- Investors are willing to hold LTC, indicating the price might get close to 2021’s peak.

- The Pi Cycle Top showed that LTC was not yet overheated.

Reaching $250 means Litecoin’s [LTC] price has to increase by more than 150% from its press time value. As of this writing, the coin changed hands at $80.61.

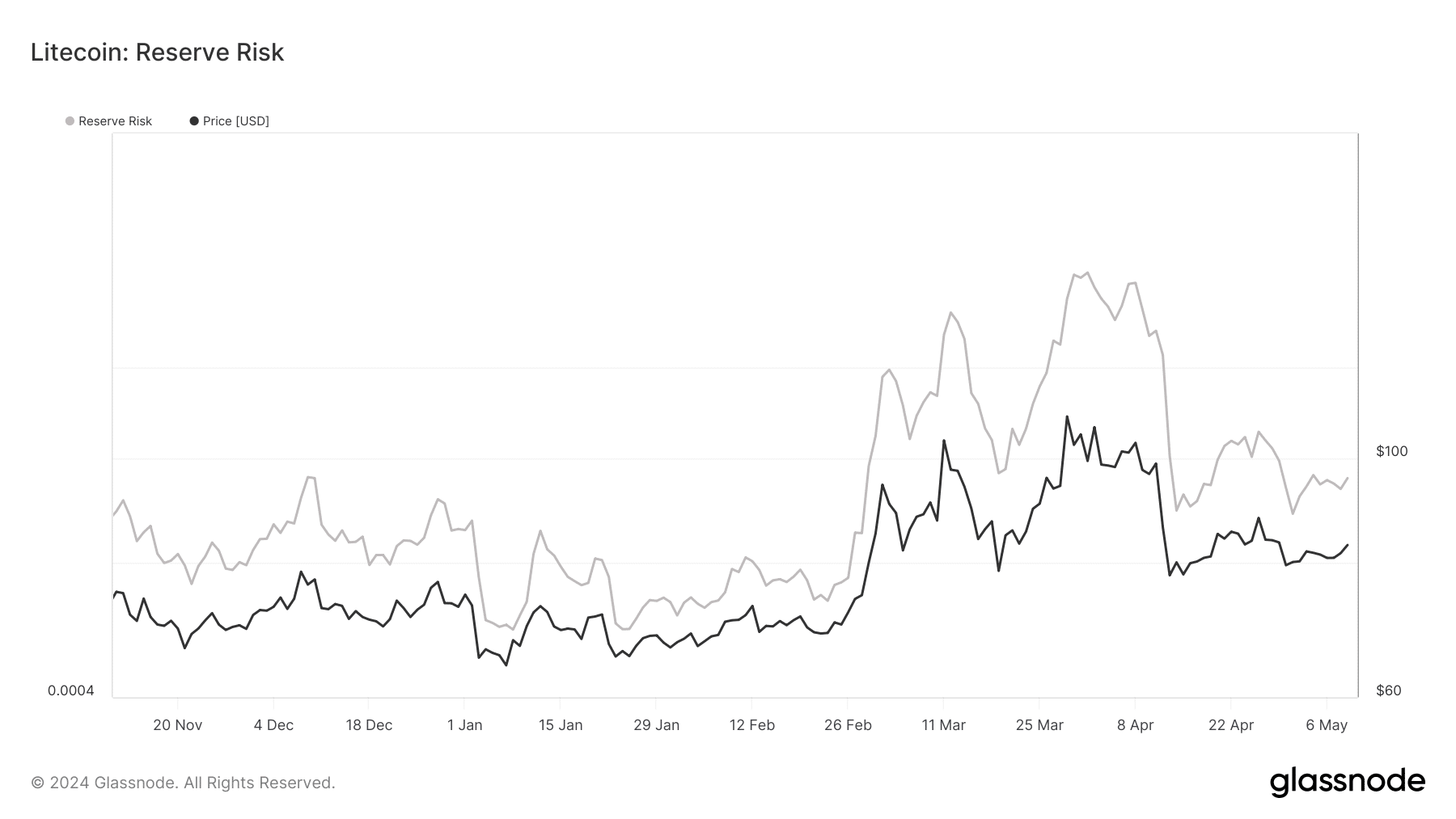

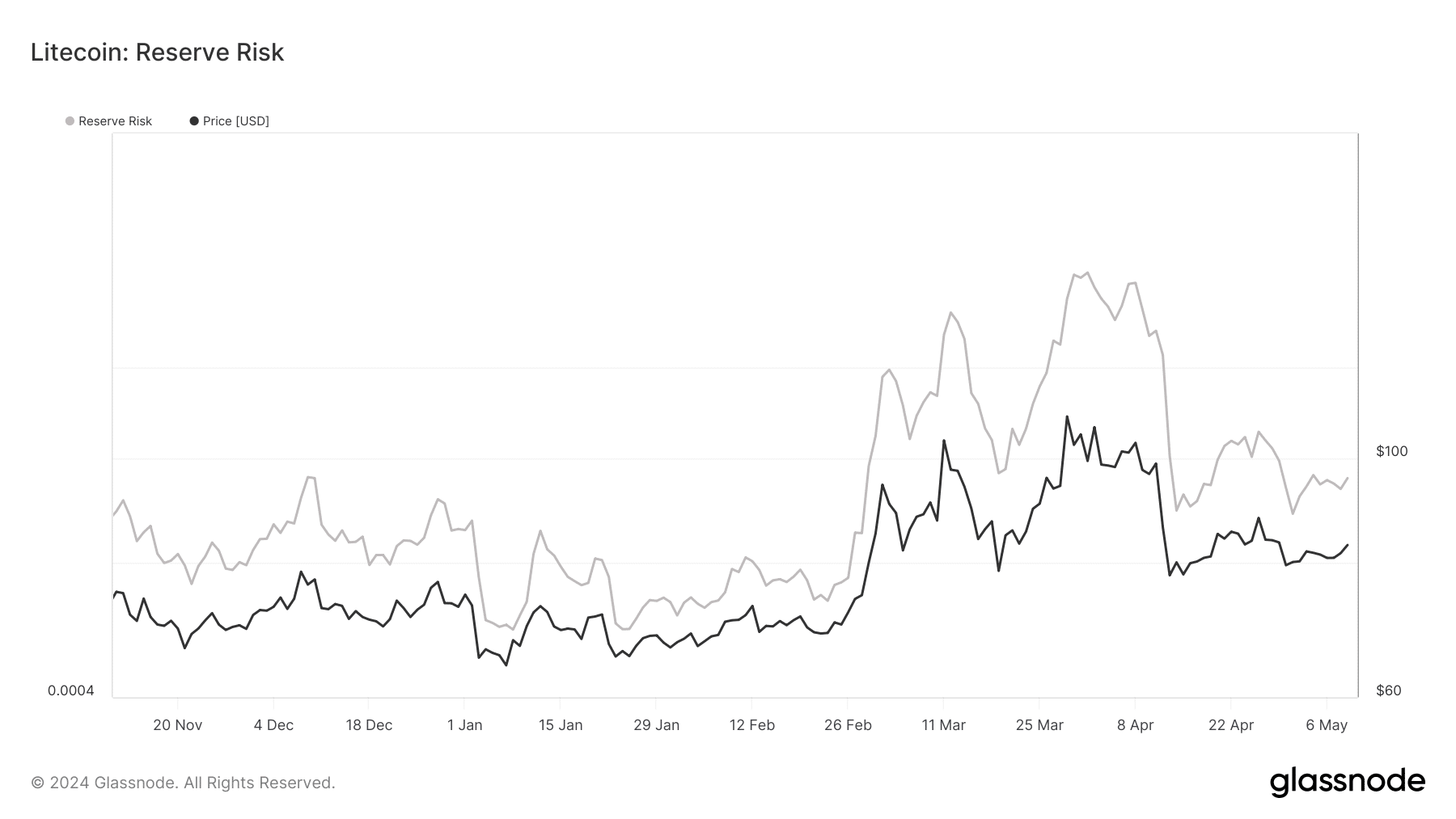

This value was a 15.60% correction in the last 30 days. However, AMBCrypto’s assessment of Litecoin’s Reserve Risk indicated that better days are coming.

Reserve Risk has an alias, called the “HODL bank.” For the uninitiated, HODL stands for Hold On to Dear Life. It describes a situation where cryptocurrency investors refrain from selling irrespective of the price movement.

The stakes are high

With the Reserve Risk, traders can tell if long-term holders are confident in the price or otherwise. If the price is high and confidence is low, it means that the risk-to-reward ratio might not be worth betting on.

However, a rising Reserve Risk and a low value indicate superb conviction in the long-term value of the coin, and this was the situation with Litecoin.

Source: Glassnode

From the look of things, this metric might continue to increase. If this is the case, the price of LTC might retest $100 again. However, breaking $100 would mean that the coin might rise by another 100%.

Should this be the case, a jump to $250 could be possible. The last time Litecoin changed hands at that price was in November 2021.

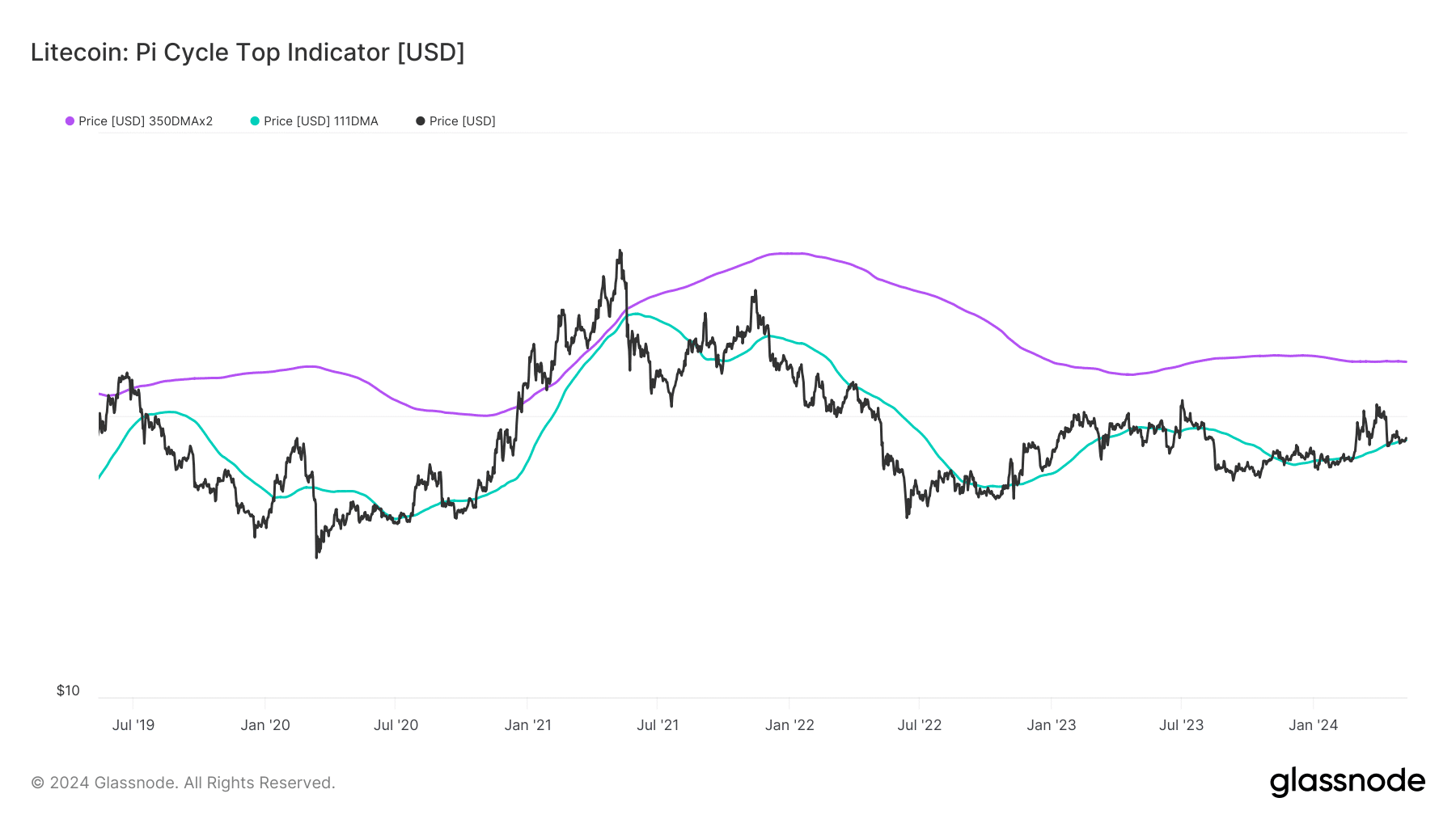

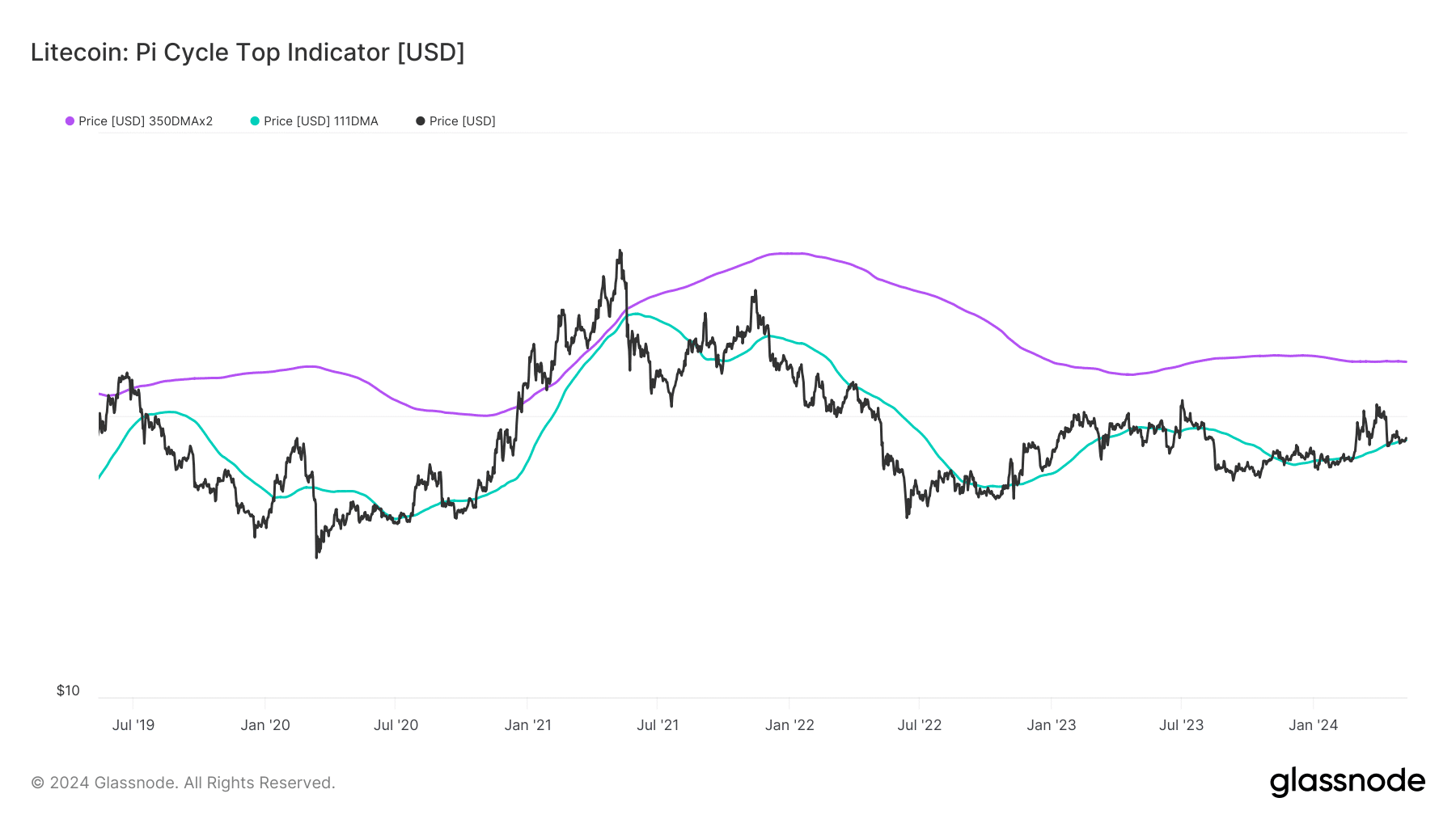

Since then, the value has been swinging lower. However, AMBCrypto found another metric supporting the price increase. This time, it was the Pi Cycle Top indicator.

LTC shows signs of expanding

On this chart, you will find two lines, One green— representing the 111-day Simple Moving Average (SMA). Another one colored purple, which indicated the 350-day SMA.

Historically, prices hit the peak when the shorter SMA reached the same level as the larger SMA. Evidence of this showed in the last quarter of 2021 when Litecoin’s price dropped from $385 to $136 months later.

However, data at press time showed that the 111-day SMA was at a lower point when compared to the 350-day SMA. This indicates that LTC still has a lot of room to grow before the end of the bull market.

Source: Glassnode

While this might not be immediate, the position of this metric reinforces the prediction that Litecoin might rise to $200 or $250 in a matter of months.

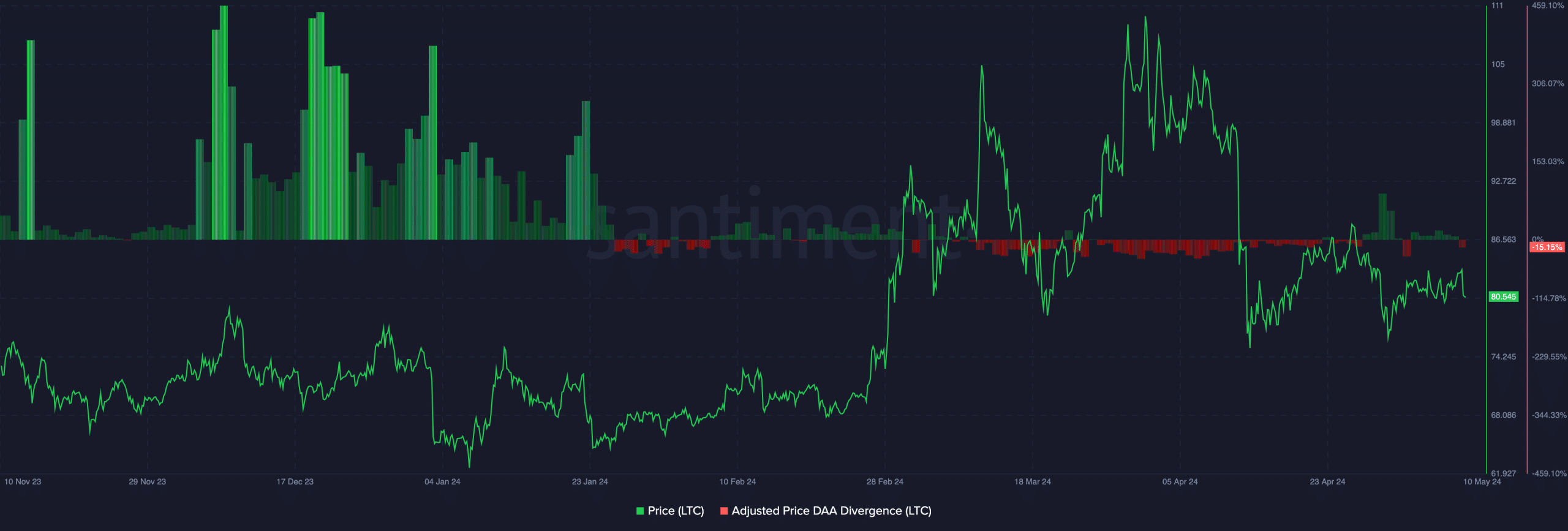

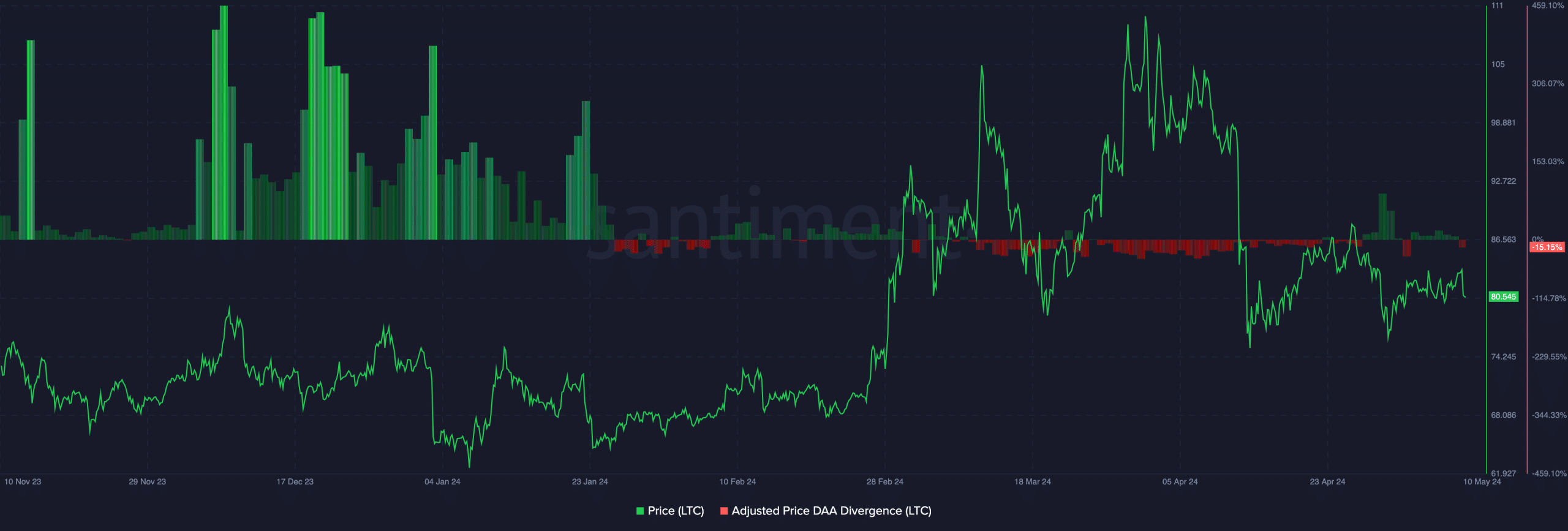

Meanwhile, the adjusted price-DAA divergence was -15.15%, according to data from Santiment. DAA is an acronym for Daily Active Addresses. It is the number of unique crypto addresses interacting with a network.

When the price is combined with DAA, traders can have an idea of entry and exit points. The negative reading of the price metric implied that Litecoin’s price grew more than the active addresses in recent times.

Source: Glassnode

Read Litecoin’s [LTC] Price Prediction 2024-2025

From a trading perspective, this is a buy signal. Hence, LTC might have provided a rare accumulation opportunity.

However, market participants might need to watch out for complementary metrics before doubling down on the entry price.

- Investors are willing to hold LTC, indicating the price might get close to 2021’s peak.

- The Pi Cycle Top showed that LTC was not yet overheated.

Reaching $250 means Litecoin’s [LTC] price has to increase by more than 150% from its press time value. As of this writing, the coin changed hands at $80.61.

This value was a 15.60% correction in the last 30 days. However, AMBCrypto’s assessment of Litecoin’s Reserve Risk indicated that better days are coming.

Reserve Risk has an alias, called the “HODL bank.” For the uninitiated, HODL stands for Hold On to Dear Life. It describes a situation where cryptocurrency investors refrain from selling irrespective of the price movement.

The stakes are high

With the Reserve Risk, traders can tell if long-term holders are confident in the price or otherwise. If the price is high and confidence is low, it means that the risk-to-reward ratio might not be worth betting on.

However, a rising Reserve Risk and a low value indicate superb conviction in the long-term value of the coin, and this was the situation with Litecoin.

Source: Glassnode

From the look of things, this metric might continue to increase. If this is the case, the price of LTC might retest $100 again. However, breaking $100 would mean that the coin might rise by another 100%.

Should this be the case, a jump to $250 could be possible. The last time Litecoin changed hands at that price was in November 2021.

Since then, the value has been swinging lower. However, AMBCrypto found another metric supporting the price increase. This time, it was the Pi Cycle Top indicator.

LTC shows signs of expanding

On this chart, you will find two lines, One green— representing the 111-day Simple Moving Average (SMA). Another one colored purple, which indicated the 350-day SMA.

Historically, prices hit the peak when the shorter SMA reached the same level as the larger SMA. Evidence of this showed in the last quarter of 2021 when Litecoin’s price dropped from $385 to $136 months later.

However, data at press time showed that the 111-day SMA was at a lower point when compared to the 350-day SMA. This indicates that LTC still has a lot of room to grow before the end of the bull market.

Source: Glassnode

While this might not be immediate, the position of this metric reinforces the prediction that Litecoin might rise to $200 or $250 in a matter of months.

Meanwhile, the adjusted price-DAA divergence was -15.15%, according to data from Santiment. DAA is an acronym for Daily Active Addresses. It is the number of unique crypto addresses interacting with a network.

When the price is combined with DAA, traders can have an idea of entry and exit points. The negative reading of the price metric implied that Litecoin’s price grew more than the active addresses in recent times.

Source: Glassnode

Read Litecoin’s [LTC] Price Prediction 2024-2025

From a trading perspective, this is a buy signal. Hence, LTC might have provided a rare accumulation opportunity.

However, market participants might need to watch out for complementary metrics before doubling down on the entry price.

![[Latest] North America Turbomachinery Control Systems Market: Analyzing the Influence of Consumer Reviews](https://coininsights.com/wp-content/uploads/2025/03/L316986520_g-350x250.jpg)

cost clomid without rx how to get generic clomid pill how to buy cheap clomid without prescription can you buy generic clomid without rx where buy clomid price order clomid pill can i purchase cheap clomiphene without rx

This is a question which is near to my fundamentals… Myriad thanks! Quite where can I find the acquaintance details for questions?

More posts like this would make the online play more useful.

buy zithromax 500mg generic – purchase tinidazole metronidazole 200mg uk

buy semaglutide tablets – purchase semaglutide pills order periactin 4 mg

order domperidone 10mg sale – buy flexeril 15mg generic cyclobenzaprine 15mg without prescription

inderal price – where can i buy methotrexate order methotrexate 10mg pill

buy generic amoxil for sale – order valsartan pills ipratropium drug

order zithromax 250mg – purchase nebivolol generic nebivolol 20mg drug

clavulanate sale – atbioinfo acillin usa

esomeprazole 20mg for sale – anexa mate esomeprazole pills

generic warfarin 2mg – anticoagulant buy losartan 50mg for sale

mobic 7.5mg tablet – mobo sin mobic generic

prednisone us – aprep lson deltasone 40mg tablet

the best ed pill – https://fastedtotake.com/ medicine for erectile

amoxil uk – comba moxi cheap amoxil pills

order fluconazole online cheap – diflucan brand fluconazole where to buy

order cenforce without prescription – this cenforce 50mg brand

cialis stopped working – https://ciltadgn.com/ buy a kilo of tadalafil powder

is there a generic cialis available in the us – https://strongtadafl.com/ canadian no prescription pharmacy cialis Este enlace se abrirГЎ en una ventana nueva

ranitidine 300mg us – aranitidine ranitidine oral

herb viagra sale – site sildenafil 50 mg price at walmart

This is the tolerant of enter I find helpful. nolvadex over the counter

I’ll certainly return to review more. https://ursxdol.com/azithromycin-pill-online/

This is the tolerant of advise I find helpful. https://prohnrg.com/product/priligy-dapoxetine-pills/

More articles like this would pretence of the blogosphere richer. https://aranitidine.com/fr/prednisolone-achat-en-ligne/