- OKX denied claims of aiding Bybit hackers in laundering funds.

- Mixed ETH projections between whales and Options traders.

OKX leadership has refuted allegations of laundering part of Bybit’s $1.5 billion stolen Ethereum [ETH] through its DEX aggregator platform (OKX Web3 wallet).

Commenting on the damning headlines, Star Xu, OKX Founder, and CEO, termed the reports “incorrect” and “misleading.”

“According to Bloomberg report, Bybit appears to blame OKX by suggesting we assist the hacker’s to launder stolen funds ($100M)…This is incorrect and misleading.”

The Bloomberg report noted that the OKX laundering allegations had attracted scrutiny from EU regulators. However, Xu reiterated that the firm was open to collaborating with global regulators on Web3 policy.

For his part, Ben Zhou, Bybit’s CEO, clarified that Bloomberg misquoted them.

“We did not provide any statement to this Bloomberg article, I believe when they say “according to Bybit” it was referring to http://lazarusbounty.com and the facts on it.”

Source: X

U.S. ETH ETFs bleeds

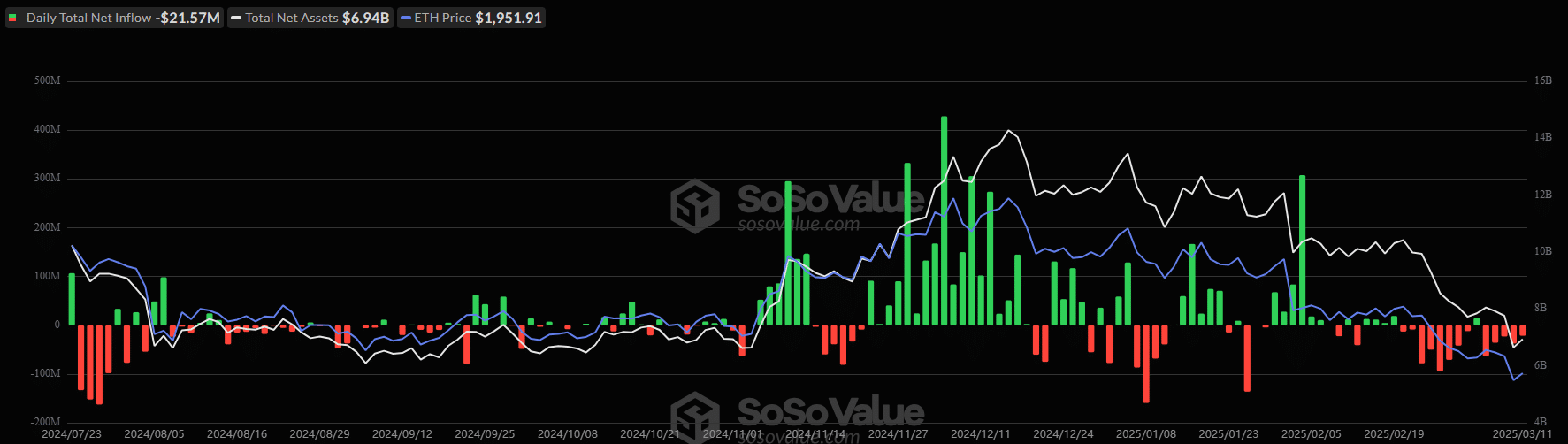

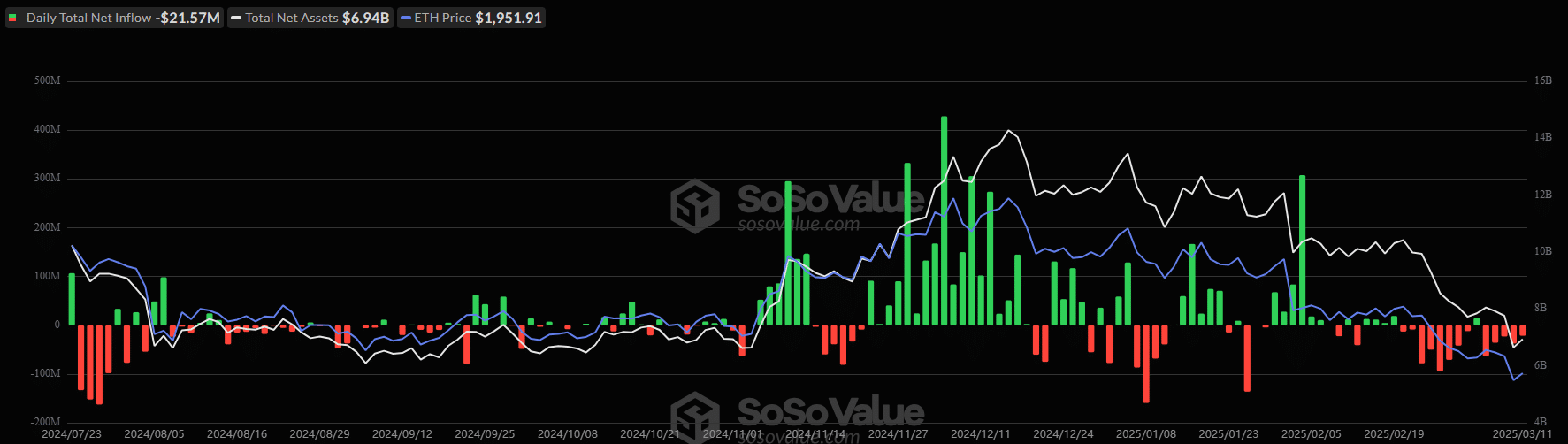

After the Bybit hack, a broader weak sentiment has dented the Ethereum market. U.S. spot ETH ETFs logged over $500M in outflows for the past three weeks.

In fact, for six consecutive days, the products have seen consistent bleed-out as investors reacted to U.S. recession fears.

Source: Soso Value

On Tuesday, they saw $21.5m outflows, while $37.5m of ETH ETF products were sold on the 10th of March.

Unsurprisingly, the risk-off mood has dragged ETH value to a 2-year low of $1.7K. This has brought the altcoin back to levels before the current bull cycle began.

Even so, there were mixed outlooks and sentiments from market participants. Some analysts were optimistic about a potential rebound for the altcoin, citing technical indicators and price fractals.

For example, Titan of Crypto noted that ETH’s market structure resembled BTC’s prior cycle, and a V-recovery could send it soaring higher.

Source: X

On his part, pseudonymous analyst Crypto Rover, projected that ETH could surge to $8K, citing historical trendline resistance that marked its previous cycle tops.

Source: X

ETH was valued at $1.9K at press time, down 53% from a recent peak of $4K. Whether the Pectra Upgrade will boost recovery odds remains to be seen.

However, at press time, Options traders on Deribit were pricing less than a 1% chance of ETH reclaiming $4K by the end of March.

Source: Deribit

- OKX denied claims of aiding Bybit hackers in laundering funds.

- Mixed ETH projections between whales and Options traders.

OKX leadership has refuted allegations of laundering part of Bybit’s $1.5 billion stolen Ethereum [ETH] through its DEX aggregator platform (OKX Web3 wallet).

Commenting on the damning headlines, Star Xu, OKX Founder, and CEO, termed the reports “incorrect” and “misleading.”

“According to Bloomberg report, Bybit appears to blame OKX by suggesting we assist the hacker’s to launder stolen funds ($100M)…This is incorrect and misleading.”

The Bloomberg report noted that the OKX laundering allegations had attracted scrutiny from EU regulators. However, Xu reiterated that the firm was open to collaborating with global regulators on Web3 policy.

For his part, Ben Zhou, Bybit’s CEO, clarified that Bloomberg misquoted them.

“We did not provide any statement to this Bloomberg article, I believe when they say “according to Bybit” it was referring to http://lazarusbounty.com and the facts on it.”

Source: X

U.S. ETH ETFs bleeds

After the Bybit hack, a broader weak sentiment has dented the Ethereum market. U.S. spot ETH ETFs logged over $500M in outflows for the past three weeks.

In fact, for six consecutive days, the products have seen consistent bleed-out as investors reacted to U.S. recession fears.

Source: Soso Value

On Tuesday, they saw $21.5m outflows, while $37.5m of ETH ETF products were sold on the 10th of March.

Unsurprisingly, the risk-off mood has dragged ETH value to a 2-year low of $1.7K. This has brought the altcoin back to levels before the current bull cycle began.

Even so, there were mixed outlooks and sentiments from market participants. Some analysts were optimistic about a potential rebound for the altcoin, citing technical indicators and price fractals.

For example, Titan of Crypto noted that ETH’s market structure resembled BTC’s prior cycle, and a V-recovery could send it soaring higher.

Source: X

On his part, pseudonymous analyst Crypto Rover, projected that ETH could surge to $8K, citing historical trendline resistance that marked its previous cycle tops.

Source: X

ETH was valued at $1.9K at press time, down 53% from a recent peak of $4K. Whether the Pectra Upgrade will boost recovery odds remains to be seen.

However, at press time, Options traders on Deribit were pricing less than a 1% chance of ETH reclaiming $4K by the end of March.

Source: Deribit

can i order generic clomiphene without insurance where to buy cheap clomiphene pill clomiphene price in usa can i purchase cheap clomid for sale can i get generic clomid online cost of generic clomiphene online where to buy cheap clomid pill

The sagacity in this ruined is exceptional.

The vividness in this ruined is exceptional.

order zithromax 500mg for sale – generic zithromax buy metronidazole 400mg pill

rybelsus 14mg for sale – periactin 4 mg us oral periactin

domperidone us – cyclobenzaprine 15mg ca buy generic flexeril online

buy inderal 20mg generic – order methotrexate 5mg pills buy generic methotrexate

amoxiclav ca – atbio info purchase ampicillin pill

nexium canada – https://anexamate.com/ order esomeprazole

purchase warfarin – coumamide cheap hyzaar

buy cheap mobic – moboxsin meloxicam 7.5mg pill

prednisone online – apreplson.com buy prednisone 20mg online cheap

buy ed pills us – https://fastedtotake.com/ ed pills

purchase amoxicillin online cheap – combamoxi.com cheap amoxicillin without prescription

buy diflucan 100mg – https://gpdifluca.com/ fluconazole price

where can i buy cenforce – https://cenforcers.com/# cenforce order online

cialis tadalafil 20mg price – cialis free trial canada cialis online no prescription

canadian no prescription pharmacy cialis – https://strongtadafl.com/ tadalafil 20mg canada

buy ranitidine 150mg online cheap – https://aranitidine.com/ purchase zantac pill

buy cheap viagra mastercard – https://strongvpls.com/# viagra sale sydney

This is the amicable of serenity I enjoy reading. gnolvade.com

This is the big-hearted of scribble literary works I positively appreciate. azithromycin online

This is a question which is forthcoming to my verve… Many thanks! Faithfully where can I find the contact details in the course of questions? https://ursxdol.com/get-cialis-professional/

I’ll certainly carry back to read more. https://prohnrg.com/product/lisinopril-5-mg/

This is the compassionate of literature I positively appreciate. on this site

Thanks towards putting this up. It’s okay done. https://ondactone.com/simvastatin/

The thoroughness in this break down is noteworthy.

where can i buy zofran

More articles like this would make the blogosphere richer. http://forum.ttpforum.de/member.php?action=profile&uid=424438

forxiga brand – https://janozin.com/ order generic forxiga 10 mg

order orlistat without prescription – on this site xenical 60mg uk

This website really has all of the information and facts I needed there this subject and didn’t identify who to ask. http://www.underworldralinwood.ca/forums/member.php?action=profile&uid=493525