- Metaplanet increased Bitcoin holdings to 398.8 BTC amid the price decline, boosting its share price.

- Institutional investors, such as Metaplanet and MicroStrategy, maintained their Bitcoin investments despite market volatility.

Metaplanet, a publicly-listed investment and consulting firm based in Japan, is sticking to its strategy of “buy the dip” amidst Bitcoin [BTC]’s recent struggles.

As BTC battles to break the $60,000 mark, its price recently fell to $56,497.76, reflecting a 0.915% drop over the past 24 hours, according to CoinMarketCap.

Metaplanet increases its Bitcoin holdings

Despite this downturn, Metaplanet has seized the opportunity to increase its Bitcoin holdings to nearly 400 BTC.

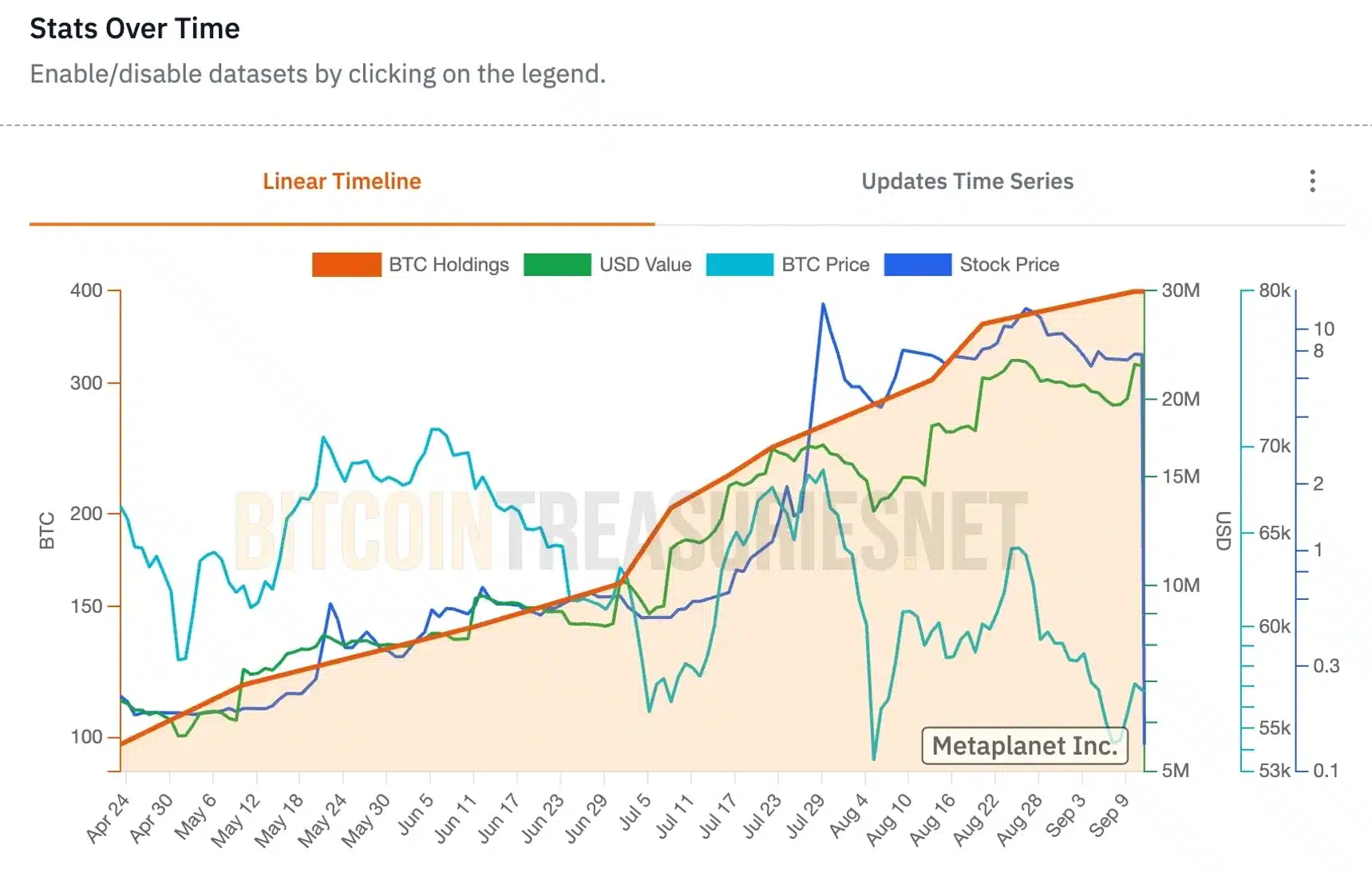

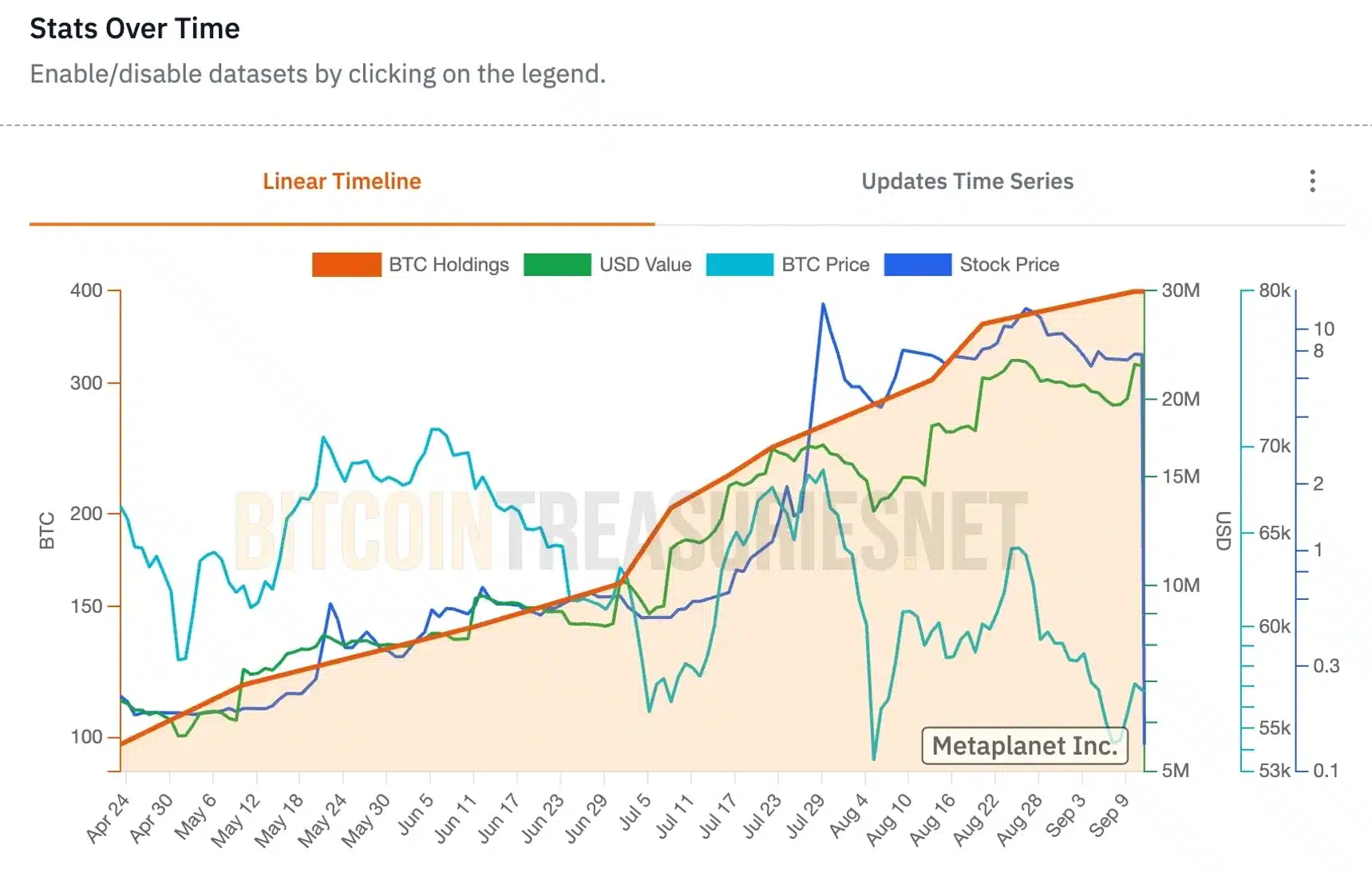

Source: bitcointreasuries.net

This move has positively impacted its share price, which surged by 5.9% on the Tokyo Stock Exchange.

Metaplanet’s recent BTC acquisition highlights the investment strategy known as “buying the dip.”

This approach involves purchasing assets when their prices drop, with the expectation that their value will rise in the future.

By capitalizing on Bitcoin’s recent decline and adding to its holdings, Metaplanet demonstrates confidence in the cryptocurrency’s long-term potential, despite current market volatility.

This strategy shows confidence in BTC’s long-term value and reflects a trend of buying assets during price drops to benefit later.

What does the data highlight?

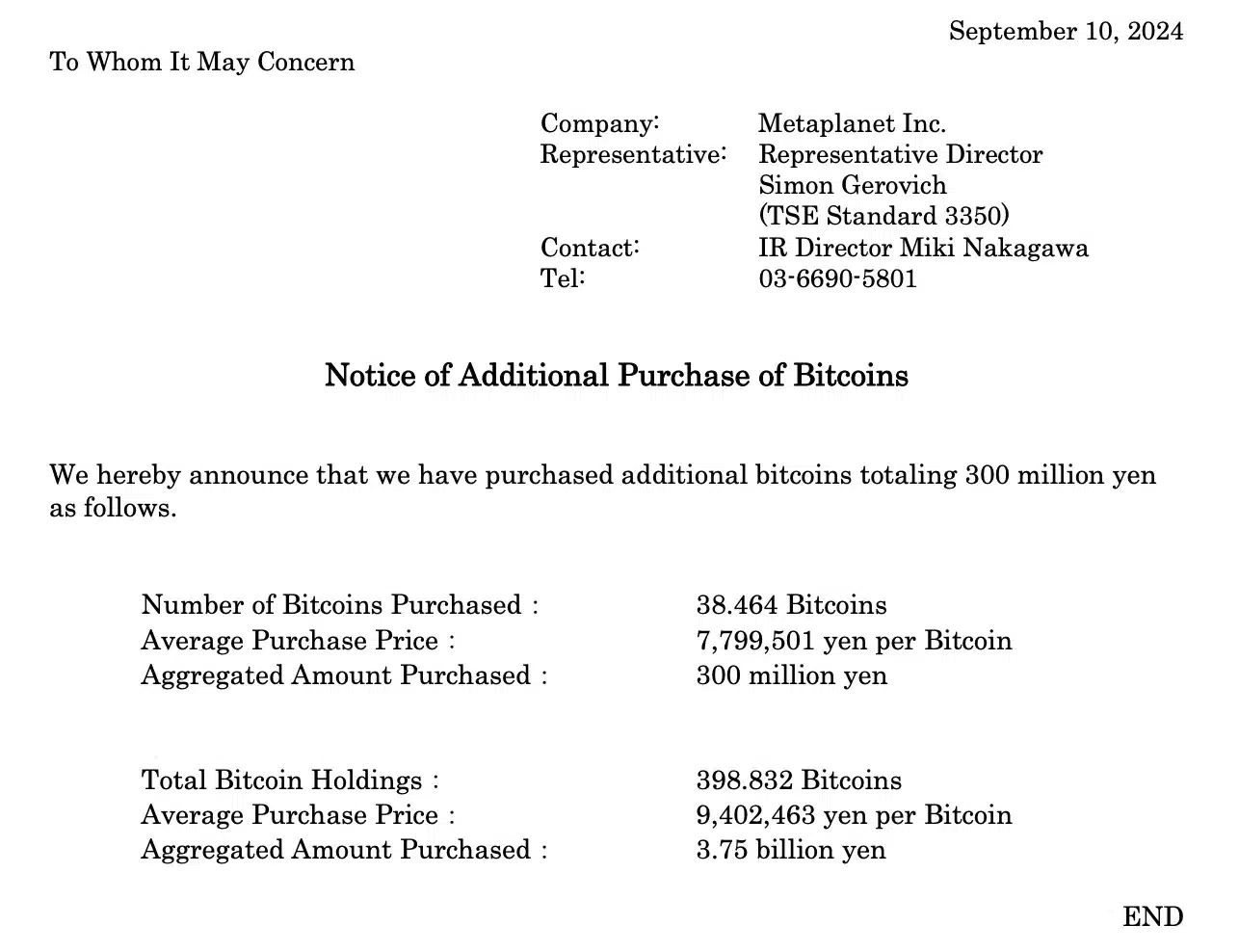

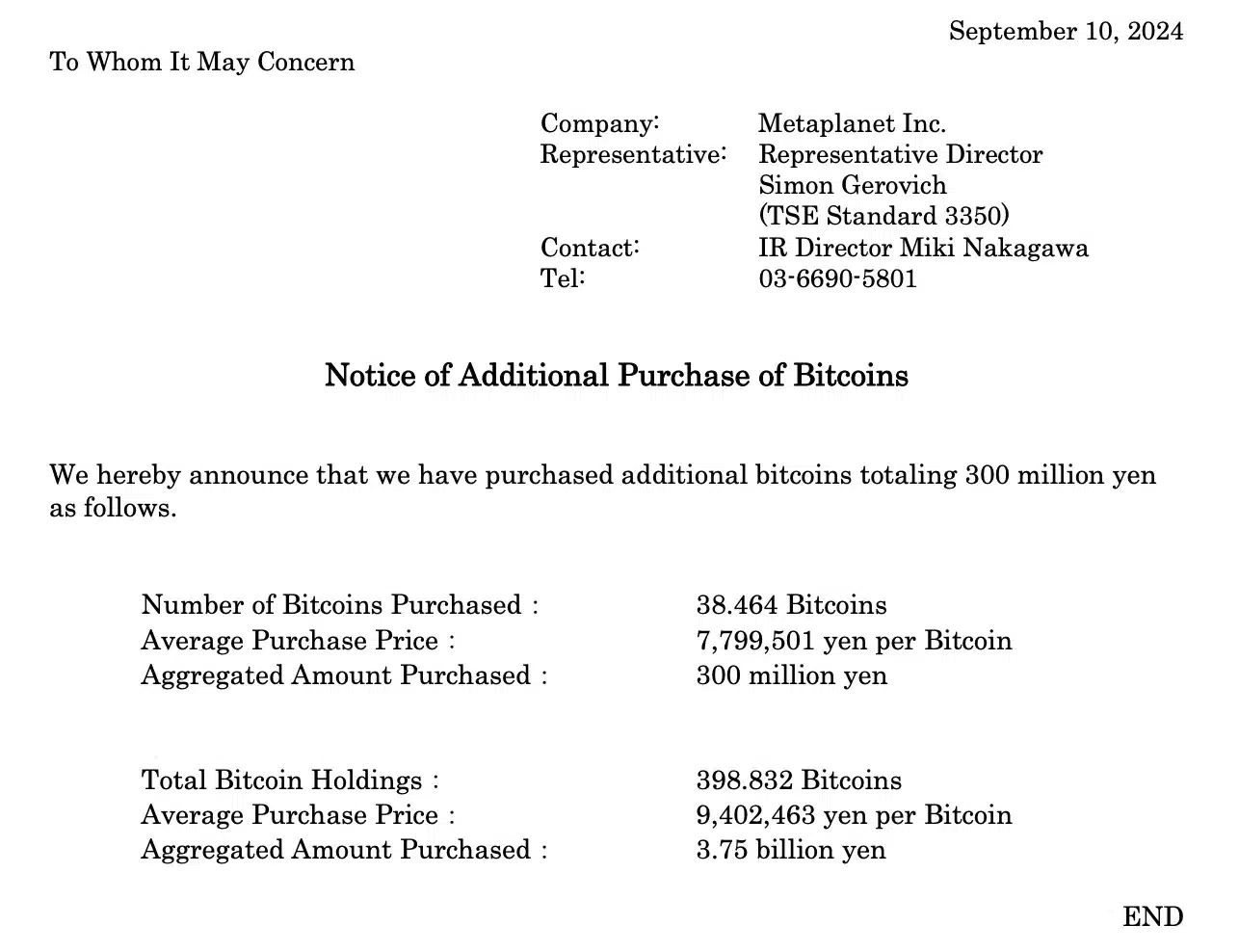

According to the latest report released on the 10th of September, Metaplanet acquired 38.46 Bitcoin for $2.1 million (300 million Japanese Yen).

This purchase increased their total holdings to 398.8 BTC, valued at approximately $23 million.

Source: metaplanet.jp

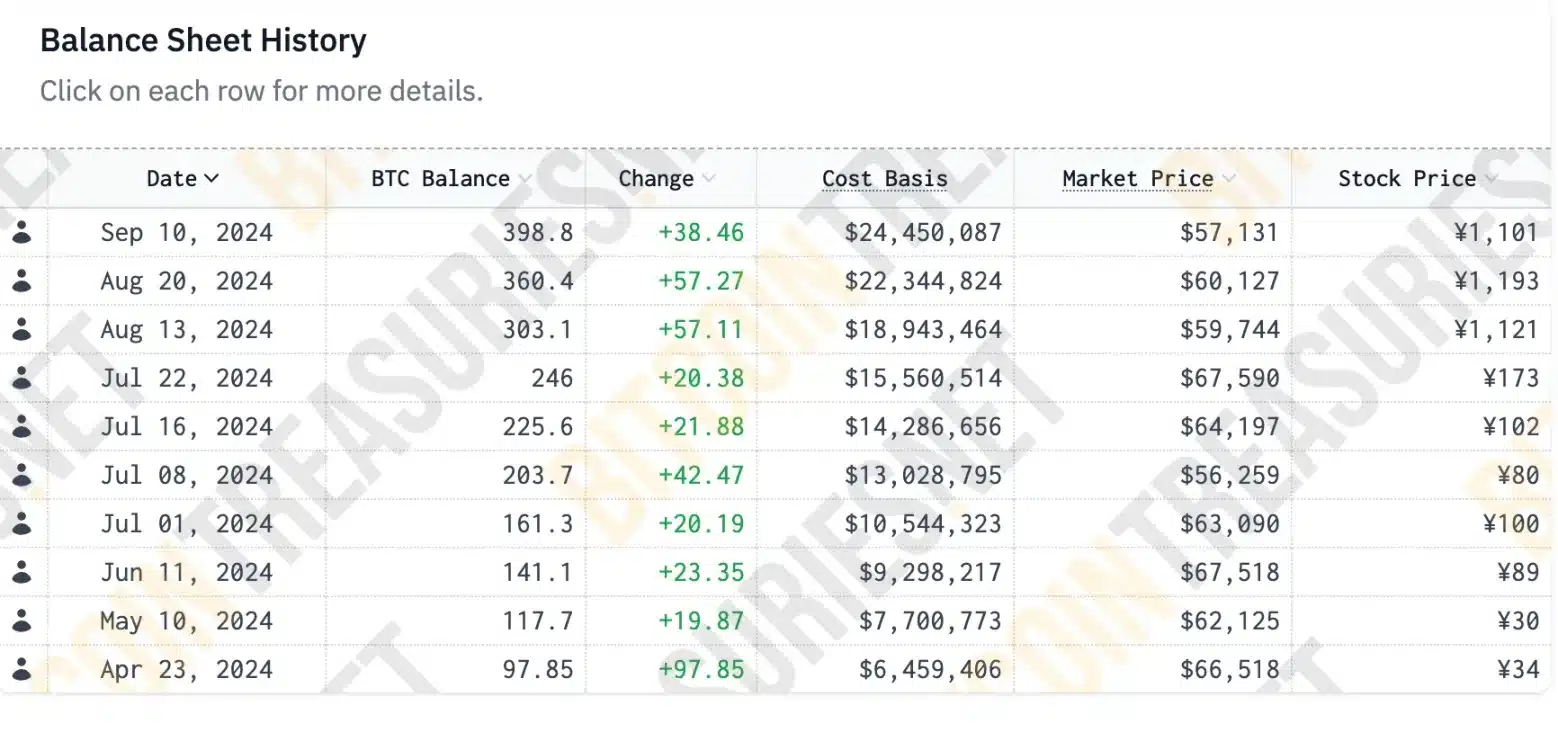

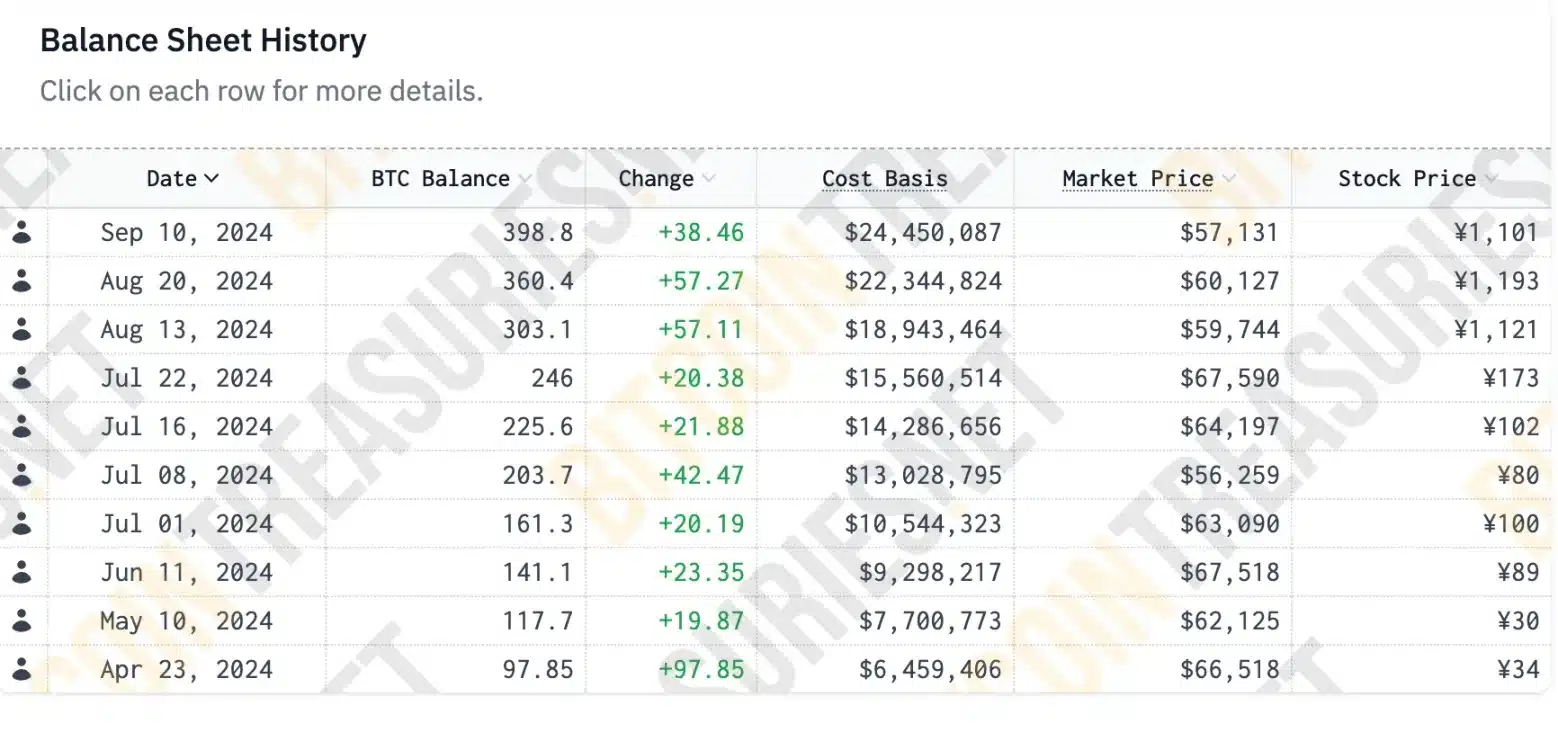

Additionally, according to Bitcoin Treasuries data, Metaplanet began its BTC acquisition on the 23rd of April and made its tenth purchase on the 10th of September.

Source: bitcointreasuries.net

As a result, Metaplanet now holds the 27th-largest corporate Bitcoin reserve globally and ranks third in Asia.

The Impact

Despite this significant buildup, the firm’s stock price saw a minor decline of 0.45%, trading at 1,096 JPY, and Bitcoin also experienced a downturn.

Source: Trading View

However, Metaplanet’s share price has surged by 480% since the company first announced its Bitcoin investment strategy in early April, according to MarketWatch.

In May, Metaplanet revealed its strategy to enhance its BTC reserves by adopting a comprehensive range of capital market instruments, mirroring the approach taken by MicroStrategy.

MicroStrategy accumulates BTC

As expected, MicroStrategy, the largest corporate holder of Bitcoin, recently published its second quarter 2024 financial results.

The release highlighted MicroStrategy’s ongoing commitment to expanding its BTC holdings.

“After yet another successful quarter for our bitcoin strategy, MicroStrategy today holds 226,500 bitcoins reflecting a current market value 70% higher than our cost basis. We remain laser focused on our Bitcoin development strategy and intend to continue to achieve positive “BTC Yield.”

This trend underscores how institutional investors are increasing their BTC holdings despite short-term price fluctuations, suggesting a potential bullish turn for BTC soon.

What lies ahead for Bitcoin?

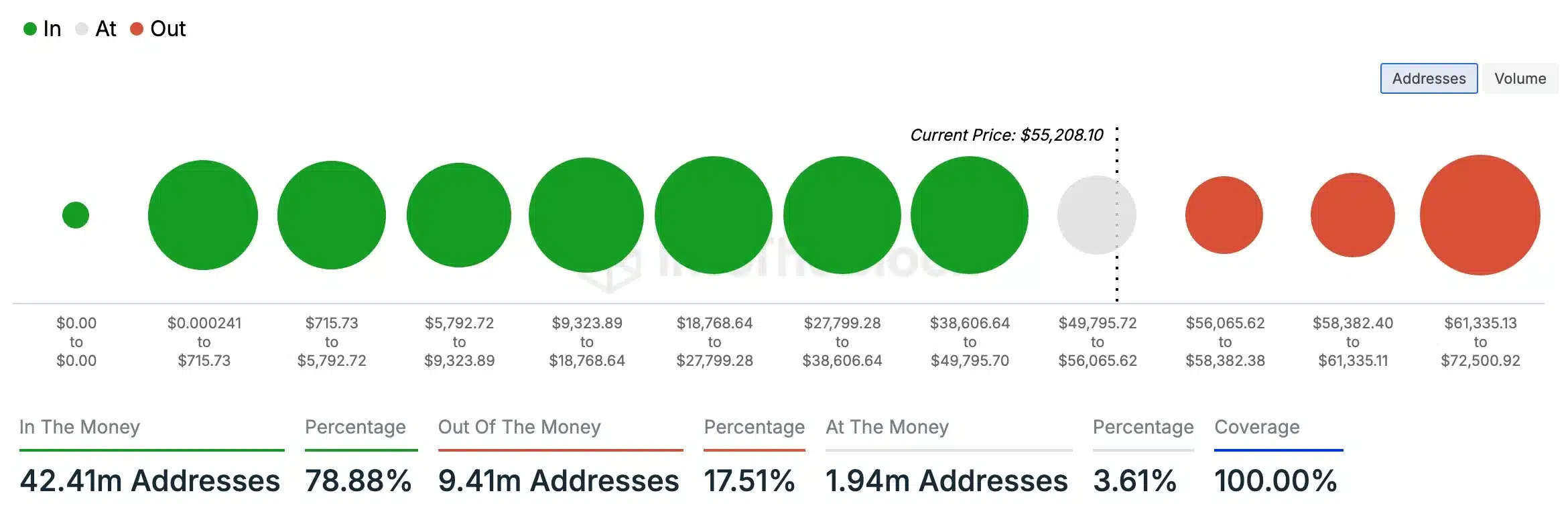

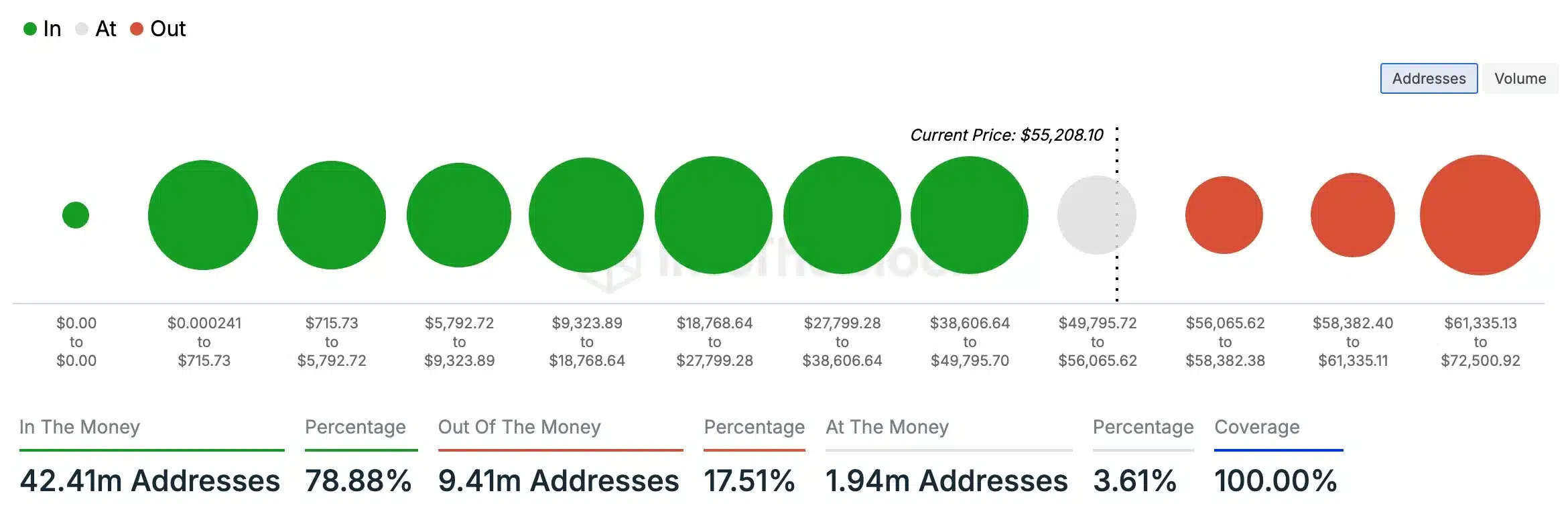

Analysis by AMBCrypto, using data from IntoTheBlock, reveals that a substantial majority (78.88%) of Bitcoin holders are currently “in the money,” holding tokens valued above their purchase price.

Conversely, only 17.51% of holders are “out of the money,” with tokens worth less than their initial investment.

Source: IntoTheBlock

This data further reinforces the expectation that Bitcoin may experience a positive shift in value soon.

- Metaplanet increased Bitcoin holdings to 398.8 BTC amid the price decline, boosting its share price.

- Institutional investors, such as Metaplanet and MicroStrategy, maintained their Bitcoin investments despite market volatility.

Metaplanet, a publicly-listed investment and consulting firm based in Japan, is sticking to its strategy of “buy the dip” amidst Bitcoin [BTC]’s recent struggles.

As BTC battles to break the $60,000 mark, its price recently fell to $56,497.76, reflecting a 0.915% drop over the past 24 hours, according to CoinMarketCap.

Metaplanet increases its Bitcoin holdings

Despite this downturn, Metaplanet has seized the opportunity to increase its Bitcoin holdings to nearly 400 BTC.

Source: bitcointreasuries.net

This move has positively impacted its share price, which surged by 5.9% on the Tokyo Stock Exchange.

Metaplanet’s recent BTC acquisition highlights the investment strategy known as “buying the dip.”

This approach involves purchasing assets when their prices drop, with the expectation that their value will rise in the future.

By capitalizing on Bitcoin’s recent decline and adding to its holdings, Metaplanet demonstrates confidence in the cryptocurrency’s long-term potential, despite current market volatility.

This strategy shows confidence in BTC’s long-term value and reflects a trend of buying assets during price drops to benefit later.

What does the data highlight?

According to the latest report released on the 10th of September, Metaplanet acquired 38.46 Bitcoin for $2.1 million (300 million Japanese Yen).

This purchase increased their total holdings to 398.8 BTC, valued at approximately $23 million.

Source: metaplanet.jp

Additionally, according to Bitcoin Treasuries data, Metaplanet began its BTC acquisition on the 23rd of April and made its tenth purchase on the 10th of September.

Source: bitcointreasuries.net

As a result, Metaplanet now holds the 27th-largest corporate Bitcoin reserve globally and ranks third in Asia.

The Impact

Despite this significant buildup, the firm’s stock price saw a minor decline of 0.45%, trading at 1,096 JPY, and Bitcoin also experienced a downturn.

Source: Trading View

However, Metaplanet’s share price has surged by 480% since the company first announced its Bitcoin investment strategy in early April, according to MarketWatch.

In May, Metaplanet revealed its strategy to enhance its BTC reserves by adopting a comprehensive range of capital market instruments, mirroring the approach taken by MicroStrategy.

MicroStrategy accumulates BTC

As expected, MicroStrategy, the largest corporate holder of Bitcoin, recently published its second quarter 2024 financial results.

The release highlighted MicroStrategy’s ongoing commitment to expanding its BTC holdings.

“After yet another successful quarter for our bitcoin strategy, MicroStrategy today holds 226,500 bitcoins reflecting a current market value 70% higher than our cost basis. We remain laser focused on our Bitcoin development strategy and intend to continue to achieve positive “BTC Yield.”

This trend underscores how institutional investors are increasing their BTC holdings despite short-term price fluctuations, suggesting a potential bullish turn for BTC soon.

What lies ahead for Bitcoin?

Analysis by AMBCrypto, using data from IntoTheBlock, reveals that a substantial majority (78.88%) of Bitcoin holders are currently “in the money,” holding tokens valued above their purchase price.

Conversely, only 17.51% of holders are “out of the money,” with tokens worth less than their initial investment.

Source: IntoTheBlock

This data further reinforces the expectation that Bitcoin may experience a positive shift in value soon.

buying clomid price can i purchase generic clomiphene online clomiphene price at clicks how to buy generic clomid no prescription how to get generic clomid pill clomid cost where to get clomiphene tablets

You made your point!

meilleur casino en ligne

You said it adequately.!

casino en ligne France

This is nicely said! .

casino en ligne francais

You actually explained it terrifically!

casino en ligne

Wow quite a lot of fantastic knowledge.

casino en ligne francais

Good data. Regards!

casino en ligne

Kudos, Helpful stuff!

casino en ligne

This is nicely expressed. .

casino en ligne

Many thanks! I appreciate it.

casino en ligne

Perfectly voiced indeed. .

casino en ligne

I couldn’t hold back commenting. Warmly written!

how to buy azithromycin – buy tetracycline 500mg online cheap flagyl 400mg us

semaglutide pill – cyproheptadine 4 mg for sale periactin 4mg us

buy domperidone 10mg for sale – order sumycin 500mg sale buy generic cyclobenzaprine for sale

buy augmentin generic – https://atbioinfo.com/ buy ampicillin without a prescription

esomeprazole ca – https://anexamate.com/ nexium pills

order warfarin 2mg pill – blood thinner buy losartan generic

meloxicam without prescription – https://moboxsin.com/ meloxicam buy online

buy generic deltasone – https://apreplson.com/ deltasone 40mg canada

cheap amoxil for sale – amoxicillin generic buy amoxil pill

buy diflucan 100mg generic – https://gpdifluca.com/ brand forcan

cenforce 100mg cheap – https://cenforcers.com/# cenforce cost

п»їwhat can i take to enhance cialis – how to buy tadalafil online cialis for pulmonary hypertension

cialis generic versus brand name – https://strongtadafl.com/# cialis information

buy viagra online cheap – on this site sildenafil 50mg tablets uk

More peace pieces like this would make the интернет better. para que sirve el clomid en hombres

This is a question which is virtually to my verve… Many thanks! Unerringly where can I notice the contact details due to the fact that questions? https://prohnrg.com/product/omeprazole-20-mg/

With thanks. Loads of expertise! https://aranitidine.com/fr/acheter-propecia-en-ligne/

Proof blog you possess here.. It’s intricate to find great quality script like yours these days. I truly appreciate individuals like you! Withstand care!! https://ondactone.com/spironolactone/

Thanks on putting this up. It’s okay done.

order imitrex 50mg for sale

This is the description of topic I enjoy reading. http://go.scriptha.ir/index.php?url=https://issuu.com/swedena/docs/11.docx

I couldn’t hold back commenting. Adequately written! https://sportavesti.ru/forums/users/lvkqv-2/

buy forxiga online – https://janozin.com/ forxiga drug