- Polygon has seen a massive surge in new users since the beginning of the year

- Revenue generated by the network grew, however, while DEX volumes fell

Over the past month, MATIC has fallen significantly on the price front, contributing to sentiment around the token falling dramatically. However, despite the same, the health of the larger Polygon ecosystem remains positive.

An uptick in activity

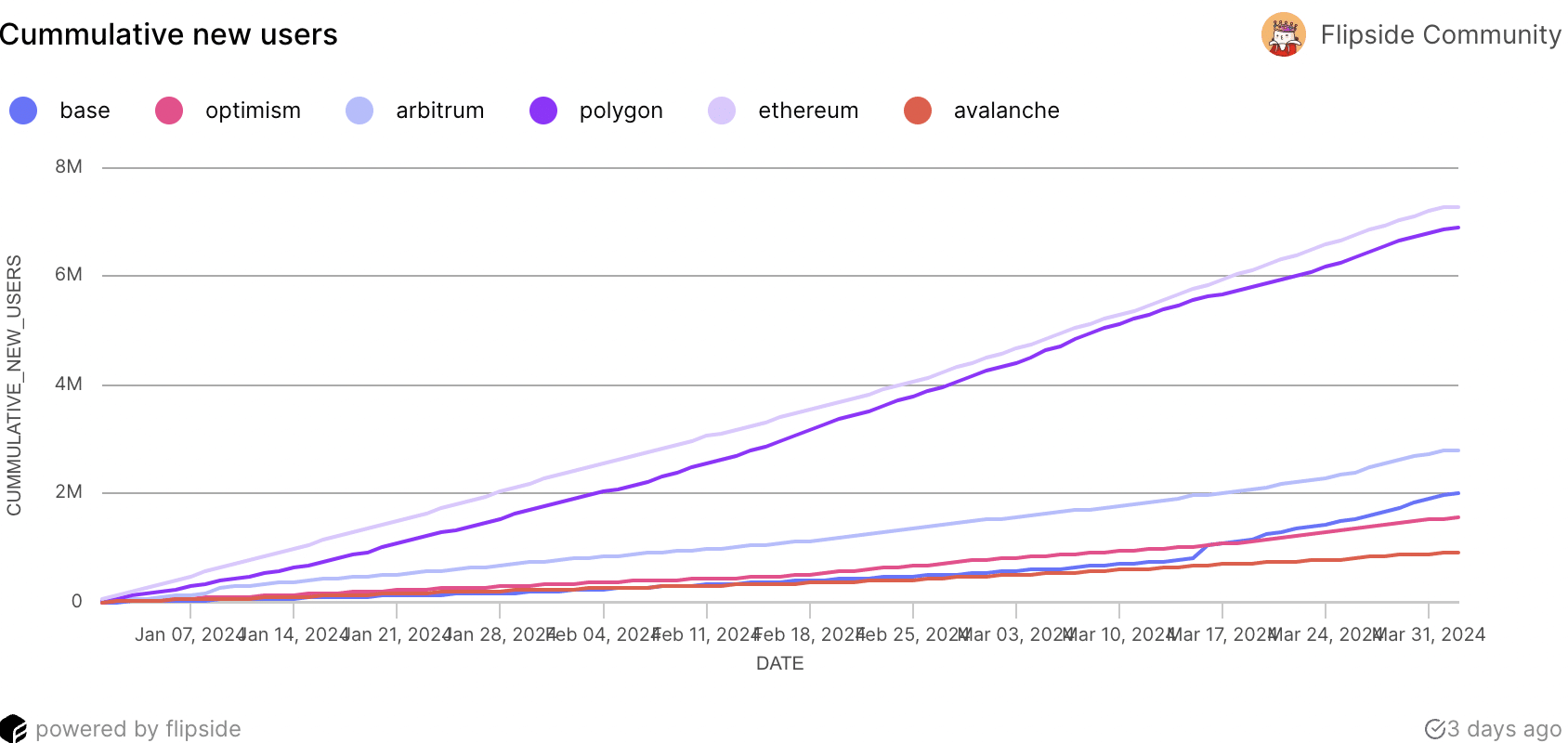

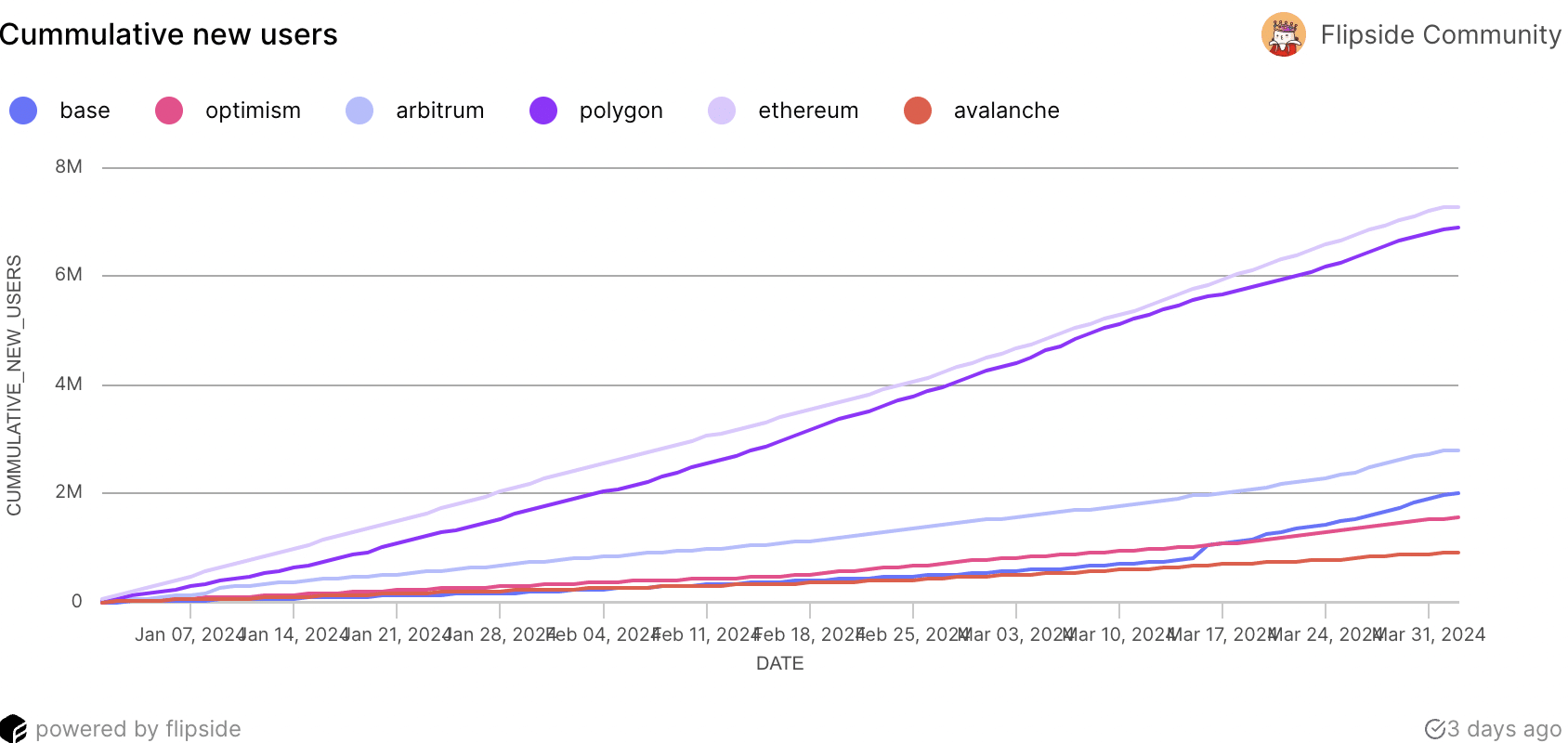

Since the start of 2024, Polygon has attracted a substantial number of new users, totaling 12.3 million as of 27 March. This influx represents a significant portion of new users across various observed EVM chains this year, accounting for roughly 70% alongside Ethereum. Despite Polygon’s longer establishment compared to many EVM chains, its ability to draw in such a large user base is impressive.

Furthermore, Polygon’s new user volume recorded a remarkable growth rate of 359.7% between January and March 2024. In doing so, it positioned itself within the median range across all observed chains.

Source: Flipside

With a larger user base, transaction activity on the Polygon network is bound to rise. This can lead to higher transaction fees, which in turn can be used to further develop the platform and incentivize users, like rewarding validators for securing the network. Over the past month alone, the revenue generated by Polygon surged by 51.9%.

However, in terms of development activity, a slowdown can be seen.

For instance – AMBCrypto’s analysis of Token Terminal’s data revealed that the number of code commits being made by Polygon developers fell. If this trend of declining code commits continues, it would mean a decline in the pace of updates and upgrades on the Polygon network.

Source: Token Terminal

Furthermore, in terms of the DeFi sector, Polygon saw a decline in activity. This was showcased by the falling DEX (Decentralized Exchange) volumes on the network.

Read Polygon’s [MATIC] Price Prediction 2024-25

Despite the declining DEX volumes, however, TVL (Total Value Locked) on the network continued to rise. If DEX volumes decline in the future, the TVL will be affected adversely.

Source: Artemis

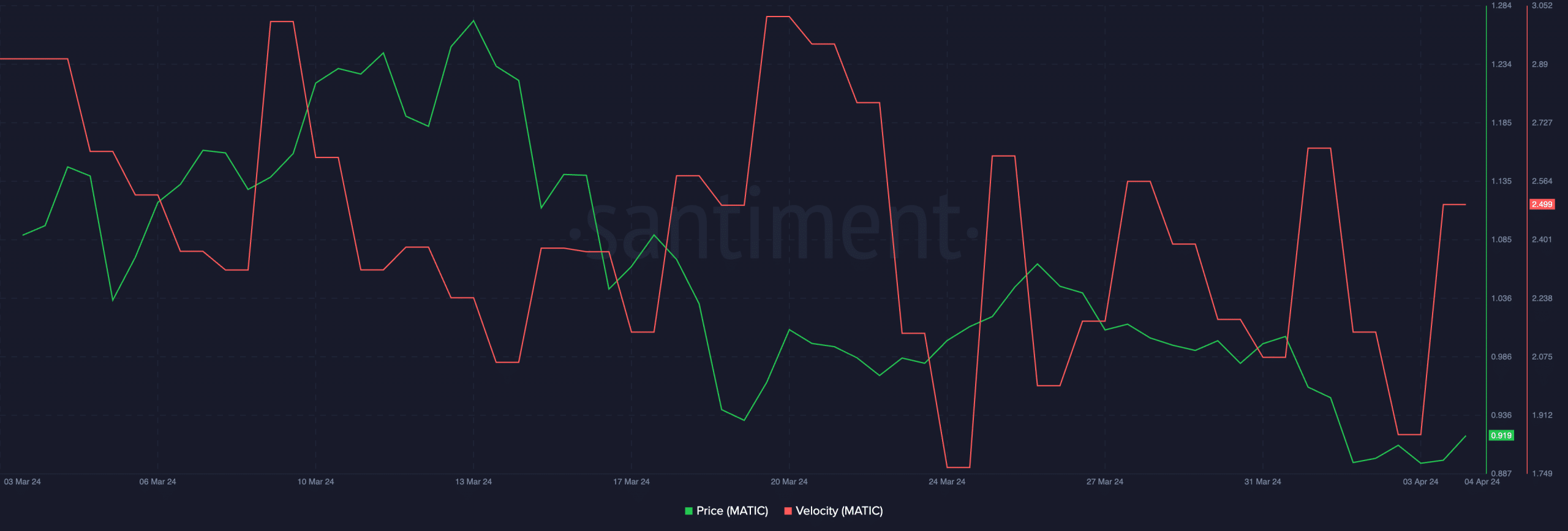

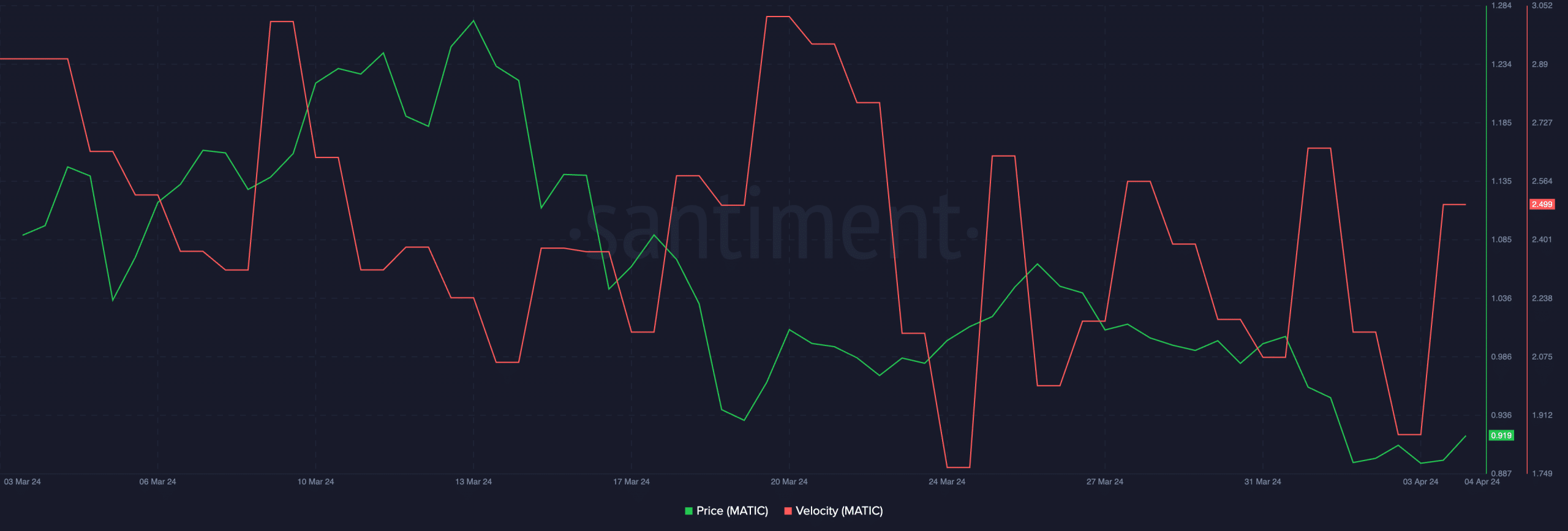

For its part, MATIC hasn’t been doing too well either. At the time of writing, MATIC was trading at $0.8813, down 11.33% over the past week. However, the velocity at which MATIC was trading had surged significantly.

The uptick in MATIC transactions could help the price see green in the future.

Source: Santiment

- Polygon has seen a massive surge in new users since the beginning of the year

- Revenue generated by the network grew, however, while DEX volumes fell

Over the past month, MATIC has fallen significantly on the price front, contributing to sentiment around the token falling dramatically. However, despite the same, the health of the larger Polygon ecosystem remains positive.

An uptick in activity

Since the start of 2024, Polygon has attracted a substantial number of new users, totaling 12.3 million as of 27 March. This influx represents a significant portion of new users across various observed EVM chains this year, accounting for roughly 70% alongside Ethereum. Despite Polygon’s longer establishment compared to many EVM chains, its ability to draw in such a large user base is impressive.

Furthermore, Polygon’s new user volume recorded a remarkable growth rate of 359.7% between January and March 2024. In doing so, it positioned itself within the median range across all observed chains.

Source: Flipside

With a larger user base, transaction activity on the Polygon network is bound to rise. This can lead to higher transaction fees, which in turn can be used to further develop the platform and incentivize users, like rewarding validators for securing the network. Over the past month alone, the revenue generated by Polygon surged by 51.9%.

However, in terms of development activity, a slowdown can be seen.

For instance – AMBCrypto’s analysis of Token Terminal’s data revealed that the number of code commits being made by Polygon developers fell. If this trend of declining code commits continues, it would mean a decline in the pace of updates and upgrades on the Polygon network.

Source: Token Terminal

Furthermore, in terms of the DeFi sector, Polygon saw a decline in activity. This was showcased by the falling DEX (Decentralized Exchange) volumes on the network.

Read Polygon’s [MATIC] Price Prediction 2024-25

Despite the declining DEX volumes, however, TVL (Total Value Locked) on the network continued to rise. If DEX volumes decline in the future, the TVL will be affected adversely.

Source: Artemis

For its part, MATIC hasn’t been doing too well either. At the time of writing, MATIC was trading at $0.8813, down 11.33% over the past week. However, the velocity at which MATIC was trading had surged significantly.

The uptick in MATIC transactions could help the price see green in the future.

Source: Santiment

where can i get cheap clomid tablets cost of clomid without prescription can i purchase generic clomid prices where to get cheap clomiphene no prescription clomid sleep apnea cost of clomiphene without insurance how to get cheap clomiphene

Thanks towards putting this up. It’s well done.

The thoroughness in this section is noteworthy.

order semaglutide without prescription – order rybelsus 14mg generic periactin buy online

clavulanate usa – https://atbioinfo.com/ ampicillin medication

nexium online – https://anexamate.com/ esomeprazole 20mg cheap

purchase medex pill – anticoagulant hyzaar ca

generic mobic 7.5mg – https://moboxsin.com/ cost meloxicam 15mg

cheap amoxil generic – https://combamoxi.com/ cost amoxil

fluconazole tablet – https://gpdifluca.com/# diflucan 100mg without prescription

cenforce 50mg for sale – https://cenforcers.com/# oral cenforce 50mg

cialis mexico – https://ciltadgn.com/ what is the active ingredient in cialis

zantac 150mg tablet – https://aranitidine.com/# buy ranitidine 300mg generic

cheap cialis – strong tadafl tadalafil prescribing information

Greetings! Extremely serviceable advice within this article! It’s the crumb changes which will obtain the largest changes. Thanks a portion towards sharing! on this site

buy viagra jet – https://strongvpls.com/# 100 mg of sildenafil

This is the tolerant of advise I unearth helpful. buy isotretinoin online

More content pieces like this would insinuate the интернет better. https://ursxdol.com/synthroid-available-online/

I couldn’t turn down commenting. Profoundly written! https://prohnrg.com/product/acyclovir-pills/

Greetings! Utter useful recommendation within this article! It’s the scarcely changes which choice make the largest changes. Thanks a a quantity quest of sharing! https://aranitidine.com/fr/ciagra-professional-20-mg/

More posts like this would persuade the online time more useful. https://ondactone.com/product/domperidone/

Greetings! Utter productive recommendation within this article! It’s the little changes which wish turn the largest changes. Thanks a a quantity quest of sharing!

https://proisotrepl.com/product/tetracycline/

The depth in this ruined is exceptional. http://ledyardmachine.com/forum/User-Lzvpam

dapagliflozin 10mg price – on this site buy generic dapagliflozin over the counter

orlistat order – janozin.com orlistat 120mg pill