- Optimism saw a massive uptick in terms of liquidity over the past few days

- Despite the surge in liquidity, the price of OP continued to fall

Optimism [OP], among other Layer 2 networks, benefitted immensely from the recent Dencun upgrade on the Ethereum network due to the reduction of gas fees on these networks.

Getting liquid

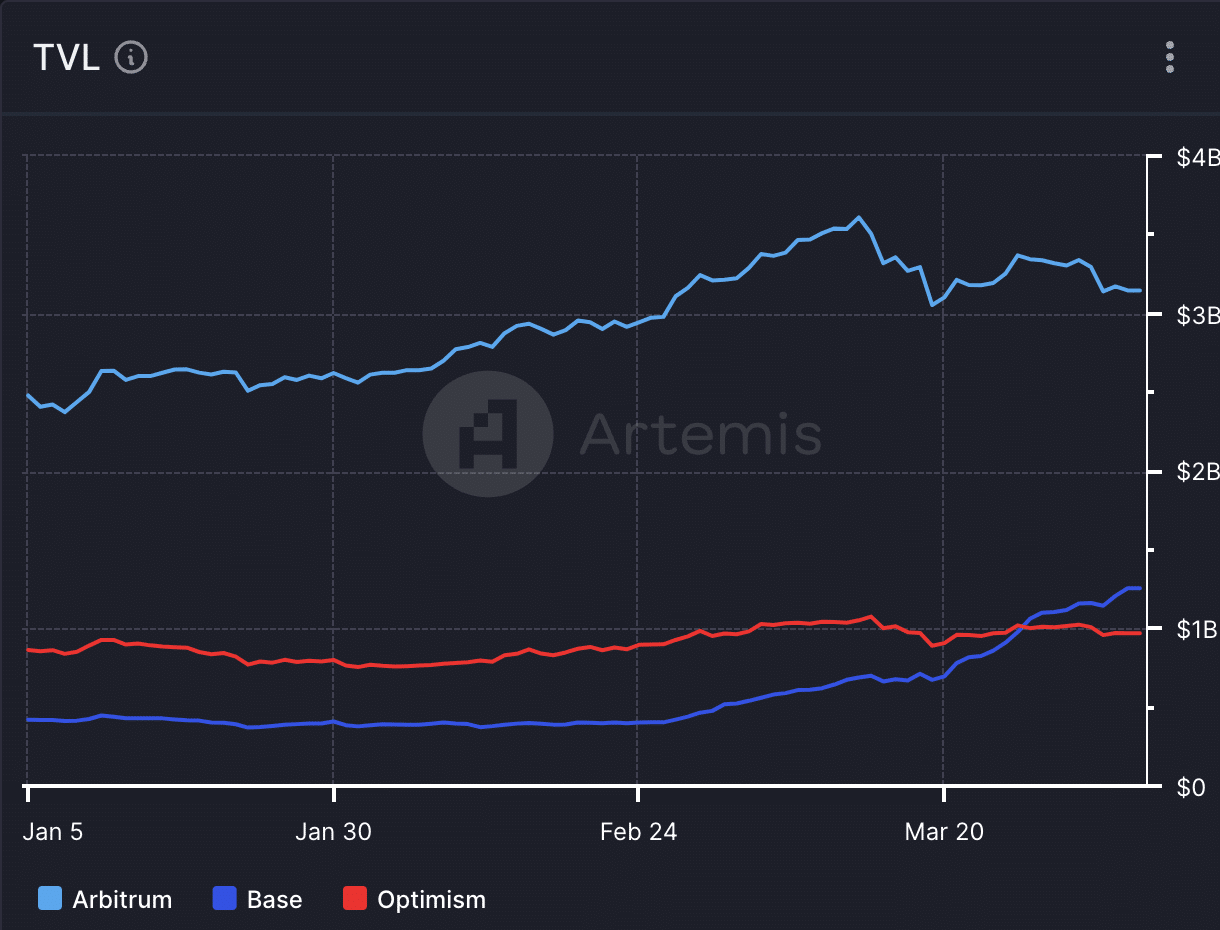

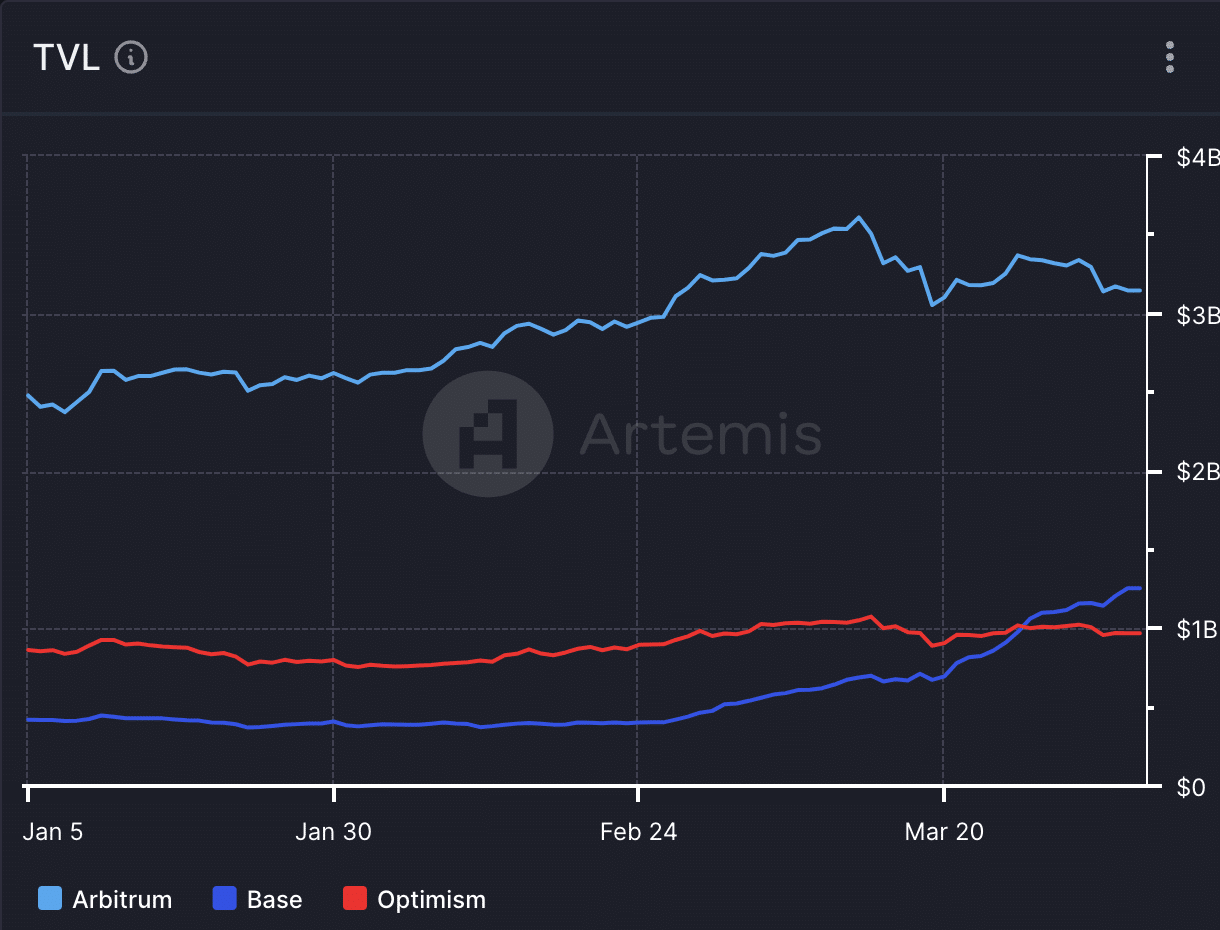

Over the past week, liquidity on Optimism has risen by $62 million. Higher liquidity generally leads to improved market efficiency and reduced slippage, making it more attractive for traders and investors to participate in transactions on the network. This can stimulate increased trading activity and volumes, contributing to a healthier ecosystem overall.

Additionally, the rise in liquidity may enhance the overall stability and resilience of Optimism. A deep and liquid market can help absorb large buy or sell orders without causing significant price fluctuations, promoting confidence among users and investors.

Source: Artemis

Tough competition

Even though high liquidity was seen on the Optimism network, the DEX (Decentralized Exchange Volumes) on the network continued to decline. The network wasn’t able to compete with networks such as Arbitrum and Base on this front. Due to the declining DEX volume, Optimism failed to lead in terms of TVL (Total Value Locked) as well.

New entrants in the market such as Base were able to outperform Optimism over the last few days in this regard.

Source: Artemis

State of OP

OP hasn’t been doing too well in terms of price either.

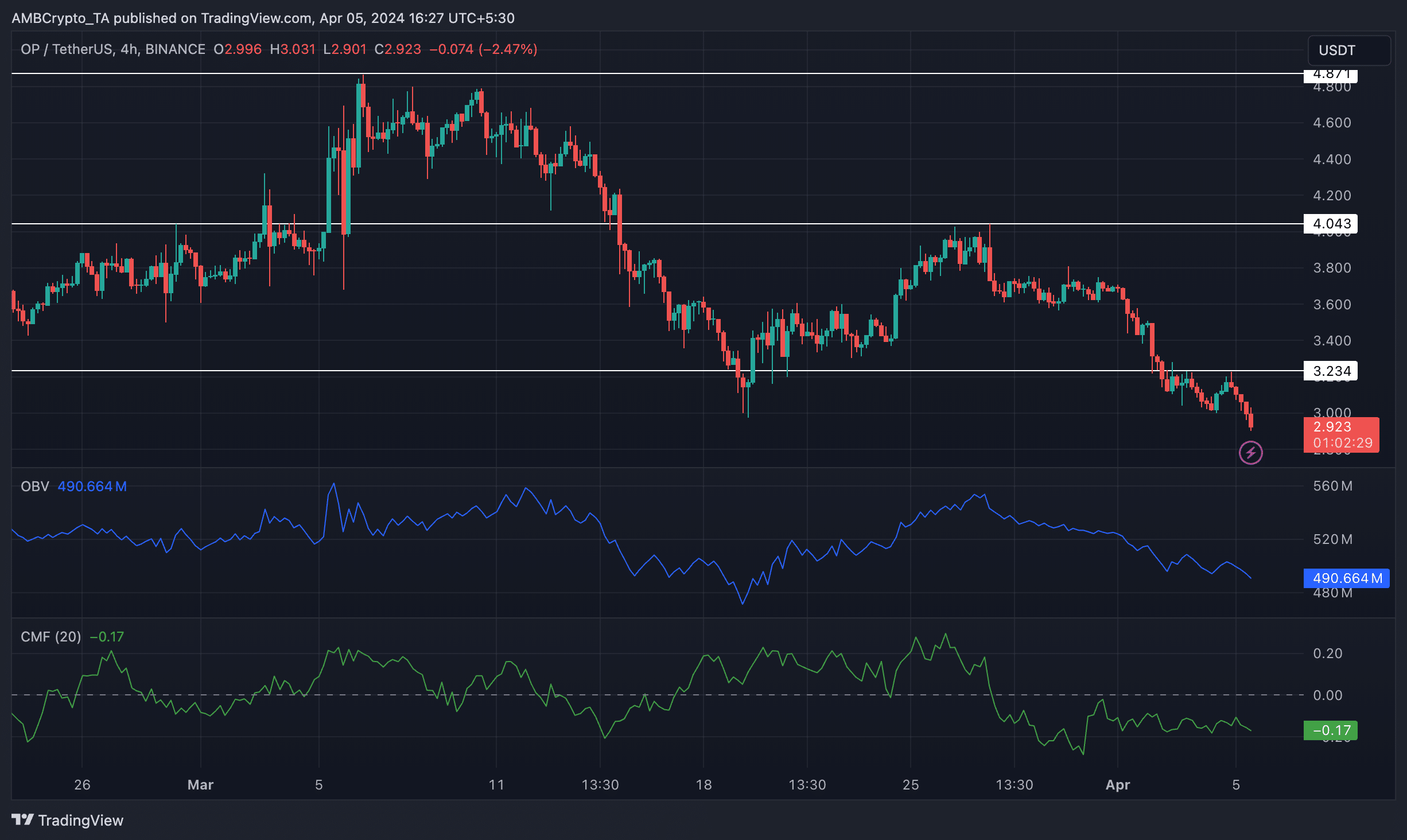

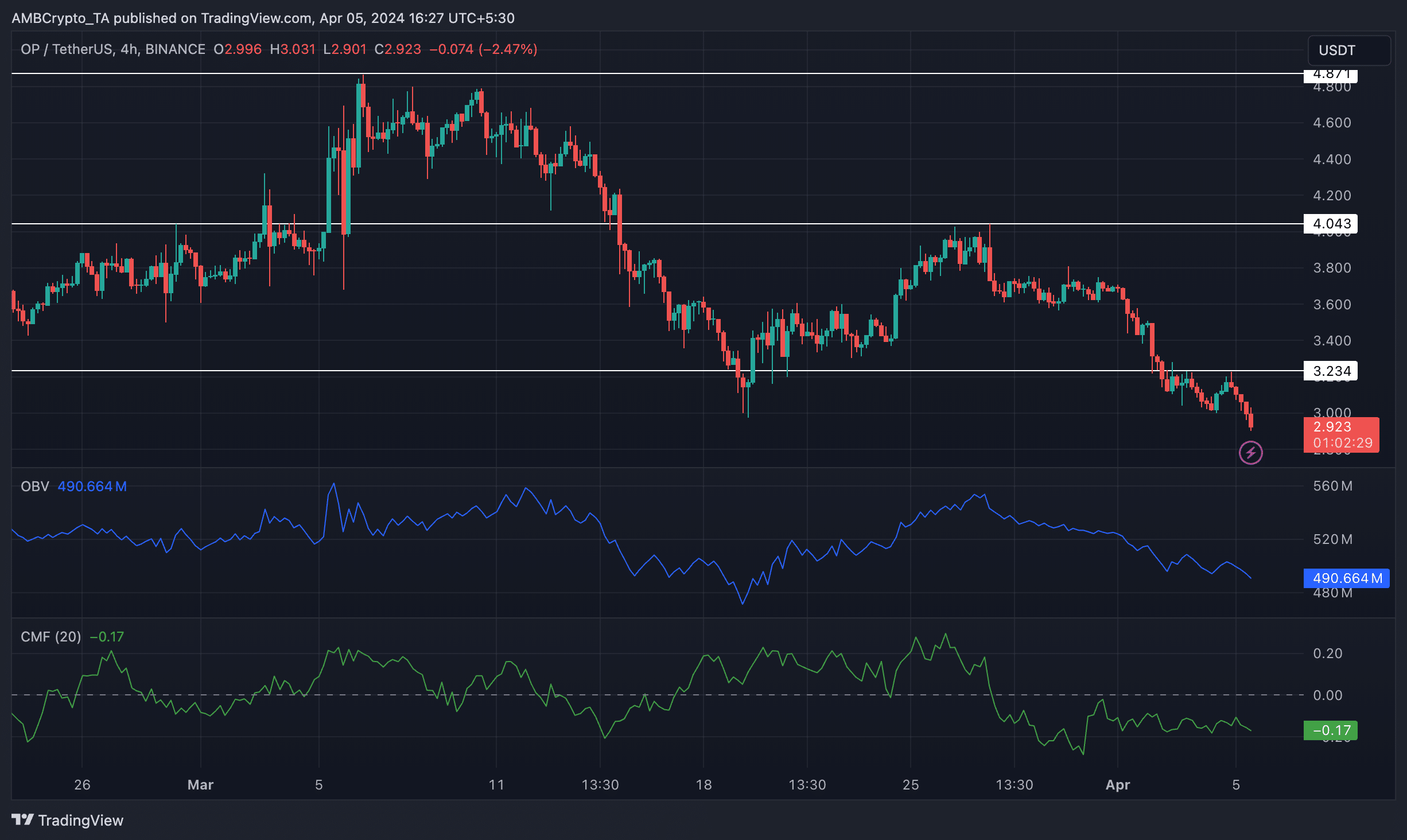

Over the past month, the price of OP has fallen by 39.27%. The price of OP showcased multiple lower lows and lower highs during this period, indicating a bearish trend. At press time, the OP token had fallen past the $3.234-level and was trading at $2.924. Moreover, the On-Balance Volume (OBV) for OP noted a decline.

A falling OBV suggests weakening buying pressure and potentially bearish sentiment among traders Additionally, a decrease in OBV could indicate a reduction in overall market demand and participation, which may further exacerbate downward price pressure.

Realistic or not, here’s OP market cap in BTC’s terms

Finally, a decline was seen in the Chaikin Money Flow (CMF) for OP as well. This decrease in CMF signifies a reduction in the flow of money into OP compared to the outflows. As CMF is a momentum oscillator that measures the strength of buying and selling pressure in the market, a falling CMF for OP indicates that selling pressure may be dominant, leading to downward price pressure.

Source: Trading View

- Optimism saw a massive uptick in terms of liquidity over the past few days

- Despite the surge in liquidity, the price of OP continued to fall

Optimism [OP], among other Layer 2 networks, benefitted immensely from the recent Dencun upgrade on the Ethereum network due to the reduction of gas fees on these networks.

Getting liquid

Over the past week, liquidity on Optimism has risen by $62 million. Higher liquidity generally leads to improved market efficiency and reduced slippage, making it more attractive for traders and investors to participate in transactions on the network. This can stimulate increased trading activity and volumes, contributing to a healthier ecosystem overall.

Additionally, the rise in liquidity may enhance the overall stability and resilience of Optimism. A deep and liquid market can help absorb large buy or sell orders without causing significant price fluctuations, promoting confidence among users and investors.

Source: Artemis

Tough competition

Even though high liquidity was seen on the Optimism network, the DEX (Decentralized Exchange Volumes) on the network continued to decline. The network wasn’t able to compete with networks such as Arbitrum and Base on this front. Due to the declining DEX volume, Optimism failed to lead in terms of TVL (Total Value Locked) as well.

New entrants in the market such as Base were able to outperform Optimism over the last few days in this regard.

Source: Artemis

State of OP

OP hasn’t been doing too well in terms of price either.

Over the past month, the price of OP has fallen by 39.27%. The price of OP showcased multiple lower lows and lower highs during this period, indicating a bearish trend. At press time, the OP token had fallen past the $3.234-level and was trading at $2.924. Moreover, the On-Balance Volume (OBV) for OP noted a decline.

A falling OBV suggests weakening buying pressure and potentially bearish sentiment among traders Additionally, a decrease in OBV could indicate a reduction in overall market demand and participation, which may further exacerbate downward price pressure.

Realistic or not, here’s OP market cap in BTC’s terms

Finally, a decline was seen in the Chaikin Money Flow (CMF) for OP as well. This decrease in CMF signifies a reduction in the flow of money into OP compared to the outflows. As CMF is a momentum oscillator that measures the strength of buying and selling pressure in the market, a falling CMF for OP indicates that selling pressure may be dominant, leading to downward price pressure.

Source: Trading View

clomid uses clomiphene uk buy clomiphene prescription cost generic clomiphene pill clomid risks can i get clomiphene without insurance buy cheap clomiphene price

This is a keynote which is forthcoming to my fundamentals… Myriad thanks! Faithfully where can I upon the phone details in the course of questions?

More articles like this would remedy the blogosphere richer.

buy azithromycin 500mg online cheap – ciplox 500mg sale metronidazole 200mg us

rybelsus for sale – buy generic rybelsus online cyproheptadine 4mg generic

order domperidone online – tetracycline 500mg tablet order cyclobenzaprine without prescription

buy cheap generic amoxil – generic amoxil buy generic ipratropium 100mcg

clavulanate ca – https://atbioinfo.com/ buy acillin pill

esomeprazole 20mg for sale – anexa mate esomeprazole 20mg us

cost coumadin 2mg – https://coumamide.com/ buy cozaar 25mg pills

meloxicam online order – mobo sin mobic pills

deltasone 20mg cost – https://apreplson.com/ order prednisone 5mg without prescription

ed pills no prescription – causes of erectile dysfunction erectile dysfunction medicines

buy generic amoxicillin – combamoxi amoxicillin tablet

buy forcan generic – https://gpdifluca.com/ buy fluconazole pill

order cenforce pills – site cenforce 50mg brand

tadalafil generic in usa – cheap generic cialis cialis no perscription overnight delivery

who makes cialis – https://strongtadafl.com/# does tadalafil lower blood pressure

I’ll certainly return to be familiar with more. on this site

cheap viagra mexico – viagra pfizer 50 mg viagra sale ireland

This website really has all of the tidings and facts I needed adjacent to this thesis and didn’t identify who to ask. https://ursxdol.com/sildenafil-50-mg-in/

More posts like this would make the online play more useful. cheap amoxil generic

More posts like this would make the online elbow-room more useful. https://prohnrg.com/product/orlistat-pills-di/

More delight pieces like this would urge the web better. https://aranitidine.com/fr/clenbuterol/

With thanks. Loads of erudition! https://ondactone.com/spironolactone/

The reconditeness in this serving is exceptional.

https://doxycyclinege.com/pro/ondansetron/

More articles like this would pretence of the blogosphere richer. http://www.predictive-datascience.com/forum/member.php?action=profile&uid=44947

dapagliflozin 10 mg uk – purchase forxiga online cheap forxiga 10 mg usa

buy orlistat cheap – https://asacostat.com/ buy xenical 60mg

This is the kind of glad I have reading. http://www.dbgjjs.com/home.php?mod=space&uid=532983