- The SEC has approved the first leveraged MicroStrategy ETF

- Market indicators suggested an upward move for Bitcoin

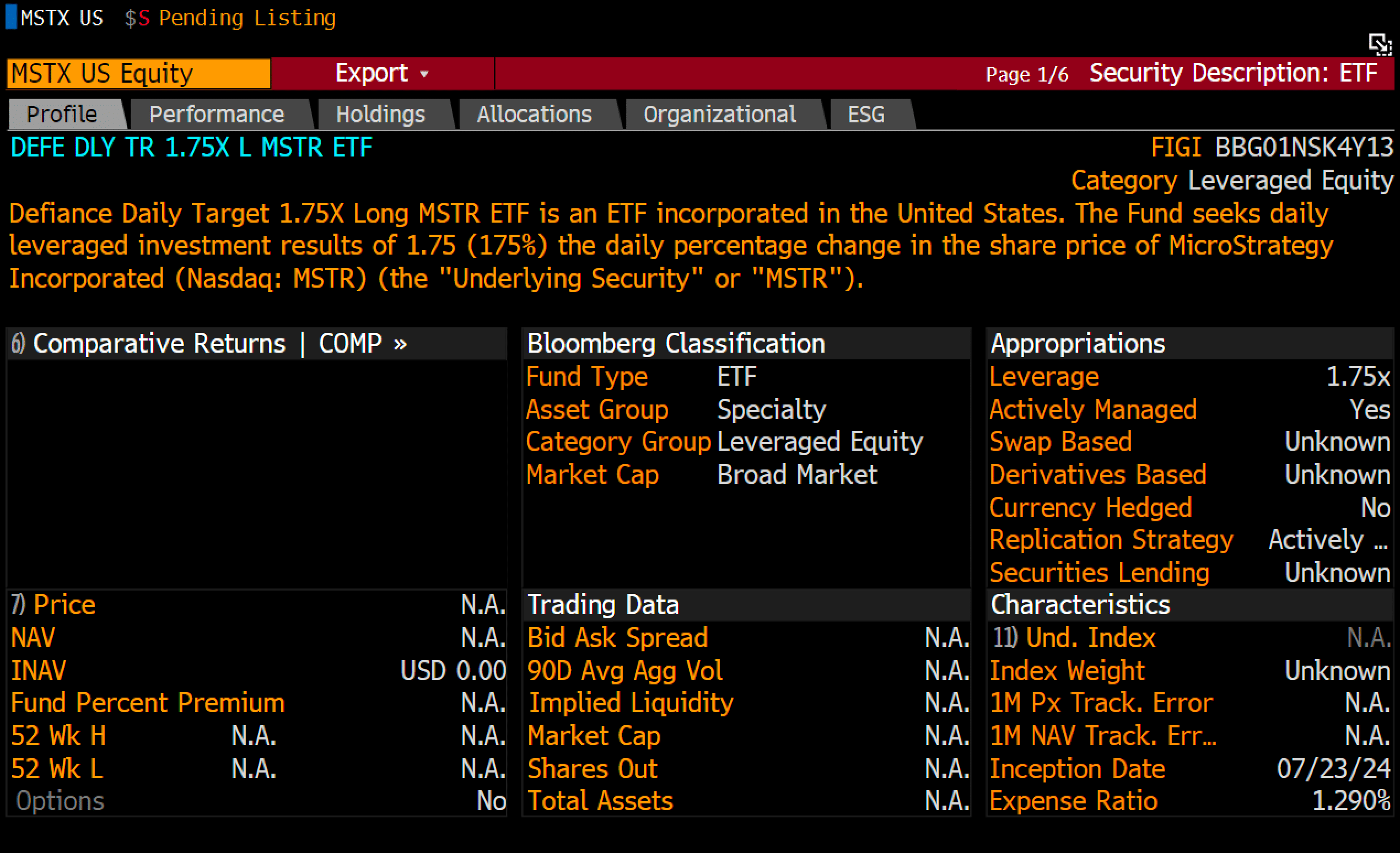

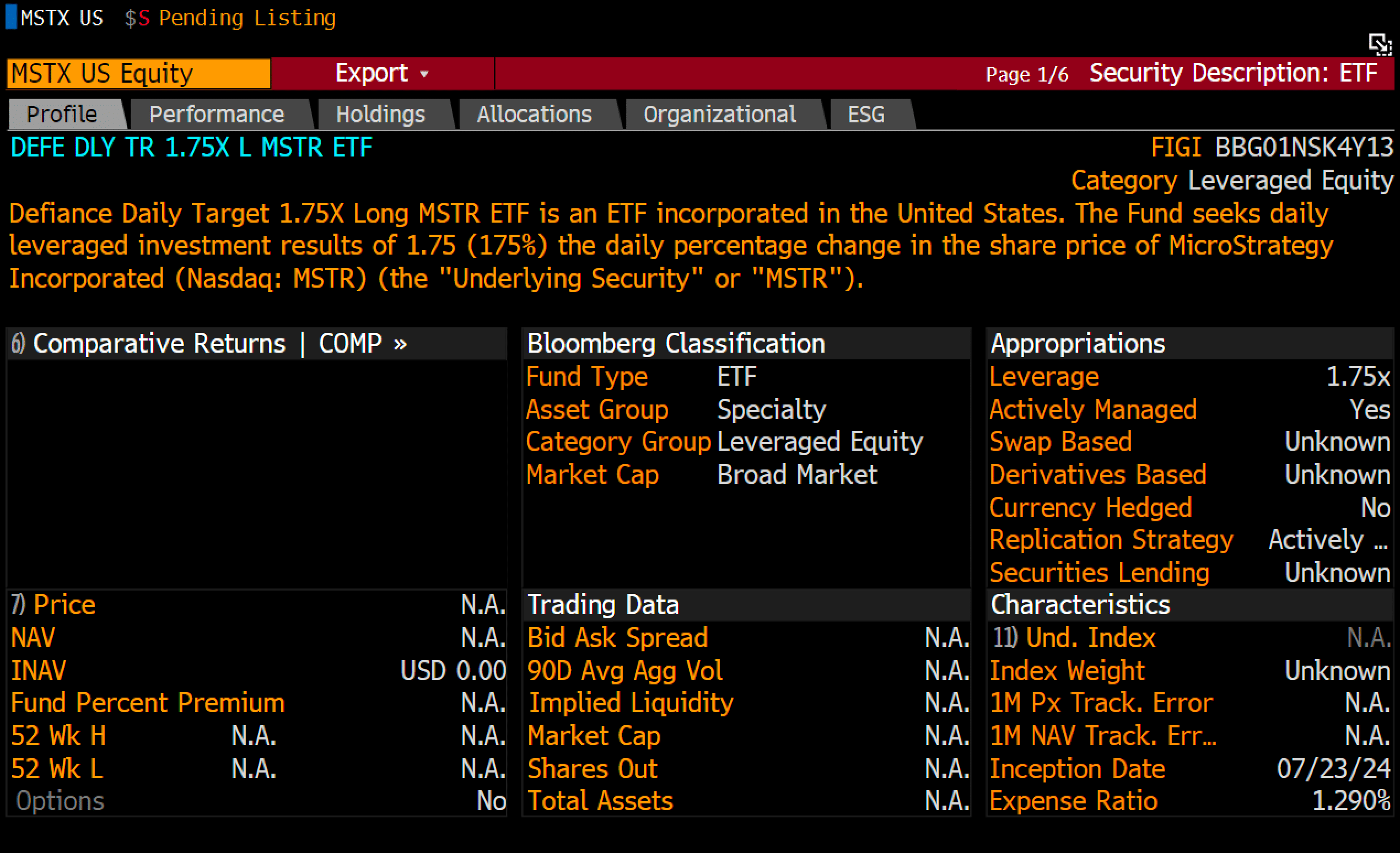

The SEC is in the news today after it approved the first leveraged MicroStrategy ETF, launched by Defiance as a 1.75x fund ($MSTX). This update was first shared by Bloomberg’s ETF Analyst Eric Balchunas on X.

Though initially intended as a 2x ETF, the SEC’s restrictions limit its leverage. This ETF will be highly volatile, similar to a 13x SPY ETF, surpassing even the $MSOX (2x weed ETF) in risk.

Source: Eric Balchunas on X

Defiance has beaten Tuttle to market with this product, although Tuttle is also attempting a 2x MicroStrategy ETF.

The market for highly volatile ETFs is strong, evident from the $5 billion Nvidia 2x ETF. This approval may be a sign of greater buying pressure and bullish sentiment for Bitcoin.

USD cycles, treasury, & BTC bull markets

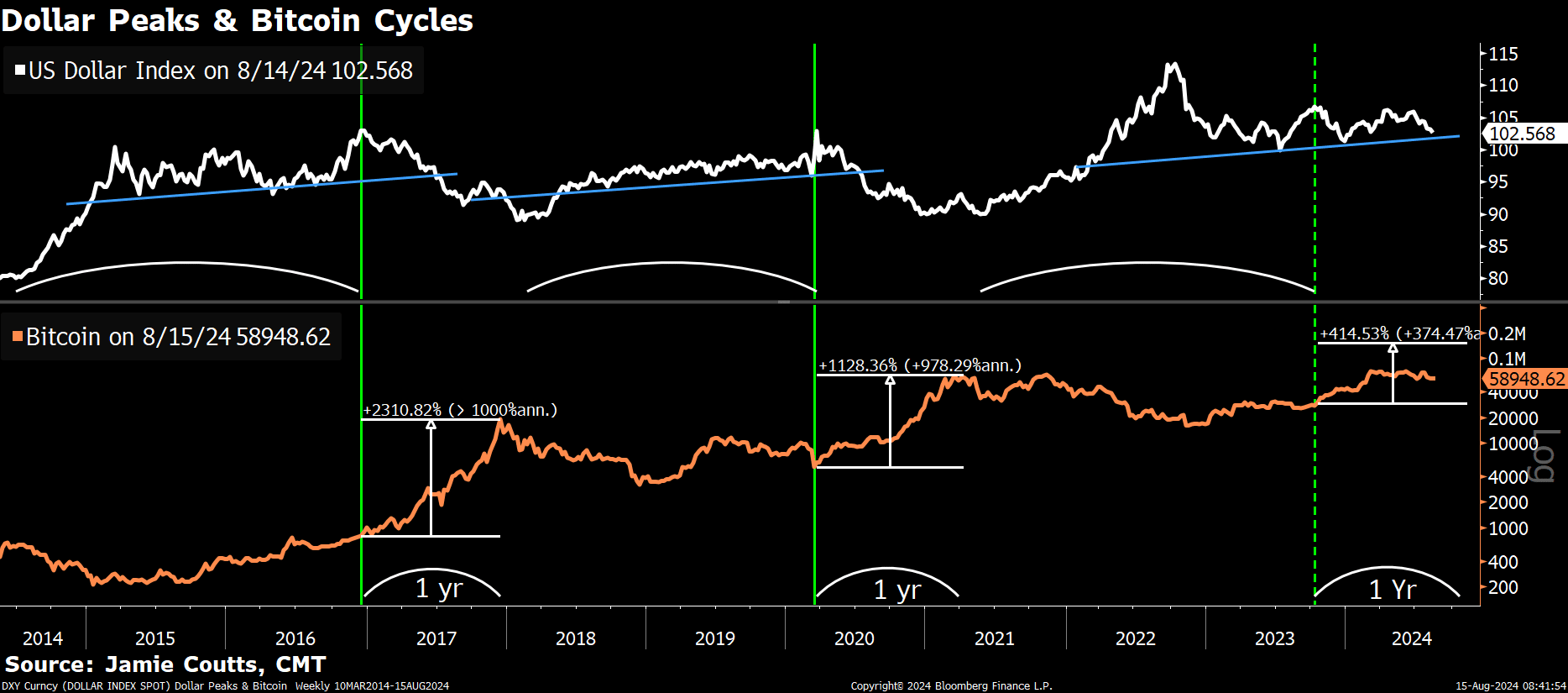

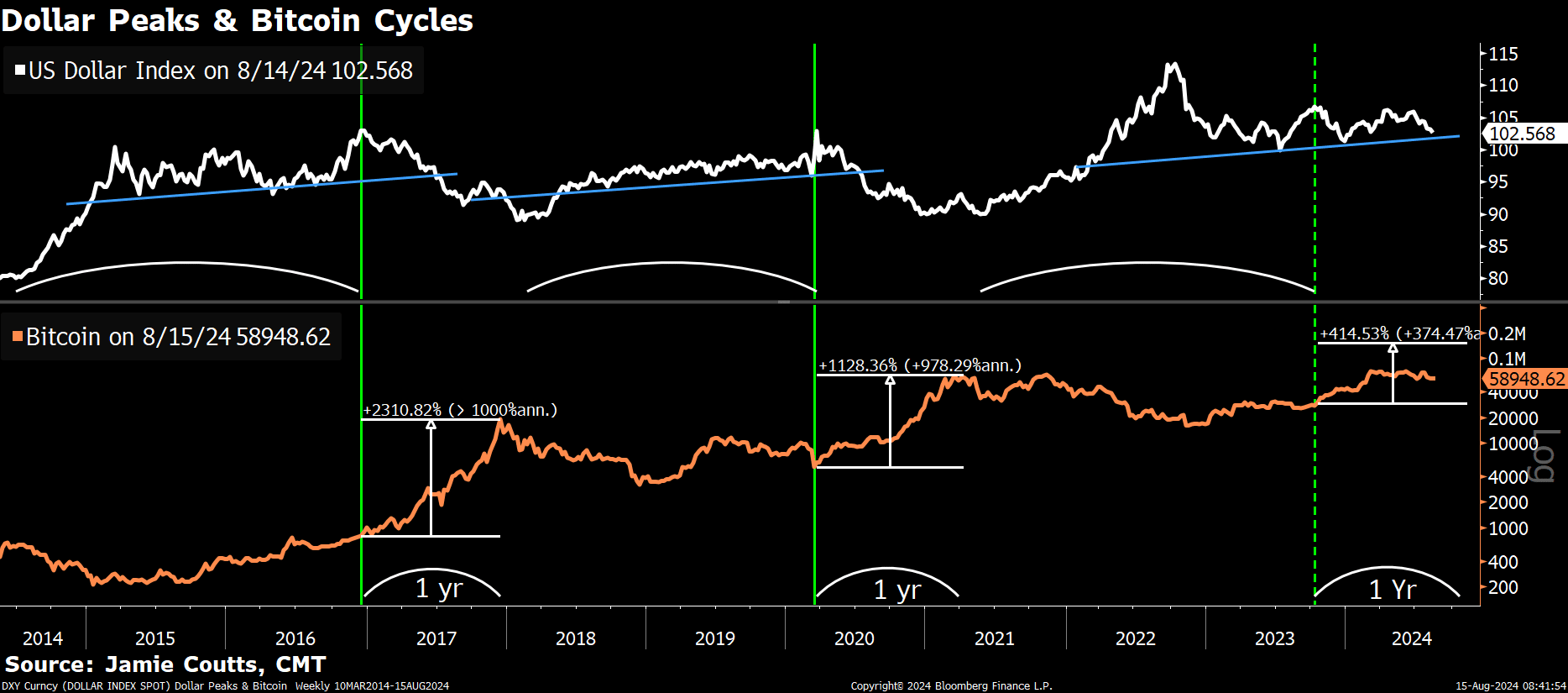

Bitcoin [BTC] tends to rise most sharply when the U.S dollar ($DXY) weakens. The Federal Reserve’s actions and increased global liquidity are likely causing the DXY to decline.

The DXY has now hit equal highs, indicating a potential reversal. As the DXY drops, Bitcoin is expected to climb higher, potentially surpassing its all-time high on the charts.

Source: Bloomberg

Treasury market volatility is a crucial yet often overlooked factor in shaping risk asset strategies. It’s a major concern for Federal Reserve Chair Jerome Powell and his team.

To prevent market instability, they aim to reduce treasury volatility. As a result, this suppressed volatility may shift to Bitcoin, potentially driving its price higher.

Source: Bloomberg

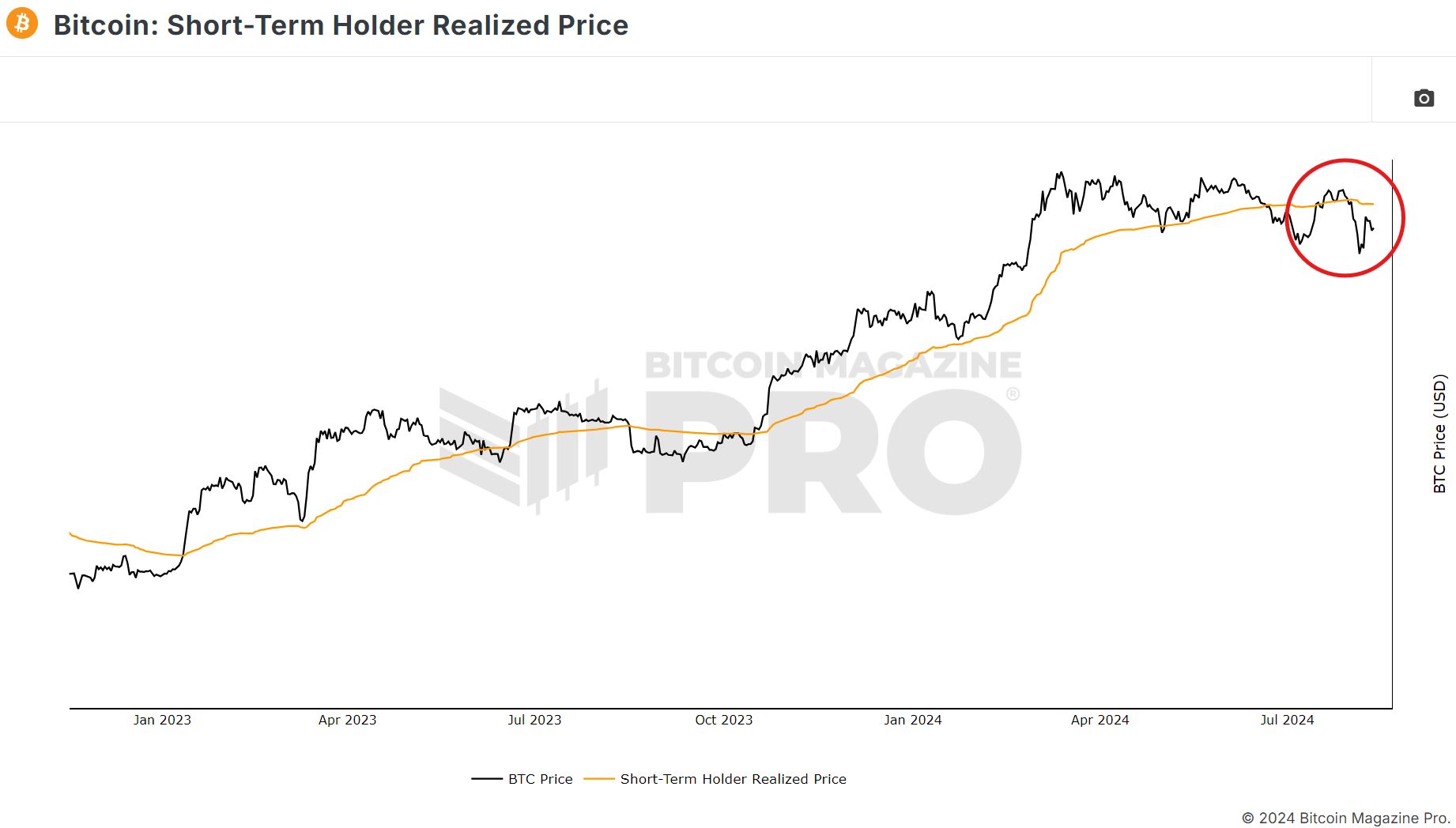

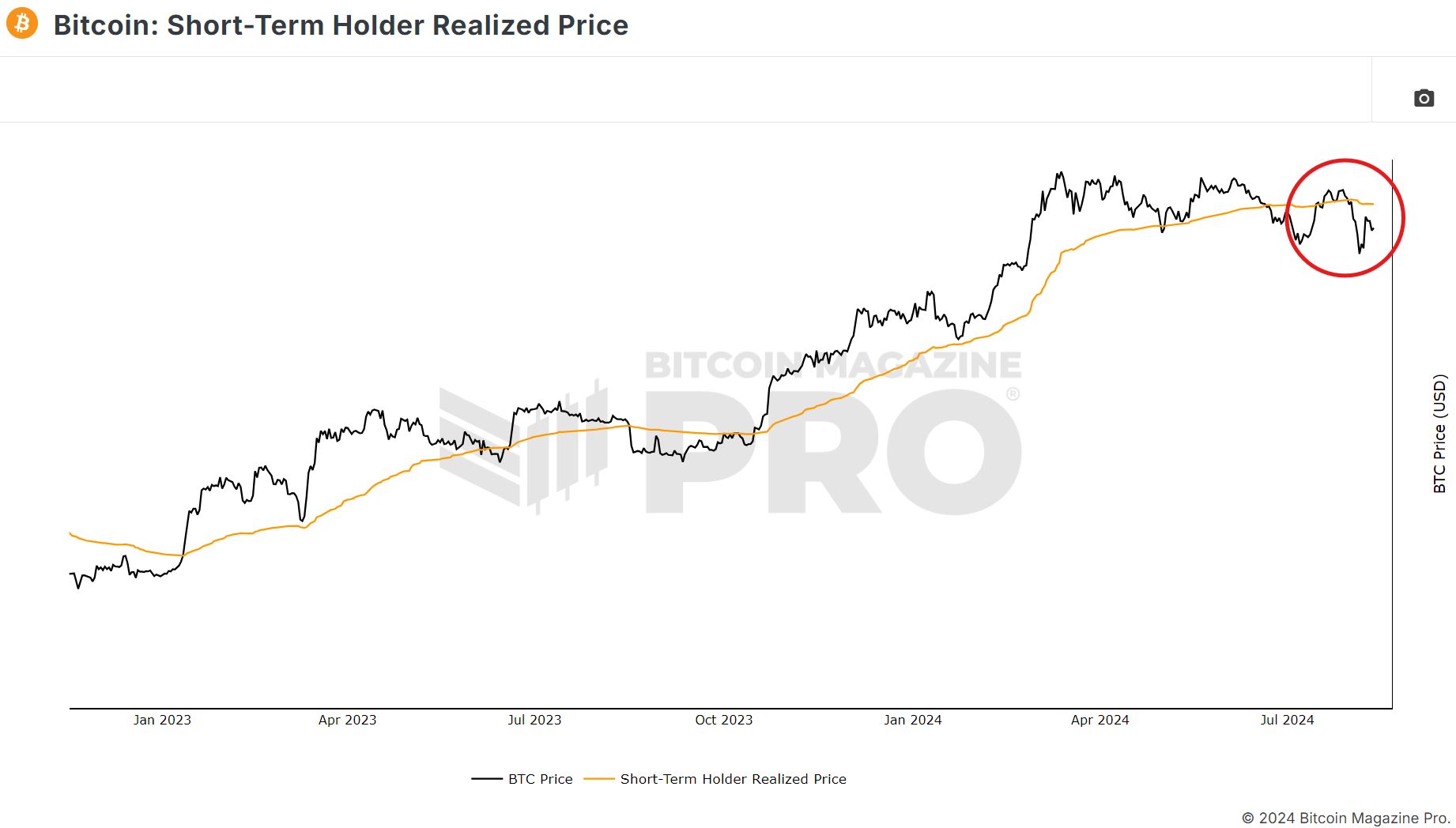

Bitcoin is demonstrating strong momentum too, breaking above the Short-Term Holder Realized Price of approximately $65K.

If this level is reclaimed on the charts, it could serve as a foundation for Bitcoin to push towards the $70,000-mark and possibly beyond. This performance reinforces Bitcoin’s position as a top choice for crypto investment.

Source: Bitcoin Magazine PRO

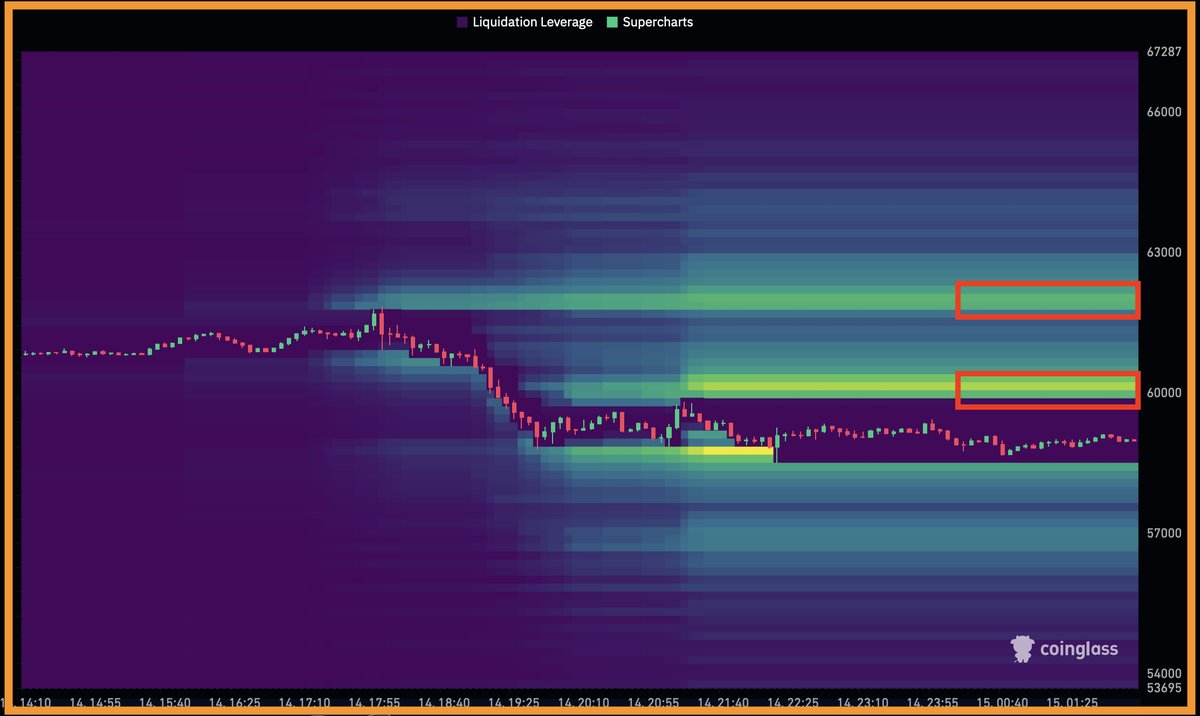

Leverage liquidations and RSI signal bullish sentiment

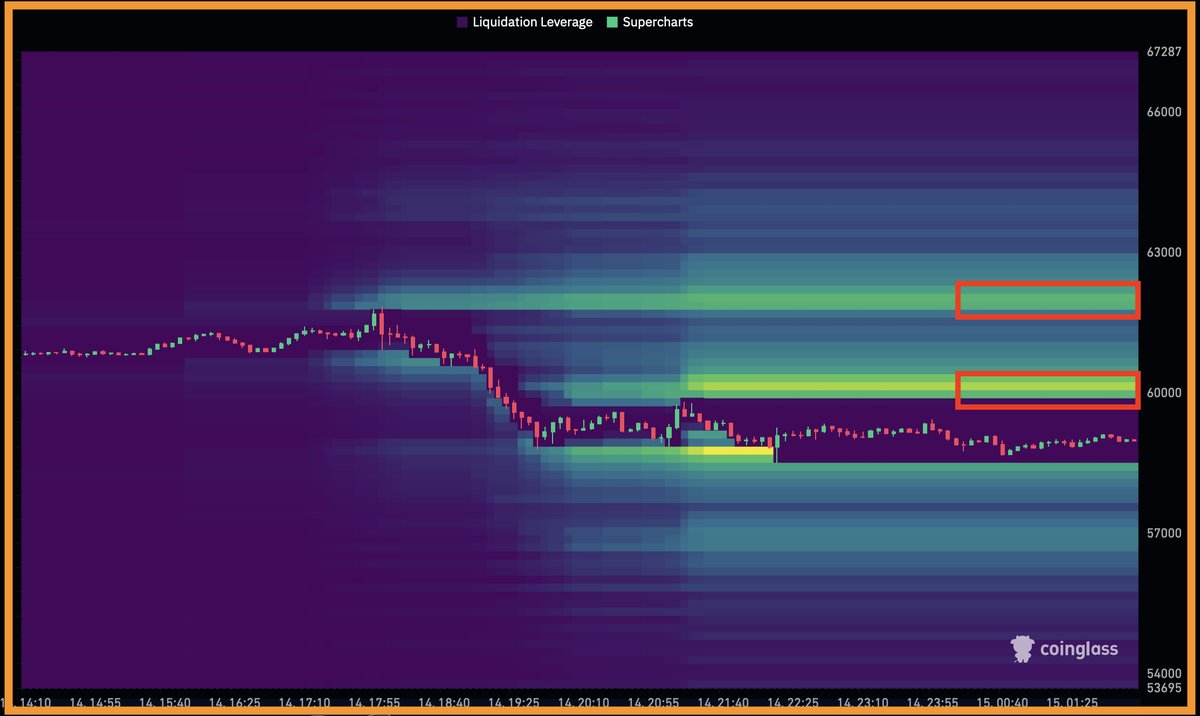

Leverage liquidation hunting is a key factor causing price movements across high timeframes.

Bitcoin could climb and hold above $60k to trigger liquidations, where $93 million is positioned between $60-60.4K, and another $75 million between $61.8-62.2K.

This could drive Bitcoin to surpass its previous all-time high of $74,000, potentially leading to even higher prices.

Source: Coinglass

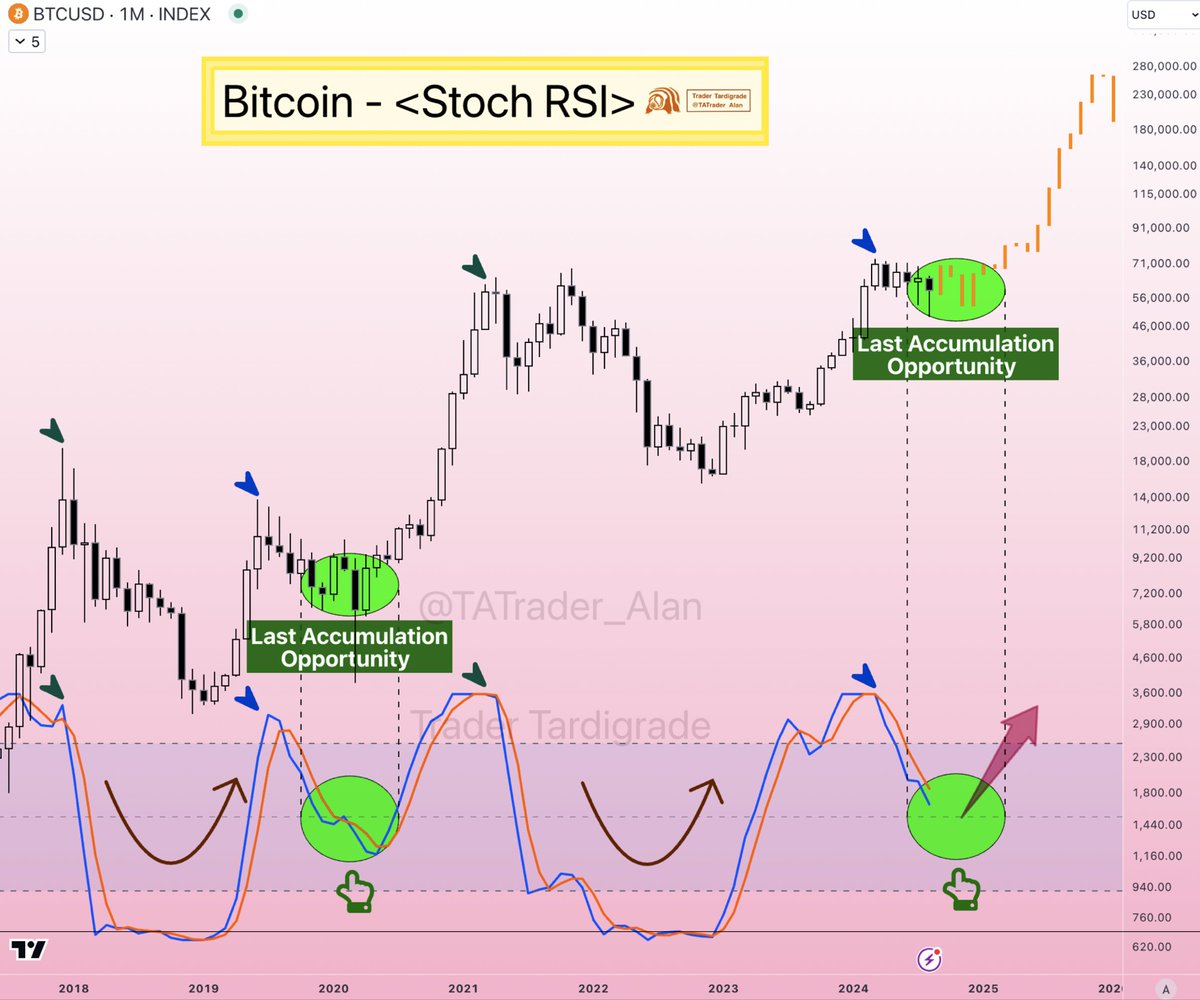

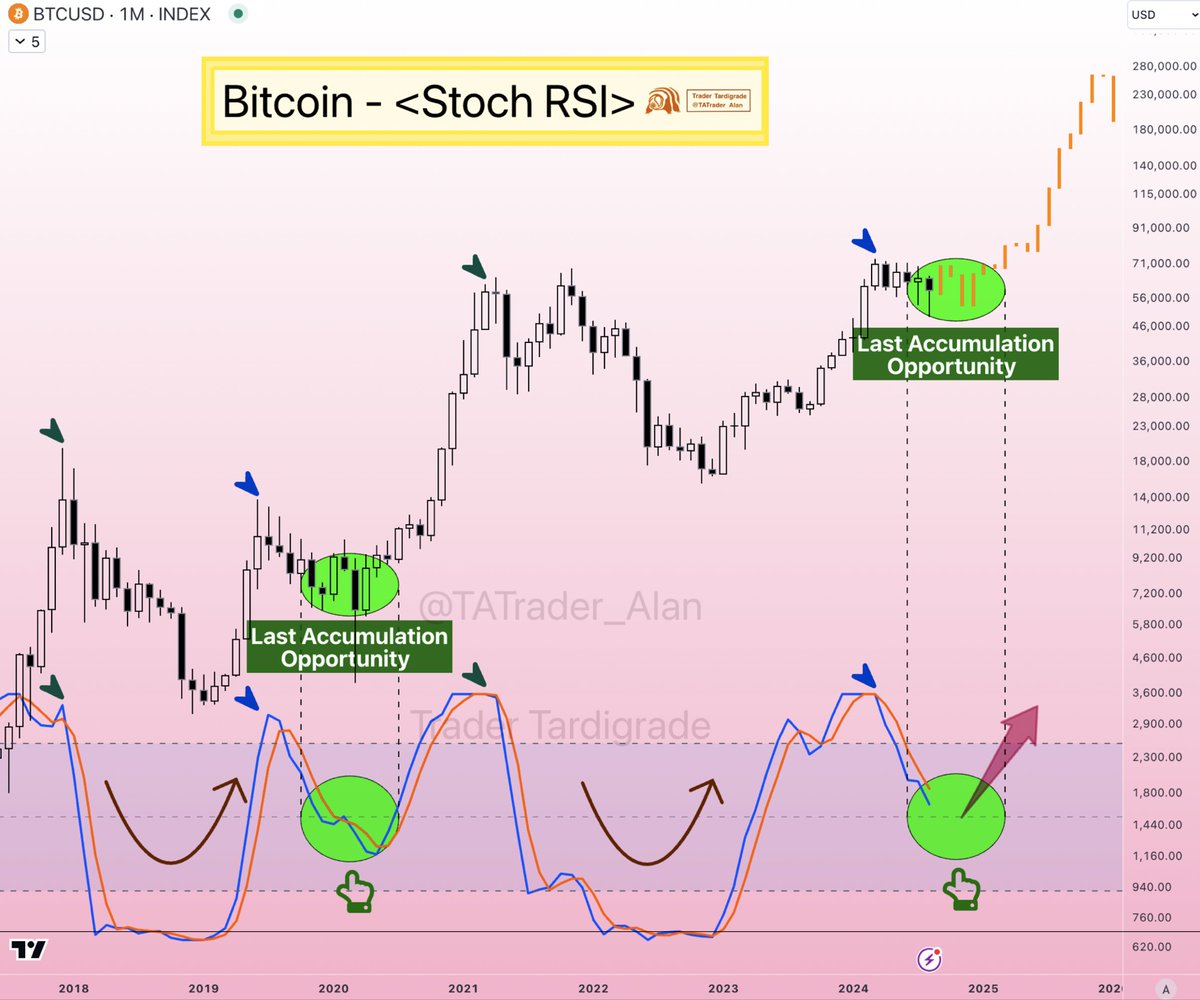

Finally, Bitcoin’s Stochastic RSI signaled that BTC will enter a “Rebound Zone” in the coming months. This is a key opportunity for traders and investors to accumulate Bitcoin before a potential surge in its price.

What this indicator also implies is a high likelihood of BTC hitting new highs, reinforcing the idea that now is a strategic time to invest in Bitcoin.

Source: Trader Tardigrade, TradingView

- The SEC has approved the first leveraged MicroStrategy ETF

- Market indicators suggested an upward move for Bitcoin

The SEC is in the news today after it approved the first leveraged MicroStrategy ETF, launched by Defiance as a 1.75x fund ($MSTX). This update was first shared by Bloomberg’s ETF Analyst Eric Balchunas on X.

Though initially intended as a 2x ETF, the SEC’s restrictions limit its leverage. This ETF will be highly volatile, similar to a 13x SPY ETF, surpassing even the $MSOX (2x weed ETF) in risk.

Source: Eric Balchunas on X

Defiance has beaten Tuttle to market with this product, although Tuttle is also attempting a 2x MicroStrategy ETF.

The market for highly volatile ETFs is strong, evident from the $5 billion Nvidia 2x ETF. This approval may be a sign of greater buying pressure and bullish sentiment for Bitcoin.

USD cycles, treasury, & BTC bull markets

Bitcoin [BTC] tends to rise most sharply when the U.S dollar ($DXY) weakens. The Federal Reserve’s actions and increased global liquidity are likely causing the DXY to decline.

The DXY has now hit equal highs, indicating a potential reversal. As the DXY drops, Bitcoin is expected to climb higher, potentially surpassing its all-time high on the charts.

Source: Bloomberg

Treasury market volatility is a crucial yet often overlooked factor in shaping risk asset strategies. It’s a major concern for Federal Reserve Chair Jerome Powell and his team.

To prevent market instability, they aim to reduce treasury volatility. As a result, this suppressed volatility may shift to Bitcoin, potentially driving its price higher.

Source: Bloomberg

Bitcoin is demonstrating strong momentum too, breaking above the Short-Term Holder Realized Price of approximately $65K.

If this level is reclaimed on the charts, it could serve as a foundation for Bitcoin to push towards the $70,000-mark and possibly beyond. This performance reinforces Bitcoin’s position as a top choice for crypto investment.

Source: Bitcoin Magazine PRO

Leverage liquidations and RSI signal bullish sentiment

Leverage liquidation hunting is a key factor causing price movements across high timeframes.

Bitcoin could climb and hold above $60k to trigger liquidations, where $93 million is positioned between $60-60.4K, and another $75 million between $61.8-62.2K.

This could drive Bitcoin to surpass its previous all-time high of $74,000, potentially leading to even higher prices.

Source: Coinglass

Finally, Bitcoin’s Stochastic RSI signaled that BTC will enter a “Rebound Zone” in the coming months. This is a key opportunity for traders and investors to accumulate Bitcoin before a potential surge in its price.

What this indicator also implies is a high likelihood of BTC hitting new highs, reinforcing the idea that now is a strategic time to invest in Bitcoin.

Source: Trader Tardigrade, TradingView

Your blog has quickly become one of my favorites. Your writing is both insightful and thought-provoking, and I always come away from your posts feeling inspired. Keep up the phenomenal work!

clomid nz prescription clomid cycle how to get clomid without prescription clomid pills can you get clomid without a prescription how can i get cheap clomid without prescription order clomid pills

More posts like this would make the online space more useful.

Proof blog you have here.. It’s intricate to on great quality belles-lettres like yours these days. I justifiably respect individuals like you! Withstand guardianship!!

azithromycin uk – ciprofloxacin pill buy flagyl 200mg pill

buy generic semaglutide – order semaglutide sale buy periactin paypal

order motilium 10mg pills – cheap sumycin where to buy cyclobenzaprine without a prescription

buy augmentin 375mg sale – https://atbioinfo.com/ acillin pill

nexium 40mg us – https://anexamate.com/ cheap esomeprazole 20mg

cheap mobic 7.5mg – relieve pain order mobic

buy deltasone 5mg sale – https://apreplson.com/ buy deltasone 40mg generic

buy ed pills for sale – https://fastedtotake.com/ red ed pill

buy amoxicillin – generic amoxicillin buy amoxil online

order fluconazole pill – https://gpdifluca.com/# buy fluconazole no prescription

order cenforce 50mg pill – https://cenforcers.com/ buy cenforce 50mg pills

cialis indications – https://ciltadgn.com/# pharmacy 365 cialis

order zantac 150mg generic – site ranitidine for sale

difference between tadalafil and sildenafil – cialis max dose take cialis the correct way

Good blog you procure here.. It’s severely to on strong calibre article like yours these days. I honestly comprehend individuals like you! Take guardianship!! online

viagra cheap fast delivery – https://strongvpls.com/ viagra buy pharmacy

I couldn’t weather commenting. Warmly written! purchase amoxil

I’ll certainly bring to be familiar with more. https://ursxdol.com/furosemide-diuretic/

I’ll certainly bring to review more. https://prohnrg.com/product/atenolol-50-mg-online/

Good blog you be undergoing here.. It’s hard to assign high quality belles-lettres like yours these days. I justifiably appreciate individuals like you! Go through guardianship!!

buy inderal medication

I am in fact happy to coup d’oeil at this blog posts which consists of tons of of use facts, thanks representing providing such data. http://www.gtcm.info/home.php?mod=space&uid=1158220

buy dapagliflozin 10 mg – where can i buy dapagliflozin forxiga without prescription

orlistat canada – on this site orlistat 60mg for sale