- RNDR experienced a 13% fall in the last seven days.

- Market sentiment showed optimism even though the prices have been declining.

Render [RNDR] has experienced a 13 % decline in the last seven days and 1.62% in 24 hrs.

The continued decline has extensively impacted the trading volume in the previous 24 hrs, with a 52% decline according to CoinMarketCap. RNDR’s market cap reduced by 1.52% in the same period to $3.08B.

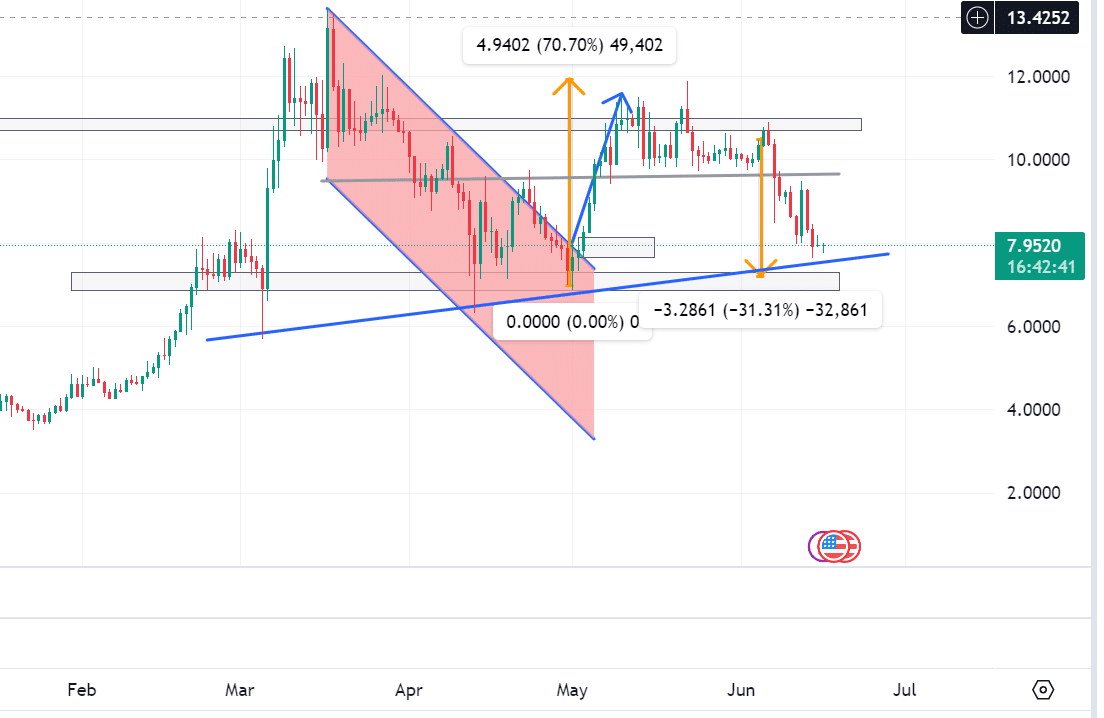

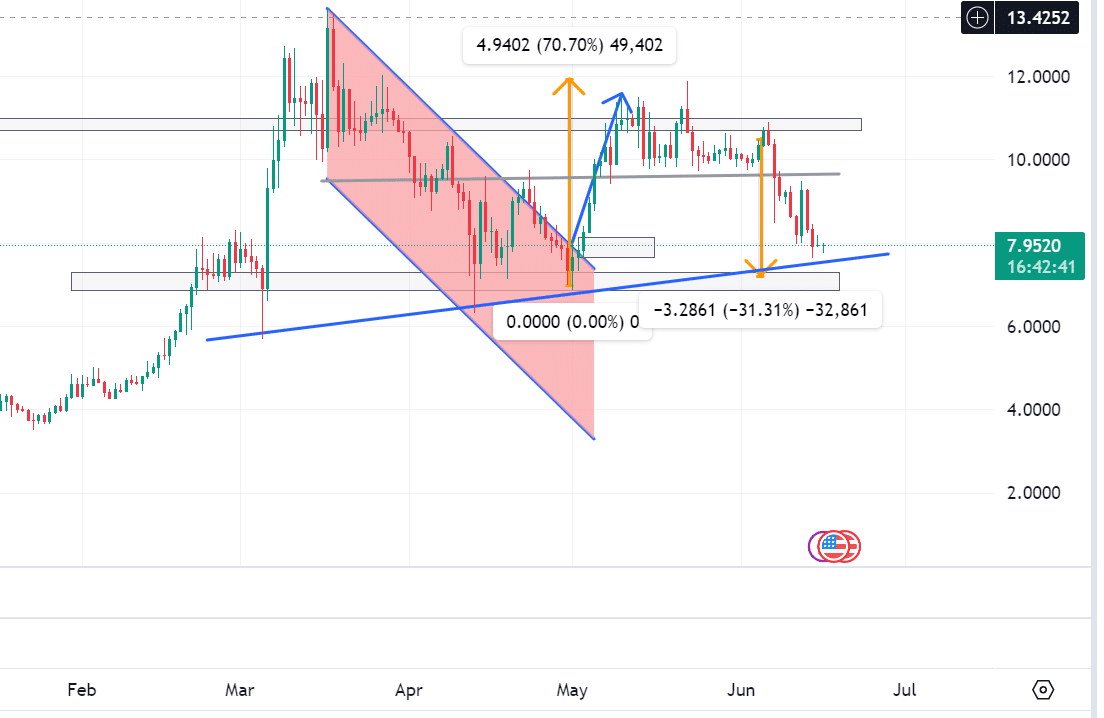

Source: TradingView

AMBCrypto’s analysis indicated that RNDR has experienced a 31% price decline since the 3rd of June. After trading at $10 at the start of the month, RNDR’s price has experienced a bearish trend overall.

With a resistance level of around $9, it’s trading at $7.9 while trying to retest.

This implies that if it retests at the support level of around $7.2, it will reverse to an uptrend. However, if it breaks down, it might experience a further decline to $5.2.

Market outlook

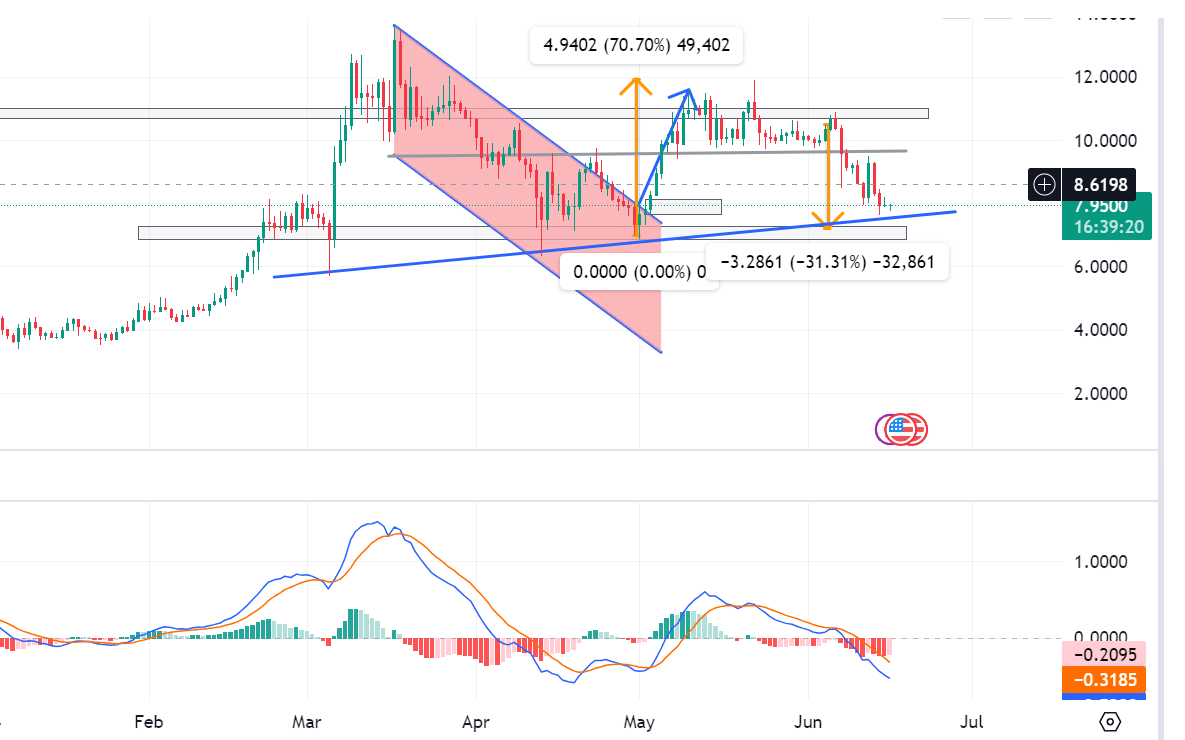

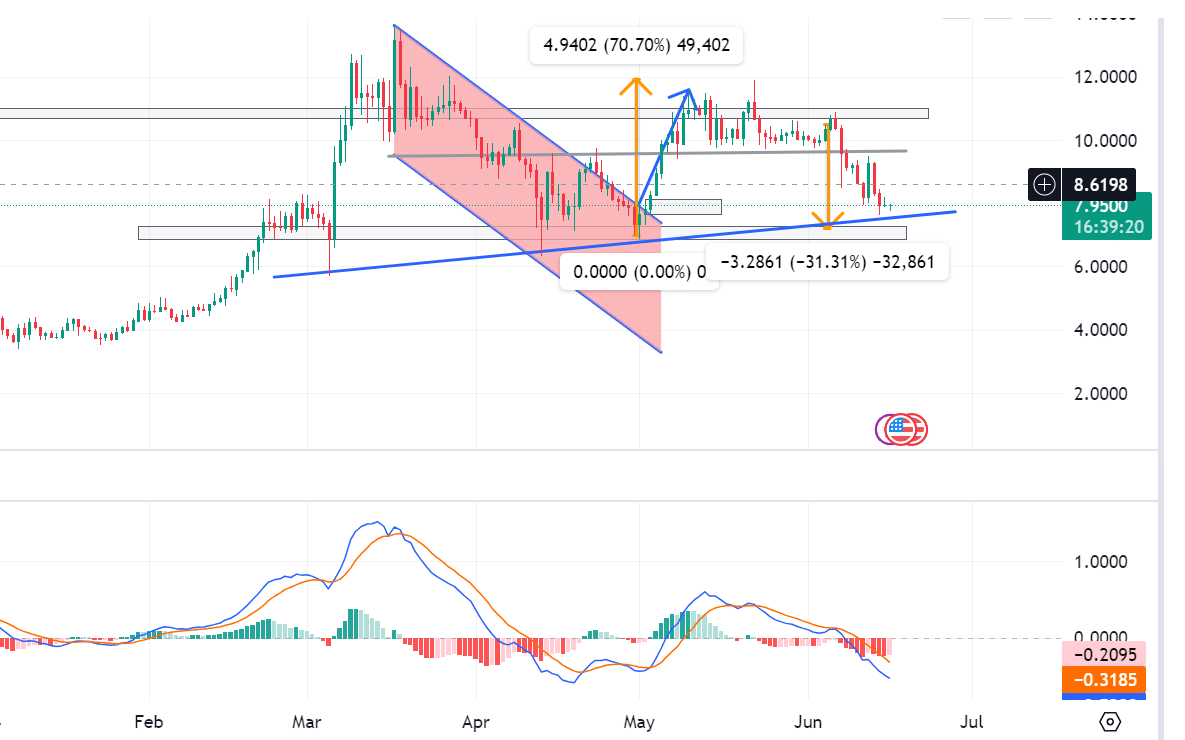

Source: TradingView

After hitting an ATH of $13 in March, the current market sentiment turned bearish. It experienced a decline over the last two months, with June recording the lowest in the same period.

Despite the attempts to break out, it has failed to reverse to a bullish trend.

In fact, at press time, the MACD reflected the current market sentiment. RNDR’s MACD was negative at -0.32 during press time, signaling a continued bearish trend.

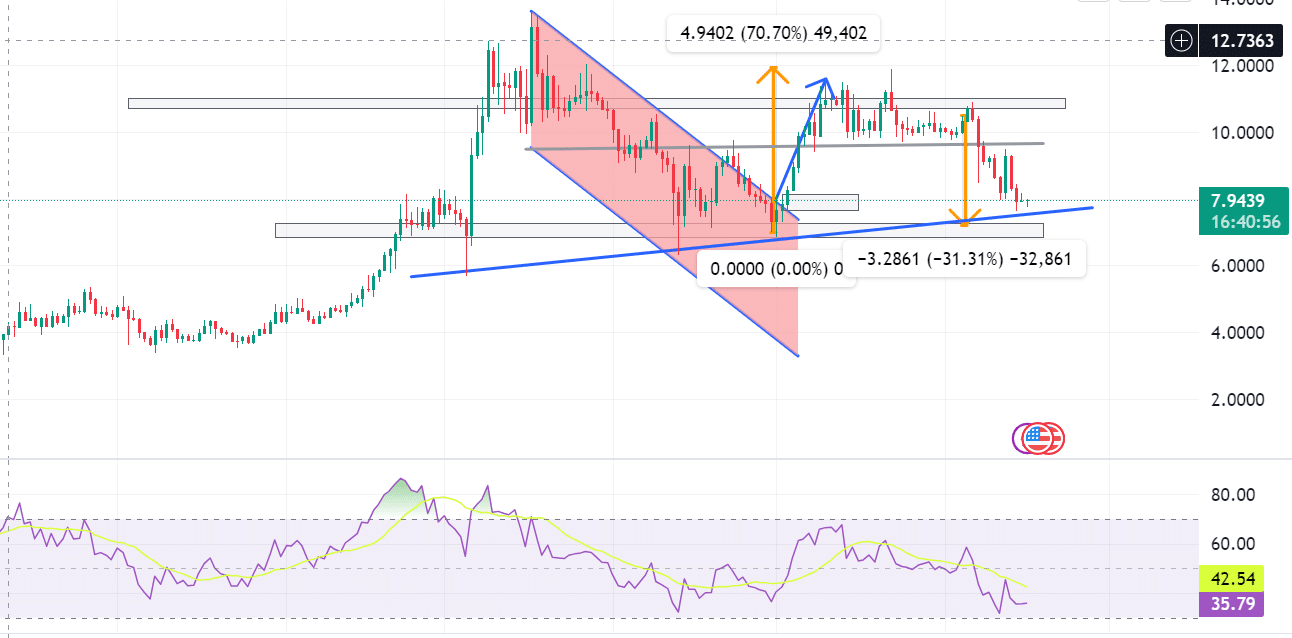

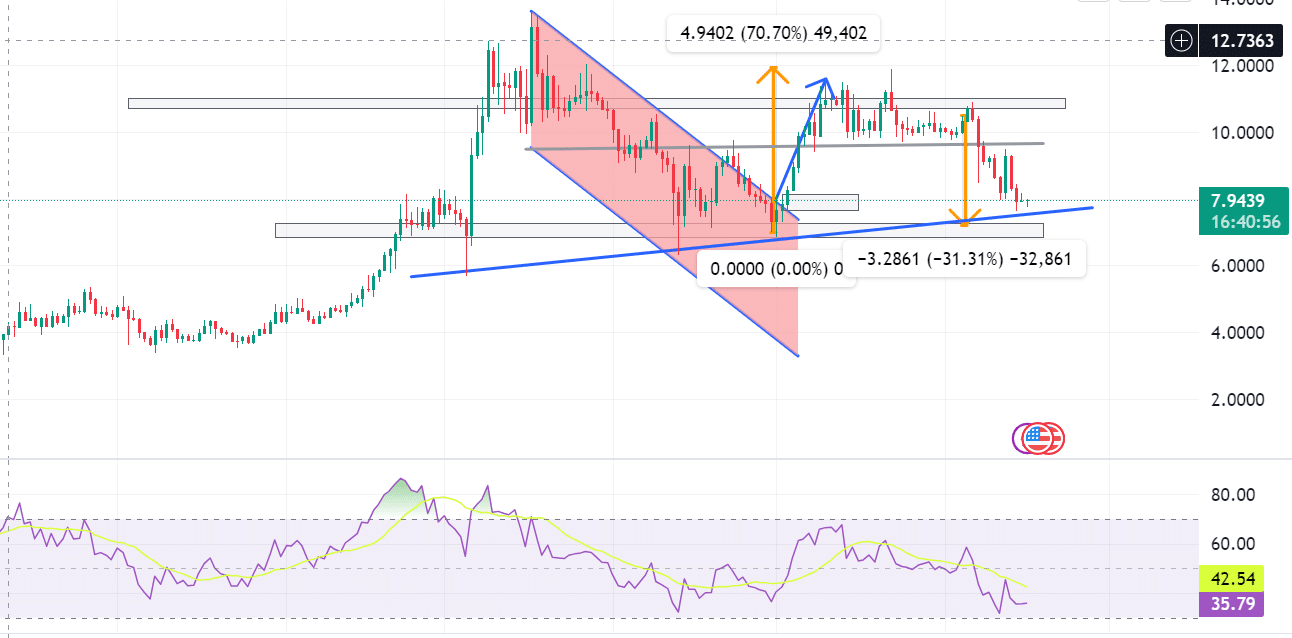

Source: TradingView

Render: Optimism in long term?

At the time of writing, the RSI was at the neutral level of 35, which showed that the market was at an indecisive level.

Thus, the market sentiment showed low investor confidence especially under short-term investments but higher for long term.

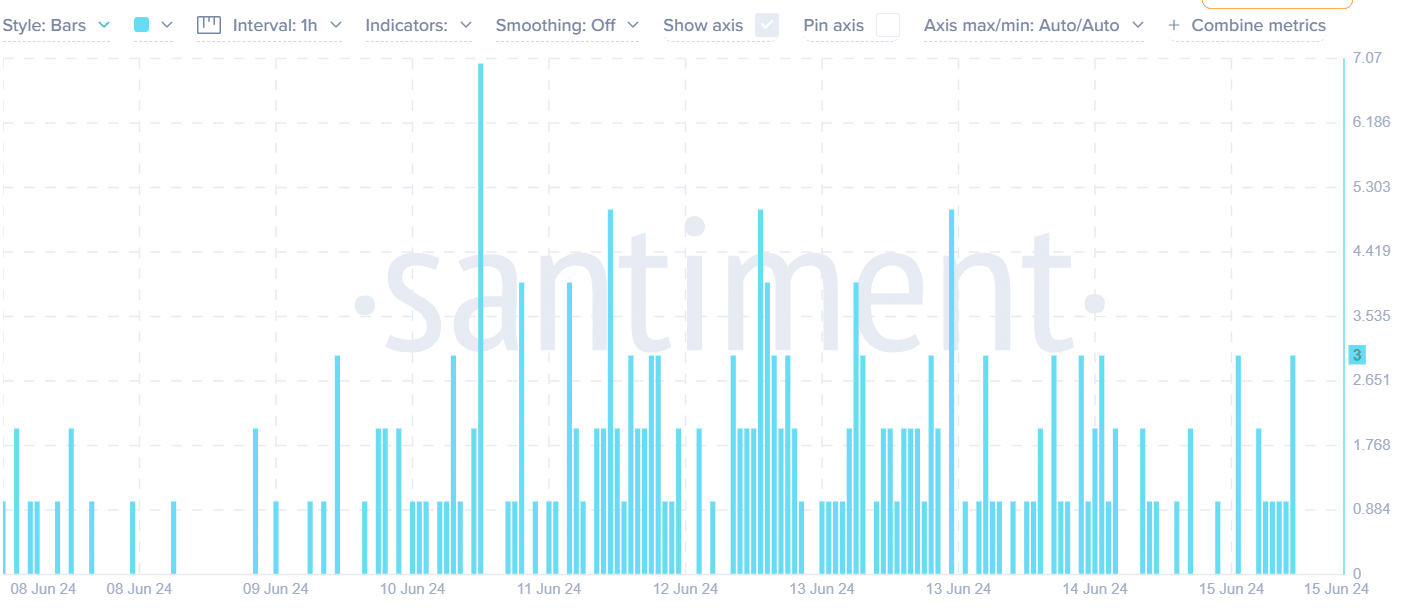

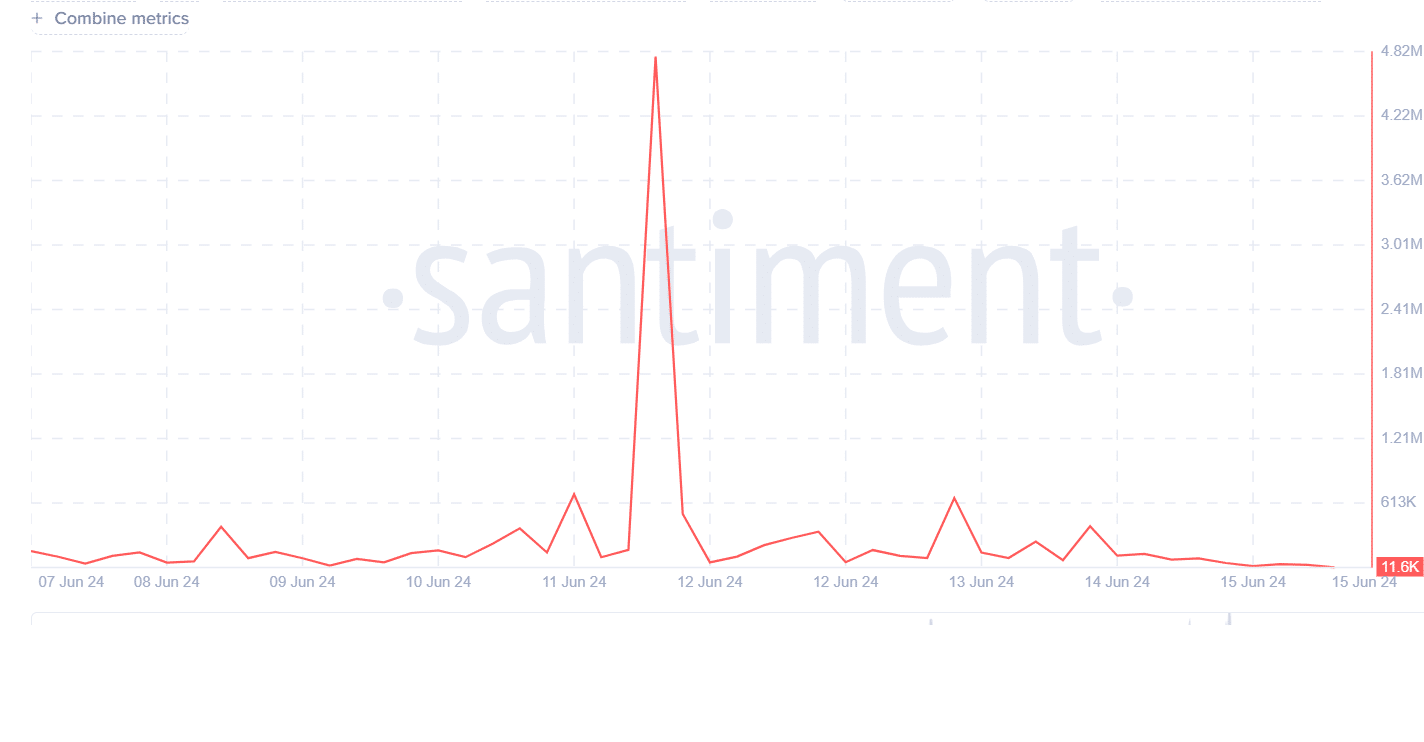

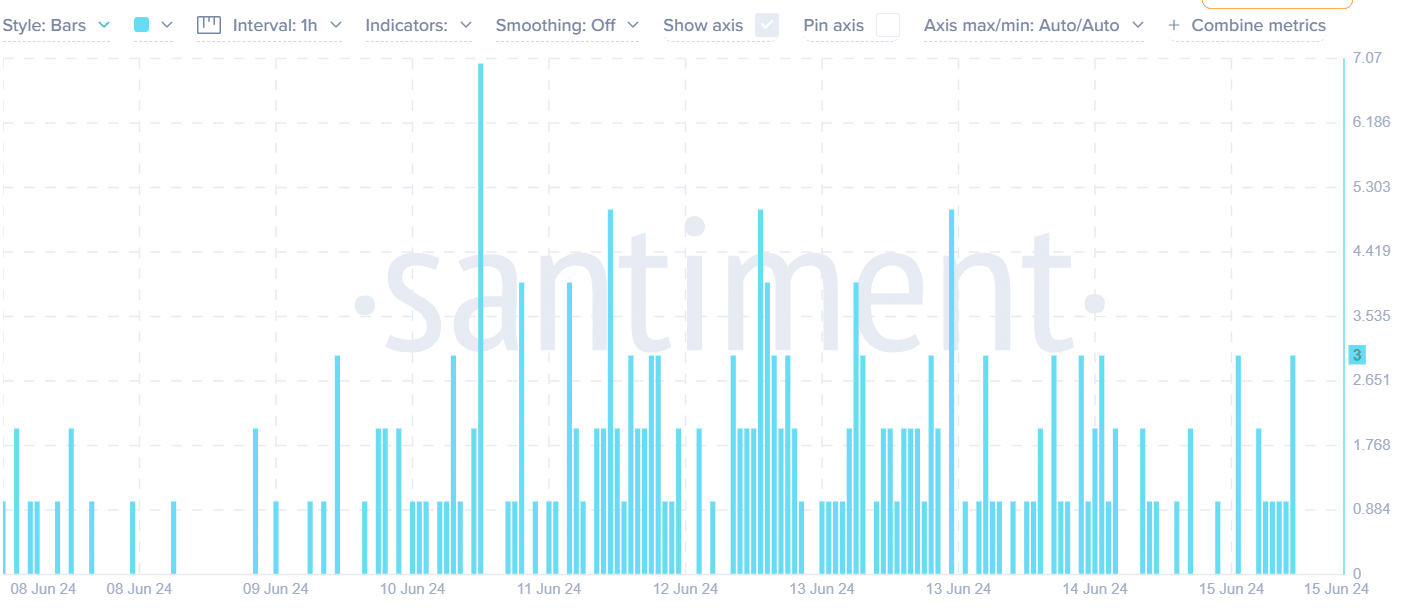

Source: Santiment

Looking further, according to Santiment, RNDR has experienced moderate to low social volume. This shows a reduced public appetite for crypto.

This implied a possible reversal in prices as markets went against public anticipation.

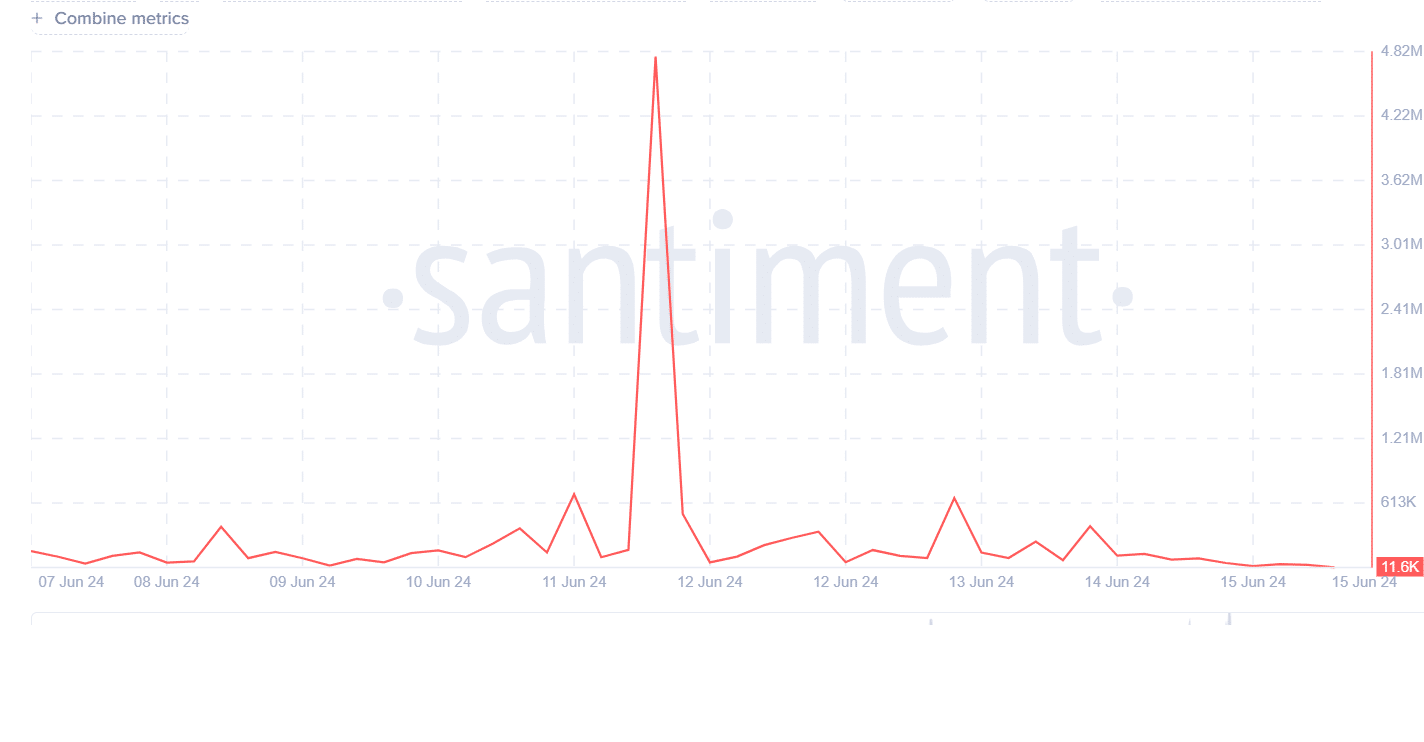

Source: Santiment

Read Render’s [RNDR] Price Prediction 2024-2025

According to Santiment data on Exchange inflow, RNDR has experienced low exchange inflows. Typically, low exchange inflows mean reduced selling pressure and investors are confident with long-term investments.

Despite the continued price decline, the market sentiment implies a possible reversal in the future to an uptrend.

- RNDR experienced a 13% fall in the last seven days.

- Market sentiment showed optimism even though the prices have been declining.

Render [RNDR] has experienced a 13 % decline in the last seven days and 1.62% in 24 hrs.

The continued decline has extensively impacted the trading volume in the previous 24 hrs, with a 52% decline according to CoinMarketCap. RNDR’s market cap reduced by 1.52% in the same period to $3.08B.

Source: TradingView

AMBCrypto’s analysis indicated that RNDR has experienced a 31% price decline since the 3rd of June. After trading at $10 at the start of the month, RNDR’s price has experienced a bearish trend overall.

With a resistance level of around $9, it’s trading at $7.9 while trying to retest.

This implies that if it retests at the support level of around $7.2, it will reverse to an uptrend. However, if it breaks down, it might experience a further decline to $5.2.

Market outlook

Source: TradingView

After hitting an ATH of $13 in March, the current market sentiment turned bearish. It experienced a decline over the last two months, with June recording the lowest in the same period.

Despite the attempts to break out, it has failed to reverse to a bullish trend.

In fact, at press time, the MACD reflected the current market sentiment. RNDR’s MACD was negative at -0.32 during press time, signaling a continued bearish trend.

Source: TradingView

Render: Optimism in long term?

At the time of writing, the RSI was at the neutral level of 35, which showed that the market was at an indecisive level.

Thus, the market sentiment showed low investor confidence especially under short-term investments but higher for long term.

Source: Santiment

Looking further, according to Santiment, RNDR has experienced moderate to low social volume. This shows a reduced public appetite for crypto.

This implied a possible reversal in prices as markets went against public anticipation.

Source: Santiment

Read Render’s [RNDR] Price Prediction 2024-2025

According to Santiment data on Exchange inflow, RNDR has experienced low exchange inflows. Typically, low exchange inflows mean reduced selling pressure and investors are confident with long-term investments.

Despite the continued price decline, the market sentiment implies a possible reversal in the future to an uptrend.

![Render [RNDR] falls 13% in 7 days: Will the AI token gain soon?](https://coininsights.com/wp-content/uploads/2024/06/rndr-tv-1-750x488.png)

how to get cheap clomid tablets buy clomid price how to buy clomid pill can i buy cheap clomid no prescription order generic clomid without rx buying generic clomiphene no prescription how can i get cheap clomiphene

With thanks. Loads of conception!

More peace pieces like this would make the web better.

order azithromycin 250mg online cheap – order ciplox 500mg online flagyl without prescription

semaglutide 14 mg pills – generic rybelsus periactin cheap

domperidone 10mg oral – sumycin cost buy flexeril cheap

buy amoxicillin – purchase valsartan without prescription order combivent pills

buy azithromycin 500mg sale – order bystolic for sale cost nebivolol

cheap augmentin – https://atbioinfo.com/ buy generic acillin over the counter

buy nexium 40mg online – https://anexamate.com/ oral esomeprazole

order coumadin online cheap – https://coumamide.com/ cozaar usa

order mobic generic – https://moboxsin.com/ order mobic 15mg online

order deltasone 40mg for sale – corticosteroid prednisone 20mg pills

top ed pills – erection pills viagra online non prescription ed drugs

order amoxicillin pills – https://combamoxi.com/ amoxil oral

buy fluconazole medication – on this site order diflucan 100mg sale

generic cenforce 100mg – https://cenforcers.com/# cenforce canada

how well does cialis work – https://ciltadgn.com/ safest and most reliable pharmacy to buy cialis

buy cialis generic online 10 mg – cialis delivery held at customs tadalafil no prescription forum

buy cheap viagra blog – can i buy viagra in japan buy viagra in dubai

This is the amicable of content I get high on reading. https://gnolvade.com/

More articles like this would make the blogosphere richer. isotretinoin generic

This website positively has all of the bumf and facts I needed about this thesis and didn’t comprehend who to ask. https://ursxdol.com/sildenafil-50-mg-in/

More posts like this would make the online elbow-room more useful. prohnrg.com

With thanks. Loads of conception! click

Palatable blog you be undergoing here.. It’s severely to find elevated calibre article like yours these days. I really respect individuals like you! Take guardianship!! https://ondactone.com/simvastatin/