CRV, the native token of the stablecoin decentralized exchange Curve Finance, has been dumping in over the last year or so. After last week’s plunge, the token fell by as much as 75% from March 2024 highs, a huge concern for token holders.

CRV Recovers, Adds 45% After Plunging

However, according to one analyst who took to X, the bottom could be in, arguing that favorable fundamental events in roughly two months could propel the token to as high as $2. CRV is changing hands at around $0.32, up 42% from last week’s lows.

Most importantly, prices are stabilizing, with the impressive follow-through of June 13. After the flash crash that day, prices fell to as low as $0.22.

Related Reading

However, what was encouraging was the long lower wick, pointing to welcomed demand by the close of the trading day. This push was clear the next day when prices closed higher, with bulls extending gains over the weekend.

Whether the June 13 plunge marked the end of CRV woes remains to be seen. For now, the sharp 45% recovery from last week’s lows and the expansion in Ethereum prices could create demand, further propelling CRV to the $0.40 mark.

Curve To Change Token Emission As Erogov’s Bad Debt Cleared

The analyst thinks something big is in the pipeline for Curve Finance as a protocol and CRV as the primary token priming platform. In mid-August, the token’s inflation rate would fall from 20.37% to as low as 6.34%. This reduction would be primarily because of the protocol’s shift to CRV distribution.

From August 12, Curve will automatically cease allocating CRV to the core team for vesting. Instead, gauges will distribute the token directly to the community, drastically slashing inflation.

Curve gauges determine how CRV is distributed to various liquidity pools. Through gauges, Curve Finance remains decentralized. This is because token holders can now vote on how much the liquidity providers of a given pool can receive CRV as an incentive.

Related Reading

Besides the shift in CRV distribution, the liquidation of Michael Egorov’s position eliminates the issue of bad debt. Accordingly, Curve can not generate real revenue for CRV holders, drawing value.

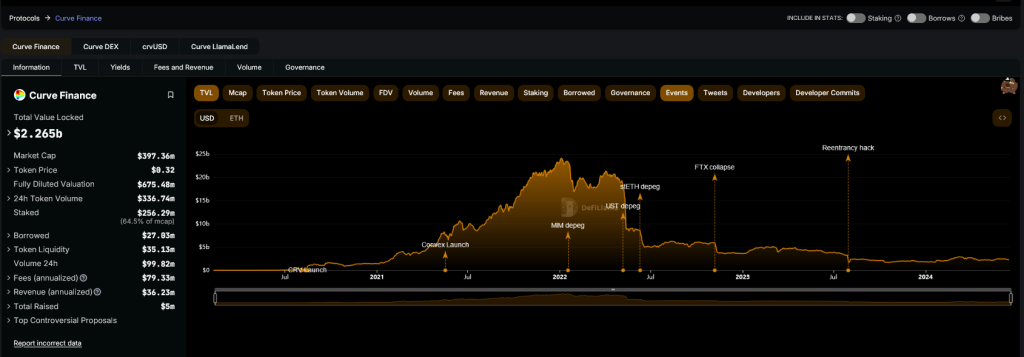

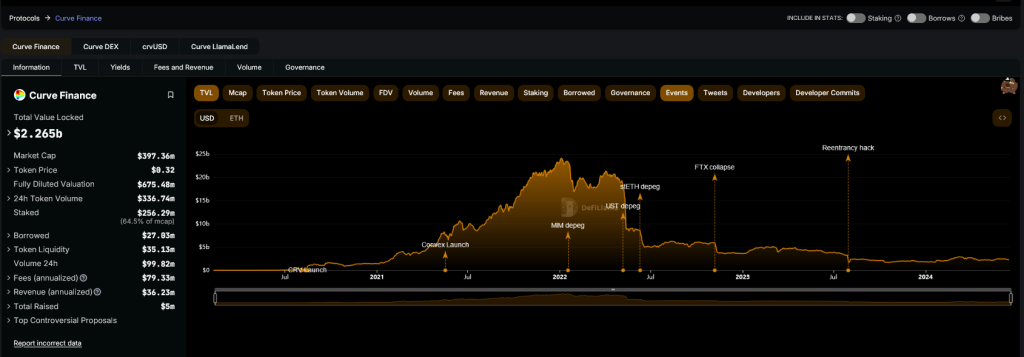

According to the analyst, Curve could evolve to be a leading decentralized Forex market over the coming years. The protocol is one of the largest decentralized finance (DeFi) platforms. According to DeFiLlama, it commands a total value locked of over $2.2 billion.

Feature image from DALLE, chart from TradingView

CRV, the native token of the stablecoin decentralized exchange Curve Finance, has been dumping in over the last year or so. After last week’s plunge, the token fell by as much as 75% from March 2024 highs, a huge concern for token holders.

CRV Recovers, Adds 45% After Plunging

However, according to one analyst who took to X, the bottom could be in, arguing that favorable fundamental events in roughly two months could propel the token to as high as $2. CRV is changing hands at around $0.32, up 42% from last week’s lows.

Most importantly, prices are stabilizing, with the impressive follow-through of June 13. After the flash crash that day, prices fell to as low as $0.22.

Related Reading

However, what was encouraging was the long lower wick, pointing to welcomed demand by the close of the trading day. This push was clear the next day when prices closed higher, with bulls extending gains over the weekend.

Whether the June 13 plunge marked the end of CRV woes remains to be seen. For now, the sharp 45% recovery from last week’s lows and the expansion in Ethereum prices could create demand, further propelling CRV to the $0.40 mark.

Curve To Change Token Emission As Erogov’s Bad Debt Cleared

The analyst thinks something big is in the pipeline for Curve Finance as a protocol and CRV as the primary token priming platform. In mid-August, the token’s inflation rate would fall from 20.37% to as low as 6.34%. This reduction would be primarily because of the protocol’s shift to CRV distribution.

From August 12, Curve will automatically cease allocating CRV to the core team for vesting. Instead, gauges will distribute the token directly to the community, drastically slashing inflation.

Curve gauges determine how CRV is distributed to various liquidity pools. Through gauges, Curve Finance remains decentralized. This is because token holders can now vote on how much the liquidity providers of a given pool can receive CRV as an incentive.

Related Reading

Besides the shift in CRV distribution, the liquidation of Michael Egorov’s position eliminates the issue of bad debt. Accordingly, Curve can not generate real revenue for CRV holders, drawing value.

According to the analyst, Curve could evolve to be a leading decentralized Forex market over the coming years. The protocol is one of the largest decentralized finance (DeFi) platforms. According to DeFiLlama, it commands a total value locked of over $2.2 billion.

Feature image from DALLE, chart from TradingView

clomiphene prescription cost how to get cheap clomid price can you get cheap clomiphene without insurance clomid tablete buy cheap clomid no prescription how can i get clomid without prescription can i order cheap clomid without a prescription

This is a theme which is forthcoming to my verve… Numberless thanks! Exactly where can I upon the contact details due to the fact that questions?

This is the stripe of topic I enjoy reading.

how to get zithromax without a prescription – tetracycline 500mg generic buy generic metronidazole for sale

buy rybelsus 14mg pills – rybelsus 14mg ca how to buy cyproheptadine

order domperidone pills – motilium 10mg oral cost cyclobenzaprine 15mg

order augmentin 1000mg sale – https://atbioinfo.com/ buy ampicillin online

buy generic esomeprazole 40mg – https://anexamate.com/ buy esomeprazole 40mg sale

order coumadin 2mg generic – anticoagulant order cozaar 25mg online

mobic 7.5mg brand – swelling buy mobic 15mg without prescription

order prednisone sale – aprep lson deltasone 5mg tablet

buying ed pills online – fast ed to take male erection pills

amoxicillin us – brand amoxicillin amoxicillin usa

forcan generic – this diflucan online

buy cenforce 50mg generic – https://cenforcers.com/# order cenforce 100mg pill

cialis trial – what is tadalafil made from tadalafil pulmonary hypertension

cialis overnight shipping – https://strongtadafl.com/ what does cialis look like

purchase ranitidine without prescription – on this site ranitidine 150mg usa