- The solana price has dropped by about 7% over the last 24 hours.

- Metrics indicate mixed reactions.

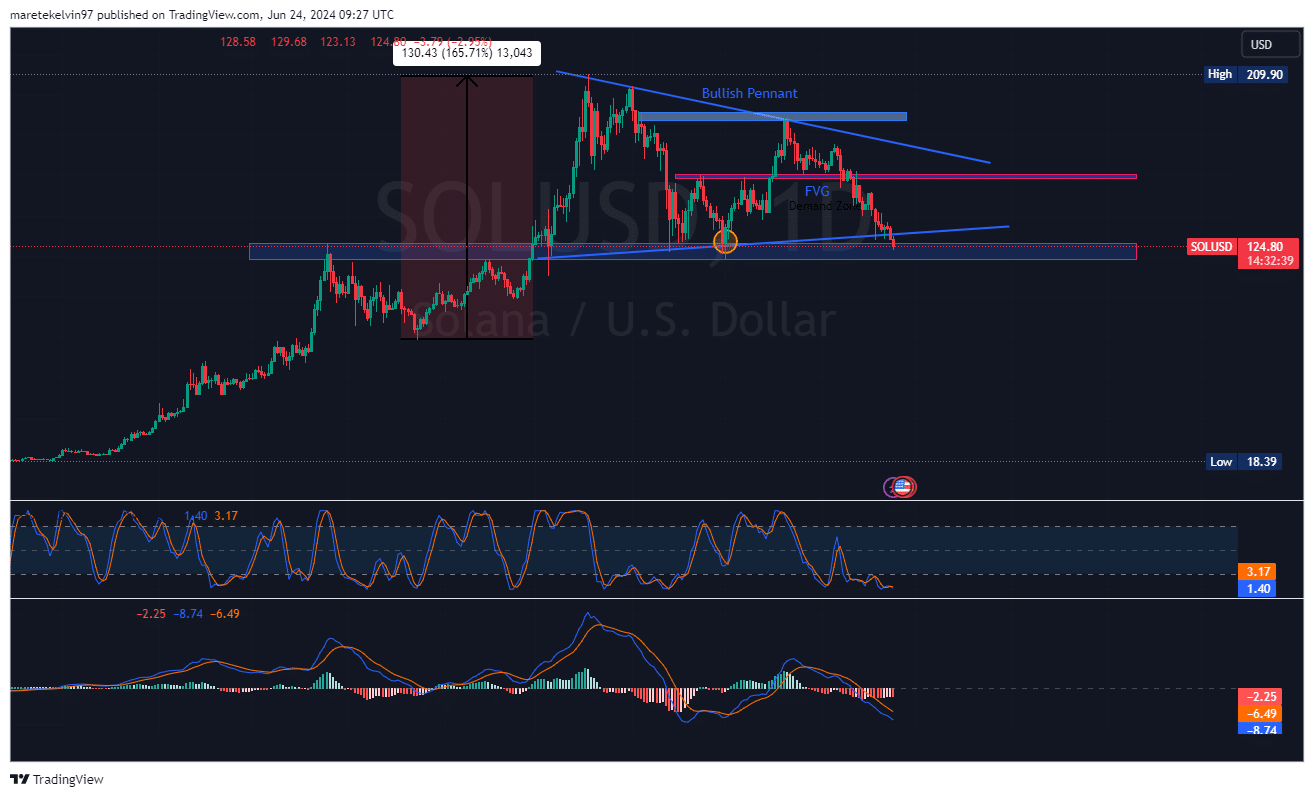

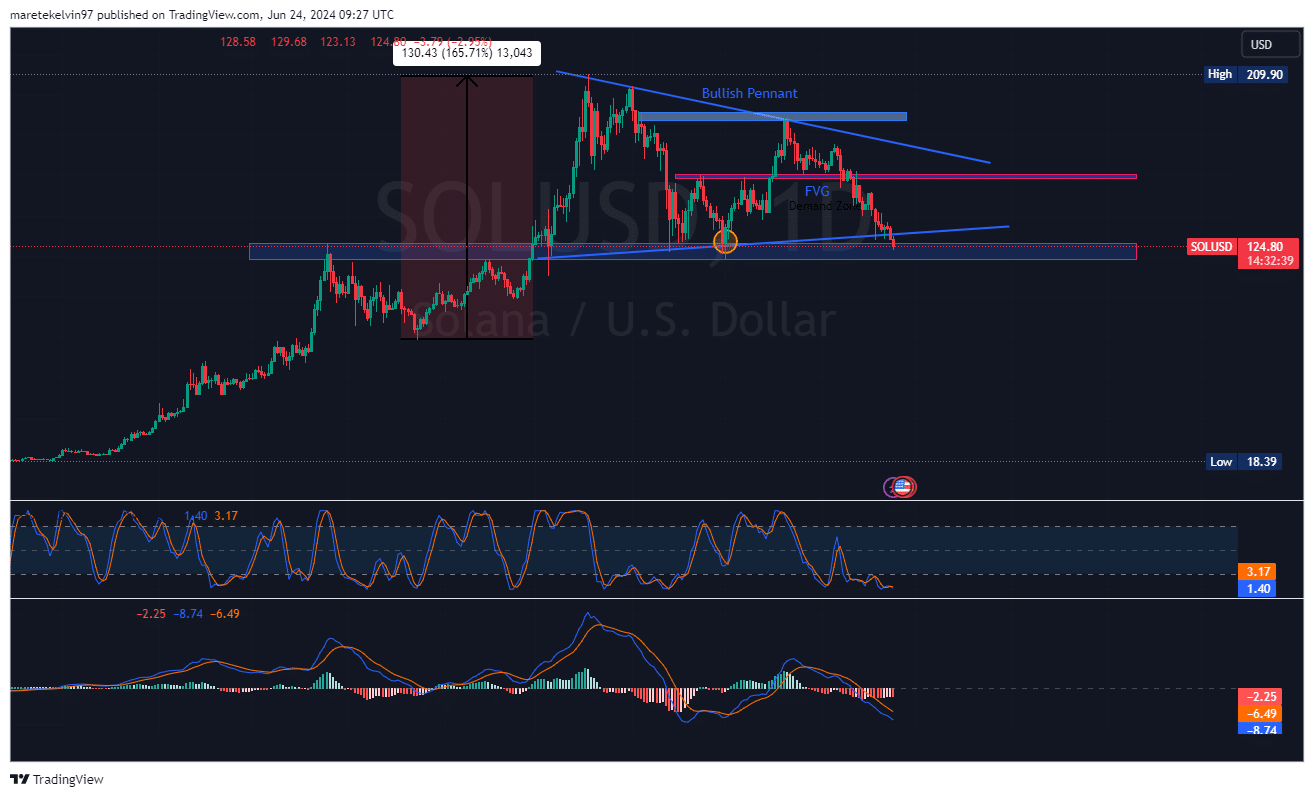

Solana [SOL] has seen a big price drop of 7% in the last 24 hours. It was initially consolidating within a bullish pennant pattern.

However, over the last 38 hours, Solana has broken out of this pattern, resulting in the current decline.

As of this writing, CoinMarketCap priced Solana at $125.18, a 7% decrease in the last 24 hours and a 13.54% dip in the last seven days.

Solana’s market capitalization dropped by 6.65% to 57.9 billion, while trading volume surged massively by 181.15% in the last 24 hours.

SOL was testing a major support level of around $125. This support level is critical since it has been rejected several times in the past.

If Solana fails to hold this support level, the price could dip further.On the other hand, a potential price reversal to the bullish pennant support may occur if the support level is respected.

Source: Tradingview

Whale activity and development insights

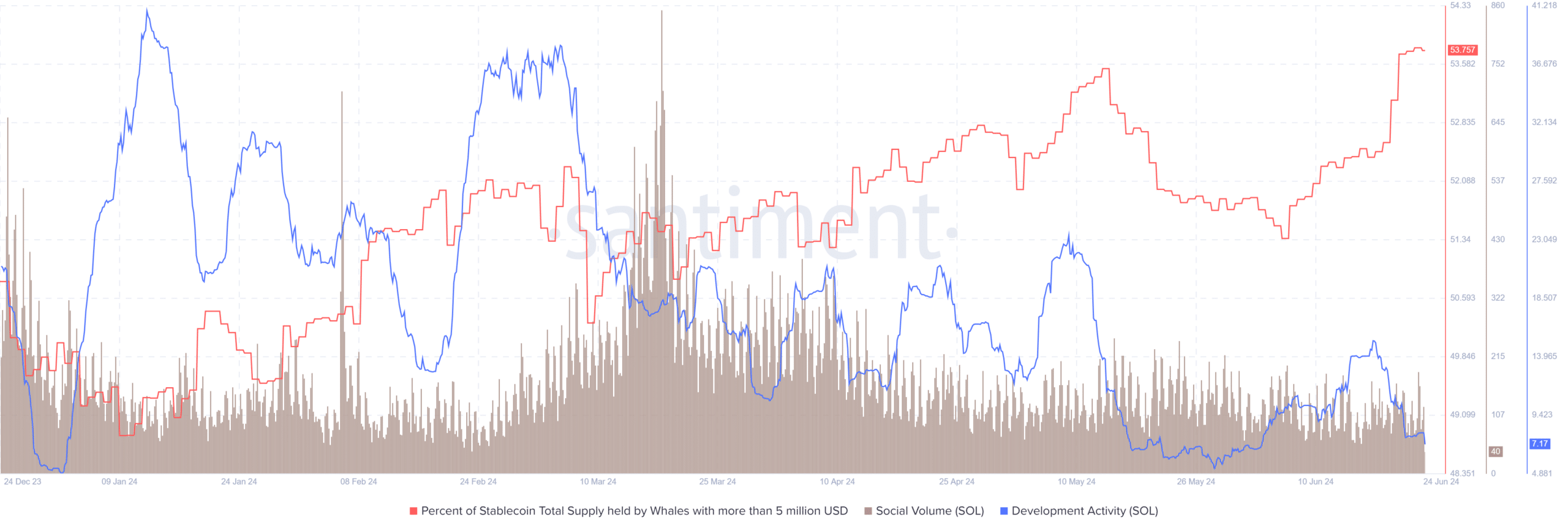

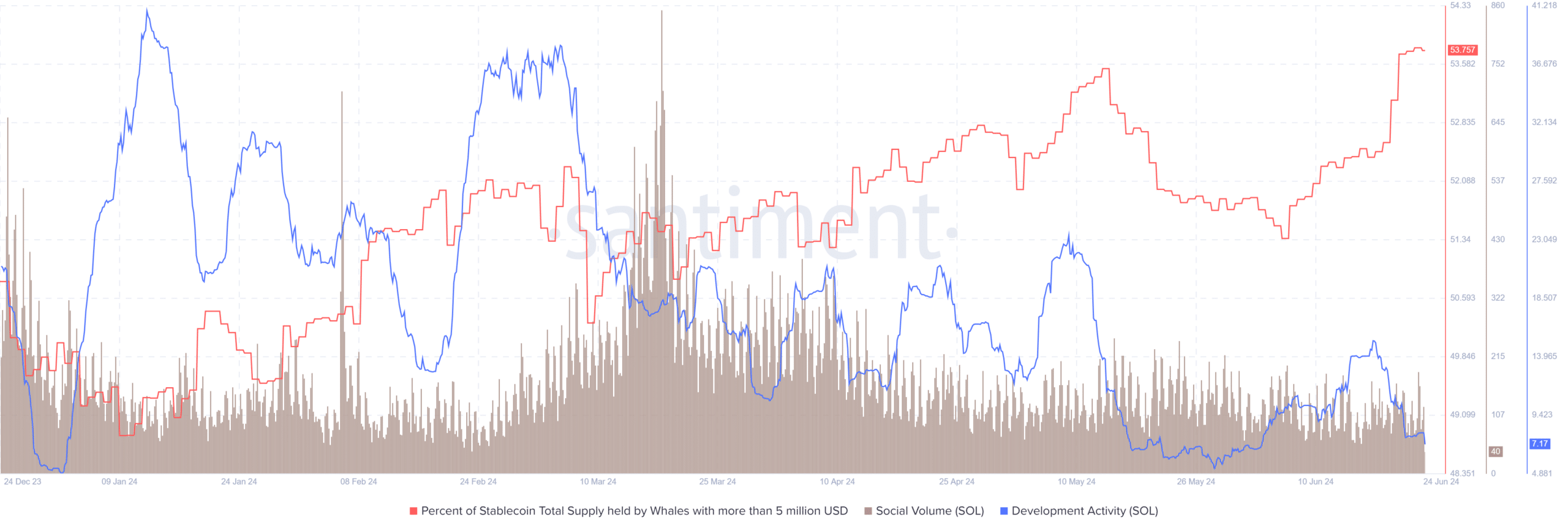

AMBCrypto’s analysis of Santiment’s whale and development activities data indicated significant trends.

The percentage of Solana’s total supply held by whales has remained relatively stable. This suggests that big players are observing the market direction before taking significant positions.

However, social volumes and development activities have indicated some volatility. These fluctuations correlate with long-term price movements, making them a key indicator for investors to watch in the near future.

Source: Santiment

Liquidation pressure mounts

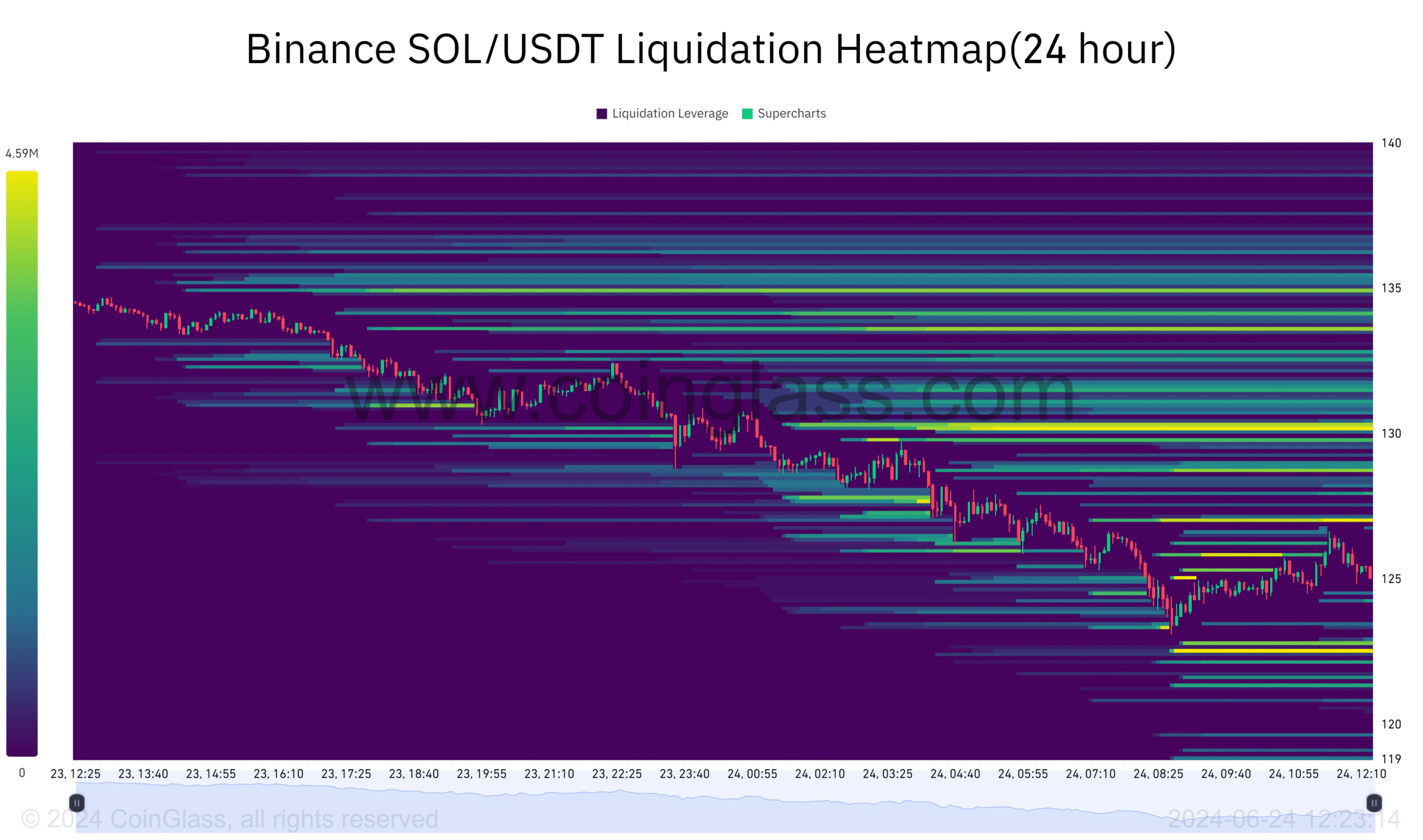

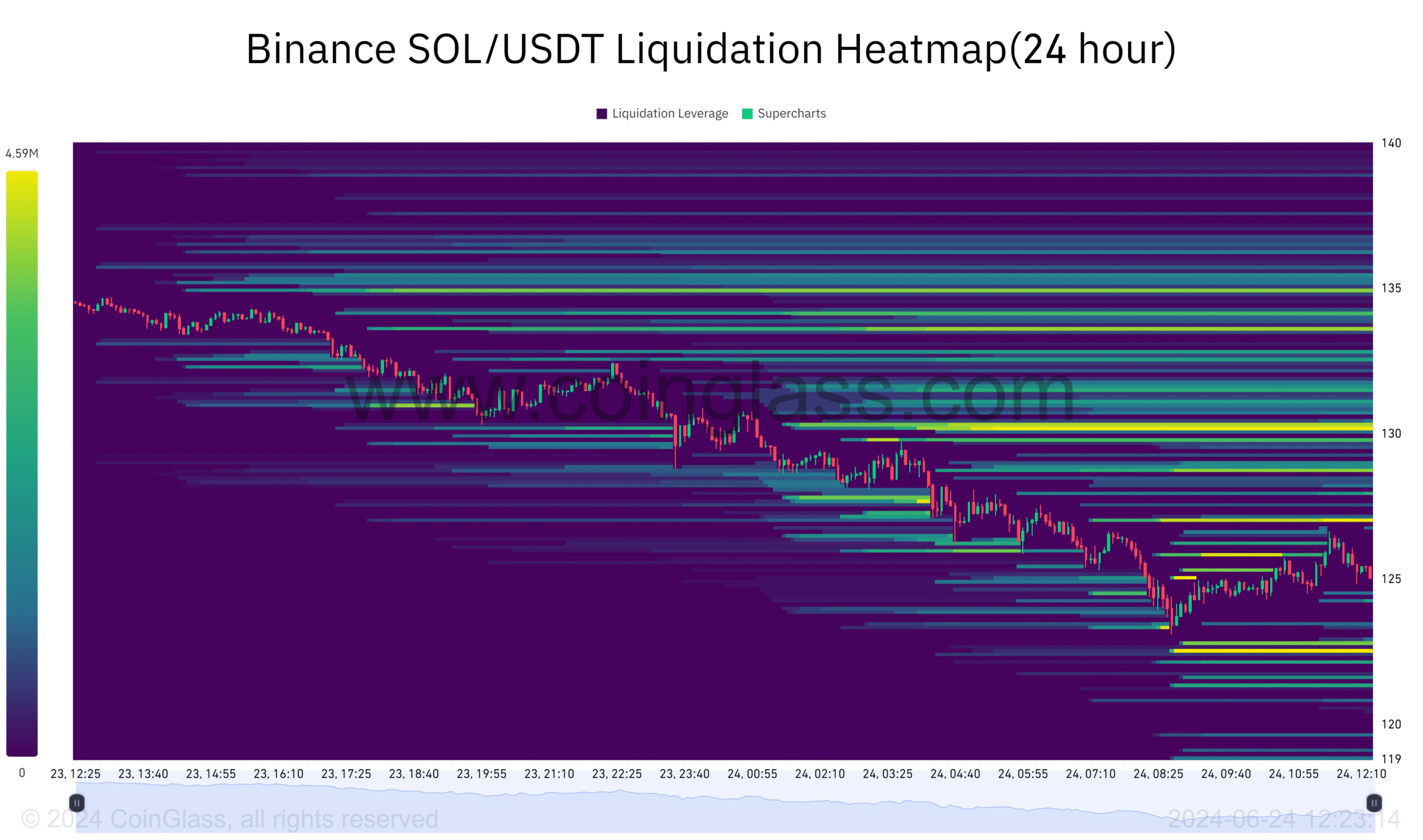

According to Binance liquidation heat-map data from Coinglass, there is increasing pressure on leveraged positions. As the Solana price continues to dip, the likelihood of consecutive liquidations increases.

This could potentially fuel the current decline.

Source: Coinglass

Read Solana’s [SOL] Price Prediction 2024-2025

What next for Solana?

The future of Solana depends on its ability to hold to its support level. If SOL breaks below the support level, further declines are likely, potentially testing the lower support levels.

Conversely, a successful defense from the support level could steer bullish momentum for a reversal.

- The solana price has dropped by about 7% over the last 24 hours.

- Metrics indicate mixed reactions.

Solana [SOL] has seen a big price drop of 7% in the last 24 hours. It was initially consolidating within a bullish pennant pattern.

However, over the last 38 hours, Solana has broken out of this pattern, resulting in the current decline.

As of this writing, CoinMarketCap priced Solana at $125.18, a 7% decrease in the last 24 hours and a 13.54% dip in the last seven days.

Solana’s market capitalization dropped by 6.65% to 57.9 billion, while trading volume surged massively by 181.15% in the last 24 hours.

SOL was testing a major support level of around $125. This support level is critical since it has been rejected several times in the past.

If Solana fails to hold this support level, the price could dip further.On the other hand, a potential price reversal to the bullish pennant support may occur if the support level is respected.

Source: Tradingview

Whale activity and development insights

AMBCrypto’s analysis of Santiment’s whale and development activities data indicated significant trends.

The percentage of Solana’s total supply held by whales has remained relatively stable. This suggests that big players are observing the market direction before taking significant positions.

However, social volumes and development activities have indicated some volatility. These fluctuations correlate with long-term price movements, making them a key indicator for investors to watch in the near future.

Source: Santiment

Liquidation pressure mounts

According to Binance liquidation heat-map data from Coinglass, there is increasing pressure on leveraged positions. As the Solana price continues to dip, the likelihood of consecutive liquidations increases.

This could potentially fuel the current decline.

Source: Coinglass

Read Solana’s [SOL] Price Prediction 2024-2025

What next for Solana?

The future of Solana depends on its ability to hold to its support level. If SOL breaks below the support level, further declines are likely, potentially testing the lower support levels.

Conversely, a successful defense from the support level could steer bullish momentum for a reversal.

clomiphene price uk where can i get cheap clomid can i purchase generic clomiphene for sale where to buy clomid pill clomiphene pills generic clomiphene for sale clomid generic

You said it nicely..

casino en ligne

Nicely put. Appreciate it.

casino en ligne

Nicely put, Thank you.

casino en ligne fiable

Kudos! I appreciate it.

casino en ligne

Many thanks! I appreciate it.

casino en ligne

Amazing info, Thanks.

casino en ligne

Thanks. Terrific information.

casino en ligne francais

Incredible plenty of excellent facts.

casino en ligne francais

You actually stated that effectively!

casino en ligne

Superb information, Thank you.

casino en ligne France

Thanks for sharing. It’s first quality.

Facts blog you procure here.. It’s hard to find great worth article like yours these days. I truly recognize individuals like you! Go through mindfulness!!

azithromycin over the counter – oral metronidazole buy metronidazole 200mg online

buy motilium no prescription – order sumycin 250mg online cheap buy cyclobenzaprine 15mg pills

buy inderal 20mg generic – order plavix 150mg sale buy methotrexate 10mg generic

cheap amoxil sale – combivent brand order generic combivent

clavulanate over the counter – https://atbioinfo.com/ acillin pill

order nexium 20mg generic – https://anexamate.com/ esomeprazole 20mg for sale

coumadin sale – https://coumamide.com/ hyzaar cost

buy meloxicam 15mg generic – https://moboxsin.com/ buy meloxicam generic

deltasone 10mg tablet – https://apreplson.com/ deltasone 20mg brand

over the counter erectile dysfunction pills – male ed pills erectile dysfunction drug

buy fluconazole online – https://gpdifluca.com/# diflucan 100mg ca

cenforce 100mg without prescription – order cenforce 50mg pill buy cenforce 100mg pills

cialis online without perscription – https://ciltadgn.com/# sildalis sildenafil tadalafil

More posts like this would add up to the online space more useful. https://gnolvade.com/es/como-comprar-cialis-en-es/

viagra blue pill 100 – https://strongvpls.com/# viagra 100mg cost

This is the kind of glad I have reading. https://ursxdol.com/cialis-tadalafil-20/

This is the kind of advise I turn up helpful. https://buyfastonl.com/furosemide.html

Thanks for putting this up. It’s okay done. https://aranitidine.com/fr/ivermectine-en-france/

Thanks towards putting this up. It’s evidently done. https://ondactone.com/simvastatin/

I am actually delighted to glance at this blog posts which consists of tons of useful facts, thanks representing providing such data.

order lioresal

Thanks for sharing. It’s top quality. http://www.predictive-datascience.com/forum/member.php?action=profile&uid=44951

buy forxiga 10 mg for sale – https://janozin.com/# dapagliflozin over the counter

how to buy xenical – buy xenical order xenical 60mg generic

Thanks towards putting this up. It’s evidently done. http://www.cs-tygrysek.ugu.pl/member.php?action=profile&uid=98763