- Lido’s market dominance has fallen to its lowest in the last year.

- The protocol has seen a significant uptick in withdrawals.

The market share of liquid staking protocol Lido Finance [LDO] in the Ether staking market has plummeted to a one-year low.

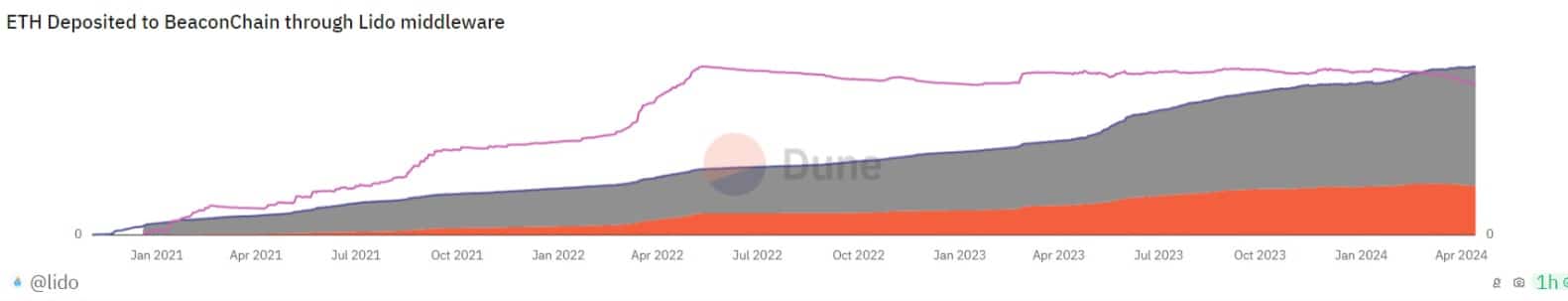

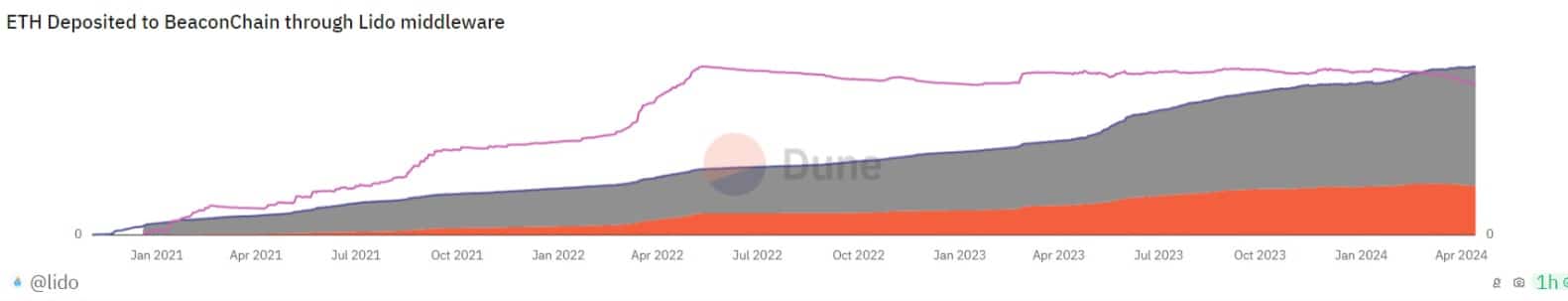

According to a Dune Analytics dashboard, the share of ETH deposited to the beacon chain through Lido middleware was at 29.1% at press time. The last time it was under 30% was in February 2023.

Source: Dune Analytics

On a year-to-date (YTD) basis, Lido’s market share has dropped by 8%. This decline is due to a spike in withdrawals from the liquid-staking protocol in the last month.

On-chain data from Dune Analytics showed that since 12th March, withdrawals from Lido have exceeded the deposits made through the protocol.

Ranking as the staking platform with the most outflows in the last week, withdrawals from Lido have totaled 117,000 ETH at press time, valued at 35.69 million USD.

Source: Dune Analytics

Lido has witnessed a spike in withdrawals as the Annual Percentage Rate (APR) offered to users staking on the platform has dropped.

As of the 10th of April, the user APR assessed on a seven-day moving average was 3.28%, having declined by 14% since the 11th of March.

What you should expect from LDO

At press time, the protocol’s native token LDO exchanged hands at $2.61. In the last month, its value has dropped by over 20%, according to CoinMarketCap’s data.

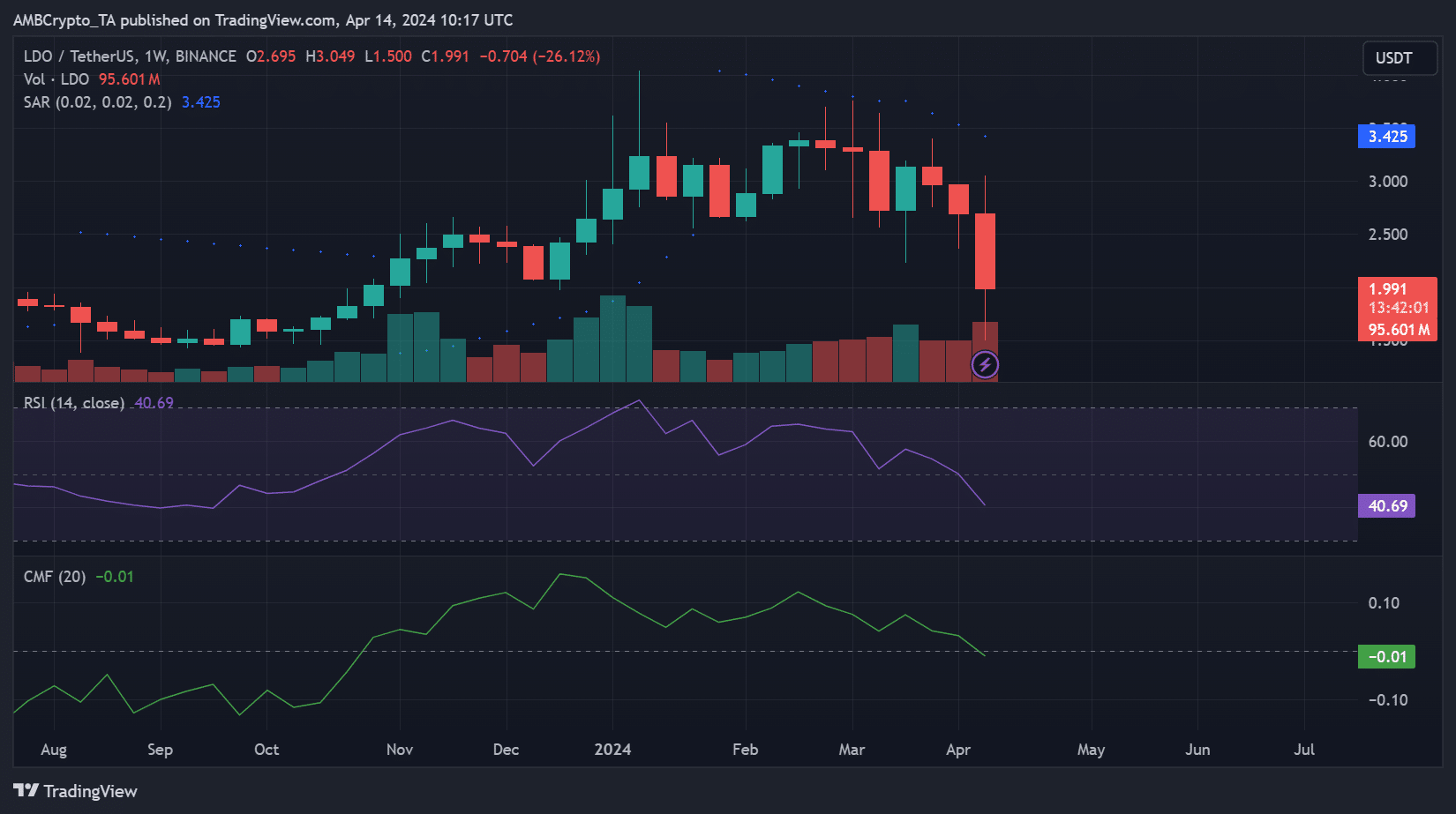

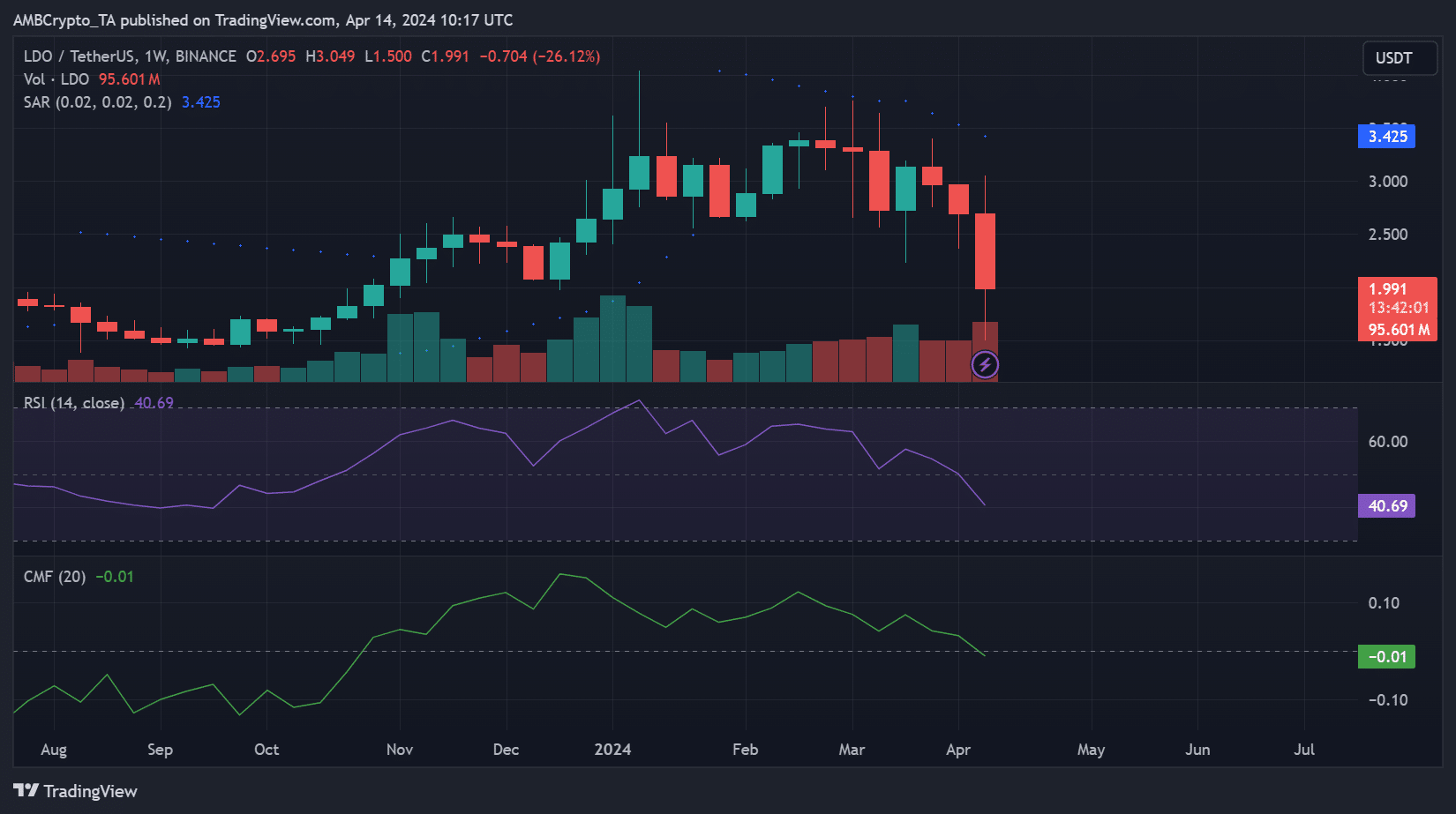

Its performance on a weekly chart hinted at the possibility of a further decline in the midterm.

Its Chaikin Money Flow (CMF), which measures the flow of money into and out of the asset, had breached the zero line at press time and was poised to trend downward.

A CMF value below zero is a sign of market weakness. It suggests a rally in liquidity outflow from the market and a spike in selling pressure.

Confirming the hike in LDO distribution, its Relative Strength Index (RSI) was 40.69 and further declining at the time of writing.

This RSI value showed that market participants preferred to sell their LDO holdings rather than accumulate more tokens.

Further, the dotted lines of LDO’s Parabolic SAR indicator rested above its price at press time.

Source: BNB/USDT on TradingView

Realistic or not, here’s LDO’s market cap in BTC’s terms

This indicator measures the potential reversal points in an asset’s price direction. When its dotted lines rest above an asset’s price, it is a bearish signal.

It confirms that an asset’s price is in decline, and the fall will continue if sentiment remains the same.

- Lido’s market dominance has fallen to its lowest in the last year.

- The protocol has seen a significant uptick in withdrawals.

The market share of liquid staking protocol Lido Finance [LDO] in the Ether staking market has plummeted to a one-year low.

According to a Dune Analytics dashboard, the share of ETH deposited to the beacon chain through Lido middleware was at 29.1% at press time. The last time it was under 30% was in February 2023.

Source: Dune Analytics

On a year-to-date (YTD) basis, Lido’s market share has dropped by 8%. This decline is due to a spike in withdrawals from the liquid-staking protocol in the last month.

On-chain data from Dune Analytics showed that since 12th March, withdrawals from Lido have exceeded the deposits made through the protocol.

Ranking as the staking platform with the most outflows in the last week, withdrawals from Lido have totaled 117,000 ETH at press time, valued at 35.69 million USD.

Source: Dune Analytics

Lido has witnessed a spike in withdrawals as the Annual Percentage Rate (APR) offered to users staking on the platform has dropped.

As of the 10th of April, the user APR assessed on a seven-day moving average was 3.28%, having declined by 14% since the 11th of March.

What you should expect from LDO

At press time, the protocol’s native token LDO exchanged hands at $2.61. In the last month, its value has dropped by over 20%, according to CoinMarketCap’s data.

Its performance on a weekly chart hinted at the possibility of a further decline in the midterm.

Its Chaikin Money Flow (CMF), which measures the flow of money into and out of the asset, had breached the zero line at press time and was poised to trend downward.

A CMF value below zero is a sign of market weakness. It suggests a rally in liquidity outflow from the market and a spike in selling pressure.

Confirming the hike in LDO distribution, its Relative Strength Index (RSI) was 40.69 and further declining at the time of writing.

This RSI value showed that market participants preferred to sell their LDO holdings rather than accumulate more tokens.

Further, the dotted lines of LDO’s Parabolic SAR indicator rested above its price at press time.

Source: BNB/USDT on TradingView

Realistic or not, here’s LDO’s market cap in BTC’s terms

This indicator measures the potential reversal points in an asset’s price direction. When its dotted lines rest above an asset’s price, it is a bearish signal.

It confirms that an asset’s price is in decline, and the fall will continue if sentiment remains the same.

can i purchase generic clomid without a prescription order generic clomiphene without a prescription where to buy clomiphene no prescription can i purchase clomid prices how to get cheap clomiphene without prescription buy cheap clomiphene without dr prescription good rx clomiphene

Thanks for putting this up. It’s understandably done.

This is a theme which is near to my fundamentals… Myriad thanks! Exactly where can I find the phone details for questions?

semaglutide order online – purchase semaglutide online cyproheptadine 4 mg sale

buy domperidone online cheap – sumycin 250mg price cyclobenzaprine 15mg us

buy inderal without a prescription – order methotrexate sale purchase methotrexate online cheap

purchase amoxil without prescription – order ipratropium 100 mcg for sale order combivent sale

zithromax 250mg uk – zithromax price bystolic 5mg cost

buy augmentin for sale – atbioinfo.com how to buy ampicillin

esomeprazole medication – nexiumtous order generic nexium 40mg

coumadin 2mg over the counter – https://coumamide.com/ losartan where to buy

meloxicam 15mg uk – moboxsin.com buy meloxicam pills for sale

buy prednisone 20mg sale – https://apreplson.com/ buy prednisone without a prescription

buy ed medications – fast ed to take ed pills no prescription

buy amoxicillin tablets – https://combamoxi.com/ amoxil brand

fluconazole tablet – fluconazole 100mg generic order generic diflucan

purchase escitalopram pill – https://escitapro.com/# lexapro us

buy cheap cenforce – https://cenforcers.com/# buy cenforce generic

shelf life of liquid tadalafil – https://ciltadgn.com/# tadalafil long term usage

does tadalafil lower blood pressure – https://strongtadafl.com/# cialis and cocaine

zantac price – https://aranitidine.com/ where can i buy ranitidine

cheap viagra cialis uk – viagra half pill purple viagra 100

This is the amicable of topic I get high on reading. https://gnolvade.com/es/provigil-espana-comprar/

The thoroughness in this piece is noteworthy. https://buyfastonl.com/

This is the description of content I get high on reading. https://ursxdol.com/ventolin-albuterol/

I am actually thrilled to coup d’oeil at this blog posts which consists of tons of profitable facts, thanks object of providing such data. https://prohnrg.com/product/acyclovir-pills/

The thoroughness in this break down is noteworthy. https://aranitidine.com/fr/en_ligne_kamagra/

I am actually thrilled to gleam at this blog posts which consists of tons of profitable facts, thanks towards providing such data. https://ondactone.com/spironolactone/

The vividness in this piece is exceptional.

ketorolac oral

The thoroughness in this draft is noteworthy. http://web.symbol.rs/forum/member.php?action=profile&uid=1171357

order forxiga 10 mg generic – https://janozin.com/ dapagliflozin online order

buy xenical pill – https://asacostat.com/ xenical buy online

More posts like this would make the blogosphere more useful. http://www.kiripo.com/forum/member.php?action=profile&uid=1193185