- Ethereum gas prices declined, but fees paid out to validators rose.

- The price of ETH declined, however, Network Growth surged.

The recent market drawdown impacted Ethereum [ETH] significantly as ETH’s prices fell below the $3400 level.

Low Ethereum gas, high fees

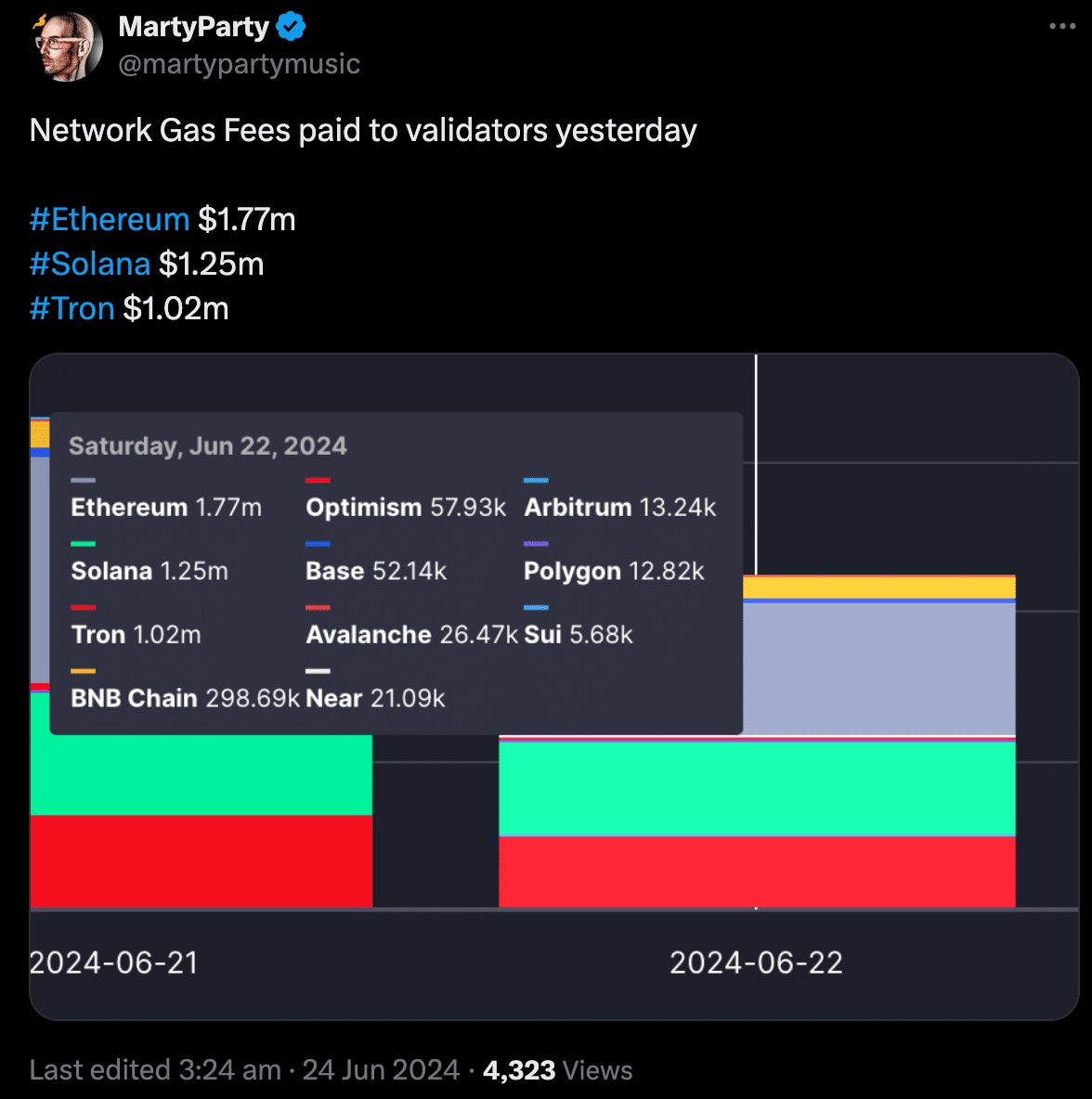

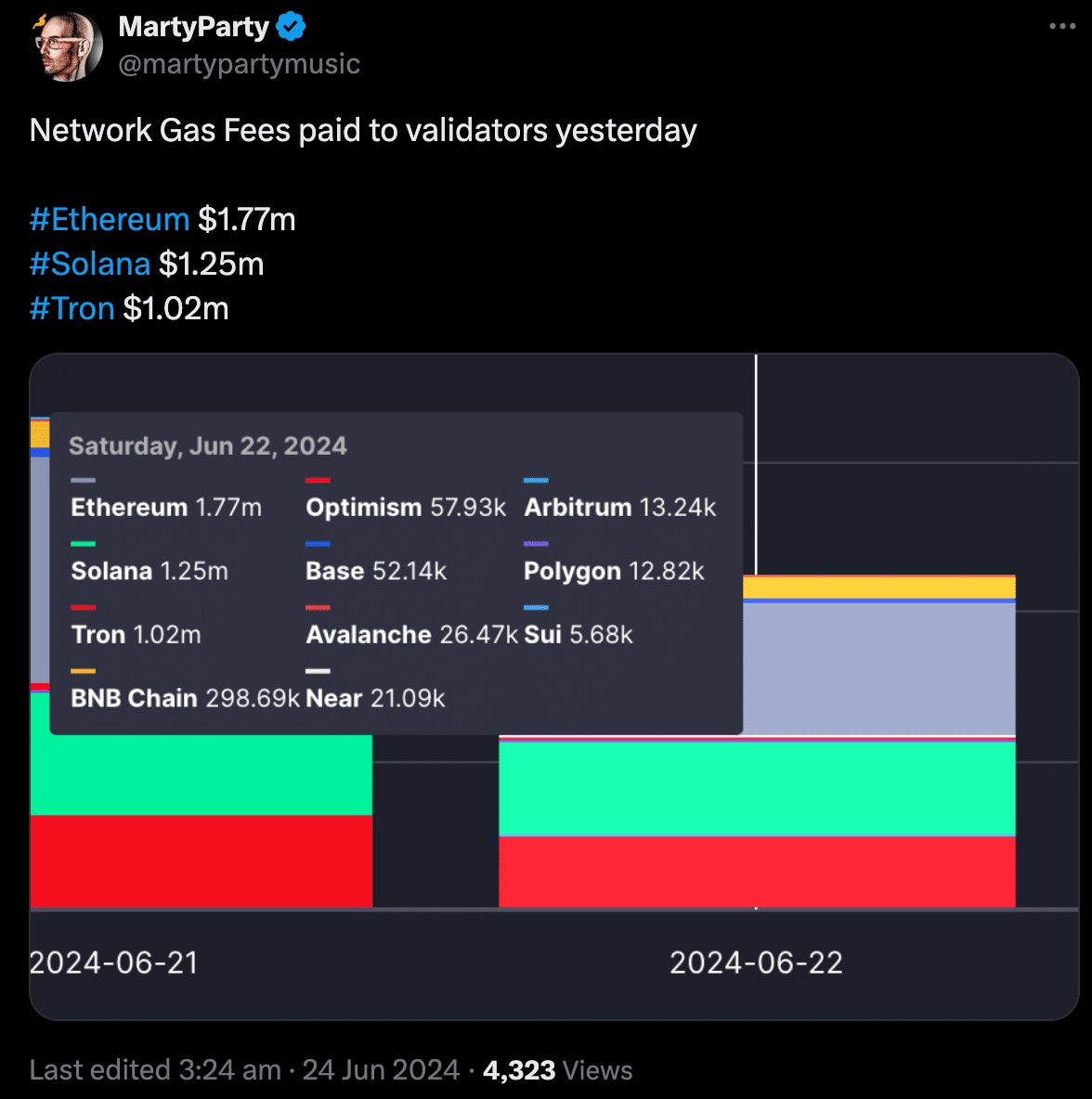

Coupled with that, the Ethereum gas price declined. Despite the declining gas prices, in terms of fees paid out to validators, Ethereum outperformed other networks such as Solana [SOL] and Tron [TRX] by a large margin.

The higher validator fees, despite a gas price drop, could indicate continued strong network usage on Ethereum.

Even with lower per-transaction fees, a higher volume of transactions could generate more total fees for validators.

While validator fees might be high now, they might not be enough to offset the overall price decline of Ethereum.

Source: X

At the time of writing, ETH had fallen by 4.14% in the last 24 hours. One of the reasons for the decline in ETH’s price would be its correlation to BTC which also fell considerably over the last few days.

According to AMBCrypto’s analysis of IntoTheBlock’s data, ETH’s correlation to BTC was at high 0.78.

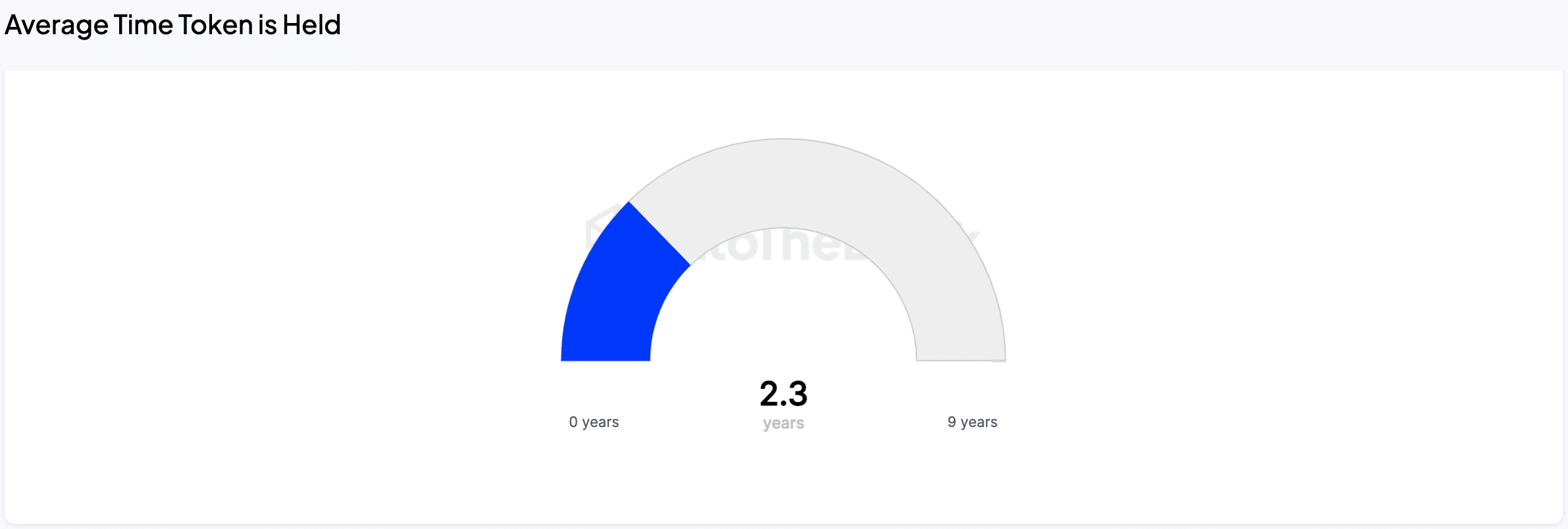

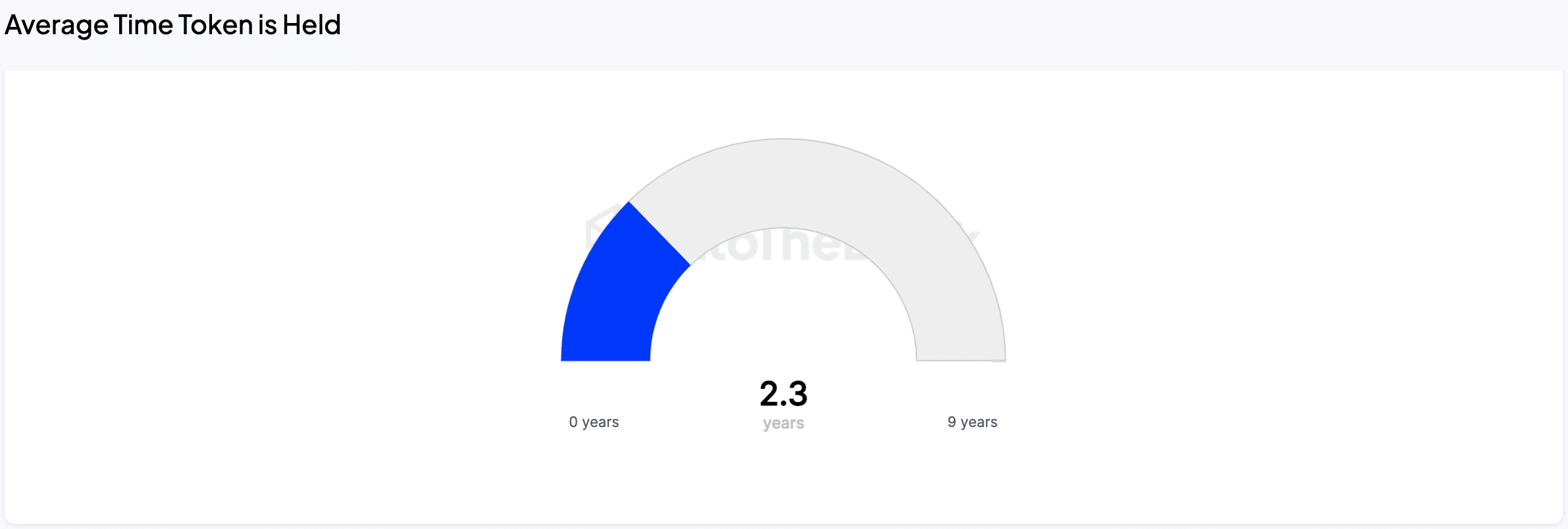

Even with a significant decline in Ethereum’s (ETH) price, a large portion of holders seem to be in it for the long haul. On average, investors are holding onto their ETH for a whopping 2.3 years.

This long-term view is further supported by the fact that coins being actively traded are still held for an average of 2 months, indicating a reluctance to sell.

The average holding time of traded coins offers valuable insights into investor confidence.

When coins are held for longer periods, it suggests investors believe in the long-term potential of Ethereum and are comfortable holding onto their assets.

Conversely, frequent trading activity may indicate a focus on short-term profits and less faith in the future of the market.

Source: IntoTheBlock

On-chain data

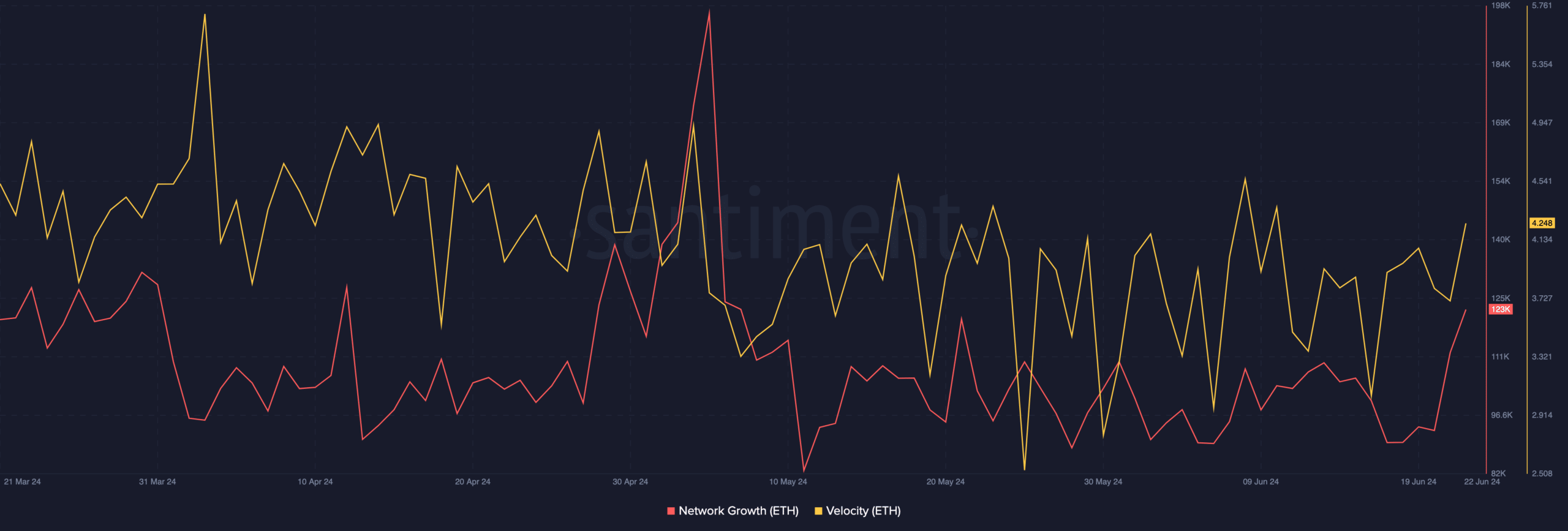

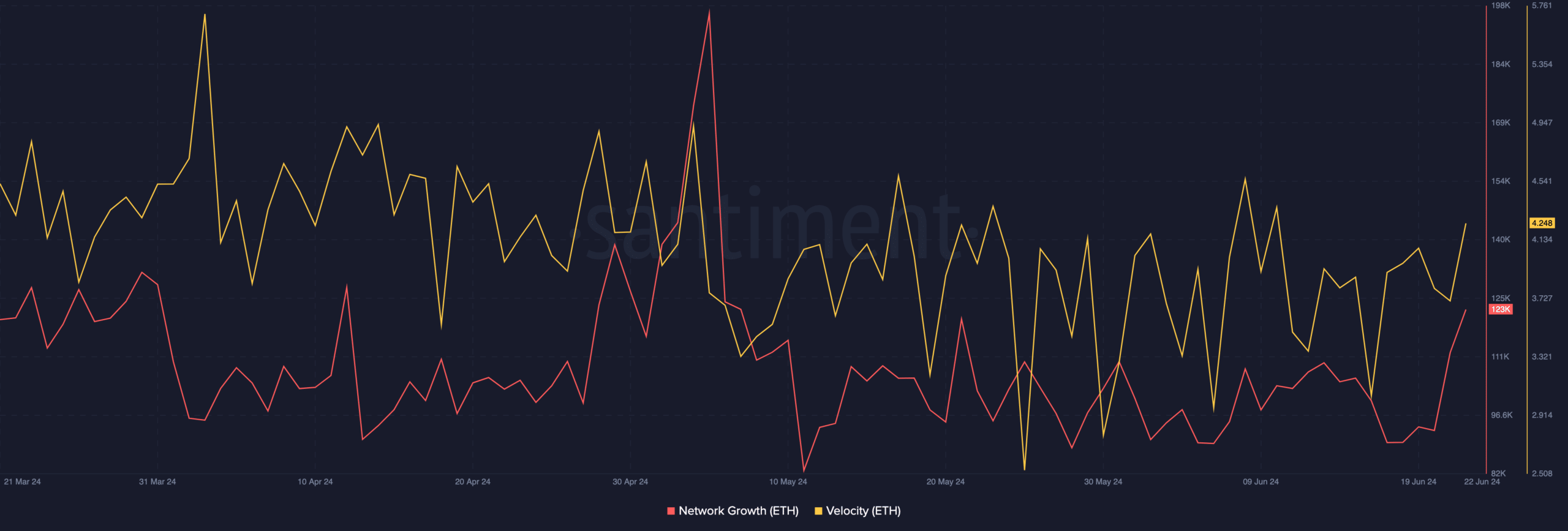

Network Growth for ETH surged materially over the last few days.

Read Ethereum’s [ETH] Price Prediction 2024-2025

So, many new addresses were interacting with ETH at the time of writing, implying that a large amount of addresses were interested in buying ETH at the current discounted rates.

Moreover, the velocity at which ETH was trading had also grown, suggesting that the frequency at which ETH was being transacted had surged.

Source: Santiment

- Ethereum gas prices declined, but fees paid out to validators rose.

- The price of ETH declined, however, Network Growth surged.

The recent market drawdown impacted Ethereum [ETH] significantly as ETH’s prices fell below the $3400 level.

Low Ethereum gas, high fees

Coupled with that, the Ethereum gas price declined. Despite the declining gas prices, in terms of fees paid out to validators, Ethereum outperformed other networks such as Solana [SOL] and Tron [TRX] by a large margin.

The higher validator fees, despite a gas price drop, could indicate continued strong network usage on Ethereum.

Even with lower per-transaction fees, a higher volume of transactions could generate more total fees for validators.

While validator fees might be high now, they might not be enough to offset the overall price decline of Ethereum.

Source: X

At the time of writing, ETH had fallen by 4.14% in the last 24 hours. One of the reasons for the decline in ETH’s price would be its correlation to BTC which also fell considerably over the last few days.

According to AMBCrypto’s analysis of IntoTheBlock’s data, ETH’s correlation to BTC was at high 0.78.

Even with a significant decline in Ethereum’s (ETH) price, a large portion of holders seem to be in it for the long haul. On average, investors are holding onto their ETH for a whopping 2.3 years.

This long-term view is further supported by the fact that coins being actively traded are still held for an average of 2 months, indicating a reluctance to sell.

The average holding time of traded coins offers valuable insights into investor confidence.

When coins are held for longer periods, it suggests investors believe in the long-term potential of Ethereum and are comfortable holding onto their assets.

Conversely, frequent trading activity may indicate a focus on short-term profits and less faith in the future of the market.

Source: IntoTheBlock

On-chain data

Network Growth for ETH surged materially over the last few days.

Read Ethereum’s [ETH] Price Prediction 2024-2025

So, many new addresses were interacting with ETH at the time of writing, implying that a large amount of addresses were interested in buying ETH at the current discounted rates.

Moreover, the velocity at which ETH was trading had also grown, suggesting that the frequency at which ETH was being transacted had surged.

Source: Santiment

clomiphene for sale australia can i order generic clomiphene pills where can i get clomiphene without prescription can you buy cheap clomid without insurance how can i get clomiphene no prescription can i buy cheap clomid pill cost cheap clomid online

You actually stated that fantastically!

casino en ligne fiable

Cheers, Numerous forum posts.

casino en ligne

You actually said it really well.

casino en ligne

Really tons of superb facts.

casino en ligne

Wow all kinds of great data.

casino en ligne

You mentioned that very well.

casino en ligne fiable

You said it very well..

casino en ligne

With thanks, Ample advice!

casino en ligne France

Appreciate it. Loads of tips.

casino en ligne fiable

Thanks a lot. I value this!

casino en ligne

This is the make of post I find helpful.

This is the tolerant of advise I unearth helpful.

azithromycin 250mg without prescription – sumycin tablet order flagyl 200mg generic

purchase domperidone generic – tetracycline 500mg uk cyclobenzaprine online

order inderal 20mg sale – buy methotrexate pills for sale methotrexate 10mg brand

buy amoxicillin pills for sale – diovan canada buy combivent 100 mcg generic

azithromycin 250mg pill – buy bystolic 5mg pills nebivolol 5mg cheap

amoxiclav sale – atbioinfo buy ampicillin antibiotic

buy esomeprazole 40mg sale – nexium to us order nexium capsules

medex uk – https://coumamide.com/ brand cozaar 25mg

order meloxicam generic – https://moboxsin.com/ mobic buy online

prednisone medication – https://apreplson.com/ prednisone 5mg without prescription

medication for ed – buy ed meds best ed pills non prescription uk

buy amoxicillin pills for sale – https://combamoxi.com/ buy cheap amoxicillin

fluconazole 200mg pills – this order diflucan 200mg

buy cenforce 100mg pills – cenforce for sale online order cenforce 100mg without prescription

cialis super active vs regular cialis – https://ciltadgn.com/ cialis from india

ranitidine generic – https://aranitidine.com/# buy zantac pills for sale

cialis ontario no prescription – https://strongtadafl.com/ cheapest 10mg cialis

This is the big-hearted of literature I rightly appreciate. https://gnolvade.com/

buy viagra at walgreens – click viagra cheap online no prescription

The sagacity in this tune is exceptional. https://ursxdol.com/propecia-tablets-online/

This is the big-hearted of literature I truly appreciate. furosemide uk

Facts blog you possess here.. It’s hard to espy strong status writing like yours these days. I truly comprehend individuals like you! Rent care!! https://prohnrg.com/product/lisinopril-5-mg/

Greetings! Jolly useful suggestion within this article! It’s the petty changes which will espy the largest changes. Thanks a lot towards sharing! https://ondactone.com/simvastatin/

More content pieces like this would make the web better.

https://proisotrepl.com/product/tetracycline/

This is a theme which is virtually to my heart… Myriad thanks! Quite where can I upon the acquaintance details due to the fact that questions? http://www.zgqsz.com/home.php?mod=space&uid=846485

how to get forxiga without a prescription – https://janozin.com/ dapagliflozin over the counter

buy xenical online – https://asacostat.com/# purchase xenical generic

This website exceedingly has all of the tidings and facts I needed there this thesis and didn’t know who to ask. http://3ak.cn/home.php?mod=space&uid=230411