- SEC greenlighted option trading for BlackRock, Fidelity, and Bitwise spot ETH ETFs.

- The agency could approve staking on the products as soon as May or August, noted a Bloomberg analyst.

The U.S. Securities and Exchange Commission (SEC) has approved options trading for spot Ethereum [ETH] ETFs. The agency greenlighted options trading for BlackRock’s ETHA, Bitwise’s BITW, and Fidelity’s FETH.

According to Nate Geraci of ETF Store, the update could attract more ETH investments. He noted,

“SEC has approved options trading on spot eth ETFs…Like with BTC ETFs, expect to see a bunch of new launches from issuers.Covered call strategy ETH ETFs, buffer ETH ETFs, etc.”

Assessing ETH price impact

Despite the positive update, however, Bloomberg analyst James Seyffart stated that the outcome was ‘100% expected’ because it was the deadline for the SEC decision. Simply put, ETH had priced in the outcome.

But he added that staking on the products could be approved by early May or August, despite their October deadline.

“Its possible they could be approved for staking early, but the final deadline is at the end of October.”

Most experts expected staking approval to impact ETH demand and value more, especially from institutional investors seeking the extra 3% annual yield.

In fact, some analysts believed that the lack of staking was partly to blame for spot ETH ETF’s lukewarm performance compared to BTC ETFs.

Since their debut, the products have logged $2.3B in cumulative inflows. However, spot BTC ETFs recorded $35B in total inflows — that’s 17x time outperformance by BTC ETFs.

That said, ETH jumped +10% from $1400 to $1600 on the 9th of April. This followed President Donald Trump’s 90-day pause on various tariffs. Hence, the options’ approval wasn’t a key catalyst for the price upswing.

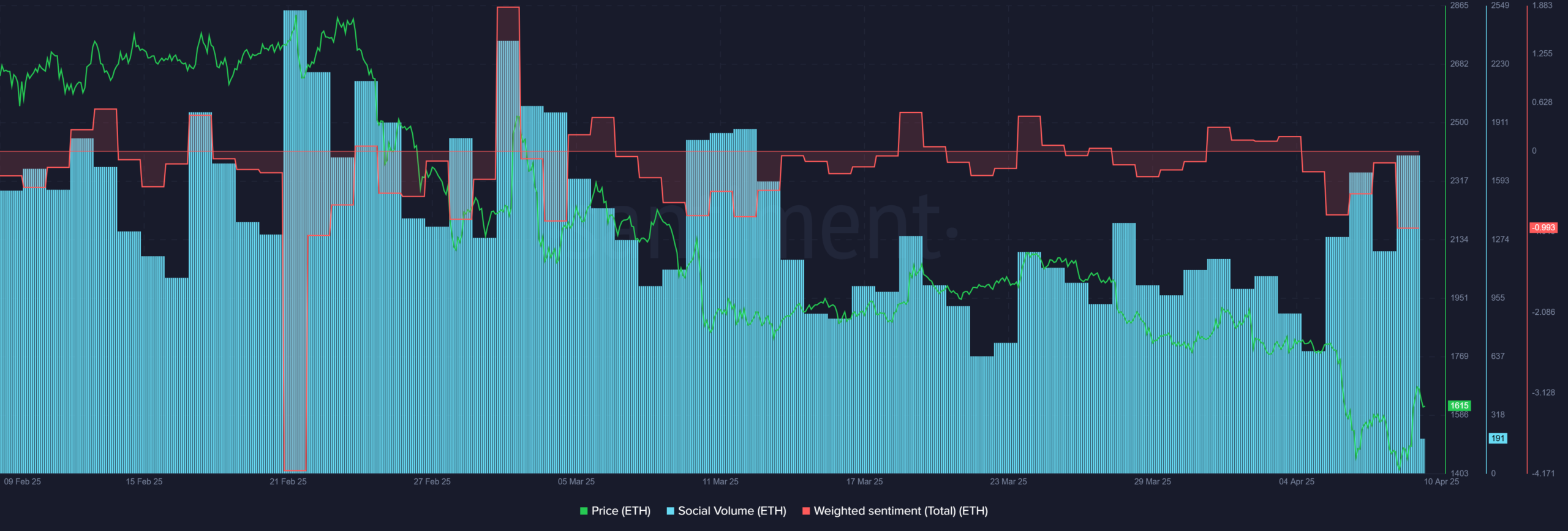

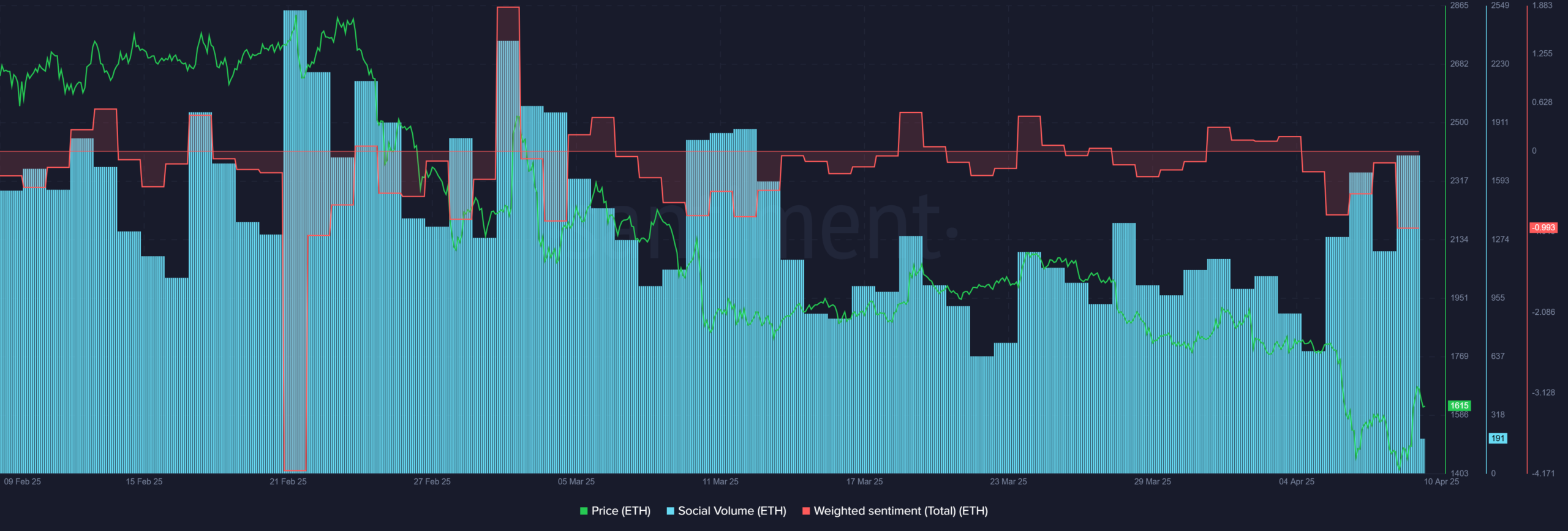

Even so, there was a notable spike in market interest for the altcoin, as revealed by the new high in April’s Social Volume.

Source: Santiment

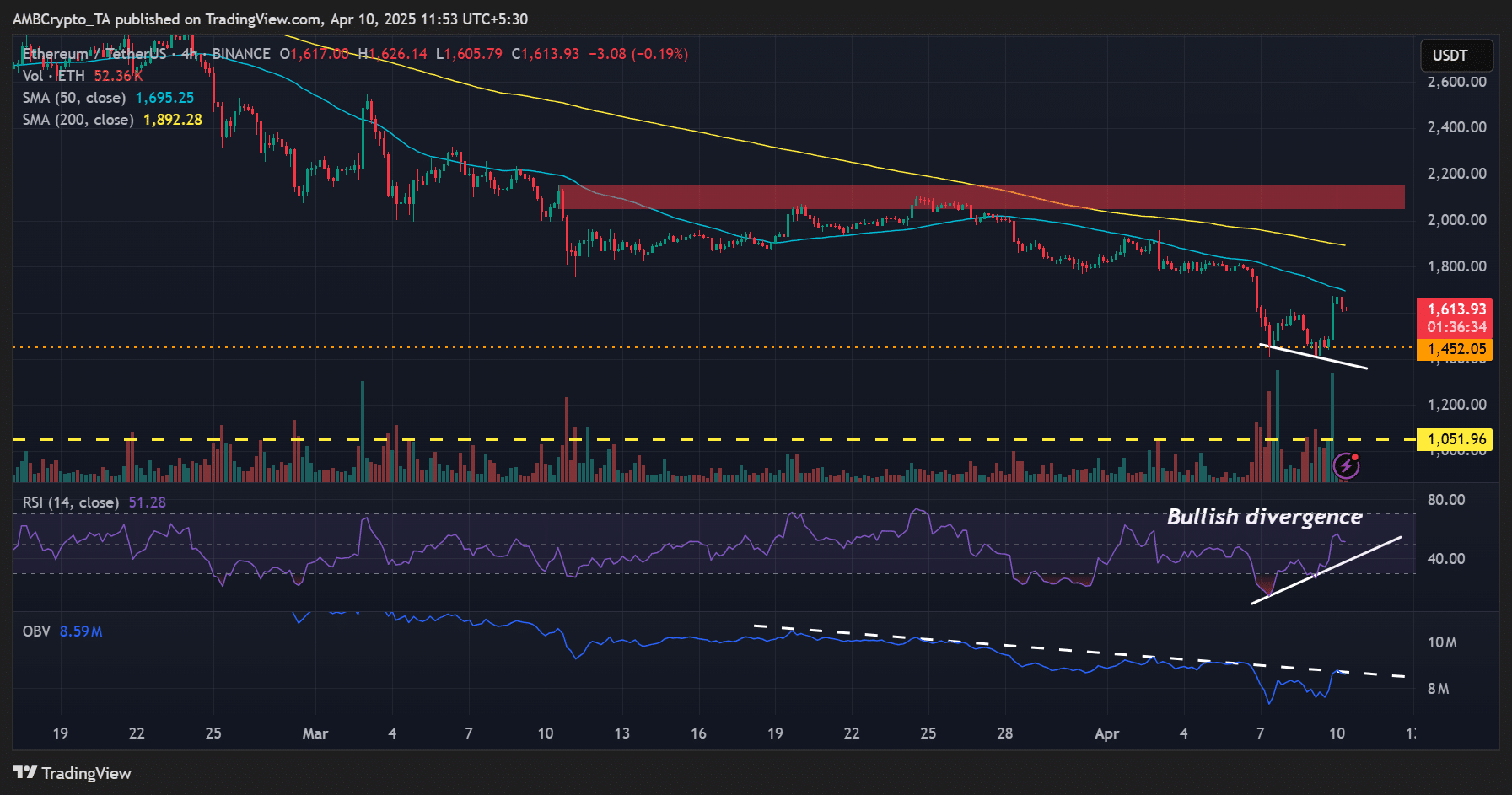

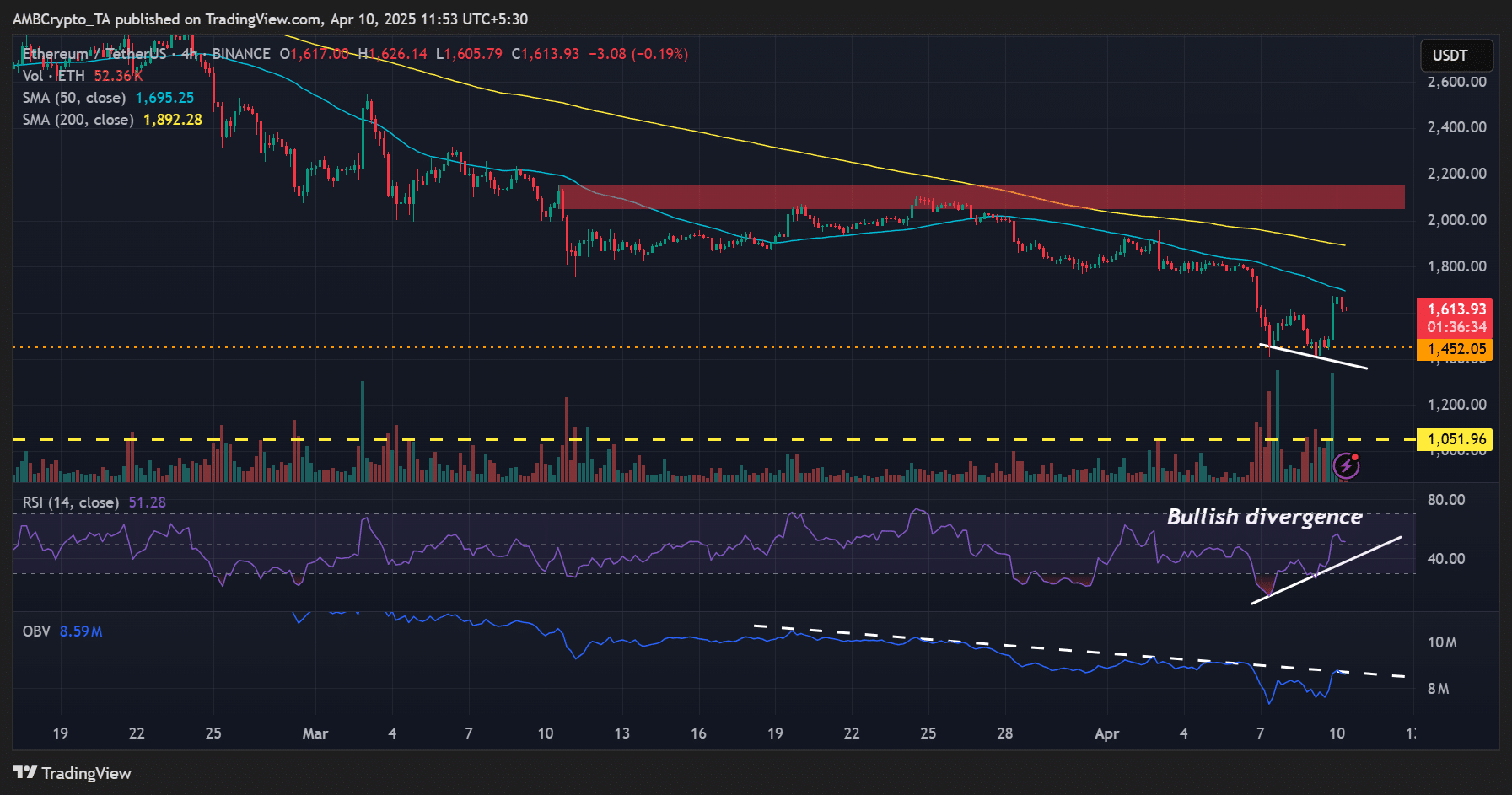

But the sentiment was still negative to drive a sustainable recovery for ETH. On the 4-hour price chart, ETH had a bullish RSI divergence, which could signal that a likely recovery was in sight.

However, the momentum could only be confirmed if the On Balance Volume (OBV) cleared the overhead hurdle (trendline resistance).

Source: ETH/USDT, TradingView

In conclusion, ETH price could stall near 50EMA ($1600) in the short term, like it did in the past few days.

However, a decisive move and improved trading volume above the hurdle could push it higher. But the long-term recovery might hinge on a positive macro shift and likely ETH ETF staking approval.

- SEC greenlighted option trading for BlackRock, Fidelity, and Bitwise spot ETH ETFs.

- The agency could approve staking on the products as soon as May or August, noted a Bloomberg analyst.

The U.S. Securities and Exchange Commission (SEC) has approved options trading for spot Ethereum [ETH] ETFs. The agency greenlighted options trading for BlackRock’s ETHA, Bitwise’s BITW, and Fidelity’s FETH.

According to Nate Geraci of ETF Store, the update could attract more ETH investments. He noted,

“SEC has approved options trading on spot eth ETFs…Like with BTC ETFs, expect to see a bunch of new launches from issuers.Covered call strategy ETH ETFs, buffer ETH ETFs, etc.”

Assessing ETH price impact

Despite the positive update, however, Bloomberg analyst James Seyffart stated that the outcome was ‘100% expected’ because it was the deadline for the SEC decision. Simply put, ETH had priced in the outcome.

But he added that staking on the products could be approved by early May or August, despite their October deadline.

“Its possible they could be approved for staking early, but the final deadline is at the end of October.”

Most experts expected staking approval to impact ETH demand and value more, especially from institutional investors seeking the extra 3% annual yield.

In fact, some analysts believed that the lack of staking was partly to blame for spot ETH ETF’s lukewarm performance compared to BTC ETFs.

Since their debut, the products have logged $2.3B in cumulative inflows. However, spot BTC ETFs recorded $35B in total inflows — that’s 17x time outperformance by BTC ETFs.

That said, ETH jumped +10% from $1400 to $1600 on the 9th of April. This followed President Donald Trump’s 90-day pause on various tariffs. Hence, the options’ approval wasn’t a key catalyst for the price upswing.

Even so, there was a notable spike in market interest for the altcoin, as revealed by the new high in April’s Social Volume.

Source: Santiment

But the sentiment was still negative to drive a sustainable recovery for ETH. On the 4-hour price chart, ETH had a bullish RSI divergence, which could signal that a likely recovery was in sight.

However, the momentum could only be confirmed if the On Balance Volume (OBV) cleared the overhead hurdle (trendline resistance).

Source: ETH/USDT, TradingView

In conclusion, ETH price could stall near 50EMA ($1600) in the short term, like it did in the past few days.

However, a decisive move and improved trading volume above the hurdle could push it higher. But the long-term recovery might hinge on a positive macro shift and likely ETH ETF staking approval.

can you buy clomid without a prescription can you get cheap clomid without a prescription rx clomiphene buy generic clomid without dr prescription clomiphene risks clomid price walmart cost clomiphene prices

This is the make of delivery I find helpful.

semaglutide 14mg oral – order periactin buy cyproheptadine 4 mg generic

motilium 10mg brand – sumycin drug buy cyclobenzaprine without a prescription

augmentin 1000mg tablet – https://atbioinfo.com/ ampicillin online buy

nexium online order – https://anexamate.com/ esomeprazole 20mg ca

purchase coumadin pills – anticoagulant losartan ca

order mobic online – tenderness meloxicam order online

buy prednisone paypal – apreplson.com buy generic prednisone online

ed remedies – fastedtotake.com buy generic ed pills

buy amoxicillin online – amoxicillin canada purchase amoxil pills

forcan canada – click buy generic fluconazole

order cenforce 50mg generic – https://cenforcers.com/# buy cenforce 50mg pills

why does tadalafil say do not cut pile – this cialis efectos secundarios

buy zantac medication – zantac 150mg us brand ranitidine 300mg

100mg sildenafil tablets – https://strongvpls.com/ viagra sale ottawa

Thanks for putting this up. It’s okay done. comprar super kamagra

Thanks on putting this up. It’s understandably done. https://buyfastonl.com/

This is the description of content I have reading. https://ursxdol.com/cenforce-100-200-mg-ed/

Thanks for putting this up. It’s understandably done. https://aranitidine.com/fr/acheter-cenforce/

Greetings! Jolly productive recommendation within this article! It’s the crumb changes which wish make the largest changes. Thanks a a quantity for sharing! https://ondactone.com/simvastatin/

This is the tolerant of delivery I recoup helpful. http://ledyardmachine.com/forum/User-Gippwe

xenical order – https://asacostat.com/# buy cheap xenical

This is the kind of serenity I enjoy reading. https://myrsporta.ru/forums/users/peszw-2/