- Litecoin has declined by 5.64% in 24 hours.

- Various technical indicators showed a possible reverse with increased whale accumulation.

Litecoin [LTC] has experienced a considerable price decline in the last seven days. Over the same period, it has declined 7.84% while falling 5.64% in 24 hrs.

At press time, LTC was trading at $72.98 with a 121.34% increase in trading volume to $558M in the last 24 hrs. According to CoinMarketCap, LTC’s market cap has reduced by 5.6% to $4.5 Billion at press time.

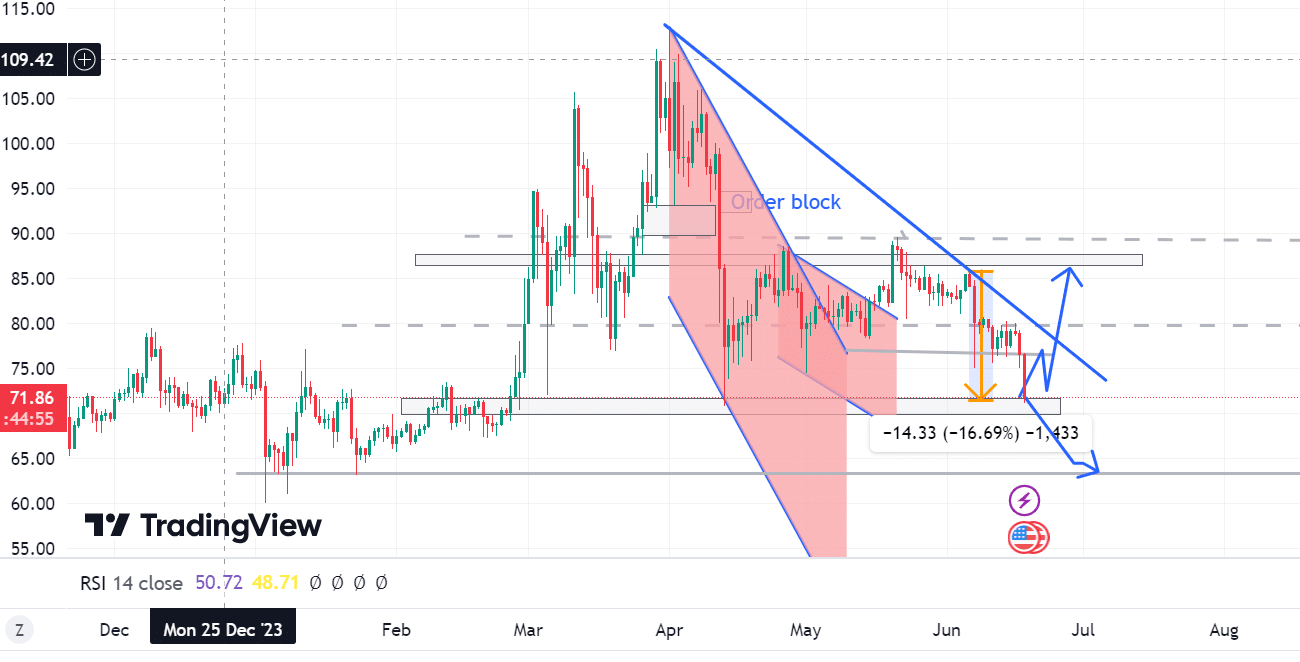

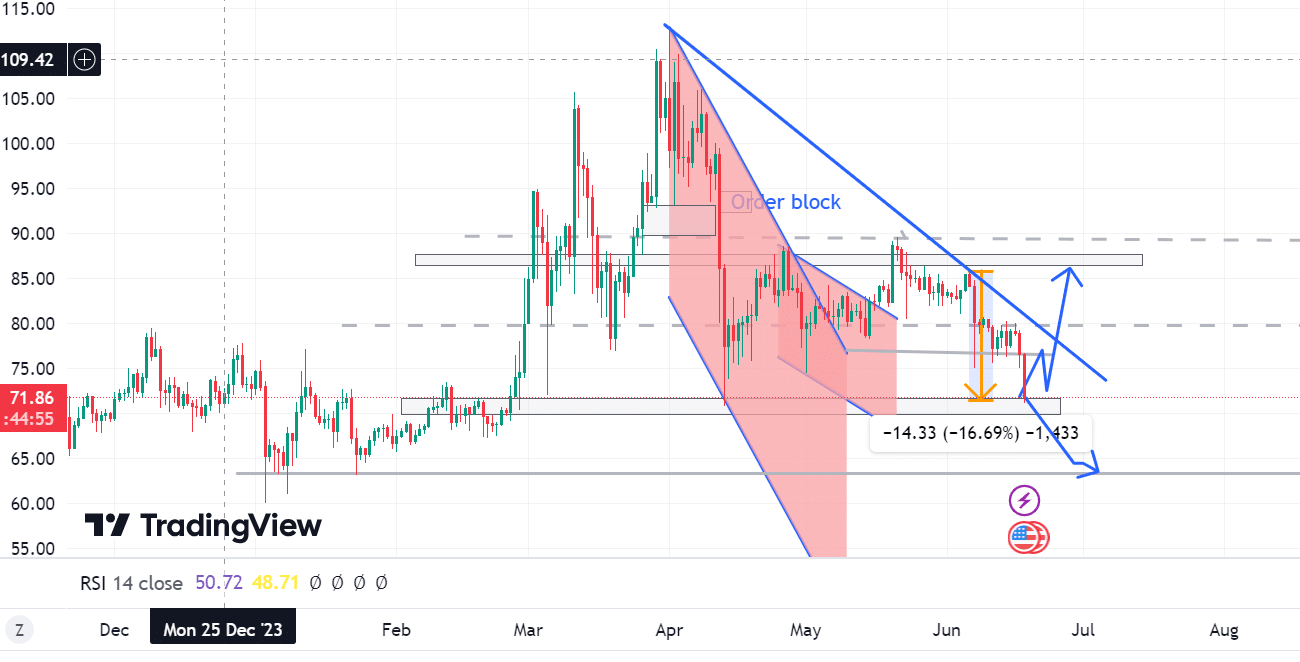

Source: TradingView

AMBcrypto’s analysis indicated that LTC was struggling to build an uptrend swing. The prices were facing massive pressure, with a local low support level of around $70.89 and a resistance level of 80.29.

With the continued price consolidation, the price is positioned to go below the $70.89 support level.

The market pressure is pushing prices down, and if such a downtrend holds, the new support level will fall to around $63.46.

However, the 121% surge in trading volume showed that bears were attempting to retain the current prices, resulting in consolidation.

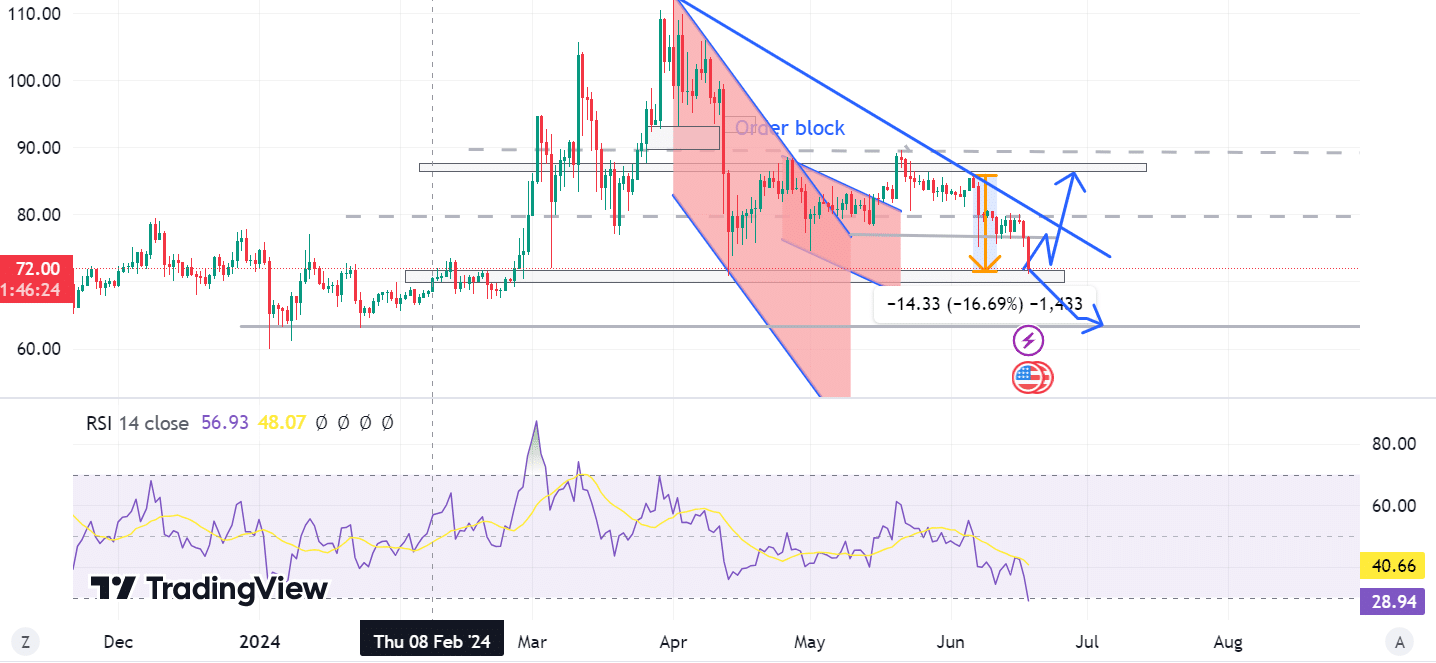

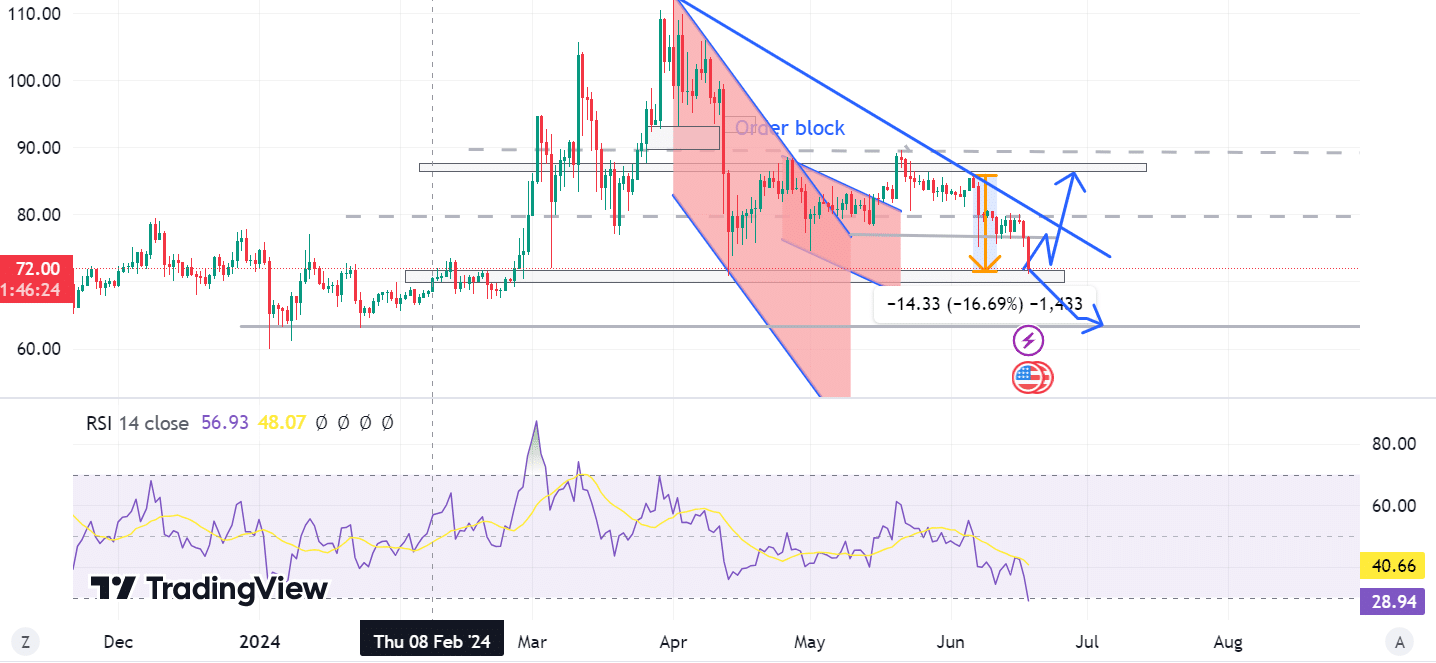

Source: TradingView

The RSI was at 29.52, and RSI-based MA was at 40.70. When RSI-based MA goes below its MLA, it showed a strong bearish trend. The RSI falling below 30 means LTC Is in oversold territory.

The oversold territory is typically a sign of reversal, where the price can bounce back in the near future. An oversold territory allows buying opportunities as prices recover from oversold conditions.

Litecoin: Possible upswing?

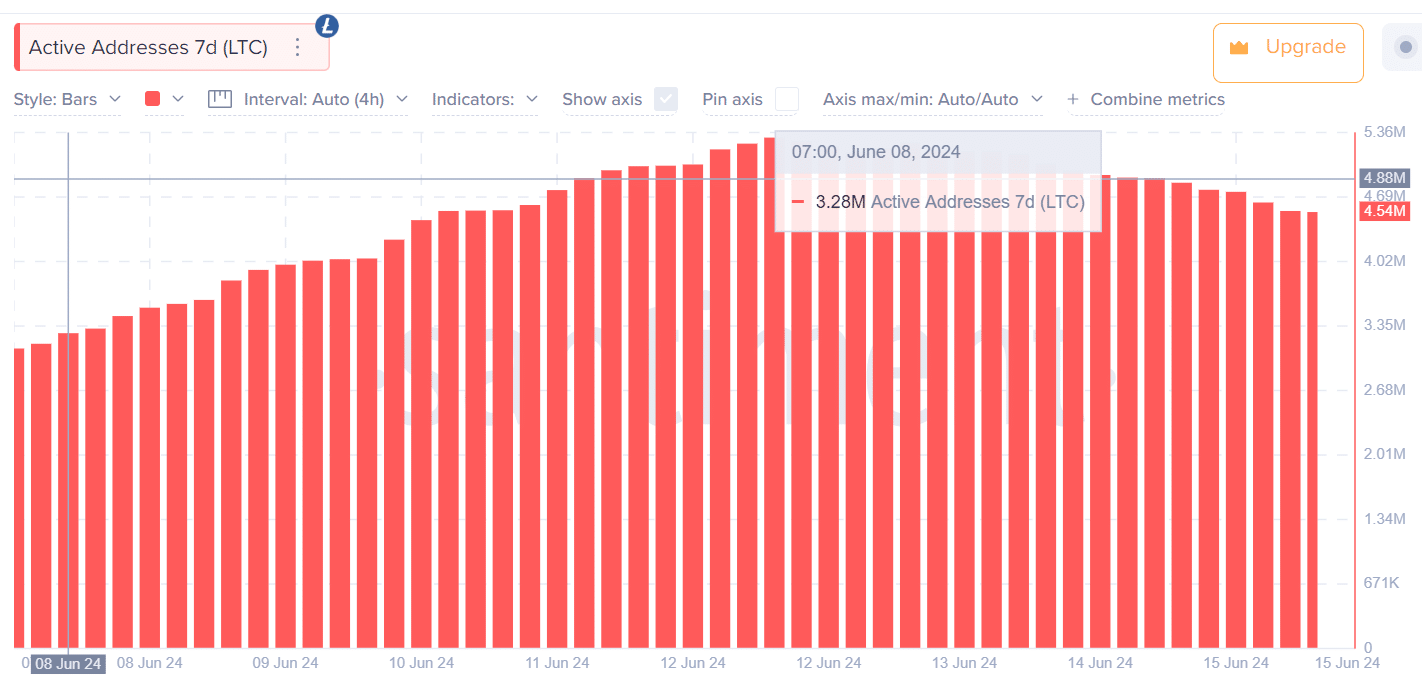

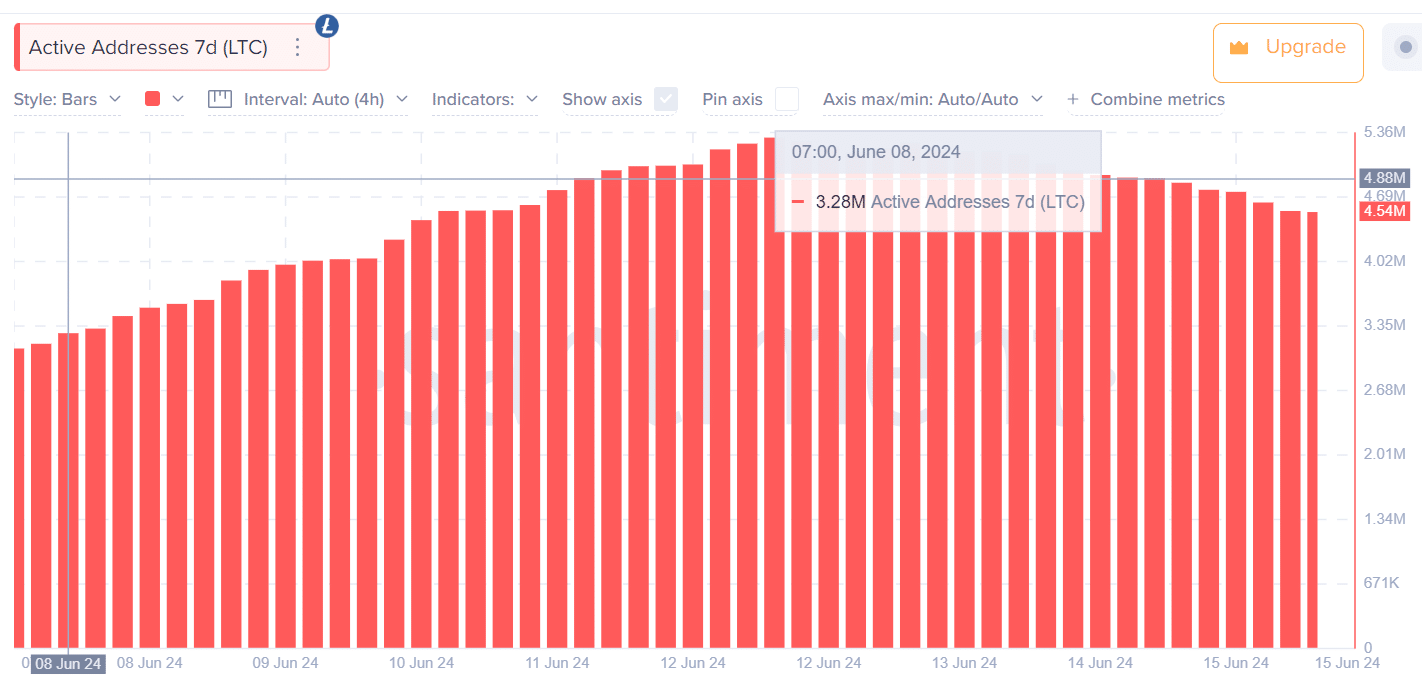

Source: Santiment

According to Santiment, LTC has experienced a considerable surge in active addresses. Active addresses have increased from 3.13 million to 4.54 million between the 7th and the 15th of June, by 45%.

The increased active address in the last seven days is a good indicator of positive market sentiment. Broadly, heightened activities show improved interest and trust towards LTC.

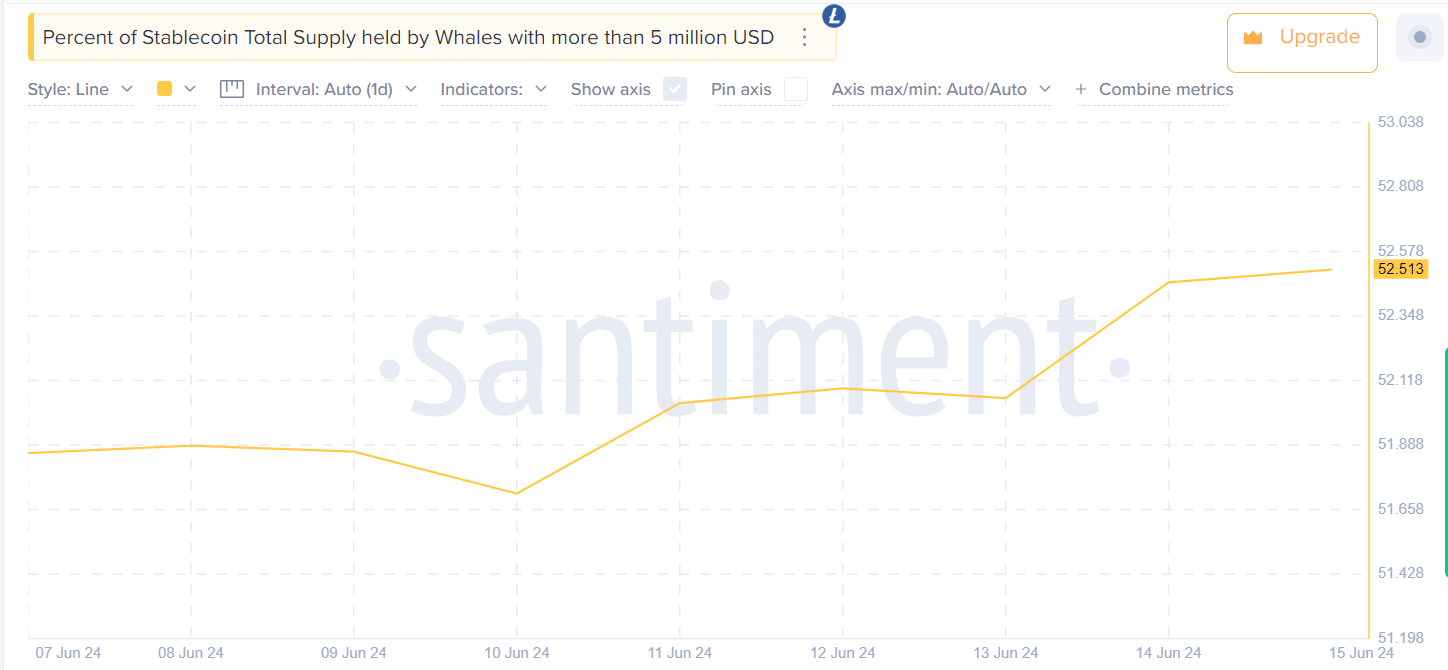

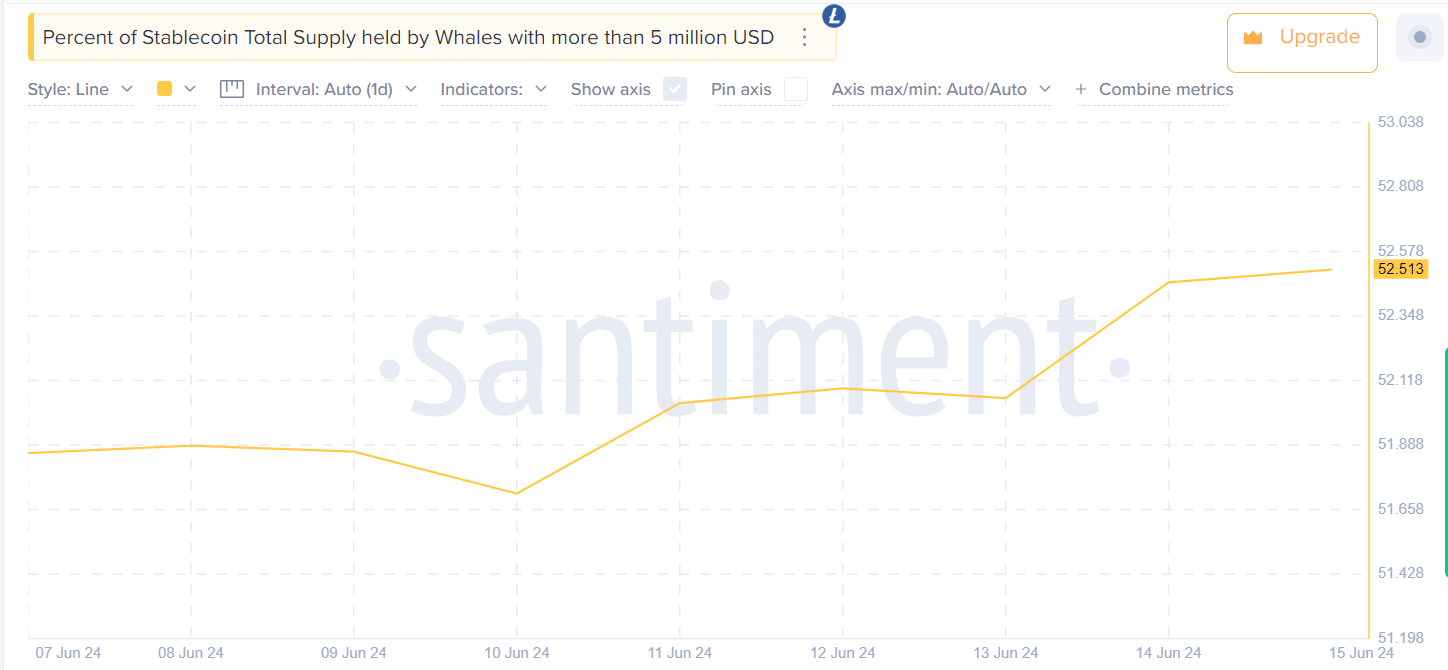

Source: Santiment

Notably, data on whales holding more than $5 million shows increased interest and trust in LTC. At press time, 52.513% of the total supply was held by whales.

From the 13th of June, the total supply held by whales increased from 52.06 to 52.513 on the 15th of June. Over this period, there was increased positive sentiment implied by the accumulation and reduced sell-off.

Realistic or not, here’s LTC’s market cap in BTC terms

Will bearish trends persist?

LTC has experienced a volatile market in the last seven days, falling from a recent high of $85.5 to $72.28. If the negative trend continues, LTC will record a new low of $63.58, thus establishing a new support level.

However, if the positive market sentiment persists, LTC will reverse into a bullish trend to $85.96, holding that Bitcoin [BTC] rebounds from its current decline.

- Litecoin has declined by 5.64% in 24 hours.

- Various technical indicators showed a possible reverse with increased whale accumulation.

Litecoin [LTC] has experienced a considerable price decline in the last seven days. Over the same period, it has declined 7.84% while falling 5.64% in 24 hrs.

At press time, LTC was trading at $72.98 with a 121.34% increase in trading volume to $558M in the last 24 hrs. According to CoinMarketCap, LTC’s market cap has reduced by 5.6% to $4.5 Billion at press time.

Source: TradingView

AMBcrypto’s analysis indicated that LTC was struggling to build an uptrend swing. The prices were facing massive pressure, with a local low support level of around $70.89 and a resistance level of 80.29.

With the continued price consolidation, the price is positioned to go below the $70.89 support level.

The market pressure is pushing prices down, and if such a downtrend holds, the new support level will fall to around $63.46.

However, the 121% surge in trading volume showed that bears were attempting to retain the current prices, resulting in consolidation.

Source: TradingView

The RSI was at 29.52, and RSI-based MA was at 40.70. When RSI-based MA goes below its MLA, it showed a strong bearish trend. The RSI falling below 30 means LTC Is in oversold territory.

The oversold territory is typically a sign of reversal, where the price can bounce back in the near future. An oversold territory allows buying opportunities as prices recover from oversold conditions.

Litecoin: Possible upswing?

Source: Santiment

According to Santiment, LTC has experienced a considerable surge in active addresses. Active addresses have increased from 3.13 million to 4.54 million between the 7th and the 15th of June, by 45%.

The increased active address in the last seven days is a good indicator of positive market sentiment. Broadly, heightened activities show improved interest and trust towards LTC.

Source: Santiment

Notably, data on whales holding more than $5 million shows increased interest and trust in LTC. At press time, 52.513% of the total supply was held by whales.

From the 13th of June, the total supply held by whales increased from 52.06 to 52.513 on the 15th of June. Over this period, there was increased positive sentiment implied by the accumulation and reduced sell-off.

Realistic or not, here’s LTC’s market cap in BTC terms

Will bearish trends persist?

LTC has experienced a volatile market in the last seven days, falling from a recent high of $85.5 to $72.28. If the negative trend continues, LTC will record a new low of $63.58, thus establishing a new support level.

However, if the positive market sentiment persists, LTC will reverse into a bullish trend to $85.96, holding that Bitcoin [BTC] rebounds from its current decline.

how can i get cheap clomiphene tablets can you get clomid without insurance how to get generic clomiphene without dr prescription where to buy cheap clomiphene without prescription can i get generic clomiphene without insurance can i get cheap clomid no prescription cost of generic clomiphene online

I’ll certainly carry back to be familiar with more.

More articles like this would remedy the blogosphere richer.

buy rybelsus 14mg generic – cost cyproheptadine 4 mg where can i buy periactin

buy motilium medication – buy cyclobenzaprine generic buy generic cyclobenzaprine for sale

buy inderal paypal – order methotrexate 2.5mg pill order methotrexate 5mg pills

clavulanate without prescription – https://atbioinfo.com/ ampicillin brand

buy generic esomeprazole 20mg – https://anexamate.com/ esomeprazole 20mg tablet

buy warfarin for sale – anticoagulant cozaar pill

buy mobic 7.5mg without prescription – relieve pain meloxicam 15mg without prescription

prednisone 20mg sale – aprep lson prednisone 10mg price

buy cheap generic ed pills – https://fastedtotake.com/ buy ed medication online

cheap amoxicillin pill – comba moxi order amoxicillin generic

fluconazole drug – https://gpdifluca.com/ buy forcan pills for sale

cheap escitalopram 20mg – escita pro buy lexapro pills for sale

order cenforce without prescription – buy cenforce buy generic cenforce