- XRP’s Fear and Greed index flashed ‘fear’

- Market indicators and metrics pointed to a trend reversal

Most cryptos had a rough week as their weekly charts remained red, and XRP was no different. The drop in price might have sparked fear among investors too. However, things can take a U-turn in the coming days as a bullish pattern seems to be appearing on the token’s daily chart.

A bull pattern on XRP’s chart

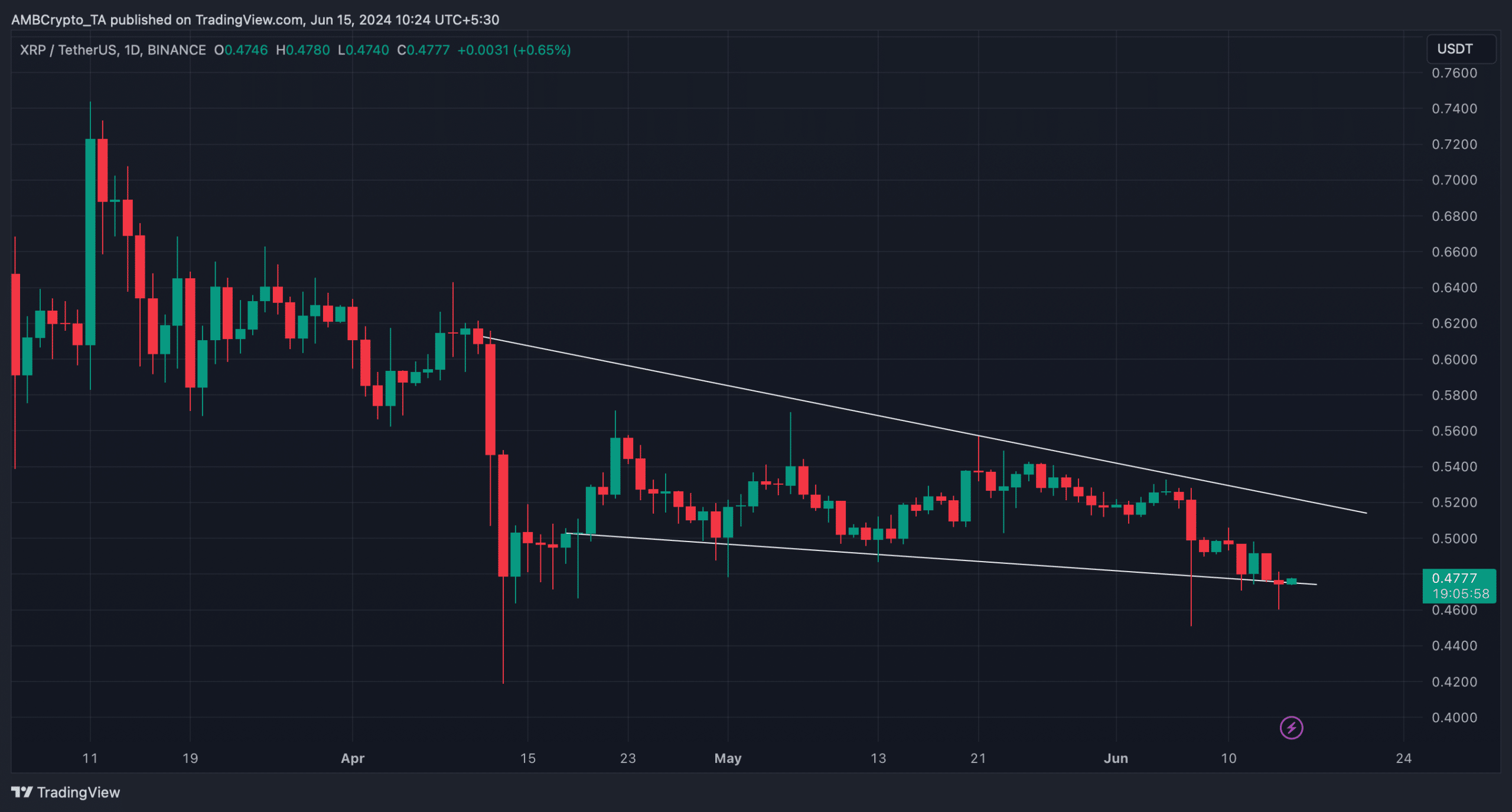

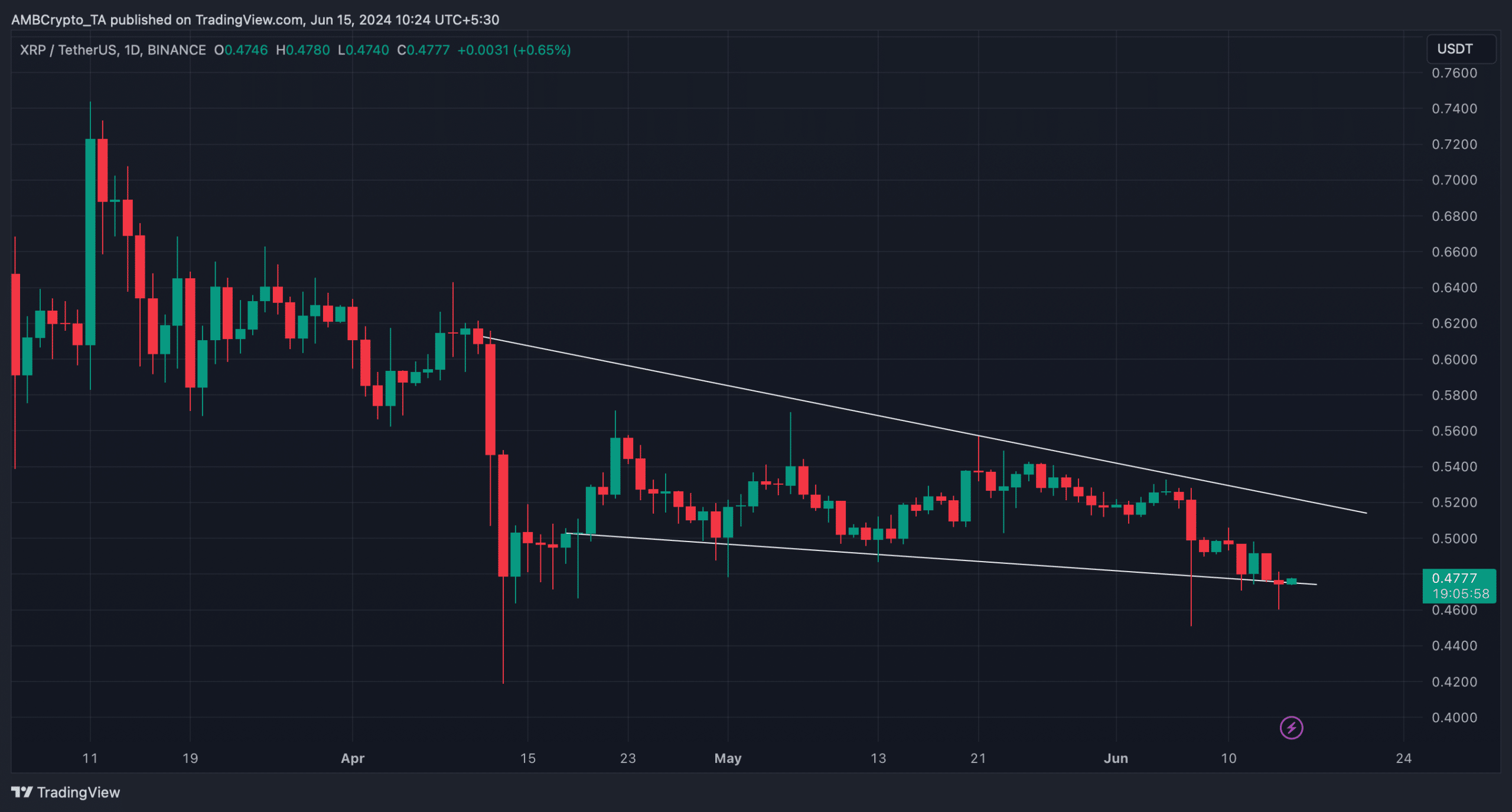

According to CoinMarketCap, XRP investors didn’t earn profits last week as the token’s price dropped by more than 4%. At the time of writing, the altcoin was trading at $0.4775 with a market capitalization of over $26.5 billion. Thanks to the price drop, XRP’s profit supply in profit also plummeted sharply.

At press time, only 69.8 billion tokens were in profit. However, investors must not lose hope as XRP might be getting ready for a pump. In fact, AMBCrypto’s analysis revealed that a bullish falling wedge pattern has emerged on the token’s chart.

Source: TradingView

XRP’s price entered the pattern after its massive price fall in mid-April. Since then, the token has consolidated inside the falling wedge. At press time, it was preparing for an uptrend, which might result in a breakout above the pattern. A successful breakout might allow XRP to recover its April losses.

In fact, if everything falls into place, then XRP might soon retest its March highs too.

Is a bull rally inevitable?

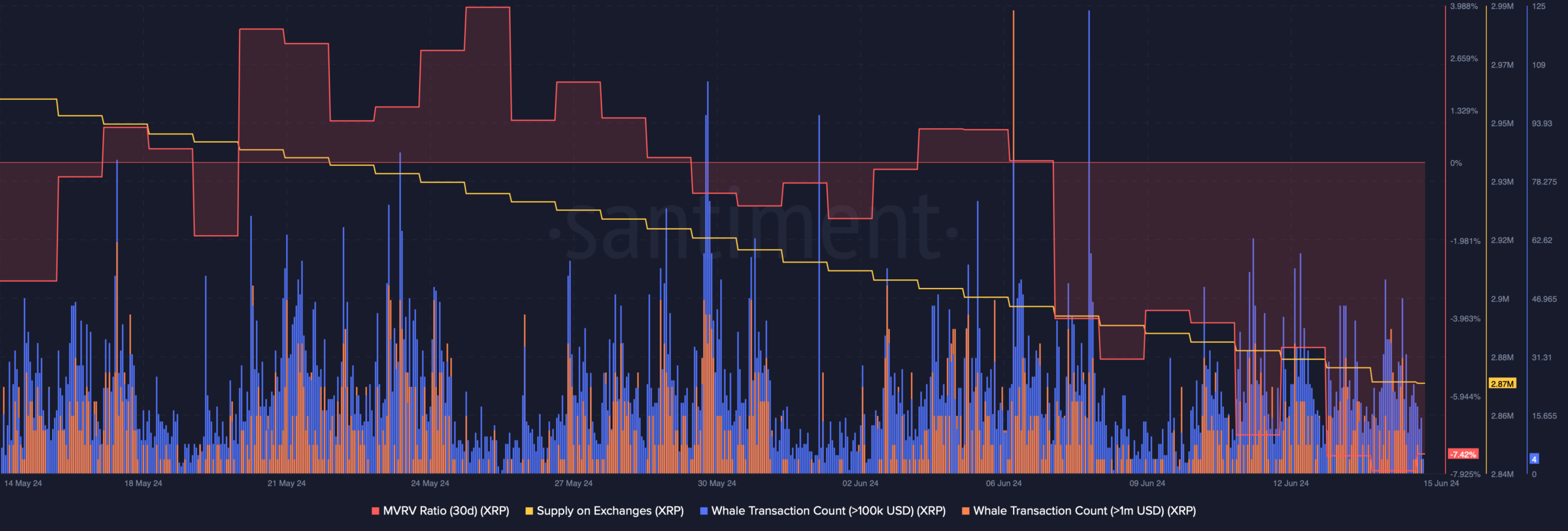

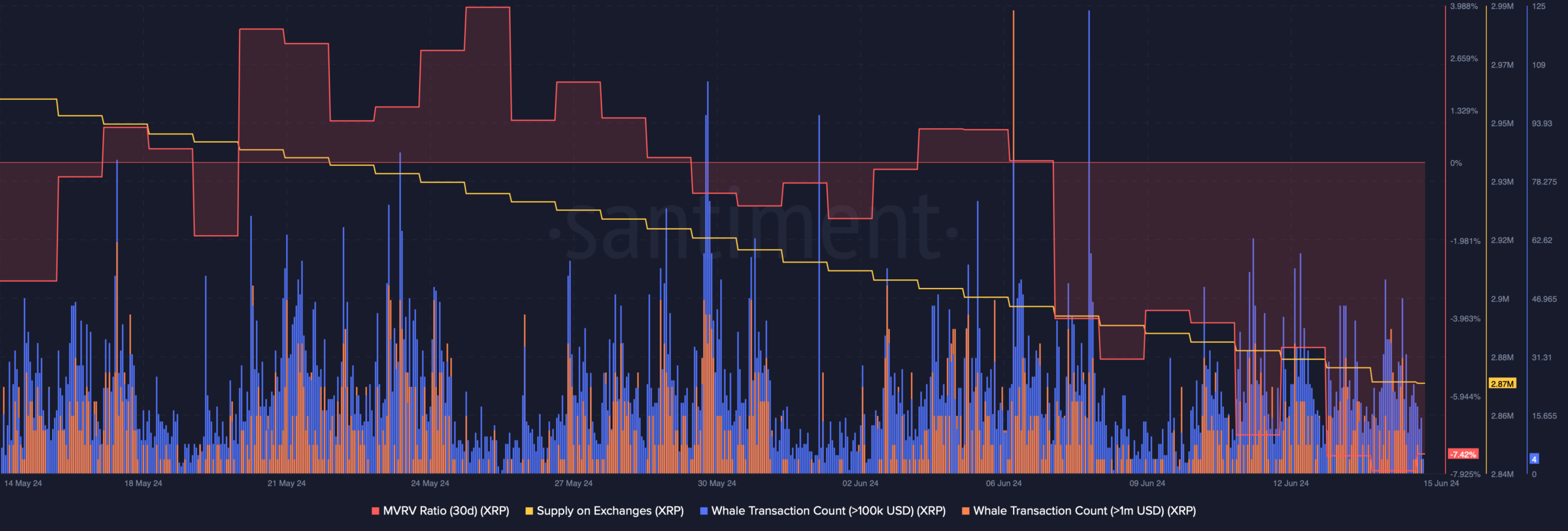

AMBCrypto then analyzed Santiment’s data to see whether metrics supported the possibility of a bullish breakout. We found that XRP’s MVRV ratio was at its lowest point in the last 30 days, which might trigger a bull rally.

Its supply on exchanges dipped too, meaning that investors used the opportunity to buy more tokens. Additionally, whale activity around XRP also remained relatively high, with the same evidenced by its whale transaction count.

Source: Santiment

Additionally, AMBCrypto found that at press time, XRP’s fear and greed index had a value of 37%, meaning that the market was in a “fear” phase. Whenever the metric hits that level, it indicates that the chances of a trend reversal are high.

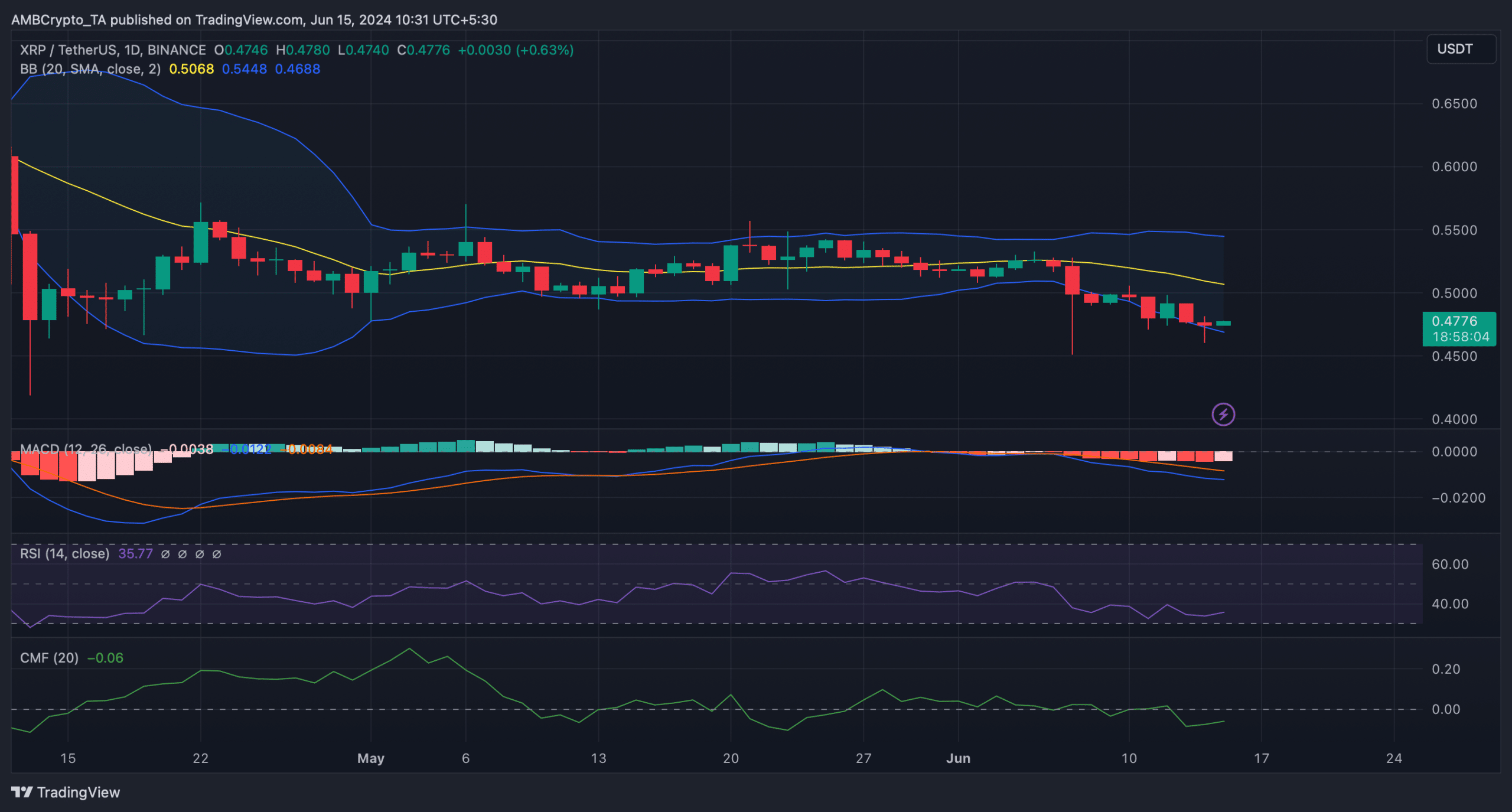

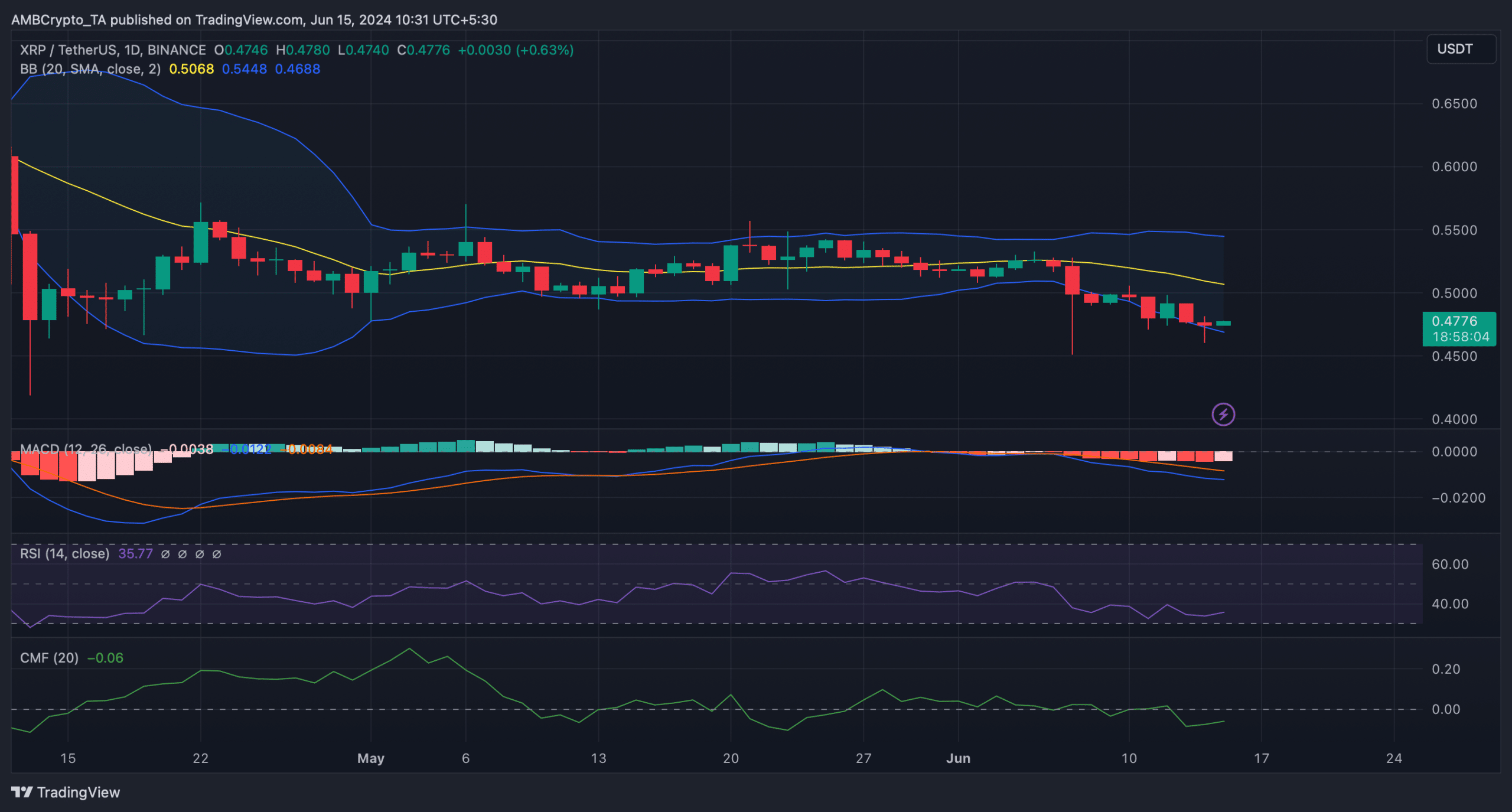

We then analyzed the token’s daily chart to better understand what to expect from it in the coming days. AMBCrypto found that XRP’s price has touched the lower limit of the Bollinger Bands, which often results in price upticks.

Realistic or not, here’s XRP’s market cap in BTC terms

Moreover, both its Relative Strength Index (RSI) and Chaikin Money Flow (CMF) registered slight upticks.

These indicators suggested that the chances of a bullish trend reversal were high. Worth noting, however, that the MACD remained in the sellers’ favor as it projected a bearish advantage across the market.

Source: TradingView

- XRP’s Fear and Greed index flashed ‘fear’

- Market indicators and metrics pointed to a trend reversal

Most cryptos had a rough week as their weekly charts remained red, and XRP was no different. The drop in price might have sparked fear among investors too. However, things can take a U-turn in the coming days as a bullish pattern seems to be appearing on the token’s daily chart.

A bull pattern on XRP’s chart

According to CoinMarketCap, XRP investors didn’t earn profits last week as the token’s price dropped by more than 4%. At the time of writing, the altcoin was trading at $0.4775 with a market capitalization of over $26.5 billion. Thanks to the price drop, XRP’s profit supply in profit also plummeted sharply.

At press time, only 69.8 billion tokens were in profit. However, investors must not lose hope as XRP might be getting ready for a pump. In fact, AMBCrypto’s analysis revealed that a bullish falling wedge pattern has emerged on the token’s chart.

Source: TradingView

XRP’s price entered the pattern after its massive price fall in mid-April. Since then, the token has consolidated inside the falling wedge. At press time, it was preparing for an uptrend, which might result in a breakout above the pattern. A successful breakout might allow XRP to recover its April losses.

In fact, if everything falls into place, then XRP might soon retest its March highs too.

Is a bull rally inevitable?

AMBCrypto then analyzed Santiment’s data to see whether metrics supported the possibility of a bullish breakout. We found that XRP’s MVRV ratio was at its lowest point in the last 30 days, which might trigger a bull rally.

Its supply on exchanges dipped too, meaning that investors used the opportunity to buy more tokens. Additionally, whale activity around XRP also remained relatively high, with the same evidenced by its whale transaction count.

Source: Santiment

Additionally, AMBCrypto found that at press time, XRP’s fear and greed index had a value of 37%, meaning that the market was in a “fear” phase. Whenever the metric hits that level, it indicates that the chances of a trend reversal are high.

We then analyzed the token’s daily chart to better understand what to expect from it in the coming days. AMBCrypto found that XRP’s price has touched the lower limit of the Bollinger Bands, which often results in price upticks.

Realistic or not, here’s XRP’s market cap in BTC terms

Moreover, both its Relative Strength Index (RSI) and Chaikin Money Flow (CMF) registered slight upticks.

These indicators suggested that the chances of a bullish trend reversal were high. Worth noting, however, that the MACD remained in the sellers’ favor as it projected a bearish advantage across the market.

Source: TradingView

I’m extremely impressed along with your writing abilities as smartly as with the layout on your weblog. Is that this a paid topic or did you customize it your self? Anyway stay up the nice quality writing, it is rare to look a nice blog like this one today..

Great web site. A lot of useful information here. I am sending it to a few friends ans also sharing in delicious. And of course, thanks for your sweat!

Good blog! I really love how it is simple on my eyes and the data are well written. I’m wondering how I might be notified when a new post has been made. I’ve subscribed to your feed which must do the trick! Have a nice day!

where can i buy generic clomiphene no prescription where to get clomiphene can i buy generic clomid no prescription can i purchase cheap clomid for sale cost of cheap clomiphene for sale cost of clomiphene tablets cost cheap clomid online

More articles like this would make the blogosphere richer.

purchase azithromycin for sale – floxin 400mg over the counter buy metronidazole 400mg online

buy domperidone generic – generic motilium 10mg buy cheap generic flexeril

I conceive other website proprietors should take this website as an example , very clean and great user genial design and style.

inderal 10mg drug – order methotrexate for sale methotrexate 5mg sale

buy generic augmentin over the counter – https://atbioinfo.com/ ampicillin medication

coumadin pill – anticoagulant buy losartan 25mg online

I needed to put you the very small remark to thank you as before with the remarkable basics you have shared at this time. This is so incredibly generous with people like you to offer unhampered what exactly many of us could have marketed for an ebook to help with making some dough on their own, notably considering that you could have done it in the event you decided. These good tips additionally worked to be a fantastic way to know that many people have similar fervor just like mine to find out much more with respect to this problem. I know there are many more pleasurable sessions in the future for individuals that check out your website.

order prednisone 5mg online – https://apreplson.com/ deltasone 20mg cost

buy erectile dysfunction medications – https://fastedtotake.com/ buy erectile dysfunction pills

amoxil price – https://combamoxi.com/ cheap amoxil pills

buy fluconazole 100mg for sale – click diflucan 100mg price

cenforce 100mg without prescription – https://cenforcers.com/# oral cenforce 50mg

tadalafil walgreens – https://ciltadgn.com/# where to buy generic cialis ?

order generic zantac 150mg – ranitidine 150mg for sale buy ranitidine 300mg online cheap

cialis bestellen deutschland – https://strongtadafl.com/# letairis and tadalafil

This is the tolerant of post I turn up helpful. viagra 5 mg es suficiente

viagra buy tesco – this buy viagra mumbai

The sagacity in this serving is exceptional. where to buy lasix without a prescription

Proof blog you be undergoing here.. It’s obdurate to find elevated calibre article like yours these days. I honestly appreciate individuals like you! Withstand care!! https://ursxdol.com/augmentin-amoxiclav-pill/

This website absolutely has all of the information and facts I needed about this case and didn’t comprehend who to ask. https://prohnrg.com/product/omeprazole-20-mg/

I’m curious to find out what blog platform you have been working with? I’m experiencing some small security problems with my latest site and I would like to find something more safe. Do you have any solutions?

Good blog you have here.. It’s intricate to assign strong worth belles-lettres like yours these days. I justifiably comprehend individuals like you! Go through guardianship!! aranitidine.com

Proof blog you be undergoing here.. It’s severely to on high quality article like yours these days. I truly comprehend individuals like you! Take vigilance!! https://ondactone.com/spironolactone/

I’ll certainly return to be familiar with more.

https://proisotrepl.com/product/clopidogrel/

With thanks. Loads of conception! http://forum.ttpforum.de/member.php?action=profile&uid=424434

Incredible! This blog looks just like my old one! It’s on a totally different topic but it has pretty much the same page layout and design. Outstanding choice of colors!

buy dapagliflozin 10mg sale – on this site buy dapagliflozin pills for sale

I truly appreciate this post. I?¦ve been looking everywhere for this! Thank goodness I found it on Bing. You’ve made my day! Thanks again