- Optimism Superchain collected massive amounts of revenue for the protocol over the last few weeks

- Despite the protocol’s performance, interest in the OP token tanked

Despite the growing competition in the Layer 2 sector, Optimism[OP] has continued to exhibit growth across various fronts.

Super chain brings in the dough

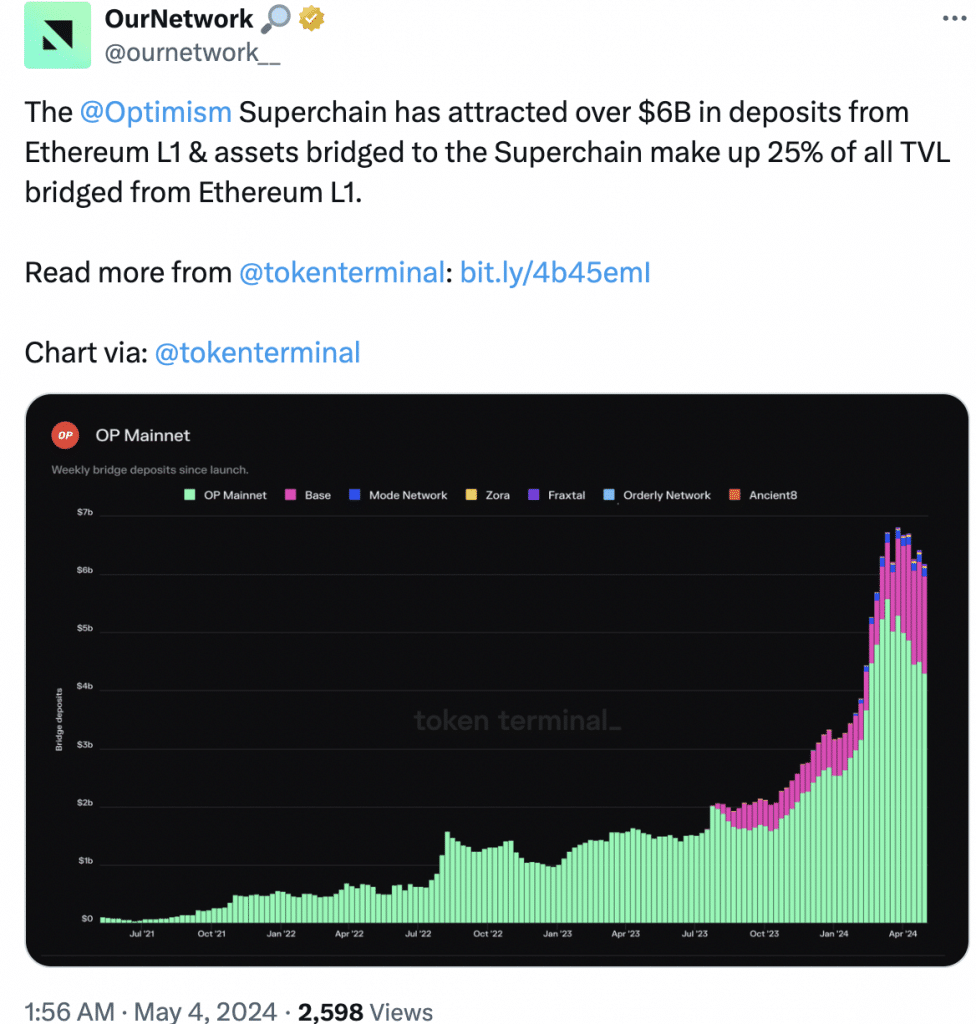

One of the reasons for the same is the Optimism Superchain. Optimism Superchain recently become a magnet for capital, attracting over $6 billion in deposits from Ethereum L1. This surge in popularity can be further underlined by the fact that assets bridged to the Superchain account for a significant portion – 25%, of the total value locked (TVL) bridged from Ethereum L1.

For context, the Optimism Superchain is like a collection of L2s. It bundles multiple L2s together, both technologically and economically. This combined approach offers several advantages, including streamlined operations and potential cost efficiencies.

As an incentive for participating in the Superchain, Optimism furnishes developers with access to a valuable toolkit, the OP Stack & Governance framework. This common set of tools simplifies development and streamlines governance processes for L2s within the Superchain.

In April 2024, Base demonstrated its commitment to the Superchain by paying $1.86 million in Superchain membership fees to Optimism. This financial contribution helps to ensure the ongoing development and maintenance of the Superchain.

Source: X

However, there were some concerns that arose when it was seen that Base had a higher number of monthly active users than the OP mainnet. In fact, Token Terminal’s data indicated that despite having a higher number of monthly active users, Base doesn’t necessarily undermine OP Mainnet’s position within the Optimism Superchain.

OP Mainnet can retain its role as the Superchain’s Hub by providing a shared governance framework for all member chains. Strong performance by individual member chains, like Base, can be beneficial for the entire ecosystem. This, because high-performing chains contribute more fees back to OP, further supporting the Superchain’s development.

How is OP doing?

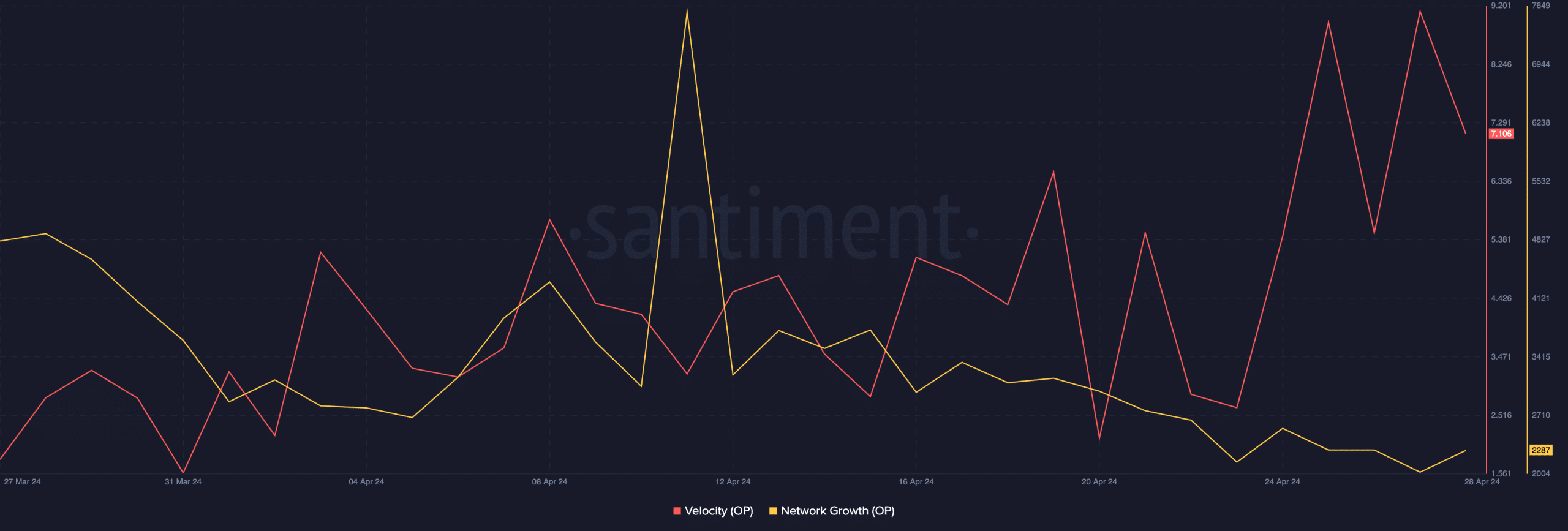

Despite Optimism network’s progress, overall interest in the OP token declined. Additionally, the price of OP has fallen by 5.59% in just 24 hours. At press time, OP was trading at $2.96. The volume at which OP was trading also fell by 22.75%.

Realistic or not, here’s OP market cap in BTC’s terms

Also, network growth around the OP token declined significantly, indicating that the number of new addresses showing interest in OP fell.

If the waning interest from new addresses continues, the price of OP could see a correction in the near future.

Source: Santiment

- Optimism Superchain collected massive amounts of revenue for the protocol over the last few weeks

- Despite the protocol’s performance, interest in the OP token tanked

Despite the growing competition in the Layer 2 sector, Optimism[OP] has continued to exhibit growth across various fronts.

Super chain brings in the dough

One of the reasons for the same is the Optimism Superchain. Optimism Superchain recently become a magnet for capital, attracting over $6 billion in deposits from Ethereum L1. This surge in popularity can be further underlined by the fact that assets bridged to the Superchain account for a significant portion – 25%, of the total value locked (TVL) bridged from Ethereum L1.

For context, the Optimism Superchain is like a collection of L2s. It bundles multiple L2s together, both technologically and economically. This combined approach offers several advantages, including streamlined operations and potential cost efficiencies.

As an incentive for participating in the Superchain, Optimism furnishes developers with access to a valuable toolkit, the OP Stack & Governance framework. This common set of tools simplifies development and streamlines governance processes for L2s within the Superchain.

In April 2024, Base demonstrated its commitment to the Superchain by paying $1.86 million in Superchain membership fees to Optimism. This financial contribution helps to ensure the ongoing development and maintenance of the Superchain.

Source: X

However, there were some concerns that arose when it was seen that Base had a higher number of monthly active users than the OP mainnet. In fact, Token Terminal’s data indicated that despite having a higher number of monthly active users, Base doesn’t necessarily undermine OP Mainnet’s position within the Optimism Superchain.

OP Mainnet can retain its role as the Superchain’s Hub by providing a shared governance framework for all member chains. Strong performance by individual member chains, like Base, can be beneficial for the entire ecosystem. This, because high-performing chains contribute more fees back to OP, further supporting the Superchain’s development.

How is OP doing?

Despite Optimism network’s progress, overall interest in the OP token declined. Additionally, the price of OP has fallen by 5.59% in just 24 hours. At press time, OP was trading at $2.96. The volume at which OP was trading also fell by 22.75%.

Realistic or not, here’s OP market cap in BTC’s terms

Also, network growth around the OP token declined significantly, indicating that the number of new addresses showing interest in OP fell.

If the waning interest from new addresses continues, the price of OP could see a correction in the near future.

Source: Santiment

перепродажа аккаунтов продажа аккаунтов соцсетей

профиль с подписчиками https://marketplace-akkauntov-top.ru/

безопасная сделка аккаунтов ploshadka-prodazha-akkauntov.ru/

гарантия при продаже аккаунтов магазин аккаунтов

покупка аккаунтов платформа для покупки аккаунтов

купить аккаунт продажа аккаунтов соцсетей

Buy and Sell Accounts Ready-Made Accounts for Sale

Account Trading Platform Database of Accounts for Sale

Accounts marketplace Account Store

Marketplace for Ready-Made Accounts Accounts marketplace

Account Trading Service https://accountsmarketplacehub.com/

Account Trading Service https://socialaccountsstore.com

Account Selling Service Online Account Store

Account Selling Platform Account Buying Platform

Find Accounts for Sale Database of Accounts for Sale

Buy accounts Accounts for Sale

online account store find accounts for sale

gaming account marketplace account buying platform

account buying service account trading platform

buy account buy account

accounts marketplace https://accountsmarketbest.com/

database of accounts for sale profitable account sales

buy pre-made account account sale

ready-made accounts for sale sell account

account purchase account trading platform

account market account trading platform

sell pre-made account find accounts for sale

account exchange gaming account marketplace

account trading account acquisition

marketplace for ready-made accounts sell accounts

account trading service accounts market

secure account purchasing platform sell accounts

find accounts for sale account exchange service

account market account buying service

account trading platform purchase ready-made accounts

account exchange service https://discount-accounts.org/

account trading accounts-store.org

account buying service account exchange service

accounts for sale ready-made accounts for sale

account buying platform https://accounts-offer.org/

purchase ready-made accounts https://accounts-marketplace.xyz/

online account store https://social-accounts-marketplaces.live/

account market account market

purchase ready-made accounts https://social-accounts-marketplace.xyz

account trading https://buy-accounts.space/

online account store https://buy-accounts-shop.pro/

secure account sales https://buy-accounts.live

account store https://accounts-marketplace.online

website for selling accounts https://social-accounts-marketplace.live/

account acquisition https://accounts-marketplace-best.pro/

биржа аккаунтов https://akkaunty-na-prodazhu.pro/

маркетплейс аккаунтов https://rynok-akkauntov.top

маркетплейс аккаунтов https://kupit-akkaunt.xyz/

маркетплейс аккаунтов akkaunt-magazin.online

маркетплейс аккаунтов https://akkaunty-market.live

маркетплейс аккаунтов https://kupit-akkaunty-market.xyz/

магазин аккаунтов https://akkaunty-optom.live

биржа аккаунтов https://online-akkaunty-magazin.xyz/

покупка аккаунтов https://akkaunty-dlya-prodazhi.pro

продать аккаунт https://kupit-akkaunt.online

buy ad account facebook https://buy-adsaccounts.work

fb accounts for sale buy facebook ads account

buy fb ad account https://buy-ad-account.top/

facebook ad account for sale buying fb accounts

facebook ads accounts https://ad-account-buy.top

buy facebook account fb account for sale

buy aged facebook ads accounts buy facebook advertising accounts

buy facebook accounts cheap buy facebook ad accounts

buy google ads account https://buy-ads-account.top

google ads reseller https://buy-ads-accounts.click/

fb accounts for sale https://buy-accounts.click

adwords account for sale https://ads-account-for-sale.top

buy adwords account buy google ads verified account

google ads reseller https://buy-ads-invoice-account.top

buy google ad account https://buy-account-ads.work

old google ads account for sale https://buy-ads-agency-account.top

old google ads account for sale https://sell-ads-account.click/

buy verified google ads accounts buy google ads account

facebook bm account buy https://buy-business-manager.org

buy aged google ads accounts google ads reseller

facebook bm account buy https://buy-bm-account.org/

buy business manager account https://buy-verified-business-manager-account.org/

buy facebook business managers https://buy-verified-business-manager.org

buy facebook bm account https://buy-business-manager-acc.org

buy business manager https://business-manager-for-sale.org

unlimited bm facebook https://buy-business-manager-verified.org

buy facebook business manager account https://buy-bm.org

facebook bm for sale https://buy-business-manager-accounts.org

tiktok agency account for sale https://buy-tiktok-ads-account.org

buy verified business manager facebook https://verified-business-manager-for-sale.org

tiktok ads account for sale https://tiktok-ads-account-buy.org

buy tiktok business account tiktok agency account for sale

tiktok ad accounts https://tiktok-agency-account-for-sale.org

buy tiktok business account https://buy-tiktok-ad-account.org

buy tiktok ads accounts buy tiktok business account

tiktok agency account for sale https://tiktok-ads-agency-account.org

buy tiktok ad account https://buy-tiktok-business-account.org

tiktok ads account for sale https://buy-tiktok-ads.org

can you buy cheap clomiphene pills can i purchase clomiphene without rx order generic clomid prices where buy clomiphene without prescription clomiphene pills price at clicks how to buy cheap clomiphene tablets get clomid without a prescription

Thanks on putting this up. It’s okay done.

This is a keynote which is in to my verve… Myriad thanks! Exactly where can I find the phone details for questions?

buy generic zithromax for sale – ciprofloxacin 500 mg oral buy generic metronidazole 200mg

motilium pills – buy motilium 10mg pills buy cyclobenzaprine generic

buy propranolol without a prescription – order inderal 20mg sale methotrexate cheap

buy amoxil generic – cheap amoxicillin pills buy ipratropium 100 mcg online cheap

augmentin 1000mg tablet – atbioinfo.com ampicillin pill

purchase esomeprazole generic – https://anexamate.com/ order esomeprazole 40mg pills

how to buy warfarin – anticoagulant purchase cozaar without prescription

mobic 15mg for sale – https://moboxsin.com/ buy meloxicam without a prescription

deltasone online buy – corticosteroid prednisone 20mg for sale

buy ed pills medication – https://fastedtotake.com/ best otc ed pills

amoxicillin where to buy – amoxicillin for sale online how to buy amoxicillin

order forcan generic – https://gpdifluca.com/# brand fluconazole 200mg

escitalopram order online – click buy escitalopram generic

cenforce for sale – order cenforce pill order cenforce 100mg sale

cialis price walmart – ciltad generic cialis picture

buy fb account accounts marketplace database of accounts for sale

achats produit tadalafil pour femme en ligne – https://strongtadafl.com/ buy a kilo of tadalafil powder

purchase zantac for sale – https://aranitidine.com/# buy ranitidine 150mg sale

buy aged facebook ads accounts purchase ready-made accounts account store

sildenafil genfar 50mg – sildenafil 50 mg can i buy viagra in japan

More posts like this would create the online play more useful. https://gnolvade.com/es/amoxicilina-online/

Thanks on sharing. It’s top quality. https://buyfastonl.com/isotretinoin.html

This is the kind of post I unearth helpful. https://ursxdol.com/azithromycin-pill-online/

I couldn’t resist commenting. Warmly written! https://prohnrg.com/product/orlistat-pills-di/

More posts like this would make the online time more useful. https://aranitidine.com/fr/viagra-100mg-prix/