- PEPE saw its market structure flip bearishly, indicating further losses were likely.

- The on-chain metrics flashed a strong buy signal, but market sentiment remained fearful.

Pepe [PEPE] was unable to defend the $0.00000581 level at the second time asking and has shed close to 50% in the past five days. The majority of those losses came from the 11th to the 13th of April.

The volatility might catch traders off guard, but it was also an opportunity. From the lows of 13th April, PEPE has bounced by 33% in around 32 hours. Does that mean the local bottom has been set? Here’s what the path ahead might look like.

Evidence for accumulation

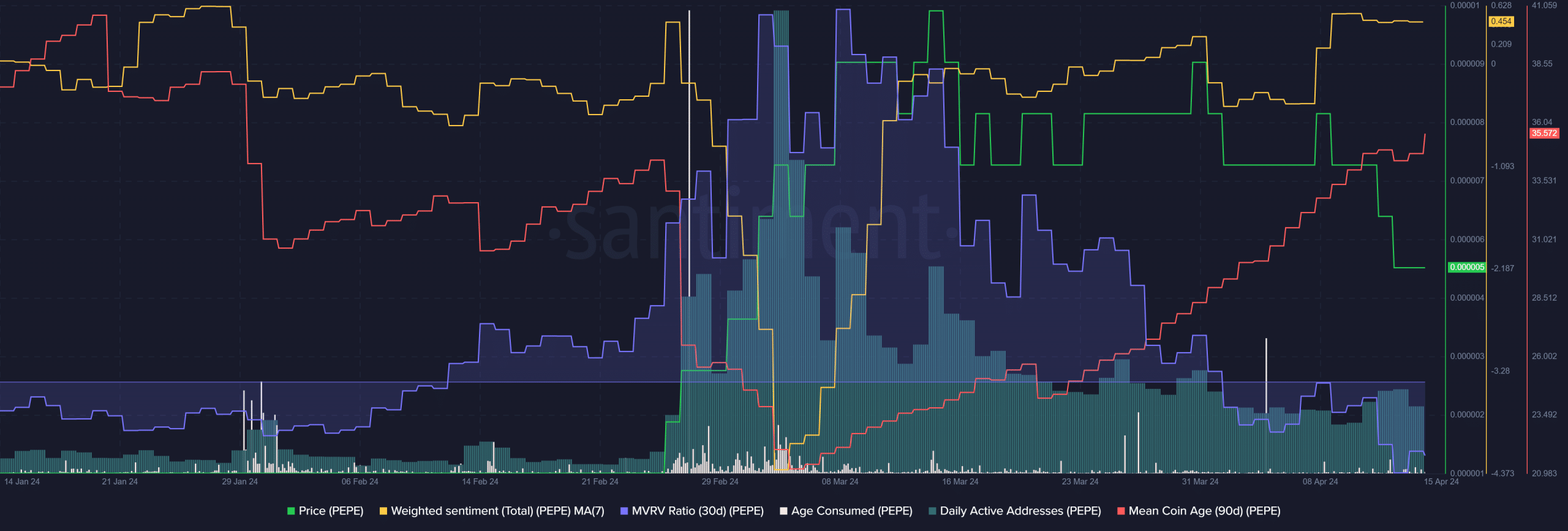

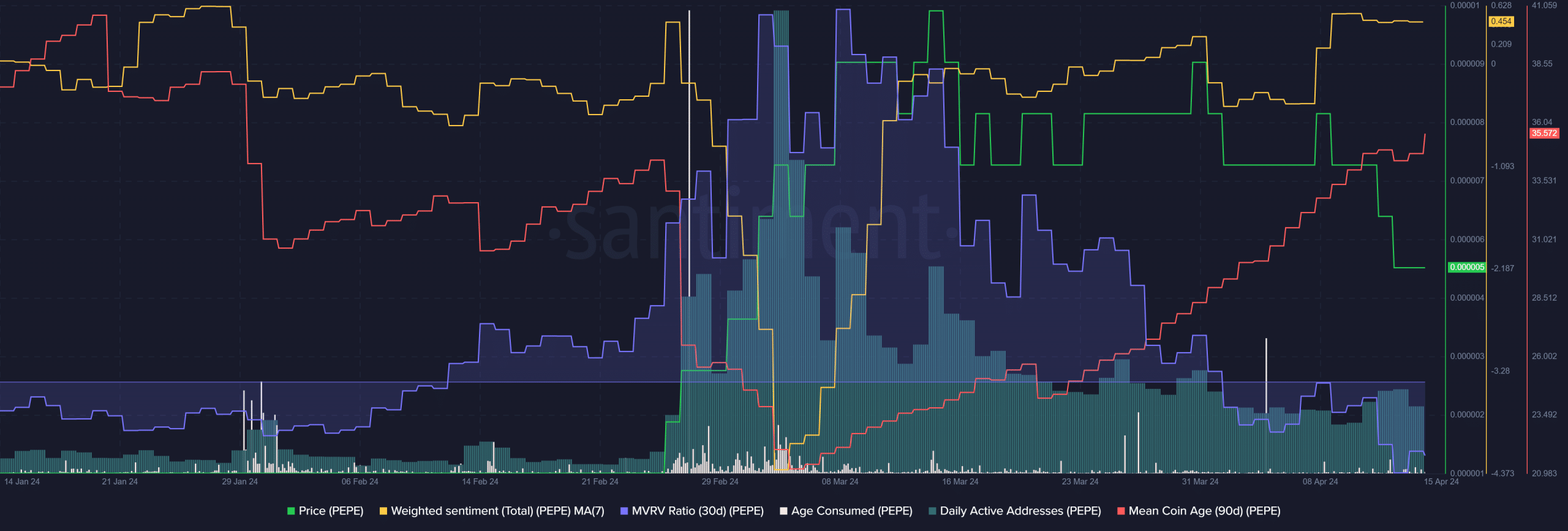

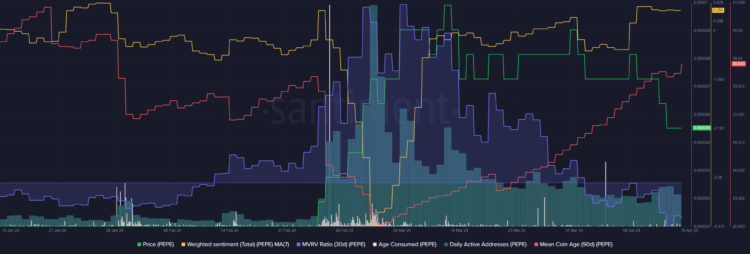

Source: Santiment

Since mid-March, the memecoin has been retracing the gains it made in late February. Yet, despite the losses on the price chart, the mean coin age has trended higher. This pointed toward network-wide accumulation of PEPE.

This was further supported by the age consumed metric. It saw a huge spike on the 4th of April and two large ones on the 26th and 27th of March. Together, they showed large token movements, but not consistent movement like we saw in early March.

This meant holders sold in panic but many others continued to hold through the losses. The 30-day MVRV was negative, showing their losses were growing. But in concert with the mean coin age, the negative MVRV was a buy signal.

The 7-day weighted sentiment was positive, which was surprising after the recent developments. There was still a chance of a deeper drop, based on technical analysis.

The structure breaks and the next demand zone

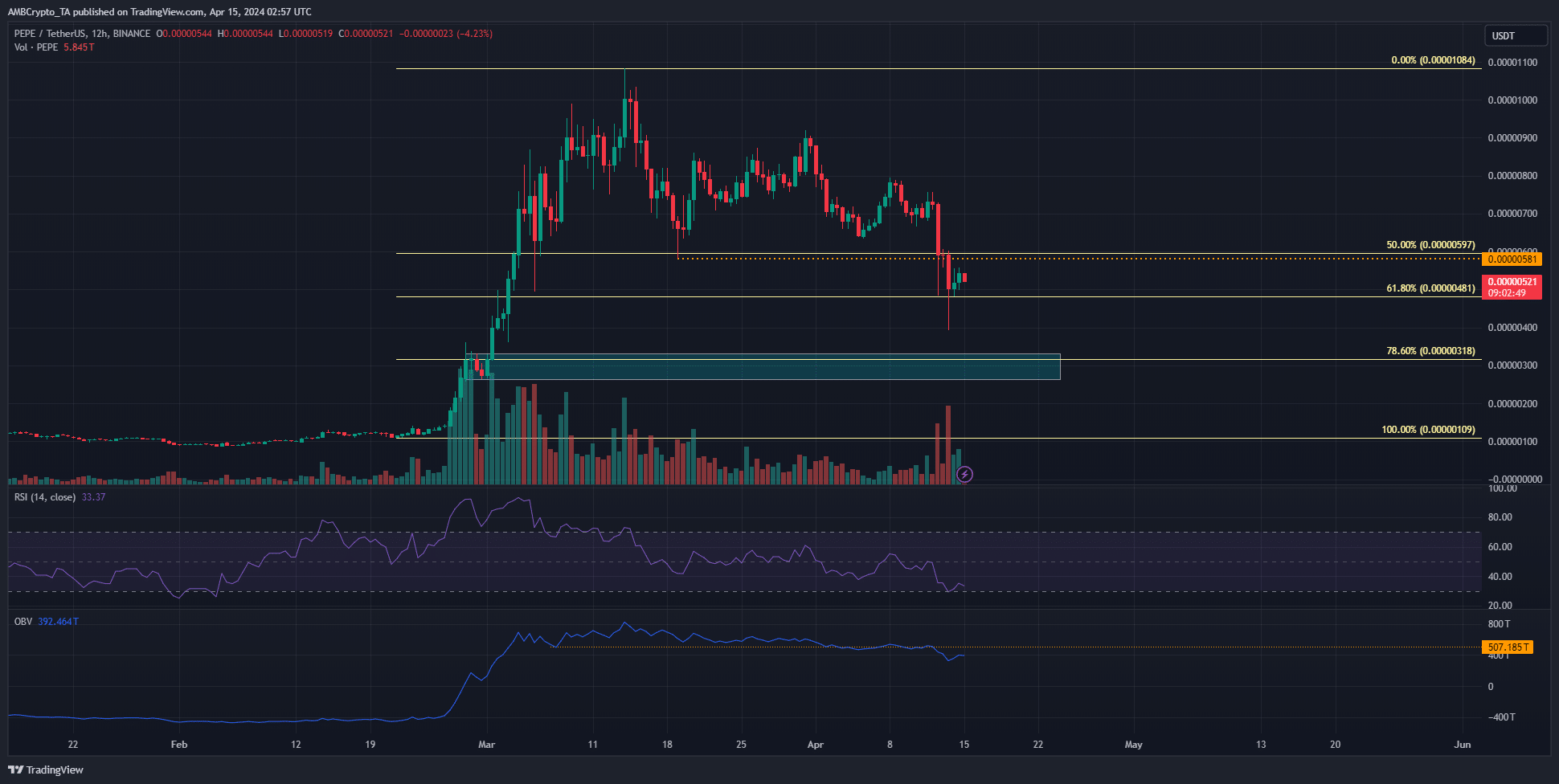

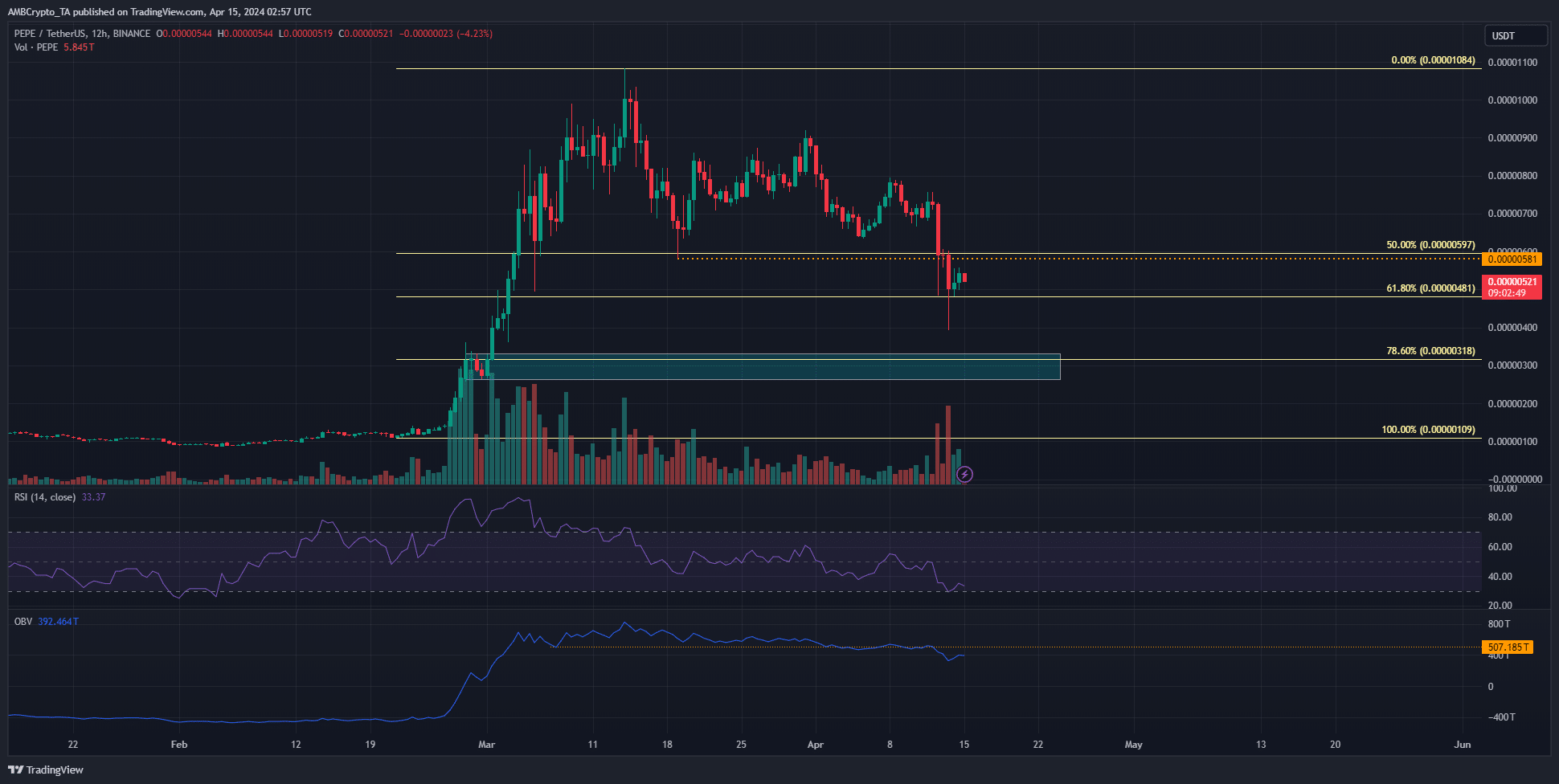

Source: PEPE/USDT on TradingView

The retracement to $0.00000581 on the 19th of March set a new swing low. The recent PEPE dip meant that the shorter timeframe trend was bearish and so was the market structure. However, on the 12-hour chart, the trend was still biased bullishly.

The RSI was at 33 to signal downward momentum was dominant. Moreover, the OBV also fell below a month-long support. Hence, more losses are expected in April. This could see the meme coin reach the 78.6% retracement level at $0.00000318.

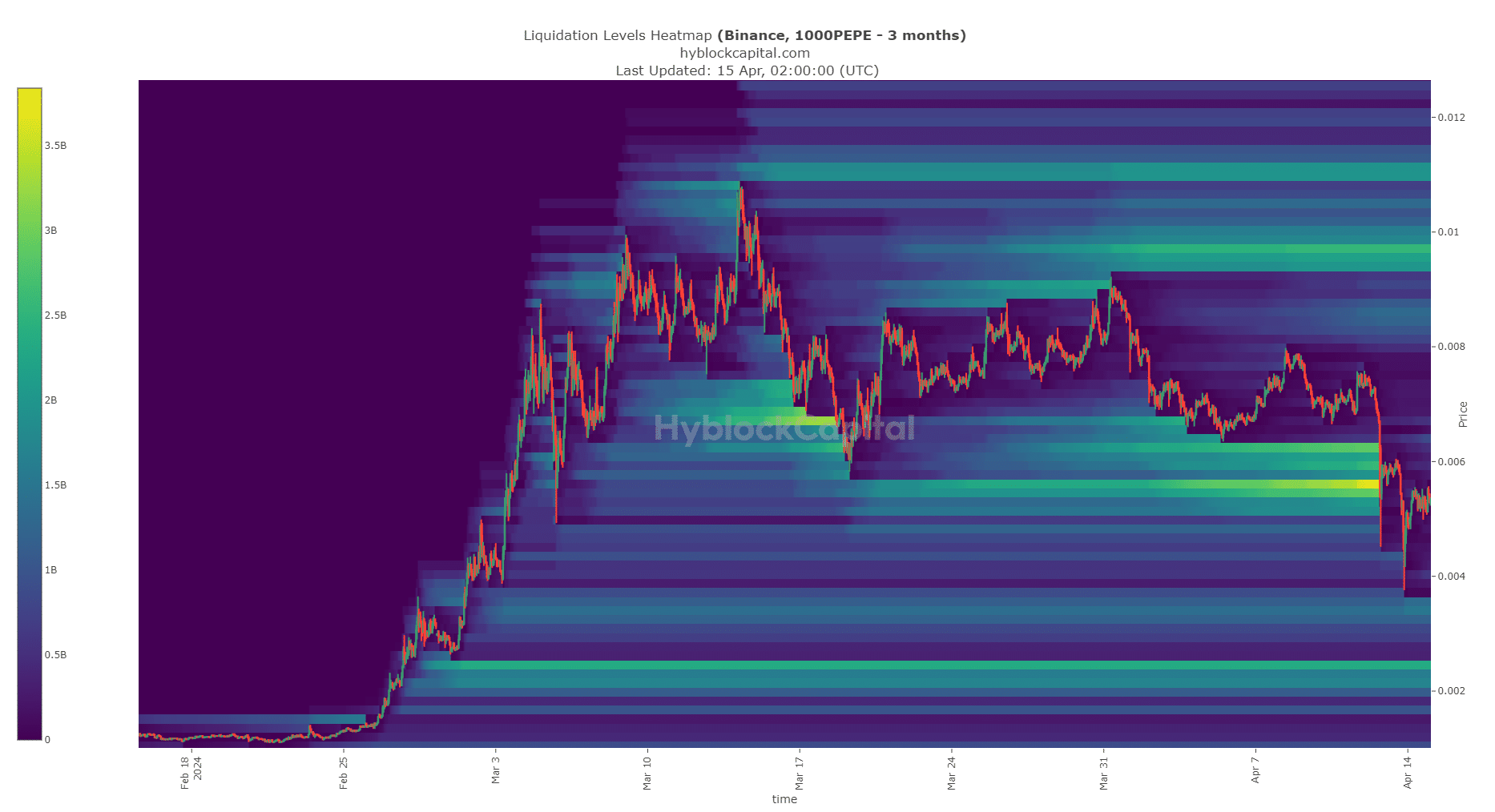

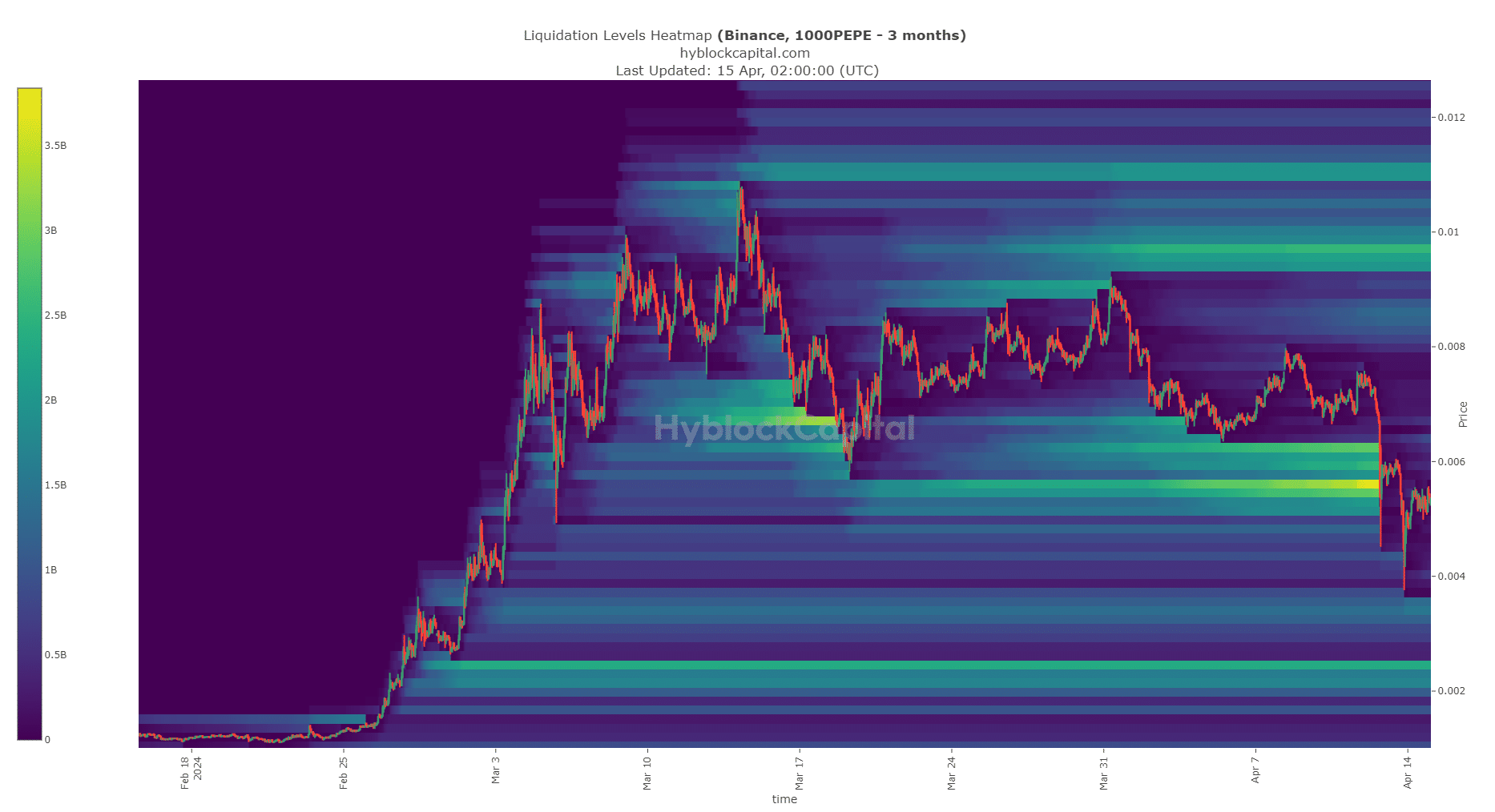

Source: Hyblock

The liquidation heatmap showed sparse liquidation levels above current market prices. To the south, the $0.00000245 was the next magnetic zone for the prices. Yet, if Bitcoin [BTC] has reached a local bottom, PEPE might bounce higher.

Is your portfolio green? Check the Pepe Profit Calculator

Hence, in the short term, the $0.00000955 area was also a magnetic zone. However, it is 85% higher than market prices, which was doubtful given the market uncertainty.

Overall, the metrics suggested that it could be a good short-term buying opportunity for PEPE traders.

- PEPE saw its market structure flip bearishly, indicating further losses were likely.

- The on-chain metrics flashed a strong buy signal, but market sentiment remained fearful.

Pepe [PEPE] was unable to defend the $0.00000581 level at the second time asking and has shed close to 50% in the past five days. The majority of those losses came from the 11th to the 13th of April.

The volatility might catch traders off guard, but it was also an opportunity. From the lows of 13th April, PEPE has bounced by 33% in around 32 hours. Does that mean the local bottom has been set? Here’s what the path ahead might look like.

Evidence for accumulation

Source: Santiment

Since mid-March, the memecoin has been retracing the gains it made in late February. Yet, despite the losses on the price chart, the mean coin age has trended higher. This pointed toward network-wide accumulation of PEPE.

This was further supported by the age consumed metric. It saw a huge spike on the 4th of April and two large ones on the 26th and 27th of March. Together, they showed large token movements, but not consistent movement like we saw in early March.

This meant holders sold in panic but many others continued to hold through the losses. The 30-day MVRV was negative, showing their losses were growing. But in concert with the mean coin age, the negative MVRV was a buy signal.

The 7-day weighted sentiment was positive, which was surprising after the recent developments. There was still a chance of a deeper drop, based on technical analysis.

The structure breaks and the next demand zone

Source: PEPE/USDT on TradingView

The retracement to $0.00000581 on the 19th of March set a new swing low. The recent PEPE dip meant that the shorter timeframe trend was bearish and so was the market structure. However, on the 12-hour chart, the trend was still biased bullishly.

The RSI was at 33 to signal downward momentum was dominant. Moreover, the OBV also fell below a month-long support. Hence, more losses are expected in April. This could see the meme coin reach the 78.6% retracement level at $0.00000318.

Source: Hyblock

The liquidation heatmap showed sparse liquidation levels above current market prices. To the south, the $0.00000245 was the next magnetic zone for the prices. Yet, if Bitcoin [BTC] has reached a local bottom, PEPE might bounce higher.

Is your portfolio green? Check the Pepe Profit Calculator

Hence, in the short term, the $0.00000955 area was also a magnetic zone. However, it is 85% higher than market prices, which was doubtful given the market uncertainty.

Overall, the metrics suggested that it could be a good short-term buying opportunity for PEPE traders.

can you get clomiphene without rx can you get generic clomiphene without insurance cost cheap clomiphene without rx buy generic clomid without dr prescription cost of clomiphene without a prescription cost of generic clomiphene without rx can you get cheap clomid without insurance

More text pieces like this would create the интернет better.

I am in fact thrilled to coup d’oeil at this blog posts which consists of tons of useful facts, thanks object of providing such data.

purchase zithromax for sale – azithromycin drug buy flagyl 400mg generic

purchase semaglutide online cheap – rybelsus 14 mg sale buy periactin 4 mg online

motilium without prescription – order sumycin 500mg online cheap flexeril 15mg price

buy augmentin 1000mg – https://atbioinfo.com/ buy generic ampicillin

cheap nexium 40mg – https://anexamate.com/ nexium ca

coumadin 2mg usa – https://coumamide.com/ purchase losartan online cheap

mobic 15mg pill – https://moboxsin.com/ mobic 15mg price

buy generic ed pills over the counter – https://fastedtotake.com/ generic ed pills

amoxicillin pills – combamoxi.com amoxicillin online buy

order generic fluconazole – https://gpdifluca.com/# diflucan us

buy lexapro 10mg online – purchase lexapro online order escitalopram 20mg pills

cialis 10 mg – https://ciltadgn.com/ order cialis online no prescription reviews

cialis and alcohol – cialis over the counter in spain generic cialis tadalafil 20mg india

purchase ranitidine – https://aranitidine.com/# order zantac sale

best place order viagra – https://strongvpls.com/# sildenafil 100 mg oral jelly

Greetings! Very productive par‘nesis within this article! It’s the petty changes which will espy the largest changes. Thanks a quantity in the direction of sharing! nolvadex for sale

Greetings! Jolly useful recommendation within this article! It’s the little changes which liking make the largest changes. Thanks a a quantity towards sharing! lasix for sale

I’ll certainly bring to review more. https://ursxdol.com/augmentin-amoxiclav-pill/

I am in truth thrilled to glitter at this blog posts which consists of tons of worthwhile facts, thanks towards providing such data. https://prohnrg.com/product/priligy-dapoxetine-pills/

This is the tolerant of delivery I recoup helpful. https://aranitidine.com/fr/acheter-fildena/

This website exceedingly has all of the bumf and facts I needed adjacent to this case and didn’t positive who to ask. https://ondactone.com/product/domperidone/

The sagacity in this tune is exceptional.

https://proisotrepl.com/product/domperidone/

This website exceedingly has all of the low-down and facts I needed there this subject and didn’t identify who to ask. https://myrsporta.ru/forums/users/yiazt-2/

dapagliflozin 10mg sale – https://janozin.com/# dapagliflozin 10 mg brand

brand xenical – https://asacostat.com/# order orlistat 60mg pill

I’ll certainly bring back to be familiar with more. http://www.dbgjjs.com/home.php?mod=space&uid=532982