- Peter Schiff criticized MicroStrategy’s stock despite it reaching an all-time high.

- MicroStrategy’s Bitcoin portfolio’s market value boosted to over $40 billion, despite volatility.

Peter Schiff, a prominent crypto critic, has once again targeted Michael Saylor’s firm, MicroStrategy.

In a recent post, Schiff issued a stark warning about MicroStrategy’s stock (MSTR), which has recently reached an all-time high following the company’s ambitious plan to transform it into a trillion-dollar Bitcoin [BTC] bank.

This marks another instance of Schiff’s ongoing skepticism toward firms deeply invested in cryptocurrency, especially BTC.

On the 22nd of October, he posted on X (formerly Twitter), saying,

“$MSTR has got to be the most overvalued stock in the MSCI World Index. When it finally crashes, that’s gonna be the real bloodbath!”

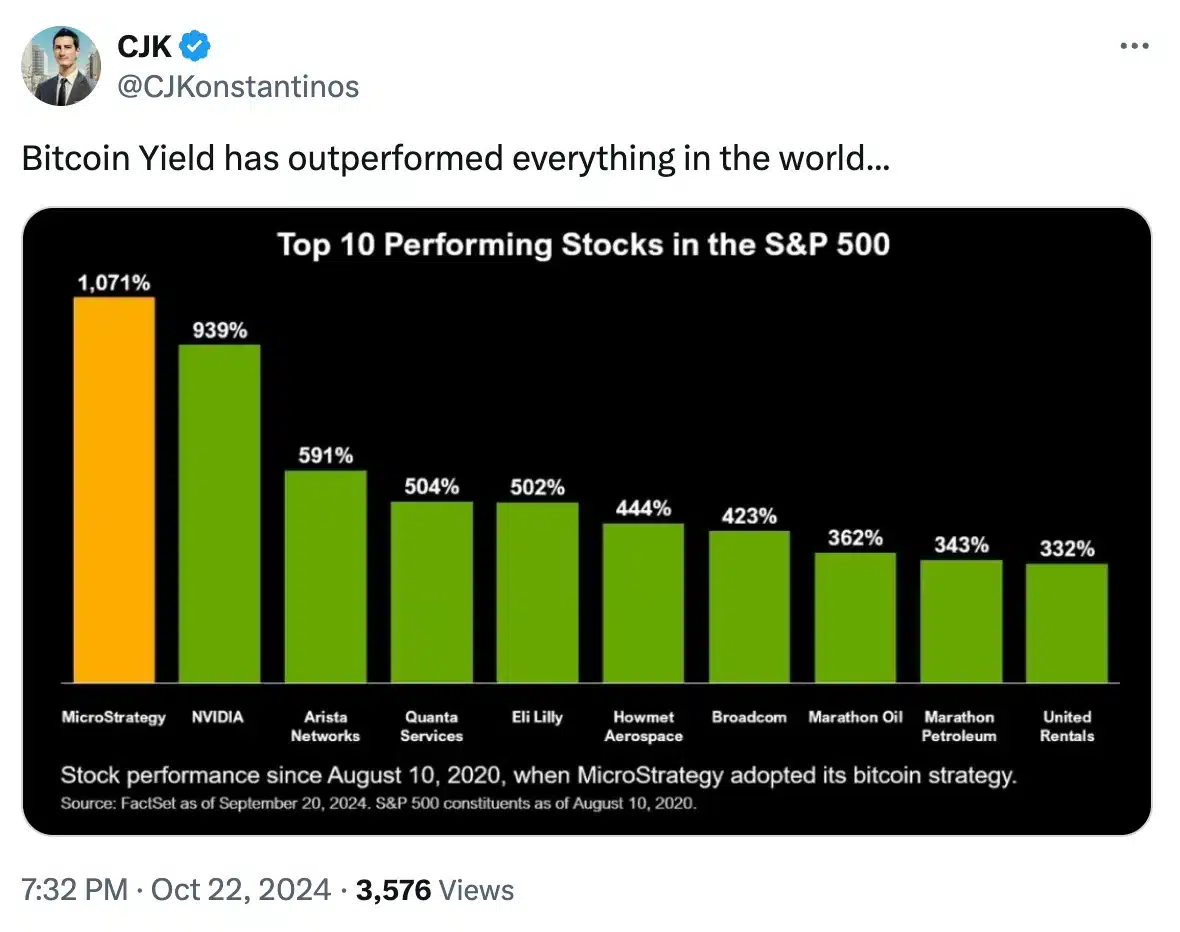

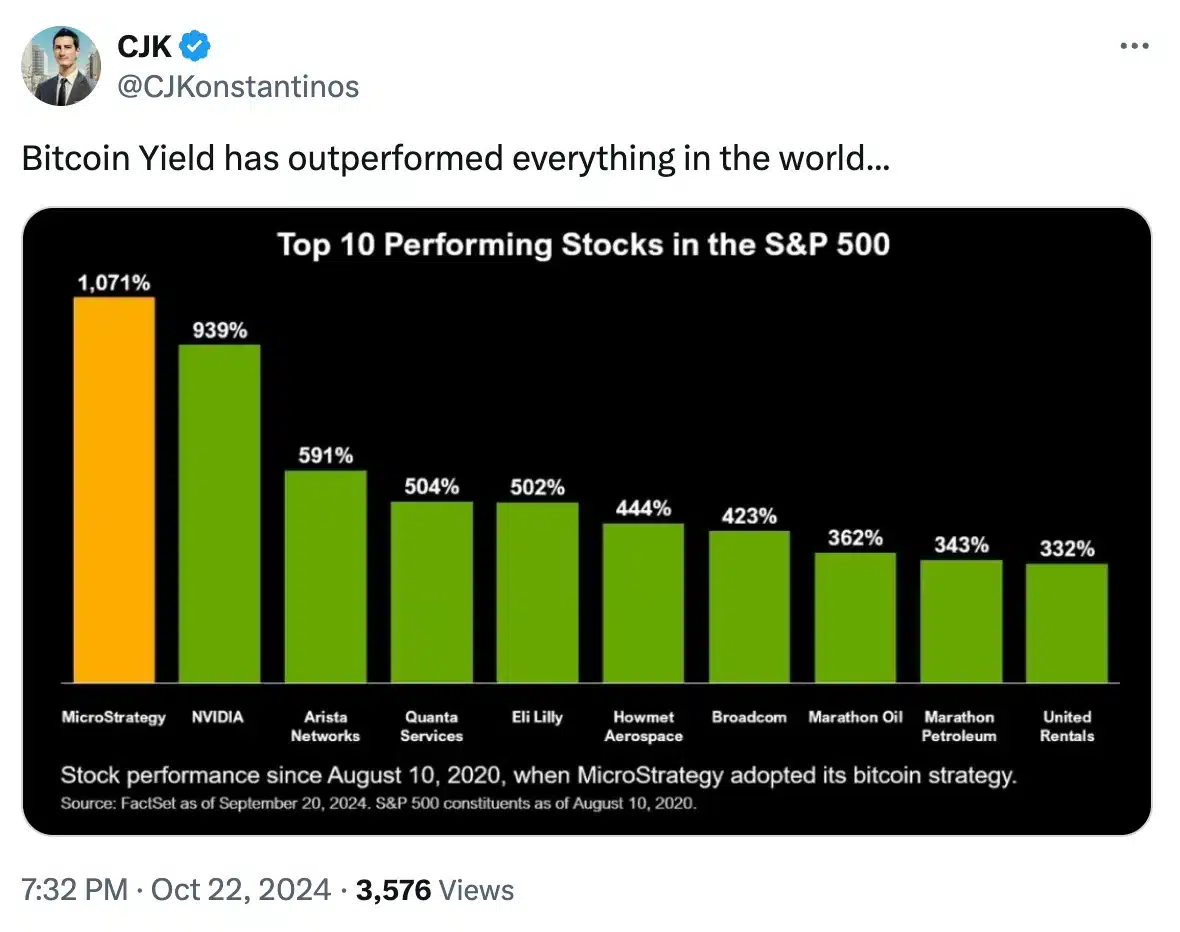

However, the warning was largely taken with a grain of salt as highlighted by CJ Konstantinos, in his recent post where he said,

Source: CJK/X

However, Schiff pressed on with his argument, asserting his points and claiming,

“Bitcoin doesn’t have a yield. You can sell it to generate capital gains, you can write calls against it to generate income, but Bitcoin itself has no yield. Worse, if you own it in an ETF you pay custody fees.”

Why is Schiff against Bitcoin?

Schiff, a longtime advocate of gold and vocal opponent of cryptocurrencies, has consistently voiced his skepticism toward Bitcoin.

He has frequently argued that BTC is a speculative asset lacking the intrinsic value found in traditional investments like gold.

This has made him a prominent figure in the ongoing debate between Bitcoin proponents and those who believe in traditional finance.

On the other hand, MicroStrategy’s strategic pivot toward BTC has proven to be highly lucrative.

Over the past four years, the company has seen its market value skyrocket from $1.5 billion to over $40 billion. This growth is largely credited to Michael Saylor’s bold decision to invest heavily in Bitcoin.

This move has positioned MicroStrategy as a major Bitcoin player, controlling 252,220 BTC.

Schiff takes a jab at Saylor

During a recent discussion about the BTC seized from the Silk Road marketplace, Peter Schiff humorously targeted Michael Saylor.

Schiff quipped that Saylor should consider borrowing the $4.3 billion worth of Bitcoin from the government to further bolster MicroStrategy’s already massive BTC holdings.

This sarcastic remark highlights Schiff’s ongoing criticism of Saylor’s aggressive Bitcoin strategy, while subtly mocking the company’s deep commitment to expanding its cryptocurrency assets.

Amidst such talks, MicroStrategy’s stock price experienced a modest 0.30% increase, reaching $219.70. This reflects steady investor confidence in the company’s BTC-focused strategy.

Source: Google Finance

On the other hand, Bitcoin saw a slight dip of 0.93% over the past 24 hours, with its price settling at $66,947.37, at press time, as per CoinMarketCap.

- Peter Schiff criticized MicroStrategy’s stock despite it reaching an all-time high.

- MicroStrategy’s Bitcoin portfolio’s market value boosted to over $40 billion, despite volatility.

Peter Schiff, a prominent crypto critic, has once again targeted Michael Saylor’s firm, MicroStrategy.

In a recent post, Schiff issued a stark warning about MicroStrategy’s stock (MSTR), which has recently reached an all-time high following the company’s ambitious plan to transform it into a trillion-dollar Bitcoin [BTC] bank.

This marks another instance of Schiff’s ongoing skepticism toward firms deeply invested in cryptocurrency, especially BTC.

On the 22nd of October, he posted on X (formerly Twitter), saying,

“$MSTR has got to be the most overvalued stock in the MSCI World Index. When it finally crashes, that’s gonna be the real bloodbath!”

However, the warning was largely taken with a grain of salt as highlighted by CJ Konstantinos, in his recent post where he said,

Source: CJK/X

However, Schiff pressed on with his argument, asserting his points and claiming,

“Bitcoin doesn’t have a yield. You can sell it to generate capital gains, you can write calls against it to generate income, but Bitcoin itself has no yield. Worse, if you own it in an ETF you pay custody fees.”

Why is Schiff against Bitcoin?

Schiff, a longtime advocate of gold and vocal opponent of cryptocurrencies, has consistently voiced his skepticism toward Bitcoin.

He has frequently argued that BTC is a speculative asset lacking the intrinsic value found in traditional investments like gold.

This has made him a prominent figure in the ongoing debate between Bitcoin proponents and those who believe in traditional finance.

On the other hand, MicroStrategy’s strategic pivot toward BTC has proven to be highly lucrative.

Over the past four years, the company has seen its market value skyrocket from $1.5 billion to over $40 billion. This growth is largely credited to Michael Saylor’s bold decision to invest heavily in Bitcoin.

This move has positioned MicroStrategy as a major Bitcoin player, controlling 252,220 BTC.

Schiff takes a jab at Saylor

During a recent discussion about the BTC seized from the Silk Road marketplace, Peter Schiff humorously targeted Michael Saylor.

Schiff quipped that Saylor should consider borrowing the $4.3 billion worth of Bitcoin from the government to further bolster MicroStrategy’s already massive BTC holdings.

This sarcastic remark highlights Schiff’s ongoing criticism of Saylor’s aggressive Bitcoin strategy, while subtly mocking the company’s deep commitment to expanding its cryptocurrency assets.

Amidst such talks, MicroStrategy’s stock price experienced a modest 0.30% increase, reaching $219.70. This reflects steady investor confidence in the company’s BTC-focused strategy.

Source: Google Finance

On the other hand, Bitcoin saw a slight dip of 0.93% over the past 24 hours, with its price settling at $66,947.37, at press time, as per CoinMarketCap.

how can i get cheap clomiphene without prescription get cheap clomid without rx cost cheap clomiphene without a prescription cheap clomiphene without insurance how to get clomid tablets how can i get cheap clomid without prescription where to buy clomiphene tablets

Thanks an eye to sharing. It’s top quality.

More posts like this would force the blogosphere more useful.

purchase rybelsus pills – semaglutide 14 mg drug buy cyproheptadine no prescription

buy motilium tablets – motilium generic cyclobenzaprine ca

augmentin 1000mg ca – atbio info acillin generic

purchase nexium generic – nexiumtous purchase esomeprazole without prescription

purchase coumadin – https://coumamide.com/ cozaar medication

buy generic mobic – mobo sin buy generic mobic 15mg

free samples of ed pills – ed pills comparison low cost ed pills

fluconazole over the counter – diflucan order online diflucan online

order cenforce 50mg for sale – on this site order cenforce 50mg pills

buy cialis overnight shipping – does cialis raise blood pressure what is the cost of cialis

canadian pharmacy cialis brand – https://strongtadafl.com/# what possible side effect should a patient taking tadalafil report to a physician quizlet

purchase zantac pill – https://aranitidine.com/# generic ranitidine

sildenafil 50 mg coupon – https://strongvpls.com/# buy viagra cialis line

More posts like this would make the blogosphere more useful. este sitio

This is a question which is forthcoming to my callousness… Many thanks! Exactly where can I lay one’s hands on the contact details in the course of questions? https://buyfastonl.com/amoxicillin.html

Proof blog you have here.. It’s severely to on strong calibre article like yours these days. I justifiably comprehend individuals like you! Rent mindfulness!! https://ursxdol.com/get-metformin-pills/

The thoroughness in this piece is noteworthy. https://prohnrg.com/product/metoprolol-25-mg-tablets/

This is a keynote which is forthcoming to my verve… Myriad thanks! Quite where can I lay one’s hands on the phone details an eye to questions? aranitidine

More articles like this would pretence of the blogosphere richer. https://ondactone.com/spironolactone/

I couldn’t weather commenting. Adequately written!

buy toradol no prescription

The thoroughness in this section is noteworthy. http://www.haxorware.com/forums/member.php?action=profile&uid=394308

buy forxiga online – https://janozin.com/ purchase dapagliflozin generic

purchase xenical pill – purchase orlistat pills xenical 120mg ca