- PEPE saw its OBV fall below a recent low.

- On-chain activity faltered alongside the price decline.

Pepe [PEPE], the meme coin, saw losses worth 26.5% in the past four days. It came alongside a Bitcoin [BTC] pullback from $71.3k to $65.5k at press time.

More losses could follow, based on the technical indicators of PEPE.

Before the price drop, an AMBCrypto report noted a huge Pepe movement on-chain. Since then, the selling pressure has been persistent.

The buyers need to arrest the short-term losses- but at press time, they lacked the strength to do so.

The bullish structure remained intact…for now

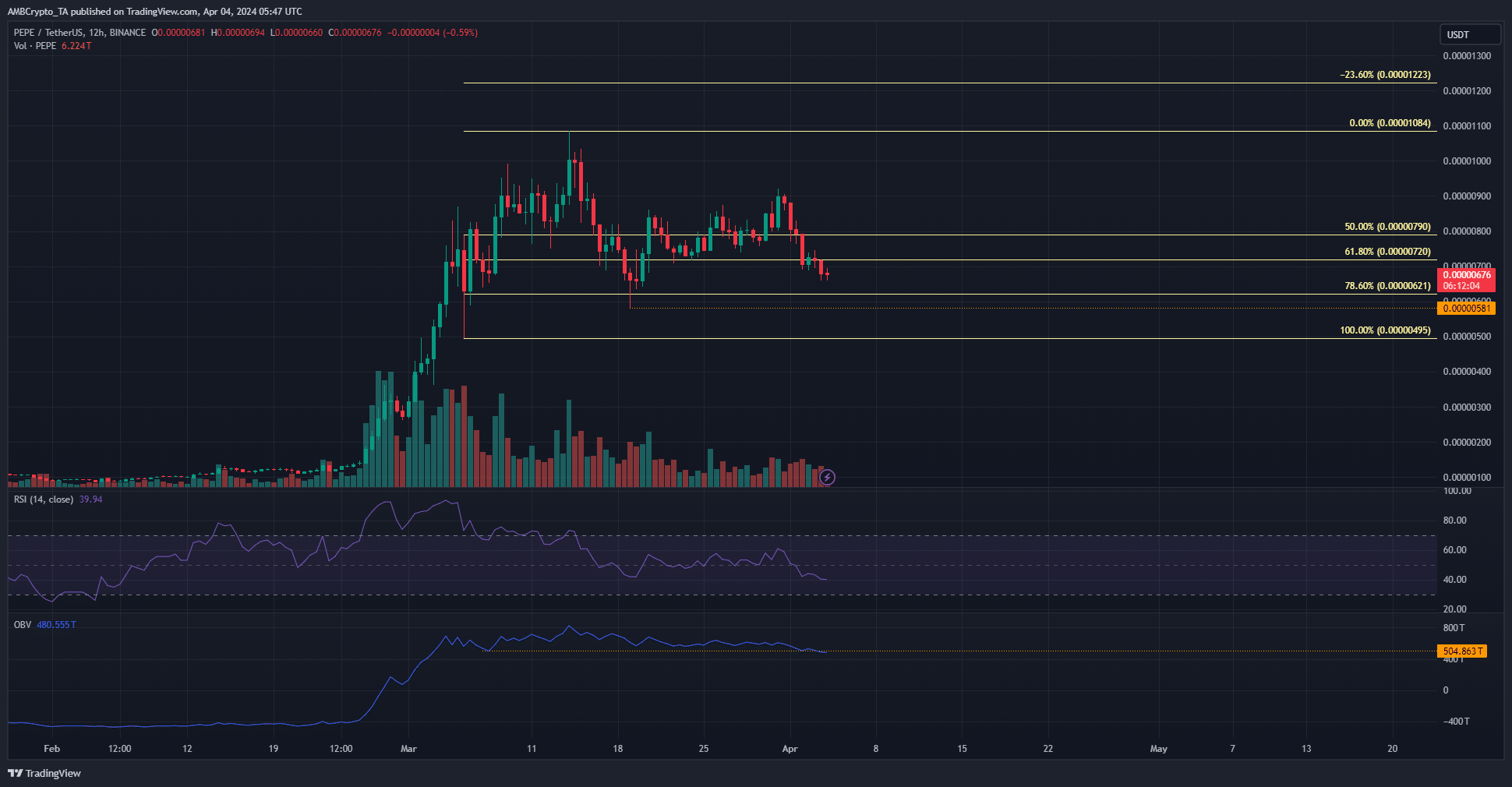

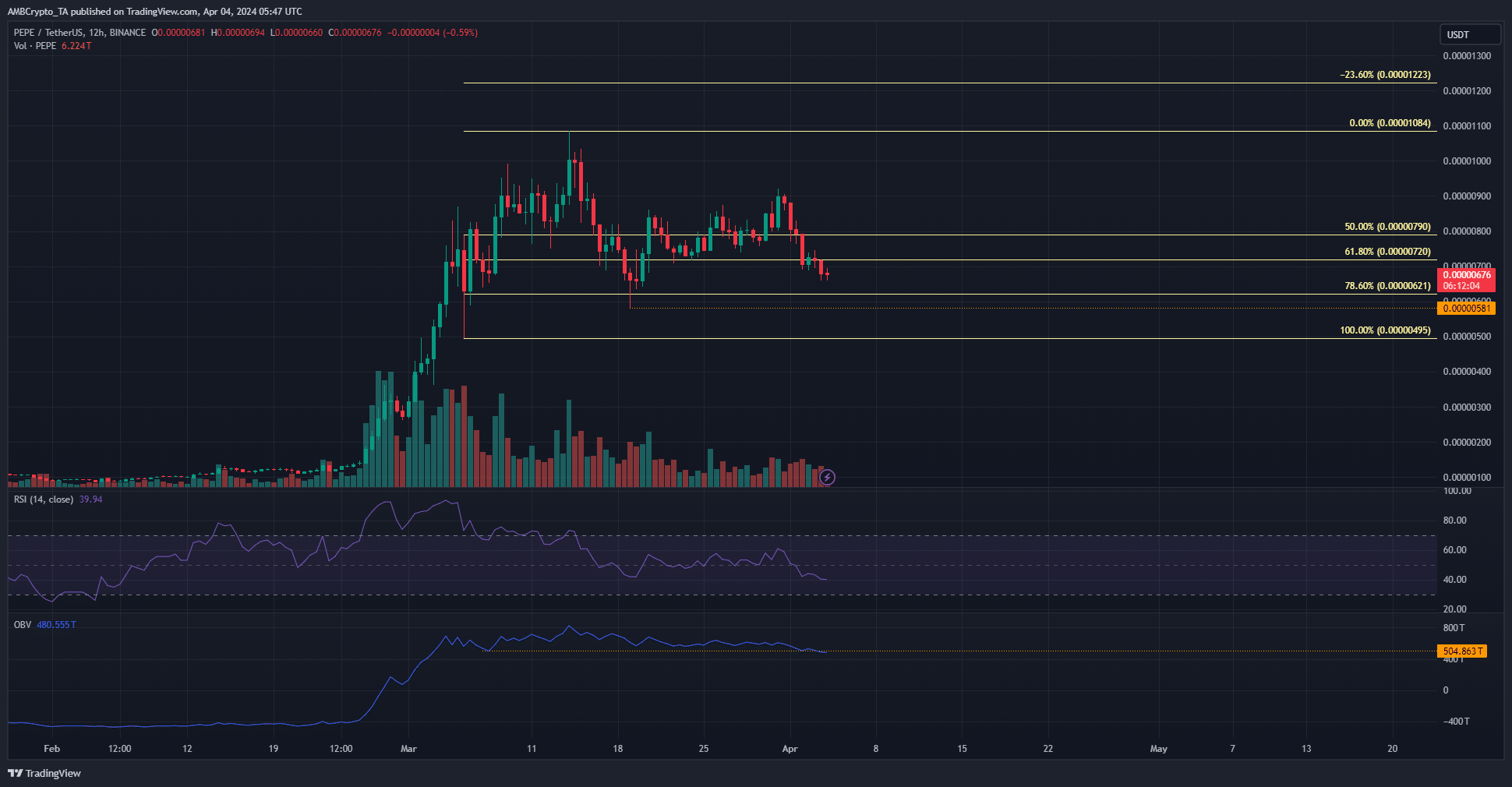

Source: PEPE/USDT on TradingView

In the 12-hour timeframe, the RSI slipped below neutral 50 to signal bearish momentum was taking hold. To complement this, the OBV also fell below a low it formed during the rally in March.

This indicated that selling volume had the upper hand at press time, and we are likely to see further losses.

The trading volume has trended downward in recent weeks. Since the recent losses were not accompanied by a surge in volume, it suggested that the current drop was more of a dip than the beginning of a downtrend.

The price action showed the key swing low at $0.00000581 on the H12 chart. If PEPE drops below this level, the market structure will shift bearishly.

Bulls need to defend this level to keep alive the hopes of continuing the uptrend from the first half of March.

The active addresses count has dropped enormously

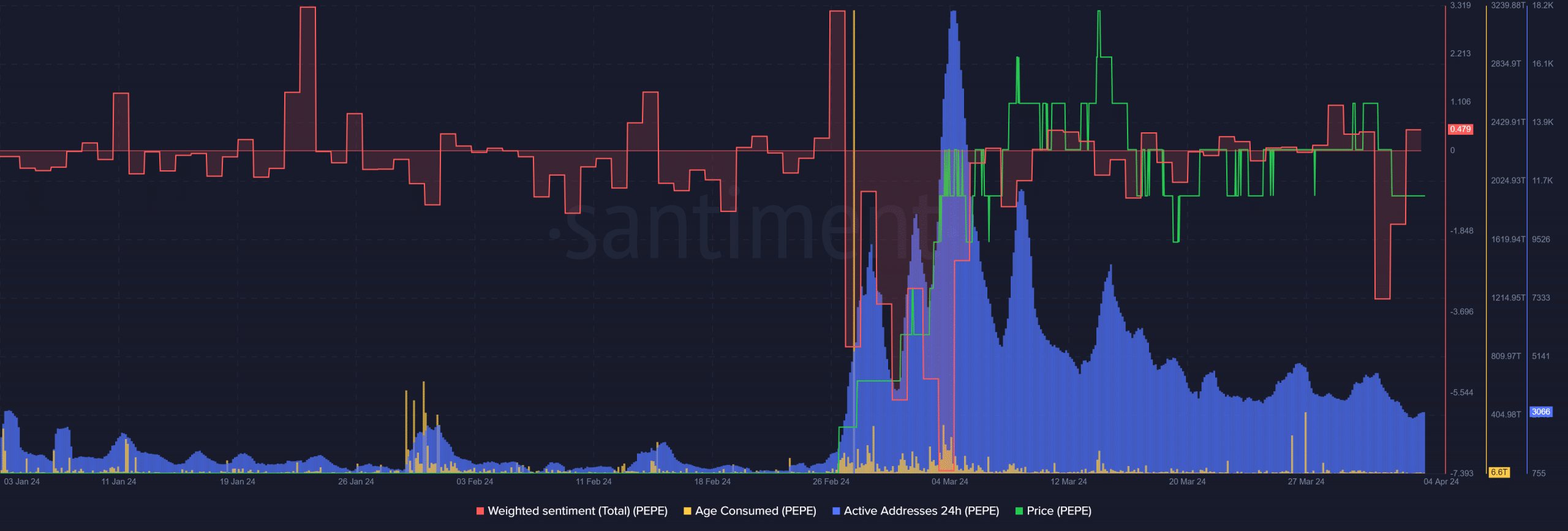

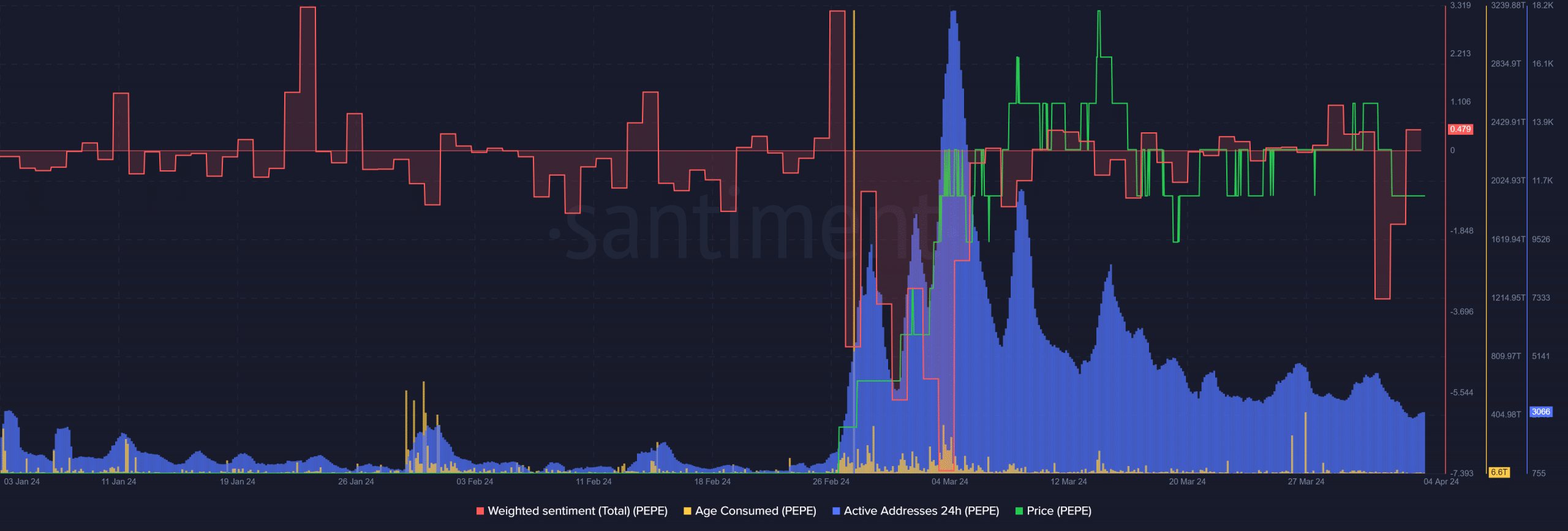

Source: Santiment

The Weighted Sentiment behind PEPE dropped quite low last week just as PEPE began its short-term downtrend.

The age-consumed metric saw large spikes on the 26th and 27th of March, which rivaled the early February ones.

Is your portfolio green? Check out the PEPE Profit Calculator

This surge was likely an early sign of a wave of selling. Spikes in this metric outline previously dormant PEPE tokens being moved around, likely for selling purposes.

The daily active addresses have fallen dramatically from the recent highs. While it was still above January and February highs, it represented a massive decline in crowd participation.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- PEPE saw its OBV fall below a recent low.

- On-chain activity faltered alongside the price decline.

Pepe [PEPE], the meme coin, saw losses worth 26.5% in the past four days. It came alongside a Bitcoin [BTC] pullback from $71.3k to $65.5k at press time.

More losses could follow, based on the technical indicators of PEPE.

Before the price drop, an AMBCrypto report noted a huge Pepe movement on-chain. Since then, the selling pressure has been persistent.

The buyers need to arrest the short-term losses- but at press time, they lacked the strength to do so.

The bullish structure remained intact…for now

Source: PEPE/USDT on TradingView

In the 12-hour timeframe, the RSI slipped below neutral 50 to signal bearish momentum was taking hold. To complement this, the OBV also fell below a low it formed during the rally in March.

This indicated that selling volume had the upper hand at press time, and we are likely to see further losses.

The trading volume has trended downward in recent weeks. Since the recent losses were not accompanied by a surge in volume, it suggested that the current drop was more of a dip than the beginning of a downtrend.

The price action showed the key swing low at $0.00000581 on the H12 chart. If PEPE drops below this level, the market structure will shift bearishly.

Bulls need to defend this level to keep alive the hopes of continuing the uptrend from the first half of March.

The active addresses count has dropped enormously

Source: Santiment

The Weighted Sentiment behind PEPE dropped quite low last week just as PEPE began its short-term downtrend.

The age-consumed metric saw large spikes on the 26th and 27th of March, which rivaled the early February ones.

Is your portfolio green? Check out the PEPE Profit Calculator

This surge was likely an early sign of a wave of selling. Spikes in this metric outline previously dormant PEPE tokens being moved around, likely for selling purposes.

The daily active addresses have fallen dramatically from the recent highs. While it was still above January and February highs, it represented a massive decline in crowd participation.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

I’ve been visiting this site for years, and it never fails to impress me with its fresh perspectives and wealth of knowledge. The attention to detail and commitment to quality is evident. This is a true asset for anyone seeking to learn and grow.

can i buy clomiphene order cheap clomiphene without dr prescription can you get clomid without insurance clomid cycle can you get cheap clomiphene without insurance clomid price cvs generic clomiphene

More articles like this would make the blogosphere richer.

Thanks recompense sharing. It’s outstrip quality.

zithromax 250mg usa – buy azithromycin generic purchase metronidazole sale

buy rybelsus generic – semaglutide 14 mg drug how to get cyproheptadine without a prescription

motilium where to buy – buy tetracycline medication flexeril order online

purchase amoxil sale – diovan order ipratropium without prescription

cost zithromax 250mg – azithromycin 250mg pills order generic nebivolol

augmentin 375mg drug – https://atbioinfo.com/ acillin price

esomeprazole 20mg generic – https://anexamate.com/ nexium pills

purchase warfarin generic – https://coumamide.com/ cozaar 50mg over the counter

meloxicam 15mg pill – swelling purchase meloxicam generic

deltasone 10mg for sale – aprep lson deltasone 10mg over the counter

mens ed pills – https://fastedtotake.com/ buy ed pills

buy generic amoxicillin online – comba moxi purchase amoxicillin without prescription

buy forcan generic – https://gpdifluca.com/# order diflucan pill

cenforce 100mg tablet – cenforcers.com where to buy cenforce without a prescription

what is cialis taken for – fast ciltad no prescription female cialis

e-cialis hellocig e-liquid – https://strongtadafl.com/# where can i buy cialis

zantac 300mg pills – https://aranitidine.com/ buy zantac 300mg online

More posts like this would prosper the blogosphere more useful. https://buyfastonl.com/amoxicillin.html

I’ll certainly return to read more. https://ursxdol.com/amoxicillin-antibiotic/

More articles like this would pretence of the blogosphere richer. https://prohnrg.com/product/metoprolol-25-mg-tablets/

This is the amicable of serenity I enjoy reading. https://aranitidine.com/fr/ciagra-professional-20-mg/

Thanks for putting this up. It’s understandably done. https://ondactone.com/spironolactone/

Good blog you procure here.. It’s obdurate to on high quality script like yours these days. I truly comprehend individuals like you! Take mindfulness!!

https://proisotrepl.com/product/clopidogrel/

More articles like this would frame the blogosphere richer. http://forum.ttpforum.de/member.php?action=profile&uid=425015

purchase forxiga for sale – https://janozin.com/ buy dapagliflozin 10mg for sale

buy orlistat pills for sale – buy xenical generic orlistat where to buy