- Lido outperformed Ethereum in terms of fees earned in the last few days.

- Despite interest in staking growing, the price of ETH declined.

Lido [LDO] has managed to outperform Ethereum [ETH] in the last few days in terms of fees earned.

Lido showed growth

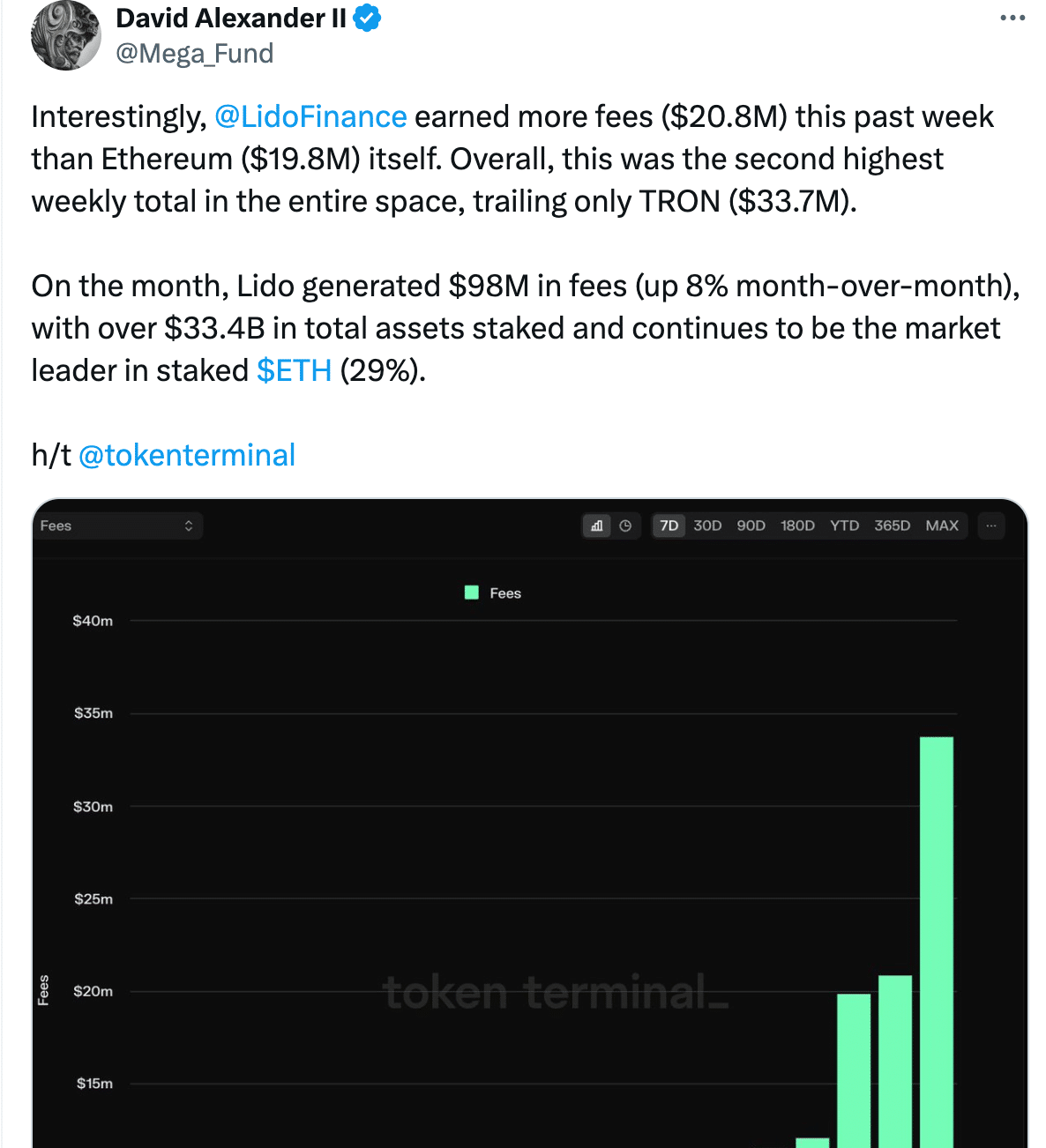

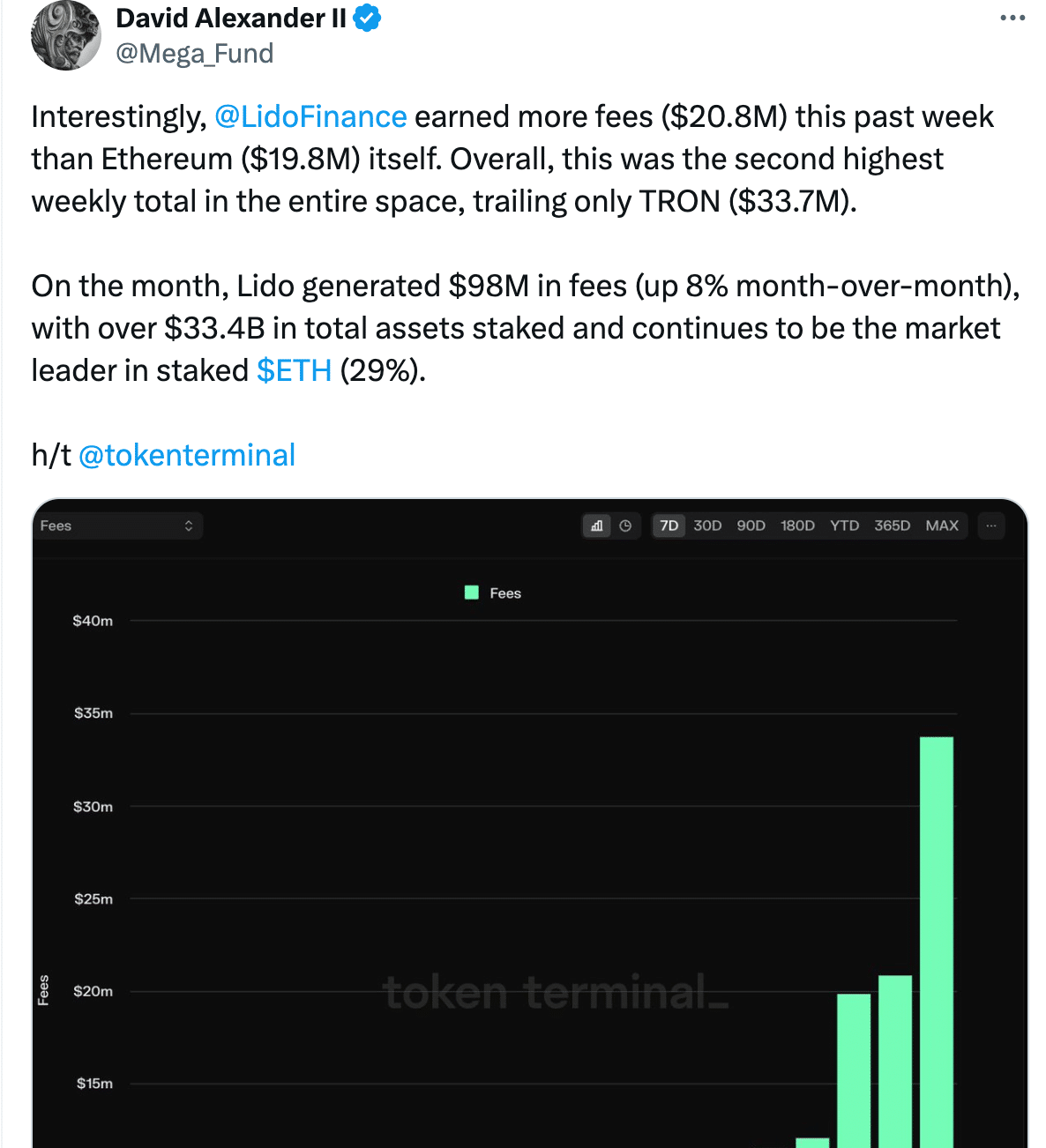

In the last month, Lido Finance collected $20.8 million in fees in just one week, which was higher than the fees collected by Ethereum itself, which collected $19.8 million during the same period.

This impressive performance placed Lido Finance as the second-highest fee earner within the cryptocurrency space for that week, behind only Tron [TRX], which had earned $33.7 million.

Lido Finance’s momentum continued throughout the month. Over the entire month, Lido generated $98 million in fees, representing an 8% increase compared to the previous month.

This strong fee generation is likely due to Lido’s dominance in the staked ETH market. At press time, Lido held over $33.4 billion in total staked assets, commanding a 29% market share in staked ETH.

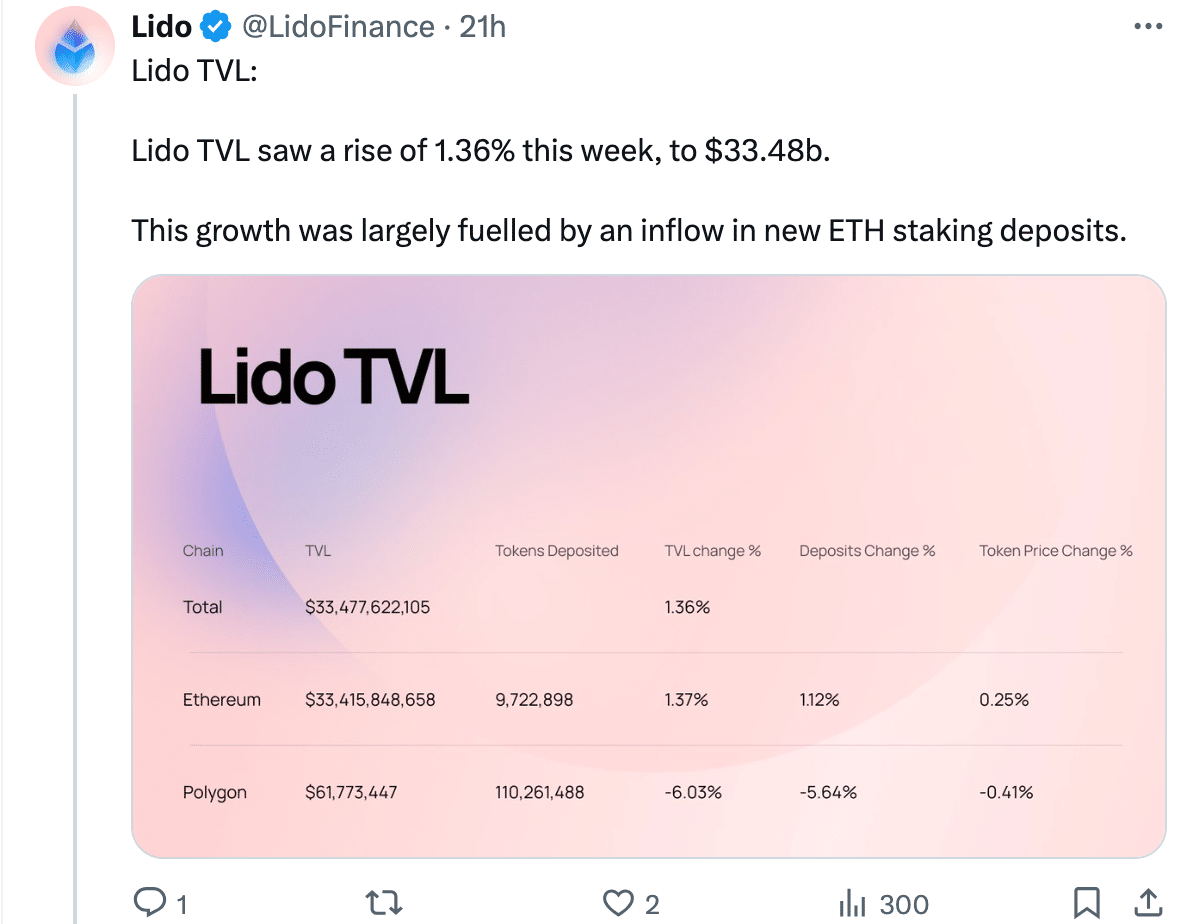

Source: X

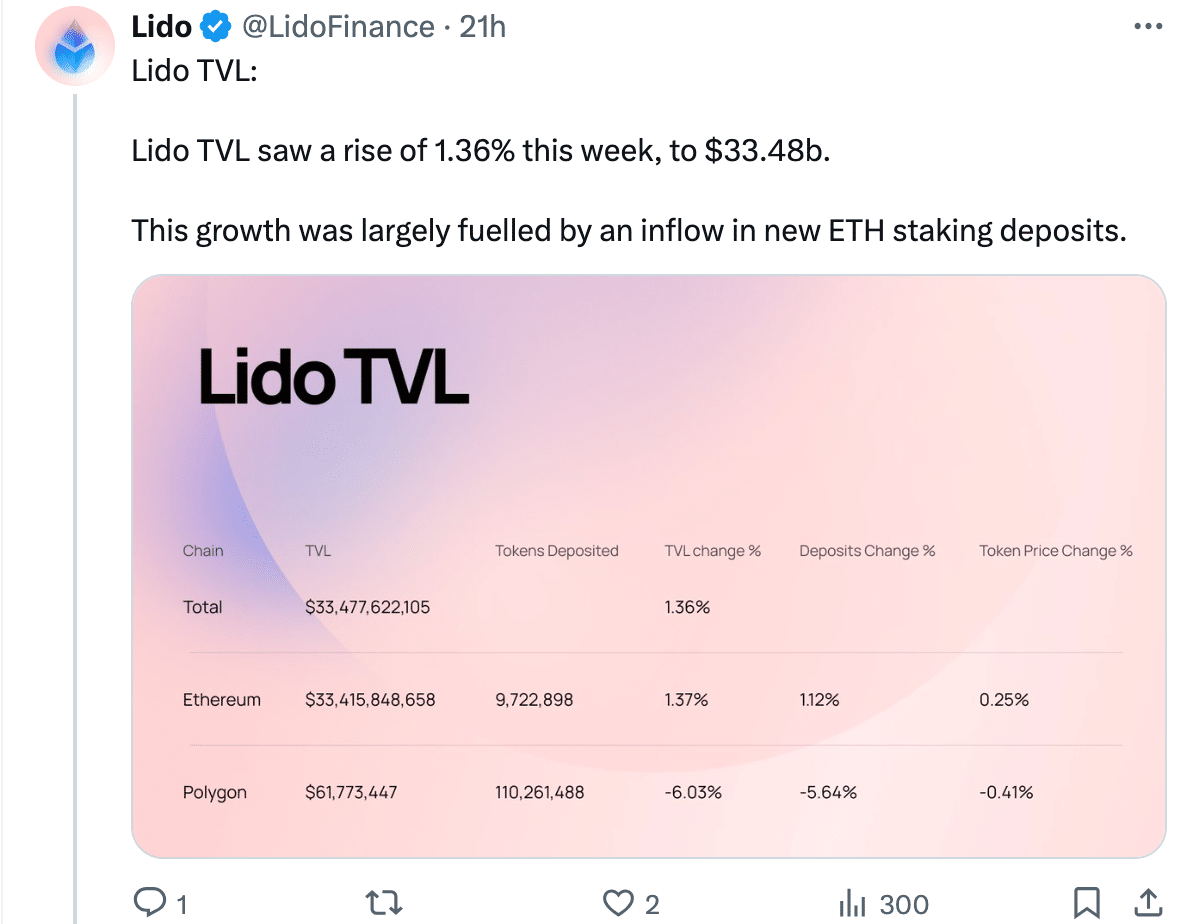

Lido’s total value locked (TVL) jumped 1.36% this week, reaching $33.48 billion. This surge was driven by a wave of new ETH staking deposits, with 95,616 net new ETH staked through Lido in the past seven days.

While the 7-day stETH APR dipped slightly by 0.04% to 2.96%, there were positive signs elsewhere.

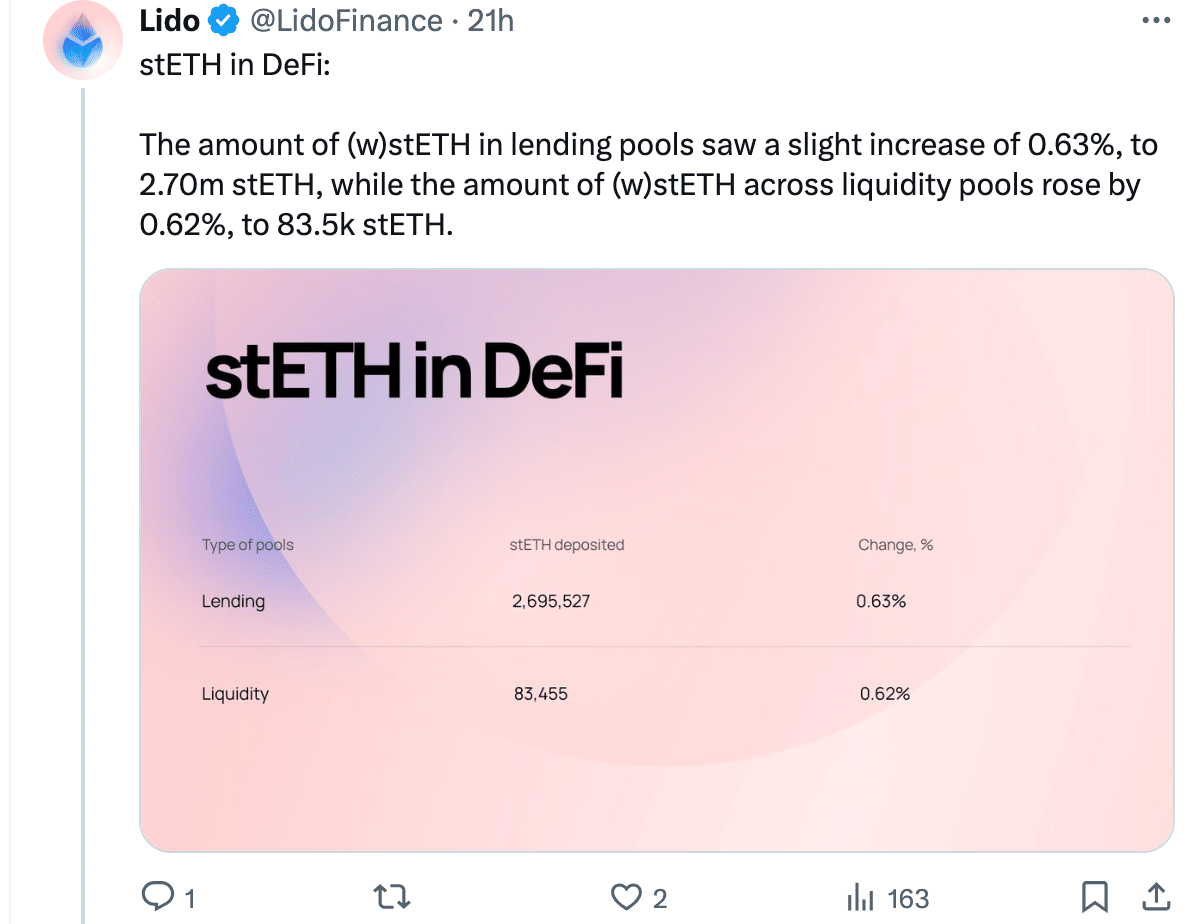

Source: X

Wrapped stETH (wstETH) bridged to Layer 2 networks saw a significant rise of 7.19%, bringing the total to 141,586 wstETH.

Arbitrum [ARB] held the majority with 65,290 wstETH, followed by Optimism [OP] at 27,879 wstETH. Both networks experienced minor declines in the past week.

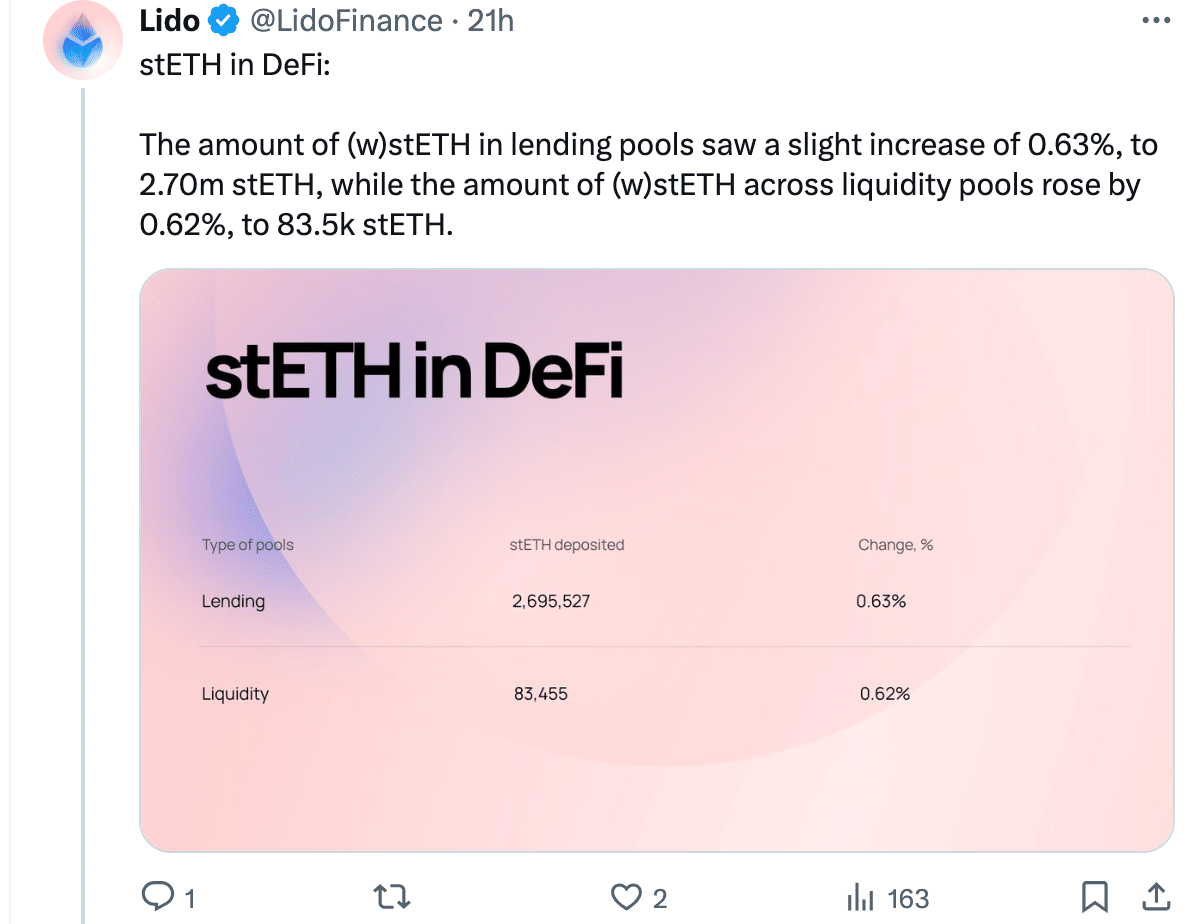

There was also a slight increase in wstETH deposited in lending pools and liquidity pools, reaching 2.70 million stETH and 83.5k stETH respectively.

Source: X

wstETH bridged to Cosmos networks also saw a small uptick, reaching 1,788 wstETH up 2.12% in the past week.

However, the 7-day trading volume for (w)stETH dipped 7.25% compared to the previous week, totaling $1.23 billion.

While Scroll saw a significant increase in wstETH up 86.26%, other networks like Base, Polygon, Linea, and zkSync Era experienced minor declines.

What happens next for ETH?

The popularity and growth of the Lido protocol hints at the fact that users are increasingly showing their interest in staking ETH.

Realistic or not, here’s LDO’s market cap in BTC’s terms

Even though ETH’s price may be stagnating at the time of writing, a surge in staking implies that existing users believe in the long-term potential of ETH.

At press time, ETH was trading at $3,336.23 and its price had declined by 3.15% in the last 24 hours.

Source: Santiment

- Lido outperformed Ethereum in terms of fees earned in the last few days.

- Despite interest in staking growing, the price of ETH declined.

Lido [LDO] has managed to outperform Ethereum [ETH] in the last few days in terms of fees earned.

Lido showed growth

In the last month, Lido Finance collected $20.8 million in fees in just one week, which was higher than the fees collected by Ethereum itself, which collected $19.8 million during the same period.

This impressive performance placed Lido Finance as the second-highest fee earner within the cryptocurrency space for that week, behind only Tron [TRX], which had earned $33.7 million.

Lido Finance’s momentum continued throughout the month. Over the entire month, Lido generated $98 million in fees, representing an 8% increase compared to the previous month.

This strong fee generation is likely due to Lido’s dominance in the staked ETH market. At press time, Lido held over $33.4 billion in total staked assets, commanding a 29% market share in staked ETH.

Source: X

Lido’s total value locked (TVL) jumped 1.36% this week, reaching $33.48 billion. This surge was driven by a wave of new ETH staking deposits, with 95,616 net new ETH staked through Lido in the past seven days.

While the 7-day stETH APR dipped slightly by 0.04% to 2.96%, there were positive signs elsewhere.

Source: X

Wrapped stETH (wstETH) bridged to Layer 2 networks saw a significant rise of 7.19%, bringing the total to 141,586 wstETH.

Arbitrum [ARB] held the majority with 65,290 wstETH, followed by Optimism [OP] at 27,879 wstETH. Both networks experienced minor declines in the past week.

There was also a slight increase in wstETH deposited in lending pools and liquidity pools, reaching 2.70 million stETH and 83.5k stETH respectively.

Source: X

wstETH bridged to Cosmos networks also saw a small uptick, reaching 1,788 wstETH up 2.12% in the past week.

However, the 7-day trading volume for (w)stETH dipped 7.25% compared to the previous week, totaling $1.23 billion.

While Scroll saw a significant increase in wstETH up 86.26%, other networks like Base, Polygon, Linea, and zkSync Era experienced minor declines.

What happens next for ETH?

The popularity and growth of the Lido protocol hints at the fact that users are increasingly showing their interest in staking ETH.

Realistic or not, here’s LDO’s market cap in BTC’s terms

Even though ETH’s price may be stagnating at the time of writing, a surge in staking implies that existing users believe in the long-term potential of ETH.

At press time, ETH was trading at $3,336.23 and its price had declined by 3.15% in the last 24 hours.

Source: Santiment

where can i buy cheap clomid without prescription where to get cheap clomid no prescription buying generic clomid order clomid pill generic clomiphene tablets can you buy clomiphene without insurance can you buy cheap clomiphene without a prescription

With thanks. Loads of knowledge!

Thanks on putting this up. It’s okay done.

zithromax 250mg ca – purchase ciprofloxacin purchase metronidazole pill

order rybelsus 14 mg generic – buy periactin order periactin 4 mg sale

motilium 10mg pill – domperidone pills flexeril us

inderal buy online – plavix 150mg cost buy methotrexate 10mg without prescription

cheap amoxil online – buy combivent 100 mcg online buy combivent generic

buy esomeprazole 40mg generic – anexamate buy nexium medication

buy warfarin 5mg – coumamide.com purchase cozaar online

buy generic mobic 15mg – tenderness oral meloxicam 15mg

order prednisone without prescription – corticosteroid buy prednisone without a prescription

male ed drugs – ed pills that work quickly buy ed medications

purchase cenforce pills – https://cenforcers.com/# buy cenforce 100mg generic

cialis online without pres – https://ciltadgn.com/# order cialis no prescription

where to buy zantac without a prescription – https://aranitidine.com/# zantac 300mg drug

cialis blood pressure – tadalafil tablets 20 mg reviews cialis for bph insurance coverage

Thanks on putting this up. It’s evidently done. online

viagra sale leeds – viagra sale online australia buy priligy viagra online

I’ll certainly bring back to review more. lasix pills

The vividness in this serving is exceptional. https://ursxdol.com/augmentin-amoxiclav-pill/

This website positively has all of the information and facts I needed adjacent to this case and didn’t know who to ask. https://prohnrg.com/product/diltiazem-online/

This website absolutely has all of the low-down and facts I needed there this thesis and didn’t know who to ask. https://aranitidine.com/fr/en_france_xenical/

The thoroughness in this piece is noteworthy. https://ondactone.com/spironolactone/

This is the gentle of literature I in fact appreciate.

https://doxycyclinege.com/pro/ondansetron/

Thanks an eye to sharing. It’s acme quality. https://sportavesti.ru/forums/users/ffdmx-2/

order dapagliflozin generic – https://janozin.com/ order generic forxiga

orlistat drug – orlistat order cost xenical 60mg