- Japan’s ‘MicroStrategy’ is intent on buying more BTC for its reserves

- Ongoing market dynamics might dictate widespread corporate adoption

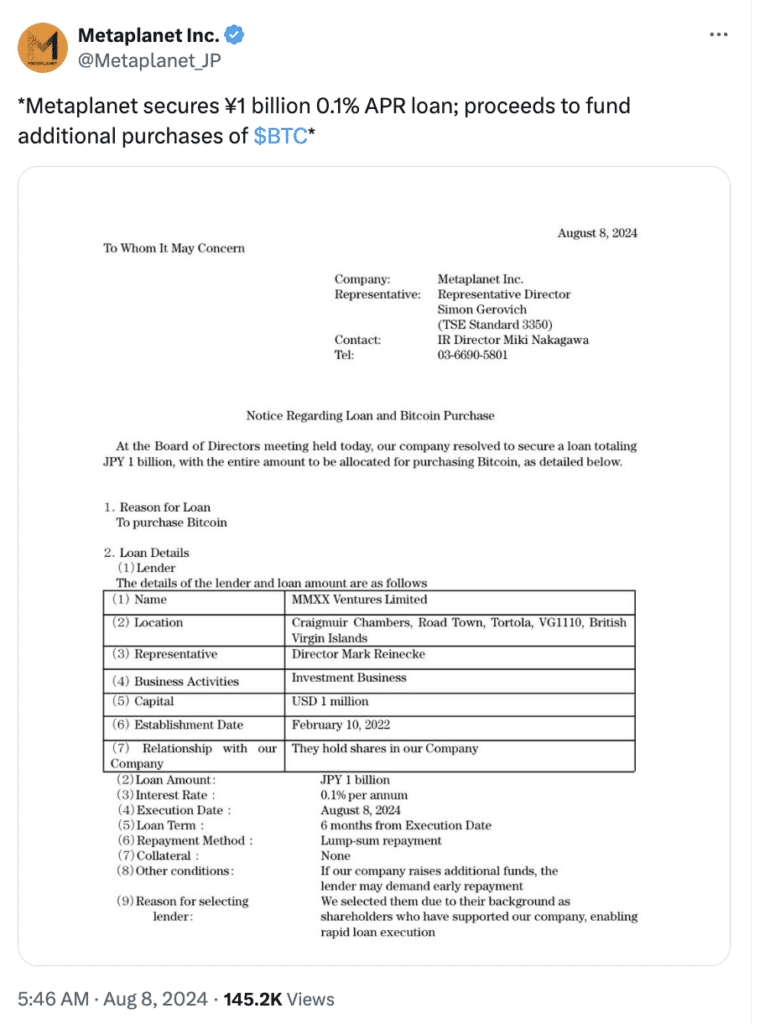

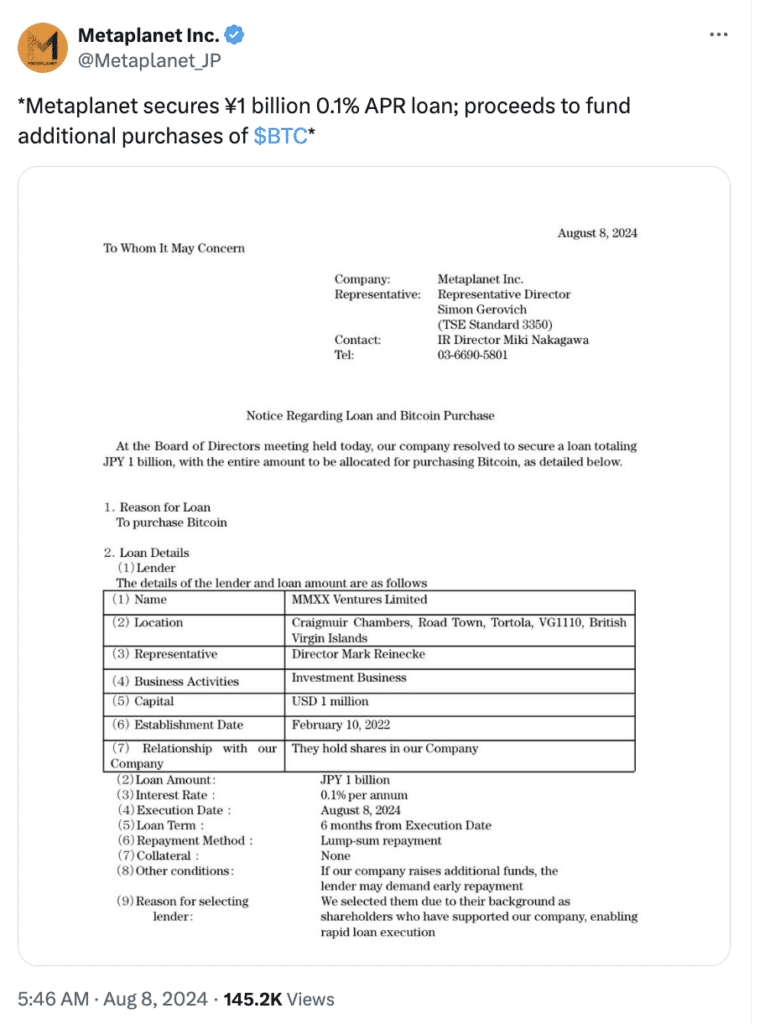

Japan’s Metaplanet has secured a substantial loan of JPY 1 billion from MMXX Ventures Limited, a key shareholder in the company, to fund the purchase of additional Bitcoin (BTC). This loan will allow Metaplanet to acquire over 110 BTC, significantly bolstering its cryptocurrency holdings.

Source: X

Not the first step…

This move follows a series of strategic decisions aimed at increasing the company’s BTC reserves. For example, a few days ago, Metaplanet announced a JPY 10.08 billion Gratis Allotment of Stock Acquisition Rights, also intended to facilitate the purchase of more BTC.

Additionally, the company recently joined the ‘Bitcoin for Corporations’ initiative, aligning itself with a growing number of firms that view Bitcoin as a viable treasury reserve asset.

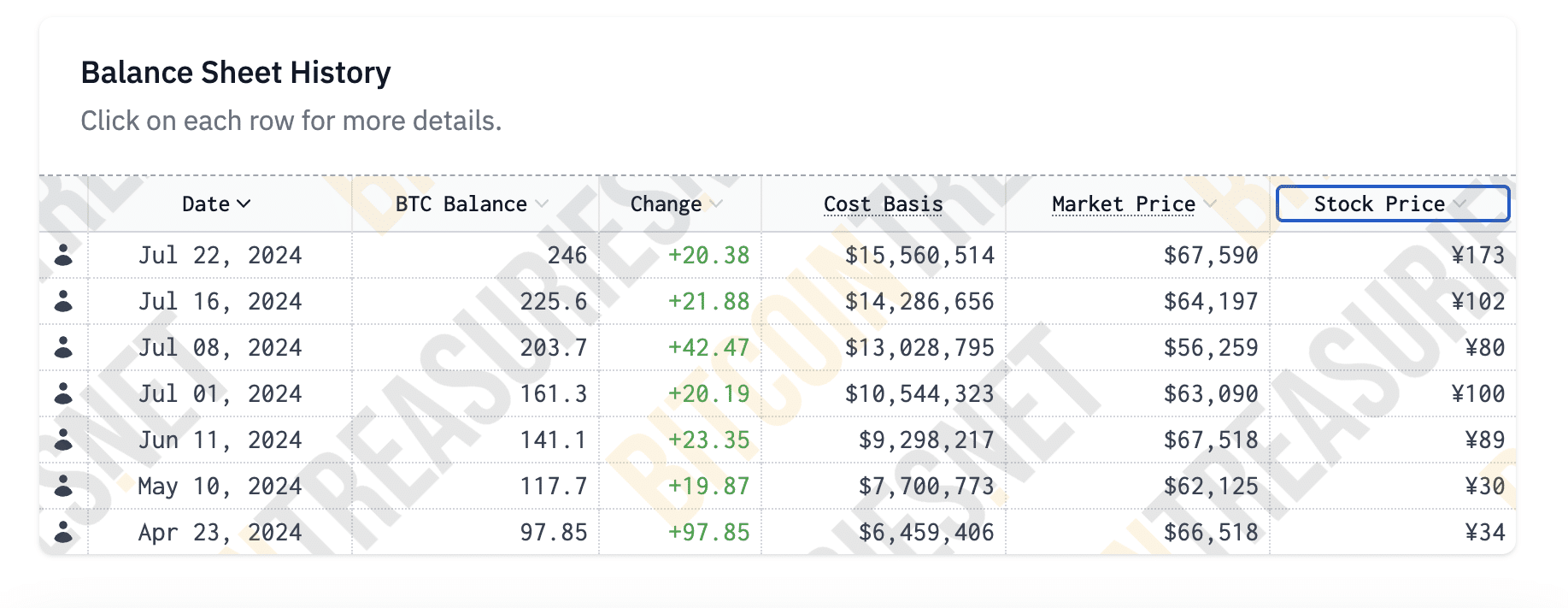

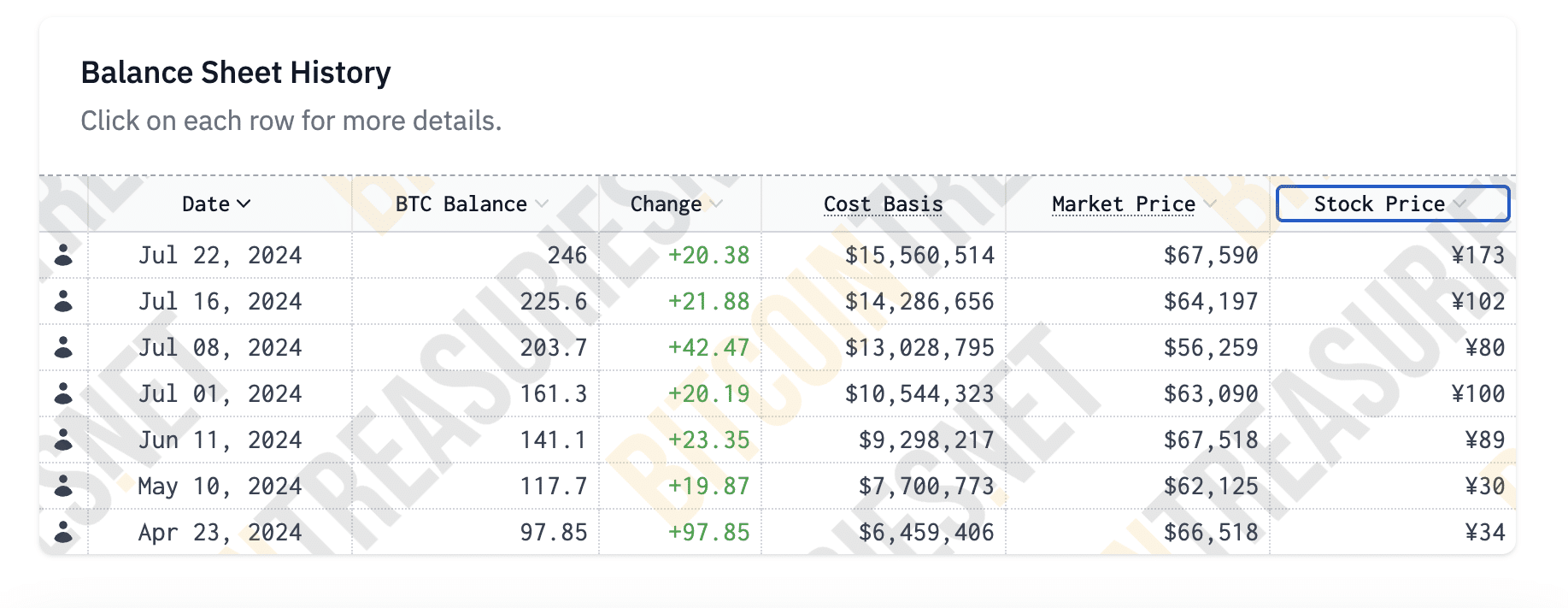

According to Bitcoin Treasuries, Metaplanet owns approximately 246 Bitcoin right now. The firm’s aggressive accumulation strategy is a sign of a strong belief in the long-term value and stability of Bitcoin.

Source: BitcoinTreasuries

By increasing its BTC holdings, Metaplanet aims to hedge against inflation and diversify its asset base, leveraging Bitcoin’s potential for high returns and its growing acceptance as a store of value.

The decision to dive deeper into Bitcoin and cryptocurrency is driven by several factors though.

For starters, Bitcoin’s finite supply and decentralized nature make it an attractive hedge against traditional financial market volatility and inflation.

Secondly, as central banks continue to implement expansive monetary policies, companies like Metaplanet see Bitcoin as a safeguard against currency devaluation and economic instability.

A trend in the making?

Metaplanet’s bold moves may inspire other public companies to follow suit. If more corporations begin to maintain BTC treasury reserves, it could have a significant impact on Bitcoin’s price. Not only that, but this trend could also polish Bitcoin’s legitimacy as a credible and mainstream financial asset.

Take MicroStrategy, for instance – The business intelligence firm has already set a precedent by converting a substantial portion of its cash reserves into Bitcoin. This move not only boosted MicroStrategy’s stock value, but also signaled a shift in how corporations view Bitcoin.

Similarly, Tesla’s announcement of a major Bitcoin purchase led to a notable price surge too.

Moves like these allow corporations to be more confident about adopting Bitcoin, an asset that has for long struggled with skepticism from many quarters. Especially on the regulatory and governmental front.

- Japan’s ‘MicroStrategy’ is intent on buying more BTC for its reserves

- Ongoing market dynamics might dictate widespread corporate adoption

Japan’s Metaplanet has secured a substantial loan of JPY 1 billion from MMXX Ventures Limited, a key shareholder in the company, to fund the purchase of additional Bitcoin (BTC). This loan will allow Metaplanet to acquire over 110 BTC, significantly bolstering its cryptocurrency holdings.

Source: X

Not the first step…

This move follows a series of strategic decisions aimed at increasing the company’s BTC reserves. For example, a few days ago, Metaplanet announced a JPY 10.08 billion Gratis Allotment of Stock Acquisition Rights, also intended to facilitate the purchase of more BTC.

Additionally, the company recently joined the ‘Bitcoin for Corporations’ initiative, aligning itself with a growing number of firms that view Bitcoin as a viable treasury reserve asset.

According to Bitcoin Treasuries, Metaplanet owns approximately 246 Bitcoin right now. The firm’s aggressive accumulation strategy is a sign of a strong belief in the long-term value and stability of Bitcoin.

Source: BitcoinTreasuries

By increasing its BTC holdings, Metaplanet aims to hedge against inflation and diversify its asset base, leveraging Bitcoin’s potential for high returns and its growing acceptance as a store of value.

The decision to dive deeper into Bitcoin and cryptocurrency is driven by several factors though.

For starters, Bitcoin’s finite supply and decentralized nature make it an attractive hedge against traditional financial market volatility and inflation.

Secondly, as central banks continue to implement expansive monetary policies, companies like Metaplanet see Bitcoin as a safeguard against currency devaluation and economic instability.

A trend in the making?

Metaplanet’s bold moves may inspire other public companies to follow suit. If more corporations begin to maintain BTC treasury reserves, it could have a significant impact on Bitcoin’s price. Not only that, but this trend could also polish Bitcoin’s legitimacy as a credible and mainstream financial asset.

Take MicroStrategy, for instance – The business intelligence firm has already set a precedent by converting a substantial portion of its cash reserves into Bitcoin. This move not only boosted MicroStrategy’s stock value, but also signaled a shift in how corporations view Bitcoin.

Similarly, Tesla’s announcement of a major Bitcoin purchase led to a notable price surge too.

Moves like these allow corporations to be more confident about adopting Bitcoin, an asset that has for long struggled with skepticism from many quarters. Especially on the regulatory and governmental front.

Eu nem sei como vim parar aqui, mas achei esse post ótimo, não sei quem você é, mas com certeza você está indo para um blogueiro famoso, se ainda não estiver.

order cheap clomid cost of clomid at cvs clomiphene without dr prescription where can i buy clomiphene pill buying clomiphene no prescription cost cheap clomid for sale order clomid without rx

I am no longer positive the place you’re getting your info, but good topic. I must spend some time finding out more or understanding more. Thank you for excellent information I used to be on the lookout for this info for my mission.

This is the type of post I unearth helpful.

With thanks. Loads of erudition!

buy azithromycin sale – buy floxin generic buy metronidazole paypal

semaglutide 14 mg us – order cyproheptadine sale buy periactin 4 mg pills

buy domperidone – brand cyclobenzaprine flexeril medication

order esomeprazole 20mg generic – https://anexamate.com/ nexium canada

order coumadin pills – coumamide cheap cozaar 25mg

I have been exploring for a little for any high-quality articles or weblog posts on this sort of area . Exploring in Yahoo I eventually stumbled upon this web site. Reading this information So i’m glad to exhibit that I have a very just right uncanny feeling I discovered exactly what I needed. I such a lot indubitably will make sure to do not omit this site and provides it a glance regularly.

order deltasone 10mg sale – corticosteroid deltasone ca

where to buy otc ed pills – natural ed pills can you buy ed pills online

amoxil order online – comba moxi order generic amoxil

fluconazole without prescription – buy forcan order fluconazole pills

purchase lexapro online – https://escitapro.com/# buy generic escitalopram for sale

cenforce where to buy – site order generic cenforce 100mg

cialis drug – https://ciltadgn.com/ mambo 36 tadalafil 20 mg

zantac canada – buy zantac pill buy ranitidine paypal

buy viagra without rx – https://strongvpls.com/# viagra sale cheap

More content pieces like this would urge the интернет better. azithromycin 250mg price

Thanks for sharing. It’s top quality. https://ursxdol.com/levitra-vardenafil-online/

I couldn’t weather commenting. Warmly written! order loratadine without prescription

More articles like this would make the blogosphere richer. https://aranitidine.com/fr/ciagra-professional-20-mg/

I’ll certainly bring to review more. https://ondactone.com/product/domperidone/

This is the tolerant of delivery I turn up helpful.

how to buy meloxicam

I am in truth delighted to glitter at this blog posts which consists of tons of useful facts, thanks object of providing such data. http://3ak.cn/home.php?mod=space&uid=229259

Thank you for some other excellent article. Where else could anyone get that type of information in such an ideal method of writing? I have a presentation subsequent week, and I am on the search for such info.

I’m not sure where you are getting your information, but great topic. I needs to spend some time learning more or understanding more. Thanks for wonderful information I was looking for this information for my mission.

I as well conceive thence, perfectly written post! .

cheap dapagliflozin 10 mg – https://janozin.com/ dapagliflozin 10 mg sale

Very efficiently written article. It will be beneficial to everyone who usess it, including myself. Keep up the good work – looking forward to more posts.

orlistat cheap – https://asacostat.com/ buy orlistat tablets

This is the type of post I turn up helpful. http://furiouslyeclectic.com/forum/member.php?action=profile&uid=24900