- Bitcoin could potentially reach $250,000 with a total crypto market cap of $10 trillion.

- Solana’s price might surge to $800 if its market dominance increases to 5%.

Bitcoin [BTC] and Solana [SOL] have now been projected to reach remarkable valuations by the end of 2025.

The prediction came at a time when Bitcoin, despite its recent volatile price action, embarked on a recovery path, showing resilience above the $58,000 mark after dipping below $54,000 last week.

On the other hand, Solana, although slightly down by 1.6% over the past week, maintained a steady trading price around $144.06.

Diving into Bitcoin and Solana’s future

A crypto analyst from the VirtualBacon YouTube channel has set ambitious targets for Bitcoin and Solana, rooted in detailed market analysis and future potential.

Bitcoin is projected to hit a market cap of around $5 trillion by the end of 2025, translating to a price of $250,000 per Bitcoin.

This projection is based on the assumption that Bitcoin will maintain a 50% dominance in the cryptocurrency market, which is expected to reach a total market cap of $10 trillion.

Solana’s projections are equally bullish, with predictions of reaching up to $800 per token.

These forecasts are based on its current market cap growth and increasing dominance, which has risen from 0.75% to 3% over the past year. If Solana’s market share reaches 5%, its valuation could see even higher peaks.

This optimistic outlook for Solana is supported by its growing supply, expected to increase to 625 million tokens by 2025, and an annual inflation rate of 5.2%.

It is worth noting that this prediction for Solana can be seen as an update from the analyst’s previous prediction on SOL. In the YouTube video, the analyst noted,

“I had estimated a price of $240 to $250 based on a lower market dominance assumption for Solana. However, with its current growth, I now expect Solana’s price to reach around $480, assuming a 3% market dominance. If Solana’s market dominance increases to 5%, the price could potentially reach $800.”

Who’s hitting the predicted mark first?

It is worth looking at Solana and Bitcoin’s fundamentals to see which of these assets is likely to hit their predicted price mark first. To know this, Bitcoin’s retail interest gives us a tip.

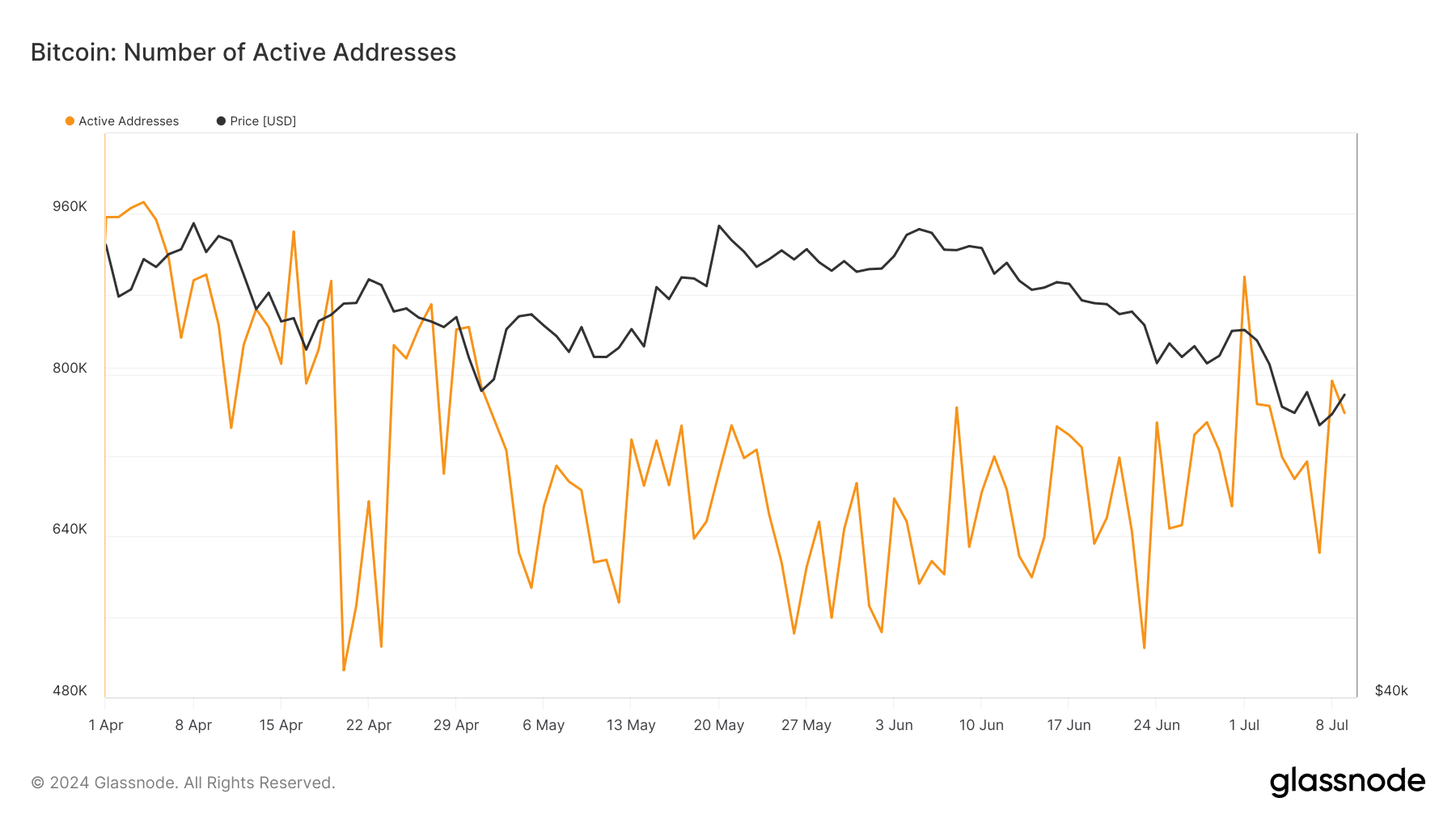

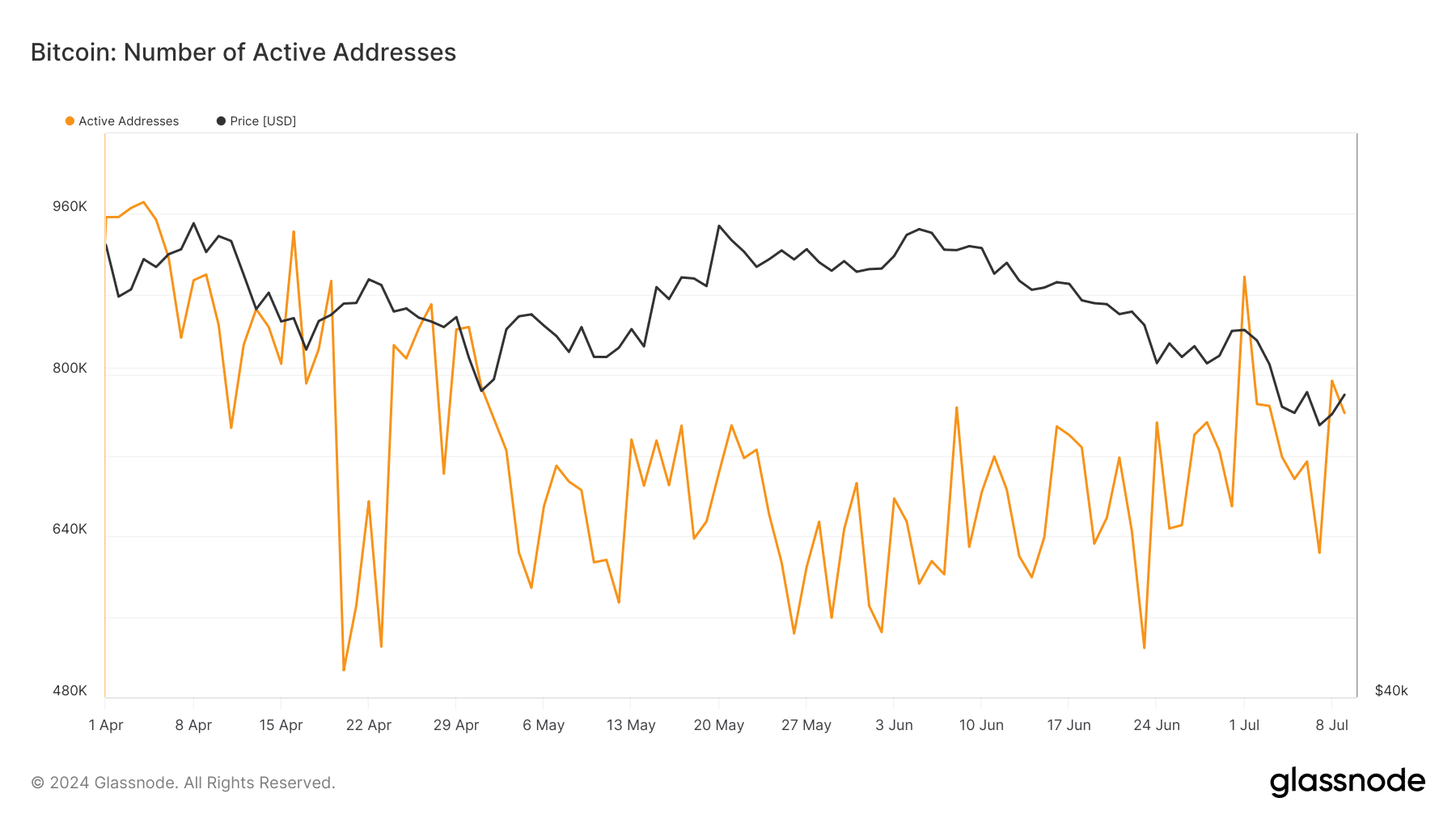

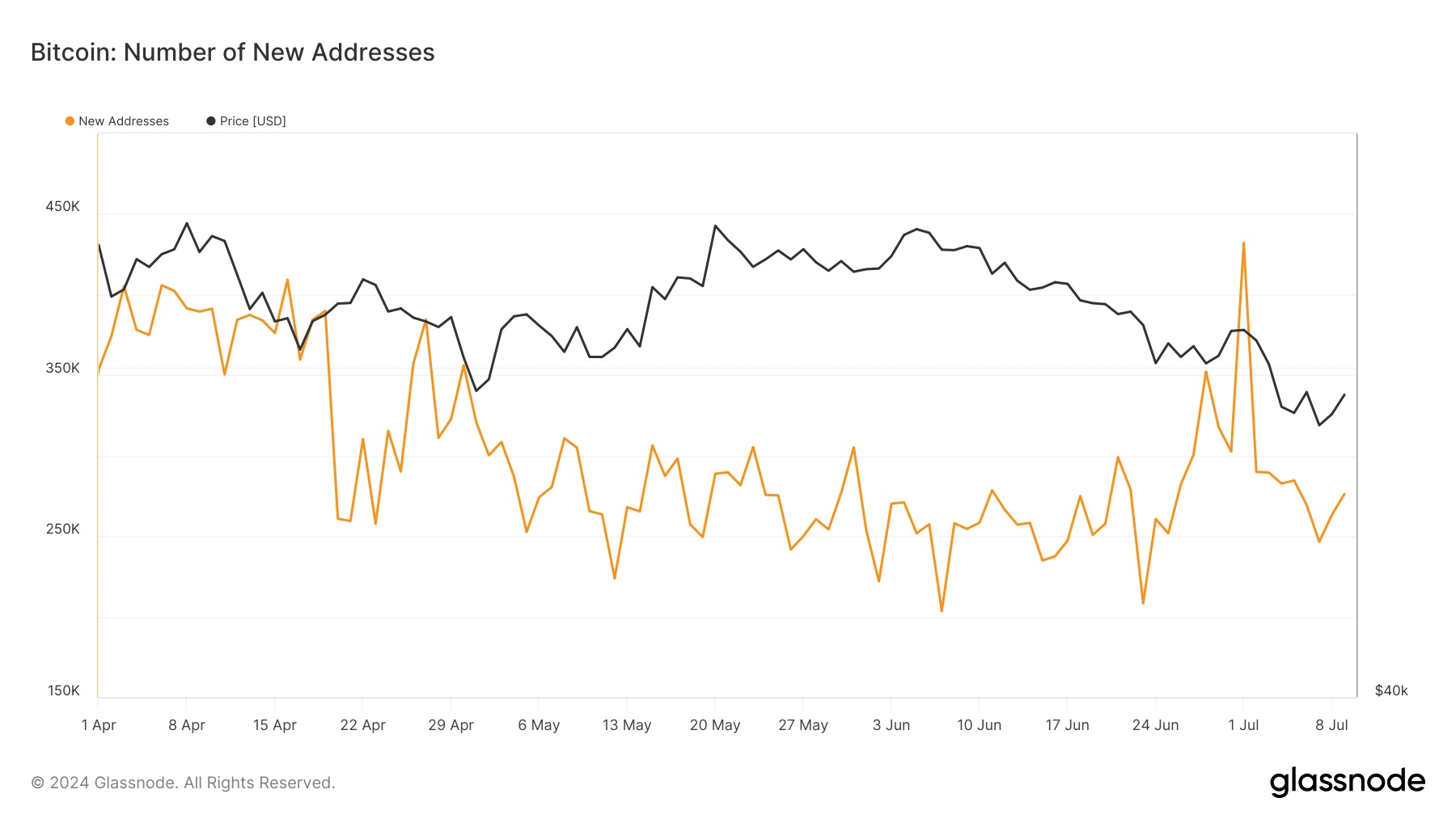

Analyzing retail interest revealed significant trends — data from Glassnode showed a fluctuation in Bitcoin’s active addresses, decreasing from over 900k three months ago to below 600k by late June.

It rebounded to 897k on the 2nd of July, nearly reaching its April peak.

Source: Glassnode

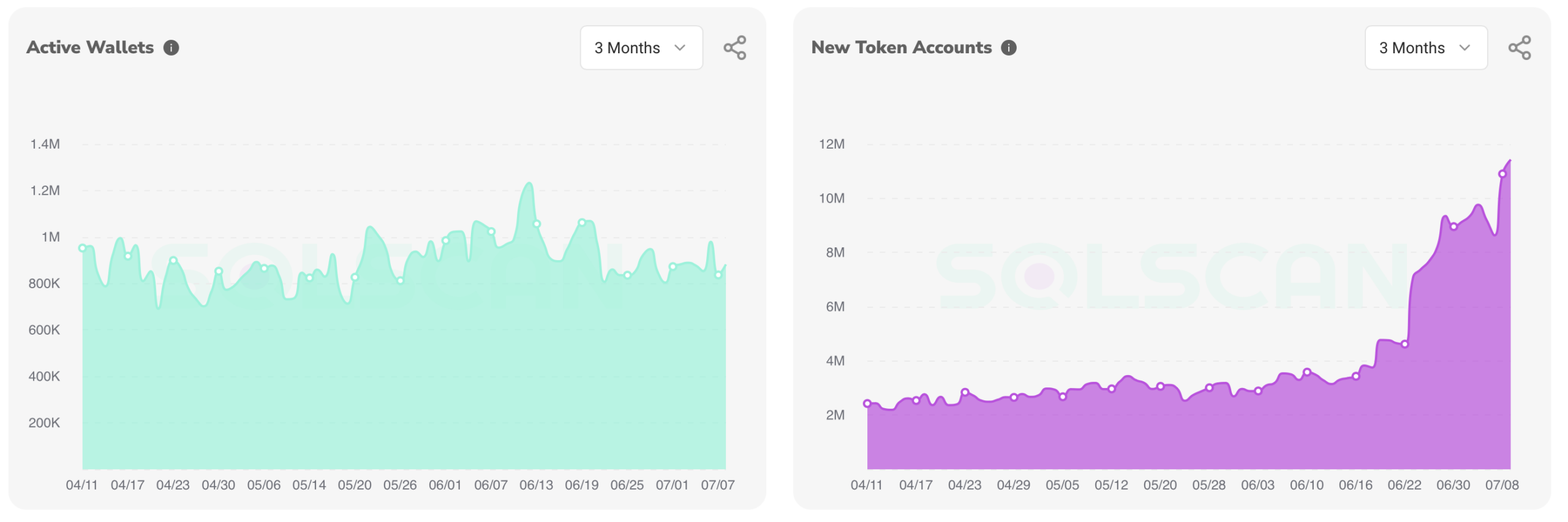

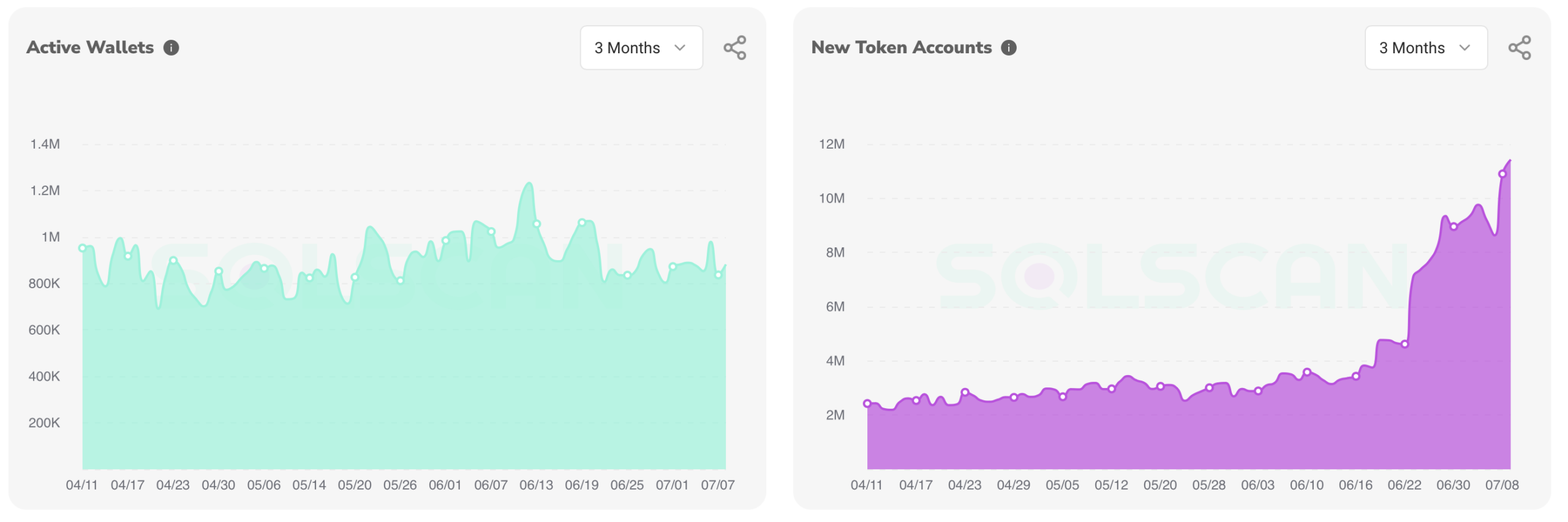

Conversely, Solana’s active addresses have shown less stability. Despite peaking at over 1.2 million in June, the count fell to 882k, reflecting a less positive trend.

However, Solana demonstrated remarkable growth in new addresses, escalating from under 3 million in April to over 11 million recently, showcasing strong new user adoption.

Source: Solscan

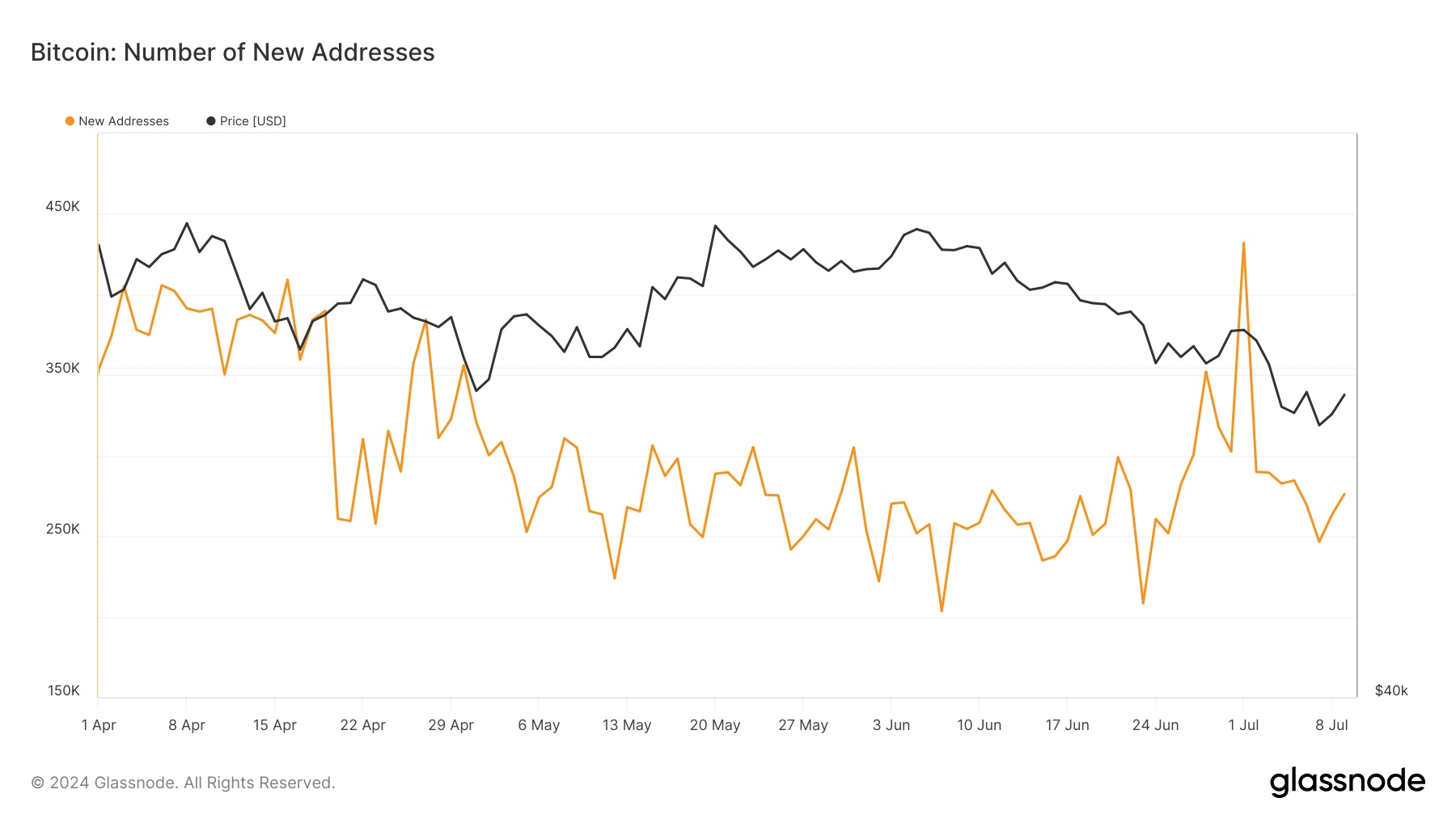

Bitcoin’s new addresses also spiked to over 432k on the 30th of June after a steady decline, but retracted to 272k shortly after. This suggested a resurgence in interest, which could either stabilize or grow further.

Source: Glassnode

The comparison of these metrics indicated that Bitcoin retained a robust base of committed investors, while Solana has been attracting a surge of new users.

Deciding which asset will hit its price target first depends on whether long-standing investors or new entrants more significantly influence the market.

Historically, new investors tend to propel markets to new highs by increasing demand.

Read Solana’s [SOL] Price Prediction 2024-25

Given the current data and trends, Solana may reach its projected price sooner than Bitcoin. However, the volatile nature of the cryptocurrency market makes this a speculative assessment.

Supporting this, AMBCrypto recently suggested that Solana could achieve a price of $1,200 by 2025, highlighting its potential rapid growth in the coming years.

- Bitcoin could potentially reach $250,000 with a total crypto market cap of $10 trillion.

- Solana’s price might surge to $800 if its market dominance increases to 5%.

Bitcoin [BTC] and Solana [SOL] have now been projected to reach remarkable valuations by the end of 2025.

The prediction came at a time when Bitcoin, despite its recent volatile price action, embarked on a recovery path, showing resilience above the $58,000 mark after dipping below $54,000 last week.

On the other hand, Solana, although slightly down by 1.6% over the past week, maintained a steady trading price around $144.06.

Diving into Bitcoin and Solana’s future

A crypto analyst from the VirtualBacon YouTube channel has set ambitious targets for Bitcoin and Solana, rooted in detailed market analysis and future potential.

Bitcoin is projected to hit a market cap of around $5 trillion by the end of 2025, translating to a price of $250,000 per Bitcoin.

This projection is based on the assumption that Bitcoin will maintain a 50% dominance in the cryptocurrency market, which is expected to reach a total market cap of $10 trillion.

Solana’s projections are equally bullish, with predictions of reaching up to $800 per token.

These forecasts are based on its current market cap growth and increasing dominance, which has risen from 0.75% to 3% over the past year. If Solana’s market share reaches 5%, its valuation could see even higher peaks.

This optimistic outlook for Solana is supported by its growing supply, expected to increase to 625 million tokens by 2025, and an annual inflation rate of 5.2%.

It is worth noting that this prediction for Solana can be seen as an update from the analyst’s previous prediction on SOL. In the YouTube video, the analyst noted,

“I had estimated a price of $240 to $250 based on a lower market dominance assumption for Solana. However, with its current growth, I now expect Solana’s price to reach around $480, assuming a 3% market dominance. If Solana’s market dominance increases to 5%, the price could potentially reach $800.”

Who’s hitting the predicted mark first?

It is worth looking at Solana and Bitcoin’s fundamentals to see which of these assets is likely to hit their predicted price mark first. To know this, Bitcoin’s retail interest gives us a tip.

Analyzing retail interest revealed significant trends — data from Glassnode showed a fluctuation in Bitcoin’s active addresses, decreasing from over 900k three months ago to below 600k by late June.

It rebounded to 897k on the 2nd of July, nearly reaching its April peak.

Source: Glassnode

Conversely, Solana’s active addresses have shown less stability. Despite peaking at over 1.2 million in June, the count fell to 882k, reflecting a less positive trend.

However, Solana demonstrated remarkable growth in new addresses, escalating from under 3 million in April to over 11 million recently, showcasing strong new user adoption.

Source: Solscan

Bitcoin’s new addresses also spiked to over 432k on the 30th of June after a steady decline, but retracted to 272k shortly after. This suggested a resurgence in interest, which could either stabilize or grow further.

Source: Glassnode

The comparison of these metrics indicated that Bitcoin retained a robust base of committed investors, while Solana has been attracting a surge of new users.

Deciding which asset will hit its price target first depends on whether long-standing investors or new entrants more significantly influence the market.

Historically, new investors tend to propel markets to new highs by increasing demand.

Read Solana’s [SOL] Price Prediction 2024-25

Given the current data and trends, Solana may reach its projected price sooner than Bitcoin. However, the volatile nature of the cryptocurrency market makes this a speculative assessment.

Supporting this, AMBCrypto recently suggested that Solana could achieve a price of $1,200 by 2025, highlighting its potential rapid growth in the coming years.