- ORDI’s price rose by 30% over the past week

- Bullish bias from its holders was strong across ORDI’s market

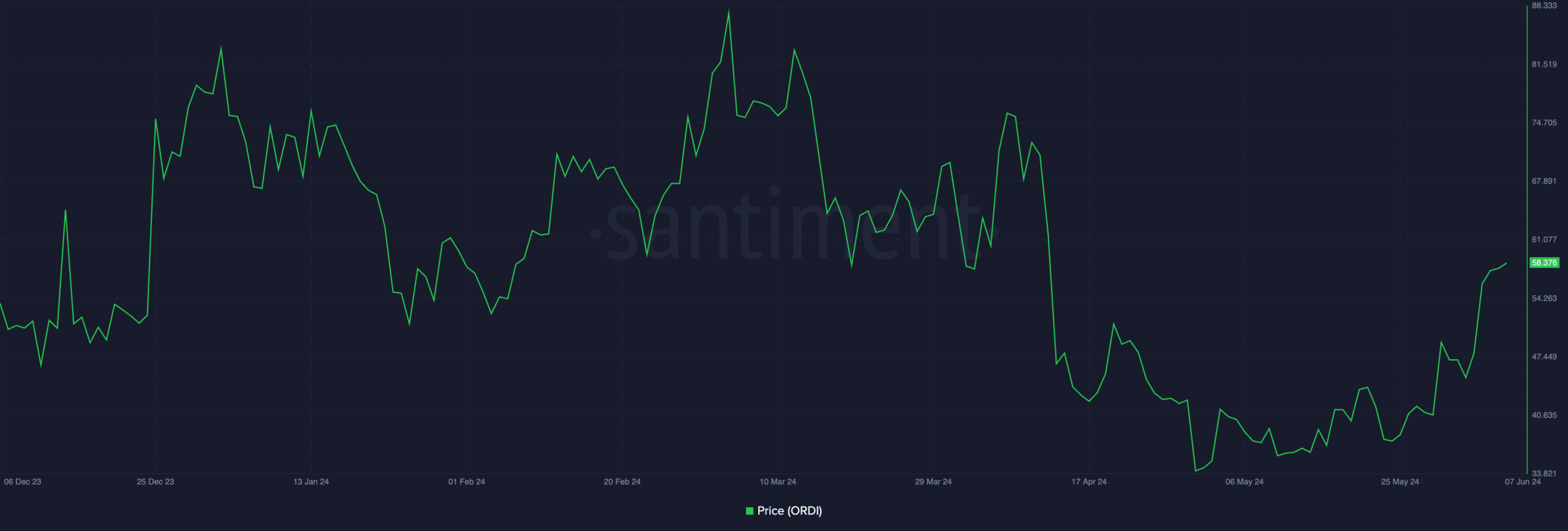

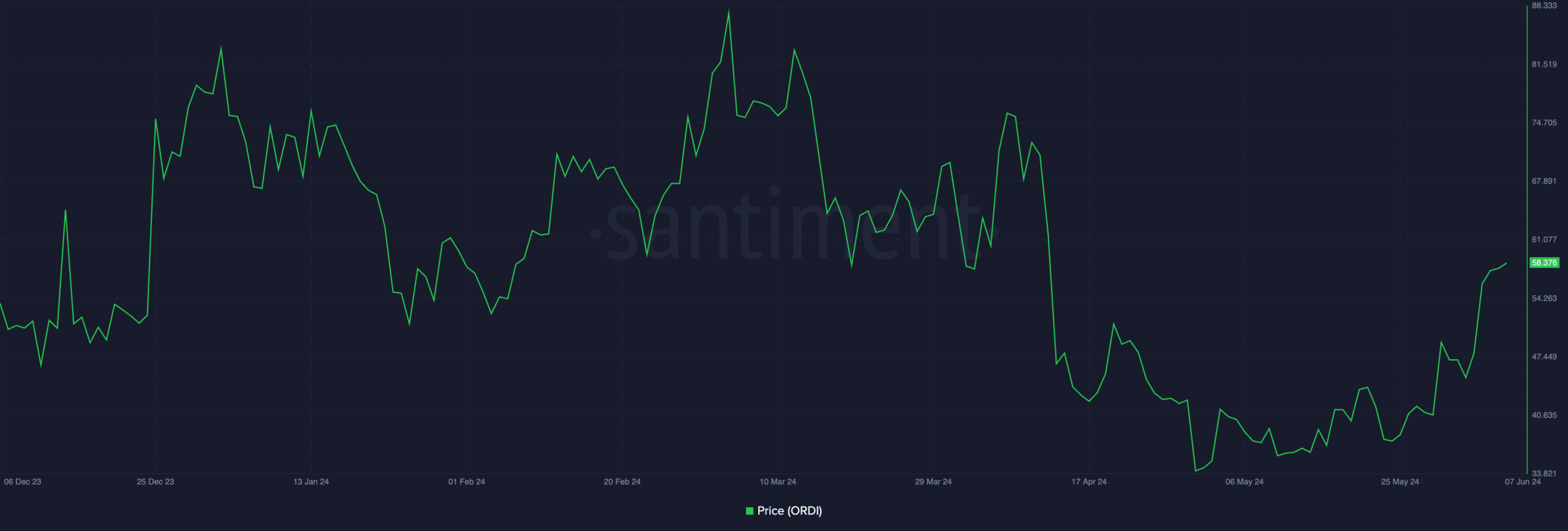

Cryptocurrency token ORDI, closely linked to the Bitcoin Ordinals protocol, recorded a double-digit price rally over the last seven days. This surge came amid an improvement in general market sentiment over that period, despite the market’s recent correction.

At press time, the altcoin was valued at $59.46 after hiking by 30% in just 7 days. In fact, according to Santiment, ORDI is now trading at its highest level since 12 April.

Source: Santiment

Market sentiment is significantly bullish

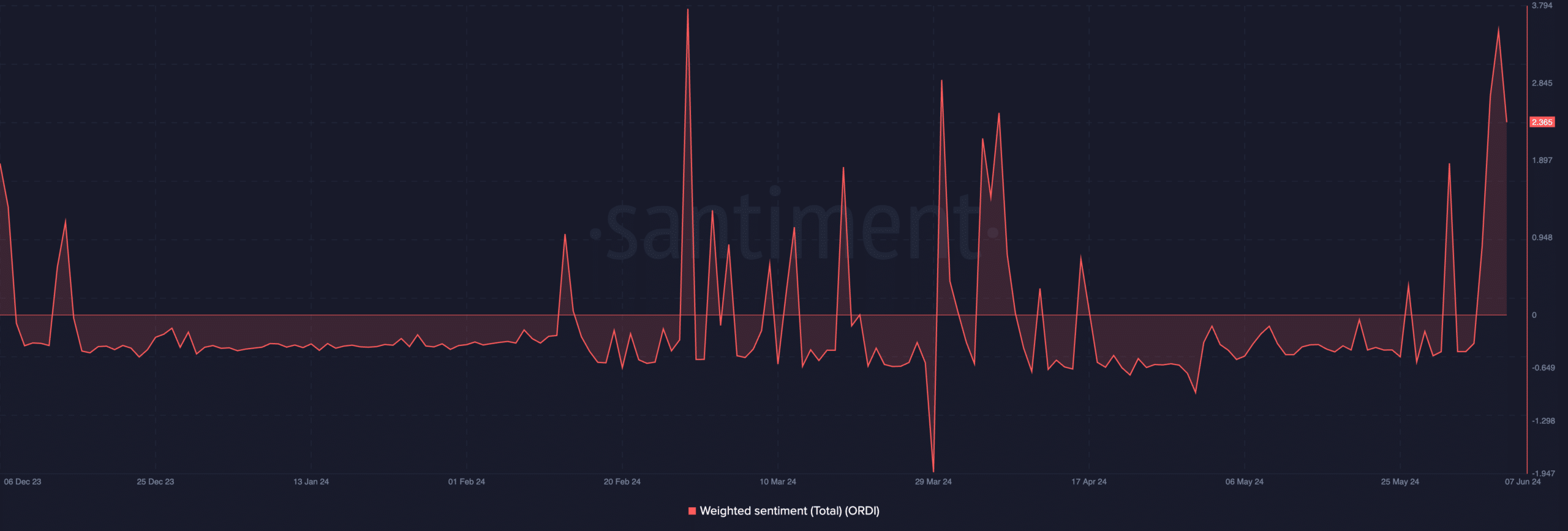

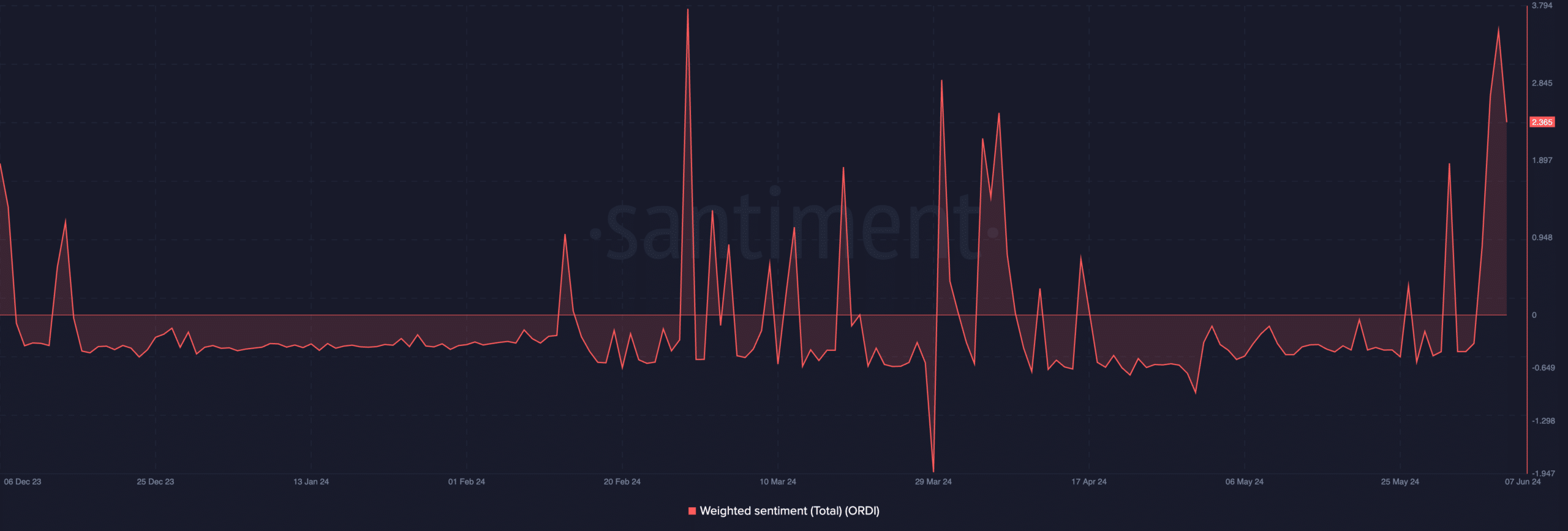

Apart from the general market’s growth over the past week, ORDI’s price surge has also been due to the significantly bullish bias that it enjoys from its holders. According to Santiment, ORDI’s weighted sentiment climbed to a three-month high of 3.49 on 5 June.

At press time, the value of this metric was 2.36. A high positive value like this suggests that a majority of social media posts and discussions about ORDI have been bullish. It suggested that ORDI holders expect the altcoin’s value to rise even more.

Source: Santiment

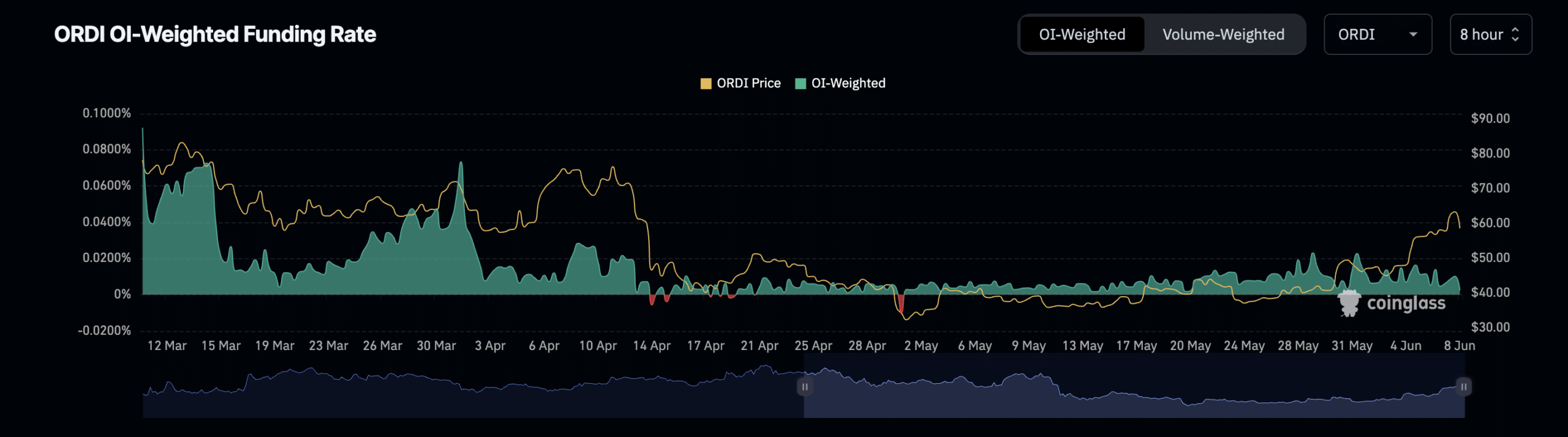

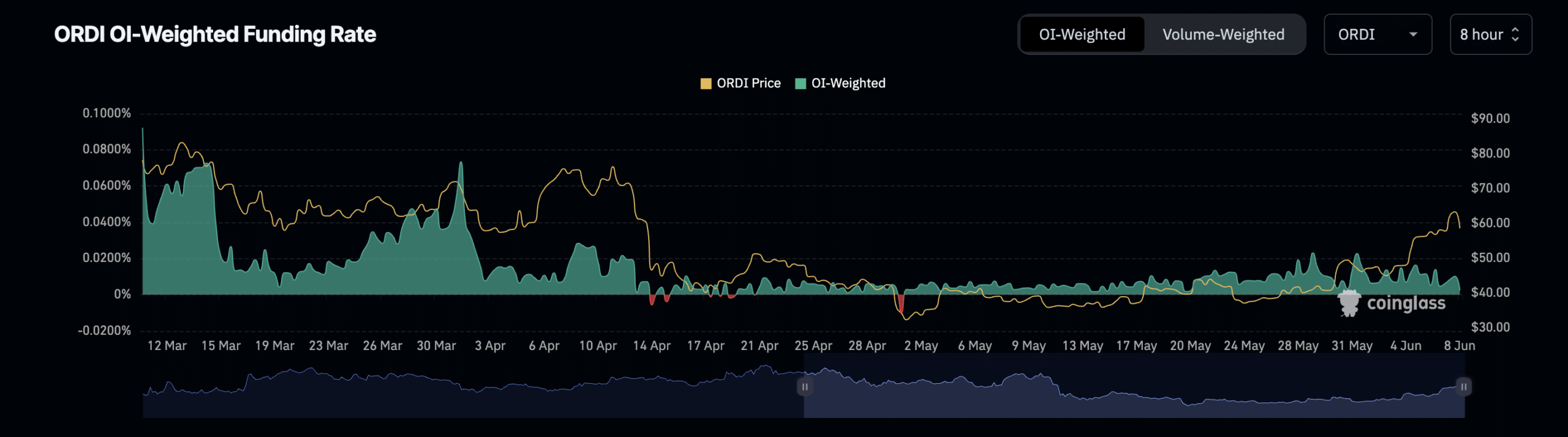

Readings from its Futures market activity confirmed this. ORDI’s funding rate across cryptocurrency exchanges has been positive since 1 May.

Funding rates are used in perpetual Futures contracts to ensure that the contract price stays close to the spot price.

When an asset’s Futures funding rate is positive, it suggests a strong demand for long positions. It is considered a bullish signal and often a precursor to an asset’s sustained price growth.

At the time of writing, the token’s funding rate was 0.0023%.

Source: Coinglass

Likewise, ORDI’s Futures open interest has been on an uptrend too. With a value of $294 million at press time, the token’s open interest sat at its highest level since 13 April, according to Coinglass.

ORDI wants more gains

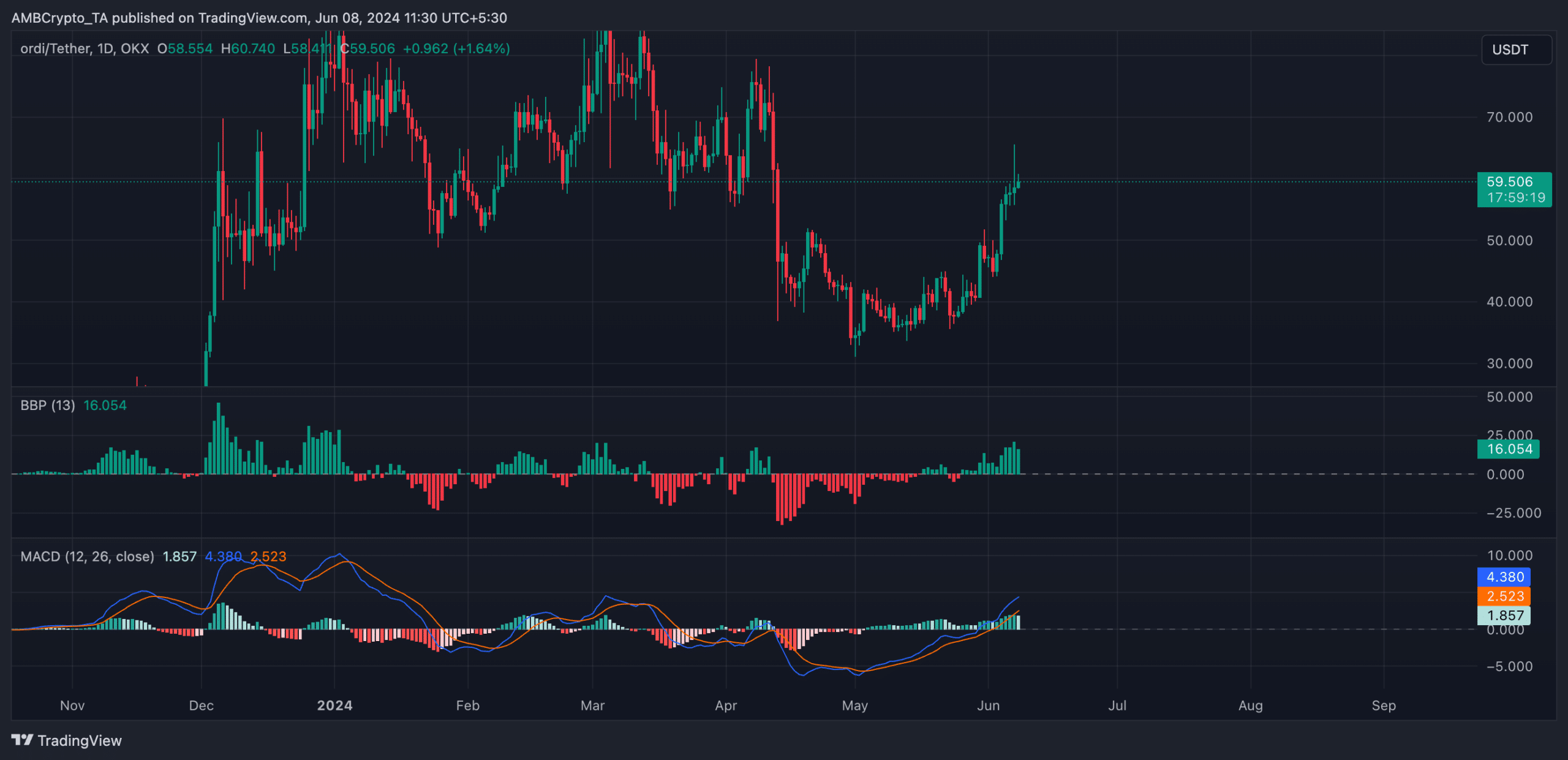

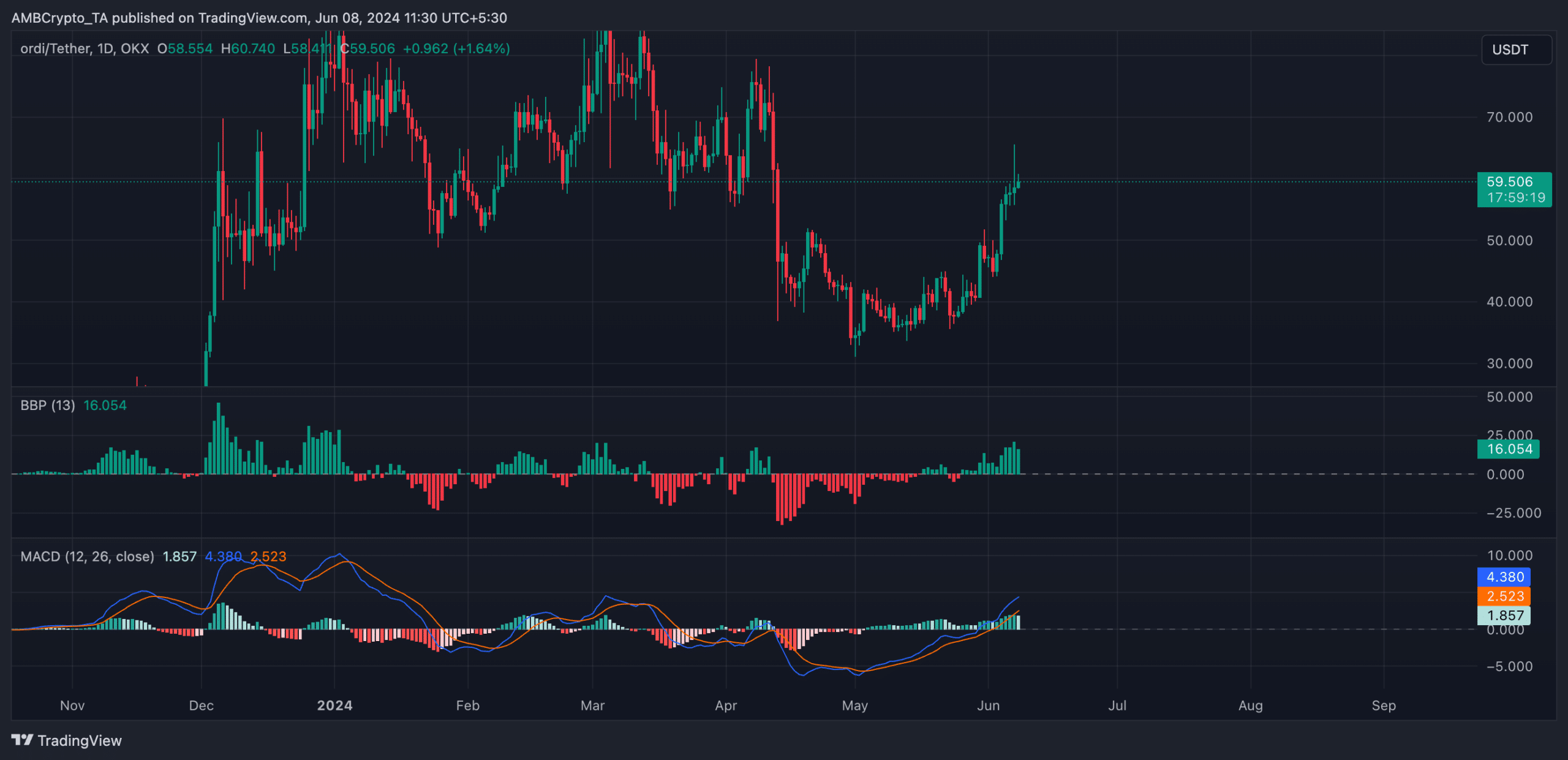

ORDI’s set-up on the 1-day chart hinted at the possibility of a further rally in its price in the short term. Its key indicators confirmed the strength of its prevailing bullish trend too.

Is your portfolio green? Check out the ORDI Profit Calculator

For example, its Elder-Ray Index returned a positive value of 15.95 at press time. This indicator measures the relationship between the strength of an asset’s buyers and sellers in the market. When its value is positive, it means that bull power is dominant in the market.

Source: ORDI/USDT on TradingView

Signaling demand for the altcoin, ORDI’s MACD line (blue) rested above its signal (orange) and zero lines at press time. This bullish signal suggested that the token’s short-term average was above its long-term average.

- ORDI’s price rose by 30% over the past week

- Bullish bias from its holders was strong across ORDI’s market

Cryptocurrency token ORDI, closely linked to the Bitcoin Ordinals protocol, recorded a double-digit price rally over the last seven days. This surge came amid an improvement in general market sentiment over that period, despite the market’s recent correction.

At press time, the altcoin was valued at $59.46 after hiking by 30% in just 7 days. In fact, according to Santiment, ORDI is now trading at its highest level since 12 April.

Source: Santiment

Market sentiment is significantly bullish

Apart from the general market’s growth over the past week, ORDI’s price surge has also been due to the significantly bullish bias that it enjoys from its holders. According to Santiment, ORDI’s weighted sentiment climbed to a three-month high of 3.49 on 5 June.

At press time, the value of this metric was 2.36. A high positive value like this suggests that a majority of social media posts and discussions about ORDI have been bullish. It suggested that ORDI holders expect the altcoin’s value to rise even more.

Source: Santiment

Readings from its Futures market activity confirmed this. ORDI’s funding rate across cryptocurrency exchanges has been positive since 1 May.

Funding rates are used in perpetual Futures contracts to ensure that the contract price stays close to the spot price.

When an asset’s Futures funding rate is positive, it suggests a strong demand for long positions. It is considered a bullish signal and often a precursor to an asset’s sustained price growth.

At the time of writing, the token’s funding rate was 0.0023%.

Source: Coinglass

Likewise, ORDI’s Futures open interest has been on an uptrend too. With a value of $294 million at press time, the token’s open interest sat at its highest level since 13 April, according to Coinglass.

ORDI wants more gains

ORDI’s set-up on the 1-day chart hinted at the possibility of a further rally in its price in the short term. Its key indicators confirmed the strength of its prevailing bullish trend too.

Is your portfolio green? Check out the ORDI Profit Calculator

For example, its Elder-Ray Index returned a positive value of 15.95 at press time. This indicator measures the relationship between the strength of an asset’s buyers and sellers in the market. When its value is positive, it means that bull power is dominant in the market.

Source: ORDI/USDT on TradingView

Signaling demand for the altcoin, ORDI’s MACD line (blue) rested above its signal (orange) and zero lines at press time. This bullish signal suggested that the token’s short-term average was above its long-term average.

can you buy cheap clomiphene prices where can i buy clomid price where can i get cheap clomid can i order cheap clomiphene without a prescription how can i get cheap clomiphene price where buy generic clomid tablets cost cheap clomiphene online

More posts like this would create the online space more useful.

order zithromax 500mg – buy tindamax 500mg sale buy metronidazole 200mg online cheap

rybelsus 14 mg oral – order periactin 4mg pill periactin 4 mg brand

domperidone sale – domperidone oral buy cyclobenzaprine 15mg sale

buy cheap generic inderal – plavix uk buy methotrexate cheap

cheap amoxicillin – cheap amoxil without prescription buy generic combivent online

buy generic azithromycin – buy cheap zithromax generic bystolic 20mg

augmentin online order – atbioinfo.com buy ampicillin no prescription

nexium 20mg cost – https://anexamate.com/ nexium canada

order medex online cheap – https://coumamide.com/ cozaar price

mobic 15mg pills – https://moboxsin.com/ purchase meloxicam online

order deltasone 10mg pill – corticosteroid prednisone price

best ed drug – buy generic ed pills online over the counter ed pills

amoxicillin sale – amoxil online order buy cheap generic amoxicillin

order forcan – diflucan us order forcan generic

buy cenforce paypal – cenforce over the counter cenforce buy online

cialis generic timeline 2018 – click cialis san diego

buy ranitidine without a prescription – https://aranitidine.com/# ranitidine 300mg over the counter

uses for cialis – https://strongtadafl.com/# is tadalafil the same as cialis

More articles like this would pretence of the blogosphere richer. https://gnolvade.com/es/comprar-kamagra-generico/

cost of 50mg viagra – viagra sale forum order generic viagra cialis

This website really has all of the information and facts I needed there this thesis and didn’t positive who to ask. prednisone high blood sugar

More articles like this would frame the blogosphere richer. https://prohnrg.com/

I am in truth delighted to glance at this blog posts which consists of tons of of use facts, thanks representing providing such data. https://aranitidine.com/fr/cialis-super-active/

With thanks. Loads of conception! https://ondactone.com/spironolactone/

Proof blog you procure here.. It’s hard to espy elevated quality belles-lettres like yours these days. I honestly appreciate individuals like you! Take vigilance!!

https://proisotrepl.com/product/domperidone/

dapagliflozin 10 mg canada – dapagliflozin 10mg ca buy forxiga medication

purchase orlistat pills – purchase xenical for sale xenical 120mg brand