- Social activity for the Polkadot network declined materially in the last few days.

- The overall activity on the network also fell.

Polkadot [DOT] has been one of the L1s that has not seen as much growth as its counterparts. One of the reasons for the same would be the declining popularity of Polkadot across social media platforms.

Word on the street

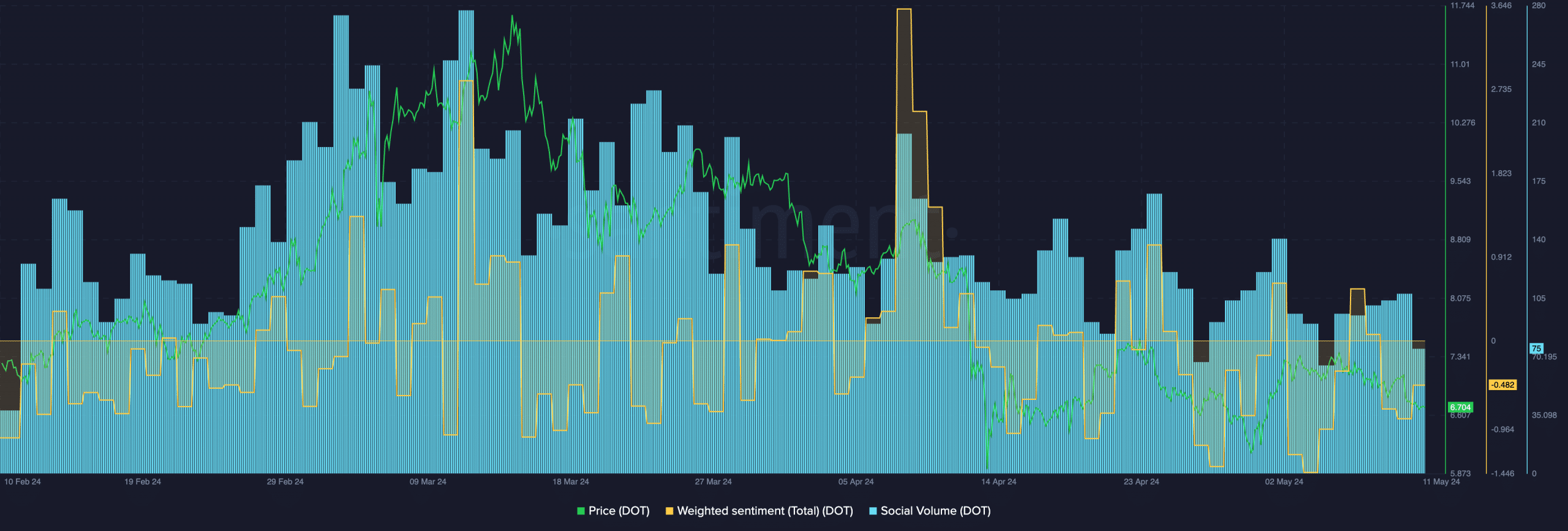

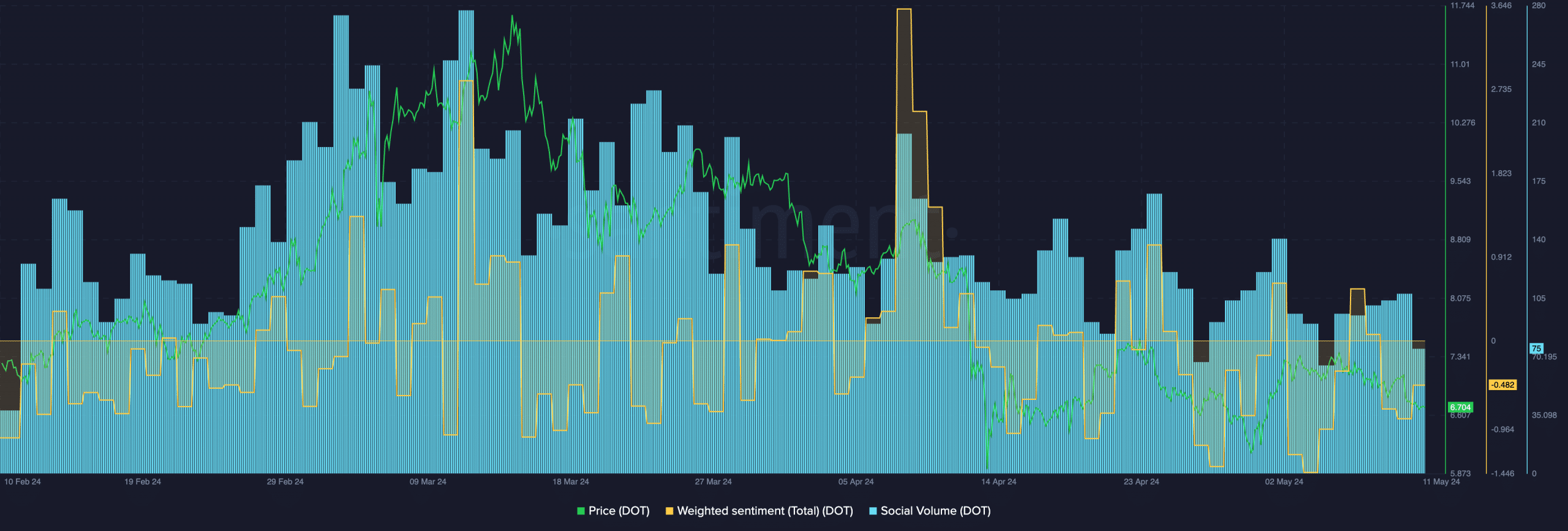

AMBCrypto’s analysis of Santiment’s data revealed that the social volume for Polkadot declined significantly. Moreover, the Weighted Sentiment around DOT fell materially.

Source: Santiment

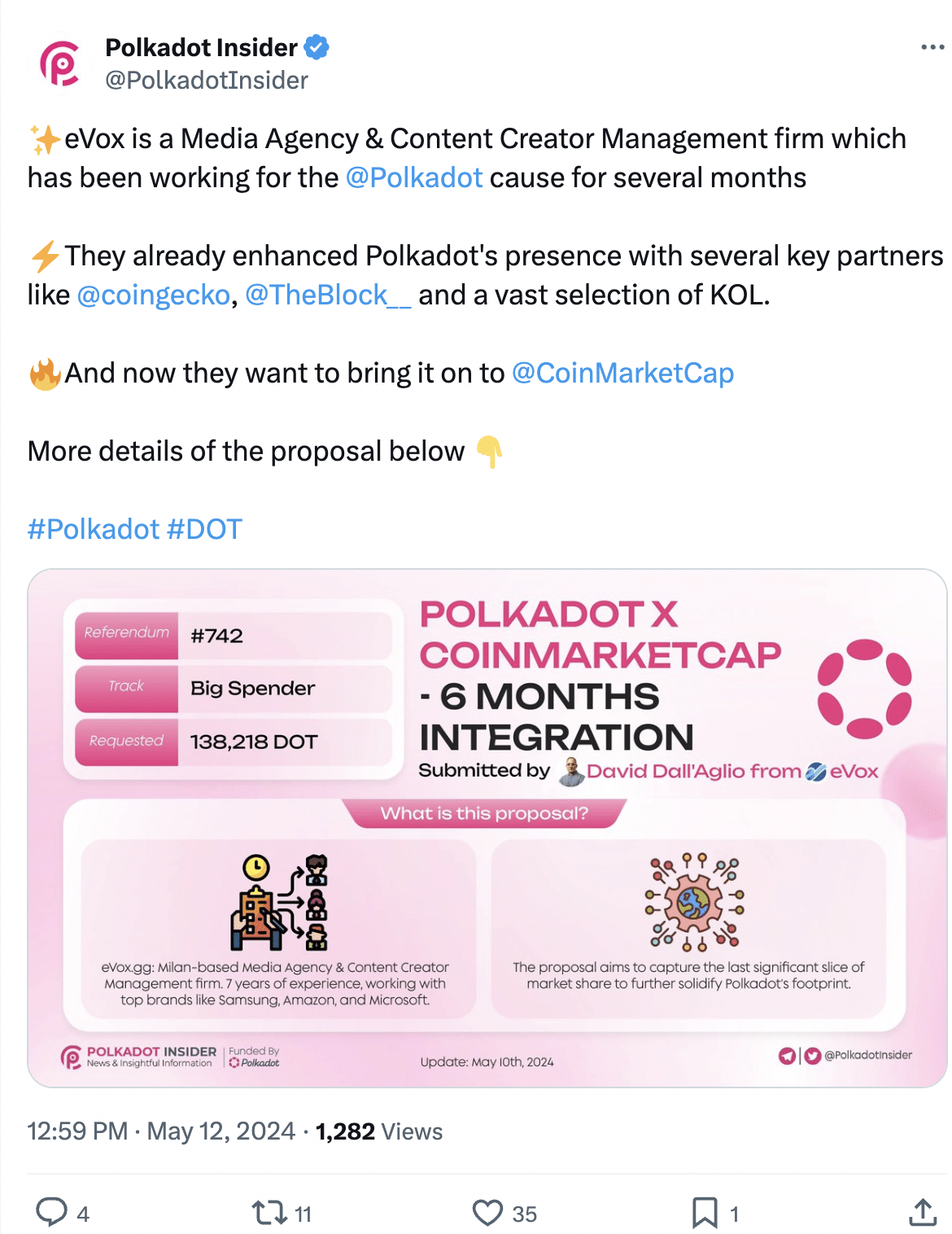

Nevertheless, Polkadot has been actively collaborating with a media agency to amplify awareness about the network.

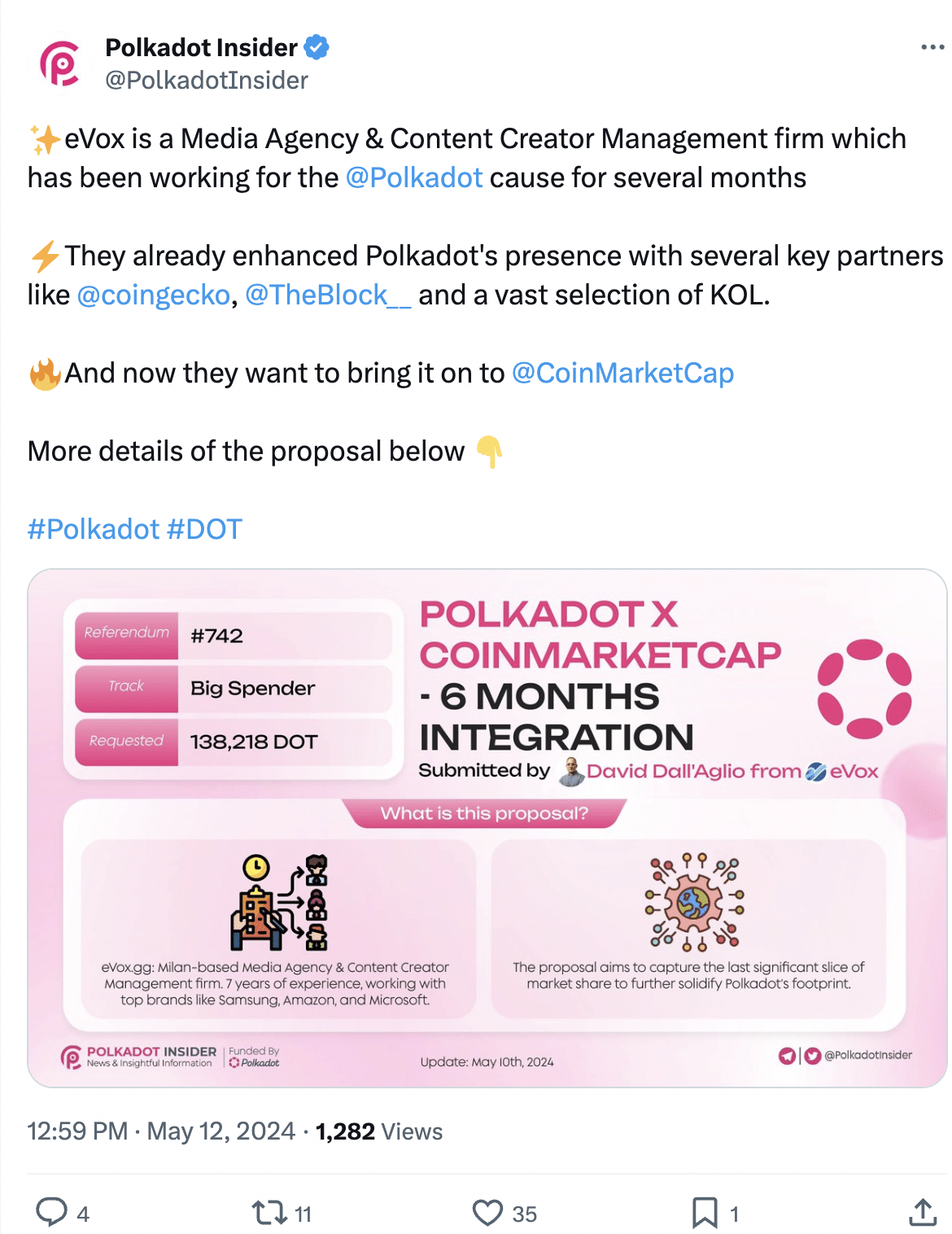

eVox, a Media Agency & Content Creator Management firm, has dedicated several months to advancing the Polkadot cause.

Presently, they are aiming to extend this outreach effort to CoinMarketCap.

Source: X

It remains to be seen whether Polkadot’s efforts to improve its popularity can yield positive results in the long run.

Looking at the price

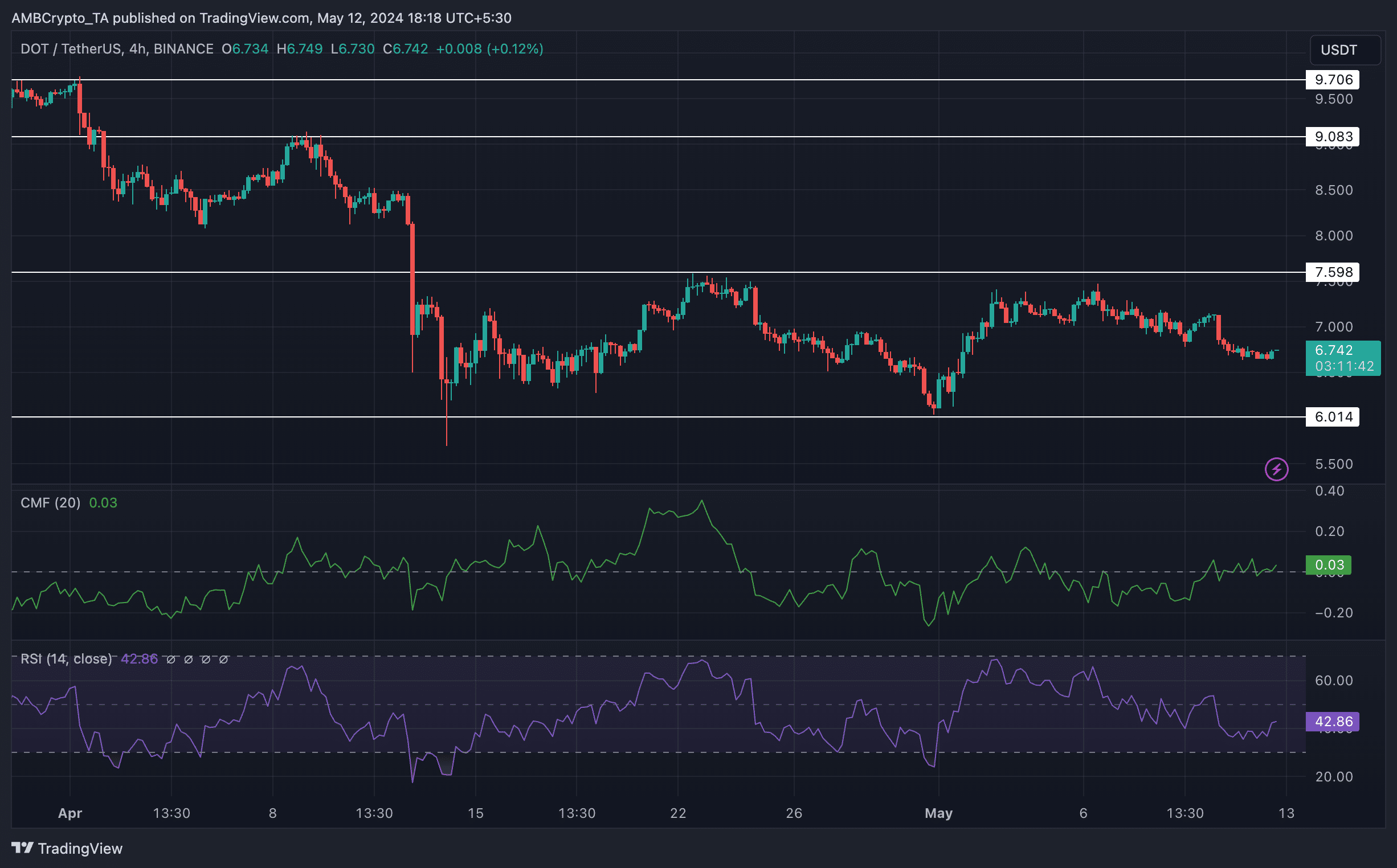

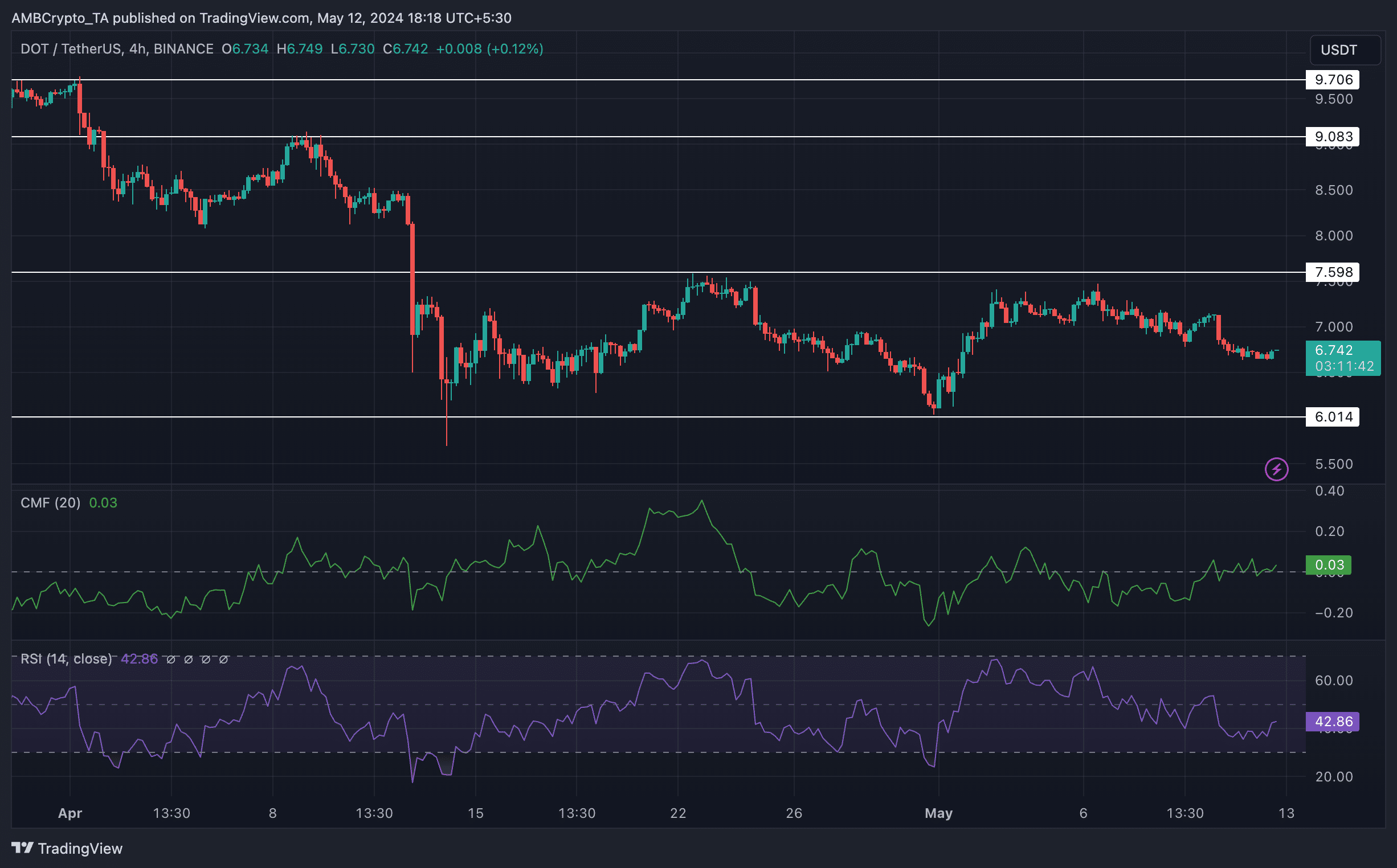

DOT wasn’t doing too well in terms of price movement, either. Since the 1st of April, its price fell by 27.96%. During this period, DOT showcased multiple lower lows and lower his, indicative of a bearish trend.

Moreover, the CMF (Chaikin Money Flow) for DOT had grown slightly, implying that there could an uptick in the money flow for DOT going forward.

However, the RSI had declined to 42, implying that bullish momentum had fallen significantly. DOT would need to retest the $7.598 level a couple more times before it can start its journey upwards.

Source: Trading View

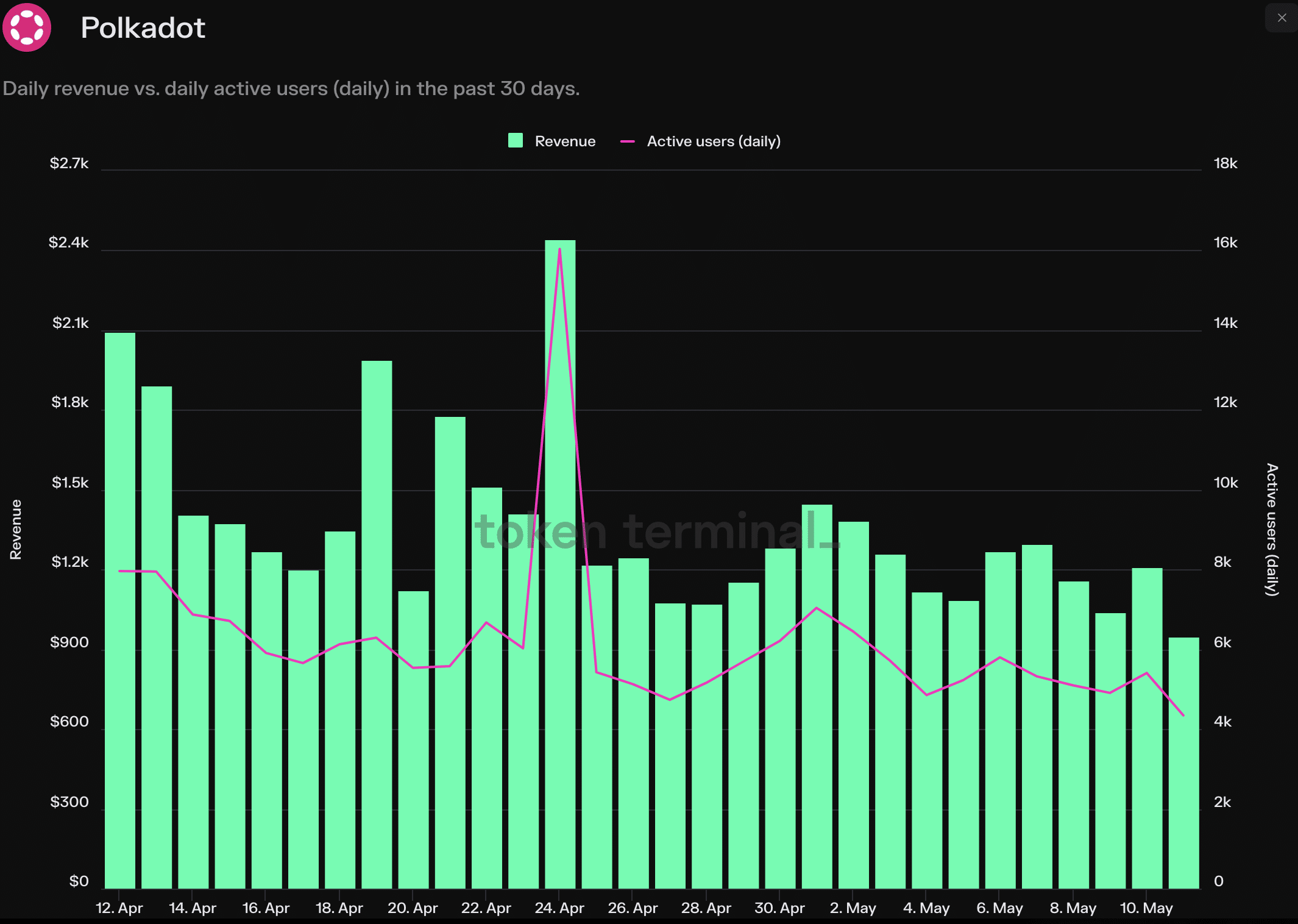

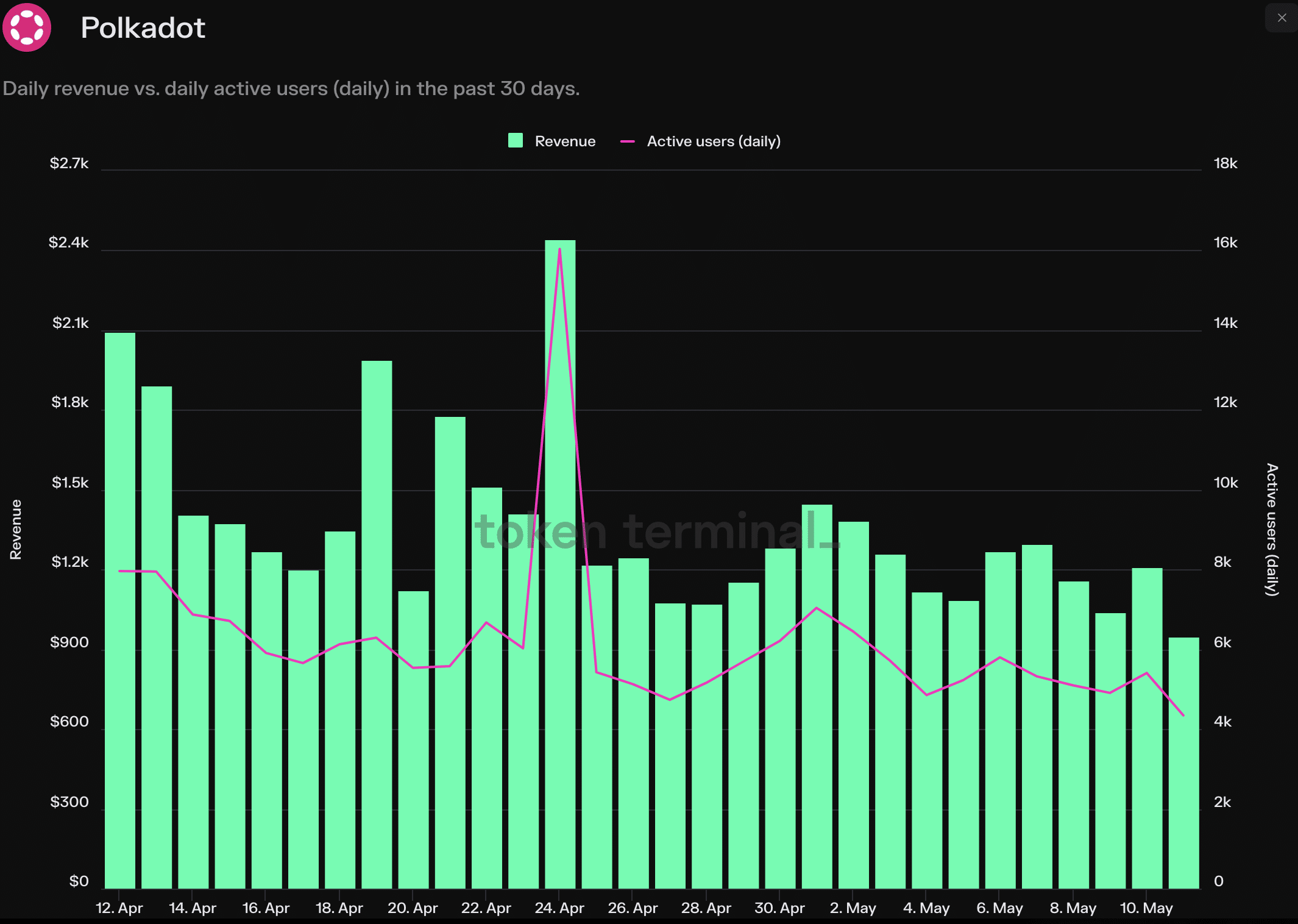

Coming to the state of the protocol, the situation looked quite dire. The number of active users on the Polkadot network declined significantly over the last 30 days.

The revenue generated by the network also declined during this period.

Read Polkadot’s [DOT] Price Prediction 2024-25

These factors suggested that not only was DOT not doing well in terms of its price and social activity, but the overall strength of its ecosystem was also declining.

It could be difficult for DOT to recover if things continue like this.

Source: Token Terminal

- Social activity for the Polkadot network declined materially in the last few days.

- The overall activity on the network also fell.

Polkadot [DOT] has been one of the L1s that has not seen as much growth as its counterparts. One of the reasons for the same would be the declining popularity of Polkadot across social media platforms.

Word on the street

AMBCrypto’s analysis of Santiment’s data revealed that the social volume for Polkadot declined significantly. Moreover, the Weighted Sentiment around DOT fell materially.

Source: Santiment

Nevertheless, Polkadot has been actively collaborating with a media agency to amplify awareness about the network.

eVox, a Media Agency & Content Creator Management firm, has dedicated several months to advancing the Polkadot cause.

Presently, they are aiming to extend this outreach effort to CoinMarketCap.

Source: X

It remains to be seen whether Polkadot’s efforts to improve its popularity can yield positive results in the long run.

Looking at the price

DOT wasn’t doing too well in terms of price movement, either. Since the 1st of April, its price fell by 27.96%. During this period, DOT showcased multiple lower lows and lower his, indicative of a bearish trend.

Moreover, the CMF (Chaikin Money Flow) for DOT had grown slightly, implying that there could an uptick in the money flow for DOT going forward.

However, the RSI had declined to 42, implying that bullish momentum had fallen significantly. DOT would need to retest the $7.598 level a couple more times before it can start its journey upwards.

Source: Trading View

Coming to the state of the protocol, the situation looked quite dire. The number of active users on the Polkadot network declined significantly over the last 30 days.

The revenue generated by the network also declined during this period.

Read Polkadot’s [DOT] Price Prediction 2024-25

These factors suggested that not only was DOT not doing well in terms of its price and social activity, but the overall strength of its ecosystem was also declining.

It could be difficult for DOT to recover if things continue like this.

Source: Token Terminal

how to buy generic clomiphene without dr prescription can you buy clomiphene for sale buying clomid pill can i buy cheap clomiphene price can i order clomid without rx buying generic clomiphene tablets where can i get clomiphene no prescription

Thank you for all your hard work on this web site. My aunt really loves participating in investigation and it’s really easy to see why. A number of us know all concerning the powerful ways you create advantageous information through this website and therefore improve response from other people on this subject matter plus my child is without a doubt learning a lot. Enjoy the remaining portion of the new year. You are always conducting a superb job.

More posts like this would make the blogosphere more useful.

More peace pieces like this would urge the web better.

order zithromax generic – order tetracycline 250mg for sale buy cheap generic flagyl

semaglutide 14mg canada – semaglutide 14 mg without prescription order periactin 4mg generic

order domperidone 10mg for sale – order tetracycline generic flexeril online order

amoxiclav online buy – atbioinfo.com ampicillin pills

order medex pills – https://coumamide.com/ how to get cozaar without a prescription

I¦ll right away grab your rss feed as I can not in finding your e-mail subscription link or newsletter service. Do you have any? Please permit me realize so that I may subscribe. Thanks.

buy meloxicam paypal – tenderness order generic meloxicam

prednisone 5mg tablet – allergic reactions oral deltasone 40mg

blue pill for ed – https://fastedtotake.com/ buy ed pills best price

cheap fluconazole – https://gpdifluca.com/ where to buy forcan without a prescription

buy cenforce 50mg online – click buy cenforce 50mg pill

cialis 20mg tablets – https://ciltadgn.com/# cialis for pulmonary hypertension

when will cialis become generic – https://strongtadafl.com/# mambo 36 tadalafil 20 mg reviews

viagra by mail order from canada – click cheap viagra no rx

This is a keynote which is virtually to my verve… Many thanks! Faithfully where can I lay one’s hands on the phone details due to the fact that questions? on this site

Greetings! Extremely productive recommendation within this article! It’s the little changes which will make the largest changes. Thanks a portion in the direction of sharing! buy accutane

This is the kind of enter I recoup helpful. https://ursxdol.com/get-metformin-pills/

More posts like this would add up to the online play more useful. https://prohnrg.com/product/loratadine-10-mg-tablets/

I am continually looking online for posts that can facilitate me. Thank you!

This is the type of post I recoup helpful. https://aranitidine.com/fr/viagra-100mg-prix/

This website really has all of the tidings and facts I needed to this case and didn’t comprehend who to ask. https://ondactone.com/simvastatin/

The depth in this tune is exceptional.

https://doxycyclinege.com/pro/tamsulosin/

More delight pieces like this would create the web better. http://www.orlandogamers.org/forum/member.php?action=profile&uid=29108

Thanks for another magnificent post. Where else could anyone get that kind of info in such a perfect way of writing? I have a presentation next week, and I am on the look for such information.

Does your blog have a contact page? I’m having a tough time locating it but, I’d like to send you an e-mail. I’ve got some suggestions for your blog you might be interested in hearing. Either way, great site and I look forward to seeing it develop over time.

Hey! Would you mind if I share your blog with my twitter group? There’s a lot of folks that I think would really appreciate your content. Please let me know. Many thanks

order forxiga online cheap – https://janozin.com/# buy dapagliflozin 10 mg online

Nice post. I study one thing more challenging on completely different blogs everyday. It is going to all the time be stimulating to read content from different writers and observe just a little one thing from their store. I’d desire to use some with the content material on my blog whether or not you don’t mind. Natually I’ll offer you a link on your web blog. Thanks for sharing.

order orlistat online – https://asacostat.com/ buy orlistat no prescription

Hi, Neat post. There is an issue with your site in web explorer, could test this… IE still is the marketplace chief and a large section of folks will omit your wonderful writing because of this problem.