- Justin Sun’s strategic move on WBTC raises concerns.

- A few hours later, there was no significant impact on WBTC’s TVL or flows.

Tron’s founder Justin Sun has hit headlines following his involvement with Wrapped Bitcoin (WBTC) custody operations. His firm, BiT Global, has partnered with BitGo, to drive ‘first multi-jurisdictional and multi-institutional custody.’

However, the partnership has raised decentralization concerns among community members, prompting the executive to respond and defend himself. Part of Sun’s statement read,

‘My personal involvement in WBTC is entirely strategic. I do not control the private keys to the WBTC reserves and cannot move any BTC reserves.’

Sun added that,

‘But my goal with all these relationships is to promote projects dedicated to decentralization, security protocols, and safety. WBTC is a critical part of the defi ecosystem, and I look forward to ensuring it continues to be!’

Reaction to Justin Sun’s WBTC move

For perspective, WBTC is one of the largest DeFi collateral tokens. It’s backed 1:1 with Bitcoin to bring BTC’s liquidity within Ethereum’s DeFi ecosystem.

Following the Sun’s partnership with WBTC, a key DeFi player Maker flagged the move as a risk.

‘We find that Sun’s involvement as a controlling interest in the new WBTC joint venture presents an unacceptable level of risk.’

Maker cited a lack of transparency in other Sun’s projects, including Huobi’s USDT reserves. Additionally, the firm labeled BitGo a counter-party risk after Galaxy Digital’s recent failed acquisition.

As a result, Maker was mulling delisting WBTC from its platforms unless BitGo assured that the new partnership would be safe.

‘We will consider further recommendations for parameter changes to protect the protocol and mitigate counterparty risks, up to and including potential full offboarding of all Maker and Spark WBTC collateral integrations.’

However, in a rejoinder, BitGo CEO Mike Belshe dismissed Maker’s concerns, stating that they are ‘reaction to Justin Sun and not facts.’

‘This seems to be more a reaction to the Justin Sun name than to facts.’

On his part, Wormhole co-founder Dan Reecer nudged players to opt for decentralized wrapped BTC with decentralized custodians.

‘Another example of decentralization not being a priority until there’s a wakeup call.’

The decentralized wrapped BTC calls were also echoed by Austin Federa, Strategy executive at Solana Foundation.

‘Decentralized wrapped bitcoin is badly needed. It’s wild we’re 15 years into the Bitcoin revolution and still have to trust centralized custodians.’

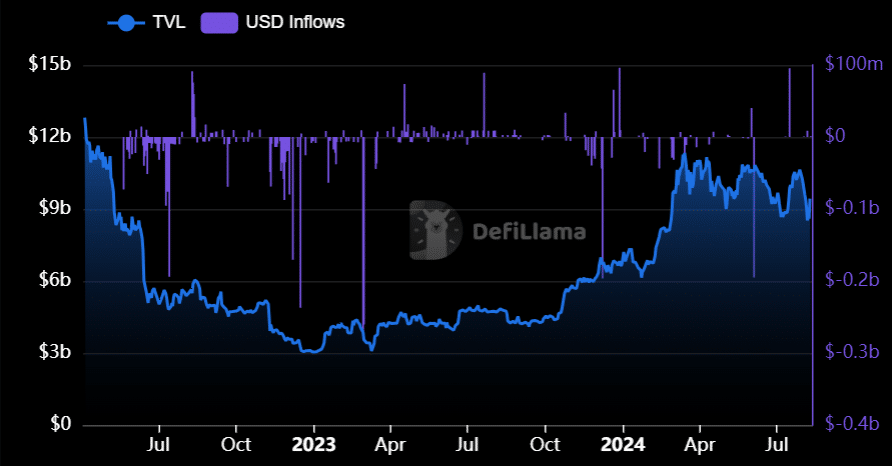

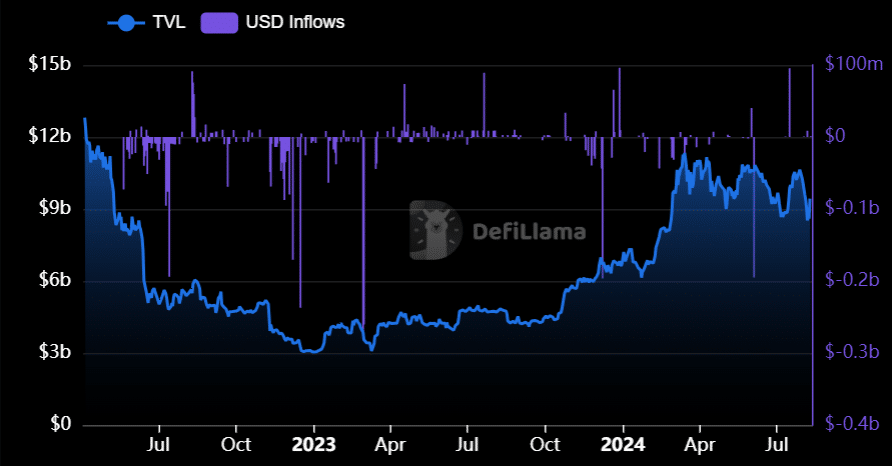

State of WBTC

Source: DeFillama

At the time of writing, WBTC had $9.4 billion in TVL (total value locked). A few hours after concerns were raised about Sun’s involvement, there was no sign of a steep decline in TVL or outflows.

- Justin Sun’s strategic move on WBTC raises concerns.

- A few hours later, there was no significant impact on WBTC’s TVL or flows.

Tron’s founder Justin Sun has hit headlines following his involvement with Wrapped Bitcoin (WBTC) custody operations. His firm, BiT Global, has partnered with BitGo, to drive ‘first multi-jurisdictional and multi-institutional custody.’

However, the partnership has raised decentralization concerns among community members, prompting the executive to respond and defend himself. Part of Sun’s statement read,

‘My personal involvement in WBTC is entirely strategic. I do not control the private keys to the WBTC reserves and cannot move any BTC reserves.’

Sun added that,

‘But my goal with all these relationships is to promote projects dedicated to decentralization, security protocols, and safety. WBTC is a critical part of the defi ecosystem, and I look forward to ensuring it continues to be!’

Reaction to Justin Sun’s WBTC move

For perspective, WBTC is one of the largest DeFi collateral tokens. It’s backed 1:1 with Bitcoin to bring BTC’s liquidity within Ethereum’s DeFi ecosystem.

Following the Sun’s partnership with WBTC, a key DeFi player Maker flagged the move as a risk.

‘We find that Sun’s involvement as a controlling interest in the new WBTC joint venture presents an unacceptable level of risk.’

Maker cited a lack of transparency in other Sun’s projects, including Huobi’s USDT reserves. Additionally, the firm labeled BitGo a counter-party risk after Galaxy Digital’s recent failed acquisition.

As a result, Maker was mulling delisting WBTC from its platforms unless BitGo assured that the new partnership would be safe.

‘We will consider further recommendations for parameter changes to protect the protocol and mitigate counterparty risks, up to and including potential full offboarding of all Maker and Spark WBTC collateral integrations.’

However, in a rejoinder, BitGo CEO Mike Belshe dismissed Maker’s concerns, stating that they are ‘reaction to Justin Sun and not facts.’

‘This seems to be more a reaction to the Justin Sun name than to facts.’

On his part, Wormhole co-founder Dan Reecer nudged players to opt for decentralized wrapped BTC with decentralized custodians.

‘Another example of decentralization not being a priority until there’s a wakeup call.’

The decentralized wrapped BTC calls were also echoed by Austin Federa, Strategy executive at Solana Foundation.

‘Decentralized wrapped bitcoin is badly needed. It’s wild we’re 15 years into the Bitcoin revolution and still have to trust centralized custodians.’

State of WBTC

Source: DeFillama

At the time of writing, WBTC had $9.4 billion in TVL (total value locked). A few hours after concerns were raised about Sun’s involvement, there was no sign of a steep decline in TVL or outflows.

cost clomiphene without rx clomiphene pills for sale clomiphene chart order clomiphene without insurance generic clomid for sale can i order generic clomid without a prescription can i get cheap clomid price

Thanks towards putting this up. It’s well done.

This website exceedingly has all of the tidings and facts I needed to this participant and didn’t positive who to ask.

azithromycin 250mg cost – azithromycin 500mg oral metronidazole 200mg brand

semaglutide uk – order generic rybelsus 14 mg buy periactin generic

motilium pill – buy flexeril online cheap buy cheap generic flexeril

buy amoxil online – order combivent generic oral combivent

azithromycin 500mg pills – purchase zithromax pill bystolic online order

amoxiclav sale – atbioinfo.com order ampicillin sale

brand esomeprazole 40mg – https://anexamate.com/ nexium 20mg uk

coumadin buy online – https://coumamide.com/ cozaar oral

buy mobic 7.5mg without prescription – https://moboxsin.com/ buy meloxicam cheap

deltasone 5mg us – https://apreplson.com/ buy prednisone 40mg generic

buy cheap generic ed pills – fast ed to take site buy ed pills without a prescription

amoxil brand – https://combamoxi.com/ buy amoxil cheap

diflucan canada – https://gpdifluca.com/ fluconazole cheap

cenforce medication – https://cenforcers.com/# order cenforce online cheap

buy cialis online overnight delivery – tadalafil citrate research chemical cialis professional review

buy ranitidine 300mg generic – https://aranitidine.com/ buy ranitidine pill

difference between sildenafil and tadalafil – https://strongtadafl.com/# cialis covered by insurance

Thanks an eye to sharing. It’s acme quality. precio propecia espaГ±a

buy viagra kamagra – buy viagra 100 mg online viagra sale jamaica

This website absolutely has all of the low-down and facts I needed there this participant and didn’t know who to ask. https://ursxdol.com/levitra-vardenafil-online/

Greetings! Utter productive suggestion within this article! It’s the scarcely changes which will make the largest changes. Thanks a quantity in the direction of sharing! https://buyfastonl.com/furosemide.html

I’ll certainly bring to read more. https://prohnrg.com/product/priligy-dapoxetine-pills/

More posts like this would prosper the blogosphere more useful. https://aranitidine.com/fr/prednisolone-achat-en-ligne/

The vividness in this ruined is exceptional. https://ondactone.com/product/domperidone/

The thoroughness in this draft is noteworthy.

buy mobic cheap

With thanks. Loads of erudition! http://sols9.com/batheo/Forum/User-Toaqpr