The world’s largest cryptocurrency, Bitcoin (BTC), has been consolidating over the past week, trading between $67,000 and $70,000 after experiencing a brief 20% price correction that sent it as low as $56,400 in early May.

This consolidation period comes as inflows into the US spot Bitcoin ETF market have reignited, and selling pressure appears to have cooled off, both in the ETF market and among Bitcoin investors more broadly.

Bitcoin Selling Pressure Fades

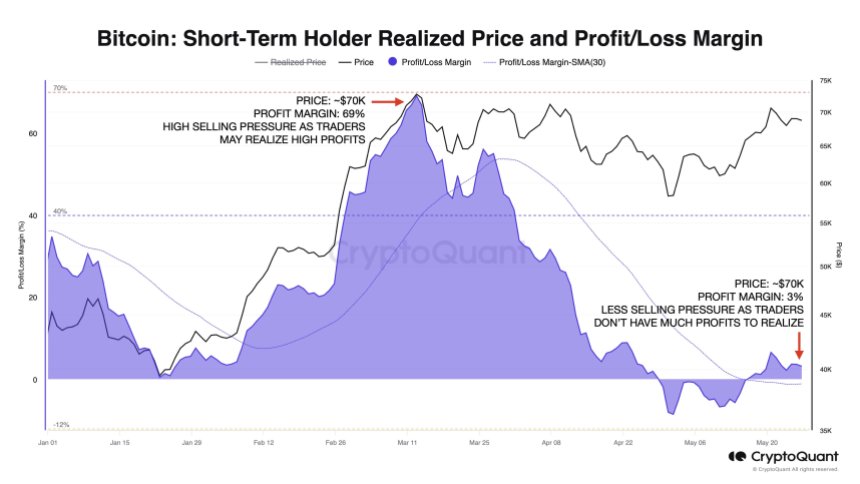

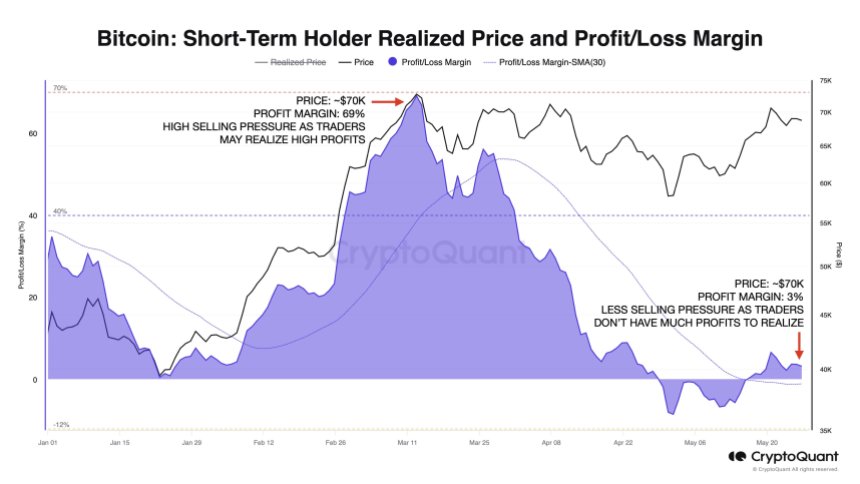

According to Julio Moreno, head of research at on-chain market analytics firm CryptoQuant, the current Bitcoin price level of $70,000 differs from when it last reached that mark in March.

Moreno notes that traders are now exerting much lower selling pressure, as unrealized profits are only around 3%, compared to 69% in early March. This suggests that much of the “heavy selling” has been exhausted, as seen in the chart below.

Related Reading

Santiment data also shows that Bitcoin has once again eclipsed a $70,000 market capitalization, even as the US stock market took a hiatus for the Memorial Day holiday.

Market intelligence platform Santiment sees this as an encouraging sign, as it demonstrates BTC’s ability to perform positively on days when it is not closely correlated with the primary stock market, which has been the case for much of 2022.

Final Pre-Breakout Consolidation Phase

Despite this positive momentum, crypto analyst Rekt Capital has noted that Bitcoin’s latest weekly candle closed below the range high resistance of its ongoing “re-accumulation” phase, which spans roughly $60,000 to $70,000.

This likely sentences the leading cryptocurrency to further consolidation within this range, aligned with Rekt Capital’s thesis that two phases remain in the current bull cycle: the post-halving re-accumulation phase and the “parabolic rally phase.”

Historically, Bitcoin has tended to consolidate around all-time highs before embarking on the most illustrative stretch of its bull cycles. According to the analyst, Bitcoin has indeed been consolidating at these highs for quite some time now, especially by the standards of previous cycles.

While there is still room for further sideways trading at these elevated price levels, the time remaining in this phase is slowly running out. This leads to the belief that the long-awaited post-Halving rally, coupled with renewed investor sentiment, is poised to take the largest cryptocurrency on the market to even higher levels than the current $73,700 reached in mid-March.

Related Reading

As such, Bitcoin appears to be entering a critical juncture in its current bull cycle. The consolidation and re-accumulation that has dominated the market in recent months could soon give way to the next parabolic surge, should historical patterns hold.

As of now, BTC has gained 2% in the past 24 hours, adding to its 10% positive movement in the past month alone. Bitcoin is currently trading at $70,200.

Featured image from Shutterstock, chart from TradingView.com

The world’s largest cryptocurrency, Bitcoin (BTC), has been consolidating over the past week, trading between $67,000 and $70,000 after experiencing a brief 20% price correction that sent it as low as $56,400 in early May.

This consolidation period comes as inflows into the US spot Bitcoin ETF market have reignited, and selling pressure appears to have cooled off, both in the ETF market and among Bitcoin investors more broadly.

Bitcoin Selling Pressure Fades

According to Julio Moreno, head of research at on-chain market analytics firm CryptoQuant, the current Bitcoin price level of $70,000 differs from when it last reached that mark in March.

Moreno notes that traders are now exerting much lower selling pressure, as unrealized profits are only around 3%, compared to 69% in early March. This suggests that much of the “heavy selling” has been exhausted, as seen in the chart below.

Related Reading

Santiment data also shows that Bitcoin has once again eclipsed a $70,000 market capitalization, even as the US stock market took a hiatus for the Memorial Day holiday.

Market intelligence platform Santiment sees this as an encouraging sign, as it demonstrates BTC’s ability to perform positively on days when it is not closely correlated with the primary stock market, which has been the case for much of 2022.

Final Pre-Breakout Consolidation Phase

Despite this positive momentum, crypto analyst Rekt Capital has noted that Bitcoin’s latest weekly candle closed below the range high resistance of its ongoing “re-accumulation” phase, which spans roughly $60,000 to $70,000.

This likely sentences the leading cryptocurrency to further consolidation within this range, aligned with Rekt Capital’s thesis that two phases remain in the current bull cycle: the post-halving re-accumulation phase and the “parabolic rally phase.”

Historically, Bitcoin has tended to consolidate around all-time highs before embarking on the most illustrative stretch of its bull cycles. According to the analyst, Bitcoin has indeed been consolidating at these highs for quite some time now, especially by the standards of previous cycles.

While there is still room for further sideways trading at these elevated price levels, the time remaining in this phase is slowly running out. This leads to the belief that the long-awaited post-Halving rally, coupled with renewed investor sentiment, is poised to take the largest cryptocurrency on the market to even higher levels than the current $73,700 reached in mid-March.

Related Reading

As such, Bitcoin appears to be entering a critical juncture in its current bull cycle. The consolidation and re-accumulation that has dominated the market in recent months could soon give way to the next parabolic surge, should historical patterns hold.

As of now, BTC has gained 2% in the past 24 hours, adding to its 10% positive movement in the past month alone. Bitcoin is currently trading at $70,200.

Featured image from Shutterstock, chart from TradingView.com

clomiphene sleep apnea can you get generic clomiphene pills can i purchase clomid without rx where buy generic clomiphene without dr prescription where can i get clomiphene without prescription order clomid without insurance order clomid without rx

I’ll certainly bring back to read more.

With thanks. Loads of knowledge!

zithromax 250mg drug – order tetracycline sale metronidazole 400mg for sale

buy rybelsus 14mg pill – buy cyproheptadine 4 mg for sale buy periactin without a prescription

domperidone 10mg usa – buy motilium online cheap cyclobenzaprine

augmentin uk – atbio info purchase ampicillin online cheap

buy nexium 40mg generic – https://anexamate.com/ nexium order online

warfarin 2mg brand – blood thinner buy hyzaar generic

order mobic online cheap – relieve pain order mobic 15mg for sale

buy prednisone 20mg pills – https://apreplson.com/ order deltasone 20mg sale

best ed drug – buy ed pills generic erection pills online

order amoxicillin pills – combamoxi.com amoxil tablet

brand diflucan – https://gpdifluca.com/# diflucan sale

purchase cenforce generic – buy generic cenforce 100mg cost cenforce 100mg

online cialis prescription – https://strongtadafl.com/ tadalafil troche reviews

zantac 300mg price – https://aranitidine.com/ ranitidine 300mg ca

cheap viagra no prescription online – https://strongvpls.com/# viagra without doctor prescription

More articles like this would remedy the blogosphere richer. https://gnolvade.com/es/comprar-cenforce-online/

More articles like this would pretence of the blogosphere richer. prednisone taper copd

More peace pieces like this would urge the интернет better. https://ursxdol.com/furosemide-diuretic/

The sagacity in this serving is exceptional. https://prohnrg.com/product/priligy-dapoxetine-pills/