- Notcoin’s price rallied, volume hits $4.54 billion, only behind BTC, ETH, and USDT.

- The price could drop to $0.015 as indicators showed that the token was overbought.

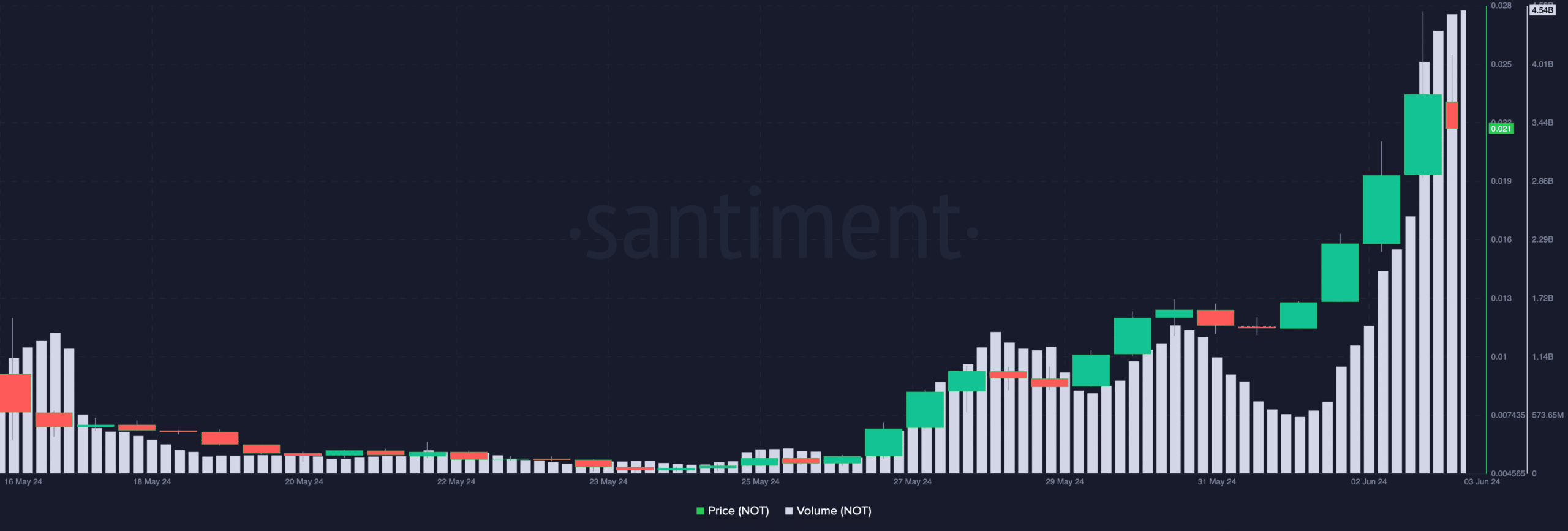

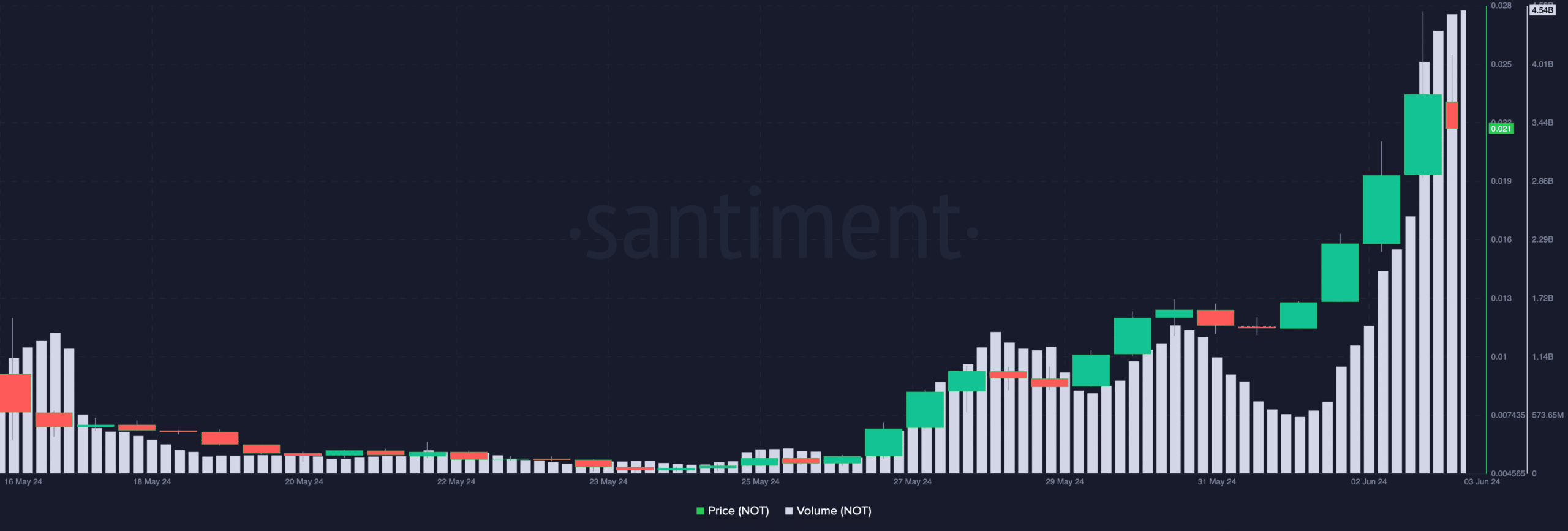

The 24-hour volume of Notcoin [NOT], fueled by the tremendous price increase, was more than that of Solana [SOL] and BNB. As of this writing, NOT’s volume was $.4.54 billion, according to Santiment.

The price, on the other hand, was $0.021. This value was at a 287% hike in the last seven days. However, the price mentioned was a decline as Notcoin had initially hit $0.028 on the 2nd of June.

During the same period, BNB’s volume was $1.75 billion while Solana recorded $1.72 billion in trading volume. The metric is an indicator of interest. Therefore, the surge meant a lot of capital was deployed in the token’s favor.

Source: Santiment

Back-to-back jumps

For those unfamiliar, Notcoin launched about a month ago. And previously, AMBCrypto had reported how its launch was marred by selling pressure.

However, another article explained what led to the price surge and the jump into the top 100 per market cap. In the mentioned piece, we had predicted that NOT would hit $0.01.

Interestingly, it did not take long for the project to do that. Moreso, Notcoin is now part of the top 60 in terms of market cap, rising above Bonk [BONK].

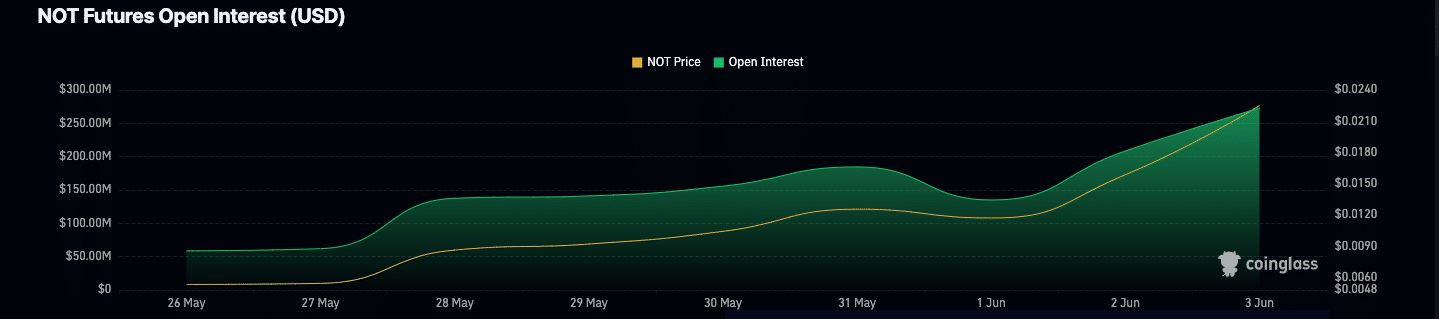

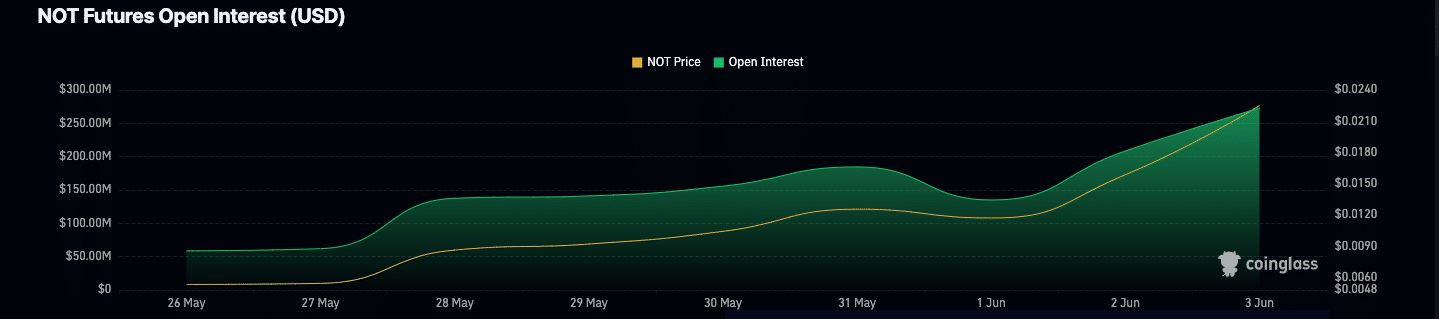

Apart from that, the Open Interest (OI) around the token surged over the weekend. According to Coinglass, Notcoin’s OI was as high as $273.02 million.

Source: Coinglass

When the OI decreases, it means that money is exiting the market as more contracts get closed. However, an increase in the metric is a sign of the presence of new liquidity.

For the price, the rising OI was one of the reasons NOT was able to sustain its uptrend. This is because increasing Open Interest can serve as a strength for the direction a token is moving.

However, traders, as well as NOT holders might need to be careful.

NOT becomes overbought, hurts traders’ positions

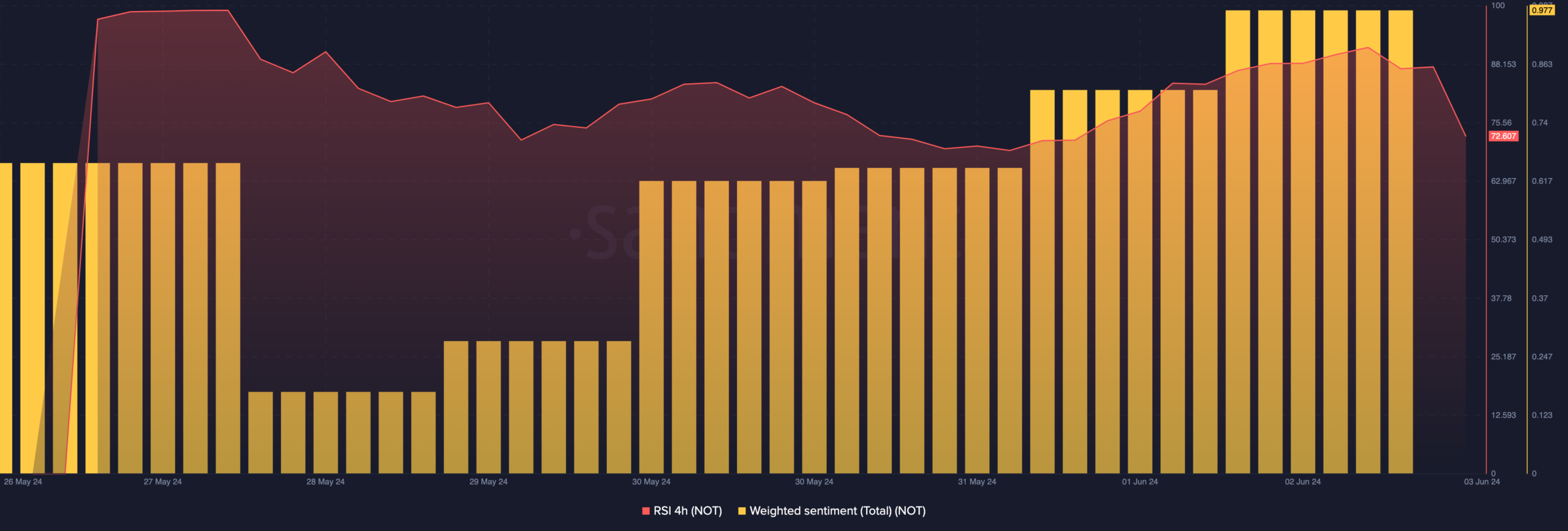

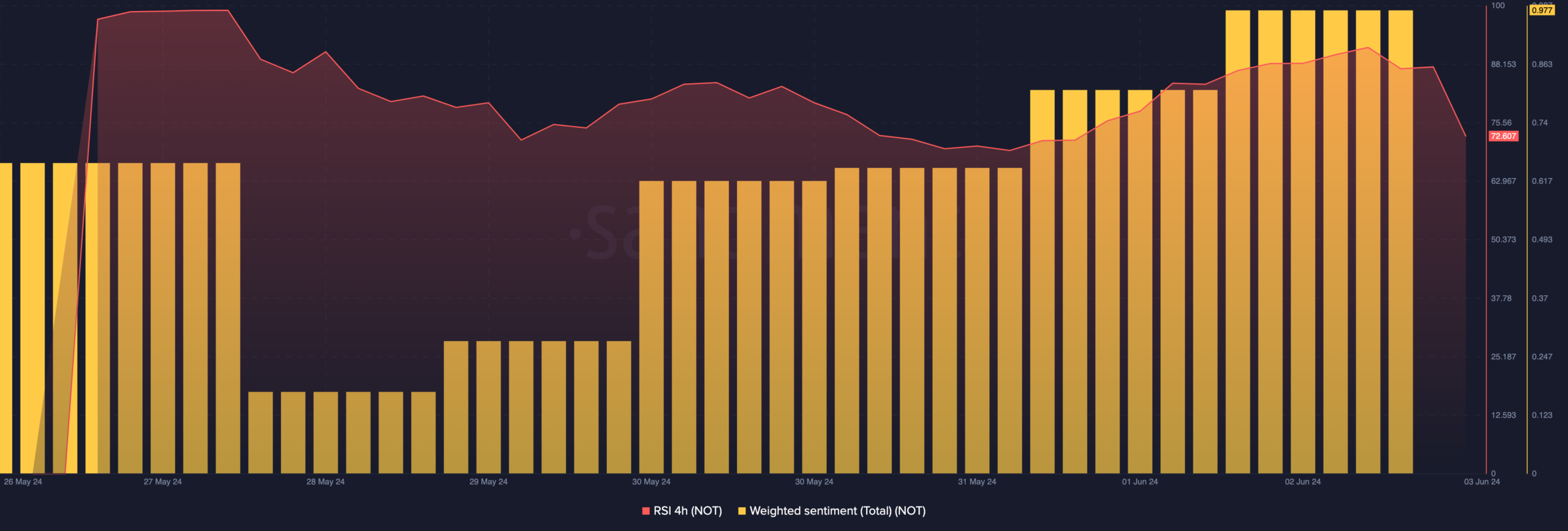

For instance, the Relative Strength Index (RSI) on the 4-hour timeframe was 72.60. The RSI measures momentum. A reading below 30 indicates that an asset is oversold.

But a reading over 70 indicates that the cryptocurrency is overbought, and that was the situation with Notcoin. Considering this position, NOT’s price could fall.

Source: Santiment

If the potential decline continues, the price of NOT could drop to $0.015. However, a resurgence in buying pressure could push the price back in the upward direction.

Beyond that, the Weighted Sentiment was a lot higher than normal, suggesting that many market participants were bullish on NOT. However, this metric seemed to have reached an extreme level. As such, it could validate the bearish prediction above.

Meanwhile, interesting things were happening with Notcoin in the derivatives market.

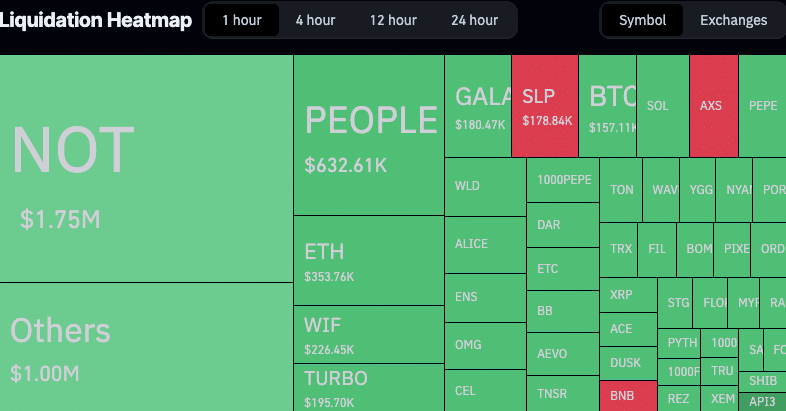

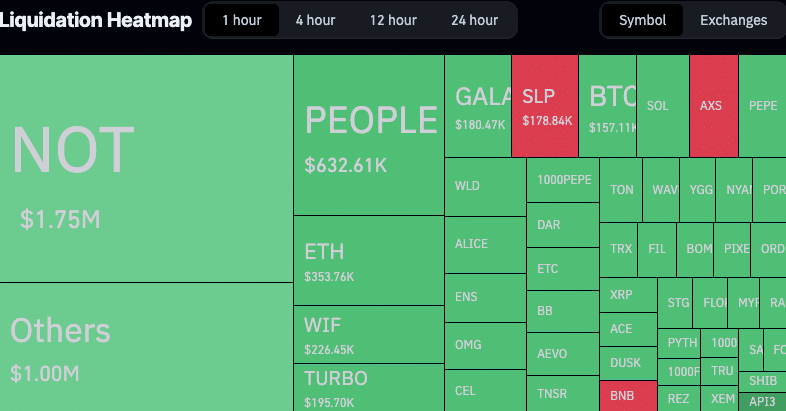

Source: Coinglass

Realistic or not, here’s NOT’s market cap in SOL terms

According to Coinglass, NOT was only behind Bitcoin [BTC] in terms of 24-hour liquidation.

For that period, shorts were the most affected by the $23.48 million liquidation. However, that has changed within the last hour as the decline in NOT’s price has forced longs to record a large part of the $1.75 million wipeout.

- Notcoin’s price rallied, volume hits $4.54 billion, only behind BTC, ETH, and USDT.

- The price could drop to $0.015 as indicators showed that the token was overbought.

The 24-hour volume of Notcoin [NOT], fueled by the tremendous price increase, was more than that of Solana [SOL] and BNB. As of this writing, NOT’s volume was $.4.54 billion, according to Santiment.

The price, on the other hand, was $0.021. This value was at a 287% hike in the last seven days. However, the price mentioned was a decline as Notcoin had initially hit $0.028 on the 2nd of June.

During the same period, BNB’s volume was $1.75 billion while Solana recorded $1.72 billion in trading volume. The metric is an indicator of interest. Therefore, the surge meant a lot of capital was deployed in the token’s favor.

Source: Santiment

Back-to-back jumps

For those unfamiliar, Notcoin launched about a month ago. And previously, AMBCrypto had reported how its launch was marred by selling pressure.

However, another article explained what led to the price surge and the jump into the top 100 per market cap. In the mentioned piece, we had predicted that NOT would hit $0.01.

Interestingly, it did not take long for the project to do that. Moreso, Notcoin is now part of the top 60 in terms of market cap, rising above Bonk [BONK].

Apart from that, the Open Interest (OI) around the token surged over the weekend. According to Coinglass, Notcoin’s OI was as high as $273.02 million.

Source: Coinglass

When the OI decreases, it means that money is exiting the market as more contracts get closed. However, an increase in the metric is a sign of the presence of new liquidity.

For the price, the rising OI was one of the reasons NOT was able to sustain its uptrend. This is because increasing Open Interest can serve as a strength for the direction a token is moving.

However, traders, as well as NOT holders might need to be careful.

NOT becomes overbought, hurts traders’ positions

For instance, the Relative Strength Index (RSI) on the 4-hour timeframe was 72.60. The RSI measures momentum. A reading below 30 indicates that an asset is oversold.

But a reading over 70 indicates that the cryptocurrency is overbought, and that was the situation with Notcoin. Considering this position, NOT’s price could fall.

Source: Santiment

If the potential decline continues, the price of NOT could drop to $0.015. However, a resurgence in buying pressure could push the price back in the upward direction.

Beyond that, the Weighted Sentiment was a lot higher than normal, suggesting that many market participants were bullish on NOT. However, this metric seemed to have reached an extreme level. As such, it could validate the bearish prediction above.

Meanwhile, interesting things were happening with Notcoin in the derivatives market.

Source: Coinglass

Realistic or not, here’s NOT’s market cap in SOL terms

According to Coinglass, NOT was only behind Bitcoin [BTC] in terms of 24-hour liquidation.

For that period, shorts were the most affected by the $23.48 million liquidation. However, that has changed within the last hour as the decline in NOT’s price has forced longs to record a large part of the $1.75 million wipeout.

Ive read several just right stuff here Certainly price bookmarking for revisiting I wonder how a lot effort you place to create this kind of great informative website

how can i get generic clomid pill where buy cheap clomid tablets can i buy cheap clomid tablets order cheap clomiphene pill where buy generic clomiphene no prescription where to buy generic clomiphene no prescription clomiphene nz prescription

With thanks. Loads of expertise!

Thanks on putting this up. It’s evidently done.

purchase azithromycin without prescription – azithromycin buy online metronidazole 400mg for sale

buy domperidone generic – buy generic sumycin 250mg buy cyclobenzaprine without a prescription

cheap inderal 20mg – order clopidogrel online cheap order methotrexate 10mg pills

buy amoxicillin without prescription – ipratropium price buy ipratropium pills

azithromycin cost – nebivolol 5mg cost buy nebivolol medication

purchase amoxiclav pill – atbioinfo ampicillin for sale online

buy esomeprazole 40mg for sale – anexamate.com nexium ca

warfarin 5mg pill – blood thinner losartan generic

buy meloxicam tablets – https://moboxsin.com/ mobic 7.5mg uk

cheap prednisone – corticosteroid order deltasone 20mg online

medications for ed – https://fastedtotake.com/ generic ed pills

order amoxil without prescription – https://combamoxi.com/ amoxicillin over the counter

diflucan 100mg usa – forcan order oral forcan

escitalopram 20mg cost – buy lexapro 10mg for sale lexapro pill

cenforce without prescription – cenforce rs order cenforce 50mg pills

where to buy cialis online for cheap – https://ciltadgn.com/# cialis picture

buy generic cialiss – erectile dysfunction tadalafil п»їwhat can i take to enhance cialis