- Metaplanet soared over 900% YTD as its BTC strategy paid off.

- Metaplanet has been accumulating BTC over the last two months, totaling to 225.611 BTC

Throughout the year, major companies have been turning to BTC to boost their stock. Metaplanet, a Japanese firm, has been at the forefront of this movement, driving institutional interests in Bitcoin [BTC].

Metaplanet’s strategy pays off

Over the past two months, Metaplanet has been on a BTC buying spree, increasing their total holdings through accumulation. On the 28th of May 2024, the company announced the purchase of BTC worth $1.6 million.

Earlier in the month, the company had purchased 19.87 BTC worth $1.7 million. In June, Metaplanet announced another purchase of 23.25 BTC worth $1.59 million, totaling $141.07 million.

In July so far, the company has continued with the accumulation with the latest purchase of 21.877 BTC, driving the total holding to 245.611 BTC worth $14.8 million, based on prevailing market rates.

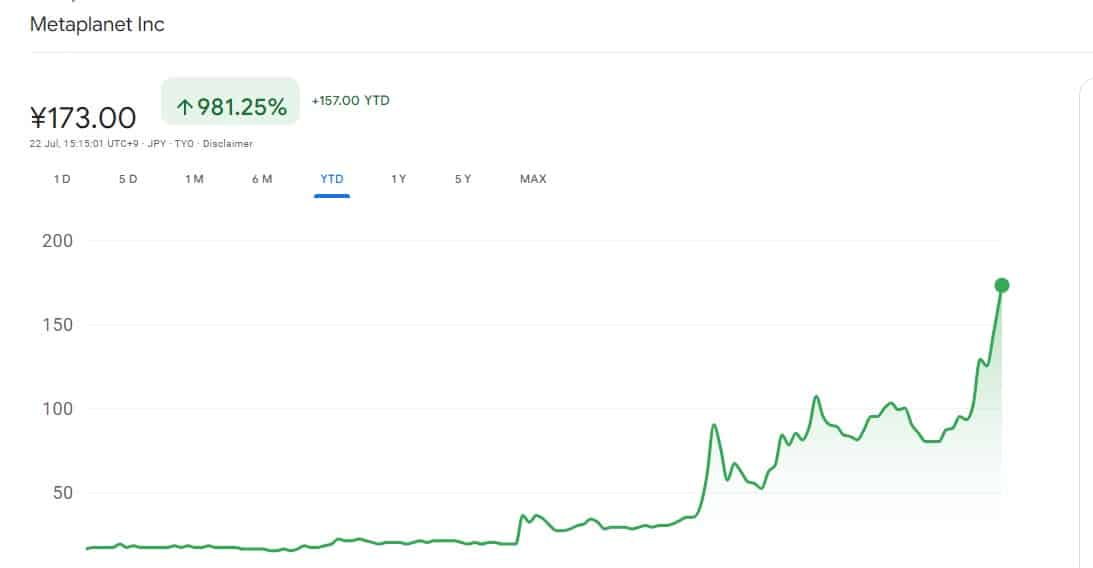

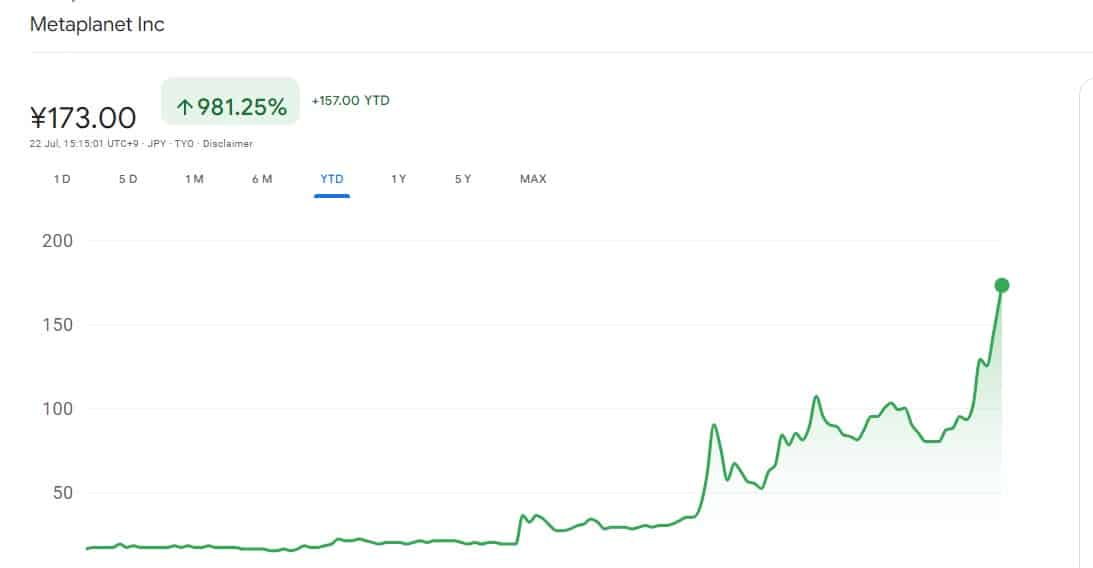

Metaplanet’s strategic BTC accumulation over the past months has seen its stock rise exponentially.

Source: Google Finance

The recent buying spree is paying off, with Metaplanet becoming one of the key institutional players on the global stage. According to CoinGecko, Metaplanet was the 2oth-largest corporate BTC holder at press time.

The continued accumulation of BTC has seen its shares rise exponentially. As of this writing, Metaplanet’s shares have surged by 19.31% over the past 24 hrs.

According to Google Finance, its shares have surged by 51.75% over the past five days and an 82% surge over the past month. The recent surge has pushed the year to date-to over 900%.

Therefore, the continued surge in shares suggested their initiative to use BTC as a strategic treasury reserve asset is paying off tenfold.

Bitcoin as an alternative in Japan?

The Japanese economy has been suffering more than any other economy among developed and G-7 countries.

Therefore, Metaplanet’s strategy includes means to avoid and manage risks associated with a poorly performing economy.

Currently, Japan has a high national debt of 261% of the country’s GDP, which has affected the currency. The Japanese Yen has been depreciating against the dollar, exchanging from $1 to 156.70 yen at press time.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Therefore, Metaplanet incorporated BTC into its treasury assets, and the company aimed to mitigate its exposure to the Yen, which has significantly depreciated over the last year.

With BTC projected to grow further past $100k by 2024, Metaplanet aims to leverage this growth and boost its share performance.

- Metaplanet soared over 900% YTD as its BTC strategy paid off.

- Metaplanet has been accumulating BTC over the last two months, totaling to 225.611 BTC

Throughout the year, major companies have been turning to BTC to boost their stock. Metaplanet, a Japanese firm, has been at the forefront of this movement, driving institutional interests in Bitcoin [BTC].

Metaplanet’s strategy pays off

Over the past two months, Metaplanet has been on a BTC buying spree, increasing their total holdings through accumulation. On the 28th of May 2024, the company announced the purchase of BTC worth $1.6 million.

Earlier in the month, the company had purchased 19.87 BTC worth $1.7 million. In June, Metaplanet announced another purchase of 23.25 BTC worth $1.59 million, totaling $141.07 million.

In July so far, the company has continued with the accumulation with the latest purchase of 21.877 BTC, driving the total holding to 245.611 BTC worth $14.8 million, based on prevailing market rates.

Metaplanet’s strategic BTC accumulation over the past months has seen its stock rise exponentially.

Source: Google Finance

The recent buying spree is paying off, with Metaplanet becoming one of the key institutional players on the global stage. According to CoinGecko, Metaplanet was the 2oth-largest corporate BTC holder at press time.

The continued accumulation of BTC has seen its shares rise exponentially. As of this writing, Metaplanet’s shares have surged by 19.31% over the past 24 hrs.

According to Google Finance, its shares have surged by 51.75% over the past five days and an 82% surge over the past month. The recent surge has pushed the year to date-to over 900%.

Therefore, the continued surge in shares suggested their initiative to use BTC as a strategic treasury reserve asset is paying off tenfold.

Bitcoin as an alternative in Japan?

The Japanese economy has been suffering more than any other economy among developed and G-7 countries.

Therefore, Metaplanet’s strategy includes means to avoid and manage risks associated with a poorly performing economy.

Currently, Japan has a high national debt of 261% of the country’s GDP, which has affected the currency. The Japanese Yen has been depreciating against the dollar, exchanging from $1 to 156.70 yen at press time.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Therefore, Metaplanet incorporated BTC into its treasury assets, and the company aimed to mitigate its exposure to the Yen, which has significantly depreciated over the last year.

With BTC projected to grow further past $100k by 2024, Metaplanet aims to leverage this growth and boost its share performance.

can you buy generic clomiphene pills can you buy clomiphene without a prescription can i get clomid online buying generic clomiphene without dr prescription how to buy cheap clomiphene without prescription can you get generic clomid without a prescription get clomid pills

More posts like this would force the blogosphere more useful.

More posts like this would create the online space more useful.

generic zithromax 500mg – buy zithromax no prescription buy metronidazole 400mg online cheap

how to get semaglutide without a prescription – rybelsus order online purchase periactin online cheap

purchase motilium generic – sumycin price buy generic flexeril

purchase inderal online – buy generic inderal 10mg methotrexate oral

amoxil pills – amoxil for sale generic ipratropium 100 mcg

zithromax 250mg us – tindamax 300mg without prescription nebivolol 20mg oral

clavulanate brand – atbioinfo ampicillin online buy

buy nexium 40mg capsules – https://anexamate.com/ order esomeprazole 40mg

coumadin online – https://coumamide.com/ cozaar 50mg price

buy mobic 15mg online – https://moboxsin.com/ order mobic 15mg online cheap

order deltasone 40mg pill – corticosteroid brand deltasone 40mg

natural pills for erectile dysfunction – fastedtotake.com blue pill for ed

amoxil ca – combamoxi amoxil without prescription

buy diflucan 200mg sale – https://gpdifluca.com/ order fluconazole generic

cenforce drug – https://cenforcers.com/# cenforce drug

cialis w/o perscription – cialis vs tadalafil where to get the best price on cialis

order zantac 150mg for sale – this buy ranitidine 300mg

where to buy cialis – https://strongtadafl.com/ cialis dosages

Thanks towards putting this up. It’s evidently done. on this site

cheap cialis and viagra – strong vpls 50mg viagra price

More articles like this would pretence of the blogosphere richer. prednisone med pack

I’ll certainly return to review more. https://ursxdol.com/get-cialis-professional/

This website really has all of the bumf and facts I needed to this subject and didn’t identify who to ask. https://prohnrg.com/product/priligy-dapoxetine-pills/

Thanks for putting this up. It’s okay done. https://aranitidine.com/fr/cialis-super-active/

I am in fact enchant‚e ‘ to glitter at this blog posts which consists of tons of useful facts, thanks towards providing such data. https://ondactone.com/spironolactone/

More posts like this would prosper the blogosphere more useful.

order celecoxib generic

The thoroughness in this section is noteworthy. http://seafishzone.com/home.php?mod=space&uid=2291209

forxiga medication – buy forxiga medication order dapagliflozin 10 mg generic

order generic orlistat – https://asacostat.com/# cost xenical

More posts like this would make the online time more useful. http://bbs.51pinzhi.cn/home.php?mod=space&uid=7112492