- Metaplanet raises 10 billion yen to expand its Bitcoin holdings, following MicroStrategy’s lead.

- Despite a 5.85% stock drop, Metaplanet boasts 644% year-to-date gains.

Japanese firm Metaplanet has recently gained attention for significantly increasing its Bitcoin [BTC] holdings.

As of the latest update, Metaplanet, often referred to as Asia’s MicroStrategy, has raised 10 billion Yen in fresh capital through its recent stock sale under the 11th series of Stock Acquisition Rights.

Metaplanet’s new Bitcoin strategy

In fact, according to the latest data from Bitcoin Treasuries, Metaplanet recently made two substantial BTC acquisitions on the 15th and 16th of October, pushing the company’s total Bitcoin balance to 861.4 BTC.

This highlights the company’s plans to follow MicroStrategy’s lead by using these funds to expand its Bitcoin holdings.

With 13,774 shareholders participating, the exercise of these rights was fully backed by EVO FUND, resulting in significant proceeds.

Meanwhile, Bitcoin saw over 2% price dip after facing resistance at the $69,000 mark, reflecting ongoing volatility in the market.

As of the latest update from CoinMarketCap, BTC was trading at $66,942.

Metaplanet’s CEO weighs in

Remarking on the same, Metaplanet CEO Somin Gerovich noted,

“Metaplanet Inc. has concluded the exercise period for its 11th Stock Acquisition Rights, achieving a 72.8% exercise rate with participation from 13,774 individual shareholders.”

He added,

“The Company has also approved the transfer of unexercised rights to EVO FUND, which has committed to exercising all transferred rights by October 22, 2024.”

Gerovich explained that once the process of issuing stock acquisition rights is fully completed, Metaplanet will have successfully raised a total of 10 billion yen.

He further expressed gratitude to its shareholders for their support and financial contributions, which are crucial for its goal of becoming a major holder of BTC.

The “final results” refer to the complete accounting and reporting of the funds raised after EVO FUND (the entity involved in exercising these stock acquisition rights) completes its transaction.

All in all, Metaplanet is updating its shareholders on the progress and reaffirming its commitment to using the capital to advance its Bitcoin-focused mission.

Impact on Metaplanet’s share price

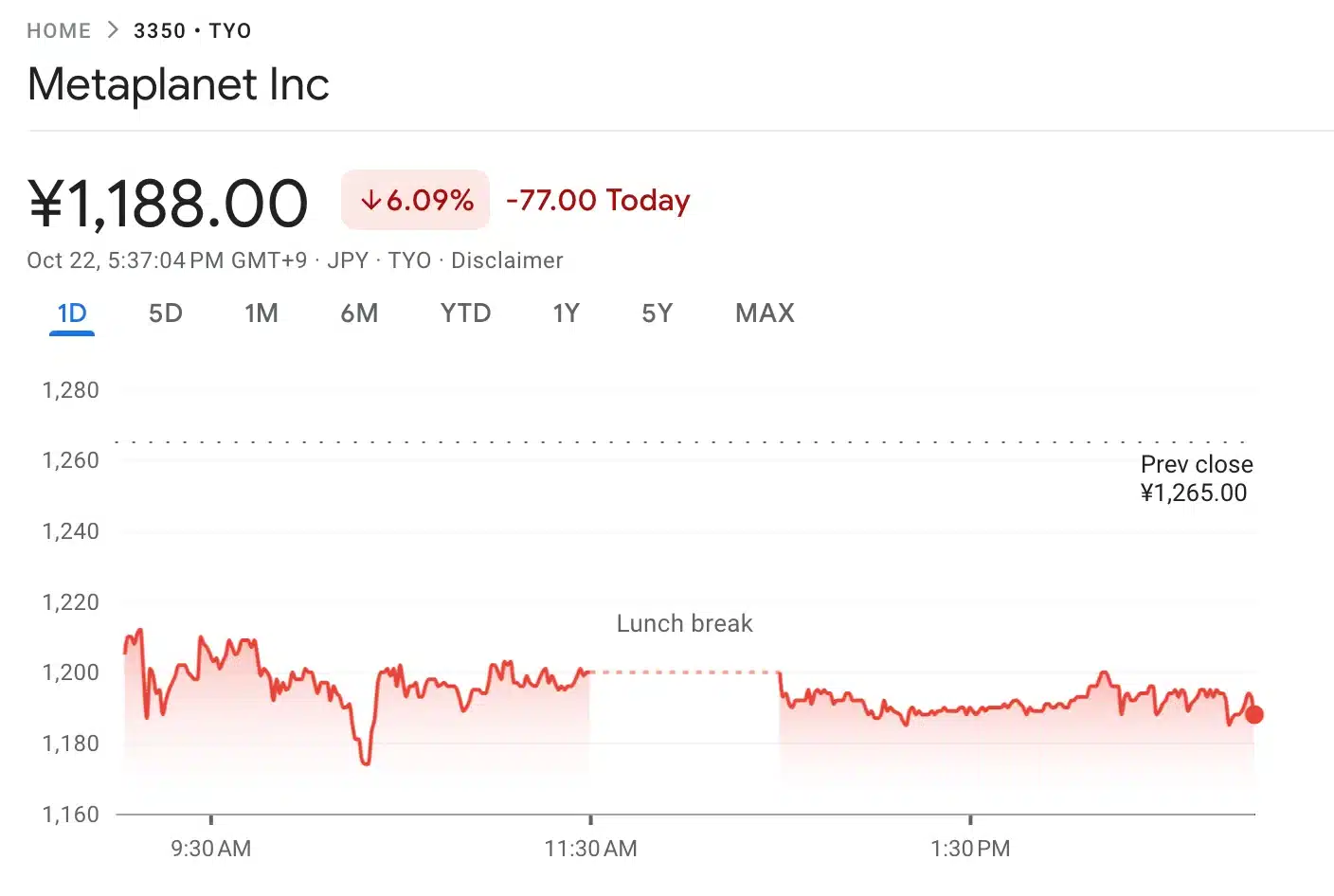

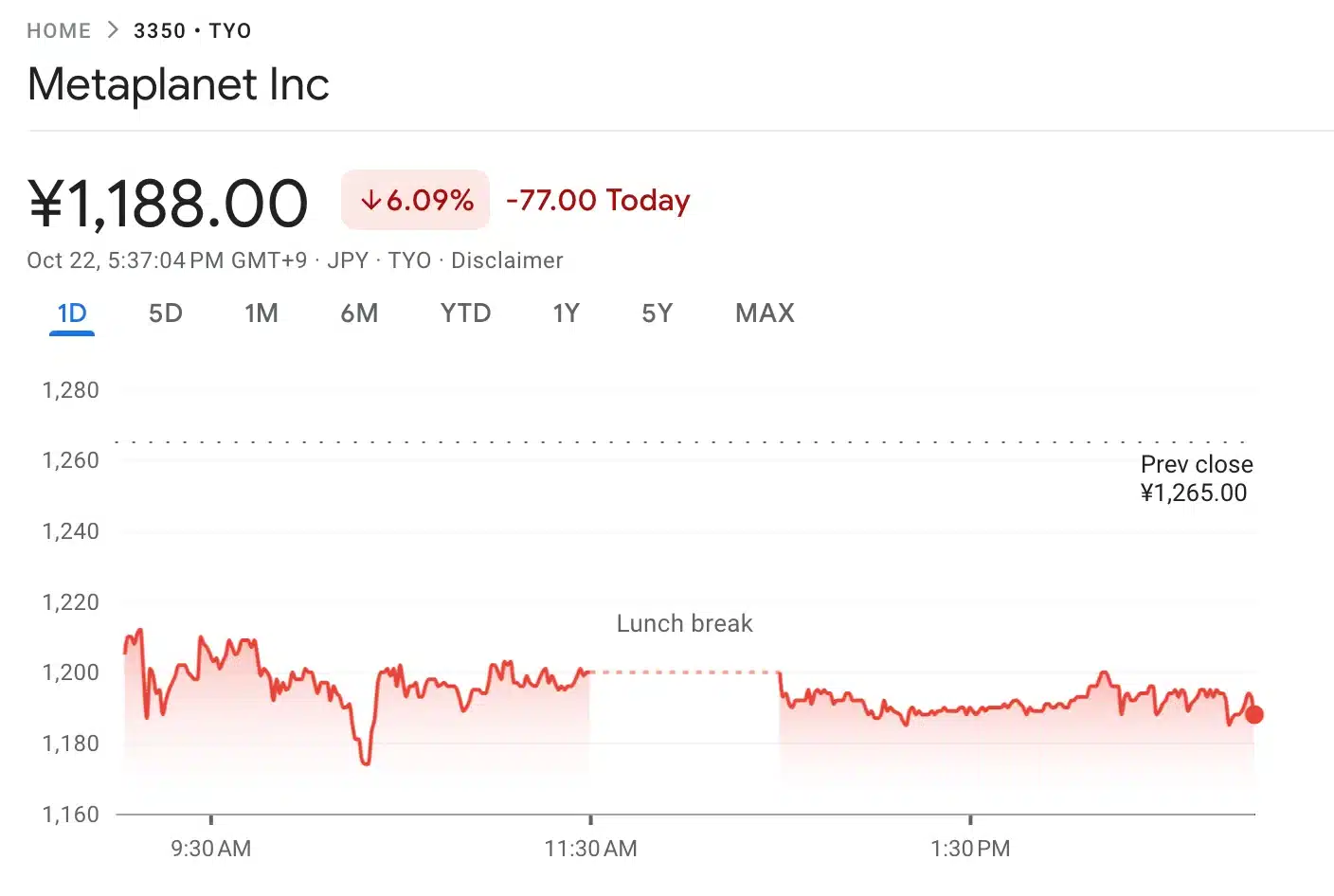

After today’s stock sale, Metaplanet’s share price saw a significant decline, falling by 5.85% to below 1,200 JPY.

Despite this drop, the company remains in strong standing with a remarkable 644% increase in year-to-date gains.

As of the latest update, Metaplanet’s stock price further dipped by 6.09%, trading at 1,188 JPY.

Source: Google Finance

This volatility reflects the market’s immediate reaction to the stock sale, yet the company’s overall performance continues to demonstrate impressive growth in the longer term.

Hence, by embracing BTC, Metaplanet seeks to navigate Japan’s challenging economic conditions marked by negative interest rates and quantitative easing.

This bold approach positions the company to hedge against the country’s financial challenges while aligning with the global shift towards digital assets.

- Metaplanet raises 10 billion yen to expand its Bitcoin holdings, following MicroStrategy’s lead.

- Despite a 5.85% stock drop, Metaplanet boasts 644% year-to-date gains.

Japanese firm Metaplanet has recently gained attention for significantly increasing its Bitcoin [BTC] holdings.

As of the latest update, Metaplanet, often referred to as Asia’s MicroStrategy, has raised 10 billion Yen in fresh capital through its recent stock sale under the 11th series of Stock Acquisition Rights.

Metaplanet’s new Bitcoin strategy

In fact, according to the latest data from Bitcoin Treasuries, Metaplanet recently made two substantial BTC acquisitions on the 15th and 16th of October, pushing the company’s total Bitcoin balance to 861.4 BTC.

This highlights the company’s plans to follow MicroStrategy’s lead by using these funds to expand its Bitcoin holdings.

With 13,774 shareholders participating, the exercise of these rights was fully backed by EVO FUND, resulting in significant proceeds.

Meanwhile, Bitcoin saw over 2% price dip after facing resistance at the $69,000 mark, reflecting ongoing volatility in the market.

As of the latest update from CoinMarketCap, BTC was trading at $66,942.

Metaplanet’s CEO weighs in

Remarking on the same, Metaplanet CEO Somin Gerovich noted,

“Metaplanet Inc. has concluded the exercise period for its 11th Stock Acquisition Rights, achieving a 72.8% exercise rate with participation from 13,774 individual shareholders.”

He added,

“The Company has also approved the transfer of unexercised rights to EVO FUND, which has committed to exercising all transferred rights by October 22, 2024.”

Gerovich explained that once the process of issuing stock acquisition rights is fully completed, Metaplanet will have successfully raised a total of 10 billion yen.

He further expressed gratitude to its shareholders for their support and financial contributions, which are crucial for its goal of becoming a major holder of BTC.

The “final results” refer to the complete accounting and reporting of the funds raised after EVO FUND (the entity involved in exercising these stock acquisition rights) completes its transaction.

All in all, Metaplanet is updating its shareholders on the progress and reaffirming its commitment to using the capital to advance its Bitcoin-focused mission.

Impact on Metaplanet’s share price

After today’s stock sale, Metaplanet’s share price saw a significant decline, falling by 5.85% to below 1,200 JPY.

Despite this drop, the company remains in strong standing with a remarkable 644% increase in year-to-date gains.

As of the latest update, Metaplanet’s stock price further dipped by 6.09%, trading at 1,188 JPY.

Source: Google Finance

This volatility reflects the market’s immediate reaction to the stock sale, yet the company’s overall performance continues to demonstrate impressive growth in the longer term.

Hence, by embracing BTC, Metaplanet seeks to navigate Japan’s challenging economic conditions marked by negative interest rates and quantitative easing.

This bold approach positions the company to hedge against the country’s financial challenges while aligning with the global shift towards digital assets.

http://www.modric-luka-ar.biz

last news about modric luka

modric-luka-ar.biz

http://www.ali-al-bulaihi-ar.biz

last news about ali al bulaihi

https://ali-al-bulaihi-ar.biz

Thinker Pedia Great information shared.. really enjoyed reading this post thank you author for sharing this post .. appreciated

Some truly interesting points you have written.Assisted me a lot, just what I was searching for : D.

What i do not realize is in reality how you’re no longer actually a lot more smartly-liked than you may be now. You’re so intelligent. You already know thus significantly on the subject of this subject, made me personally consider it from a lot of varied angles. Its like men and women are not interested except it¦s something to accomplish with Lady gaga! Your individual stuffs excellent. Always maintain it up!

Very interesting information!Perfect just what I was looking for!

With havin so much written content do you ever run into any issues of plagorism or copyright violation? My blog has a lot of exclusive content I’ve either authored myself or outsourced but it seems a lot of it is popping it up all over the web without my authorization. Do you know any techniques to help stop content from being stolen? I’d really appreciate it.

I really like your writing style, great information, thanks for posting : D.

Purdentix

Purdentix reviews

I love how user-friendly and intuitive everything feels.

It provides an excellent user experience from start to finish.

The layout is visually appealing and very functional.

This site truly stands out as a great example of quality web design and performance.

I love how user-friendly and intuitive everything feels.

This site truly stands out as a great example of quality web design and performance.

I love how user-friendly and intuitive everything feels.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

I’m really impressed by the speed and responsiveness.

It provides an excellent user experience from start to finish.

The content is engaging and well-structured, keeping visitors interested.

This site truly stands out as a great example of quality web design and performance.

It provides an excellent user experience from start to finish.

I love how user-friendly and intuitive everything feels.

The design and usability are top-notch, making everything flow smoothly.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

The content is engaging and well-structured, keeping visitors interested.

The design and usability are top-notch, making everything flow smoothly.

This website is amazing, with a clean design and easy navigation.

The content is engaging and well-structured, keeping visitors interested.

I’m really impressed by the speed and responsiveness.

This website is amazing, with a clean design and easy navigation.

This is such an important and often overlooked topic Thank you for bringing attention to it and offering valuable advice

The cosmos is said to be an ordered place, ruled by laws and principles, yet within that order exists chaos, unpredictability, and the unexpected. Perhaps true balance is not about eliminating chaos but embracing it, learning to see the beauty in disorder, the harmony within the unpredictable. Maybe to truly understand the universe, we must stop trying to control it and simply become one with its rhythm.

Purdentix

where can i buy generic clomid pill clomid order clomiphene pills price at clicks order cheap clomid where to buy generic clomiphene can i get generic clomiphene online can i purchase cheap clomid without a prescription

The thoroughness in this section is noteworthy.

More articles like this would pretence of the blogosphere richer.

azithromycin us – buy tinidazole tablets metronidazole pill

order rybelsus 14 mg online cheap – semaglutide 14 mg ca buy cyproheptadine 4mg without prescription

motilium price – motilium 10mg sale cyclobenzaprine 15mg over the counter

I have been exploring for a bit for any high quality articles or weblog posts in this sort of house . Exploring in Yahoo I at last stumbled upon this site. Studying this information So i’m happy to express that I have an incredibly excellent uncanny feeling I discovered just what I needed. I so much for sure will make certain to do not disregard this site and give it a glance regularly.

purchase amoxiclav pill – https://atbioinfo.com/ acillin without prescription

esomeprazole 20mg canada – nexium to us buy esomeprazole 40mg generic

where to buy warfarin without a prescription – coumamide.com order cozaar online cheap

mobic over the counter – relieve pain brand mobic 7.5mg

buy prednisone generic – https://apreplson.com/ brand prednisone 40mg

Hmm it appears like your site ate my first comment (it was super long) so I guess I’ll just sum it up what I had written and say, I’m thoroughly enjoying your blog. I too am an aspiring blog blogger but I’m still new to the whole thing. Do you have any tips and hints for beginner blog writers? I’d really appreciate it.

erectile dysfunction medicines – https://fastedtotake.com/ ed solutions

amoxicillin canada – comba moxi buy amoxicillin cheap

forcan canada – on this site diflucan price

order cenforce 100mg online – https://cenforcers.com/# cenforce ca

cialis directions – https://ciltadgn.com/# cialis 5mg price comparison

purchase ranitidine pills – brand zantac 300mg ranitidine 300mg ca

Cialis Online Access – Trusted Solutions for Men’s | Tadal Access – prescription for cialis no prescription female cialis

I am actually delighted to glance at this blog posts which consists of tons of profitable facts, thanks object of providing such data. site

100mg viagra – viagra sildenafil 50mg tablets best price for viagra 100mg

I’ll certainly return to be familiar with more. https://ursxdol.com/provigil-gn-pill-cnt/

With thanks. Loads of erudition! https://prohnrg.com/product/priligy-dapoxetine-pills/

Hey! This is my first comment here so I just wanted to give a quick shout out and tell you I genuinely enjoy reading through your articles. Can you recommend any other blogs/websites/forums that deal with the same subjects? Thanks!

This website absolutely has all of the tidings and facts I needed adjacent to this participant and didn’t know who to ask. levitra 20 mg prix

This is the kind of enter I turn up helpful. https://ondactone.com/product/domperidone/

This is the kind of literature I truly appreciate.

https://proisotrepl.com/product/tetracycline/

Rattling fantastic information can be found on blog. “Life without a friend is death without a witness.” by Eugene Benge.

Thank you for sharing superb informations. Your web-site is very cool. I’m impressed by the details that you’ve on this site. It reveals how nicely you perceive this subject. Bookmarked this website page, will come back for more articles. You, my pal, ROCK! I found simply the information I already searched all over the place and just couldn’t come across. What a great web site.

I’ll certainly carry back to skim more. http://bbs.yongrenqianyou.com/home.php?mod=space&uid=4272506&do=profile

Hello there, I discovered your website by the use of Google at the same time as looking for a comparable topic, your web site got here up, it appears good. I’ve bookmarked it in my google bookmarks.

I went over this web site and I believe you have a lot of fantastic info , saved to favorites (:.

I am always browsing online for posts that can aid me. Thank you!

dapagliflozin 10mg for sale – https://janozin.com/ purchase dapagliflozin without prescription

orlistat order online – https://asacostat.com/# order xenical 60mg without prescription