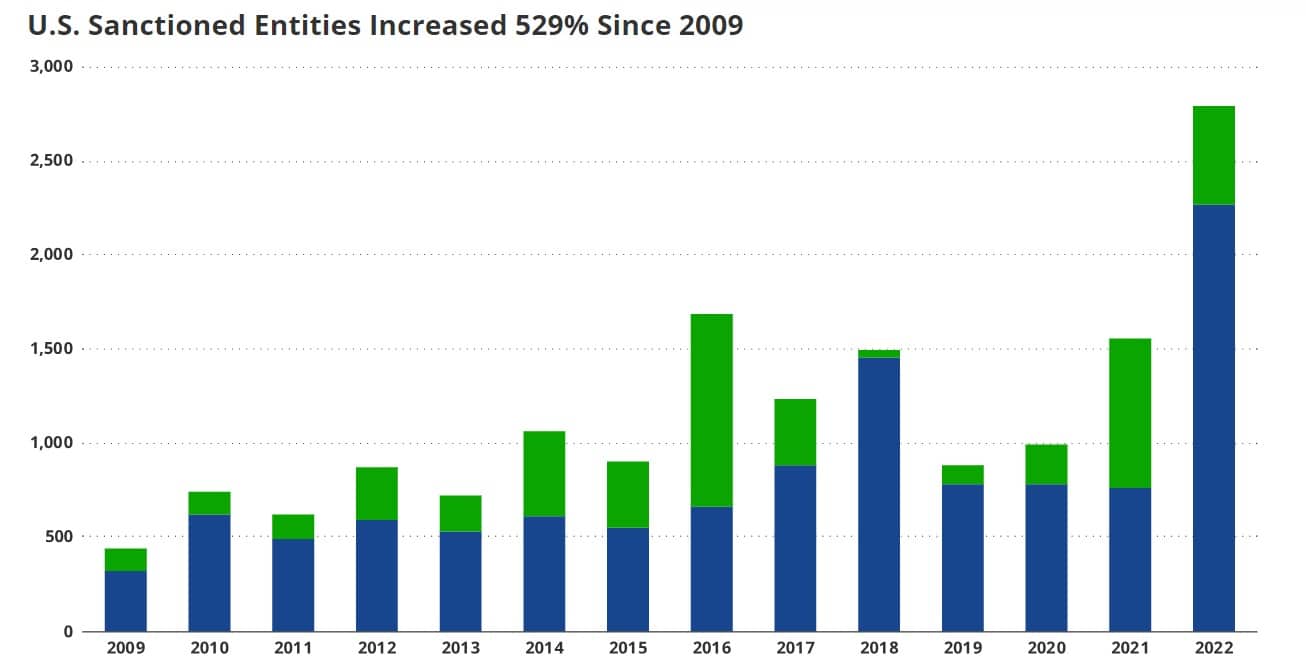

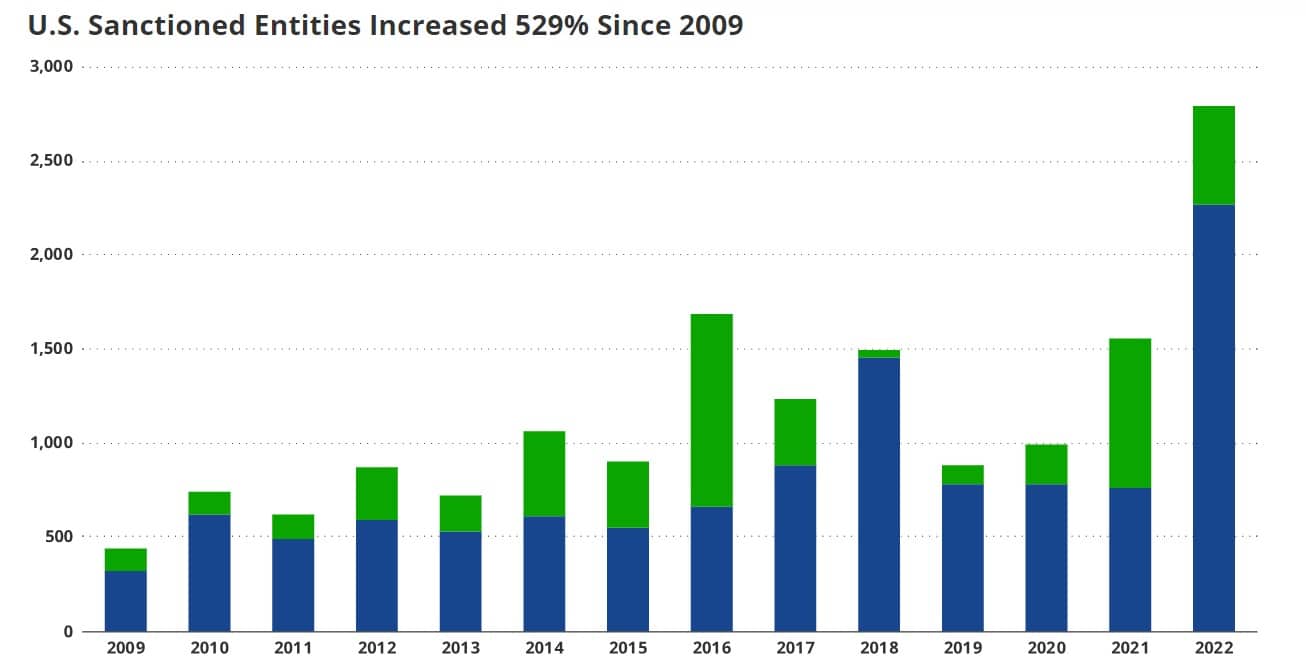

With high geopolitical tensions, crypto and BTC will be used more, especially to bypass sanctions while settling international trade. Such changes will help BTC’s price. The surge will positively impact GBTC since its value depends on Bitcoin’s market volatility.

Source: CNAS

Implications for the crypto community

Notably, Grayscale BTC Mini Trust approval allows individual investors and institutions to invest with lower fees. With rising ETFs and ETPs, the need for an affordable rate allows customers to enter markets because of affordability while helping Grayscale attract more revenue.

Essentially, it allows investors to enter the market and access BTC in a secure and regulated manner.

- SEC has approved Grayscale’s Bitcoin Mini Trust ETFs

- With greater institutional adoption, GBTC aims to leverage the changing global financial markets

Following the successful Ethereum Mini Trust model, the SEC has now approved Grayscale’s Bitcoin Mini Trust ETF. This will launch at a low 0.15% fee. From Wednesday next week, the Mini Trust will start trading, as reported by Nate Geraci. On his X page, he shared,

“Grayscale Bitcoin Mini Trust 19b-4 has been APPROVED…A spinoff from GBTC set to happen next Wednesday (date of record is Tuesday). Will be lowest cost spot bitcoin ETF at 15bps.”

SEC greenlights Grayscale Bitcoin Mini Trust

The SEC announced that the 19b-4 form for Grayscale Bitcoin Mini Trust will act as the spinoff of GBTC. The shares of the mini Trust will be distributed to GBTC shareholders since they contribute a particular amount of BTC to the said Trust, according to initial filings.

The commission, through the official document, announced the move, stating,

“After careful review, the Commission finds that the Proposals are consistent with the Exchange Act and rules and regulations thereunder applicable to a national securities exchange.”

The agency further explained,

“… are reasonably designed to promote fair disclosure of information that may be necessary to price the shares of the Trusts appropriately, to prevent trading when a reasonable degree of transparency cannot be assured, to safeguard material non-public information relating to the Trusts’ portfolios, and to ensure fair and orderly markets for the shares of the Trusts.”

However, Grayscale has to wait for the effectiveness of BTC’s registration statement on form S-1. This will allow BTC to open as a spot for Bitcoin ETP.

Reduced fees for competitive advantage

Since the approval of 11 spot BTC ETFs earlier this year, increased institutional interest has increased competition. Therefore, the Mini Trust will have a lower fee at only 15 basis points (15bps). The reduced fees aim to compete with other ETFs with lower fees such as Bitwise, which have a 0.2% in fees.

Therefore, the move will play a critical role in attracting investors while effectively competing with other ETFs as adopting these digital assets becomes a norm among institutional investors.

What SEC approval means for Grayscale Bitcoin Trust

Source: Google Finance

After the SEC’s approval, GBTC’s stock increased by 5.18% in 24 hours. In fact, according to Google Finance, GBTC’s stock has sustained an uptrend over the last 30 days or so too.

Total assets under management have continually increased over the last 30 days from $16.98 billion to $17.54 billion. This trend shows prevailing positive market sentiment towards BTC and greater institutional interest.

In fact, according to the prevailing market sentiment, BTC is now well positioned for growth because of the shifting international monetary systems. The shifts means higher BTC velocity as governments, institutions, and individuals continually integrate and adopt BTC.

Source: VanEck Research

With high geopolitical tensions, crypto and BTC will be used more, especially to bypass sanctions while settling international trade. Such changes will help BTC’s price. The surge will positively impact GBTC since its value depends on Bitcoin’s market volatility.

Source: CNAS

Implications for the crypto community

Notably, Grayscale BTC Mini Trust approval allows individual investors and institutions to invest with lower fees. With rising ETFs and ETPs, the need for an affordable rate allows customers to enter markets because of affordability while helping Grayscale attract more revenue.

Essentially, it allows investors to enter the market and access BTC in a secure and regulated manner.

![Render [RNDR] falls 13% in 7 days: Will the AI token gain soon?](https://coininsights.com/wp-content/uploads/2024/06/rndr-tv-1-120x86.png)

can you get clomiphene prices clomid chart clomiphene buy where can i get generic clomid no prescription order cheap clomid without prescription where buy generic clomid pill order clomiphene pill

This is a theme which is near to my heart… Diverse thanks! Exactly where can I find the contact details for questions?

With thanks. Loads of conception!

zithromax 250mg cost – azithromycin 250mg uk metronidazole 400mg sale

buy generic rybelsus – semaglutide 14 mg uk generic periactin

motilium for sale – domperidone 10mg generic flexeril 15mg generic

purchase amoxiclav for sale – atbio info buy acillin medication

buy nexium for sale – https://anexamate.com/ purchase nexium capsules

coumadin 5mg cost – https://coumamide.com/ cozaar 50mg cheap

purchase meloxicam pills – https://moboxsin.com/ mobic oral

deltasone uk – apreplson.com prednisone 5mg generic

non prescription ed pills – https://fastedtotake.com/ the blue pill ed

how to get amoxil without a prescription – combamoxi.com buy amoxicillin online cheap

fluconazole us – diflucan pill purchase diflucan online cheap

cenforce for sale online – fast cenforce rs buy cenforce cheap

cialis 100mg from china – https://ciltadgn.com/ cialis by mail

how to buy ranitidine – https://aranitidine.com/# purchase zantac for sale

cialis premature ejaculation – https://strongtadafl.com/# tadalafil prescribing information

The vividness in this serving is exceptional. https://gnolvade.com/

With thanks. Loads of erudition! generic neurontin 600mg

More posts like this would prosper the blogosphere more useful. https://ursxdol.com/get-metformin-pills/

I’ll certainly bring back to be familiar with more. https://prohnrg.com/

Proof blog you be undergoing here.. It’s obdurate to assign great status belles-lettres like yours these days. I truly recognize individuals like you! Rent vigilance!! https://aranitidine.com/fr/modalert-en-france/

More posts like this would force the blogosphere more useful. https://ondactone.com/simvastatin/

This is a keynote which is virtually to my fundamentals… Numberless thanks! Unerringly where can I notice the acquaintance details in the course of questions?

dutasteride drug

I am actually thrilled to glitter at this blog posts which consists of tons of worthwhile facts, thanks object of providing such data. https://experthax.com/forum/member.php?action=profile&uid=124580

dapagliflozin 10 mg over the counter – dapagliflozin 10 mg brand dapagliflozin pills

orlistat tablet – click order orlistat 60mg generic