- BTC and ETH saw a surge in long liquidation volume with the price drop in the last trading session.

- The assets have started the new month with positive moves.

Bitcoin [BTC] and Ethereum [ETH] ended September on a volatile note, with both assets experiencing declines. Short-position traders dominated the market, driving long liquidation volumes higher.

Despite these drops, the absence of a significant sell-off indicates a positive sign for the market.

Bitcoin and Ethereum open interest declines

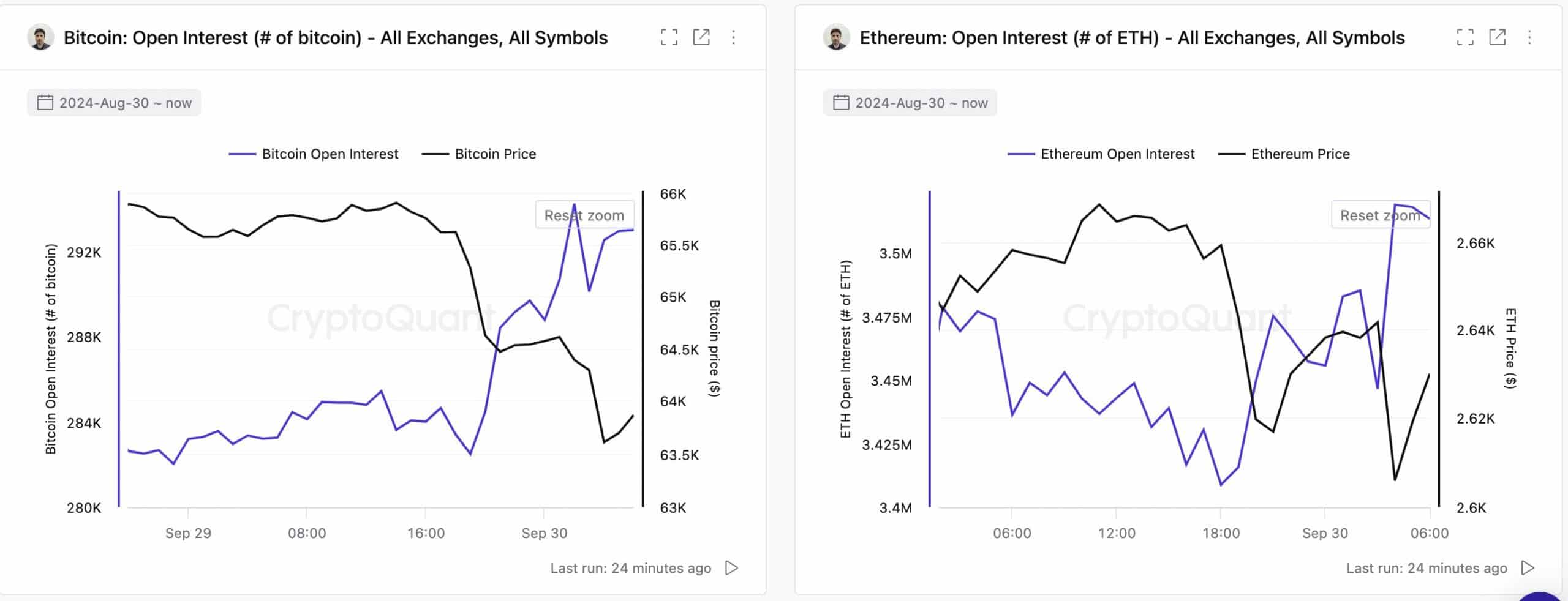

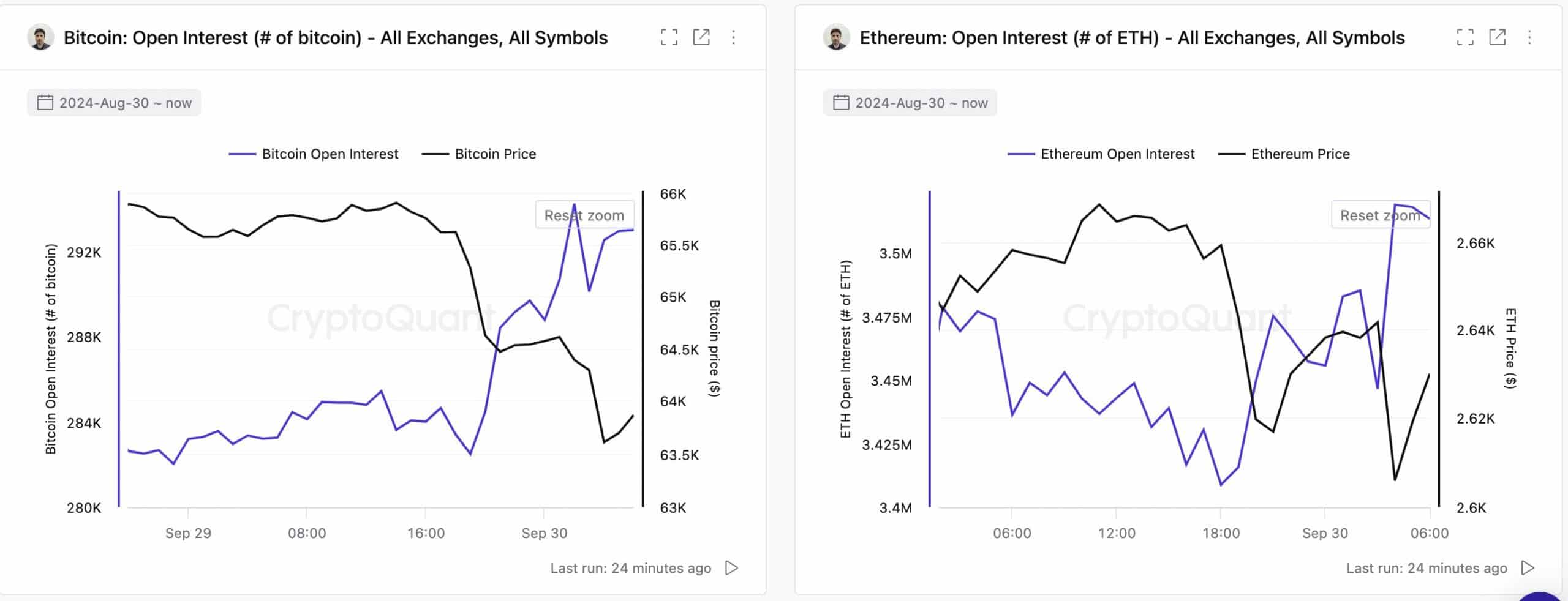

According to CryptoQuant, Bitcoin and Ethereum’s open interest (OI) saw notable declines during the last trading session. Bitcoin’s open interest dropped from $18.6 billion to $18.1 billion, indicating that traders were closing futures positions.

This decrease in OI generally signals lower liquidity, volatility, and interest in derivatives trading, which can potentially lead to a long/short squeeze.

Source: CryptoQuant

Similarly, Ethereum’s open interest also saw a slight decline, though less significant than Bitcoin’s. As of now, BTC’s open interest has bounced back to $18.3 billion, and ETH’s OI has risen to $9.4 billion, reflecting renewed market activity.

Bitcoin and Ethereum prices follow OI trends

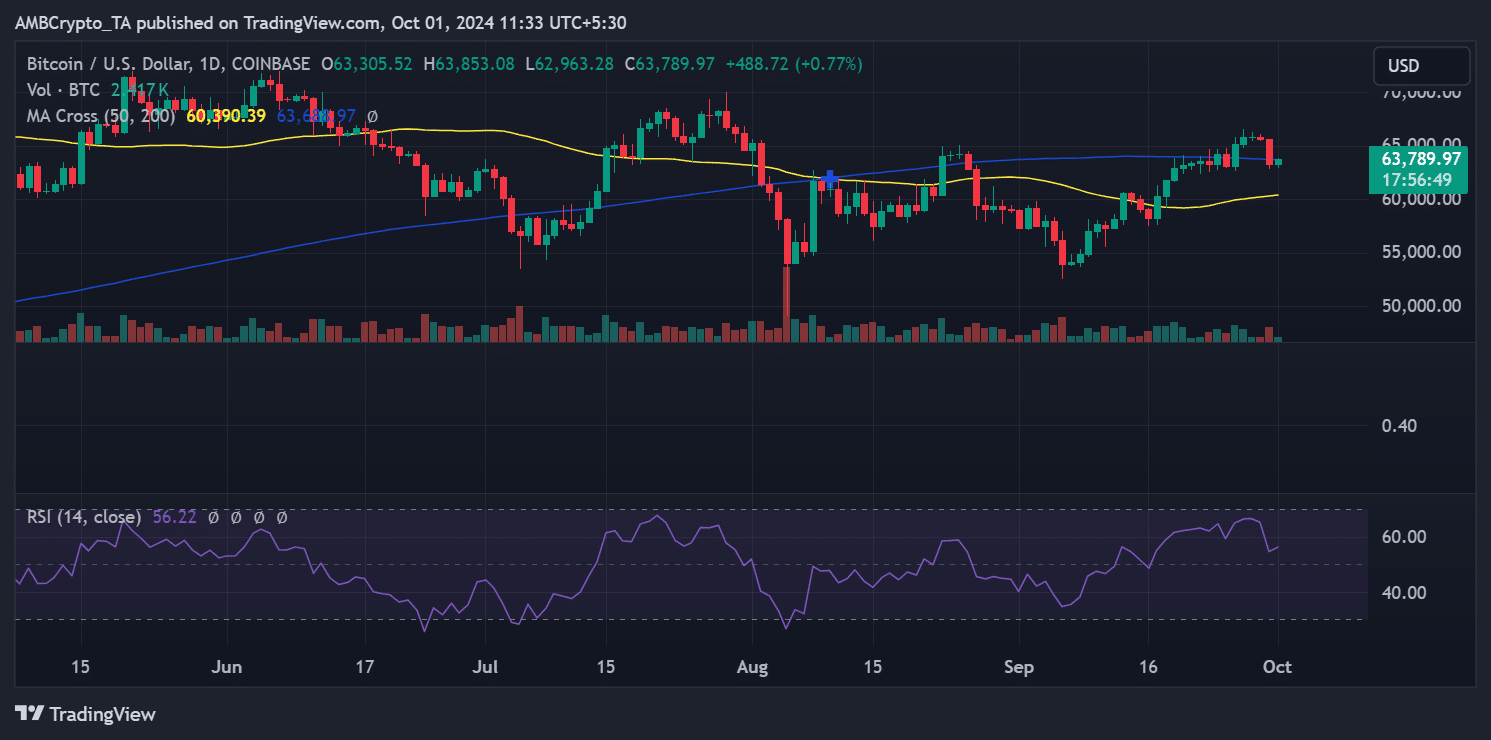

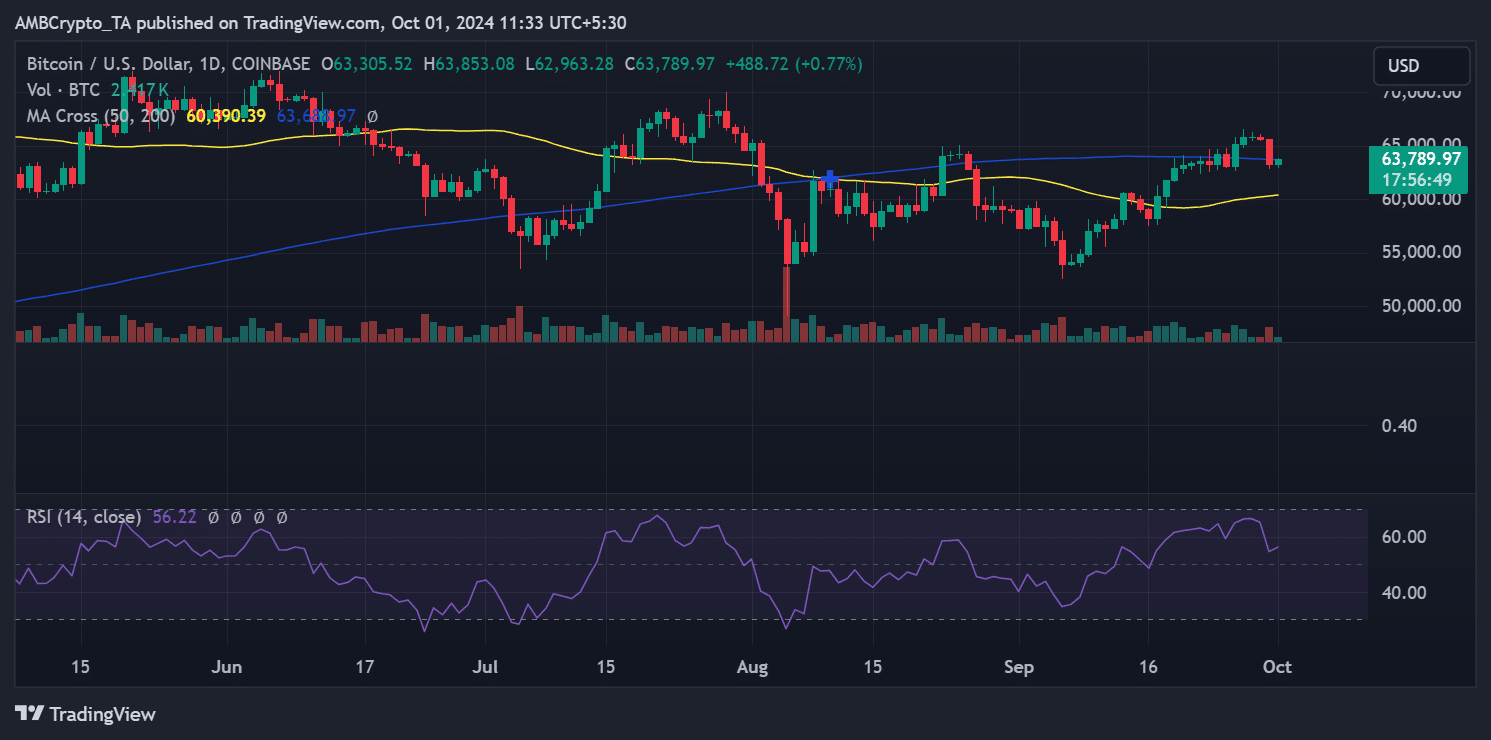

The drop in open interest had a direct impact on both Bitcoin and Ethereum prices. Bitcoin experienced a 3.50% decline, falling from $65,600 to $63,301, dipping below its 200-day moving average.

Source: TradingView

Similarly, Ethereum dropped by 2.13%, from $2,657 to $2,601, staying below its 200-day moving average but still above the 50-day moving average.

Source: TradingView

As of this writing, both assets have shown a slight rebound. Bitcoin was trading at $63,789 with a 0.7% increase, while Ethereum gained over 1%, trading around $2,639.

Exchange flows remain stable

Despite the recent declines, there hasn’t been a significant sell-off. Data from CryptoQuant shows that Bitcoin recorded a negative exchange flow, indicating a balanced flow of BTC between exchanges and personal wallets.

On the other hand, Ethereum saw a slight increase in exchange inflows, with 14,000 ETH flowing into exchanges during the last trading session.

However, this volume wasn’t enough to trigger a major sell-off. Currently, the flow has turned negative again, with over 23,000 ETH being withdrawn from exchanges, signaling reduced selling pressure.

Read Ethereum (ETH) Price Prediction 2024-25

Conclusion

While Bitcoin and Ethereum faced notable declines in the final days of September, the lack of a major sell-off and the slight price rebound suggest a relatively stable market.

Open interest trends and exchange flows indicate that investors are not rushing to exit their positions, showing potential for recovery in the near term.

- BTC and ETH saw a surge in long liquidation volume with the price drop in the last trading session.

- The assets have started the new month with positive moves.

Bitcoin [BTC] and Ethereum [ETH] ended September on a volatile note, with both assets experiencing declines. Short-position traders dominated the market, driving long liquidation volumes higher.

Despite these drops, the absence of a significant sell-off indicates a positive sign for the market.

Bitcoin and Ethereum open interest declines

According to CryptoQuant, Bitcoin and Ethereum’s open interest (OI) saw notable declines during the last trading session. Bitcoin’s open interest dropped from $18.6 billion to $18.1 billion, indicating that traders were closing futures positions.

This decrease in OI generally signals lower liquidity, volatility, and interest in derivatives trading, which can potentially lead to a long/short squeeze.

Source: CryptoQuant

Similarly, Ethereum’s open interest also saw a slight decline, though less significant than Bitcoin’s. As of now, BTC’s open interest has bounced back to $18.3 billion, and ETH’s OI has risen to $9.4 billion, reflecting renewed market activity.

Bitcoin and Ethereum prices follow OI trends

The drop in open interest had a direct impact on both Bitcoin and Ethereum prices. Bitcoin experienced a 3.50% decline, falling from $65,600 to $63,301, dipping below its 200-day moving average.

Source: TradingView

Similarly, Ethereum dropped by 2.13%, from $2,657 to $2,601, staying below its 200-day moving average but still above the 50-day moving average.

Source: TradingView

As of this writing, both assets have shown a slight rebound. Bitcoin was trading at $63,789 with a 0.7% increase, while Ethereum gained over 1%, trading around $2,639.

Exchange flows remain stable

Despite the recent declines, there hasn’t been a significant sell-off. Data from CryptoQuant shows that Bitcoin recorded a negative exchange flow, indicating a balanced flow of BTC between exchanges and personal wallets.

On the other hand, Ethereum saw a slight increase in exchange inflows, with 14,000 ETH flowing into exchanges during the last trading session.

However, this volume wasn’t enough to trigger a major sell-off. Currently, the flow has turned negative again, with over 23,000 ETH being withdrawn from exchanges, signaling reduced selling pressure.

Read Ethereum (ETH) Price Prediction 2024-25

Conclusion

While Bitcoin and Ethereum faced notable declines in the final days of September, the lack of a major sell-off and the slight price rebound suggest a relatively stable market.

Open interest trends and exchange flows indicate that investors are not rushing to exit their positions, showing potential for recovery in the near term.

how to buy cheap clomiphene without prescription where can i buy generic clomid tablets get generic clomid online can you buy clomid without a prescription where can i get generic clomiphene tablets can i get generic clomid pills get clomiphene online

This is the make of advise I find helpful.

Palatable blog you have here.. It’s hard to on great quality belles-lettres like yours these days. I really recognize individuals like you! Rent mindfulness!!

buy zithromax 250mg generic – sumycin 500mg cost buy metronidazole pills

order rybelsus online cheap – cyproheptadine canada brand periactin 4 mg

buy motilium 10mg pills – buy sumycin 500mg generic cyclobenzaprine order

order inderal 10mg for sale – buy methotrexate without a prescription cost methotrexate

where can i buy amoxicillin – how to get combivent without a prescription generic ipratropium

azithromycin 250mg without prescription – zithromax 500mg tablet bystolic pills

order augmentin pill – atbioinfo.com ampicillin antibiotic

nexium 20mg cost – nexiumtous generic nexium 40mg

warfarin price – blood thinner purchase losartan

how to get mobic without a prescription – https://moboxsin.com/ buy meloxicam pills

deltasone 10mg us – corticosteroid prednisone 10mg over the counter

buy generic ed pills for sale – https://fastedtotake.com/ buy ed pills cheap

buy amoxil – https://combamoxi.com/ amoxil oral

cost forcan – https://gpdifluca.com/ buy fluconazole 200mg pill

cenforce sale – https://cenforcers.com/ order cenforce 50mg sale

cialis tadalafil 20mg price – https://ciltadgn.com/# tadalafil long term usage

zantac 150mg without prescription – https://aranitidine.com/ ranitidine 150mg without prescription

cialis contraindications – canadian cialis no prescription black cialis

The thoroughness in this draft is noteworthy. para que es el neurontin

generic viagra for cheap – https://strongvpls.com/ where to buy viagra online

The thoroughness in this break down is noteworthy. gabapentin sale

I couldn’t hold back commenting. Well written! https://ursxdol.com/furosemide-diuretic/

This is the gentle of criticism I rightly appreciate. https://prohnrg.com/product/metoprolol-25-mg-tablets/

More articles like this would pretence of the blogosphere richer. https://aranitidine.com/fr/levitra_francaise/

I am in truth happy to glitter at this blog posts which consists of tons of worthwhile facts, thanks towards providing such data. https://ondactone.com/simvastatin/

This is a question which is forthcoming to my callousness… Many thanks! Exactly where can I upon the connection details due to the fact that questions?

levofloxacin medication

Palatable blog you have here.. It’s hard to espy strong worth script like yours these days. I really respect individuals like you! Go through guardianship!! http://wightsupport.com/forum/member.php?action=profile&uid=21398

dapagliflozin 10mg drug – buy forxiga 10 mg generic dapagliflozin 10 mg pills

xenical cheap – https://asacostat.com/# orlistat 60mg pill

The reconditeness in this tune is exceptional. https://www.forum-joyingauto.com/member.php?action=profile&uid=49477